PDF Attached includes Friday OI and Option volume plus update weather maps. FI US CP and inspections included.

Grains

ended Friday higher. Several countries warned of potentially restricting rice exports and one staple for replacement is wheat. Soybeans ended mixed. Soybean meal was higher while soybean oil sold off from increasing Indonesia export prospects for palm oil.

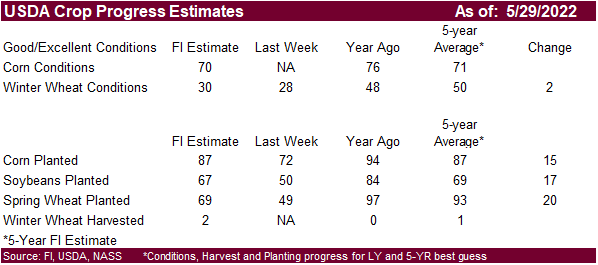

Expect good US Midwest plantings next week, similar to the past week as we predict for the upcoming USDA crop progress released Tuesday afternoon, per US holiday. Opening calls look for Monday night look unchanged to higher per global inflationary measures,

but we need to soak in outside related markets when that time comes.

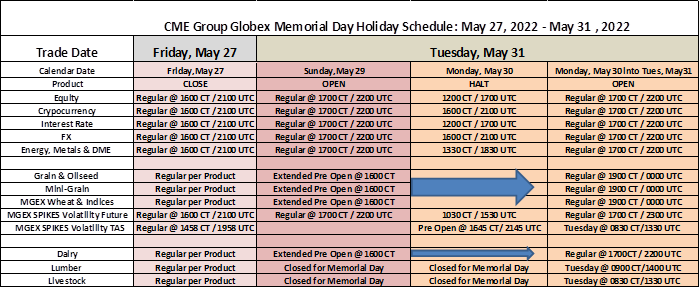

CME

https://www.cmegroup.com/tools-information/holiday-calendar.html