PDF Attached

FI crop progress tables will be related Tuesday as I am out of the office.

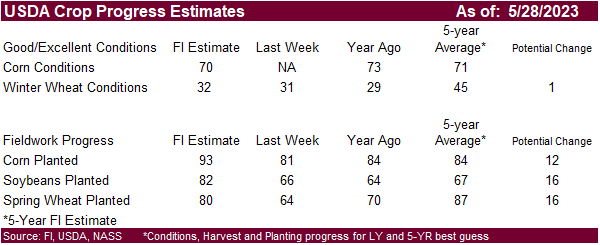

US corn planting 92% (exp 92%) 84% 5yr avg

US corn 69% G/E (exp 71%) 73% yr ago

US soybean planting 83% (exp 82%) 65% 5yr avg

US spring wheat planting 85% (exp 82%) 86% 5yr avg

US winter wheat 34% G/E (exp 32% G/E) 29% yr ago

Calls:

Corn unchanged to 2c higher

Wheat down 1-4c

KC/Minn unchanged to down 3c

Soybeans unchanged to down 3c

Liquidations

was noted across the board on the improved weather outlook adding more rain and the “hot and dry” talk pushed to the last half of June. We are still early in the crop cycle to get the market to have a sustained rally on weather. US HRW wheat areas saw rain

over the weekend, but drought conditions are not expected to improve much.

