PDF Attached

Looking

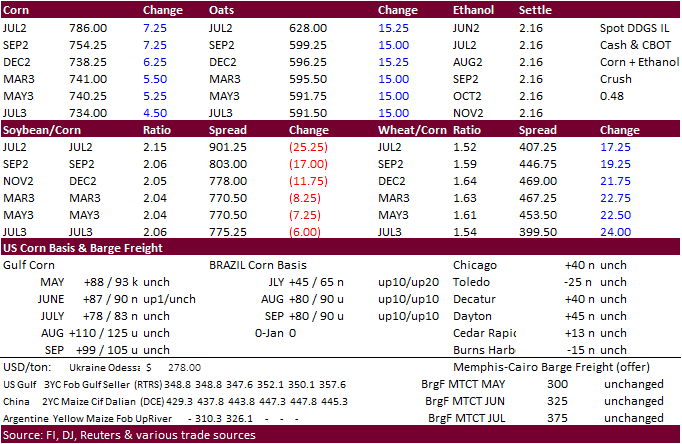

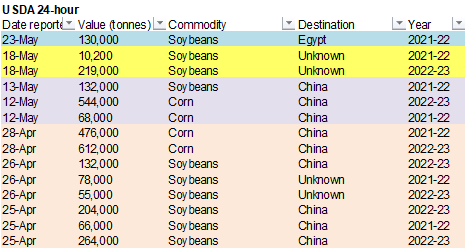

for a steady to easier open tonight. This morning private exporters reported sales of 130,000 metric tons of soybeans for delivery to Egypt during the 2021/2022 marketing year.

USD

was sharply lower (down 100+ points by 1:55 pm CT). Grains traded higher while the soybean complex sold off, with expectation of back month soybean oil. The morning weather forecast improved for the US Great Plains and parts of Brazil. Brazil saw mild frost

events over the weekend, easing trade concerns over the late planted Brazil second corn crop currently in the pollination stage. Dry areas of the US Great Plains will see rain this week.

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

-

An

active weather pattern is expected in the United States during the next ten days with rain falling at one time or another in each of the nation’s major crop areas -

West

Texas will get 0.50 to 1.50 inches of rain today into Wednesday with a few amounts over 2.00 inches in the east -

The

Delta and southeastern states will receive 0.75 to 2.50 inches of rain with a few amounts of 2.50 to more than 3.00 inches

-

Precipitation

in the U.S. Midwest will vary from 0.50 to 2.00 inches and amounts in the central U.S. Plains will vary from 0.75 to 2.00 inches with a few amounts less than 0.50 inch in the northwest and greater amounts locally in the southeast -

Precipitation

will continue to fall across the northern U.S. Plains and a part of Canada’s Prairies this week, but the precipitation may not be nearly as great as that of last week allowing some areas to experience a little drying -

However,

the drying time will be short enough to raise concern over planting progress in the wettest areas -

Southwestern

parts of Canada’s Prairies are still expecting below average precipitation in the next ten days resulting in some continued concern over limited rainfall.

-

The

precipitation is expected in June and especially July and August making the next few weeks extremely important for timely precipitation even if it is lighter than usual just to keep the crop viable until greater rain evolves -

U.S.

hard red winter wheat production areas are expecting rain early this week -

The

moisture will be great for crops in Kansas, Colorado and Nebraska, but a little too late to change production in the southern Plains (Oklahoma/Texas) -

West

Texas rainfall early this week will improve topsoil moisture for better planting conditions for cotton, corn and sorghum -

Greater

rain will still be needed dryland areas especially in the southwest where a single rain event will not be sufficient to make a big difference in the bottom line.

