PDF Attached

Global

import demand has picked up recently and that could have supported corn and wheat today along with short covering. Was also a weather trade today, IMO. Look for more chatter on that as we head into early summer growing season. WTI crude oil was up 44 cents

and USD 31 points higher. US weather outlook has not changed much of that of yesterday and net drying is still seen for parts of the US Midwest. Soybeans were lower, soybean oil lower and meal collapsed in surprise move.

Price

action was a little boggling given regular fundamentals. Perhaps squaring up ahead of the long US holiday weekend?

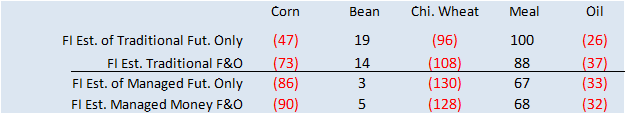

Fund

estimates as of May 23

Weather

WEATHER

TO WATCH

-

Tropical

Cyclone Mawar will overrun Guam and the southern Mariana Islands in the southwestern Pacific Ocean later today and Wednesday producing sustained wind speeds of 155 mph and gusts to 190 mph, 10-20 inches of rain and an impressive storm surge -

Serious

damage is expected to Guam and a few neighboring Islands -

The

storm will then track toward Taiwan and northeastern Luzon Island in the northern Philippines, but a turn to the northeast prior to reaching those areas should prevent landfall -

Rain

has begun in western Alberta, Canada with rainfall of 1.00 to 2.35 inches already noted in a part of the far west and amounts to 0.96 inch in central crop areas while the east was left dry -

Additional

rain will fall in the region today in virtually the same areas -

Relief

from recent drying will be welcome and should improve long term crop development potential even through fieldwork will be slowed -

Rain

is also expected in portions of central and eastern Saskatchewan and Manitoba, Canada during the middle to latter part of this week with rainfall sufficient to support recently planted seed germination, plant emergence and improved establishment -

Rain

totals of 0.50 to 1.50 inches and locally more are possible -

The

moisture will also help improve future planting conditions -

Drought

in east-central and southern Alberta and western Saskatchewan, Canada may not change this week, despite a few showers -

Next

week may not be much different -

Quebec

experienced additional frost and freezes this morning and will do so again Thursday, though the impact on wheat has been minimal and most of the corn and soybeans are not emerged -

Both

Ontario and Quebec are not expecting much rain for a while and warming is needed to stimulate corn and soybean germination, emergence and establishment -

U.S.

Midwest will be dry and warm over the next week to ten days with daily highs in the 80s Fahrenheit early this week and in the 70s and 80s late this week into next week

-

Rapid

planting, quick seed germination and good crop emergence conditions are likely throughout the week -

Timely

rainfall and continued seasonably warm weather is expected in early June -

Overall,

weather will be very good fieldwork and crop development over the next two weeks -

Some

pockets of dryness are expected to evolve and subsoil moisture will continue quite favorable. A close watch on the dry conditions will be warranted in June especially if temperatures remain a little warmer than usual

-

Winter

crop development will continue to advance quite favorably -

U.S.

Hard Red Winter wheat and West Texas crop areas will receive routinely occurring showers and thunderstorms this week favoring crop development and fieldwork -

West

Texas rain totals for the next ten days will vary from 0.75 to 1.75 inches in the high Plains and 1.00 to 3.00 inches from the Low Plains into the Rolling Plains with local totals over 4.00 inches in the latter area -

U.S.

Delta will experience net drying conditions over the coming week to ten days -

U.S.

southeastern states will experience scattered showers and thunderstorms during the next two weeks with some areas getting beneficial moisture while others will not and net drying will result -

A

tropical or subtropical low pressure center will form off the Florida coast late this week and into the weekend that may enhance rainfall along the lower U.S. Atlantic Coast Friday into the weekend -

Some

heavy rain is possible -

U.S.

