PDF Attached

Please

note I will be out of the office Tuesday and Wednesday.

Calls:

Corn

3-7 lower

Soybeans

3-6 lower

SBO

20 points lower

Meal

$1.00-$1.50 lower

Chicago

Wheat 4-6 lower

KC

wheat 4-7 lower

MN

wheat 4-7 lower

The

midday weather outlook improved for winter wheat for the 1-5 day and improved for spring wheat & the Corn Belt for the 6-10 day. Two warehouses with sunflower meal at Nikatera (Ukraine) was hit by a rocket over the weekend. This and uncertainty over Black

Sea (Ukraine) exports sent wheat futures sharply higher. Corn was higher and the soybean complex mixed. Most of Europe was on holiday.

WEATHER

EVENTS AND FEATURES TO WATCH

- Dryness

is being eased in Europe after concern about poor soil moisture last week - China’s

North China Plain is still drier than usual and needs rain - Some

relief to dryness in the North China Plain is expected this week as sporadic showers and then as a more significant rain “possibly” next week - India’s

Monsoon will continue underperforming for at least another week, although rainfall is expected to expand northward next week and intensify slightly - U.S.

ridge building advertised this weekend and next week will be closely monitored over the central states, but initially the feature will be a benefit to North America weather rather than a threat - Interior

southern Alberta, Canada received some very important rainfall during the weekend and more will occur into Tuesday with some expansion into southwestern Saskatchewan possible - Drought

will continue in east-central Alberta and west-central Saskatchewan for an extended period of time, although rain chances may improve next week

- Eastern

Canada Prairies will continue drying down for a few more days - West

Texas crop areas will be hotter and drier in this coming week - GFS

model run suggests too much rain after day 11 - Western

Argentina stays dry next ten days - Temporary

relief to dryness expected in western and southern Mato Grosso that might benefit some cotton production areas, but the moisture is too late for Safrinha corn

- Southern

Brazil will be a little too wet for a while - Beneficial

rain fell in eastern Australia during the weekend and rain is expected in the west later this week – all of which favors wheat, barley and canola planting - Frost

occurred in eastern Russia’s New Lands during the weekend without doing much harm - Eastern

Russia New Lands may trend a little too wet in the coming ten days

WEATHER

DETAILS

- France

received needed rain during the weekend as did a part of the U.K. and Germany - Local

rain totals in central France ranged from 1.00 to 4.20 inches while most of the precipitation was much lighter varying from 0.10 to 0.72 inch with a few amounts over 1.00 inch - Rainfall

in southern parts of the U.K. and portions of Germany were no more than 0.75 inch - Rain

also fell during the weekend in east-central Europe with rainfall to 0.72 inch and a local total of 1.18 inches

- Dry

biased conditions occurred elsewhere - Additional

waves of rain are expected in Europe over the next ten days to further improve topsoil moisture for better crop development in winter, spring and summer production areas - Rainfall

over the next ten days will vary from 0.50 to 2.00 inches with a few amounts of 2.00 to 3.00 inches

- Spain

and Portugal will be left mostly dry along with parts of central Italy and rainfall in the lower Danube River Basin will be less than 0.50 inch - Europe

temperatures will be near to above normal during the next two weeks with readings furthest above normal next week - Europe’s

bottom line is one of improvement with many of the areas that have been driest in recent weeks getting enough rain for a timely boost in precipitation - Developing

Tropical Storm Alex brought heavy rain to southern Florida Friday into Saturday where rainfall varied from 2.00 to more than 8.00 inches, but damage to citrus and sugarcane was not suspected - The

Everglades and urban coastal areas were wettest - Tropical

Storm Alex is passing north of Bermuda today and will move northeasterly while losing tropical characteristics the next couple of days - The

storm poses no threat to land through the balance of its lifetime - Eastern

U.S. Midwest, Delta and southeastern states were dry during the weekend favoring fieldwork and crop development - Some

rain fell in the western Corn Belt and in a few Great Lakes region locations with some moderate to heavy rain Sunday from central Iowa to southeastern Wisconsin - Rainfall

varied from 1.00 to 3.35 inches with central Iowa wettest - Temperatures

were seasonable with highs in the 70s in the far north, 80s in the central and interior south while some 90-degree Fahrenheit highs occurred in the southernmost United States - U.S.

weather in major crop areas over the next ten days will bring periods of rain and sunshine supporting normal crop development and fieldwork - Hard

red winter wheat areas will continue to get periodic rainfall which may be good for reproducing and filling crops, but will slow maturation rates in early maturing crops in the south - West

Texas rainfall is expected to be limited over the next ten days, although not completely absent - Rain

will fall in the Texas Panhandle more often than that in West Texas cotton, sorghum and corn areas - Net

drying is expected in West Texas and that may return some crop moisture stress over time - U.S.