-

NOAA’s

ENSO forecast model has been suggesting a strong weakening trend in La Nina for the next few weeks

-

The

model suggests dissipation is possible in July -

The

latest ocean data certainly supports a marginal La Nina event (at best) for the summer months -

This

change will allow the negative phase of Pacific Decadal Oscillation (PDO) to have greater influence on North America weather and that should place a trough of low pressure along the Pacific Coast and a ridge in the middle of nation -

This

change in the upper air wind flow pattern cannot occur until the jet stream slows down which may be a few weeks away -

U.S.

freezing temperatures during the weekend were mostly confined to the northwestern Plains from Nebraska and Wyoming into Montana -

Low

temperatures were in the middle and upper 20s Fahrenheit and a few lower 30s -

The

cold may have damaged early planted and emerged crops in Montana, western South Dakota, southwestern North Dakota and Wyoming -

Sugarbeets,

canola and a few potato crops may have to be Replanted in these areas -

No

winter wheat was permanently damaged and neither was most of the corn and other crops produced farther to the east across the Dakotas to Minnesota and Iowa

-

U.S.

hard red winter wheat areas reported low temperatures in the upper 30s and 40s Fahrenheit with the upper 30s occurring from the Texas Panhandle into central Kansas, but no crop damage resulted -

U.S.

weekend precipitation was most significant from the heart of the Midwest into the southeastern Plains and Delta as well as the Tennessee River Basin

-

The

precipitation was not great enough to do much more than disrupt fieldwork briefly, although there were reports of 1.00 to 3.00 inch amounts coming from the central and northern Delta -

Pockets

of heavy rain also occurred along the central Gulf of Mexico coast with central Florida wettest -

One

area in central Florida reported upwards to 6.59 inches of rain -

U.S.

weekend rainfall was not very great in the southeastern states or across the northern Plains while all of the southwestern states were dry -

U.S.

weekend temperatures were cool in the northwestern Plains and warm from the Midwest to the Middle Atlantic States and southern New England as well as throughout the southern states where many 80- and 90-degree Fahrenheit temperatures were noted.

-

The

warmest conditions occurred in the Gulf of Mexico Coast States -

Temperature

extremes over 100 occurred from Edwards Plateau in Texas to South Texas and northeastern Mexico Friday, but these areas turn much cooler Saturday afternoon and especially Sunday -

West

Texas rainfall early this week will range from 0.50 to 1.50 inches -

The

moisture will increase topsoil moisture for improved planting conditions in both dryland and irrigated corn, cotton and sorghum production areas -

South

Texas, the Texas Coastal Bend and Blacklands will also be impacted by rain with amounts of 0.50 to 1.50 inches resulting -

Local

rain totals in the Blacklands will vary from 1.50 to more than 3.00 inches

-

The

moisture will be great for improving topsoil moisture and crop conditions, although local flooding could cause some short term concerns -

U.S.

Delta and southeastern states will receive significant rain in this coming week with sufficient amounts to bolster soil moisture and further minimize the potential for drought -

U.S.

Midwest weather will be sufficiently moist in the coming week to support earlier planted summer crops.

-

Tuesday

through Thursday of this week will be wettest with favorable drying conditions Monday and late this week through early next week

-

Fieldwork

will advance most significantly this weekend into next week -

Temporary

ridge building (aloft) next week will also allow temperatures to turn much warmer accelerating drying rates and allowing fieldwork to advance fastest at that time -

The

warmth will stimulate crop development -

The

bottom line to the U.S. Midwest weather for the next two weeks will be mostly good with a favorable mix of rain and sunshine supporting fieldwork and crop development. Fieldwork will advance around the precipitation and early season crop development should

advance favorably. -

U.S.

Pacific Northwest crops need greater precipitation to improve dryland crop development potentials -

Freezes

in Canada’s Prairies during the weekend set back crop development, but very little, if any, significant damage occurred.

-

However,

a few of the coldest areas experienced temperatures as low as 20 Fahrenheit which would have damaged any crop that had emerged.

-

Quebec

and Ontario weather during the weekend was mixed with some sunshine, some rain and some warm weather -

The

favorable environment will continue over the next two weeks allowing fieldwork of all types to advance along with some aggressive crop development -

Brazil

and Argentina were mostly dry during the weekend and there were no threatening temperatures -

Safrinha

corn areas of Parana were not cold enough for seriously damaging cold -

Continued

dryness was noted in Safrinha corn and cotton areas of Brazil especially in Mato Grosso and Goias -

No

threatening cold occurred in coffee, citrus or sugarcane areas either -

Argentina

rainfall is expected later this week across some of the winter crop areas; however, greater amounts will be needed to more seriously bolster soil moisture for winter crop planting, germination and emergence -