Pacific Northwest will be dry and warm biased during much of the coming ten days in the Yakima Valley while other areas experience scattered showers and thunderstorms late this week into next week with only light rain resulting, but it will be welcome and

beneficial -

U.S.

northwestern Plains will get some welcome rain later this week into the weekend, though dry weather until then will be equally good for spring and summer crop progress -

U.S.

northeastern Plains will experience less frequent and less significant rain during the coming ten days supporting improved drying conditions and better field working opportunities -

Argentina

will experience additional rainfall during the coming week before dry weather resumes -

Additional

rain will be greatest in the central and east leaving some of the western most winter crop areas in need of greater planting moisture -

Fieldwork

will advance swiftly in the central and eastern wheat areas after the rain ends this week, though more rain will be needed to ensure ideal conditions later this autumn -

Concern

over western dryness may continue for a while, but the situation will not be critical unless June turns out to be drier than usual as well -

Temperatures

will trend cooler in Argentina later this week and through the weekend -

That

will conserve soil moisture through lower evaporation so that winter seed germination and plant emergence occur favorably once drier weather resumes -

Center

south Brazil weather will be dry biased the remainder of this week and temperatures will be warmer than usual -

Net

drying is expected and unirrigated Safrinha crops will become more stressed -

Well-timed

rain will fall in Safrinha crop areas of Mato Grosso do Sul, Sao Paul and Parana early next week resulting in a perfectly timed improvement in topsoil moisture to carry late planting corn through reproduction in a favorable manner -

Mato

Grosso and Goias may not be included in the rain event next week and crop moisture stress may continue to rise, although there is only a small amount of very late crop development in these areas relative to the remainder of the Safrinha crop region which should

limit the downside for production -

Some

recent computer forecast model runs are introducing rain for southern Mato Grosso and Goias, but confidence is not high -

Cooling

after early next week’s southern Brazil rain event may bring down temperatures into the 40s Fahrenheit, but no frost event is presently anticipated

-

Southern

Europe will continue wetter than northern Europe this week and next week as well -

Temperatures

will be seasonable to slightly warmer than usual and that may lead to some gradual drying in the north raising the need for moisture in June, but fieldwork will advance well over this next ten days while rainfall continues minimal -

Southern

Europe will need some drier days and perhaps some warmer temperatures to stimulate the best crop development -

Fieldwork

will advance slowly because of frequent rain -

The

moisture in Spain will be very helpful in easing long term dryness, but the wetter biased conditions may raise some winter crop quality issues -

CIS

New Lands will be dry and warm over the next ten days resulting in net drying and a high potential for pockets of dryness to evolve -

The

situation will be closely monitored, although no area will become critically dry in this first week of the outlook

-

Rain

prospects will improve next week with some timely moisture possible -

Western

CIS weather over the next ten days will include warm temperatures for a while and then some cooling and periods of rain -

Eastern

Ukraine and Russia’s Southern Region northward through the Volga River Basin to western Russia will receive widespread rain over the next ten days slowing fieldwork, but benefiting soil moisture and future crop development -

Greater

than usual rain is expected in northern India later this week and into the weekend

-

The

wet weather will disrupt farming activity; including the harvest of winter crops -

The

moisture will support early season cotton development and help prepare the soil for summer crop planting -

Mainland

Southeast Asia rainfall will steadily increase later this week into next week bringing notable relief from early season dryness -

Improved

rice and corn planting conditions are expected -

Improved

sugarcane, coffee and other crop development is also likely as well -

Water

supply in the region is below average and concern is rising over water supply when El Nino kicks in and starts reducing summer rainfall which makes the greater rain forthcoming all the more important -

China

weather is still expected to be well mixed over the next two weeks as it has been during much of the spring season

-

Planting

of summer crops should be advancing well -

Rapeseed

and wheat production has been good, although some rapeseed quality issues may have evolved with recent rain -

Summer

crop planting in the Yellow River Basin, east-central parts of the nation, North China Plain and Northeast Provinces should be advancing well with little change likely -

Rain

will be greatest in the north this weekend into next week -

Xinjiang,

China temperatures will continue cooler than usual over the next ten days -

Northeastern

Xinjiang will experience highs in the 70s Fahrenheit while other areas in the province experience 80s -

All

of these temperatures are still not optimum for cotton or corn -

Warming

is needed to induce the best crop development -

Some

showers will occur in the northeast. -

An

improved environment of warmer weather is needed -

The

persistent cool conditions this spring may lead to a higher potential for crop damage in the autumn if frost and freezes occur prior to crop maturity.

