PDF Attached

USDA

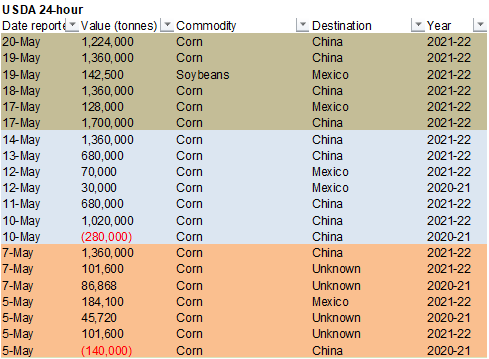

reported 1.224 million tons of corn under the 24-hour sales. Another choppy two-sided trade on lack of direction. For SBO bulls…there is new US legislation to introduce a tax credit for sustainable aviation fuel of up to $2.00 for every gallon produced.

The credit would expire at the end of 2031. https://www.reuters.com/business/sustainable-business/us-lawmakers-propose-tax-credit-sustainable-aviation-fuel-2021-05-20/

Here’s the bill’s direct language: https://schneider.house.gov/sites/schneider.house.gov/files/Sustainable%20Skies%20Act.pdf

FI

acreage adjustments.

We are hearing the US corn area could be 3 to 6 million higher and soybeans recently 4 million higher from March Intentions. However, we are looking for USDA to be a little conservative in their area upward adjustments for June Plantings report, if any.

We raised our current US corn area estimate from 92.5 to 93.5 million (+2.36 from march) and US soybeans from 89.25 to 89.50 million (+1.9 from March) from our May 5th estimate. Attached is our updated US acreage table. Combined corn and soybeans

are expected to end up a record, if realized. Latest estimates are based on SX/CZ 13.75 and 5.75 soybeans and corn.

US

crush.

Post NOPA crush and feedback for this month, we lowered our crop year crush by 3 million bushels to 2.179 billion (USDA @ 2.190 billion) for Sep-Aug (2.183 for Oct-Sep).

NOT

MUCH CHANGE AROUND THE WORLD OVERNIGHT

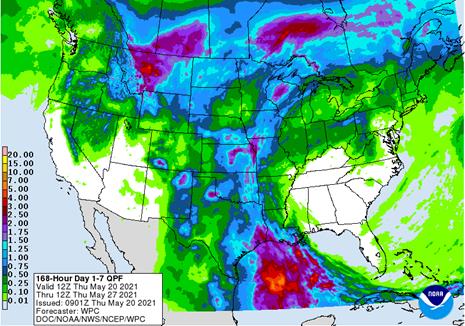

- NWS

30-Day Outlook for United States - Temperatures

will be warmer than usual in June for most of the western and northern United States as well as from Florida to southern New England and New York

- Rainfall

was advertised greater than usual from the Texas coast to Florida and northward to eastern Kansas, Missouri, Illinois, Indiana, southeastern Michigan and New York - Below

average precipitation was suggested for areas from the Pacific Northwest through the northwestern and west-central Plains; including the northwest half of the Texas Panhandle and the northeast half of New Mexico.

- Equal

chances for above, below and near normal precipitation were given to the remainder of the nation; including northern New England the Middle Atlantic Coast region from Virginia to South Carolina, most of California and the southwestern desert region as well

as the upper Midwest and from eastern Nebraska to central Texas. - NWS

90-Day Outlook for United States - Temperatures

will be warmer than usual June through August in all of the nation except Missouri, Illinois, Iowa, Wisconsin, upper Michigan and central and eastern parts of Minnesota where equal chances for above, below and near normal temperatures were suggested - Precipitation

was advertised to be greater than usual in the June through August period in Louisiana, the upper Texas coastal area, southern Mississippi and from much of Alabama and Florida through Virginia, eastern Kentucky and Ohio to New York and New England - Below

average rainfall is advertised for the high Plains region from western Texas to the western Dakotas and westward to Washington, Oregon, Utah and New Mexico. - Equal

chances for above, below and near normal precipitation was advertised in most other areas - Southern

China continues to deal with frequent bouts of excessive rain and flooding

- Some

rice and other crops near and south of the Yangtze River has been too wet - Late

season rapeseed harvesting has likely been negatively impacted, although it is unknown how much of the crop remains to be harvested - Rapeseed

production has been reduced this year because of wet weather in the south, but the losses are not as great as those of last year - Northern

rapeseed production should have been much more successful - Warmer

temperatures in the North China Plain, Yellow River Basin and northeastern provinces over the coming week to ten days will promote greater crop development and faster drying between rain events improving planting rates for many spring and summer crops - Xinjiang,

China will get a new surge of cold air today dropping temperatures Friday and Saturday morning to the frost level in the far northeast. A couple of light freezes are possible, but mostly on the fringe of crop country - Below

average temperatures will occur in many cotton and other crop areas in the province into Saturday before warming back to normal early to mid-week next week - Another

minor bout of cooling is expected in the northeast late next week - Rain

will be limited to the northeast today - Russia’s

New Lands continue to deal with warm to hot temperatures and little to no rain - Daily

highs in the 80s and lower to a few middle 90s have been occurring from the lower Volga River Valley through Kazakhstan and north into southern parts of the Russian New Lands - This

pattern will prevail for another week and then some cooling is expected - A

few showers may pop up randomly over the next couple of days and then a more favorable period for rain may evolve north and west of Kazakhstan in the last days of May and early June - Poor

germination, emergence and establishment of wheat, sunseed and other crops is likely occurring and will continue until rain and cooling evolves - Western