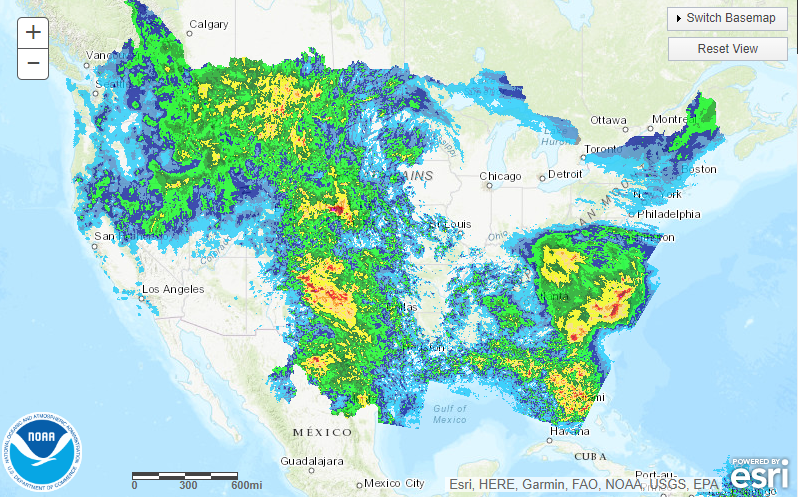

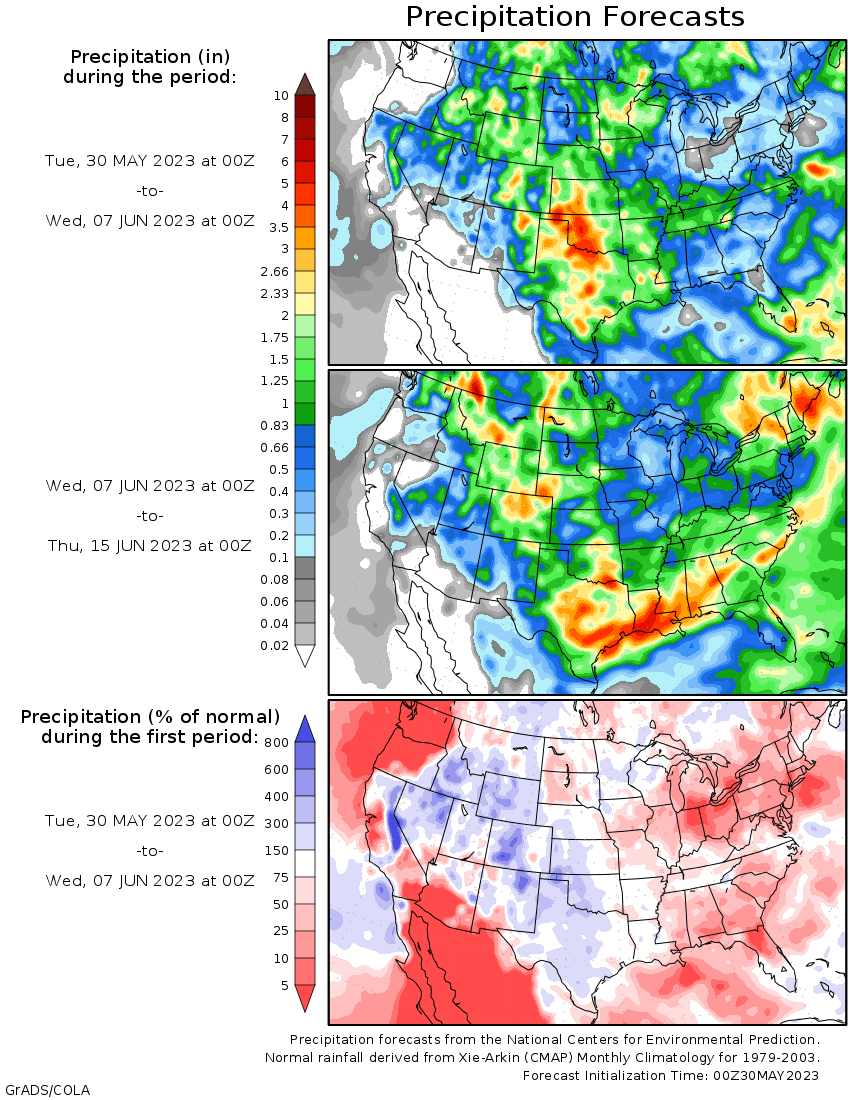

Weather

Last

seven days

Next

seven days

WEATHER

TO WATCH

-

The

heart of the U.S. Midwest will be dry and warm biased into early next week -

Rain

is expected late next week and into the following weekend with some cooling as well -

The

event will be very important in determining the longer range outlook for the region – if rainfall is limited there may be reason for more market worry -

World

Weather, Inc. is still expecting cool weather in late June over the Midwest and if that occurs after the short term break from dry and warm weather next week there may not be much reason for huge market excitement -

Rainfall

next week will be very important – early indications suggest it will be timely, but still lighter than usual offering some short term relief from drying, but more rain will be needed -

Abundant

moisture falling in the U.S. Plains and periodic rain in Canada’s central Prairies will leave the potential for a strong ridge of high pressure to develop rather low for a while -

Sufficient

moisture is going into the ground to provide feedback moisture keeping any ridge building weak for a while -

West

Texas rainfall has become frequent and significant enough to restrict planting progress in some grain and cotton production areas -

Drier

weather is needed -

Some

dryland production areas of West Texas still need greater rain -

Additional

showers and thunderstorms over the next ten days will maintain a wetter biased environment, although the dryland areas of the southwest will have need for more moisture -

Latest

Pacific Ocean surface water temperature data shows more weakening in the negative PDO -

Notable

warming has been occurring in the past couple of weeks off the west coast of North America while cooling is occurring south of the Aleutian Islands -

Both

suggest a steady reduction in the intensity of negative PDO, although the event is still significant enough to impact North America weather for several more weeks -

Today’s

Southern Oscillation Index was -14.79 and it should move erratically this week -

El

Nino continues to evolve -

Latest

ocean temperature data shows a slower progress of warming, but the trend is still in place and an El Nino event is likely to be declared in place next month -

Please

be sure to recall that El Nino’s influence will first be on the tropics and it will take a few weeks or months for a mid-latitude influence to begin -

U.S.

Midwest rainfall is expected to be limited over the coming week, although a few showers will pop up periodically -

A

cool front expected next week will bring some cooling and a little increase in rainfall coverage and amounts, but the Gulf of Mexico is still not open as a good moisture source for the Midwest or Delta this week -

Temperatures

will be warm, but not excessively hot -

Rainfall

this week (ending Sunday) will be too light to counter evaporation in the central and eastern Midwest while 0.20 to 0.75 inch occurs in the western Corn Belt with a few amounts of 0.75 to 1.50 inches

-

Portions

of Nebraska to Minnesota and eastern North Dakota will be wettest -

U.S.

Delta and southeastern states will experience restricted rainfall through the next ten days

-

U.S.

Great Plains precipitation will occur relatively often through the next ten days as atmospheric instability remains setting off isolated to scattered showers and thunderstorms relatively often through mid-week next week -

Rain

totals of 0.30 to 1.00 inch and local totals of 1.00 to 2.00 inches are expected with some potential for locally more -

Amounts

will vary greatly, though Montana and areas from Nebraska into western Texas will be wettest

-

Washington,

Oregon and California rainfall will be restricted during the next ten days while showers in Idaho Wyoming and neighboring areas benefits dry bean and sugarbeet development -

U.S.

weather Friday through Monday included dry and seasonably warm temperatures across the Midwest and a majority of the Delta -

Rain

and very cool temperatures occurred in the Carolinas, eastern Kentucky and Virginia where highs were limited to the 50s and 60s early in the weekend before warming to the lower 70s Sunday and a little warmer Monday

-

Rainfall

of 1.00 to nearly 3.00 inches resulted across the Carolinas and eastern Georgia while up to 0.50 inch occurred in central and eastern Virginia -

The

remainder of the southeastern states were dry -

Jackson,

TN reported 1.41 inches of rain from a lone thunderstorm complex that occurred Saturday evening; otherwise the Delta received very little rain and experienced net drying -

A

very intense thunderstorms complex that was slow to move or to dissipate occurred at McCook Nebraska where more than six inches of rain fell, but that was an anomaly and not representative of weather in the region during the weekend -

Thunderstorms

occurred across much of West Texas and the Texas Panhandle as well as neighboring areas during the weekend with rainfall of 0.50 to 2.00 inches resulting -

The

greatest rain fell near and east of a line from Lubbock to Plainview, Texas where several countries received at least some rain of 1.00 to more than 2.00 inches of rain -

Rainfall

in the western High Plains of West Texas varied from 0.25 to 0.75 inch with local totals to 1.50 inches

-

Kansas

rainfall was restricted once again with very little moisture occurring in the driest areas of the state -

Rain

was widespread from northeastern Colorado and north-central and northwestern Kansas through western Nebraska to Montana and the western Dakotas with 0.30 to 1.00 inch of rain common and local totals of 1.00 to 2.00 inches

-

Limited

rainfall occurred from the U.S. Pacific Northwest through California to the southwestern desert areas

-

Canada’s

Prairies will get scattered showers and thunderstorms this week, but Alberta’s drought region is not likely to be impacted by much rain leaving the region quite dry -

Rainfall

outside of east-central and southern Alberta will be erratic and light until late this week and during the weekend when a boost in rain is expected in Saskatchewan and parts of Manitoba -

Another

cool front pushing through the eastern Prairies next week will stimulate a few more showers and thunderstorms -

Ontario

and Quebec, Canada wheat, corn and soybean areas will experience much warmer temperatures and limited rainfall over the next ten days -

The

change will be welcome for a while after a cool and sometimes wet spring -

Some

timely rain and cooling will be needed and should occur late next week -

Europe

weather will continue drier than usual in the north and Baltic Sea regions for another ten days raising concern over crop and field conditions, although not much heat is expected -

Northern

Europe has been drier than usual for an extended period already and the ground is beginning to firm up – rain will be needed soon -

Southern

Europe is plenty wet and will likely remain that way for a while -

Spain

continues to receive frequent rain along with southern France, Italy and the western Balkan Countries -

North

Africa received rain Friday through Monday and more will fall periodically through the next week to ten days -

The

rain comes late in the growing season and may be threatening durum wheat quality in Morocco and northwestern Algeria while crop areas to the east may have benefited from recent rain.

-

Russia’s

New Lands continued to dry down during the weekend with limited rainfall and high temperatures in the 80s Fahrenheit -

Slowly

increasing potentials for rain are expected in this coming ten days, though the rain distribution will not be even leaving areas of needed rain -

China

reported excessive rain between the Yellow and Yangtze Rivers during the weekend

-

Several

locations in the Yangtze River Basin reported 15.00 to more than 22.00 inches of rain during the past four days -

Much

of the rain reported in east-central China varied from 4.00 to 8.00 inches

-

Wettest

north of the Yangtze River through the Yellow River Valley -

Fieldwork

was delayed, but the moisture should prove to be good for summer crop development in areas that were not flooded -

Wheat

areas need to dry down to protect grain quality -

Xinjiang,

China temperatures continued cooler than usual during the weekend with highest readings in the 60s and 70s in the northeast and in the 70s and lower 80s in the west -

Lowest

morning temperatures were in the upper 40s and 50s in the northeast and the 50s in other areas -

Xinjiang,

China will continue cooler than usual -

Degree

day accumulations are well below normal and cotton, corn and other crops are not developing normally -

Warming

is needed -

The

next ten days will continue cooler than usual -

India

was wetter than usual during the weekend in northern parts of the nation -

The

moisture was good for a few early season crops; including cotton -

A

cooler than usual and wetter than usual bias will remain in northern India for the next ten days -

India’s

monsoonal precipitation will be well below normal during the first half of June in southern and eastern portions of the nation -

Thailand,

Cambodia and Laos rainfall in this coming week will be lighter than usual -

Some

beneficial rain fell during the weekend -

Typhoon

Mawar was located 238 miles northeast of Luzon Island, Philippines at 1400 GMT today and 352 miles southeast of Taipei, Taiwan

-

Peak

wind speeds were reaching 103 mph and gusting to 127 mph -

The

storm was expected to turn to the northeast this week resulting in the storm’s passage across the Ryukyu Islands of Japan during mid- to late-week while continuing to weaken -

Mawar

should weaken sufficiently to have a low impact on the minor islands of Japan outside of heavy rain, moderately strong wind speeds and rough seas -

Taiwan

and Luzon Island, Philippines are not likely to be impacted by the storm -

Australia

rainfall during the weekend was greatest in Victoria, southeastern South Australia and southern New South Wales benefiting topsoil moisture and better winter crop establishment -

Australia

weather during the next ten days should be unsettled enough to produce rain in some of the more important winter crop areas to help get winter crops better established -

Resulting

rainfall will be light, though, leaving need for much more away from the coast

-

South

Africa rainfall in this coming week will be sufficient to support good wheat, barley and canola emergence and establishment -

Some

summer crop harvest delays are likely and some interruption to late season winter crop planting is also expected -

The

moisture will help winter crops become better established -

Argentina

rainfall will be restricted in this next ten days, but last week’s rain has soil moisture looking very good for planting from Santa Fe and Entre Rios into central and eastern Buenos Aires -

Western

Buenos Aires and Cordoba still have a big need for rain and they may have to wait for a while -

Brazil

weekend rain in Mato Grosso do Sul, Parana and immediate neighboring areas was good for Safrinha crops – especially those planted so very late -

The

moisture was also good for wheat establishment -

Additional

mid-week rain is expected from Mato Grosso to Sao Paulo and Parana bolstering soil moisture for assurance that late planted crops will finish without a serious moisture shortage threatening production -

Brazil

sugarcane, citrus and coffee harvest delays are expected briefly this week due to rain, but drier weather will be quick enough to resume to prevent any negative impact -

Central

America rainfall is expected frequently over the next ten days supporting improved soil moisture and some better runoff after a slow start to the rainy season -

Mexico

rainfall will be confined to the far east and extreme south this week while other areas are dry biased -

The

rain will be welcome, but greater amounts will soon be needed in the central and western parts of the nation -

Indonesia

and Malaysia rain frequency and intensity has been and is expected to continue better than advertised last week -

