PDF Attached

WASHINGTON, May 27, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 152,400 metric tons of corn delivery to unknown destinations during the 2021/2022 marketing year.

July corn ended 40 cents limit higher, July soybeans up 33.50 cents and July Chicago wheat up 27.75 cents. Renewed optimism China will continue buying US grains supported futures. A China official mentioned the “The Phase One economic and trade agreement is good for China, for the United States, and the whole world.”

![]()

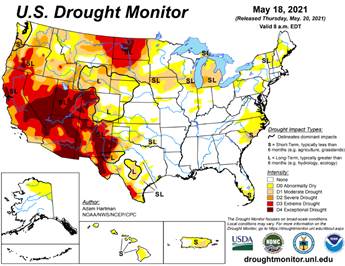

Last 24-hours

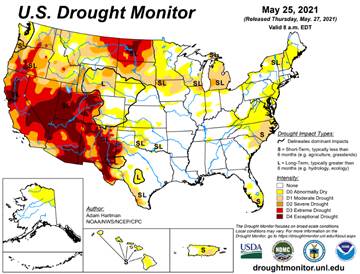

Next 7 days

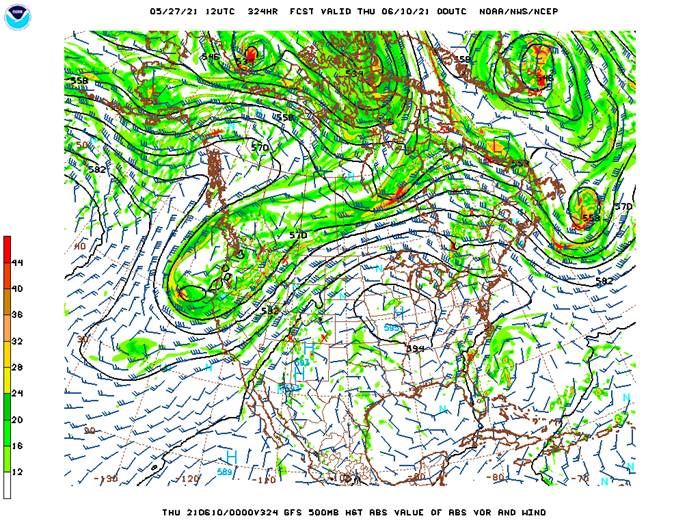

Talk of ridging for the June 9-10 period is gaining attention.

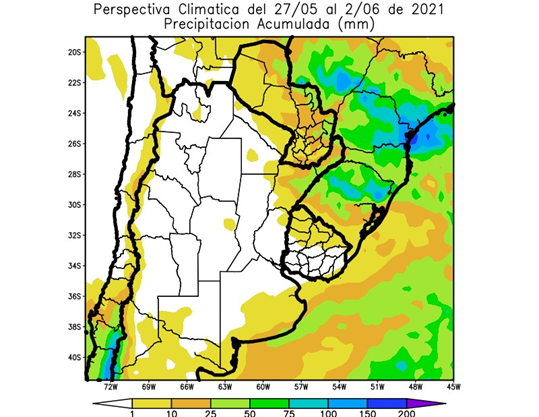

Argentina topsoil conditions could dry down according to the BA Grains Exchange latest precipitation forecast map.

World Weather, Inc.

MOST IMPORTANT WEATHER OF THE DAY

- China’s Yellow River Basin and east-central Provinces will dry down for the next ten days.

o Soil moisture today is rated favorably, and spring fieldwork has advanced quite well, but the region will experience net drying for a while

- The drier bias will be great for winter wheat maturation and harvest progress

- Northeast China will continue to experience a good mix of rain and sunshine over the next ten days supporting fine early season crop development; however, rainfall frequency may be a little higher than desired causing some disruption to fieldwork periodically

- Southern China and in particular the southeastern corner of the nation will experience too much rain and additional flooding is expected in some rice, citrus and minor corn production areas during the next week

o Damage to personal property is possible because of the wet conditions

- Xinjiang China weather was dry biased Wednesday with seasonable temperatures and this trend will continue for a while

o Daily high temperatures will be in the 70s and 80s northeast followed by lows in the 40s and 50s while highs in the southwest are in the 80s and lower 90s followed by lows in the 50s and lower 60s

- Western Australia will receive some welcome rain for the second time this month and that will translate into very good wheat, barley and canola planting, emergence and establishment conditions

- Eastern Australia winter crop areas and those in South Australia are struggling for moisture and even though planting is progressing there is need for greater rain to induce good stands of wheat, barley and canola in unirrigated fields

- Northern Kazakhstan and southern Russia’s New Lands need rain

o Recent warm and dry weather has stressed crops and depleted soil moisture

o Cooling is now under way, but significant rain is not very likely for a while, although a few showers will occur briefly with the first frontal system passage that is expected in the next couple of days