Russia continues plenty moist along with Belarus, the Baltic States and areas south and west into other parts of eastern Europe - Drier

weather is needed and will evolve in the last days of May and early June - Delays

in farming activity and slow crop development is expected for a while - Remnants

of Tropical Cyclone Tauktae spread rain across northern India Wednesday benefiting some early season cotton production areas, but disrupting the harvest of late winter crops - Property

damage from the storm was likely greatest in southern Gujarat as the tropical cyclone moved inland as a Category Three hurricane equivalent storm Monday - Not

much crop has been harmed, although some unharvested winter crops may be negatively impacted - Other

areas in India are seeing mostly good crop weather for this time of year with its winter crop harvest advancing well around shower activity - Not

much change is expected - Australia

is still waiting on greater rainfall to stimulate more aggressive autumn planting of wheat, barley and canola - Fieldwork

has been advancing, though - Canada’s

Prairies and the U.S. Northern Plains are expecting drought easing rain and snowfall today through early next week

- The

northern Plains precipitation is not likely to be as great as that in Canada and relief will occur, but more moisture will be needed - Canada’s

Prairies should receive its moisture in two waves resulting in 0.50 to 1.50 inches of moisture and local totals to nearly 2.00 inches by Wednesday of next week.

- The

first wave of rain and snow will occur today into Saturday from Montana and western North Dakota to Manitoba

- Snowfall

is expected to be heavy from north-central Montana to southwestern Saskatchewan causing stress to livestock and travel delays - A

second wave of rain is expected late Sunday into Wednesday and it will impact many areas from Alberta to Manitoba - Canada’s

Prairies have seen the temperature plummet from 80s and lower 90s early this week to the upper 20s and 30s Fahrenheit this morning

- Crop

stress has resulted, but damage should be minor because of the earliness of the season - The

coldest weather will occur during early to mid-week next week when extreme lows slow into the middle and upper 20s

- Some

crop damage will occur, but many crops are not advanced enough to suffer serious losses - Nevertheless

a few areas may have to replant - U.S.

eastern Midwest and southeastern states will experience a week to ten days of very warm and dry weather as a ridge of high pressure evolves over the region

- Today’s

soil moisture is still favorable in these areas - Net

drying over the coming week will deplete topsoil moisture relatively quickly in the southeastern states raising stress potential for some recently planted crops - Recently

planted crops have short root systems and will suffer from heat and dryness first - Early

planted crops will handle the situation favorably - U.S.

Delta and western Corn Belt weather will be favorably mixed for crop development and fieldwork over the next ten days - U.S.

hard red winter wheat areas have been getting a little too much rain recently and may be leading to a little wet weather disease potential, but most of the crop remains in favorable condition - Dry

and warm weather is needed in the south to expedite filling and maturation - Recent

wet and warm conditions have been great for summer crops that have already been planted, but some delays in additional fieldwork have occurred - West

Texas weather is still not quite as good as desired - Recent

rain has supported a flurry of planting, but rainfall this week has become more sporadic and light again - There

is a risk of showers and thunderstorms frequently into early next week, but the region’s lack of subsoil moisture remains a concern and there will be no general soaking of rain - Texas

Blacklands, Coastal Bend and South Texas will get some periodic rainfall over the next ten days maintaining favorable or improving soil conditions depending on locations

- Some

of the Blacklands are too wet and need to dry down - Oregon

and a few Idaho crop areas may get some beneficial moisture soon, but the Yakima Valley in Washington will continue quite dry - Irrigated

crops are in favorable condition - Dryland

winter crops need moisture and some of that which occurs in Oregon will benefit those dryland crops - Southeast

Canada corn, soybean and wheat production areas are experiencing good crop weather - Mexico

drought remains quite serious, but there is some rain and thunderstorms advertised for southern and eastern parts of the nation during the next two weeks - The

precipitation will be erratic, but beneficial - Some

of these areas have already experienced some dryness easing rain recently - Water

supply is quite low and winter crops in a few areas have not performed well - The

moisture will help improve planting, emergence and establishment conditions for most early season crops in the wetter areas, but the west-central and northwest parts of the nation will continue quite dry.

- South

Africa will be dry and warm biased over the coming two weeks - Southern

Oscillation Index is mostly neutral at +6.97 and the index is expected to move erratically while drifting lower over the coming week - North

Africa rainfall is expected to be erratic and mostly light during the next ten days - Temperatures

will be warmer than usual - Winter

small grains will be rushed toward maturation faster than usual without much moisture - West-central

Africa will see a mix of rain and sunshine through the coming week. - Temperatures

will be near to above average and rainfall will be below average in this coming week

- A

boost in precipitation will be needed later this month to ensure soil moisture stays as good as possible and crop development continues normally - A

boost in rainfall is expected for some areas next week - East-central

Africa rainfall will be erratic over the next two weeks. - Net

drying is expected - Crop

conditions are rated favorably, but greater rain will be needed in late May and June to maintain the best possible crop environment - Southeast

Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks - However,

the mainland areas are reporting below to well below average rainfall recently and a boost in rain is needed in Vietnam’s Central Highlands and neighboring areas

- Thailand

may receive the least rain over the next ten days - Greater

rain is also needed in the northern and western Philippines - Luzon

Island, Philippines will be last to get significant rain - A

developing tropical cyclone will bring heavy rain to Vietnam’s Central Highlands and neighboring areas of Cambodia and Thailand late this weekend into next week - New

Zealand precipitation for the next week to ten days will be sporadic and lighter than usual with many areas to experience net drying - Central

and western Europe weather is expected to include some periodic rainfall and cooler than usual temperatures during the coming week - Spain

and Portugal have been driest and need rain most significantly - Some

rain will fall in a part of the drier region soon

Source:

World Weather, Inc.

