PDF Attached

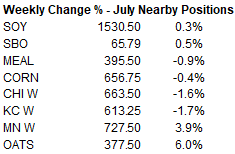

With exception to soybean meal, oats, and MN wheat, most major CBOT agriculture commodities ended lower. Brazil’s worst drought in 91 years prompted another downward revision to the second corn crop by a private group, year CBOT corn ended lower on long liquidation. Chicago & KC wheat fell the hardest today. Soybeans and soybean oil dropped amid favorable US weather and lower energy prices, respectively, despite the USD pairing most of its gains to close Friday 8 points higher (was up 40 pre-day session market).

Attached is our updated US SBO balance sheet.

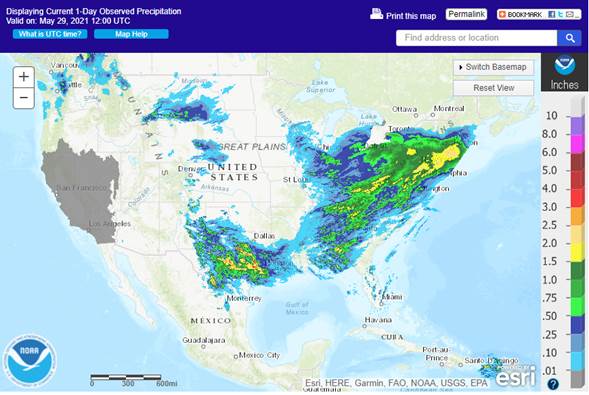

Thursday into Friday 24-hour rainfall……….

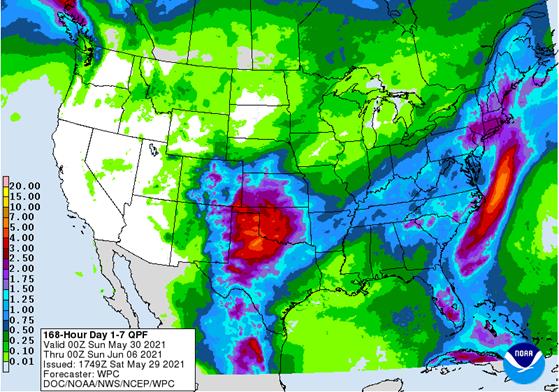

Next 7 days (populated Saturday noon CT)

World Weather, Inc.

MOST IMPORTANT WEATHER OF THE DAY

- Frost and freezes in North Dakota, northern Minnesota and northern Wisconsin overnight will have a mixed impact on crops. Central and eastern North Dakota will likely experience the greatest crop losses, but a few days will be needed to see how bad the damage was

o Most of the damage in Minnesota, Wisconsin and South Dakota was not suspected of being very great

- China’s Yellow River Basin and east-central Provinces will dry down for the next ten days.

o Totally dry weather is not expected, but much of the rain will not be generalized enough to seriously bolster soil moisture outside of a few pockets

o Soil moisture today is rated favorably, and spring fieldwork has advanced quite well, but the region will experience net drying for a while

- The drier bias will be great for winter wheat maturation and harvest progress as well as for summer crop planting, but rain will be needed soon to protect the longer range crop development potential

- Northeast China will continue to experience a good mix of rain and sunshine over the next ten days supporting fine early season crop development; however, rainfall frequency may be a little higher than desired causing some disruption to fieldwork periodically

- Southern China and in particular the southeastern corner of the nation will experience too much rain and additional flooding is expected in some rice, citrus and minor corn production areas during the next week

o Damage to personal property is possible because of the wet conditions

- Xinjiang China weather was dry biased Thursday with seasonable temperatures and this trend will continue for a while

o Daily high temperatures will be in the 70s and 80s northeast followed by lows in the 40s and 50s while highs in the southwest are in the 80s and lower 90s followed by lows in the 50s and lower 60s

- Western Australia will receive some welcome rain for the second time this month and that will translate into very good wheat, barley and canola planting, emergence and establishment conditions

- Eastern Australia winter crop areas and those in South Australia are struggling for moisture and even though planting is progressing there is need for greater rain to induce good stands of wheat, barley and canola in unirrigated fields

- Northern Kazakhstan and southern Russia’s New Lands need rain

o Recent warm and dry weather has stressed crops and depleted soil moisture

o Cooling is now under way, but significant rain is not very likely for a while, although a few showers will occur briefly with the first frontal system passage that is expected in the next couple of days