- Western Europe is expected to dry out over the next week, but most areas have good soil moisture today

o Europe’s driest areas are in Spain, Portugal, southern Italy and a few random locations in the southeast, but dryness in these areas is not unusual at this time of year

o France, Germany and the U.K. will dry down as the next week to ten days moves along because of the more limited rainfall pattern

- Eastern Europe and the western parts of Russia, the Baltic States and Belarus along with Ukraine will see a good mix of rain and sunshine during the next ten days.

o Fieldwork may advance a little slower than desired, but the long term crop outlook is favorable

- Tropical Cyclone Yaas dissipated over eastern India Wednesday

o Rainfall varied over 4.00 inches during the day from eastern Odisha into eastern Chhattisgarh and immediate neighboring areas

o The storm’s remnants will produce moderate to heavy rain northward into eastern Uttar Pradesh during the next two days

o Other areas in India are not likely to receive much rain for a while, although sporadic pre-monsoonal showers are expected periodically

- Net drying is expected in many areas

- Temperatures were seasonably warm to hot

- Cold temperatures occurred in Canada’s Prairies this morning with frost and freezes in many areas

o Most of the hard freezes were in central and northern Manitoba where readings in the 20s were noted

o Lows in southern and far western Manitoba and central through eastern Saskatchewan were mostly in the 30s with a few upper 20s.

o New damage to crops was greatest in central Manitoba and some replanting may be necessary because of the extreme cold

- The region impacted is not a part of the major production region, however

- Restricted precipitation in southern Canada’s Prairies and the northern U.S. Plains over the next ten days will support fieldwork after recent rain, but more moisture is needed

- Southeastern Canada corn and soybean production areas are experiencing a mostly good mix of weather for spring planting and winter wheat development

o The region will trend a little cooler and be mostly dry for a while allowing good field progress to continue

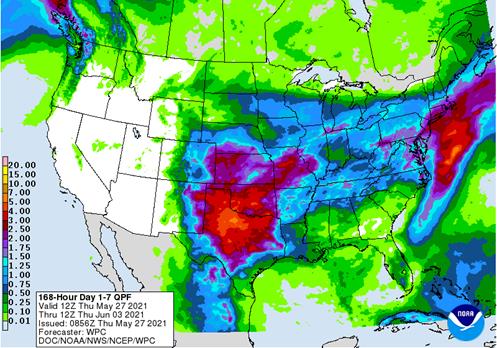

- U.S. crop weather is expected to be nearly ideal over the next ten days with all areas getting rain at one time or another except parts of the southeastern states

o Net drying in the southeastern states is already firming the soil and additional heat and dryness in this coming week is expected to stress early planted crops and slow emergence and establishment for the more recently planted fields that are not irrigated

- A close watch on this part of the nation is warranted for a while; second week rainfall is still being advertised, but confidence in its distribution and significance remains a little low

- West Texas cotton, corn, sorghum and peanut production areas will experience a good mix of rain and sunshine during the next two weeks

o Southwestern parts of the dryland production area need rain, and “some” is expected

o Other crop areas in the Low Plains, northern High Plains and Rolling Plains will receive significant rain often bolstering soil moisture for many areas especially in this coming week to ten days

- Some of these areas will receive 1.00 to 3.00 inches of rain and locally more during the next seven days

o Some drying will occur in the second week of June

- U.S. hard red winter wheat production areas may get rain a little more often than desired and there is some concern over grain quality in the more advanced crops in the south where some of the greatest rain frequency and intensity is expected

o Most of the crop will benefit from the rain and warm weather

- U.S. Northern Plains will get some rain in the coming week, but greater precipitation is going to be needed later this spring and summer as temperatures trend warmer

o Rain fell across the region overnight with 0.12 to 0.76 inch common with a few greater amounts in southwestern and south-central North Dakota and western South Dakota

- Northern North Dakota and northern Minnesota missed out on this rainfall

- U.S. Pacific Northwest crop areas are back to a dry bias after some beneficial moisture fell in Oregon during the past week

o Unirrigated winter crops in the region need more moisture for the best yields

- Most of the far western U.S. will experience net drying conditions over the next week to ten days leaving drought conditions firmly in place

- Brazil will be drier biased into the end of this week with only a few showers of limited significance expected

o A new weather disturbance will produce rain in the south in the second half of this week and during the weekend

- The additional moisture will maintain favorably moist conditions in many winter wheat production areas and will maintain a better environment for some of the late season Safrinha corn production areas

o Not much rain is expected in Mato Grosso, northern Mato Grosso do Sul, Goias, southwestern Minas Gerais or crop areas farther to the north over the next ten days

- Safrinha corn and cotton in these areas will be stressed

o Temperatures will be cooler biased in the wettest areas

o Next week’s weather will be much drier in southern areas

o Southern Safrinha crop areas will not be as dry as they have been again through the next couple of weeks, despite drying next week

- Argentina will receive very little rain for the next ten days

o Crop moisture for wheat planting is mostly very good

o Improved summer crop harvest progress is expected as this week moves forward

o Temperatures will be a little cooler biased for a while this week and into next week especially in the east

- Mexico drought remains serious, although enough rain fell last week to bring some relief in east-central parts of the nation.

o This week’s weather will be less beneficially wet with isolated to scattered showers continuing in the east with mostly light rain resulting

o A boost in rainfall may occur again in southern and eastern areas next week

o The recent moisture has helped improve planting, emergence and establishment conditions for many early season crops in the wetter areas, but the west-central and northwest parts of the nation are still quite dry.