Thursday,

May 20:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

customs to release trade data, including country breakdowns for commodities such as soybeans - BMO

Farm to Market Conference, day 2 - Black

Sea Grain conference - Port

of Rouen data on French grain exports - Malaysia

May 1-20 palm oil export data - USDA

total milk, red meat production, 3pm - EARNINGS:

Suedzucker

Friday,

May 21:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Black

Sea Grain conference - U.S.

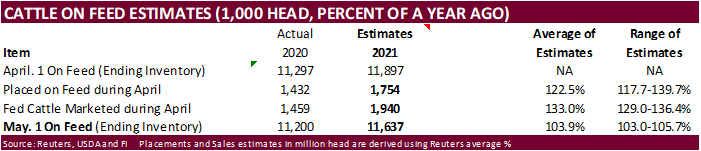

Cattle on Feed, 3pm

Monday,

May 24:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – soybeans, cotton; winter wheat condition, 4pm - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - U.S.

cold storage data — pork, beef, poultry, 3pm - HOLIDAY:

France, Germany, Argentina, Canada

Tuesday,

May 25:

- Monthly

MARS bulletin on crop conditions in Europe - Malaysia

May 1-25 palm oil export data

Wednesday,

May 26:

- EIA

weekly U.S. ethanol inventories, production - Brazil’s

Unica releases cane crush, sugar output data - HOLIDAY:

Malaysia, Indonesia, Singapore, Thailand

Thursday,

May 27:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - Brazil

orange crop forecast for 2021-22

Friday,

May 28:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received

Source:

Bloomberg and FI

U

of I: Anticipating USDA Planted Acreage Revisions for Corn and Soybeans in 2021

Irwin,

S. “Anticipating USDA Planted Acreage Revisions for Corn and Soybeans in 2021.”

farmdoc daily (11):81, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 19, 2021.

US

Philadelphia Fed Business Outlook May 31.5 (est 43.0; prev 50.2)

US

Initial Jobless Claims May 15 444K (est 450K; prevR 478K; prev 473K)

–

US Continuing Claims May 8 3.751M (est 3.640M; prevR 3.640M; prev 3.655M)

US

Philadelphia Fed Business Outlook May – Components

–

Six Month Index 52.7 (prev 66.6)

–

Capex Index 37.4 (prev 36.7)

–

Employment 19.3 (prev 30.8)

–

Capex Prices Paid 76.8 (prev 69.1)

–

Capex New Orders 32.5 (prev 36.0)

Canada

New Housing Price Index Apr 1.9% (prev 1.1%)

US

leading Index (M/M) Apr: 1.6% (est 1.4%; prev 1.3%)

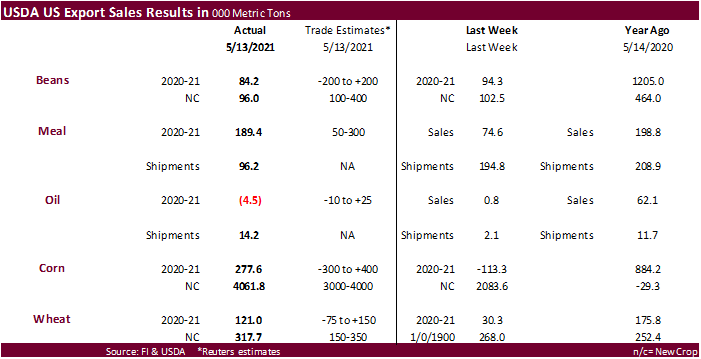

USDA

export sales

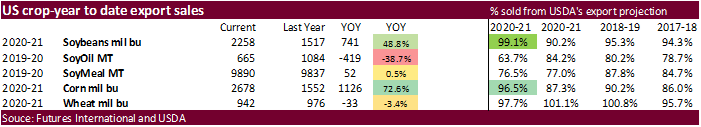

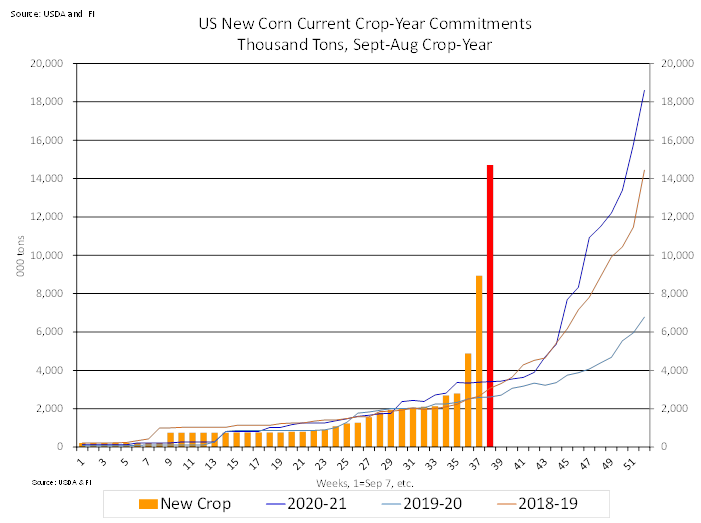

New-crop

corn sales were likely a record for around this time of year at 4,061,800 MT and were primarily for China (3,740,000 MT) and Mexico (199,800 MT). Old crop sales for corn and soybeans continue to wane with corn at 277,600 tons (some looking for net reductions)

and soybeans at 84.2 million tons. Note current crop year weekly corn exports were a marketing year high of 2,239,900 MT. New-crop soybean sales were only 96,000 tons. Soybean meal sales were 189,400 tons and soybean oil sales were a net reduction of 4,500

tons. Old crop wheat sales were good at 121,000 tons as we wind down the year, and new-crop was 317,700 tons, an improvement from the previous week. Beef net export sales were a marketing year high of 56,900 MT with bulk of countries included the Netherlands

(33,700 MT), China (9,200 MT), and Japan (5,900 MT, including decreases of 500 MT). Pork net export sales were 19,000 MT.