The

pattern will perpetuate favorable crop conditions from rice and sugarcane to oil palm, coconut and rubber development -

Philippines

rainfall will remain well mixed with sunshine over the next ten days -

West-central

Africa will continue to receive periodic rainfall over the next two weeks and that will prove favorable for main season coffee, cocoa and sugarcane -

Some

cotton areas would benefit from greater rain, though the precipitation that has occurred has been welcome -

East-central

Africa rainfall has been favorable for coffee, cocoa and other crops in recent weeks with little change likely -

Central

Asia cotton and other crop weather has been relatively good this year with adequate irrigation water and some timely rainfall reported -

The

favorable environment will continue

Source:

World Weather, INC.

Tuesday,

May 30:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

planting data for corn, cotton, spring wheat and soybeans, 4pm - US

cotton and winter wheat condition, 4pm - EU

weekly grain, oilseed import and export data - EARNINGS:

FGV

Wednesday,

May 31:

- US

agricultural prices paid, received - Malaysia’s

May palm oil exports

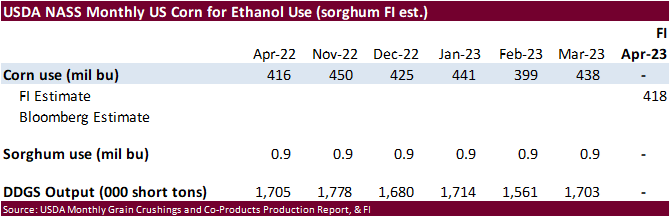

Thursday,

June 1:

- EIA

weekly US ethanol inventories, production, 11am - USDA

soybean crush, corn for ethanol, DDGS production, 3pm - Port

of Rouen data on French grain exports - HOLIDAY:

Indonesia

Friday,

June 2:

- FAO

food price index, monthly grains report - USDA

weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Italy, Indonesia

Source:

Bloomberg and FI

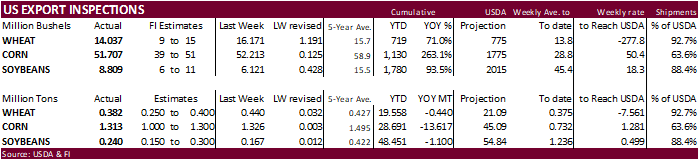

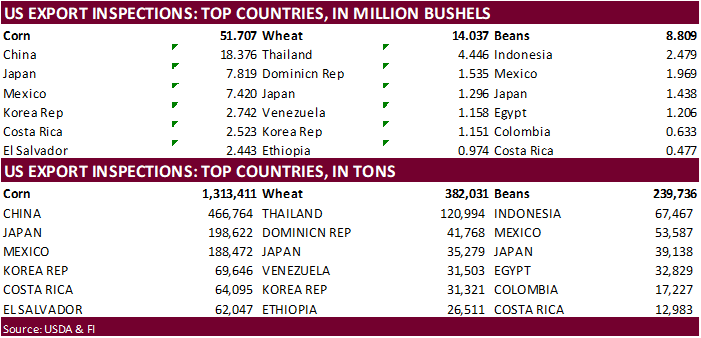

USDA

inspections versus Reuters trade range

Wheat

382,031 versus 200000-600000 range

Corn

1,313,411 versus 600000-1400000 range

Soybeans

239,736 versus 100000-400000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAY 25, 2023

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 05/25/2023 05/18/2023 05/26/2022 TO DATE TO DATE

BARLEY

0 0 73 2,154 10,229

CORN

1,313,411 1,326,281 1,412,248 28,691,303 42,308,082

FLAXSEED

0 0 0 200 324

MIXED

0 0 0 0 0

OATS

0 0 0 6,686 600

RYE

0 0 0 0 0

SORGHUM

33,169 116,048 144,690 1,669,067 6,120,819

SOYBEANS

239,736 166,590 404,350 48,450,848 49,550,493

SUNFLOWER

0 0 0 2,508 2,260

WHEAT

382,031 440,094 344,319 19,557,889 19,997,455

Total

1,968,347 2,049,013 2,305,680 98,380,655 117,990,262

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

Fed

Funds Futures Now Pricing In A 63% Chance Of A Fed Hike In June – Fedwatch

US

FHFA House Price Index (M/M) Mar: 0.6% (est 0.2%; prevR 0.7%)