- Western Europe is expected to dry out over the next week, but most areas have good soil moisture today

o Europe’s driest areas are in Spain, Portugal, southern Italy and a few random locations in the southeast, but dryness in these areas is not unusual at this time of year

o France, Germany and the U.K. will dry down as the next week to ten days moves along because of the more limited rainfall pattern

- Eastern Europe and the western parts of Russia, the Baltic States and Belarus along with Ukraine will see a good mix of rain and sunshine during the next ten days.

o Fieldwork may advance a little slower than desired, but the long term crop outlook is favorable

- Cold temperatures occurred in Canada’s southeastern Prairies this morning with frost and freezes in several areas, but the impact was low except on a few crops in southwestern Manitoba where temperatures were coldest

o Most of the hard freezes were in central and northern Manitoba where readings in the 20s were noted

o Lows in southern and far western Manitoba and central through eastern Saskatchewan were mostly in the 30s with a few upper 20s.

o New damage to crops was greatest in central Manitoba and some replanting may be necessary because of the extreme cold

- The region impacted is not a part of the major production region, however

- Restricted precipitation in southern Canada’s Prairies and the northern U.S. Plains over the next ten days will support fieldwork after recent rain, but more moisture is needed

- Southeastern Canada corn and soybean production areas are experiencing a mostly good mix of weather for spring planting and winter wheat development

o The region will trend a little cooler and be mostly dry for a while allowing good field progress to continue

- U.S. crop weather is expected to be nearly ideal over the next ten days with all areas getting rain at one time or another except parts of the southeastern states

o Net drying in the southeastern states is already firming the soil and additional heat and dryness in this coming week is expected to stress early planted crops and slow emergence and establishment for the more recently planted fields that are not irrigated

- A close watch on this part of the nation is warranted for a while; second week rainfall is still being advertised, but confidence in its distribution and significance remains a little low

- West Texas cotton, corn, sorghum and peanut production areas will experience frequent waves of rain in this coming week with substantial rain amounts likely in the central and northern parts of the production region

o Southwestern parts of the dryland production area needs rain and “some” is expected

o Other crop areas in the Low Plains, northern High Plains and Rolling Plains will receive significant rain often bolstering soil moisture for many areas especially in this coming week to ten days

- Some of these areas will receive 2.00 to 5.00 inches of rain and locally more during the next seven days with 0.80 to 2.00 inches likely in the southwestern dryland areas

o Some drying will occur in the second week of June

- U.S. hard red winter wheat production areas may get rain a little more often than desired and there is some concern over grain quality in the more advanced crops in the south where some of the greatest rain frequency and intensity is expected

o Most of the crop will benefit from the rain and warm weather

o Drying and warming is expected in the second week of June

- U.S. Pacific Northwest crop areas are back to a dry bias after some beneficial moisture fell in Oregon during the past week

o Unirrigated winter crops in the region need more moisture for the best yields

- Most of the far western U.S. will experience net drying conditions over the next week to ten days leaving drought conditions firmly in place

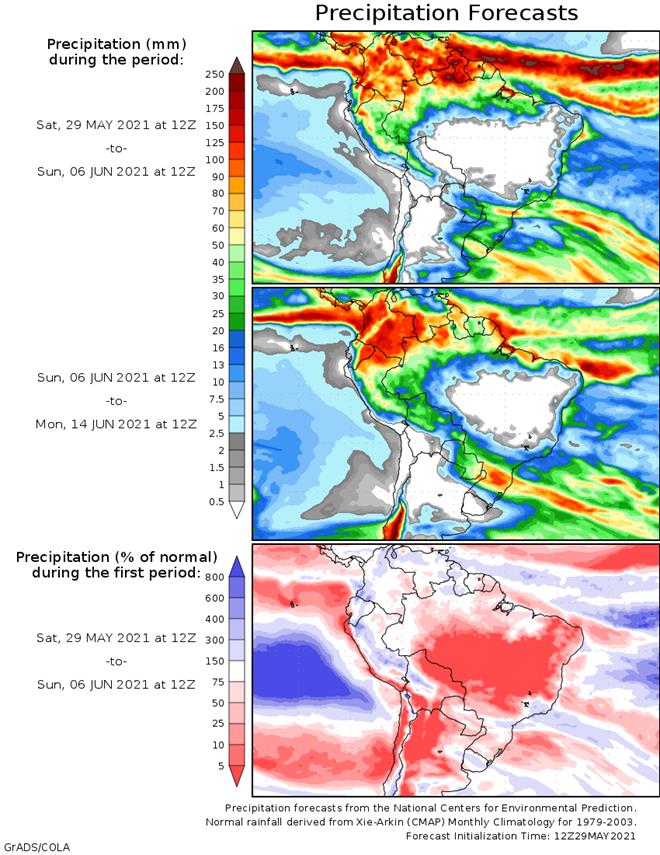

- Brazil will experience a new weather disturbance moving through southern wheat and Safrinha corn production areas this weekend into next week