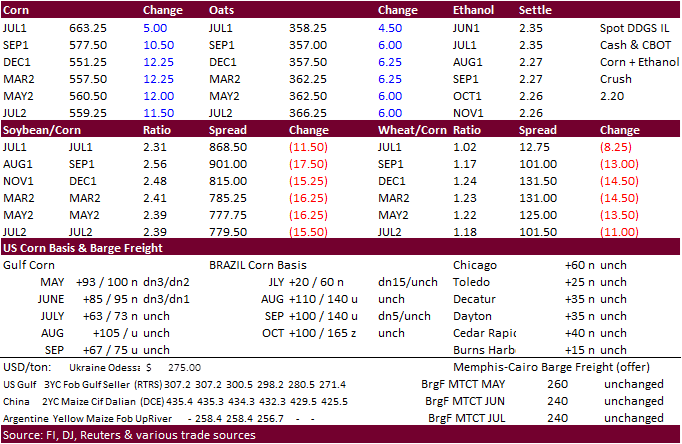

- CBOT

corn closed on a strong note after easing late last week into early this week on ongoing Chinese US corn buying. Concerns over Brazil’s shrinking corn crop and a sharply lower USD (off 42 late) also lent support.

- Funds

bought an estimated 13,000 corn contracts. - China

bought 1.224 million tons of corn (24-hour) after picking up 1.36MMT on Wednesday, 1.36MMT on Tuesday, 1.7MMT on Monday, and 1.36MMT on Friday. So far during the month of May China bought 10.744 million tons of new-crop corn under the 24-hour reporting system.

- Next

week we are looking for new-crop corn export sales to exceed 5.8 million tons after 4.062 million tons were reported this week, bringing new-crop commitments to a record for this time of year. Below is what we think US new-crop corn commitments will look

like next week (+14.7MMT).

- There

are reports the EPA plans to keep US biofuel mandates unchanged for 2021 & 2022 due to the slowdown in fuel demand from COVID-19. 20.09 billion gallons of renewable fuel was mandated for 2020, including 15 billion gallons of conventional biofuels (ethanol

mainly). - If

you burn food, prices will go higher. - On

Wednesday, the US 10th Circuit Court of Appeals vacated three waivers exempting oil refiners from biofuel blending mandates that were granted under the last presidential term (Sinclair Oil Corp refineries).

- U.S.

GENERATED 1.14 BLN ETHANOL (D6) BLENDING CREDITS IN APRIL, VS 1.19 BLN IN MARCH -EPA (Reuters) - BA

Grains Exchange reported Argentina producers harvested 28% of their 2020-21 soybean crop. Production was unchanged at 46MMT.

- Some

Argentina grain export workers went on strike due COVID-19 vaccine issues. The strike may last through Friday. In a later article overnight, it was reported they were threatening to extend it another 48 hours. There is concern seven ships recently loaded

may not be able to set sail if water levels fall across the Parana River. Most grain export operations in Rosario have been affected.

USDA

Attaché on Ukraine Grains

Export

developments.

Updated

5/7/21

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.75-$7.00 range.

- Extremely

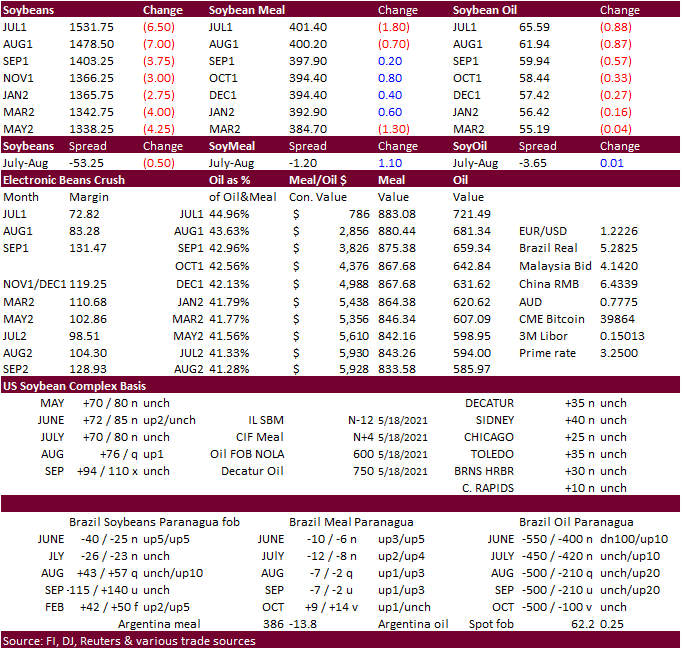

choppy trade in the US CBOT soybean complex was the result of heavy selling at the day session open followed by bottom picking. Soybean oil, down about 200 points early, paired some losses. Higher meal prices eroded from lower trade in soybeans. Some of

the choppy trade could have been associated with lack of direction. Bear spreading, like in corn, was a feature. Palm oil hit a 2-week low overnight, shedding more than 4%. USDA export sales report was viewed dismal for soybeans and ok for the products.

- There

is new US legislation to introduce a tax credit for sustainable aviation fuel of up to $2.00 for every gallon produced. The credit would expire at the end of 2031.

- U.S.

GENERATED 386 MLN BIODIESEL (D4) BLENDING CREDITS IN APRIL, VS 407 MLN IN MARCH -EPA (Reuters) - Funds

sold an estimated net 10,000 soybeans, 2,000 meal and 3,000 soybean oil. - BA

Grains Exchange reported Argentina producers harvested 85% of their 2020-21 soybean crop with an average yield of 2.75/tons per hectare. Production was unchanged at 43MMT.

- There

was some trade chatter China is swapping out old crop soybeans and rolling the purchases to new-crop Q1 crop-year shipment. Note China has very little on the US export sales books for old-crop outstanding sales.

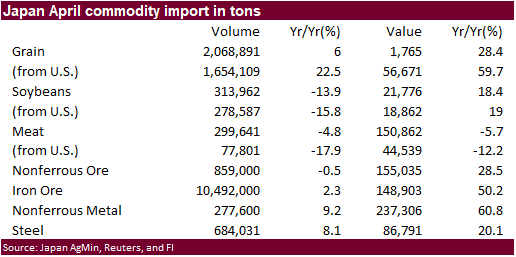

- China’s

soybean imports from Brazil during April were 5.08 million tons, up from only 315,334 tons in March and below 5.939 million tons in year earlier. China bought 2.15 million tons of soybeans from the US in April, up 223% from 665,591 tons a year ago. - ITS

reported Malaysian May 1-20 palm oil exports increased 17.1 percent to 953,474 tons from 813,946 tons shipped during April 1 – 20. AmSpec reported a 16% increase to 953,860 tons.

- South

Korea’s Feed Buying Group (FBG) bought 60,000 tons of optional origin soybean meal from the United States, South America or China, at an estimated $497.99 a ton c&f for arrival around Nov. 10.

Updated

5/19/21

July

soybeans are seen in a $15.00-$16.50; November $12.75-$15.00

Soybean

meal – July $380-$440; December $380-$460

Soybean

oil – July 64-70; December 48-60 cent range

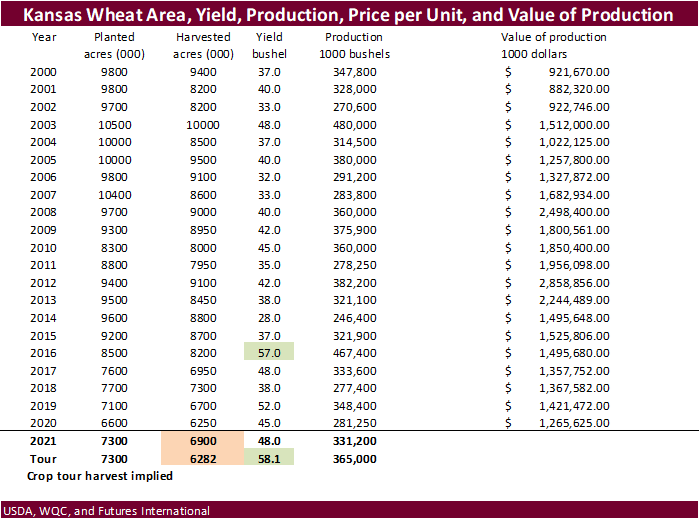

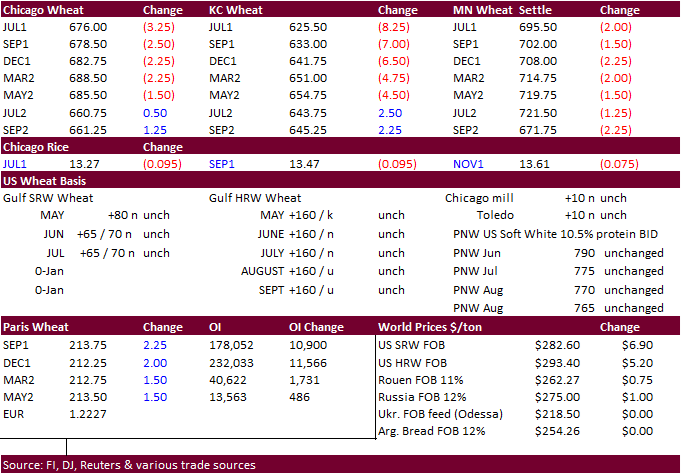

- KC

type wheat was under most pressure between the three benchmark US contracts on good US HRW yield prospects. Chicago and MN traded two-sided but eventually ended lower after fund buying dried.

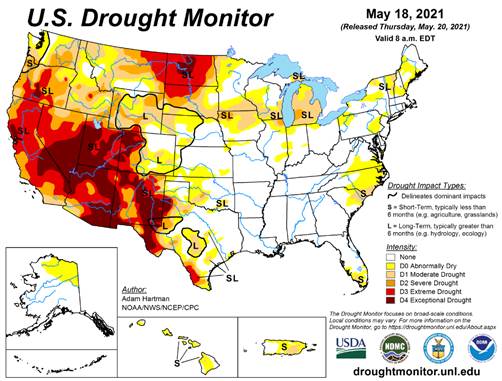

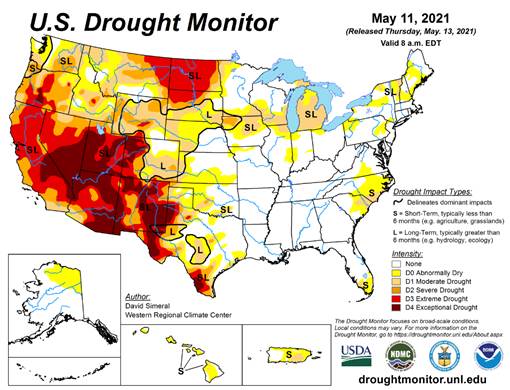

Note

the US drought monitor deteriorated for the upper US Great Plains. On Monday USDA will release initial US spring wheat crop conditions and we think the good/excellent will be report at or below 67 percent, below a 5-year average of 73 (four good years to

start + one poor year). - September

Paris wheat market basis September was up 2.25 euros at 213.75. - Funds

sold an estimated net 3,000 SRW wheat contracts. - Wheat

Quality Council’s annual Kansas tour pegged the KS wheat yield at 58.1 bushels per acre (bpa), a record high for the state if realized (using USDA data), and well above USDA’s working 48 bushels per acre for 2021. Production was pegged at 365 million bushels,

above USDA’s 331.2 million working estimate and 281.3 million in 2020. Using USDA’s planting area, the crop tour’s implied harvested area is very low compared to USDA (tour 86% of planted area versus 95% USDA…86% would be highest abandonment since 2007).