Delta and southeastern states will see a favorable mix of rain and sunshine during the next two weeks - Temperatures

will be cooler than usual in this first week of the outlook in the Midwest, but the second week temperature outlook will be near to above normal

- Warming

is expected in the northern Plains next week and that will help improve crop and field conditions - U.S.

lower Midwest, southern Plains, Delta and southeastern states will trend drier next week while timely rain occurs to the north due to a high pressure ridge - U.S.

high pressure ridge advertised for next week will be a progressive ridge initially and will be of low amplitude providing rain for the northern Plains and northern Midwest while the southern Plains, Delta and lower Midwest dry down after day ten

- The

pattern hints of negative PDO pattern which is expected during the heart of summer and could bring drier biased conditions to the central U.S. while more rain falls in Canada’s Prairies - Canada’s

Prairies weather early this week will be drier than usual in the central and eastern Prairies and a little wetter than usual in interior southern and far western Alberta - Temperatures

will be near normal - Next

week’s temperatures will be near to above normal, and rainfall will be greater than usual in Alberta and below average in many other areas to the east

- Canada’s

Prairies may trend wetter next week - Mexico

rainfall this week will be a little greater than usual in the interior west-central and northwest parts of the nation and close to normal in the far south while below average elsewhere - Next

week’s weather will trend wetter in the east and south while continuing periodically in the interior west-central and northwest - Argentina

dry weather is expected to continue through the next ten days after prevailing during the weekend - Concern

over wheat planting and establishment will continue to rise over westernmost parts of the nation

- Temperatures

will be seasonable with a slight warmer bias in the southwest and a slight cooler bias in the northeast - Brazil

rainfall Wednesday into Friday will benefit western and southern Mato Grosso, Mato Grosso do Sul, and a few neighboring areas in northern Parana, Sao Paulo and southwestern Minas Gerais - Rain

totals of 0.75 to 2.00 inches will result benefiting Safrinha cotton and a few other late season crops, but Safrinha corn will not benefit because of the lateness of the season - Net

drying will occur farther to the north - Greater

rain will impact far southern Brazil through Tuesday resulting in 2.00 to 5.00 inches of rain from northeastern Argentina through southwestern Paraguay and northern Rio Grande do Sul, Brazil to Santa Catarina and southernmost Parana

- Local

flooding is possible - Long

term late season crops will benefit from the moisture as will winter wheat - South

Africa was mostly dry during the weekend, and it will continue that way through the coming weekend resulting in good crop maturation and harvest progress - Some

winter crop planting will advance favorably as well - Rain

is expected in southwestern South Africa next week to bolster topsoil moisture for wheat, barley and canola Planting - Western

Australia will get some welcome rain later this week to improve planting and germination conditions for wheat, barley and canola - Other

areas in Australia will receive some infrequent light rainfall, but South Australia will need a big dose of rain soon to improve soil moisture for winter crop planting and establishment - Eastern

Australia received rain during the weekend and that helped improve planting moisture for wheat, barley and canola - Rainfall

varied from 0.25 to 0.92 inch in Queensland and northeastern New South Wales while varying up to 0.60 inch in Victoria, southeastern South Australia and a few southern New South Wales locations - China

weekend precipitation was limited in Shanxi, southern Hebei, Shandong and immediate neighboring areas

- Rain

fell in the interior northeast with Jilin and eastern Liaoning reporting 1.00 to 2.50 inches with local totals of 3.00 to more than 6.00 inches resulting in local flooding - Most

of northeastern China has abundant to excessive topsoil moisture - Heavy

rain occurred again in the Yangtze River Basin and areas southwest into Guizhou and Guangxi

- Rainfall

varied from 2.00 to more than 7.00 inches with a few areas getting 7.00 to more than 12.00 inches - One

location in Hunan reported 19.09 inches - Flooding

resulted in a part of the region and drier weather is still needed to improve crop and field conditions after recent excessive rainfall - China

weekend temperatures were quite warm in the dry region of the North China Plain with highs in the 90s Fahrenheit

- Highs

elsewhere in the nation were in the 80s and lower 90s with a few 70s in the far northeast - Northern

China rain late this week and into early next week will be greatest from Hebei and Liaoning to Heilongjiang - Sufficient

rainfall is expected to raise topsoil moisture which may improve early season summer crop development in the previously driest areas

- Showers

from the central Yellow River Basin to Jiangsu, southern Shandong may be a little light over the next ten days - Temporary

improvements in crop and field conditions are expected, but greater rain will still be needed - Far

southern China will continue to experience waves of rain for the next two weeks resulting in some ongoing flooding from Yunnan through Guizhou and Guangxi to Guangdong and Fujian - Rain

totals in this first week will vary from 2.00 to more than 10.00 inch - Rain

totals in the second week may also vary from 2.00 to more than 10.00 inches - The

bottom line in China includes a strong need for drying in the far south and in portions of the northeast while greater rain will soon be needed in central parts of eastern China - Xinjiang,

China weather recently has been a little stagnant including below normal rainfall except in the mountains of the north and west where rainfall has been near to above normal - Temperatures

have been warmer than usual by 2-4 degrees Celsius throughout the province in the most recent 30 days ending June 4.

- Xinjiang,

China weather is not likely to change much from that noted above in the coming two weeks

- Western

and northern Russia, Belarus and the Baltic States along with some areas in western Ukraine will see alternating periods of rain and sunshine during the next two weeks supporting most crop needs

- Portions

of Ukraine and Russia’s Southern Region will dry down over the next two weeks, although completely dry weather is unlikely - The

drying trend will firm up the soil and raise the need for precipitation later this month - The

bottom line for the CIS remains good for crops in western and northern Russia, Belarus and the Baltic States where rain will fall often enough to maintain a good outlook for crop and field conditions. Some areas in the New Lands may become too wet resulting

in delays to fieldwork and possible sluggish crop development. Rain totals in the New Lands may vary from 2.00 to 4.00 inches. In contrast Ukraine, Russia’s Southern Region and some Kazakhstan locations will experience net drying which may lead to crop moisture

stress later this summer without greater timeliness in rainfall. - All

of Southeast Asia will get rain at one time or another over the next couple of weeks. - The

precipitation will be good for most crop needs; however, it will be heavy along the Myanmar lower coast and in parts of both Laos and Vietnam into Cambodia - Northwestern

Luzon Island, Philippines and Taiwan will also be wet - Southern

Thailand may not be included in the heavier rainfall that other Southeast Asia nations will experience for a while, but scattered showers and thunderstorms are still expected - West-central

Africa rainfall during the next ten days will be favorable for coffee, cocoa, sugarcane, rice and cotton

- East-central

Africa rainfall will be most significant in Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania’s Pare region dries down seasonably - North

Africa rainfall will be limited in the next two weeks, although some rain is expected very lightly - Most

wheat and barley in the region is maturing and being harvested keeping the need for rain very low - Most

of the rain expected will be limited and should not adversely impact crop conditions or field progress - Far

western and southeastern Turkey crop areas will be dry during the next ten days while rain falls in many other areas in the nation; all other areas in the Middle East will be dry biased - A

boost in rain is needed in many Middle East crop areas, but this is the beginning of the dry season

- This

year’s wheat production was suspected of being less than usual in Iraq, Syria, Jordon and other areas to the south

- Water

supply may be less than usual this season in parts of the Middle East, although Turkey and Iran should be in relatively good shape - Central

America will see periodic rain in the coming ten days with some of it to heavy at times

- Today’s

Southern Oscillation Index was +18.61 and it will slowly decline over the next few weeks - New

Zealand rainfall will be greater than usual this week and then lighter next week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop planting data for corn, soybeans, wheat and cotton; winter wheat condition and harvesting, 4pm - US

cotton, corn, soybean and spring wheat conditions, 4pm - HOLIDAY:

Germany, South Korea, Malaysia, New Zealand - Malaysia’s

June 1-5 palm oil export data

Tuesday,

June 7:

- EU

weekly grain, oilseed import and export data - Vietnam’s

customs department releases May export data for coffee, rice and rubber - Russian

Grain Union’s International Grain Round conference, Gelendzhik, Russia, day 1 - International