The

precipitation will be greatest in the southeast -

Cooler

temperatures will be returning to Argentina later this week resulting in slower drying rates, but no crop damaging temperatures are expected -

Brazil

weather will turn wetter in the southwest and far southern parts of the nation late this week into the weekend -

The

moisture will be good for future winter crop development and for late filling and maturing Safrinha crops -

Ongoing

dryness in Mato Grosso and Goias will continue threat late season corn development -

Brazil

temperatures will be warmer than usual in the normal in this first week of the outlook and then cooler air will come into the far south next week while the northeast is warmest -

Brazil’s

bottom line remains good for early maturing Safrinha crops and for coffee, citrus and sugarcane as they mature and are harvested. Rain would not likely benefit many crops other than late maturing summer crops, some citrus and sugarcane.

-

Europe

rainfall will be scattered throughout the continent during the next two weeks; however, its intensity and daily coverage will vary greatly -

Moisture

totals will be greatest in the Alps -

Coverage

of rain will be greatest from northern Poland and eastern Germany into the Baltic States and Belarus as well as from central Ukraine into Romania and the southwestern Balkan Countries -

Net

drying is expected in most other areas -

Temperatures

will be seasonable -

Europe’s

bottom line will be mostly favorable, but there is going to be need for greater rainfall soon in parts of France, Germany, Spain, Portugal, Greece and random other areas near and in southern Poland.

-

Frequent

rain is still expected in western and northern Russia over the next ten days with some rain also falling in the Baltic States, Belarus and central and western Ukraine -

Western

and southern portions of Russia’s Southern Region will also be impacted by rain periodically with areas near Georgia wettest -

Temperatures

will be cooler than usual western Russia this week and a little more seasonable next week -

Temperatures

will be warmer than usual in the eastern New Lands this week and throughout much of the New Lands next week -

The

bottom line remains good for many winter crop areas, but spring planting progress is not likely to advance very well without some greater drying between weather events. This is especially true for western Russia -

Little

to no rain will fall in the North China Plain for the next nine to ten days -

The

region has already been drying out and this pattern will continue for a while longer -

Temperatures

will be seasonable -

Rain

is possible -

There

is “some” potential for rain in the first days of June, but confidence is low -

Other

areas in eastern China will see a mix of rain and sunshine during the next two weeks.

-

Xinjiang,

China weather is expected to be drier biased during much of the coming two weeks in crop areas with some rain falling in and near the mountains periodically -

Planting

progress in corn and cotton areas will advance normally -

India

will receive pre-monsoonal showers and thunderstorms over the next week to ten days resulting in some moistening in the topsoil, but greater rain will be needed -

Monsoonal

precipitation will begin a little earlier than usual, but the precipitation will be mostly confined to the lower west coast and in the far Eastern States -

The

monsoonal rainfall is advertised to be lighter than that suggested for the region last week -

Temperatures

will be seasonable -

South

Africa rainfall continued during the weekend, but this week’s weather will trend drier -

The

recent rain was great for bolstering topsoil moisture in favor of winter grain and oilseed planting, although Western Cape was largely missed by the greater rain -

Both

the harvest of summer crops and the planting of winter grains will advance well in the drier weather this week -

Temperatures

will be near to above normal this week -

Australia

will experience a light mix of rain and sunshine over the next two weeks. Soil conditions will slowly become wetter favoring autumn planting of wheat, barley and canola, but grater rainfall will be needed outside of Victoria, southern New South Wales and southeastern

South Australia where the greatest rain is expected. Far southwestern parts of South Australia will also be favorably moist -

Temperatures

will be seasonably warm (near to above normal) -

All

of Southeast Asia will get rain at one time or another over the next couple of weeks. -

The

precipitation will be good for most crop needs; however, it will be heavy along the Myanmar lower coast and in parts of both Laos and Vietnam into Cambodia -

Northwestern

Luzon Island, Philippines and Taiwan will also be wet -

Thailand

may not be included in the wetter weather that other Southeast Asia nations experience for a while -

West-central

Africa rainfall during the next ten days will be favorable for coffee, cocoa, sugarcane, rice and cotton

-

East-central

Africa rainfall will be most significant in Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania’s Pare region driest down seasonably -

North

Africa rainfall will be limited in the next two weeks, although some rain is expected very lightly -

Most

wheat and barley in the region is maturing and being harvested keeping the need for rain very low -

Most

of the rain expected will be limited and should not adversely impact crop conditions or field progress -

Northern

and some eastern Turkey crop areas will be the only ones in the Middle East nation to get significant rainfall during the next week to ten days -

A

boost in rain is needed in many areas, but Syria, Jordan and Iraq have been and will continue driest

-

These

areas may experience a decline in wheat, rice and cotton production this year – at least in unirrigated areas -

Mexico

rainfall is expected to slowly increase in western and southern parts of the nation during the next ten days -

The

moisture will be welcome and should be a part of the developing monsoon season -

Central

America will see periodic rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

-

Today’s

Southern Oscillation Index was +18.43 and it will steadily decline over the next few weeks -

New

Zealand rainfall will be limited this week, but should increase next week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

export inspections – corn, soybeans, wheat, 11am - MARS

monthly EU crop conditions report - U.S.

crop planting data for corn, soybeans, spring wheat and cotton; winter wheat conditions, 4pm - U.S.

cold storage data for beef, pork and poultry, 3pm - HOLIDAY:

Canada

Tuesday,

May 24:

- Grain

& Maritime Days conference in Istanbul, May 24-25 - Russian

Meat & Feed Industry conference in Moscow - EU

weekly grain, oilseed import and export data - Brazil’s

Unica may release cane crush and sugar output data during the week (tentative)

Wednesday,

May 25:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysia’s

May 1-25 palm oil export data - U.S.

poultry slaughter, 3pm - HOLIDAY:

Argentina

Thursday,

May 26:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

releases World Sugar Markets and Trade outlook - Russian

grain forum starts in Sochi - HOLIDAY:

France, Germany, Indonesia

Friday,

May 27:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

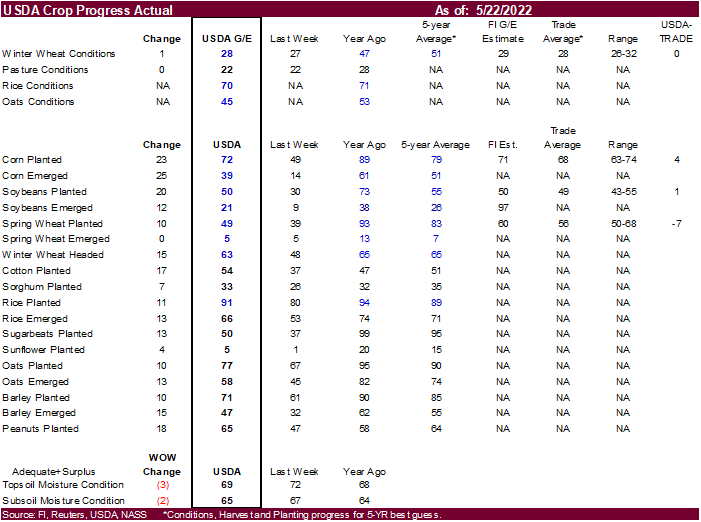

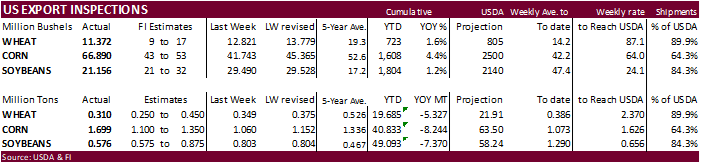

USDA

inspections versus Reuters trade range

Wheat

309,501 versus 150000-500000 range

Corn

1,699,092 versus 600000-1500000 range

Soybeans

575,781 versus 400000-900000 range

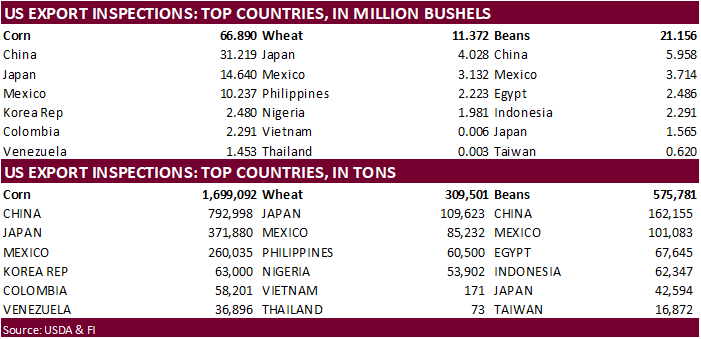

China

returning to take corn and soybeans

Macros

US

Chicago Fed Nat Activity Index Apr: 0.47(est 0.50; prev 0.44; prevR 0.36)

94

Counterparties Take $2.045 Tln At Fed Reverse Repo Op (prev $1.988 Tln, 89 Bids)

US

Crude Oil Futures Settle At $110.29/Bbl, Up $0.01 Or 0.01%

·

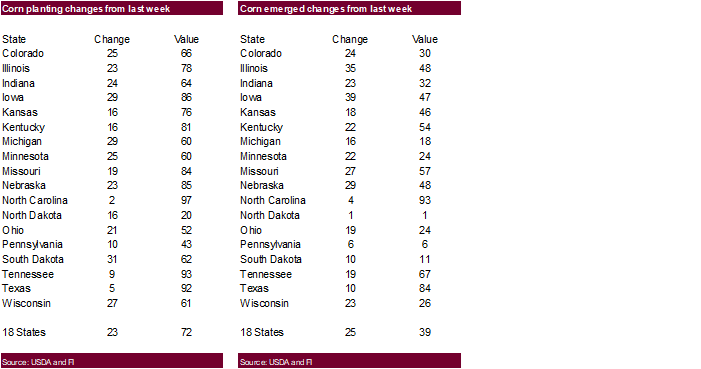

Funds bought an estimated net 5,000 corn contracts.

·

USDA US corn export inspections as of May 19, 2022, were 1,699,092 tons, above a range of trade expectations, above 1,060,330 tons previous week and compares to 1,746,162 tons year ago. Major countries included China for 792,998

tons, Japan for 371,880 tons, and Mexico for 260,035 tons.

·

The US White House is considering on cutting tariffs on Chinese goods and calling on OPEC to increase crude oil production. That could pave the way for an increase in China/US trade relations after China emerges from COVID lockdowns.

·

The Baltic Dry index increased for the seventh consecutive trading days, by 76 points or 1.7% to 4,602 points.

·

Brazil saw mild frost events last week, easing trade concerns over the late planted Brazil second corn crop currently in the pollination stage.

Export

developments.

·

Turkey’s TMO seeks 175,000 tons of feed corn on May 26 for shipment between June 7 and June 30.

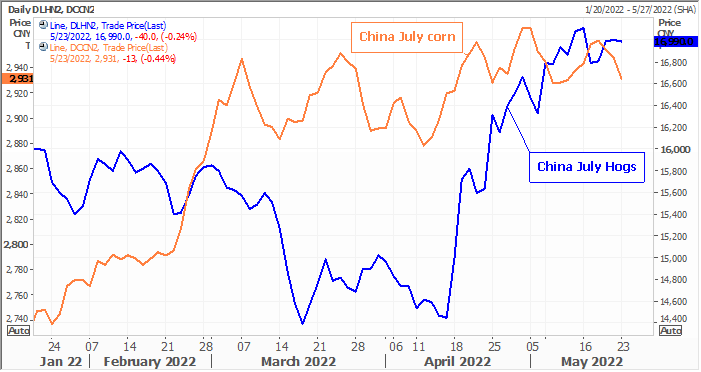

China

hog inventory is expected to increase, and may create a larger import market for feedgrains

Source:

Reuters and FI

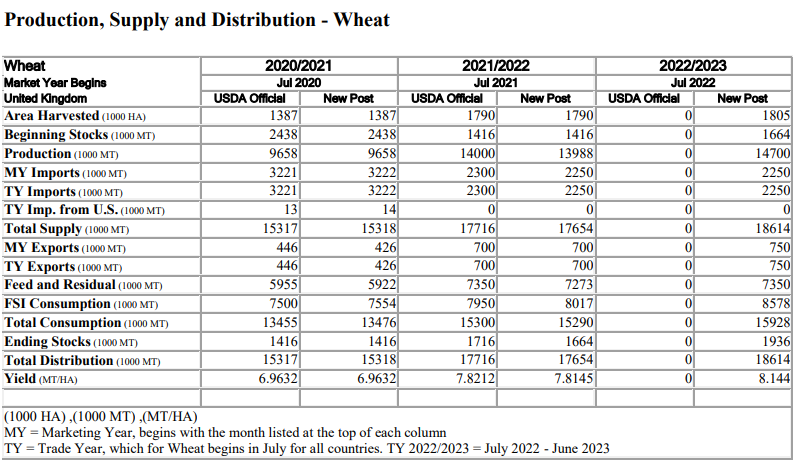

USDA

Attaché: UK Grain and Feed Annual

While

wheat supply rebounded, minor feedgrains are down

Updated

5/12/22

July

corn is seen in a $7.50 and $8.75 range

December

corn is seen in a wide $5.50-$8.50 range

·

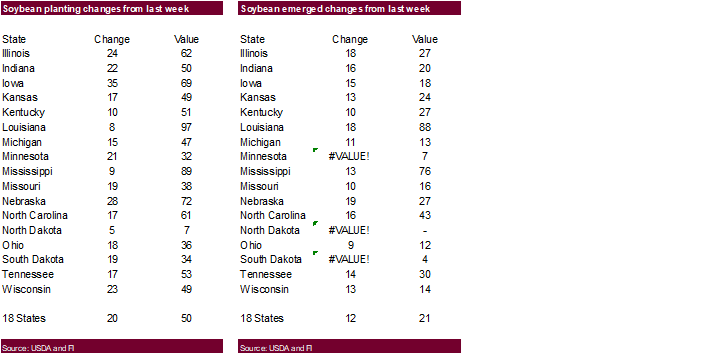

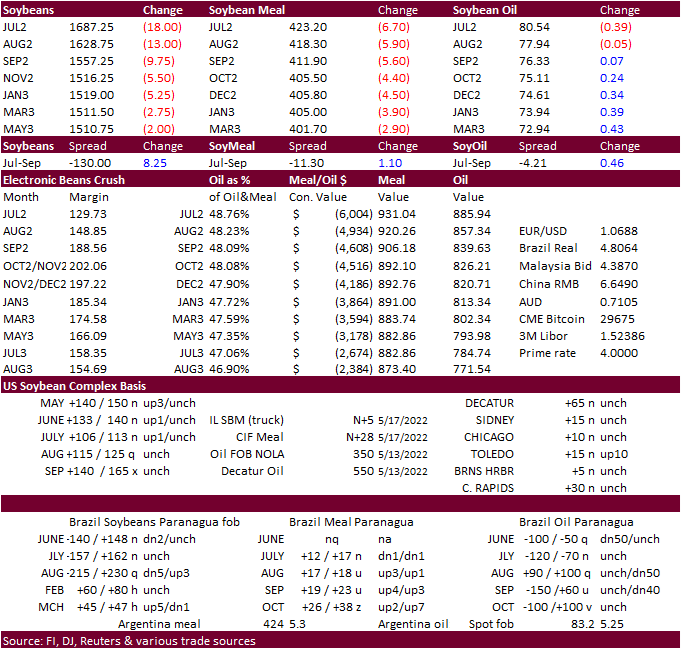

Soybeans ended lower led by the nearby contracts. Despite a higher open led by appreciation in soybean oil from a 2.6% jump in Malaysian palm oil over uncertainty with Indonesian palm oil exports. The trading range in soybean

oil was large, with prices settling lower for July and August but higher for the back months. Soybean meal lost ground on product spreading although a modest increase in corn futures limited losses. We think soybean meal is now undervalued to corn and that

could be a spread opportunity. May need to see corn to trade independently from feeds grains before that corrects.

·

Funds sold an estimated net 8,000 soybeans, sold 4,000 meal, and sold 2,000 soybean oil.

·

Indonesia palm oil export ban ended Monday. Expect shipments to be slow. They reinstated the Domestic Market Obligation (DMO) and Domestic Price Obligation (DPO) program.

·

On Monday, Malaysian palm oil ended 152 ringgit per ton higher at 6,261 and cash was up $25/ton at $1,505 ton.

Don’t

expect a rally in palm oil this midweek unless Indonesia pulls another rabbit out of their cap.

·

Private exporters reported sales of 130,000 metric tons of soybeans for delivery to Egypt during the 2021/2022 marketing year.

·

The USDA seeks 5,710 tons of packaged veg oil for use in export programs for shipping July 1-25 on June 1, with notice following day.

·

China plans to sell another 500,000 tons of soybeans from reserves on May 27.

Updated

5/17/22

Soybeans

– November is seen in a wide $12.75-$16.50 range

Soybean

meal – July $350-$450

Soybean

oil – July 78-86

·

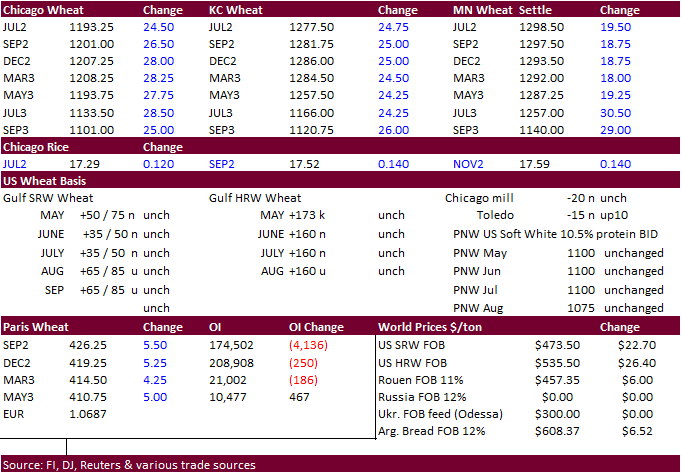

Wheat futures were higher on technical buying after funds went short at the end of last week. After three days of selling, a sharply lower USD helped lift grains higher on ideas US exports could tick higher. India wheat export

uncertainties were also helping US futures, but no recent news was to be found.

·

Funds for Chicago were buyers of an estimated net 9,000 contracts.

·

USDA US all-wheat export inspections as of May 19, 2022, were 309,501 tons, within a range of trade expectations, below 348,937 tons previous week and compares to 598,941 tons year ago. Major countries included Japan for 109,623

tons, Mexico for 85,232 tons, and Philippines for 60,500 tons.

·

Russian grain exports are slowing. SovEcon sees May exports at 1.4 million tons, with only 800,000 tons projected for wheat. It is not unusual to see Black Sea shipments decline in May as it is the tail end of the crop year.

·

Ukraine grain shipments for the month of May were estimated around 1.5 million tons, below previous expectations. India cut taxes for imports on selected commodities to battle inflation. – Ukrainian Agrarian Business Club Association.

·

September Paris wheat was up 5.50 at 426.00 euros a ton.

·

May 23 (Reuters) – “The Kremlin said on Monday that the West had triggered a global food crisis by imposing the severest sanctions in modern history on Russia over the war in Ukraine.” This is a remainder geopolitical problems

may persist for a while.

·

SovEcon: Prices for wheat with 12.5% protein content from Black Sea ports were at $395-405 free on board (FOB) at the end of last week, up $10 from a week earlier. IKAR said that the price rose by $20 to $410 per ton, but there

were no deals signed. (Reuters)

·

One offer and results awaited: Bangladesh seeks 50,000 tons of wheat for shipment within 40 days of contract signing. Price was thought to be around $548.38/ton CIF.

·

Jordan issued a new import tender for 120,000 tons of wheat set to close May 24 for Aug/Sep shipment.

·

Pakistan seeks 500,000 tons of wheat on May 25. Bulk shipment is sought to Pakistan in June to July 2022.

·

Jordan seeks on 120,000 tons of barley on May 26 for Aug/Sep shipment.

·

Bangladesh seeks 50,000 tons of wheat on May 29 for shipment within 40 days.

Rice/Other

·

None reported

Updated

5/17/22

Chicago

– July $11.00 to $13.50 range, December $8.50-$12.50

KC

– July $12.00 to $14.50 range, December $8.75-$13.50

MN

– July $12.00‐$15.00, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.