US

House Price Purchase Index (Q/Q) Q1: 0.5% (prevR 0.2%)

US

S&P CoreLogic CS 20-City (M/M) SA Mar: 0.45% (est 0.00%; prevR -0.07%)

US

S&P CoreLogic CS 20-City (Y/Y) NSA Mar: -1.15% (est -1.70%; prev 0.36%)

US

S&P CoreLogic CS US HPI (Y/Y) NSA Mar: 0.66% (prevR 2.13%)

Canadian

Current Account Balance (CAD) Q1: -6.17B (est -9.50B; prevR -8.05B)

US

Conf. Board Consumer Confidence May: 102.3 (exp 99.0; prevR 103.7)

Conf.

Board Present Situation May: 148.6 (prevR 151.8)

Conf.

Board Expectations May 71.5 (prevR 71.7)

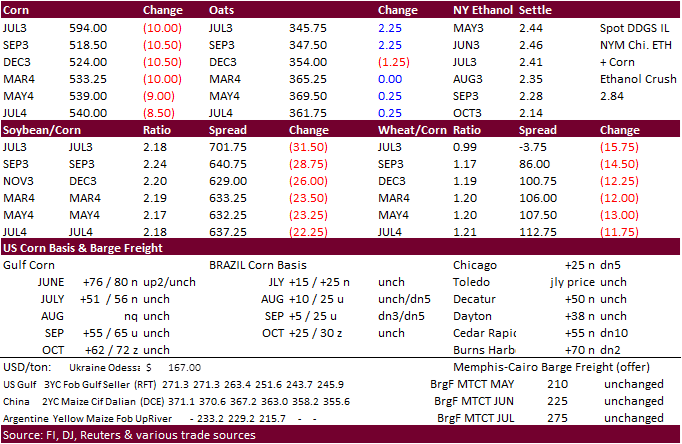

Corn

·

Corn ended lower on a slightly wetter forecast for the first week of June. Hot and dry talk is still in the market for the last half of June, but we are still many weather runs away from that so the market is keeping an eye on

it.

·

Demand worries and month-end selling was also noted. With a debt ceiling deal likely to get done we may see some safe haven commodity risk shift back into equity and interest-rate markets.

·

USDA initial corn conditions came in at 69% G/E which was below the 71% expected. Most of the miss can be attributed to the low initial rating in PA, MO, and NE. Last year we were at 73% G/E and the 5-year average of 71 percent.

Export

developments.

-

None

reported

July

corn $5.25-$6.25

September

corn $4.25-$5.50

December

corn $4.25-$5.75

·

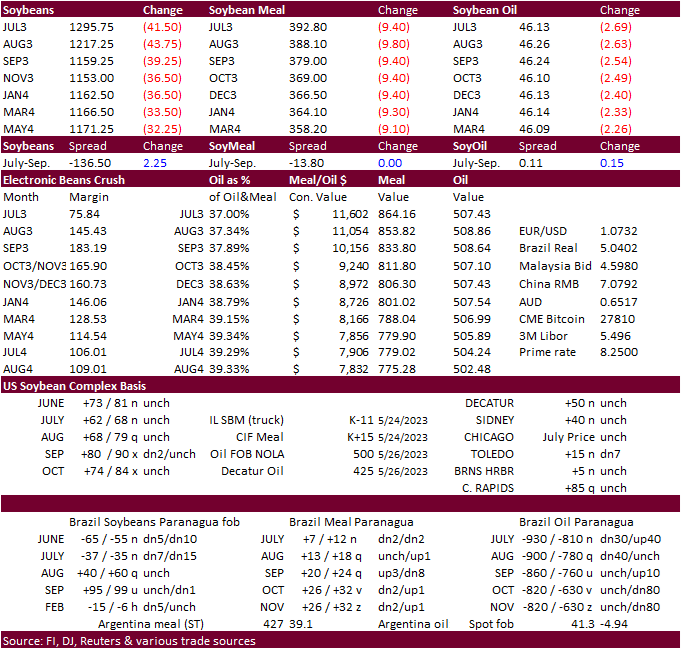

Soybeans finished lower on improving weather, and risk-off and month-end selling as in all ag markets.

