PDF Attached

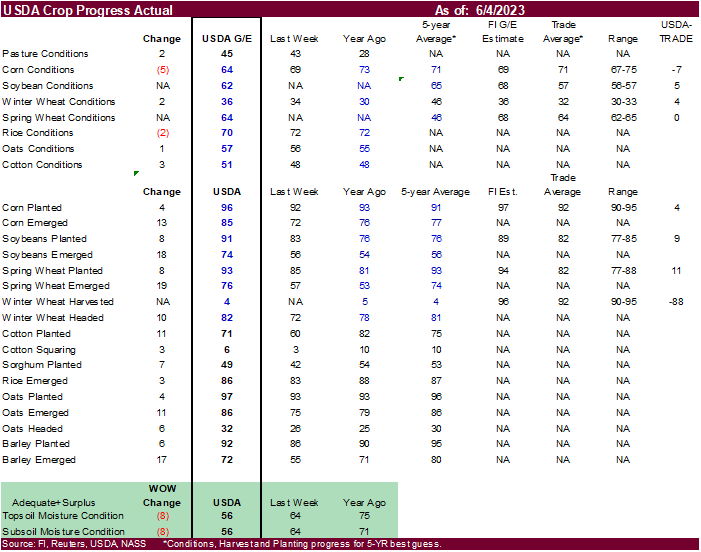

USDA:

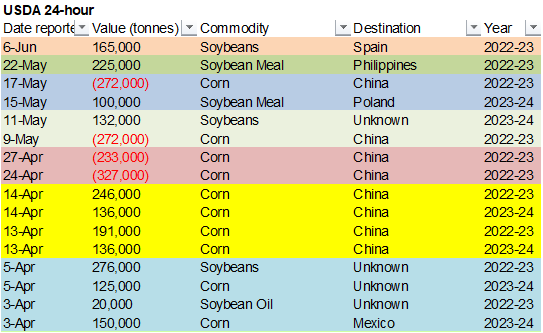

Private exporters reported sales of 165,000 tons of soybeans for delivery to Spain during the 2022-23 marketing year.

US

weather forecasts and money flow dominated the ag markets after price reaction initially reflected changes in crop conditions, Australian wheat production, and the Ukraine dam situation. Week one of the GFS model was drier for parts of the Midwest and wetter

for southern OK. Australia sees their wheat crop at 26.2 million tons, a 34 percent decline from last year. Traders are concerned the Ukraine/Russia conflict is escalating.

It’s

rare to see a large drop in US corn conditions for this time of year but not surprising given the dry areas of the WCB and upper ECB states.

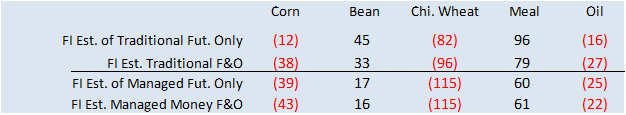

Fund

estimates as of June 6 (net in 000)

Weather

WEATHER

TO WATCH

-

Weather

changes coming to many areas in the world during the next two weeks -

Rain

is expected to fall in the U.S. Midwest to improve topsoil moisture and temperatures will trend cooler -

Canada’s

Prairies will have a little better chance for rain, although the precipitation will continue a little too erratic -

Northern

Europe is expecting rain to relieve three weeks of dry weather -

Eastern

Russia New Lands will get waves of rain and experience cooler temperatures easing long term dryness and improving crop prospects -

India

will begin receiving better rainfall during the second half of next week after the Arabian Sea tropical cyclone moves into Oman and dissipates -

Southwestern

U.S. Plains will experience less frequent and less significant rain during the next ten days especially in the High Plains of West Texas -

U.S.

Midwest will get some timely rainfall, although amounts will be a little disappointing when the time comes -

The

greatest precipitation is expected next week -

Additional

rain will be needed -

U.S.

central Plains will remain plenty wet over the next ten days maintaining a grain quality concern for some of the crop, although it will not be quite wet enough for a serious impact -

U.S.