Grains Council conference, day 1 - Global

Food Summit in Munich, day 1 - Purdue

Agriculture Sentiment - Abares

agricultural commodities outlook - New

Zealand Commodity Price - New

Zealand global dairy trade auction - France

agriculture ministry releases crop estimates

Wednesday,

June 8:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Brazil’s

Conab releases data on area, yield and output of corn and soybeans - Russian

Grain Union’s International Grain Round conference, Gelendzhik, Russia, day 2 - International

Grains Council conference, day 2 - Global

Food Summit in Munich, day 2 - France

AgriMer monthly grain outlook

Thursday,

June 9:

- China’s

first batch of May trade data, including soybeans, edible oils, rubber and meat imports - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Ecosperity

sustainability conference, Singapore - Russian

Grain Union’s International Grain Round conference, Gelendzhik, Russia, day 3

Friday,

June 10:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - Malaysian

Palm Oil Board’s data for May output, exports and stockpiles - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

June 1-10 palm oil export data - Brazil’s

Unica may release cane crush and sugar output data (tentative)

Source:

Bloomberg and FI

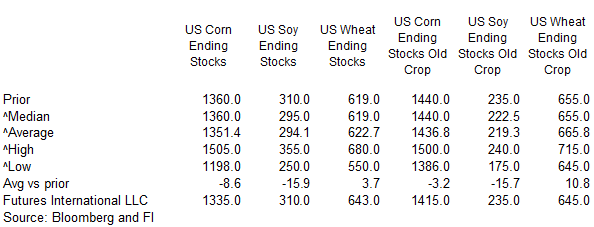

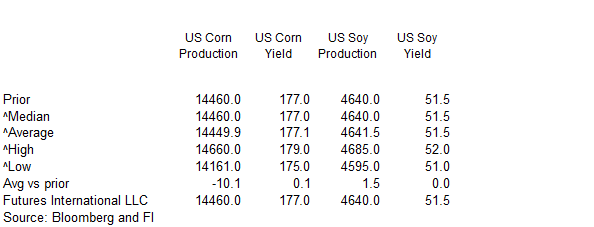

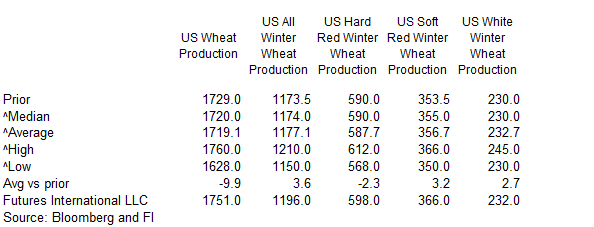

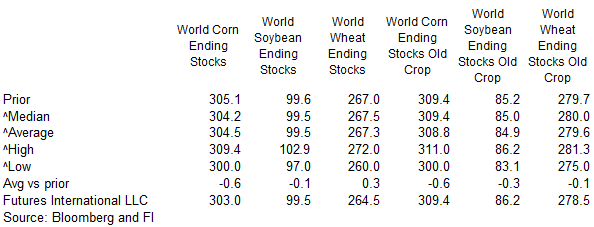

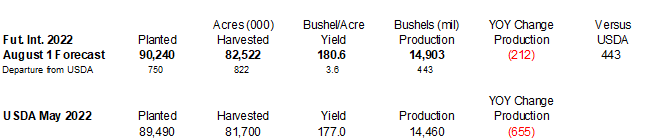

USDA

S&D estimates

Due

out June 8

USDA

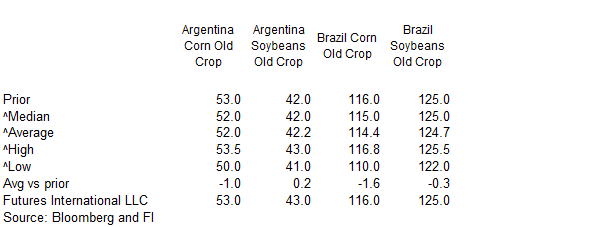

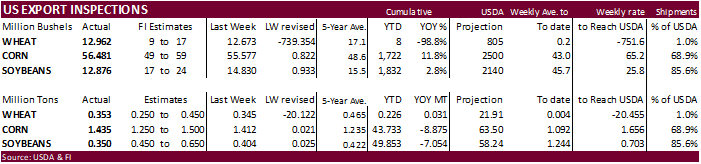

inspections versus Reuters trade range

Wheat

352,779 versus 300000-500000 range

Corn

1,434,683 versus 1175000-1500000 range

Soybeans

350,416 versus 400000-600000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUN 02, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 06/02/2022 05/26/2022 06/03/2021 TO DATE TO DATE

