PDF Attached

Spot

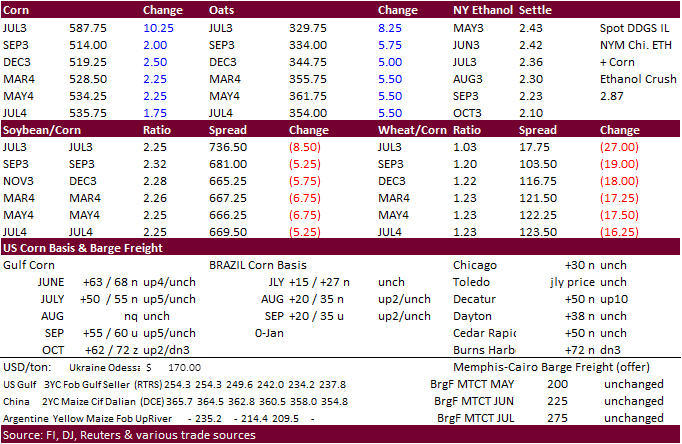

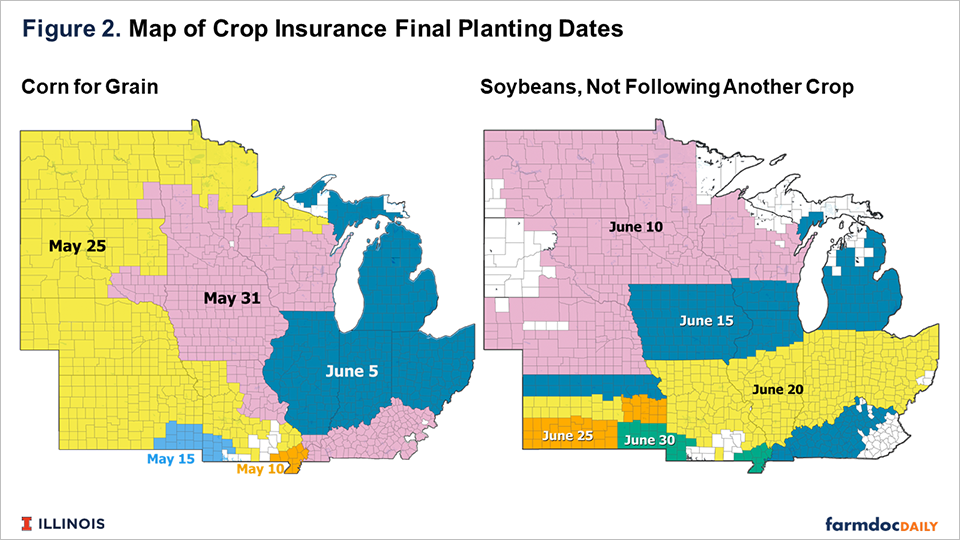

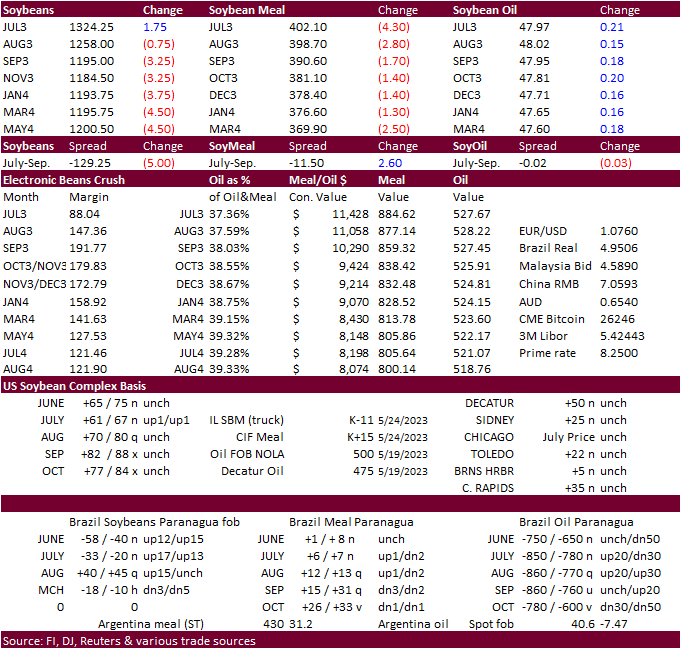

US corn basis remains very strong and that supported the spread today. Meanwhile traders are weighing in the possibility of a large US corn abandonment as some locations has reach their respected planting insurance dates this week. Soybean oil was higher in

part to higher WTI crude oil. Soybean meal fell and that weighed on soybeans. Wheat was lower on profit taking, Black Sea competition and an IL wheat tour report suggesting the states soft red winter yield could be much higher than USDA’s current projection.