- South Africa will be dry and warm this week before some rain evolves next week and temperatures turn briefly cooler

- West Africa rainfall is expected to be erratic and lighter than usual during the coming week with a boost in precipitation expected in the first week of June

o Coffee, cocoa, sugarcane, rice and cotton areas are mostly well rated, but greater rain will be needed soon as additional drying evolves

- East-central Africa has been and will continue to be lighter than usual – at least through the coming ten days

- Southern Oscillation Index is mostly neutral at +5.65 and the index is expected to move lower this week

- North Africa weather this week will produce a few showers, but resulting rainfall is expected to be infrequent and light

o Winter small grains will continue to mature and be harvested around the precipitation

- Southeast Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks

o Greater rain is needed in the northern and western Philippines

- Luzon Island, Philippines will be last to get significant rain

- New Zealand precipitation for the next week to ten days will be greatest in eastern parts of the nation and temperatures will be cooler biased

Source: World Weather, Inc.

Thursday, May 27:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- International Grains Council monthly report

- Port of Rouen data on French grain exports

- Brazil orange crop forecast for 2021-22

Friday, May 28:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- U.S. agricultural prices paid, received

Source: Bloomberg and FI

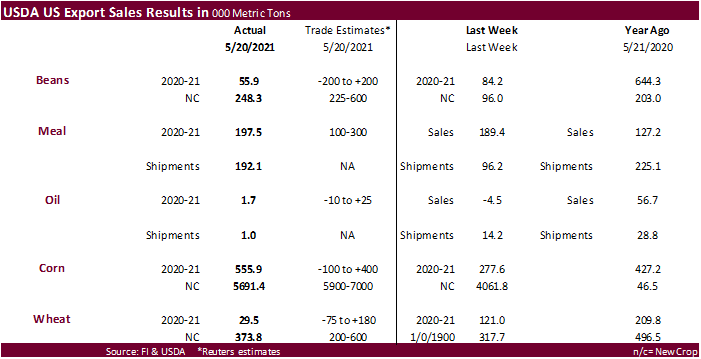

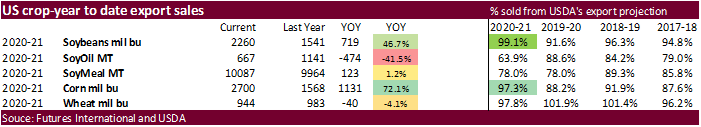

USDA Export Sales

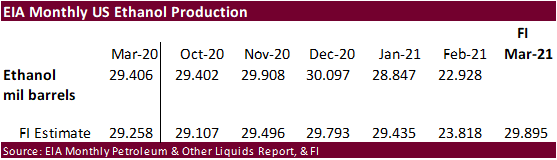

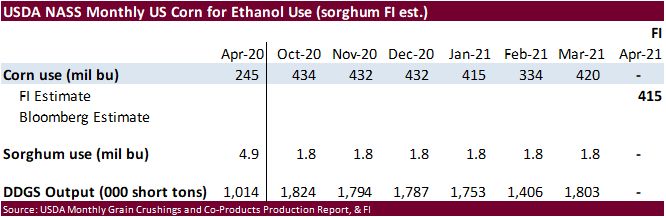

USDA reported better than expected old-crop corn export sales of 555,900 tons of corn, primarily for Mexico. China added 168,000 tons of old crop corn (66k from unknown). New crop sales were at the low end of expectations at 5.691 million tons with most for China. Sorghum sales were reductions of 81,000 tons. China cancelled 111,200 tons of sorghum. USDA reported soybean export sales at 55,900 tons old and 248,300 tons new. The new-crop sales were on the low side of expectations. Soybean meal sales were ok at 197,100 tons and SBO of 1,700 tons were poor. Shipments of meal and oil were low at 192,100 and 1,000 tons, respectively. All-wheat export sales were 29,500 tons for old crop and 373,800 tons for new-crop, lower than what we expected for new-crop. Old-crop is nearly done.

FED Reverse Repo Facility Usage Rises To Record USD485.3Bln

US GDP Annualized (Q/Q) Q1 S: 6.4% (est 6.5%; prev 6.4%)

US GDP Price Index Q1 S: 4.3% (est 4.1%; prev 4.1%)

US Personal Consumption Q1 S: 11.3% (est 10.9%; prev 10.7%)

US Core PCE (Q/Q) Q1 S: 2.5% (est 2.3%; prev 2.3%)

US Initial Jobless Claims May 22: 406K (est 425K; prev 444K)

US Continuing Claims May 15: 3642K (est 3680K; prevR 3738K; prev 3751K)

US Durable Goods Orders Apr P: -1.3% (est 0.8%; prevR 1.3%; prev 0.8%)

US Durable Goods Orders Ex-Transportation Apr P: 1.0% (est 0.7%; prevR 3.2%; prev 1.9%)

US Cap Goods Orders Nondef Ex-Air Apr P: 2.3% (est 1.0%; prevR 2.2%; prev 1.2%)

US Cap Goods Ship Nondef EX-Air Apr P: 0.9% (est 0.8%; prevR 1.6%; prev 1.6%)

Canada Non-Farm Payrolls Rose 245.8k In March To 16.1 Mln

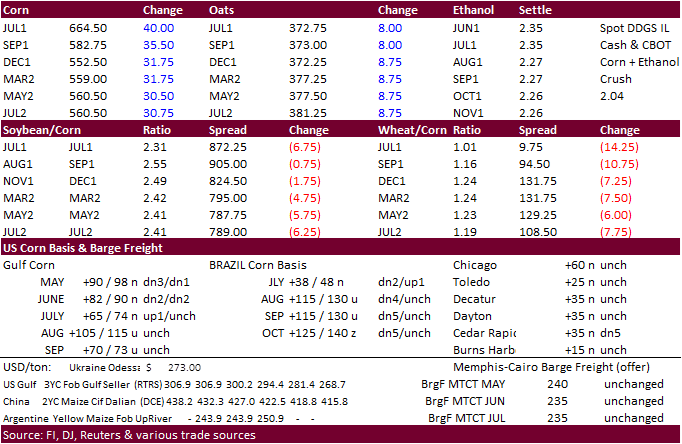

- July corn ended limit up, a 40 cent climb to $6.6450. Back months were up 33.25-37.25 cents led by nearby positions. Corn led the other agriculture market higher after a Chinese official mentioned the Phase One trade agreement between the US and China could benefit both countries and the rest of the world. Traders believe China will continue buying US grain, a reversal in views that China was actively cancelling US corn commitments as they “overbought” old and new-crop corn over the past several months.

- The investment funds were looking for a good reason to buy corn and found one this morning after old crop USDA export corn sales failed to show signs of corn cancellations by China that was talked about mid-May, in my opinion.

- USDA old crop corn export sales of 555,900 tons added to the positive undertone in the corn market during the late overnight session. Tight US supplies keeping US cash prices firm and a sharp rebound in US wheat futures were initially underpinning corn futures.

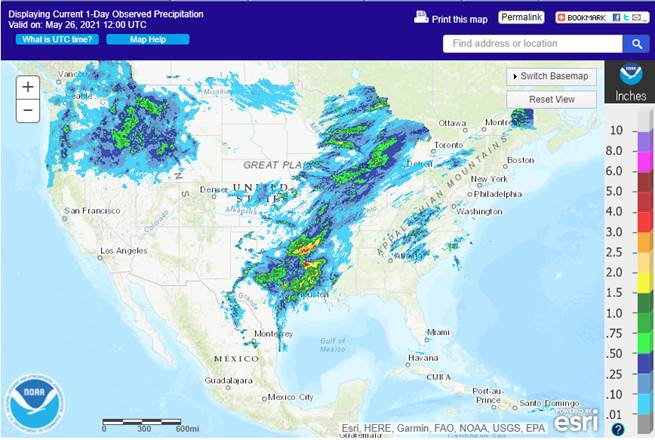

- US weather forecast was largely unchanged and rains over the past 24-hours have shifted east bringing a welcome relief from the southern Great Plains to the upper Midwest bias WCB and “I” states. Rains will fall across the Midwestern central & western areas today, ECB Friday, and west central region Monday.

- Funds bought an estimated 33,000 corn contracts, per Reuters. Note on Monday they sold 58,000. We think the net long corn position as of yesterday will end up more long than expected.

- South Africa’s Crop Estimates Committee (CEC) reported the 2020-21 SAf corn production estimate at 16.180 million tons, below expectations (Reuters poll 16.413) that includes 8.982 million tons of white and 7.198 yellow. This compares to 16.095 million last month, and up from 15.300 million previous season.

- IGC estimated global grain production 5 million tons higher than last month at 2.29 billion tons, but they lowered stocks by the same amount to nearly 600 million tons, a 7-year low. This is largely in part to a downward revision to beginning stocks.

- AgriCensus in an article this morning noted much of the trade has penciled in a 70 million ton Brazil second corn crop, well below Conab’s 79.8 million ton estimate. One estimate has 66.2 million tons.