BARLEY

0 73 0 0 0

CORN

1,434,683 1,411,734 1,426,845 43,733,073 52,608,324

FLAXSEED

0 0 0 0 0

MIXED

0 0 0 0 0

OATS

0 0 0 0 0

RYE

0 0 0 0 0

SORGHUM

207,953 144,690 65,550 6,328,772 6,271,629

SOYBEANS

350,416 403,617 239,384 49,852,901 56,907,092

SUNFLOWER

0 0 0 2,260 240

WHEAT

352,779 344,907 531,921 225,845 194,485

Total

2,345,831 2,305,021 2,263,700 100,142,851 115,981,770

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

Biden

Waives Solar Panel Tariffs, Seeks To Boost Production – AP

Nat

gas rallied a good amount today on supply fears.

98

Counterparties Take $2.040 Tln At Fed Reverse Repo Op (prev $2.031 Tln, 101 Bids)

·

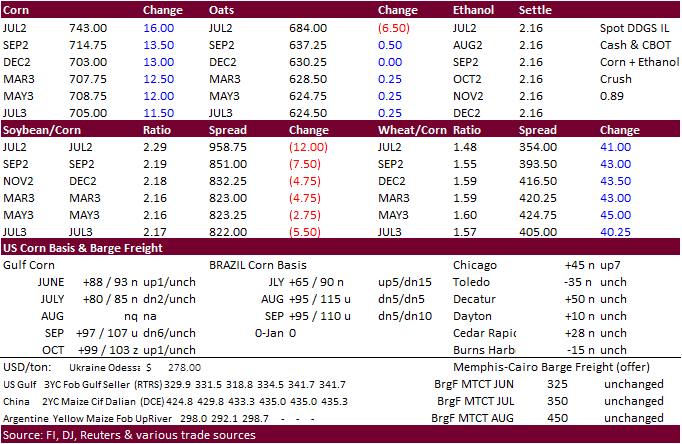

US corn futures were sharply higher following wheat over renewed Black Sea shipping concerns. News was light and today seemed to be headline driven. Corn futures were down the last four sessions. Inspections came in near the high

end of expectations. Funds bought an estimated net 13,000 corn contracts.

·

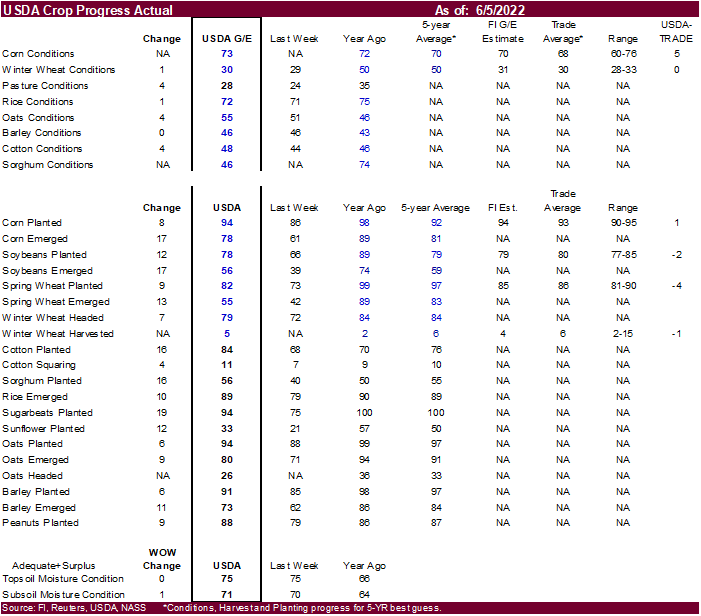

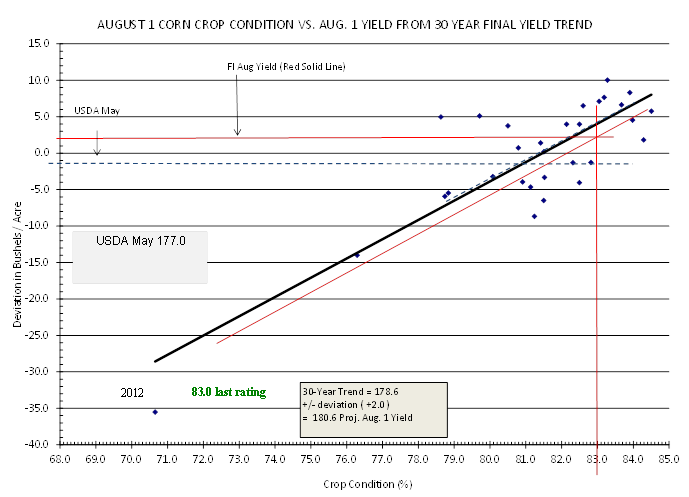

Initial US corn conditions were reported at 73 percent good/excellent, 5 points above a Reuters trade estimate of 68 percent, and compares to 72 percent year ago and 70 average.

·

Our initial estimate for the US corn yield is 180.6 bushels per acre, up from our previous working estimate of 173.6.

·

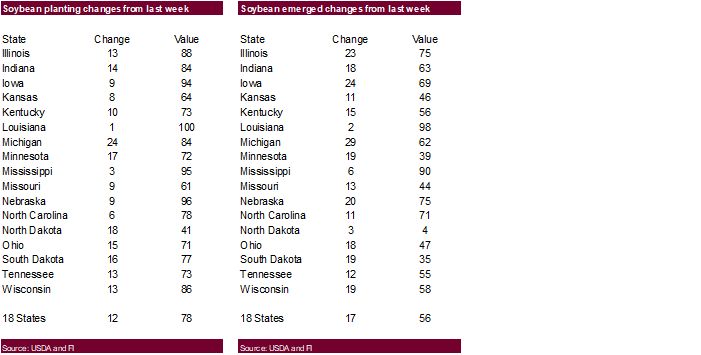

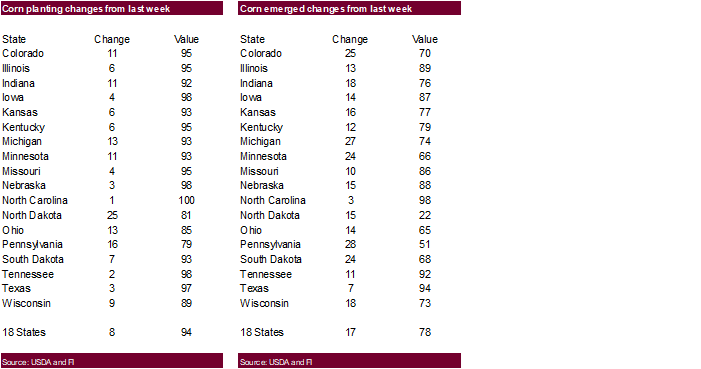

US corn planting progress was reported at 94 percent complete, up from 86 percent last week and compares to 98 percent year ago and 92 percent average. The trade was looking for 93 percent. ND and MN advanced nicely.

·

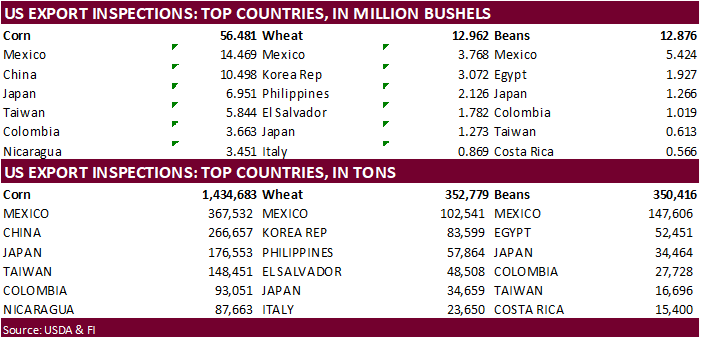

USDA US corn export inspections as of June 02, 2022, were 1,434,683 tons, within a range of trade expectations, above 1,411,734 tons previous week and compares to 1,426,845 tons year ago. Major countries included Mexico for 367,532

tons, China for 266,657 tons, and Japan for 176,553 tons.

·

Weekend weather was very good for much of North America.

·

Corn basis at a couple midwestern plants were mixed. Union City was up 25 to 45 over the July and Annawan, IL was down 10 to 25 over.

·

Janet Yellen will talk on Tuesday regarding the US 2023 budget. Separately, US farm bill and Ag Subcommittee hearings will take place this week. Climate and food assistance will be in focus.

·

The USD was 29 points higher at of 1:43 pm CT.

·

None reported

Updated

6/1/22

July

corn is seen in a $6.75 and $8.00 range

December

corn is seen in a wide $5.50-$8.00 range