Weather

World

Weather Inc.

WEATHER

TO WATCH

-

Super

Typhoon Mawar overran Guam and the southern Mariana Islands earlier today producing wind speeds of more than 130 mph near its center with gusts to 167 mph.

-

Serious

damage is suspected to Guam and a few neighboring Islands -

The

storm will now track toward Taiwan and northeastern Luzon Island in the northern Philippines, but a turn to the northeast prior to reaching those areas is still possible, although there is potential for a continued northwesterly track possibly impacting Taiwan

and/or China -

Rain

in western Alberta, Canada over the past two days has been significant in the Peace River Region and in the Swan Hills region which is mostly in far western Alberta -

Moisture

totals of 1.00 to nearly 2.50 inches has occurred inducing much improved soil moisture after the ground became too dry recently -

Other

areas in western and northern Alberta have reported lighter rain that was also beneficial, though there is need for more rain -

Drought

remains in east-central and interior southern Alberta where not much change is expected for a while -

Rain

is expected in much of central and eastern Saskatchewan and Manitoba, Canada during the coming week offering the first generalized rain seen in a very long time -

Rain

totals of 0.50 to 1.50 inches and locally more than 2.00 inches are expected by this time next week -

The

moisture will help improve future planting conditions and will stimulate improved germination, plant emergence and establishment -

Southeastern

Manitoba will be driest as will far western parts of Saskatchewan -

Quebec

and Ontario, Canada will begin warming while receiving limited rain and will do so again Thursday, though the impact on wheat has been minimal and most of the corn and soybeans are not emerged -

Frost

and freezes will occur again Thursday morning in Quebec without inducing any serious damage to wheat or summer crops -

U.S.

Midwest will be dry and warm over the next week to ten days

with daily highs in the 70s and 80s occurring often followed by lows in the 40s and 50s -

The

exception will be Thursday when a cool airmass will slip through the northeast and central parts of the region bringing down high temperatures to the 60s and 70s -

The

frontal system will retreat to the north Friday and Saturday opening the door of opportunity for multiple days of 80-degree highs beginning this weekend and last through the first half of next week

-

Rapid

planting, quick seed germination and good crop emergence conditions are likely throughout the week -

Some

beneficial rainfall and continued seasonably warm weather is expected in early June, although temperatures will trend cooler -

The

rain anticipated in early June will continue lighter than usual -

Overall,

weather will be very good fieldwork and crop development over the next two weeks -

Some

pockets of dryness are expected to evolve and subsoil moisture will continue quite favorable. A close watch on the dry conditions will be warranted in June especially if temperatures turn warmer than usual

-

Winter

crop development will continue to advance quite favorably -

U.S.

Hard Red Winter wheat and West Texas crop areas will receive routinely occurring showers and thunderstorms this week favoring crop development and fieldwork -

West

Texas rain totals for the next ten days will vary from 0.75 to 1.75 inches in the high Plains and 1.00 to 3.00 inches from the Low Plains into the Rolling Plains with local totals over 4.00 inches in the latter area -

U.S.

Delta will experience net drying conditions over the coming week to ten days -

U.S.

southeastern states will experience scattered showers and thunderstorms during the next two weeks with some areas getting beneficial moisture while others will not and net drying will result -

A

tropical or subtropical low pressure center will form off the Florida coast late this week and into the weekend that may enhance rainfall along the lower U.S. Atlantic Coast Friday into the weekend -

Preliminary

rainfall may vary from 2.00 to 6.00 inches impacting coastal areas of the Carolinas and possibly a part of eastern Georgia and/or southeastern Virginia -

U.S.

Pacific Northwest will be dry and warm biased during much of the coming ten days in the Yakima Valley while other areas experience scattered showers and thunderstorms late this week into next week with only light rain resulting, but it will be welcome and

beneficial -

U.S.

northwestern Plains will get some welcome rain the remainder of this week into the weekend -

The

moisture will be ideal for spring and summer crops, although it will disrupt fieldwork -

U.S.

northeastern Plains will experience less frequent and less significant rain during the coming ten days supporting improved drying conditions and better field working opportunities -

Temperatures

will warm to the 80s Fahrenheit as well for a few days late this week and into the weekend -

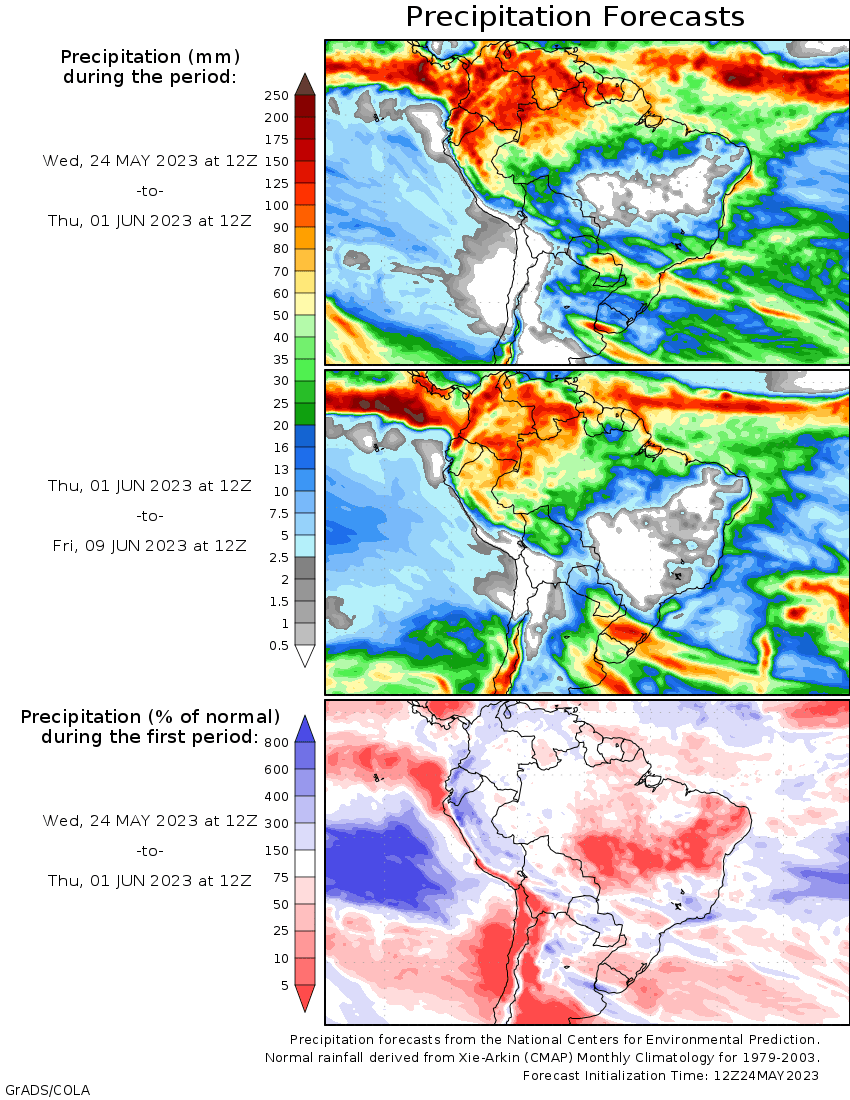

Argentina

will experience additional rainfall during the coming week -

Additional

rain will be greatest in the central and east leaving some of the southwestern most winter crop areas in need of greater planting moisture -

Fieldwork

will advance swiftly in the central and eastern wheat areas after the rain ends this week, though more rain will be needed to ensure ideal conditions later this autumn -

Concern

over western dryness may continue for a while, but the situation will not be critical unless June turns out to be drier than usual as well -

Temperatures

will trend cooler in Argentina later this week and through the weekend -

That

will conserve soil moisture through lower evaporation so that winter seed germination and plant emergence occur favorably once drier weather resumes -

Center

south Brazil weather will be dry biased the remainder of this week and temperatures will be warmer than usual -

Net

drying is expected and unirrigated Safrinha crops will become more stressed -

Early

maturing corn will be maturing and should not be seriously stressed by the environment -

Well-timed

rain will fall in Safrinha crop areas of Mato Grosso do Sul, Sao Paul and Parana early next week resulting in a perfectly timed improvement in topsoil moisture to carry late planting corn through reproduction in a favorable manner -

Mato

Grosso and Goias may not be included in the rain event next week and crop moisture stress may continue to rise, although there is only a small amount of very late crop development in these areas relative to the remainder of the Safrinha crop region which should

limit the downside for production -

Cooling

after early next week’s southern Brazil rain event may bring down temperatures into the 40s Fahrenheit, but no frost event is presently anticipated

-

Southern

Europe will continue wetter than northern Europe this week and next week as well -

Temperatures

will be seasonable to slightly warmer than usual and that may lead to some gradual drying in the north raising the need for moisture in June, but fieldwork will advance well over this next ten days while rainfall continues minimal -

Southern

Europe will need some drier days and perhaps some warmer temperatures to stimulate the best crop development -

Fieldwork

will advance slowly because of frequent rain -

The

moisture in Spain will be very helpful in easing long term dryness, but the wetter biased conditions may raise some winter crop quality issues -

CIS

New Lands will be dry and warm over the next ten days resulting in net drying and a high potential for pockets of dryness to evolve -

The

situation will be closely monitored, although no area will become critically dry in this first week of the outlook

-

A

few showers may occur in the second week of the forecast, but resulting rainfall will not be enough to change crop or field conditions in a significant manner -

Western

CIS weather over the next ten days will include warm temperatures for a while and then some cooling and periods of rain -

Eastern

Ukraine and Russia’s Southern Region northward through the Volga River Basin to western Russia will receive widespread rain over the next ten days slowing fieldwork, but benefiting soil moisture and future crop development -

Greater

than usual rain is expected in northern India later this week and into the weekend

-

The

wet weather will disrupt farming activity; including the harvest of winter crops -

The

moisture will support early season cotton development and help prepare the soil for summer crop planting -

Mainland

Southeast Asia rainfall will steadily increase later this week into next week bringing relief from early season dryness -

Improved

rice and corn planting conditions are expected -

Improved

sugarcane, coffee and other crop development is also likely as well -

Water

supply in the region is below average and concern is rising over water supply when El Nino kicks in and starts reducing summer rainfall which makes the greater rain forthcoming all the more important -

China

weather is still expected to be well mixed over the next two weeks as it has been during much of the spring season

-

Planting

of summer crops should be advancing well -

Rapeseed

and wheat production has been good, although some rapeseed quality issues may have evolved with recent rain -

Summer

crop planting in the Yellow River Basin, east-central parts of the nation, North China Plain and Northeast Provinces should be advancing well with little change likely -

Rain

will be greatest in the north this weekend into next week -

Xinjiang,

China temperatures will continue cooler than usual over the next ten days -

Northeastern

Xinjiang will experience highs in the 70s Fahrenheit while other areas in the province experience 80s -

All

of these temperatures are still not optimum for cotton or corn -

Warming

is needed to induce the best crop development -

Some

showers will occur in the northeast. -

An

improved environment of warmer weather is needed -

The

persistent cool conditions this spring may lead to a higher potential for crop damage in the autumn if frost and freezes occur prior to crop maturity.

-

Philippines

rain will be favorably mixed over the next two weeks -

Typhoon

Mawar poses a threat to northeastern Luzon next week, although landfall seems unlikely

-

Taiwan

may also be vulnerable to Typhoon Mawar, although landfall seems unlikely -

Indonesia

and Malaysia rainfall will be favorably distributed in the balance of this week, but there may be some reduction in rain intensity and coverage next week

-

Crop

conditions should remain favorable throughout the next few weeks, although southern parts of Indonesia will begin drying out soon -

Australia

rainfall during the next ten days will be greatest and most frequent in southern parts of the nation during the next ten days -

Southwestern

Western Australia, coastal areas of South Australia, Victoria and southern New South Wales will be wettest and the moisture will be good for winter crop planting, emergence and establishment -

Anticipated

rain will be lighter than usual in many areas and the need for greater rain in interior crop areas of Western Australia, South Australia, Queensland and Northern New South Wales will be rising -

South

Africa will be dry through Friday and then some showers will begin to evolve and they will last into next week benefiting winter wheat development , but disrupting some farming activity -

North

Africa rainfall will be periodic over the next ten days, but it comes a little too late to change production for Morocco and northwestern Algeria -

Recent

rain in northeastern Algeria and northern Tunisia has been timely and sufficient to improve late season production potential, though it is unclear how much benefit has resulted -

Drier

weather will soon be needed in Morocco and northwestern Algeria to protect crop quality and support harvesting -

West-central

Africa will continue to receive periodic rainfall over the next two weeks and that will prove favorable for main season coffee, cocoa and sugarcane -

Some

cotton areas would benefit from greater rain, though the precipitation that has occurred has been welcome -

East-central

Africa rainfall has been favorable for coffee, cocoa and other crops in recent weeks with little change likely -

Central

Asia cotton and other crop weather has been relatively good this year with adequate irrigation water and some timely rainfall reported -

The

favorable environment will continue -

Mexico

rainfall is expected to fall periodically over the central and eastern parts of the nation during the next ten days improving topsoil moisture for future planting of summer crops

-

Western

Mexico will continue quite dry -

Central

America rainfall is expected to be periodic and sufficient to support crop needs -

Today’s

Southern Oscillation Index was -11.23 and it should move lower over the next several days

Source:

World Weather, INC.

Bloomberg

Ag calendar

Thursday,

May 25:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Malaysia’s

May 1-25 palm oil exports - US

poultry slaughter, red meat output, 3pm - EARNINGS:

IOI - HOLIDAY:

Argentina

Friday,

May 26:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - EARNINGS:

Select Harvests - HOLIDAY:

Hong Kong

Source:

Bloomberg and FI

Macros

105

Counterparties Take $2.251 Tln At Fed Reverse Repo Op.

Fed

Minutes Show Officials Split On Support For More Hikes

Fed

Officials Stress Data-Dependent Approach, Cuts Unlikely

Officials

Saw Timely Debt Limit As Essential

Extent

Of Potential Hikes Had Become Less Certain

Almost

All Officials Saw Upside Risks To Inflation Outlook

Most

Fed Officials Saw Rising Downside Growth Risks On Credit

Fed

Staff Maintained Forecast For ‘Mild’ Recession In 2023

Corn

·

Corn traded higher from follow through buying amid the weather outlook calling for net drying across the US Midwest and possible abandonment. US ECB basis is starting to rise. We heard Bluffton IN paid +70, +80 and then +85 for

corn. This help pull July 9.75 cents higher.

·

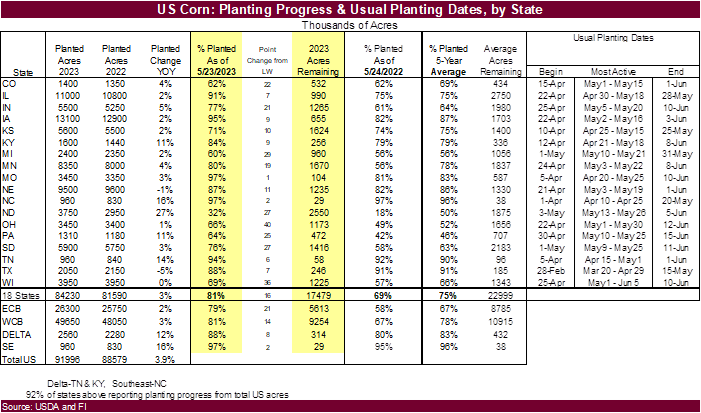

There has been a lot of talk about corn abandonment for the Dakota’s this season and now that planting insurance dates are nearing, many wonder if there could be 1.0-1.5 acres lost for the US. We know it was a problem for ND

& SD as of Sunday but with good weather through Thursday they may get a lot of corn in. with current prices for December trading around 5.24 per bushel, good industrial demand, and high WCB corn basis (spot), we think there is little reason producers will

abandon corn acres. Here was 2022 for corn and soybeans for the northern Great Plains per University of IL. Below that is a table of acres remains for corn as of last Sunday. With the holiday Monday, the trade will have to wait until Tuesday afternoon to

see what was done this week. nearly 4 million acres remained to be planted for corn for the Dakota’s as of last Sunday. In our opinion, we think a minimal amount of corn acres will be lost for the Dakota’s relative to USDA March Intentions.

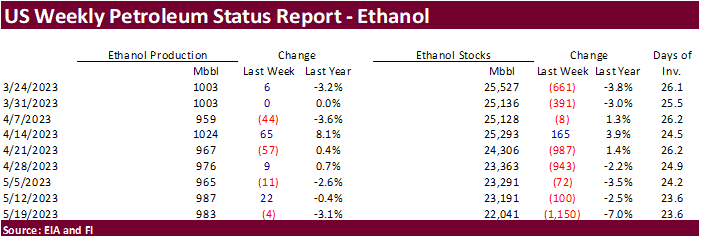

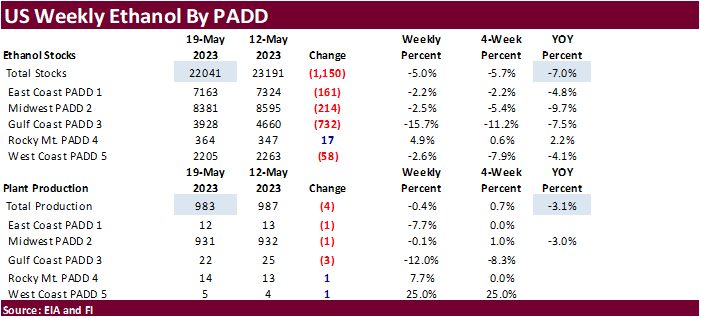

US

DoE Crude Oil Inventories (W/W) 19-May: -12456K (exp 2000K; prev 5040K)

Distillate:

-561K (exp 500K; prev 80K)

Cushing

OK Crude: +1762K (prev +1461K)

Gasoline:

-2053K (exp -1600; prev -1381K)

Refinery

Utilization: -0.30% (est 0.60%; prev 1.00%)

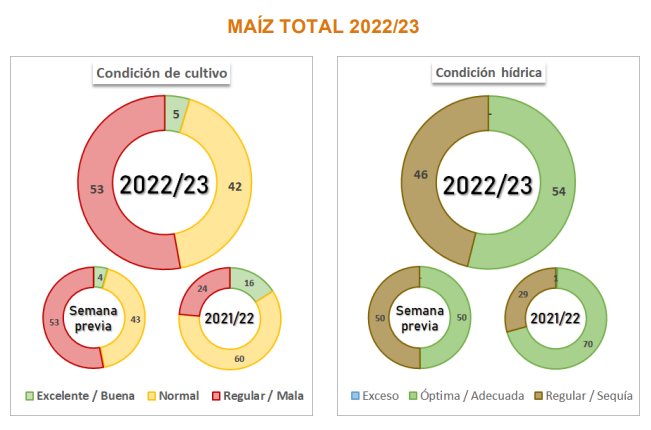

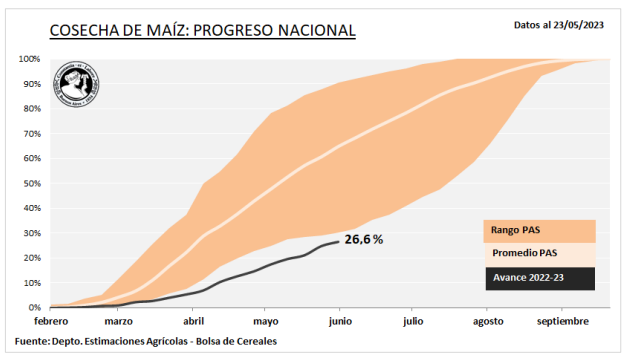

26.6

percent of the Argentina corn crop had been collected. Around this time of year, it should be near 55 percent. The second corn crop was planted very late.

Export

developments.

-

Taiwan’s

MFIG bought 65,000 tons of corn from Brazil at 139 cents over the September contract for Aug 5-Aug 24 shipment.

July

corn $5.25-$6.25

September

$4.25-$5.50

December

corn $4.25-$5.75

·

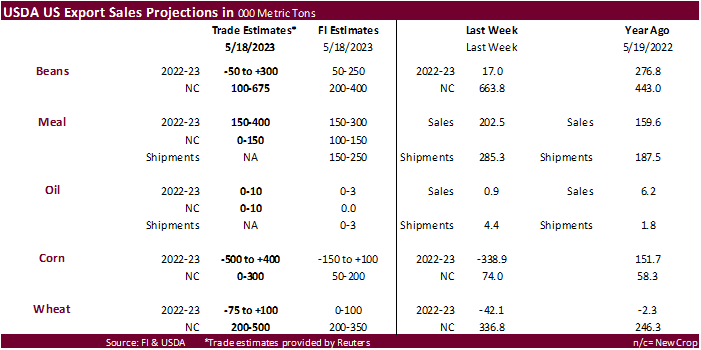

Outside markets lent support to soybean oil. Soybean meal started mixed but fell led by the font month. US soybean meal basis at the Gulf was weaker. Soybeans trended lower from lower meal. News was light. Expect the trade to

focus on NA weather over the next few weeks. We see no issue with US soybean planting progress.

·

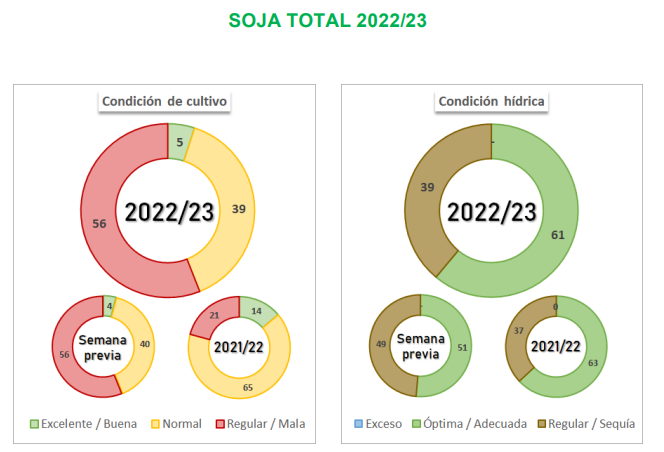

Some traders are looking at total Argentina soybean sales under the current soybean dollar to amount to around 7 million tons. This helps explain the increase of India soybean interest last month from South America.

·

78 percent of the Argentina soybean crop had been collected.

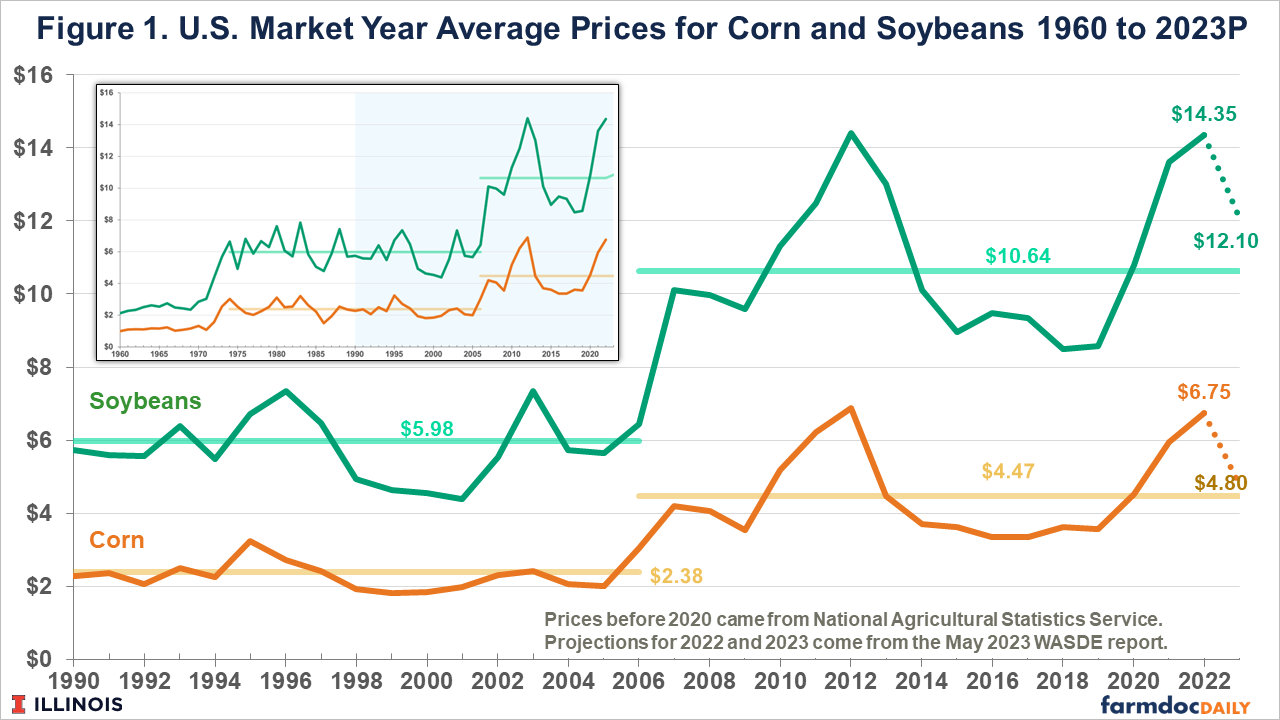

University

of Illinois.

Back

to Normal: Revised 2023 Budgets with Lower Prices

Schnitkey,

G., C. Zulauf and N. Paulson. “Back to Normal: Revised 2023 Budgets with Lower Prices.” farmdoc daily (13):94, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 23, 2023.

https://farmdocdaily.illinois.edu/2023/05/back-to-normal-revised-2023-budgets-with-lower-prices.html

Export

Developments

·

None reported

Soybeans

– July $12.750-$14.00,

November $11.00-$14.50

Soybean

meal – July $370-$450,

December $290-$450

Soybean

oil – July 44-50,

December 43-53, with bias to upside

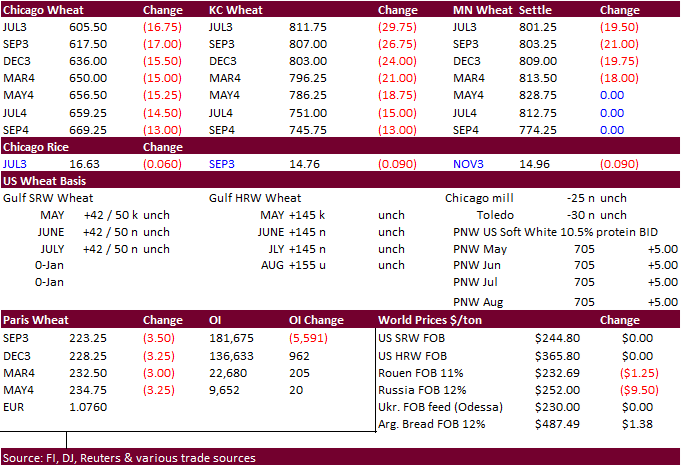

Wheat

·

US wheat traded lower on chatter of US wheat imports off the east coast and Black Sea competition. In addition a Illinois Wheat Association tour of that state estimated the winter wheat yield at a large 97.12 bushels per acre,

well above 78 bushels estimated by USDA, above the crop average of 68.5 bushels and compares to 68.5 bushels year ago. The state record was 79 bushels. IL grows primarily soft type wheat.

·

Profit taking was noted.

·

USDA’s US new-crop wheat exports are forecast to be the lowest in 52 years.

·

US spring wheat planting progress is running behind normal for some selected locations that have already passed the insurance deadline, but we don’t think this will deter producers from getting the rest of the crop in. Prices

still remain favorable.

·

September Paris wheat are down 3.50 euros to 222.50 per tons.

·

Bloomberg – Ukraine’s Grain Exports Fall 4.6% in Season So Far: Ministry. 44.6 million tons

o

15.3m tons of wheat, down 18% y/y

o

2.6m tons of barley, down 54% y/y

o

26.4m tons of corn, up 19% y/y …

Export

Developments.

·

Taiwan seeks 56,000 tons of US wheat on May 26 for LF July shipment.

Rice/Other

Chicago

Wheat – July $5.50-$6.50

KC

– July $7.50-$8.75

MN

– July $7.25-$8.75

September

– same ranges as July

#non-promo