Export developments.

- WASHINGTON, May 27, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 152,400 metric tons of corn delivery to unknown destinations during the 2021/2022 marketing year.

Updated 5/24/21

July is seen in a $6.00 and $7.25 range

December corn is seen in a $4.75-$7.00 range.

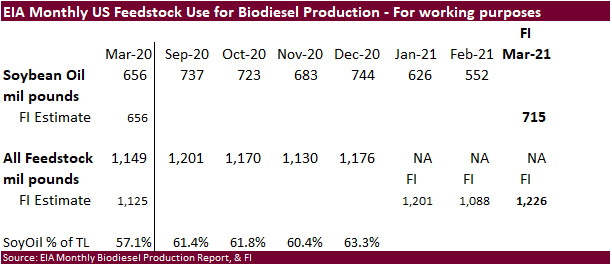

- CBOT soybean complex reversed to trade sharply higher on strength in corn and wheat. We remain slightly bearish soybeans based on favorable US weather and slow US export developments, but SBO oil inventories have already started to shrink on growing demand for feedstock for renewable fuel production. We look for end of April US SBO stocks to decline about 45 million pounds from the previous month. Export sales were neutral to poor, in our opinion. July soybeans dipped below the $15 level earlier this week as US planting progress was reported above average. Some saw this as a buying opportunity. Rain forecast for the ECB and lack of US export developments was hindering upside movement earlier this week and largely ignored today. Brazil soybean premiums for the nearby positions were mostly lower this morning but US fob still has a competitive edge.

- Funds bought an estimated net 20,000 soybeans, bought 5,000 meal and bought 7,000 soybean oil.

- ICE canola basis November was up $25.30 or 3.7% to $716.60/ton.

- Buenos Aires Grains Exchange: Argentina’s 2020-21 soy crop 43.5 million tons vs. previous 43 million. Argentina 91.4% soybean crop harvested and corn 31% corn.

- Chicago, Decatur (IL), Morristown (IN) and Fostoria (OH) meal basis all fell $2.00 to $6.00 under the July, from yesterday.

- Malaysia is back from holiday and futures slipped 2.7% on demand concerns during the June through August period.

- Argentina ended a port worker 48-hour strike after reaching a Covid-19 vaccine agreement. They are now recognized as essential workers.

- The Brazilian government will start vaccinating Santos port workers this week.

U of I: Soybeans Bringing Record Prices and Historical Exports in Brazil

Colussi, J. and G. Schnitkey. “Soybeans Bringing Record Prices and Historical Exports in Brazil.” farmdoc daily (11):85, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 26, 2021.

- South Korea’s MFG bought 59,000 tons of optional origin soybean meal at $484.28/ton for September shipment.

NOTE EIA DOES NOT REPORT TOTAL FEEDSTOCKS AND BREAKDOWN BY DIESEL TYPE USE – we use this for reference only

Updated 5/25/21

July soybeans are seen in a $14.75-$16.00; November $12.75-$15.00

Soybean meal – July $360-$420; December $380-$460

Soybean oil – July 64-70; December 48-60 cent range

- Wheat saw a rebound in prices on technical buying and renewed import demand by major importers. USDA export sales were within expectations. The southern Great Plains saw favorable rain over the past day and rains are expected across much of the Plains through Monday. The upper Great Plains will see cold temperatures and some weather forecasts predict snow falling across parts of the Dakotas.

- Funds bought an estimated net 15,000 SRW wheat contracts.

- Saudi Arabia seeks 720,000 tons of wheat.

- EU Commission: soft wheat production 126.2 million tons vs. 124.8 million last month.

- September Paris wheat market basis September was up 6.00 euros at 212.00.

- Algeria so far bought 210,000 tons of durum wheat at $351-$358/ton. Offers are valid until Thursday, for shipment between July 1-31.

- Saudi Arabia seeks 720,000 tons of 12.5% wheat on May 28-31 for July 10-September 30th shipment.

- Cancelled: Tunisia was in for 92,000 tons of wheat, optional origin, for June 15 through July 25 shipment. Lowest offer was $279.82/ton.

- Japan bought 124,620 tons of food wheat from the US and Canada later this week.

- In its weekly SBS import tender, Japan on June 2 seeks 80,000 tons of feed wheat and 100,000 tons of barley for arrival by November 25.

- Jordan cancelled their 120,000-ton barley import tender for Oct-Nov shipment.

- Bangladesh seeks 50,000 tons of milling wheat on May 30.

Rice/Other

· Egypt seeks 100,000 tons of raw cane sugar on June 5.

Updated 5/24/21

July Chicago wheat is seen in a $6.30-$7.15 range

July KC wheat is seen in a $5.95-$6.70

July MN wheat is seen in a $6.55-$7.40

USDA Export Sales

This summary is based on reports from exporters for the period May 14-May 20, 2021.

Wheat: Net sales of 29,500 metric tons (MT) for 2020/2021 were down 76 percent from the previous week and 58 percent from the prior 4-week average. Increases primarily for Canada (10,400 MT, including decreases of 2,600 MT), Burma (7,000 MT, switched from Malaysia), the Philippines (4,600 MT, including decreases of 200 MT), Indonesia (4,200 MT, including 600 MT switched from Vietnam), and Japan (2,700 MT), were offset by reductions for Malaysia (6,300 MT) and Mexico (6,100 MT). For 2021/2022, net sales of 373,800 MT primarily for Nigeria (78,000 MT), Japan (65,000 MT), the Philippines (60,000 MT), Taiwan (59,200 MT), and Vietnam (53,000 MT), were offset by reductions for unknown destinations (500 MT). Exports of 529,300 MT were down 7 percent from the previous week and 5 percent from the prior 4-week average. The destinations were primarily to Japan (92,300 MT), Mexico (85,800 MT), the Philippines (68,100 MT), China (62,900 MT), and Indonesia (57,600 MT).

Optional Origin Sales: For 2020/2021, the current outstanding balance of 63,900 MT is for Spain.

Corn: Net sales of 555,900 MT for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Mexico (378,200 MT, including decreases of 2,100 MT), China (168,000 MT, including 66,000 MT switched from unknown destinations), South Korea (64,500 MT, including 65,000 MT switched from unknown destinations and decreases of 3,100 MT), Panama (23,700 MT, including 6,500 MT switched from Colombia (2,900 MT, switched from El Salvador and decreases of 8,200 MT), and Honduras (6,500 MT), were offset by reductions primarily for unknown destinations (70,500 MT). For 2021/2022, net sales of 5,691,300 MT primarily for China (5,644,000 MT), Panama (131,900 MT), Japan (50,000 MT), Costa Rica (32,000 MT), and unknown destinations (9,000 MT), were offset by reductions for Mexico (178,000 MT). Exports of 1,850,000 MT were down 17 percent from the previous week and 6 percent from the prior 4-week average. The destinations were primarily to China (847,000 MT), Mexico (379,000 MT), Colombia (200,700 MT), Japan (200,000 MT), and South Korea (61,500 MT).

Optional Origin Sales: For 2020/2021, decreases totaling 59,000 MT were reported for unknown destinations. The current outstanding balance of 209,500 MT is for unknown destinations (130,500 MT) and South Korea (79,000 MT). For 2021/2022, new optional origin sales totaling 60,000 MT were to unknown destinations. The current outstanding balance of 60,000 MT is for unknown destinations.

Barley: Total net sales of 400 MT for 2020/2021 were for South Korea. Exports of 400 MT were down 41 percent and 21 percent from the prior 4-week average. The destination was to South Korea.

Sorghum: Net sales reduction of 81,000 MT for 2020/2021–marketing-year low–resulting in increases for Eritrea (30,100 MT) and unknown destinations (100 MT), were more than offset by reductions for China (111,200 MT). For 2021/2022, net sales of 166,000 MT were for China (113,000 MT) and unknown destinations (53,000 MT). Exports of 193,500 MT were up noticeably from the previous week and up 17 percent from the prior 4-week average. The destinations were primarily to China (133,200 MT), Eritrea (30,100 MT), and unknown destinations (30,100 MT).

Rice: Net sales of 35,500 MT for 2020/2021 were down 63 percent from the previous week and 27 percent from the prior 4-week average. Increases primarily for Haiti (15,300 MT), Honduras (6,500 MT), Guatemala (2,500 MT, including decreases of 300 MT), Saudi Arabia (2,300 MT, including decreases of 200 MT), and Canada (1,900 MT), were offset by reductions for El Salvador (200 MT). Total net sales reductions for 2021/2022, of 700 MT were for Guatemala. Exports of 74,600 MT were up 8 percent from the previous week, but down 1 percent from the prior 4-week average. The destinations were primarily to Mexico (25,300 MT), Japan (14,600 MT), El Salvador (6,700 MT), Guatemala (6,500 MT), and Honduras (6,400 MT).

Exports for Own Account: For 2020/2021, the current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans: Net sales of 55,900 MT for 2020/2021 were down 34 percent from the previous week and 65 percent from the prior 4-week average. Increases primarily for Indonesia (74,900 MT, including 55,000 MT switched from unknown destinations and decreases of 300 MT), Egypt (52,000 MT, switched from unknown destinations), Mexico (34,800 MT, including decreases of 200 MT), Japan (13,700 MT, including decreases of 3,500 MT), and Vietnam (13,600 MT), were offset by reductions primarily for unknown destinations (168,100 MT). For 2021/2022, net sales of 248,300 MT were primarily for Mexico (162,500 MT) and unknown destinations (45,000 MT). Exports of 294,600 MT were down 12 percent from the previous week and 4 percent from the prior 4-week average. The destinations were primarily to Indonesia (84,800 MT), Mexico (72,700 MT), Egypt (52,000 MT), Japan (32,900 MT), and Taiwan (13,200 MT).

Exports for Own Account: For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean Cake and Meal: Net sales of 197,400 MT for 2020/2021 were up 4 percent from the previous week and 26 percent from the prior 4-week average. Increases primarily for unknown destinations (53,500 MT), the Philippines (48,600 MT), Mexico (37,600 MT, including decreases of 2,300 MT), the Dominican Republic (11,000 MT), and Sri Lanka (9,900 MT), were offset by reductions primarily for Belgium (4,300 MT) and Guatemala (2,500 MT). For 2021/2022, net sales of 76,900 MT were for Panama (46,900 MT) and Canada (30,000 MT). Exports of 192,100 MT were up noticeably from the previous week and up 13 percent from the prior 4-week average. The destinations were primarily to the Philippines (50,100 MT), Mexico (34,500 MT), Morocco (30,300 MT), Colombia (26,900 MT), and Canada (18,800 MT).

Soybean Oil: Net sales of 1,700 MT for 2020/2021 were down noticeably from the previous week, but up 14 percent from the prior 4-week average. Increases were primarily for Canada (1,400 MT, including decreases of 200 MT). Exports of 1,000 MT were down 93 percent from the previous week and 92 percent from the prior 4-week average. The destinations were to Canada (600 MT) and Mexico (400 MT).

Cotton: Net sales of 171,200 RB for 2020/2021 were up 59 percent from the previous week and up noticeably from the prior 4-week average. Increases primarily for China (42,800 RB, including 800 RB switched from Hong Kong and decreases of 1,400 RB), Pakistan (39,500 RB), Vietnam (21,900 RB, including 1,100 RB switched from Japan, 1,100 RB switched from South Korea, and decreases of 800 RB), Turkey (19,400 RB, including decreases of 2,500 RB), and Indonesia (7,600 RB, including 1,300 RB switched from Japan and decreases of 800 RB), were offset by reductions primarily for South Korea (1,100 RB) and Hong Kong (800 RB). For 2021/2022, net sales of 92,400 RB were primarily for Turkey (37,000 RB), Mexico (35,200 RB), Pakistan (6,600 RB), Thailand (6,500 RB), and South Korea (4,000 RB). Exports of 323,500 RB were down 6 percent from the previous week and 9 percent from the prior 4-week average. Exports were primarily to Vietnam (83,300 RB), China (57,900 RB), Turkey (43,800 RB), Pakistan (40,700 RB), and Indonesia (28,000 RB). Net sales of Pima totaling 12,700 RB were up 58 percent from the previous week and 81 percent from the prior 4-week average. Increases were primarily for China (7,900 RB), India (3,200 RB), and Peru (1,400 RB). Exports of 17,500 RB were up noticeably from the previous week and up 6 percent from the prior 4-week average. The destinations were primarily to India (6,500 RB), China (6,000 RB), Peru (2,600 RB), Pakistan (900 RB), and Turkey (400 RB).

Exports for Own Account: For 2020/2021, exports for own account totaling 3,800 RB to Vietnam were applied to new or outstanding sales. The current exports for own account outstanding balance of 13,600 RB is for China (7,600 RB), Vietnam (5,600 RB), and Bangladesh (400 RB).

Hides and Skins: Net sales of 624,400 pieces for 2021 were up noticeably from the previous week and from the prior 4-week average. Increases were primarily for China (484,100 whole cattle hides, including decreases of 12,700 pieces), South Korea (54,700 whole cattle hides, including decreases of 800 pieces), Thailand (39,300 whole cattle hides, including decreases of 500 pieces), Mexico (24,600 whole cattle hides, including decreases of 3,200 pieces), and Taiwan (9,800 whole cattle hides, including decreases of 200 pieces). Exports of 372,400 pieces were up 13 percent from the previous week, but down 5 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (252,600 pieces), South Korea (58,700 pieces), Mexico (26,000 pieces), Thailand (14,200 pieces), and Japan (4,500 pieces).

Net sales of 104,800 wet blues for 2021 were up noticeably from the previous week, but down 12 percent from the prior 4-week average. Increases primarily for China (38,300 unsplit), Mexico (24,700 unsplit and 3,200 grain splits), Italy (20,000 unsplit), Thailand (9,800 unsplit, including decreases of 200 unsplit), and Vietnam (8,500 unsplit, including decreases of 100 pieces), were offset by reductions for China (2,300 grain splits). Exports of 67,600 wet blues were down 52 percent from the previous week and from the prior 4-week average. The destinations were primarily to Vietnam (24,300 unsplit), Italy (10,700 unsplit), Thailand (10,000 unsplit), China (9,600 unsplit), and Mexico (7,700 unsplit). Net sales of 165,900 splits were for Vietnam (120,500 pounds) and China (45,400 pounds). Exports of 120,000 pounds were to Vietnam.

Beef: Net sales of 27,900 MT reported for 2021 were up 19 percent from the previous week and 45 percent from the prior 4-week average. Increases were primarily for China (9,000 MT, including decreases of 100 MT), Japan (8,800 MT, including decreases of 500 MT), South Korea (6,000 MT, including decreases 400 MT), Indonesia (1,100 MT), and Taiwan (1,000 MT, including decreases of 100 MT). Exports of 19,400 MT were down 1 percent from the previous week, but up 4 percent from the prior 4-week average. The destinations were primarily to Japan (5,400 MT), South Korea (4,900 MT), China (3,500 MT), Taiwan (1,300 MT), and Mexico (1,300 MT).

Export Adjustments: Accumulated exports of beef to the Netherlands were adjusted down 33,589 MT for week ending May 13th. This shipment was reported in error.

Pork: Net sales of 45,900 MT reported for 2021 were up noticeably from the previous week and up 56 percent from the prior 4-week average. Increases primarily for Mexico (21,800 MT, including decreases of 700 MT), China (9,600 MT, including decreases of 400 MT), Japan (7,700 MT, including decreases of 200 MT), Canada (3,000 MT, including decreases of 400 MT), and Colombia (1,100 MT, including decreases of 100 MT), were offset by reductions for Peru (100 MT). Exports of 47,800 MT were up 38 percent from the previous week and 11 percent from the prior 4-week average. The destinations were primarily to Mexico (16,800 MT), China (13,500 MT), Japan (4,800 MT), South Korea (3,000 MT), and Canada (2,200 MT).

U.S. EXPORT SALES FOR WEEK ENDING 5/20/2021

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

12.5 |

461.4 |

995.3 |

135.3 |

8,267.6 |

9,038.9 |

59.1 |

1,117.5 |

|

SRW |

-7.9 |

154.7 |

175.3 |

23.6 |

1,712.7 |

2,268.0 |

45.5 |

826.5 |

|

HRS |

19.2 |

541.5 |

1,121.8 |

162.9 |

7,229.1 |

6,840.9 |

193.2 |

1,166.7 |

|

WHITE |

3.8 |

388.2 |

705.3 |

185.5 |

6,240.7 |

4,654.7 |

76.0 |

832.0 |

|

DURUM |

2.0 |

28.6 |

43.4 |

22.0 |

653.8 |

922.0 |

0.0 |

8.4 |

|

TOTAL |

29.5 |

1,574.4 |

3,041.1 |

529.3 |

24,103.9 |

23,724.5 |

373.8 |

3,951.1 |

|

BARLEY |

0.4 |

2.2 |

9.7 |

0.4 |

26.8 |

40.6 |

0.0 |

22.2 |

|

CORN |

555.9 |

19,439.7 |

12,170.5 |

1,850.0 |

49,137.4 |

27,667.8 |

5,691.3 |

14,627.9 |

|

SORGHUM |

-81.0 |

1,306.7 |

1,322.3 |

193.5 |

5,961.3 |

2,531.1 |

166.0 |

1,410.0 |

|

SOYBEANS |

55.9 |

4,274.9 |

6,719.2 |

294.6 |

57,244.2 |

35,222.2 |

248.3 |

7,270.3 |

|

SOY MEAL |

197.4 |

2,097.7 |

2,152.6 |

192.1 |

7,989.3 |

7,811.7 |

76.9 |

637.2 |

|

SOY OIL |

1.7 |

58.8 |

324.1 |

1.0 |

608.0 |

816.6 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

8.8 |

225.5 |

266.0 |

43.7 |

1,402.8 |

1,187.2 |

-0.7 |

0.0 |

|

M S RGH |

0.0 |

16.4 |

36.9 |

0.5 |

24.5 |

59.5 |

0.0 |

0.0 |

|

L G BRN |

0.2 |

2.5 |

20.4 |

0.4 |

36.8 |

46.8 |

0.0 |

0.0 |

|

M&S BR |

0.5 |

45.4 |

56.6 |

0.5 |

110.8 |

59.6 |

0.0 |

0.0 |

|

L G MLD |

19.7 |

58.6 |

48.0 |

5.5 |

537.2 |

780.8 |

0.0 |

0.0 |

|

M S MLD |

6.3 |

201.3 |

173.5 |

24.0 |

478.2 |

539.1 |

0.0 |

0.0 |

|

TOTAL |

35.5 |

549.7 |

601.4 |

74.6 |

2,590.3 |

2,673.0 |

-0.7 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

171.2 |

3,316.5 |

5,258.3 |

323.5 |

12,230.1 |

11,077.5 |

92.4 |

1,921.3 |

|

PIMA |

12.7 |

164.3 |

145.2 |

17.5 |

633.1 |

411.6 |

0.0 |

4.0 |

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.