PDF Attached

Please

note I will be out of the office on Wednesday.

QPF

5-day Precipitation

World

Weather Inc.

WORLD

WEATHER HIGHLIGHTS FOR JUNE 7, 2022

-

Additional

rain fell in parts of interior southern Alberta, Canada Monday and early today further improving topsoil in a region that has been quite dry -

Drought

remains in east-central Alberta and much of western Saskatchewan, Canada -

Rain

will eventually fall across most of Canada’s Prairies during the next two weeks, but the drought regions in the west will continue to see less than usual rainfall for a while -

U.S.

weather will be well balanced during the next two weeks bringing periods of rain and sunshine to many key Midwestern and northern Plains crop areas -

The

same is true for the central Plains, lower Midwest and Delta, although these areas will experience a drier second week of the outlook due to weak ridge building in the central United States -

Argentina’s

outlook remains mostly dry during much of the coming ten days and rain is needed in western parts of the nation in particular where soil moisture is lowest -

Brazil

is still expecting rain in western and southern Mato Grosso and Mato Grosso do Sul Wednesday into Friday offering a little moisture of benefit to cotton, but the moisture comes too late for Safrinha corn -

Southern

Brazil has been quite wet recently, but will dry down after this week for a while -

Western

Australia rainfall Wednesday through early next week will be ideal in supporting good to excellent wheat, barley and canola planting and establishment conditions

-

Eastern

Australia will dry down for a while, but recent moisture has been great for autumn planting and crop establishment -

India’s

monsoon is performing a little weaker than usual, but it is just the first week of the rainy season and there is plenty of time for improvement some of which is expected next week and into the second half of this month -

A

portion of east-central China will continue to receive less than usual rainfall over the next ten days to two weeks, but the region may not be totally dry -

Rain

is needed in the North China Plain and central Yellow River Basin and some of that need will be partially fulfilled by scattered rain and thunderstorms during the next two weeks, but not all areas will be adequately relieved of recent dryness -

Russia’s

Southern Region, western Kazakhstan and eastern Ukraine will receive less than usual rainfall for the next ten days leading to a firmer soil and a greater need for rain.

-

France

will receive less than usual rainfall over the next ten days, although recent rain has helped ease some of the dryness -

Recent

storminess in France damaged “some” crops, but the extent of the damage is not truly known

-

Much

of Europe has recently received rain and will receive some more periodically keeping soil moisture at favorable levels, but some pockets are expected to dry out again later this month

Source:

World Weather Inc.

Tuesday,

June 7:

- EU

weekly grain, oilseed import and export data - Vietnam’s

customs department releases May export data for coffee, rice and rubber - Russian

Grain Union’s International Grain Round conference, Gelendzhik, Russia, day 1 - International

Grains Council conference, day 1 - Global

Food Summit in Munich, day 1 - Purdue

Agriculture Sentiment - Abares

agricultural commodities outlook - New

Zealand Commodity Price - New

Zealand global dairy trade auction - France

agriculture ministry releases crop estimates

Wednesday,

June 8:

- EIA

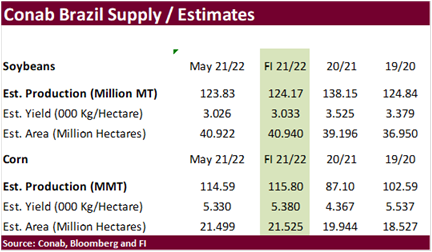

weekly U.S. ethanol inventories, production, 10:30am - Brazil’s

Conab releases data on area, yield and output of corn and soybeans - Russian

Grain Union’s International Grain Round conference, Gelendzhik, Russia, day 2 - International

Grains Council conference, day 2 - Global

Food Summit in Munich, day 2 - France

AgriMer monthly grain outlook

Thursday,

June 9:

- China’s

first batch of May trade data, including soybeans, edible oils, rubber and meat imports - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Ecosperity

sustainability conference, Singapore - Russian

Grain Union’s International Grain Round conference, Gelendzhik, Russia, day 3

Friday,

June 10:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - Malaysian

Palm Oil Board’s data for May output, exports and stockpiles - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

June 1-10 palm oil export data - Brazil’s

Unica may release cane crush and sugar output data (tentative)

Source:

Bloomberg and FI

Macros

US

Trade Balance (USD) Apr: -87.1B (exp -89.5B; R prev -107.7B)