Export

Developments.

- Algeria

bought around 400,000 tons of wheat, up from 300-400k range initially reported on Wed, at an estimated $295/ton c&f.

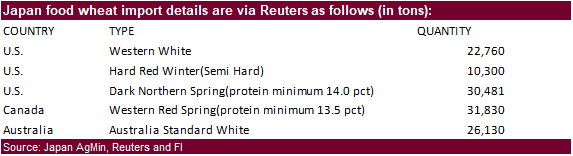

- Japan

bought 121,501 tons of food wheat this week.

- Jordan

seeks 120,000 tons of feed wheat on May 26 for Oct-Nov shipment. - Bangladesh

seeks 50,000 tons of milling wheat on May 30. - USDA

seeks 83,000 tons of hard red winter wheat for Africa on May 25 for July 6-16 shipment.

Rice/Other

·

Mauritius seeks 4,000 tons of rice, optional, origin, for delivery Aug – Sep, on June 1.

·

Results awaited:

South

Korea’s Agro-Fisheries & Food Trade Corp seeks 134,994 tons of rice from Vietnam, China, the United States and Australia, on May 13, for arrival between September 2021 and January 2022.

Updated

5/17/21

July

Chicago wheat is seen in a $6.60-$8.00 range

July

KC wheat is seen in a $6.20-$7.25

July

MN wheat is seen in a $6.75-$7.50

(NA rains are breaking the MN market)

Export Sales

This

summary is based on reports from exporters for the period May 7-May 13, 2021.

Wheat: Net

sales of 121,000 metric tons (MT) for 2020/2021 were up noticeably from the previous week and up 21 percent from the prior 4-week average. Increases primarily for Indonesia (66,500 MT, including 6,500 MT switched from Vietnam), Nigeria (60,100 MT, including

60,000 MT switched from unknown destinations and decreases of 2,300 MT), Mexico (54,500 MT, including decreases of 400 MT), Nicaragua (30,000 MT, switched from unknown destinations), and the Dominican Republic (15,300 MT, including 14,600 MT switched from

unknown destinations), were offset by reductions primarily for unknown destinations (118,900 MT). For 2021/2022, net sales of 317,700 MT were primarily for unknown destinations (123,300 MT), Japan (60,800 MT), Mexico (39,600 MT), the Philippines (33,000 MT),

and Taiwan (30,300 MT). Exports of 568,600 MT were up 9 percent from the previous week and 3 percent from the prior 4-week average. The destinations were primarily to the Philippines (110,900 MT), Nigeria (106,100 MT), China (68,200 MT), South Korea (56,900

MT), and Japan (55,200 MT).

Optional Origin Sales:

For 2020/2021, the current outstanding balance of 63,900 MT is for Spain.

Corn:

Net sales of 277,600 MT for 2020/2021 were down noticeably from the previous week, but up 19 percent from the prior 4-week average. Increases primarily for Mexico (294,100 MT, including 24,000 MT switched from unknown destinations and decreases of 12,600

MT), Japan (65,300 MT, including 7,400 MT switched from unknown destinations and decreases of 4,600 MT), South Korea (64,600 MT, including 68,000 MT switched from unknown destinations and decreases of 3,400 MT), Venezuela (41,500 MT, including 16,500 MT switched

from unknown destinations), and Panama (21,300 MT), were offset by reductions primarily for unknown destinations (195,300 MT). For 2021/2022, net sales of 4,061,800 MT primarily for China (3,740,000 MT) and Mexico (199,800 MT), were offset by reductions for

Nicaragua (31,200 MT). Exports of 2,239,900 MT–a marketing-year high– were up 45 percent from the previous week and 23 percent from the prior 4-week average. The destinations were primarily to China (1,009,700 MT), Mexico (467,100 MT), Japan (310,900 MT),

Colombia (113,000 MT), and Israel (111,200 MT).

Optional Origin Sales:

For 2020/2021, the current outstanding balance of 268,500 MT is for unknown destinations (189,500 MT) and South Korea (79,000 MT).

Late Reporting:

For 2020/2021, exports totaling 16,500 MT of corn were reported late to Venezuela.

Barley:

No net sales were reported for the week.

Exports of 600 MT were up 68 percent from the previous week and 40 percent from the prior 4-week average. The destination was to South Korea.

Sorghum:

Net sales of 119,800 MT for 2020/2021 were up 69 percent from the previous week and up noticeably from the prior 4-week average. Increases were for China (119,800 MT, including decreases of 5,200 MT). Total net sales for

2021/2022, of 53,000 MT were for China. Exports of 59,800 MT were down 68 percent from the previous week and 72 percent from the prior 4-week average. The destination was to China.

Rice:

Net sales of 96,200 MT for 2020/2021 were up noticeably from the previous week and up 98 percent from the prior 4-week average. Increases were primarily for Mexico (42,300 MT), Venezuela (28,500 MT), Haiti (18,200 MT), Canada (3,400 MT), and Saudi Arabia

(1,800 MT). Total net sales for 2021/2022, of 700 MT were for Guatemala. Exports of 69,400 MT were up noticeably from the previous week, but down 15 percent from the prior 4-week average. The destinations were primarily to Venezuela (56,300 MT), South Korea

(3,100 MT), Mexico (2,500 MT), Canada (2,200 MT), and Japan (1,200 MT).