-

Philippines

rain will be favorably mixed over the next two weeks -

Typhoon

Mawar poses a threat to northeastern Luzon next week, although landfall seems unlikely

-

Taiwan

may also be vulnerable to Typhoon Mawar, although landfall seems unlikely -

Indonesia

and Malaysia rainfall will be favorably distributed in this first week of the outlook, but there may be some reduction in rain intensity and coverage next week

-

Crop

conditions should remain favorable throughout the next few weeks, although southern parts of Indonesia will begin drying out soon -

Australia

rainfall during the next ten days will be greatest and most frequent in southern parts of the nation during the next ten days -

Southwestern

Western Australia, coastal areas of South Australia, Victoria and southern New South Wales will be wettest and the moisture will be good for winter crop planting, emergence and establishment -

Anticipated

rain will be lighter than usual in many areas and the need for greater rain in interior crop areas of Western Australia, South Australia, Queensland and Northern New South Wales will be rising -

South

Africa will be dry through Friday and then some showers will begin to evolve and they will last into next week benefiting winter wheat development , but disrupting some farming activity -

North

Africa rainfall will be periodic over the next ten days, but it comes a little too late to change production for Morocco and northwestern Algeria -

Recent

rain in northeastern Algeria and northern Tunisia has been timely and sufficient to improve late season production potential, though it is unclear how much benefit has resulted -

Drier

weather will soon be needed in Morocco and northwestern Algeria to protect crop quality and support harvesting -

West-central

Africa will continue to receive periodic rainfall over the next two weeks and that will prove favorable for main season coffee, cocoa and sugarcane -

Some

cotton areas would benefit from greater rain, though the precipitation that has occurred has been welcome -

East-central

Africa rainfall has been favorable for coffee, cocoa and other crops in recent weeks with little change likely -

Central

Asia cotton and other crop weather has been relatively good this year with adequate irrigation water and some timely rainfall reported -

The

favorable environment will continue -

Mexico

rainfall is expected to fall periodically over the central and eastern parts of the nation during the next ten days improving topsoil moisture for future planting of summer crops

-

Western

Mexico will continue quite dry -

Central

America rainfall is expected to be periodic and sufficient to support crop needs -

Today’s

Southern Oscillation Index was -9.87 and it should move lower over the next several days

Source:

World Weather, INC.

,d

Wednesday,

May 24:

- EIA

weekly US ethanol inventories, production, 10:30am - US

cold storage data for beef, pork and poultry - EARNINGS:

Sime Darby Plantation

Thursday,

May 25:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Malaysia’s

May 1-25 palm oil exports - US

poultry slaughter, red meat output, 3pm - EARNINGS:

IOI - HOLIDAY:

Argentina

Friday,

May 26:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - EARNINGS:

Select Harvests - HOLIDAY:

Hong Kong

Source:

Bloomberg and FI

Corn

and Soybean Advisory

2022/23

Argentina Soybean Estimate Lowered 1.0 mt to 22.0 Million

2022/23

Argentina Corn Estimate Unchanged at 35.0 Million Tons

2022/23

Brazil Soybean Estimate Unchanged at 155.0 Million Tons

2022/23

Brazil Corn Estimate Unchanged at 125.0 Million Tons

Macros

102

Counterparties Take $2.257 Tln At Fed Reverse Repo Op

US

Philadelphia Fed Non-Manufacturing Activity May: -16.0 (prev -22.8)

Canadian

Industrial Product Price (M/M) Apr: -0.2% (exp 0.1%; prev 0.1%)

Canadian

Raw Materials Price Index (M/M) Apr: 2.9% (exp 0.7%; prev -1.7%)

Corn

·

CBOT corn futures

were higher from short covering as concerns mount over net drying for selected parts of the US Midwest for the remainder of the week. Both US corn and soybean planting progress is moving along nicely, including the Dakota’s, an area that was in question earlier

this season over local flooding issues.

·

South Korea resumed German pork imports. ASF prompted a September 2020 ban.

·

The EPA is a step closer to excluding RINs from EV’s. Rumors earlier this week are nearly confirmed. We are unsure how this impacts the complicated RIN pool but keep an eye on RIN prices as they are closely related to impacts

on SBO futures, given the collapse in international interest (exports). US SBO has become an island when it comes to trading.

·

As mentioned before, EV prices for a new auto on average exceed the average annual income of a resident of IA.

·

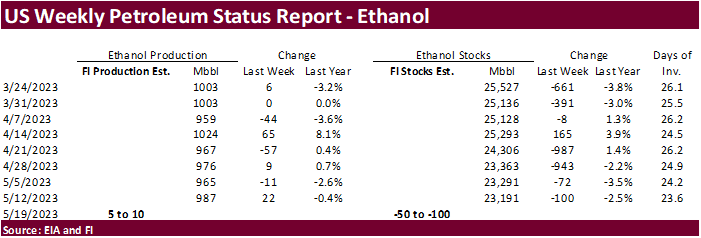

A Bloomberg poll looks for weekly US ethanol production to be up 10,000 thousand barrels to 981k (990-1010 range) from the previous week and stocks down 213,000 barrels to 23.978 million.