·

Soymeal closed down 2.3% while Bean oil fell 5.5%. Crude oil was down 4.3%

·

USDA crop progress showed that 83% of the crop was planted compared to the 65% 5yr average. Next week will get the first look at soybeans crop rating.

·

USDA US soybean export inspections as of May 25, 2023 were 239,736 tons, within a range of trade expectations, above 166,590 tons previous week and compares to 404,350 tons year ago. Major countries included Indonesia for 67,467

tons, Mexico for 53,587 tons, and Japan for 39,138 tons.

Export

Developments

·

Egypt seeks vegetable oils June 1 for July 11-25 arrival.

·

USDA seeks 1,140 tons of packaged vegetable oil on June 6 for July shipment.

Soybeans

– July $12.75-$14.00, November $11.00-$14.50

Soybean

meal – July $370-$450, December $290-$450

Soybean

oil – July 44-50, December 43-53, with bias to upside

Wheat

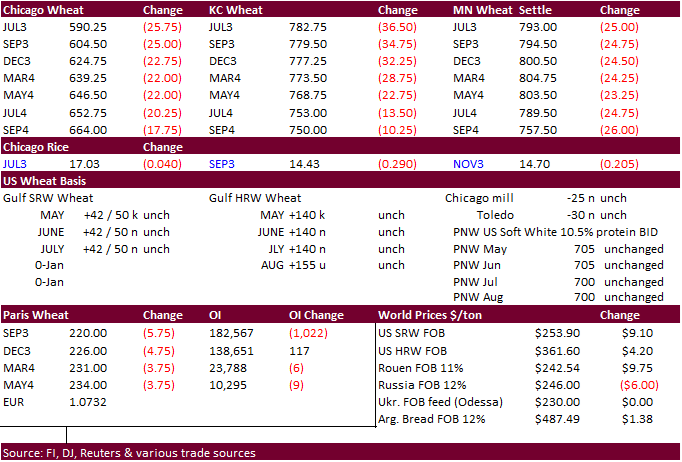

·

Wheat closed lower on demand worries and risk-off selling. Also, wheat futures are lower from improving US HRW wheat weather, ample India wheat supplies, and improving Russian grain summer production prospects.

·

Most traders were ignoring Black Sea headlines. This could become a supportive feature later this week after the funds settle down after month-end.

·

US SRW wheat futures fell below nearby corn futures. This has happened a few times since 2021, but in general rare to see. Also explains expectations for a larger SRW yield relative to USDA’s May projection.

·

The Ukraine/Russia conflict should be monitored as it continues to intensify. Russia and Ukraine traded drone attacks in Kyiv and Moscow.

·

September Paris wheat futures were down 5.75 euros to 220.25 per ton.

·

USDA US all-wheat export inspections as of May 25, 2023 were 382,031 tons, within a range of trade expectations, below 440,094 tons previous week and compares to 344,319 tons year ago. Major countries included Thailand for 120,994

tons, Dominican Rep for 41,768 tons, and Japan for 35,279 tons.

University

of Illinois: An Estimate of Winter Wheat Production

Ibendahl,

G. “An Estimate of Winter Wheat Production.” farmdoc daily (13):97, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 26, 2023.

https://farmdocdaily.illinois.edu/2023/05/an-estimate-of-winter-wheat-production.html

Export

Developments.

Rice/Other

·

Look for US rice and cotton conditions to improve this week.

Chicago Wheat – July $5.50-$6.50

KC – July $7.50-$8.75

MN – July $7.25-$8.75

September – same ranges as July

#non-promo