Canadian

International Merchandise Trade (CAD) Apr: 1.50B (exp 2.80B; R prev 2.28B)

Due

out June 8

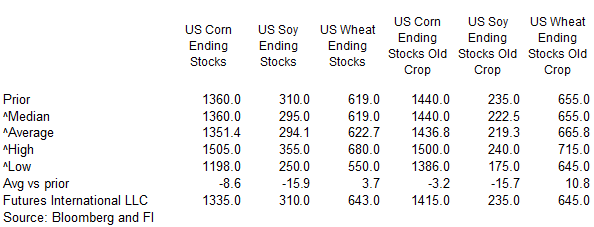

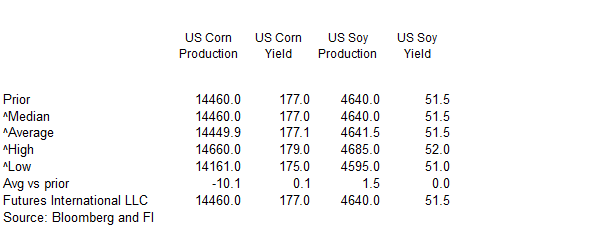

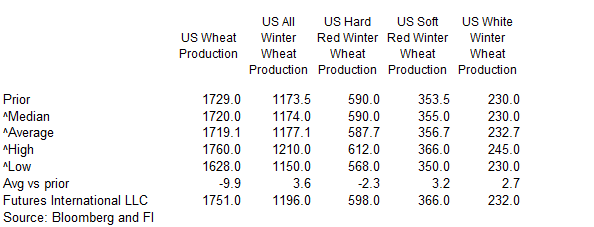

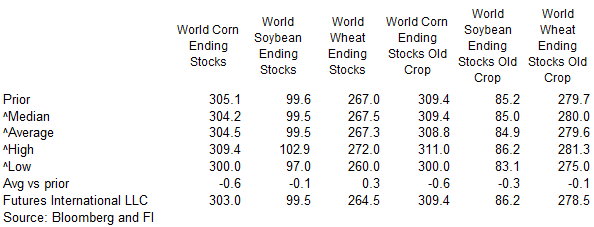

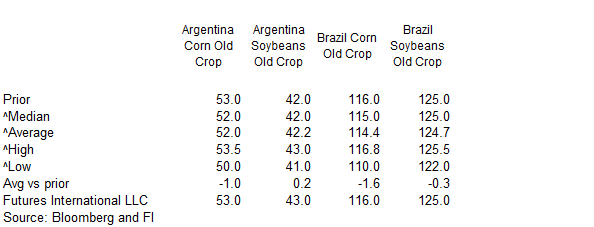

USDA

S&D estimates

·

US corn futures finished higher on demand seen from the higher cash markets. July/Sep and July/Dec spreads were firmer as bull-spreaders were active.

·

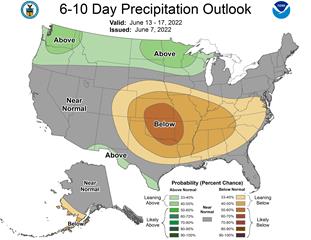

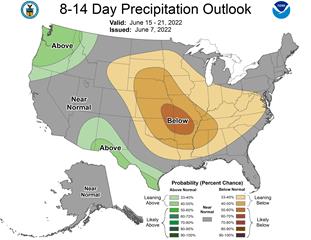

Weather does look good this week for crops, but the 6-14 day maps show above normal temps and below normal precipitation. Traders will be monitoring this for any changes.

·

Also underpinning corn is the doubt that we will see many shipments out of the Black Sea despite Russia saying it would lift its naval blockade. We have witnessed significant damage to infrastructure that would limit export capacity

even if Russia were to allow shipments.

·

Russia said two Ukrainian ports are ready to ship grain, but Kyiv must demine the approaches to its ports for exports to resume.

·

Ukraine May grain, oilseed, and product exports were 1.743 million tons. Ukraine exported 959,000 tons of corn.

·

European Commission reported maize 21/22 imports at 15.34 million tons by June 5 compared to 14.16 million tons last year.

Export

developments.

·

None reported

Updated

6/1/22

July

corn is seen in a $6.75 and $8.00 range

December

corn is seen in a wide $5.50-$8.00 range