Exports for Own Account:

For 2020/2021, new exports for own account totaling 100 MT were for Canada. The current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 84,200 MT for 2020/2021 were down 11 percent from the previous week and 45 percent from the prior 4-week average. Increases primarily for Japan (57,800 MT, including 42,300 MT switched from unknown destinations and decreases of 1,300 MT), Egypt

(55,000 MT, including 50,000 MT switched from unknown destinations), South Korea (25,800 MT, including 25,000 MT switched from unknown destinations), Vietnam (12,600 MT, including decreases of 100 MT), and Canada (12,200 MT), were offset by reductions primarily

for unknown destinations (101,300 MT). For 2021/2022, net sales of 96,000 MT were primarily for Mexico (47,500 MT) and unknown destinations (47,500 MT). Exports of 335,600 MT were up 18 percent from the previous week and 20 percent from the prior 4-week

average. The destinations were primarily to Mexico (103,400 MT), Japan (67,600 MT), Egypt (55,000 MT), Indonesia (30,900 MT), and South Korea (26,000 MT).

Exports for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Late

Reporting:

For 2020/2021, exports totaling 6,000 MT of soybeans were reported late to Venezuela.

Soybean Cake and Meal:

Net sales of 189,400 MT for 2020/2021 were up noticeably from the previous week and up 34 percent from the prior 4-week average. Increases primarily for Canada (41,700 MT, including decreases of 600 MT), Ecuador (30,000 MT), Morocco (25,000 MT), Guatemala

(23,900 MT, including decreases of 800 MT), and Mexico (21,600 MT, including decreases of 100 MT), were offset by reductions primarily for Nicaragua (5,000 MT) and Belgium (800 MT). For 2021/2022, net sales of 77,600 MT were for Mexico (24,900 MT), Honduras

(15,100 MT), El Salvador (14,600 MT), Guatemala (14,000 MT), and Costa Rica (9,000 MT). Exports of 96,200 MT were down 51 percent from the previous week and from the prior 4-week average. The destinations were primarily to Mexico (28,100 MT), Canada (18,500

MT), Guatemala (14,400 MT), Morocco (6,500 MT), and Honduras (5,100 MT).

Soybean Oil:

Net sales reductions of 4,500 MT for 2020/2021–a marketing year low– were down noticeably from the previous week and from the prior 4-week average. Increases reported for Canada (800 MT) and Mexico (100 MT), were more than offset by reductions for Nicaragua

(2,200 MT), El Salvador (2,100 MT), Trinidad and Tobago (700 MT), and Guatemala (500 MT). Exports of 14,200 MT were up noticeably from the previous week and up 25 percent from the prior 4-week average. The destinations were primarily to Guatemala (8,000

MT) and Venezuela (5,000 MT).

Cotton:

Net sales of 108,000 RB for 2020/2021 were up 99 percent from the previous week and 45 percent from the prior 4-week average. Increases primarily for China (24,800 RB, including decreases of 9,500 RB), Turkey (23,300 RB, including decreases of 1,300 RB),

Vietnam (20,800 RB, including decreases of 1,800 RB), Pakistan (14,300 RB), and Taiwan (6,100 RB), were offset by reductions for El Salvador (3,500 RB). For 2021/2022, net sales of 21,800 RB were primarily for Turkey (6,600 RB), Peru (5,600 RB), El Salvador

(4,800 RB), Pakistan (2,200 RB), and Thailand (1,400 RB). Exports of 345,400 RB were up 25 percent from the previous week, but down 2 percent from the prior 4-week average. Exports were primarily to Vietnam (101,100 RB), China (59,400 RB), Pakistan (43,000

RB), Turkey (37,000 RB), and Mexico (20,800 RB). Net sales of Pima totaling 8,100 RB were up noticeably from the previous week and up 21 percent from the prior 4-week average. Increases primarily for India (4,700 RB), Thailand (1,100 RB), Turkey (900 RB),

Vietnam (800 RB), and Peru (400 RB), were offset by reductions for Japan (300 RB) and the United Kingdom (200 RB). Total net sales for 2021/2022 of 100 RB were for Thailand. Exports of 7,700 RB were down 60 percent from the previous week and 61 percent from

the prior 4-week average. The destinations were primarily to India (1,600 RB), Austria (1,300 RB), Vietnam (1,200 RB), China (900 RB), and Peru (500 RB).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance of 17,500 RB is for Vietnam (9,500 RB), China (7,600 RB), and Bangladesh (400 RB).

Hides

and Skins:

Net sales of 246,000 pieces for 2021 were down 36 percent from the previous week and 23 percent from the prior 4-week average. Increases primarily for China (164,400 whole cattle hides, including decreases of 3,600 pieces), South Korea (46,600 whole cattle

hides, including decreases of 1,700 pieces), Mexico (19,200 whole cattle hides, including decreases of 900 pieces), Thailand (11,400 whole cattle hides, including decreases of 700 pieces), and Taiwan (3,000 whole cattle hides, including decreases of 100 pieces),

were offset by reductions for Indonesia (400 pieces) and Spain (100 pieces). Total net sales reductions of 300 kip skins were for Belgium.

Exports of 329,700 pieces were down 23 percent from the previous week and 18 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (180,300 pieces), South Korea (65,000 pieces), Thailand

(25,700 pieces), Mexico (22,300 pieces), and Brazil (9,900 pieces). Exports of 2,600 kip skins were to Belgium.

Net

sales of 48,300 wet blues for 2021 were down 27 percent from the previous week and 61 percent from the prior 4-week average. Increases primarily for Italy (21,400 unsplit, including decreases of 300 unsplit), China (8,900 unsplit), Vietnam (8,800 unsplit,

including decreases of 100 unsplit), Mexico (4,100 unsplit and 100 grain splits, including decreases of 1,000 unsplit), and Brazil (3,600 unsplit), were offset by reductions for Thailand (300 unsplit). Exports of 140,500 wet blues were down 2 percent from

the previous week, but unchanged from the prior 4-week average. The destinations were primarily to Italy (38,500 unsplit and 9,000 grain splits), Vietnam (35,100 unsplit), China (31,400 unsplit), Thailand (16,700 unsplit), and Mexico (2,600 unsplit and 1,900

grain split). Net sales of 118,100 splits resulting in increases for Taiwan (129,000 pounds) and China (1,400 pounds, including decreases of 4,000 pounds), were offset by reductions for Vietnam (12,300 pounds). Exports of 522,900 pounds were to Vietnam (278,200

pounds) and China (244,700 pounds).

Beef:

Net

sales of 56,900 MT reported for 2021–a marketing-year high–were up noticeably from the previous week and from the prior 4-week average. Increases primarily for the Netherlands (33,700 MT), China (9,200 MT), Japan (5,900 MT, including decreases of 500 MT),

South Korea (4,500 MT, including decreases of 300 MT), and Taiwan (2,200 MT, including decreases of 100 MT), were offset by reductions for Belgium (100 MT). Exports of 53,100 MT–a marketing-year high–were up noticeably from the previous week and from the

prior 4-week average. The destinations were primarily to the Netherlands (33,700 MT), Japan (5,900 MT), South Korea (5,100 MT), China (2,900 MT), and Taiwan (1,400 MT).

Pork:

Net

sales of 19,000 MT reported for 2021 were up 29 percent from the previous week, but down 1 percent from the prior 4-week average. Increases were primarily for Mexico (8,300 MT, including decreases of 700 MT), Japan (3,600 MT, including decreases of 200 MT),

China (3,100 MT, including decreases of 700 MT), Canada (1,000 MT, including decreases of 500 MT), and South Korea (1,000 MT, including decreases of 500 MT), were offset by reduction primarily for Australia (200 MT) and New Zealand (100 MT). Exports of 34,600

MT were down 17 percent from the previous week and 24 percent from the prior 4-week average. The destinations were primarily to China (11,100 MT), Mexico (10,600 MT), Japan (4,500 MT), South Korea (2,400 MT), and Canada (1,100 MT).

May 20, 2021

1 FOREIGN AGRICULTURAL SERVICE/USDA

U.S. EXPORT SALES FOR WEEK ENDING 5/13/2021

FAX 202-690-3275

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

32.0 |

584.2 |

1,170.2 |

130.3 |

8,132.3 |

8,768.4 |

155.1 |

1,058.4 |

|

SRW |

39.4 |

186.3 |

193.8 |

61.6 |

1,689.0 |

2,254.9 |

13.3 |

781.0 |

|

HRS |

47.7 |

685.3 |

1,185.7 |

237.4 |

7,066.2 |

6,688.9 |

68.8 |

973.5 |

|

WHITE |

1.8 |

569.9 |

742.1 |

139.3 |

6,055.2 |

4,567.8 |

79.5 |

756.0 |

|

DURUM |

0.0 |

48.6 |

100.8 |

0.0 |

631.8 |

883.3 |

1.0 |

8.4 |

|

TOTAL |

121.0 |

2,074.3 |

3,392.6 |

568.6 |

23,574.6 |

23,163.3 |

317.7 |

3,577.3 |

|

BARLEY |

0.0 |

2.1 |

9.8 |

0.6 |

26.5 |

40.3 |

0.0 |

22.2 |

|

CORN |

277.6 |

20,733.8 |

12,804.5 |

2,239.9 |

47,287.4 |

26,606.6 |

4,061.8 |

8,936.6 |

|

SORGHUM |

119.8 |

1,581.3 |

1,282.8 |

59.8 |

5,767.8 |

2,389.7 |

53.0 |

1,244.0 |

|

SOYBEANS |

84.2 |

4,513.6 |

6,406.7 |

335.6 |

56,949.7 |

34,890.4 |

96.0 |

7,022.0 |

|

SOY MEAL |

189.4 |

2,092.3 |

2,250.5 |

96.2 |

7,797.2 |

7,586.6 |

77.6 |

560.3 |

|

SOY OIL |

-4.5 |

58.0 |

296.3 |

14.2 |

607.0 |

787.8 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

58.9 |

260.5 |

262.2 |

57.8 |

1,359.1 |

1,186.7 |

0.7 |

0.7 |

|

M S RGH |

12.0 |

16.9 |

37.2 |

0.5 |

24.0 |

59.2 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

2.7 |

20.5 |

0.2 |

36.4 |

46.4 |

0.0 |

0.0 |

|

M&S BR |

0.4 |

45.4 |

56.9 |

0.5 |

110.2 |

59.2 |

0.0 |

0.0 |

|

L G MLD |

19.9 |

44.4 |

66.2 |

3.3 |

531.7 |

760.6 |

0.0 |

0.0 |

|

M S MLD |

4.8 |

219.0 |

178.9 |

7.0 |

454.2 |

531.8 |

0.0 |

0.0 |

|

TOTAL |

96.2 |

588.8 |

622.0 |

69.4 |

2,515.6 |

2,643.9 |

0.7 |

0.7 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

108.0 |

3,468.9 |

5,481.1 |

345.4 |

11,906.5 |

10,810.1 |

21.8 |

1,828.9 |

|

PIMA |

8.1 |

169.1 |

136.5 |

7.7 |

615.6 |

410.2 |

0.1 |

4.0 |

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.