- The additional moisture will maintain favorably moist conditions in many winter wheat production areas and will maintain a better environment for some of the late season Safrinha corn production areas

o Not much rain is expected in Mato Grosso, northern Mato Grosso do Sul, Goias, southwestern Minas Gerais or crop areas farther to the north over the next ten days

- Safrinha corn and cotton in these areas will be stressed

o Temperatures will be cooler biased in the wettest areas

o Next week’s weather will be much drier in southern areas

o Southern Safrinha crop areas will not be as dry as they have been again through the next couple of weeks, despite drying next week

- Argentina will receive very little rain for the next ten days

o Crop moisture for wheat planting is mostly very good

o Improved summer crop harvest progress is expected as this week moves forward

o Temperatures will be a little cooler biased for a while this week and into next week especially in the east

- Mexico drought remains serious, although enough rain fell last week to bring some relief in east-central parts of the nation.

o This week’s weather will be less beneficially wet with isolated to scattered showers continuing in the east with mostly light rain resulting

o A boost in rainfall may occur again in southern and eastern areas next week

o The recent moisture has helped improve planting, emergence and establishment conditions for many early season crops in the wetter areas, but the west-central and northwest parts of the nation are still quite dry.

- South Africa will be dry and warm in this coming week before some rain evolves next week and temperatures turn briefly cooler

- West Africa rainfall is expected to be erratic and lighter than usual during the coming week with a boost in precipitation expected in the first week of June

o Coffee, cocoa, sugarcane, rice and cotton areas are mostly well rated, but greater rain will be needed soon as additional drying evolves

- East-central Africa has been and will continue to be lighter than usual – at least through the coming ten days

- Southern Oscillation Index is mostly neutral at +5.11 and the index is expected to move lower into next week

- North Africa weather in the coming week will produce a few showers, but resulting rainfall is expected to be infrequent and light

o Winter small grains will continue to mature and be harvested around the precipitation

- Southeast Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks

o Greater rain is needed in the northern and western Philippines

- Luzon Island, Philippines will be last to get significant rain

- New Zealand precipitation for the next week to ten days will be greatest in eastern parts of the nation and temperatures will be cooler biased

Source: World Weather, Inc.

Monday, May 31:

- EU weekly grain, oilseed import and export data

- Ivory Coast cocoa arrivals

- Malaysia May palm oil export data

- HOLIDAY: U.S., U.K.

Tuesday, June 1:

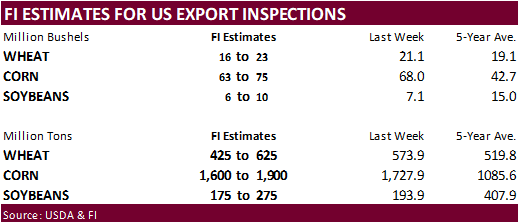

- USDA export inspections – corn, soybeans, wheat, 11am

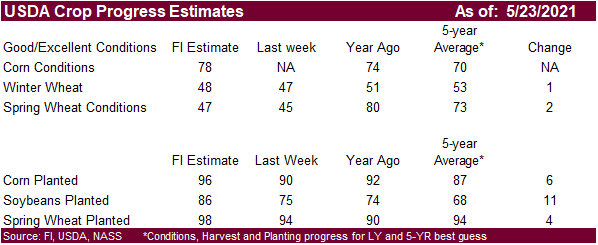

- U.S. crop condition and planting — corn, cotton, soybeans, wheat, 4pm

- Honduras and Costa Rica monthly coffee exports

- International Cotton Advisory Committee updates world outlook for fiber market

- Australia Commodity Index

- Purdue Agriculture Sentiment

- New Zealand dairy trade auction

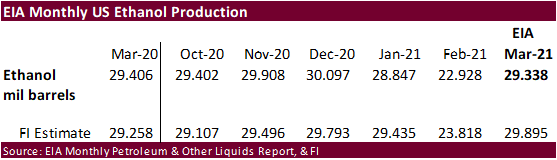

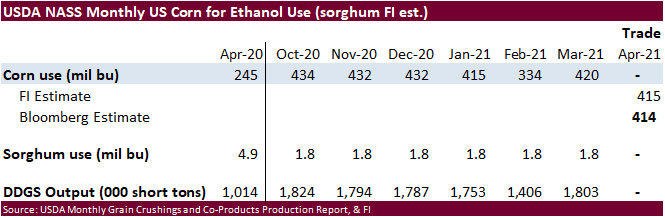

- U.S. corn for ethanol, DDGS production, 3pm

- USDA soybean crush, 3pm

- HOLIDAY: Indonesia

Wednesday, June 2:

- Nothing major scheduled

Thursday, June 3:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- FAO World Food Price Index

- EIA weekly U.S. ethanol inventories, production

- Port of Rouen data on French grain exports

- New Zealand Commodity Price

- HOLIDAY: Brazil, Thailand

Friday, June 4:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

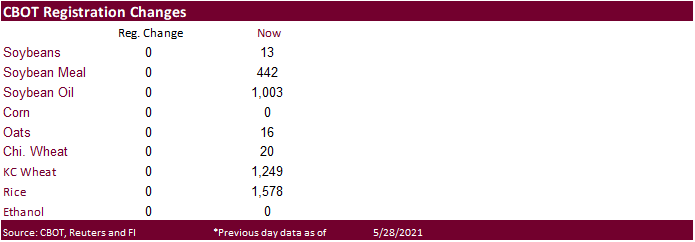

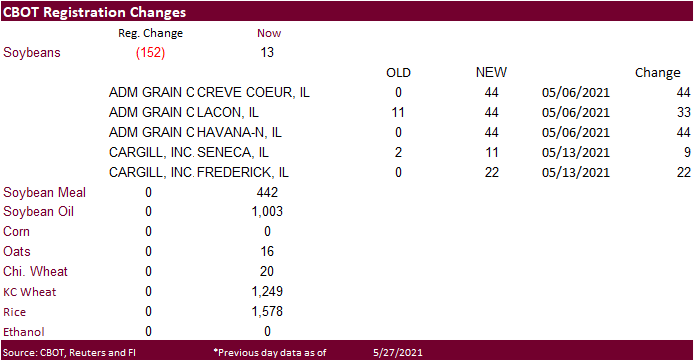

Registrations – Friday NO CHNAGES

THURSDAY CHANGES…

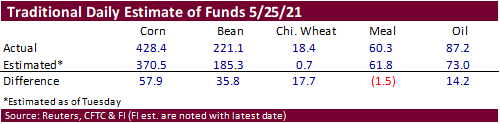

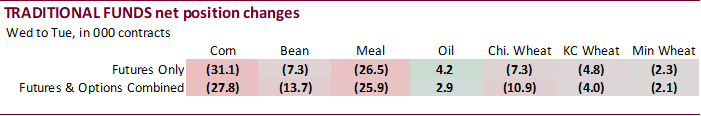

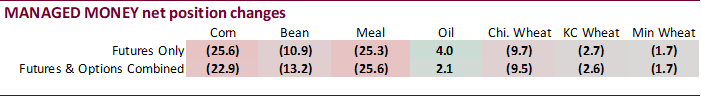

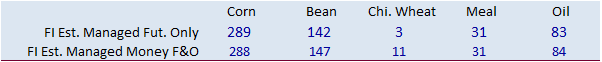

As expected, the net long corn futures only position was much longer than expected, and was also net long guesses for soybeans, wheat and soybean oil. Given the volatile trade so far this month, we don’t think the discrepancies in end of Tuesday’s fund positions will have an impact when the market opens back up Monday evening.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 232,893 -26,514 429,919 3,781 -620,252 37,814

Soybeans 87,438 -12,821 187,675 7,264 -260,621 12,494

Soyoil 53,333 2,403 126,371 579 -195,349 -2,104

CBOT wheat -38,316 -11,594 162,237 427 -110,897 13,808

KCBT wheat 8,379 -965 64,266 -4,012 -66,497 7,449

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 268,091 -22,935 248,901 9,292 -594,313 33,625

Soybeans 139,390 -13,194 94,163 9,281 -238,257 11,370

Soymeal 25,232 -25,612 80,470 250 -162,755 30,374

Soyoil 85,327 2,107 115,256 1,227 -219,490 -3,258

CBOT wheat 4,534 -9,506 83,762 3,094 -88,023 10,487

KCBT wheat 23,501 -2,599 43,794 139 -60,202 6,360

MGEX wheat 14,669 -1,746 4,365 -721 -25,379 2,585

———- ———- ———- ———- ———- ———-

Total wheat 42,704 -13,851 131,921 2,512 -173,604 19,432

Live cattle 57,908 -373 87,335 -500 -160,240 1,811

Feeder cattle 2,885 1,419 6,496 150 -1,940 -722

Lean hogs 78,737 4,776 62,344 756 -147,477 -5,960

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 119,880 -4,902 -42,560 -15,080 2,433,267 -59,989

Soybeans 19,196 -521 -14,493 -6,937 1,142,076 -33,339

Soymeal 25,744 -320 31,310 -4,692 456,909 -10,408

Soyoil 3,262 802 15,644 -878 619,928 -3,326

CBOT wheat 12,752 -1,433 -13,024 -2,641 510,434 -25,989

KCBT wheat -947 -1,428 -6,147 -2,472 244,330 556

MGEX wheat 1,982 -326 4,363 209 82,931 -1,321

———- ———- ———- ———- ———- ———-

Total wheat 13,787 -3,187 -14,808 -4,904 837,695 -26,754

Live cattle 24,523 -545 -9,527 -396 367,997 -7,162

Feeder cattle 3,418 394 -10,859 -1,241 50,831 -898

Lean hogs 13,597 365 -7,202 63 365,975 15,819

Source: Reuters and FI

US Personal Income Apr: -13.1% (est -14.2%; prevR 20.9%; prev 21.1%)

US Personal Spending Apr: 0.5% (est 0.5%; prevR 4.7%; prev 4.2%)

US Real Personal Spending Apr: -0.1% (est 0.2%; prevR 4.1%; prev 3.6%)

US Chicago PMI May: 75.2 (est 68.0; prev 72.1)

EIA: US Crude Oil Exports In March Fell To 2.685M Bpd (prev 2.703M Bpd)

– US Total Refined Oil Product Exports In March Rose To 2.402M Bpd (prev 2.314M)

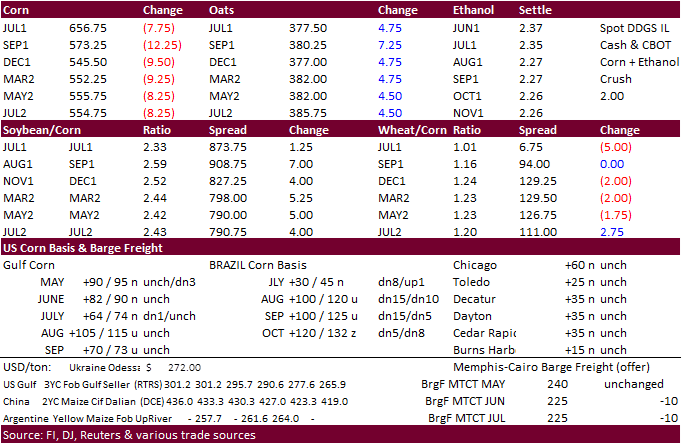

- July corn ended Friday 7.75 cents lower and December 9.50 lower, at $6.5675 and $5.4550, respectively.

- CBOT corn ended lower on lack of fresh news, favorable US Midwest weather, and positioning ahead of the long holiday weekend. Trading activity was choppy as many commercial participants were inactive. Oats ended higher.

- Funds sold an estimate net 18,000 corn contracts on the day.

- Rains fell across the ECB Friday into Saturday, and will fall across the west central region Monday.

- By noon there were 7000 September 500 puts sold from 14 3/8 to 13 1/4. For those that can recall, we saw similar action around the second week of May.

- Safras & Mercado lowered their Brazil corn crop to 95.2 million tons from 104.14 million tons, still well above many trade guesses for the total, but bullish as its down 11 percent from the previous month-one of the steepest drops we have seen. Second crop was pegged at 61.5 million tons, below 73.5 million tons last year.

- Brazil’s government issued several warnings this week linked to the drought, viewed as worst in 91 percent, from hydroelectric power generation to agriculture and fire risks. Below 7-day map is one of the driest we have seen for combined SA countries in a while. Brazil may not climb out of drought conditions until at least September. Brazil sugar and coffee (4-1/2 year high) production should be monitored, along with early plantings of the 2021-22 Brazil soybean season post US summer growing season.

- The French corn crop was rated 91% as of May 24, down from 93% previous week and up from 83% year ago.

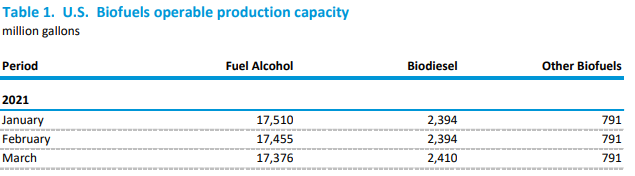

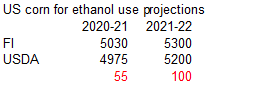

- EIA reported a slightly lower March US ethanol production versus our working March estimate.