Export

developments.

-

South

Korea flour mills bought US, Australia, and Canada milling wheat, various classes, for Aug 1 through Sep 30 shipment.

-

Taiwan’s

MFIG is in for 65,000 tons of corn on Wednesday for Aug/early Sep shipment.

July

corn $5.00-$6.50

September

$4.35-$4.45 low end

December

corn $4.25-$6.00

·

Soybeans were lower bias the nearby contracts on slowing US exports and expectations for many domestic crush plants to take downtime. A stronger USD is adding to the negative undertone.

·

A Reuters poll calls for India May palm oil imports (about 450k) to fall to a 27 month low as soybean oil and sunflower oil imports increase.

·

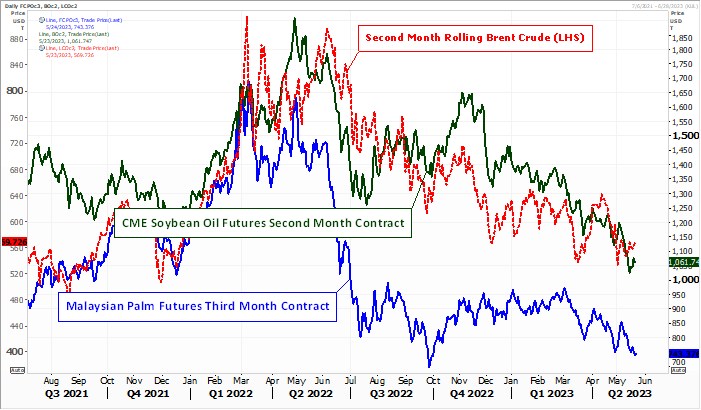

Third month (Aug) Malaysia palm futures traded at a three week low during the regular session.

·

We may see palm oil futures trend lower over the next month based on weaker world import demand, as noted above with the isolated India comment. Long term the trade needs to monitor Indonesia and Malaysian palm production per

current change with ENSO. Takes about 6-12 months for an impact on tree production, and we look for a decline in yields starting around the Northern hemisphere winter months.

Export

Developments

·

Iran’s SLAL bought 260,000 tons of soybean meal from Argentina and/or Brazil for June and July shipment. Prices were not provided.

Soybeans

– July $12.50-$14.25, November $11.00-$14.50

Soybean

meal – July $375-$475, December $290-$450

Soybean

oil – wide July 42-50 with bias to downside, December 43-53, with bias to upside

Wheat

·

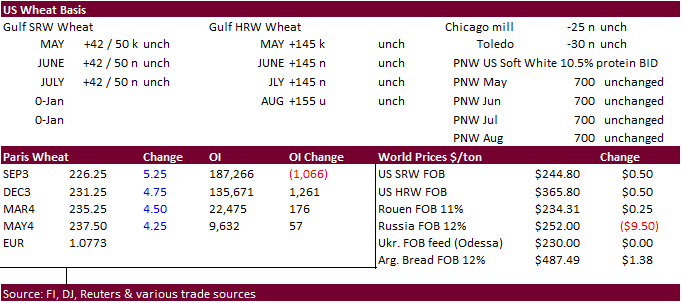

US wheat was higher on short covering and higher EU wheat futures. News was light. As expected, US winter wheat conditions increased 2 percentage points for the combined good and excellent categories but are still near historically

low levels for this time of year. Abandonment is a wild card this year as many KS producers clear fields to make way to plant summer crops. 10 percent of the KS crop was rated good/excellent.

·

September Paris wheat were up 5.25 euros to 226.75 per tons.

·

Reuters noted US wheat purchases from the EU amounted to around 210,000 tons over the past week for May and August shipment. We are uncertain additional purchases will be conducted.

·

Egypt bought 2.7 million tons of wheat from local producers so far during their harvest season. This compares to the same amount a year earlier.

Export

Developments.

·

The Philippines about 40,000 tons of feed wheat on May 17 for July shipment.

·

Results awaited: South Korean flour millers seek 135,000 tons of wheat from US, Canada, or Australia for Aug shipment.

·

Taiwan seeks 56,000 tons of US wheat on May 26 for LF July shipment.

Rice/Other

Chicago Wheat – July $5.75-$7.30

KC – July $7.75-9.25

MN – July $7.50-9.00

September – same ranges as July

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |