PDF Attached

Lower

trade in soybeans led by weakness in soybean meal. Soybean oil rallied in part to higher palm oil futures. Corn ended mixed with July higher (strong US corn basis) and back months lower. Nearby Chicago wheat fell while KC and MN ended higher on US Great Plains

weather concerns. The USD was sharply higher, up 4 consecutive sessions. USDA export sales were very good for soybean meal. Rest of the commodities were about as expected. China cancelled a good amount of corn, but Mexico stepped up purchases last week.

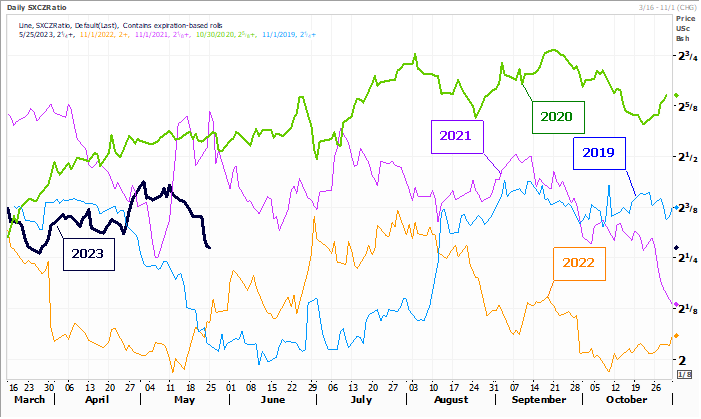

SX/CZ

Fund

estimates as of May 25

![]()

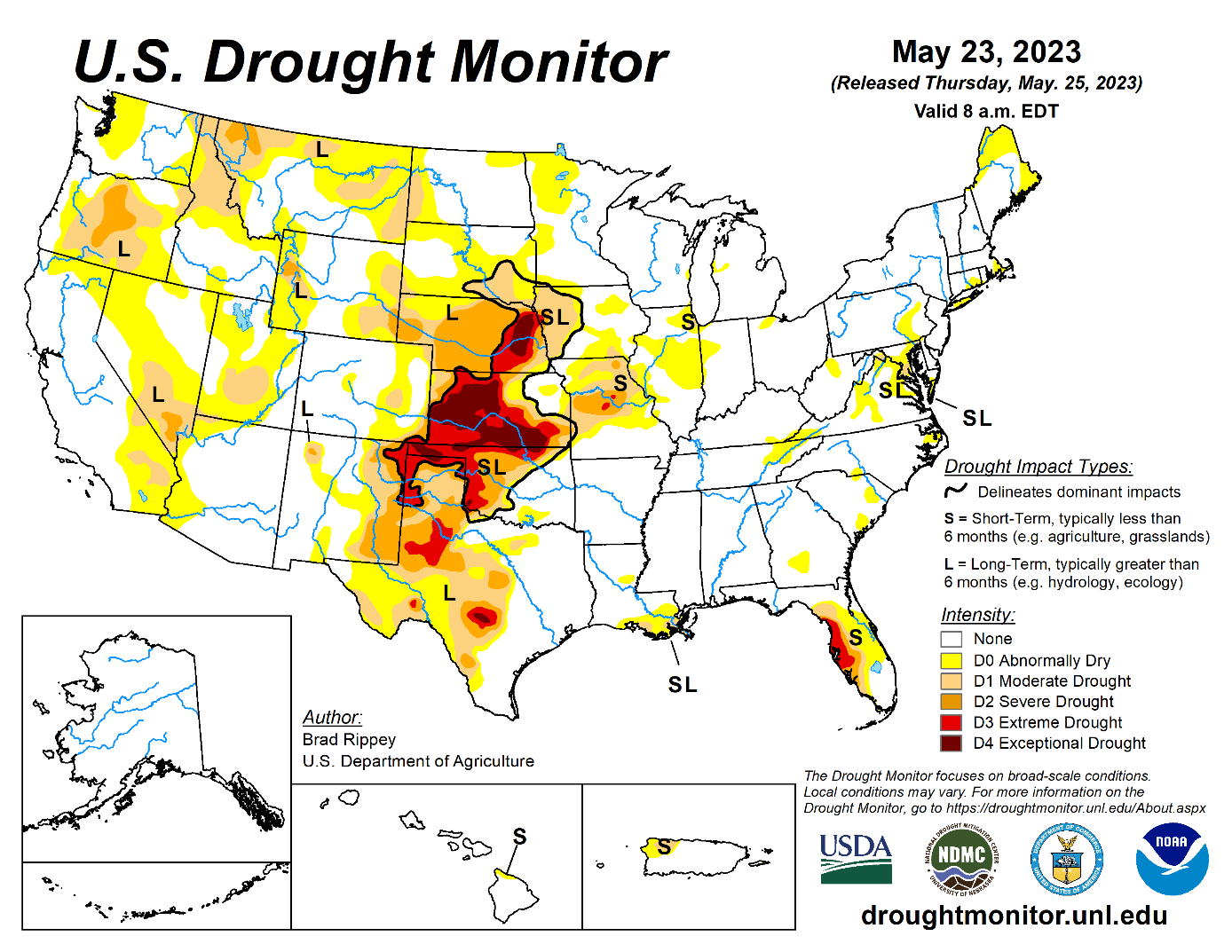

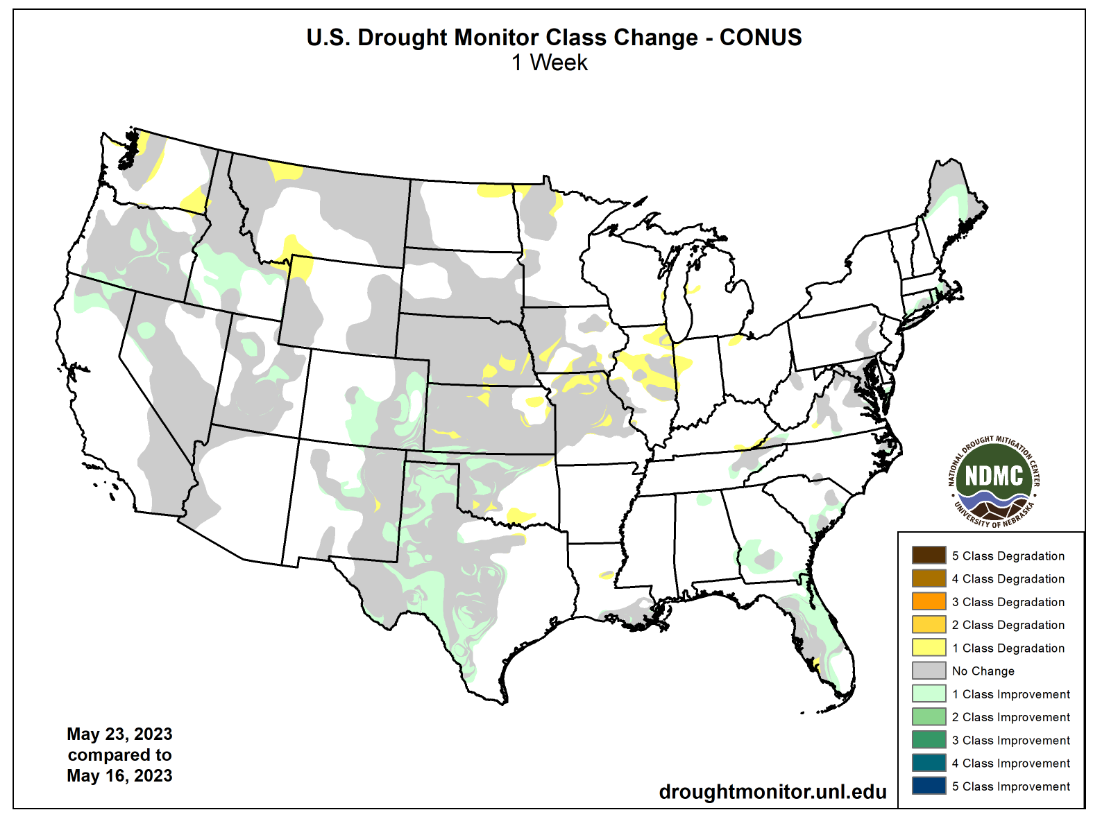

Weather

WEATHER

TO WATCH

-

U.S.

Midwest will experience another week of dry weather and temperatures will rise above normal for a while with multiple days of 80-degree Fahrenheit highs that will accelerate drying in the topsoil -

Crop

conditions and fieldwork will remain favorable during the week, but rain will become an increasingly more important need for the region -

Some

rain will develop during the June 2-8 period, though it is a little unclear how significant that will be -

U.S.

hard red winter wheat areas will continue to receive periodic showers and thunderstorms over the next week providing late season moisture for more immature crops -

There

is need for drier weather in parts of Texas and Oklahoma where crops are most advanced, but so far there has not been any serious impact on grain quality -

U.S.

Delta and southeastern states will continue to experience favorable weather over the next two weeks, despite drying for a while in the Delta -

Heavy

rain is expected in the Carolinas this weekend as a low pressure center comes inland producing 1.00 to 3.00 inches of rain and local totals near the coast of more than 5.00 inches -

West

Texas cotton areas benefited greatly from rain this past week with 1.00 to 2.65 inches common and a few amounts pushing up over 3.00 inches -

Friona,

Texas received 3.06 inches in the past seven days and Andrews, located in the southwest corner of West Texas, reported 3.60 inches

-

Texas

Panhandle 7-Day rain totals have varied from 1.50 to more than 5.00 inches raising concern over wheat quality and slowing crop maturation -

The

moisture has set the stage for a great start to the corn and sorghum season -

U.S.

Pacific Northwest weather will continued locked into a pattern with the Yakima Valley staying dry over the next ten days to two weeks and frequent, near-daily, showers occurring in the Snake River Valley and areas northeast into Wyoming and Montana sugarbeet

and dry bean country -

Western

Alberta, Canada soil moisture has improved greatly from that of last weekend because of early week rainfall varying from 1.00 to more than 3.00 inches -

Saskatchewan

and Manitoba rainfall will improve sufficiently to boost soil moisture for better canola, wheat, lentil, corn and soybean development, although southeastern Manitoba will miss much of the beneficial moisture -

Ontario

and Quebec, Canada need more consistent warm temperatures to stimulate better wheat, corn and soybean development -

Some

improving trends are expected over the next week -

Drought

in southwestern parts of Canada’s Prairies remains serious and significant rain must fall soon to save canola, wheat and other crops planted and emerged in the region -

Rain

is possible during the second week of the outlook across a part of the region, but confidence is not high over how significant the rain will be -

Australia’s

winter crops are establishing favorable in portions of the south, especially in Victoria, southeastern South Australia and southern New South Wales locations -

Greater

rain is needed in interior parts of Western and South Australia, Queensland and some north-central production areas of New South Wales -

Northern

Europe will dry out over the next ten days -

The

region will experience seasonable temperatures which may help to keep the drying rates at a reasonable level, but the region will need to be closely monitored for possible dryness issues later in June -

Southern

Europe continues to deal with frequent showers and thunderstorms -

Flooding

occurred recently in northern Italy -

Some

grain quality concerns may be developing in early maturing winter small grains -

The

pattern is not likely to change much for at least the next week and possibly ten days -

Russia’s

eastern New Lands are drying down and will need to be closely monitored over the next few weeks for moisture shortages and crop stress -

Today’s

forecast models suggest rain will fall in the June 3-9 period, but it is unclear how significant that may or may not be -

Western

Russia, Belarus and western Ukraine may dry down for the next ten days while the Volga River Basin and Ural Mountains region get periodic rain along with eastern Ukraine and Russia’s Southern Region -

Northern

India will get unusually great amounts of rain for this time of year slowing fieldwork and raising some unharvested winter crop quality concerns -

Much

of the winter crop should be harvested, though -

Rain

will be good for early season cotton in Punjab, Haryana and parts of Rajasthan as well as in parts of Pakistan

-

China

weather will continue favorably mixed except in a small part of eastern Inner Mongolia where drought is prevailing -

Alternating

periods of rain and sunshine elsewhere in China will be great for long term crop development -

Xinjiang,

China temperatures will continue cooler than usual over the next ten days -

Northeastern

Xinjiang will experience highs in the 70s Fahrenheit while other areas in the province experience 80s -

All

of these temperatures are still not optimum for cotton or corn -

Warming

is needed to induce the best crop development -

Some

showers will occur in the northeast. -

An

improved environment of warmer weather is needed -

The

persistent cool conditions this spring may lead to a higher potential for crop damage in the autumn if frost and freezes occur prior to crop maturity.

-

Mainland

Southeast Asia rainfall will steadily increase later this week into next week bringing relief from early season dryness -

Improved

rice and corn planting conditions are expected -

Improved

sugarcane, coffee and other crop development is also likely as well -

Water

supply in the region is below average and concern is rising over water supply when El Nino kicks in and starts reducing summer rainfall which makes the greater rain forthcoming all the more important -

Indonesia

and Malaysia rain frequency and intensity is expected to diminish greatly next week and on into the first full week of June

-

Some

net drying is expected, but crop conditions will remain favorably rated. -

Philippines

rainfall will remain well mixed with sunshine over the next ten days -

Super

Typhoon Mawar was producing sustained wind speeds of 173 mph today and gusts to more than 207 mph at 1500 GMT today.

-

The

storm will move west northwesterly toward Taiwan and the northeastern part of Luzon, Philippines, but landfall is not likely through Tuesday -

Taiwan

may be more vulnerable to the storm than the Philippines and notable weakening is expected prior to the storm getting near those areas -

Argentina

will experience additional rainfall during the coming week -

The

rain will be greatest in the central and east leaving some of the southwestern most winter crop areas in need of greater planting moisture -

Fieldwork

will advance swiftly in the central and eastern wheat areas after the rain ends this week, though more rain will be needed to ensure ideal conditions later this autumn -

Concern

over southwestern dryness may continue for a while, but the situation will not be critical unless June turns out to be drier than usual as well -

Temperatures

will trend cooler in Argentina later this week and through the weekend -

That

will conserve soil moisture through lower evaporation so that winter seed germination and plant emergence occur favorably once drier weather resumes -

Warming

is expected again during the second week of the outlook -

Center

south Brazil weather will be dry biased the remainder of this week and this weekend while temperatures are warmer than usual -

Net

drying is expected and unirrigated Safrinha crops will become more stressed -

Early

maturing corn will be maturing and should not be seriously stressed by the environment -

Well-timed

rain will fall in Safrinha crop areas of Mato Grosso do Sul, Sao Paul and Parana late this weekend and early next week resulting in a perfectly timed improvement in topsoil moisture to carry late planted corn through reproduction in a favorable manner -

Mato

Grosso and Goias may not be included in the rain event next week and crop moisture stress may continue to rise, although there is only a small amount of very late crop development in these areas relative to the remainder of the Safrinha crop region which should

limit the downside for production -

Cooling

after early next week’s southern Brazil rain event may bring down temperatures into the 40s Fahrenheit, but no frost event is presently anticipated

-

South

Africa will be dry today and then some showers will begin to evolve and they will last into next week benefiting winter wheat development , but disrupting some farming activity -

North

Africa rainfall will be periodic over the next ten days, but it comes a little too late to change production for Morocco and northwestern Algeria -

Recent

rain in northeastern Algeria and northern Tunisia has been timely and sufficient to improve late season production potential, though it is unclear how much benefit has resulted -

Drier

weather will soon be needed in Morocco and northwestern Algeria to protect crop quality and support harvesting -

West-central

Africa will continue to receive periodic rainfall over the next two weeks and that will prove favorable for main season coffee, cocoa and sugarcane -

Some

cotton areas would benefit from greater rain, though the precipitation that has occurred has been welcome -

East-central

Africa rainfall has been favorable for coffee, cocoa and other crops in recent weeks with little change likely -

Central

Asia cotton and other crop weather has been relatively good this year with adequate irrigation water and some timely rainfall reported -

The

favorable environment will continue -

Mexico

rainfall is expected to fall periodically over the central and eastern parts of the nation during the next ten days improving topsoil moisture for future planting of summer crops

-

Western

Mexico will continue quite dry -

Central

America rainfall is expected to be periodic and sufficient to support crop needs -

Water

levels on Gatun Lake in Panama are low once again and concern has been rising over water levels for shipping through the Panama Canal

-

Draught

restrictions have been put into place because of the low water levels -

El

Nino will not help the situation in the long run -

Today’s

Southern Oscillation Index was -12.42 and it should move lower over the next several days

Source:

World Weather, INC.

Friday,

May 26:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - EARNINGS:

Select Harvests - HOLIDAY:

Hong Kong

Monday,

May 29:

- Vietnam’s

coffee, rice and rubber exports in May - HOLIDAY:

US, UK, France, Germany

Tuesday,

May 30:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

planting data for corn, cotton, spring wheat and soybeans, 4pm - US

cotton and winter wheat condition, 4pm - EU

weekly grain, oilseed import and export data - EARNINGS:

FGV

Wednesday,

May 31:

- US

agricultural prices paid, received - Malaysia’s

May palm oil exports

Thursday,

June 1:

- EIA

weekly US ethanol inventories, production, 11am - USDA

soybean crush, corn for ethanol, DDGS production, 3pm - Port

of Rouen data on French grain exports - HOLIDAY:

Indonesia

Friday,

June 2:

- FAO

food price index, monthly grains report - USDA

weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Italy, Indonesia

Source:

Bloomberg and FI

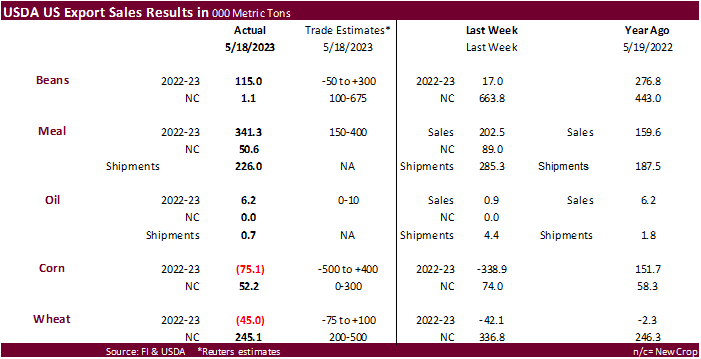

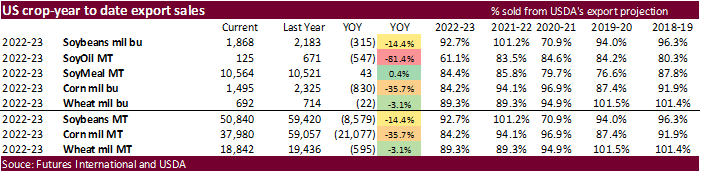

USDA

export sales

Big

soybean meal sales this week. Increases were primarily for Poland (100,000 MT), unknown destinations (46,500 MT), Colombia (45,700 MT). Soybean sales were 115,000 tons and soybean oil improved to 6,200 tons. Old crop corn net reduction was not as bad as traders

expected. China cancelled 331,600 tons of corn and unknown was reduced by 216,700 tons. This and other cancelations were partially offset by a 216,100 ton increase by Mexico. All wheat sales for 2023-24 were 245,100 tons with Japan as largest buyer. Sorghum

sales were 5,700 tons and pork 29,200 tons.

Macros

US

GDP Annualized (Q/Q) Q1 S: 1.3% (est 1.1%; prev 1.1%)

US

Core PCE (Q/Q) Q1 S: 5.0% (est 4.9%; prev 4.9%)

US

Personal Consumption Q1 S: 3.8% (est 3.7%; prev 3.7%)

US

GDP Price Index Q1 S: 4.2% (est 4.0%; prev 4.0%)

US

Initial Jobless Claims May 20: 229K (est 245K; prevR 225K)

US

Continuing Claims May 13: 1794K (est 1800K; prev 1799K)

US

Chicago Fed Nat Activity Index Apr: 0.07 (est -0.20; prevR -0.37)

Canadian

Payroll Employment Change – SEPH Mar: -9.9K (prev 62.5K)

US

Pending Home Sales (M/M) Apr: 0.0% (est 1.0%; prev -5.2%)

–

Pending Home Sales NSA (Y/Y): -22.6% (est -20.1%; prev -23.3%)