Export developments.

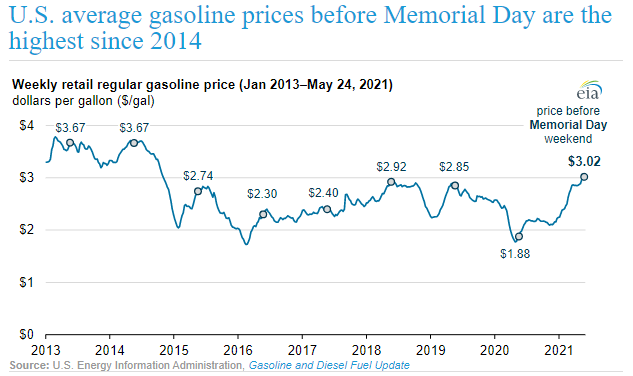

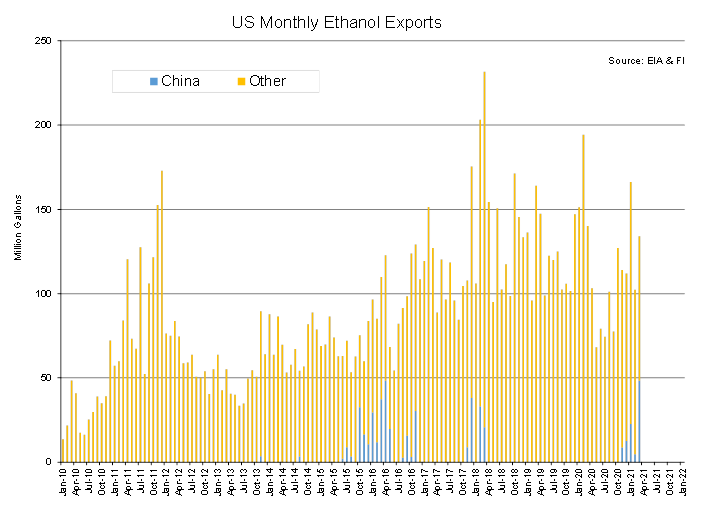

https://www.eia.gov/todayinenergy/detail.php?id=48156&src=email

Exports of US ethanol to China versus rest of world through March

Updated 5/24/21

July is seen in a $6.00 and $7.25 range

December corn is seen in a $4.75-$7.00 range.

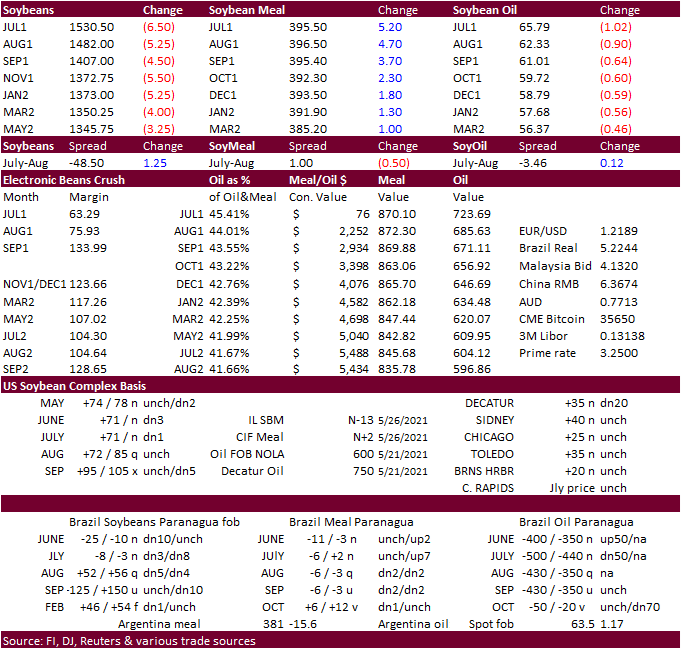

- Soybeans ended 6.5 cents lower at $15.3050 per bushel and new-crop November 5.50 lower at $13.7275. July soybean meal was up $5.20 at $395.50 a ton and CBOT July soyoil dropped 102 points to 65.79. CBOT soybean complex turned lower during the late overnight session after gold broke, but a general recovering in selected outside commodities, omitting energies, left some traders in limbo for the soybean complex. Ultimately prices appeared to have reacted to long liquidation in soybeans and soybeans oil, and a correction in oil share supported soybean meal that was already under pressure earlier in the week.

- Funds sold an estimated net 4,000 soybeans, bought 4,000 soybean meal and sold 4,000 soybean oil.