Delta and southeastern states will get waves of rain during the next two weeks, alternating with periods of sunshine -

Temperatures

will trend cooler than usual -

Cooling

in eastern North America later this week and lasting into next week will slow crop development rates in some areas and conserve soil moisture in many areas where the ground is moist -

A

returning 62-day cool cycle is possible late this month that could perpetuate the cooler bias -

Canada’s

Prairies will not experience much serious rain this week -

Scattered

showers and thunderstorms are expected, but resulting rainfall will not be enough to fix long term drought in eastern or southern Alberta or seriously ease dryness in western Saskatchewan -

Dryness

is evolving in southeastern Saskatchewan and southwestern Manitoba as well and these areas have received limited rain recently and seen frequent high temperatures in the upper 80s and lower 90s Fahrenheit -

Any

rainfall that occurs this week in the Prairies will be welcome, but it will not be enough to seriously change the moisture profile

-

Canada’s

Prairies will trend cooler next week and along with that should come a better opportunity for “some” rain, but it is too soon to get excited about a serious trend change.

-

Ontario

and Quebec weather will not include much rain for a while, although temperatures will trend cooler and that should translate into favorable field working conditions -

Rain

is needed soon to improve summer crop emergence and establishment -

Wheat

development should continue favorably -

Tropical

Activity may increase in the eastern Pacific Ocean next week -

There

are no tropical cyclones in the Atlantic Ocean Basin today and none are expected -

Tropical

Cyclone 02A in the Arabian Sea will develop into a s strong storm that will eventually reach Oman producing heavy rain and strong wind speeds -

The

most important part of this storm is its interference with southwest monsoon moisture for India resulting in poor rainfall in southern and eastern parts of that nation for the next week -

Monsoonal

moisture should improve later next week -

Southeast

Asia rainfall continues to occur routinely enough to support most crops favorably -

Northern

Europe temperatures will be warmer than usual this week and that will create a more stressful environment for crops as they deal with another week of dry conditions

-

Southern

Europe has been receiving frequent rainfall in recent weeks and the trend will continue for another week to ten days -

Eastern

CIS New Lands will begin to receive some timely rainfall the remainder of this week bringing some relief to the drier biased areas of Kazakhstan and Russia’s eastern New Lands -

The

precipitation will be sporadic helping some areas more than others -

Kazakhstan

is not likely to get nearly as much rain and unirrigated crop stress will continue -

Russia’s

Volga River Basin and Ukraine will be dry for the next week to ten days raising crop moisture stress for some crops since the ground is already drying out -

There

is some potential for relief after June 14 -

India’s

monsoon continues to perform poorly and that situation will not change greatly over the next two weeks -

A

tropical cyclone will develop in the Arabian Sea this week interfering with the southwest monsoon flow for up to ten days -

Another

Tropical Cyclone will develop northwest of Guam and well east of the Philippines this week

-

The

storm should stay over open water and is expected to curve back to the east northeast late this week keeping the system away from major land masses in Southeast Asia -

Summer

crops in China are expected to see a mostly good mix of rain and sunshine during the next ten days -

Some

far southern China crop areas may become a little too wet during the next ten days.

-

Northeast

China will see sufficient rain to maintain a good outlook for corn, soybeans, sugarbeets and spring wheat -

There

is a dryness concern from northern Jilin into Inner Mongolia and “some” relief is possible in the next couple of weeks, although more rain will be needed -

Xinjiang,

China will experience more seasonable temperatures over the next two weeks -

The

province has struggled with coolness in recent weeks and crop development is behind the usual pace -

Production

potentials have decreased because of some reduced area planted and due to the poor early season start to crop development -

There

is concern over early season frost and freeze potentials coming along before the crop is fully mature

-

Monsoonal

rainfall is expected to occur in the mainland areas of Southeast Asia during the next two weeks resulting in improved sugarcane, rice and coffee conditions among other crops like corn -

Some

caution is needed since some of the computer forecast model data is exaggerating the anticipated rainfall

-

Philippines,

Indonesia and Malaysia will see a favorable mix of weather during the next two weeks supporting most crop needs -

Australia

weather over the next ten days will include rain in Victoria, New South Wales, southeastern South Australia and southwestern Western Australia -

The

moisture will be ideal for wheat, barley and canola establishment -

A

boost in rainfall will be needed in Queensland and in interior South Australia and in some northern and eastern Western Australia crop areas -

South

Africa rainfall will be restricted over the next ten days, though some rain will benefit southwestern winter wheat, barley and canola production areas -

West-Central

Africa rainfall will be favorably distributed for coffee, cocoa, sugarcane and cotton as well as rice during the next ten days -

East-central

Africa has been and will continue to be favorably distributed from Uganda and southwestern Kenya to Ethiopia through the next ten days with western Ethiopia wettest relative to normal -

Argentina

weather over the next ten days will not provide much rainfall which will favor fieldwork in many areas, but no relief from dryness is likely in the southwest -

Brazil

weather during the coming will be dry for most of the nation’s key crop areas, although some rain will fall in coastal Bahia and areas northward -

Rain

is expected in far southern Brazil Sunday into Wednesday of next week, June 11-14 -

Mexico’s

drought is not likely to improve for the next two weeks -

Rain

will occur periodically in eastern and far southern portions of the nation, but seasonal rains are expected to be delayed by at least two more weeks -

Today’s

Southern Oscillation Index was -19.64 and it will move erratically higher over the next week

Source:

World Weather, INC.

Tuesday,

June 6:

- Russia

grain union conference in Gelendzhik, day 1 - EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - New

Zealand commodity prices - Malaysia’s

June 1-5 palm oil export data - US

Purdue Agriculture Sentiment

Wednesday,

June 7:

- China’s

1st batch of May trade data, including soybean, edible oil, rubber and meat & offal imports - EIA

weekly US ethanol inventories, production, 10:30am - Russia

grain union conference in Gelendzhik, day 2

Thursday,

June 8:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Russia

grain union conference in Gelendzhik, day 3 - HOLIDAY:

Brazil

Friday,

June 9:

- USDA’s

World Agricultural Supply & Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly supply and demand report - Sustainable

World Resources conference in Singapore - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Russia

grain union conference in Gelendzhik, day 4

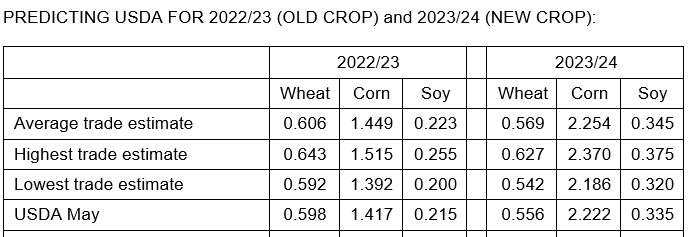

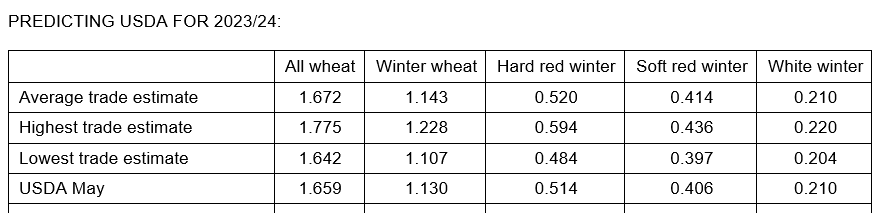

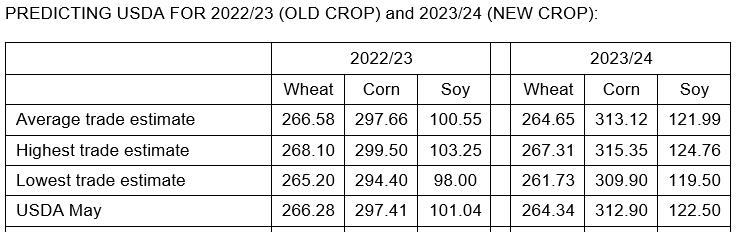

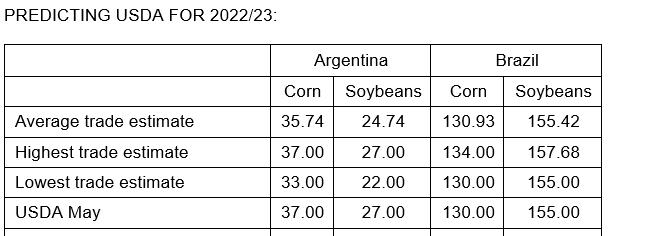

Reuters

estimates for USDA S&D

Soybean

and Soybean Advisory

2023

U.S. Corn Yield Lowered 1.0 bu/ac to 179.0 bu/ac

2023

U.S. Soybean Yield Unchanged at 52.0 bu/ac

2022/23

Brazil Soybean Estimate Unchanged at 155.0 Million Tons

2022/23

Brazil Corn Estimate Increased 3.0 mt to 129.0 Million

2022/23

Argentina Soybean Estimate Unchanged at 22.0 Million Tons

2022/23

Argentina Corn Estimate Unchanged at 35.0 Million Tons

Macros

The

Goldman Roll starts Wednesday, lasting for 5 business days.

101

Counterparties Take $2.135 Tln At Fed Reverse Repo Operation

EIA

STEO Current Yr Crude F’cast (Bpd) Jun: 12.61 (prev 12.53)

–

Forward Yr Crude F’cast (Bpd): 12.77 (prev 12.69)

–

Current Yr Dry NatGas F’cast (Bcf/d): 102.74 (prev 101.09)

–

Forward Yr Dry NatGas F’cast (Bcf/d): 103.04 (prev 101.24)

US

EIA Raises Forecast For 2023 World Oil Demand Growth By 30K Bpd, Now Sees 1.59M Bpd Y/Y Increase

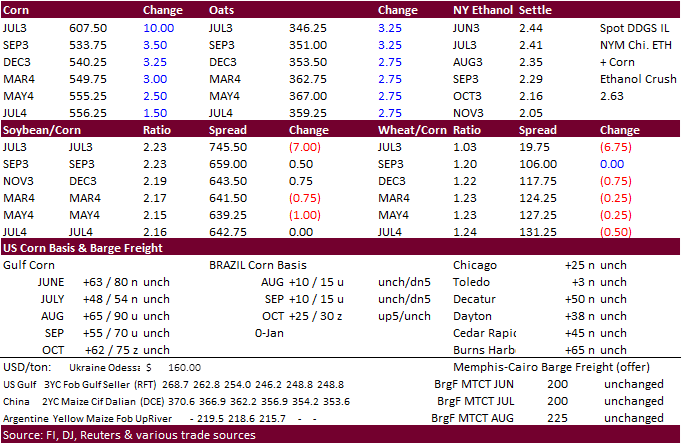

Corn

·

Corn futures traded two-sided. It was up earlier after USDA reported a 5 point drop in the US rating

to 64 percent G/E but fell on talk of a wetter outlook for the Sat-Mon period, then rallied again on fund buying.

The upper Midwest is the current problem spot when thinking about soil moisture levels. But as the ridge breaks down, rain could fall across that area later this week.

However, the GFS model for week one reduced rain from west-central and southeastern Illinois to Ohio and Michigan Sunday into next Tuesday, according to World Weather, Inc. It also was wetter for the southern half of Oklahoma Sunday into next Tuesday.

·

Reuters noted the weekly decline in corn ratings (G/E) were the largest since August 2020. The trade will start getting a better feel on conditions in about 2-3 week from now after its completely established. 85 percent of the

US corn crop is emerged.

·

A water dam bust in southern Ukraine was supportive earlier. Traders are concerned the Ukraine/Russia conflict is escalating. Local flooding of farms and villages is expected across a portion surrounding the Russian-controlled

Nova Kakhovka dam, about the same size of Utah’s Great Salt Lake. Will take time to find out how much damage occurred to fields for parts the Kherson region. Reuters noted the region produces about 6 percent of the wheat crop. We think it might become a more

of irrigation issue.

·

Several key US West Coast ports are seeing a slowdown in processing imports/exports due to a labor contract negotiations. It’s too early to see if it will impact grain loadings.

·

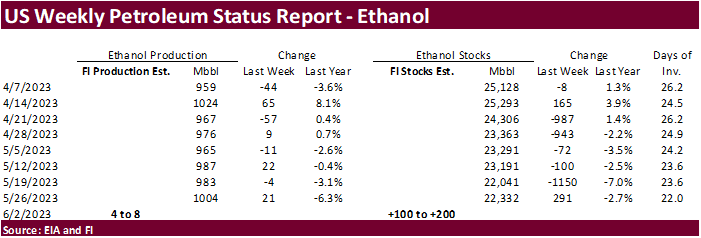

A Bloomberg poll looks for weekly US ethanol production to be up 13,000 thousand barrels to 1017k (1000-1026 range) from the previous week and stocks up 72,000 barrels to 22.404 million.

Export

developments.

-

None

reported

Updated

06/6/23

July

corn $5.75-$6.35

September

corn $4.50-$5.75

December

corn $4.25-$5.75

·

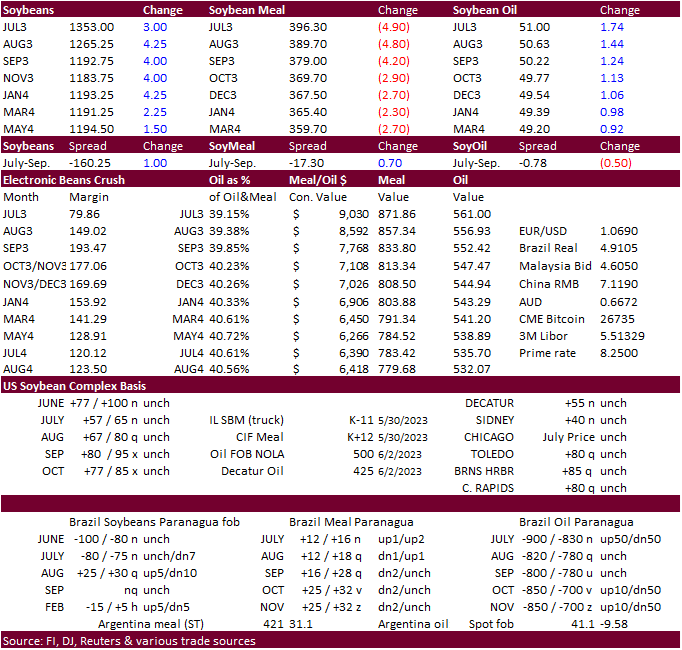

Soybeans traded higher after USDA reported the initial soybean crop ratings at 62 percent G/E, three points below an average trade guess. July was higher from strong US cash prices and an old crop USDA soybean sale announcement,

before closing below August and September. Soybean meal futures traded two-sided on product spreading.

·

August soybean crush was active today (256 last count). This tells us old crop soybeans are moving.

·

Soybean oil started the day lower on weaker palm oil and energy prices but rallied after the day session started in part from a rise in D4 Rin prices and a rumor a major commercial was looking to buy SBO receipts back after delivering

them last period. Look for registrations to potentially drop before July First Notice Day delivery. Attached is a snapshot of SBO registrations (after the text).

·

The US EPA is expected to release RVO mandates by June 14 (mid next week). Separately, the Biden Administration is expected to remove nearly 2 billion EV credits from the mandates. This was rumored two weeks ago.

·

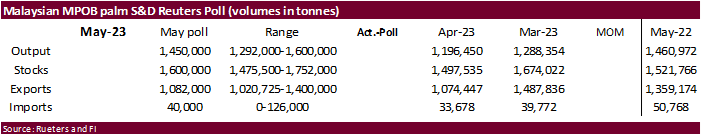

Palm oil futures traded lower on Tuesday. India palm oil imports during May were only 441,000 tons, down from 510,094 tons during April. May was at a 27-month low. India soybean oil imports for May were 319,000 tons versus 249,122

tons during April. Sunflower oil was 319,000 tons versus 249,122 tons previous.

·

European Union soybean imports so far this season (July-June) reached 12.03 million tons by June 4, against 13.60 million a year earlier. EU rapeseed imports reached 7.15 million tons, compared with 5.14 million tons a year earlier.

Soybean meal imports were 14.64 million tons, down from 15.25 million tons previous period.

Export

Developments

·

Under the 24-hour reporting system, USDA announced 165,000 tons of soybeans were sold to Spain for 2022-23 delivery.

·

USDA seeks 1,140 tons of packaged vegetable oil on June 6 for July shipment.

Reuters

MPOB estimates

Soybeans

– July $13.00-$14.00, November $11.00-$14.50

Soybean

meal – July $370-$420, December $290-$450

Soybean

oil – July 48-52, December 43-53, with bias to upside

·

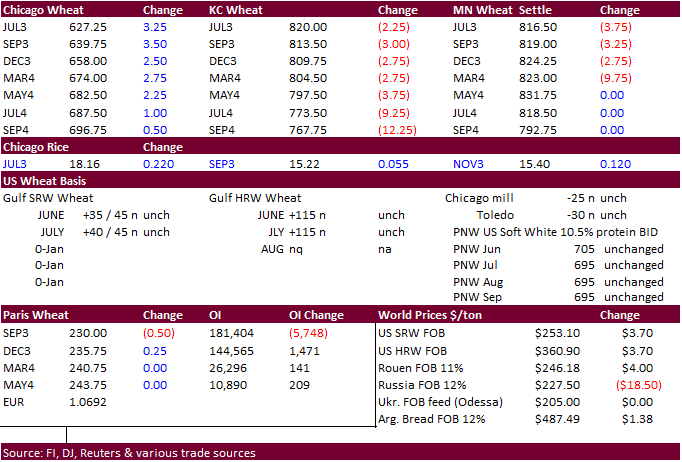

US wheat futures started higher on Black Sea conflict tensions and a low production estimate for Australian wheat. Chicago was underpinned by fund buying (money flow). By mid-morning KC and MN turned lower, pressured by talk of

improving US weather over the next 7-10 days. Also adding to the high protein wheat pressure was a low offer presented for Egypt’s wheat import tender, another reminder Russian wheat prices are grinding lower.

·

Australia sees their wheat crop at 26.2 million tons, a 34 percent decline from last year. Plantings are nearing an end for Australia. For comparison, USDA is at 29 million tons versus 39 million tons year earlier.

·

Australia’s weather outfit sees a 70 percent chance of El Nino this year.

·

US spring wheat ratings were 64 percent, two points below expectations.

·

September Paris milling wheat officially closed 0.50 euro lower, or 0.2%, at 230.25 euros a ton (about $246.00 ton). Some cited falling Russian wheat prices after Egypt’s tender.

·

Ukraine grain exports were 45.6 million tons so far, the 2022-23 July-June season, down from 47.2 million tons in the same period year ago. That includes 15.6 million tons of wheat, 27.1 million tons of corn and 2.7 million tons

of barley.

·

Kazakhstan’s AgMin expects to harvest about 16 million tons of wheat this year. USDA is a 14 million tons.

·

EU soft wheat exports so far this season reached 28.88 million tons by June 4, up from 25.93 million during the same period year earlier.

Export

Developments.

·

Egypt was thought to have bought about 55,000 tons of wheat at maybe $229/ton fob (lowest offer earlier) from Russia for July 21-31 shipment.

·

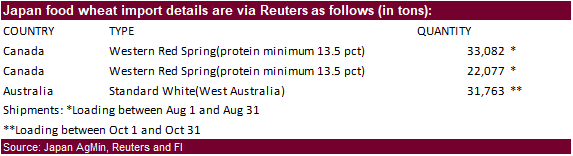

Japan seeks 86,922 tons of food wheat later this week for August shipment.

·

Iran seeks 120,000 tons of soybean meal from Brazil on June 7 for July and/or August shipment.

·

Saudi Arabia bought 624,000 tons of wheat on June 5 for September through October delivery at an average price of $261.76/ton c&f. On March 13 they purchased 1.043 million tons for July through August arrival at an average price

of $316.86/ton c&f.

·

Morocco seeks 500,000 tons of feed barley on June 14.

Rice/Other

·

South Korea seeks about 62,200 tons of rice, 44,400 tons from China and rest from Vietnam, on June 8, for arrival between September 1-30.

Chicago

Wheat – July $5.75-$6.50, September $5.50-$6.75

KC

– July $7.75-$8.75, September $7.50-$9.00

MN

– July $7.75-$8.75,

September $7.25-$9.00

#non-promo