- There were no changes in CBOT registrations across the board Friday evening. Note Thursday night there were 152 CBOT soybean registrations cancelled by ADM and Cargill at 5 locations. Registrations for soybeans now stand at 13.

- Malaysia announced a full nationwide lockdown from June 1-14. Malaysian palm oil futures rose about 2.5% following yesterday’s strength in soybean oil. The benchmark contract gained 0.6% this week after falling 11.43% in the previous week, its biggest weekly drop in one year.

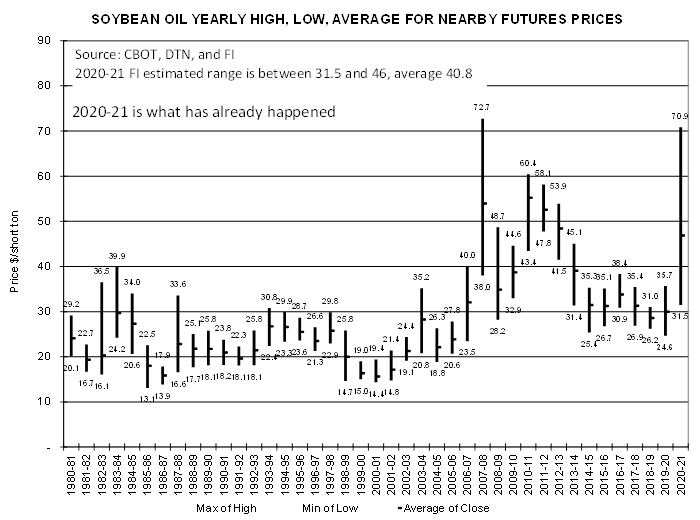

- We look for 2021-22 US soybean oil stocks to fall to 1.103 billion pounds from 1.661 billion for 2020-21 (USDA higher at 1.818 billion), smallest since the 2003-04 crop year. Remarkably the absolute crop-year high during that year for nearby SBO was around 35.2 cents. Attached is our updated US SBO balance sheet. Meal and soybean oil balances will be out mid next week post NASS crush report.

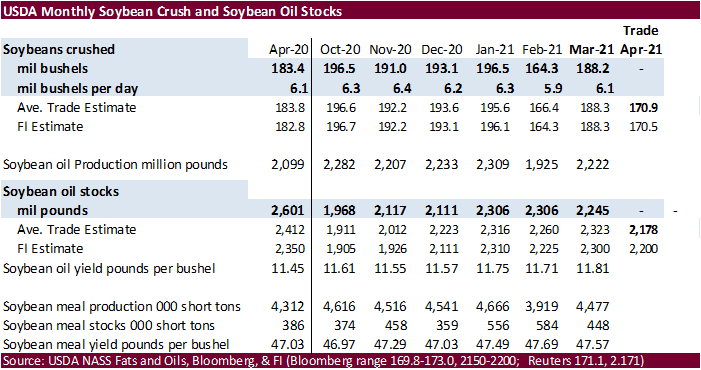

- A Reuters poll calls for the April US soybean crush to be reported at 171.1 million bushels (170.0-173.0 range), down from 188.2 million bushels in March and below 183.4 million in April 2020. US soybean oil stocks as of April 30 were estimated at 2.171 billion pounds (2.150-2.200 range), down from 2.245 billion at the end of March and 2.602 billion at the end of April 2020. Below table uses Bloomberg estimates with Reuters averages in the footnotes.

- Russia reduced the export tax on soybeans to 20% from 30% from July 1 until September 2022.

- China will launch crude palm oil and palm oil options on the Shanghai Exchange and Dalian Commodity Exchange on June 21 and June 18, respectively.

- None reported

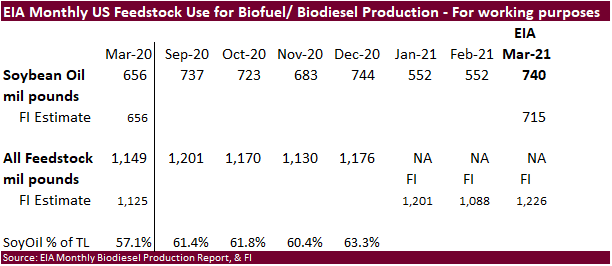

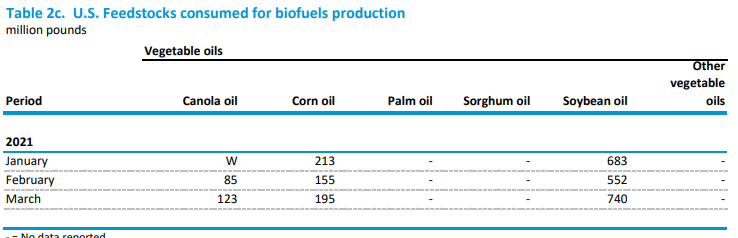

NOTE EIA DOES NOT REPORT TOTAL FEEDSTOCKS AND BREAKDOWN BY DIESEL TYPE USE – we use this for reference only

Updated 5/25/21

July soybeans are seen in a $14.75-$16.00; November $12.75-$15.00

Soybean meal – July $360-$420; December $380-$460

Soybean oil – July 64-70; December 48-60 cent range

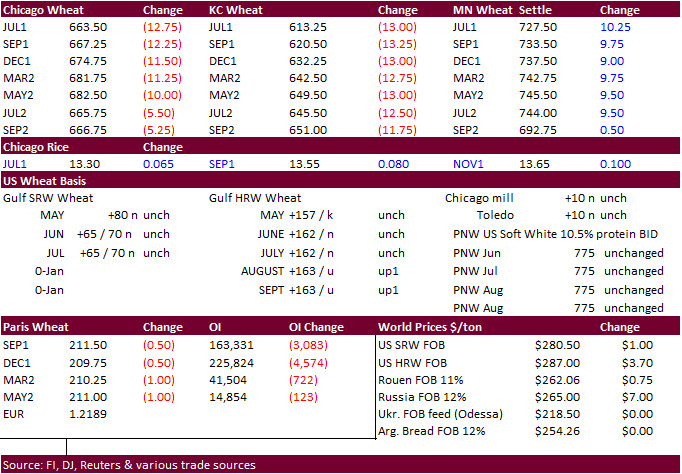

- Chicago July soft red winter wheat finished 12.75 cents lower at $6.6350, July KC wheat down 13 cents to $6.1325, but July MN spring wheat traded 10.25 cents higher to $7.2750 due to unfavorable cold temperatures across the Dakotas and parts of the Canadian Prairies.

- Chicago and KC wheat was mostly lower in a pre-holiday trade positioning and Russia officials announcing a relaxation on their wheat export tax during a short period of June 2 through June 8 to $28.10 per ton from current $61/ton, based on their export tax formula. The southern Greta Plains will see rain over the next week. French wheat conditions improved from the previous week.

- MN wheat ended higher on weather. Frost/freezes in North Dakota overnight into this morning may have had an impact on some crops. The cold temperatures occurred in patches.

- Friday morning’s weather showed mostly dry weather for the southwestern Plains before heavy rain falls through at least Monday. US spring wheat areas saw additional rain, but more is needed.

- Funds on Friday sold an estimated net 5,000 soft wheat contracts.

- Traders are awaiting results on Saudi Arabia in for wheat.

- Russia shipped 350,000 tons of wheat to Syria during since March.

- SovEcon estimated Russia’s 2021 wheat crop at 80.9 million tons, down from 81.7 million tons due to a slightly smaller winter wheat area and weather problems.

- Australia plans to petition the World Trade Organization to set up a panel to overlook talks over China barley anti-dumping and countervailing duties on Australian barley.

- French soft wheat conditions as of May 24 increase a point to 80% from the previous week. Winter barley was up 2 points to 77%. Spring barley was up 1 point to 85%.

- September Paris wheat market basis September was down 0.75 euros at 211.25.

- Results awaited: Saudi Arabia seeks 720,000 tons of 12.5% wheat on May 28-31 for July 10-September 30th shipment.

- Earlier this week USDA bought 83,000 tons of HRW wheat for Africa at $263.36-$264.01/ton for July 6-16 shipment.

- Indonesia seeks 240,000 tons of feed wheat on May 31 for Aug-Nov arrival. They bought some wheat for the week ending May 28.

- Reuters noted Indonesia bought about 60,000 tons of Black Sea wheat late this week for August shipment at $310 a ton c&f, down from $315 a ton offered last week. Australian Premium White wheat was offered at $320 a ton c&f, unchanged from last week.

- Bangladesh seeks 50,000 tons of milling wheat on May 30. In its weekly SBS import tender, Japan on June 2 seeks 80,000 tons of feed wheat and 100,000 tons of barley for arrival by November 25.

Rice/Other

· Egypt seeks 100,000 tons of raw cane sugar on June 5.

Updated 5/24/21

July Chicago wheat is seen in a $6.30-$7.15 range

July KC wheat is seen in a $5.95-$6.70

July MN wheat is seen in a $6.55-$7.40

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.