PDF Attached

Attached

are our updated US corn & wheat balance sheets. We lowered our corn crop year average for 2022-23 from $6.30 to $6.00.

2023-24

wheat was left unchanged.

Grains

and the soybean traded two-sided on Friday, ending lower. The US weather forecast for the Midwest turned slightly unfavorable from that of yesterday. Limited rains in central areas next week may allow stress to build.

Meanwhile US HRW wheat weather will gradually improve. The US failed to reach a compromise over the debt ceiling. WTI crude oil was 27 cents lower earlier (ended the day only down 6 cents) and USD 40 points lower

as of 1:50 pm CT.

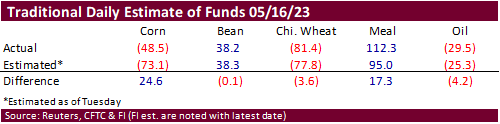

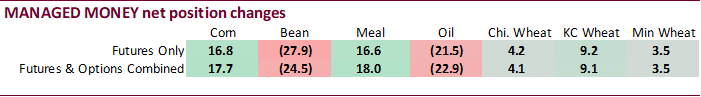

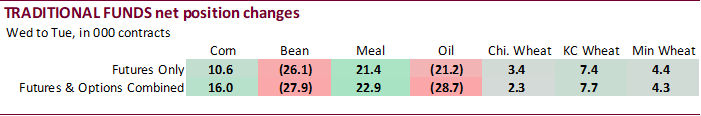

Fund

estimates as of May 19

Weather

WEATHER

TO WATCH

-

Frost

and freezes occurred this morning from the western Dakotas and eastern Montana into Saskatchewan

-

Lows

dropped to 28 Fahrenheit in several areas, although very little crop was emerged or established enough to be permanently damaged -

Another

round of frost and freezes are expected in eastern Ontario and Quebec, Canada Sunday into Monday, but the impact should be minimal after the hard freezes that occurred earlier this week -

Argentina

rain expected over the next ten days will be more than sufficient to bolster topsoil moisture for wheat planting -

Showers

this week have been too brief and light for a serious change to soil moisture, but that was to be expected -

Additional

waves of rain in the coming week to ten days will change that situation greatly bring sufficient topsoil moisture for seeding of wheat -

Subsoil

moisture will continue lighter than usual -

Brazil’s

center south and center west crop areas will continue in a net drying mode for the next two weeks – which is normal for this time of year -

Coffee

and sugarcane areas will also experience good maturation and harvest weather

-

A

few fields of corn and cotton in Mato Grosso and Goias that were planted late may experience a reduction in yield potential, but the bulk of crop has made it through the most moisture sensitive stage without much trouble -

Safrinha

corn in Mato Grosso do Sul, Sao Paulo and Parana is much farther behind in their development than areas to the north, but soil moisture is still very well rated which should carry normal crop development into early June without much problem -

There

is no risk of crop threatening cold during the next two weeks -

U.S

Midwest, Delta and southeastern states will continue to experience a very good mix of weather for aggressive planting and early season crop development -

Warmer

temperatures next week will accelerate drying rates and stimulate faster plant growth rates leading to a need for greater rainfall in June, especially while rainfall is lighter than usual as it should be for the next couple of weeks -

European

forecast model suggested very little rain would fall in the U.S. Midwest during the next ten days and frequent temperatures in the 70s and 80s would induce some steady drying -

The

forecast may be a little too dry, but the GFS is much too wet -

June

weather is expected to be dominated by a high pressure ridge in the middle of the nation and its strength will determine how much of the Midwest will be dry

-

Late

June is still advertised cooler once again – at least in the eastern Midwest -

Significant

rain fell in central western Kansas and the Texas Panhandle overnight bolstering topsoil moisture for winter wheat and spring and summer crops -

Rainfall

of 1.00 to 2.00 inches occurred often with Doppler radar suggesting some greater amounts -

The

moisture comes a little late for some of the wheat crop, but there should be some improvement in yield and grain quality -

Summer

crops will benefit most from the precipitation with a much better planting, germinating and emergence environment resulting from recent rain -

U.S.

Pacific Northwest will continue warmer and drier than usual for a while longer -

Unirrigated

crops are stressed especially in the Yakima Basin of Washington -

Relief

from dryness in the Pacific Northwest is not very likely for an extended period of time

-

West

Texas planting moisture will be favorable, but the region will not get a good soaking to fix poor subsoil moisture in unirrigated crop areas -

Showers

and thunderstorms will be in the forecast nightly across the region during the next ten days, but resulting rainfall will be erratic and coverage a little too sporadic

-

U.S.

temperatures this weekend will be very warm in the far western states and near normal in much of the central and east, although the southwestern Plains will be cooler biased for a while -

Warmer

biased temperatures are likely many key crop areas except in the southwestern Plains and Gulf of Mexico Coast States next week

-

Frequent

highs in the 70s and 80s are likely from the northern Plains into the Midwest -

Southern

Europe weather will continue active with frequent bouts of rain expected through the next week and possibly for ten days -

The

moisture will delay some planting and could raise a little concern over crop quality in a few areas -

Northern

Europe will be drier biased, although not completely dry -

The

environment will be good for planting, emergence and establishment -

North

Africa will receive greater than usual rainfall over the next week to ten days resulting in a possible crop quality concern for early maturing wheat and barley in Morocco and northwestern Algeria -

Crops

in northeastern Algeria and northern Tunisia are expected to benefit from their rain since crops should be in the reproductive and filling stages of development -

China

weather will continue a little wetter biased in rapeseed areas of the Yangtze River valley and areas to the south where some drying might be best for maturation and harvesting -

East-central

China (between the Yellow and Yangtze Rivers) will experience a good mix of weather during the next ten days favoring crop development and additional planting -

Northern

China drying has not presented much of a problem, though some spring wheat and sugarbeet areas in eastern Inner Mongolia are too dry -

Some

of this dryness has been expanding to the west and south recently including northern Hebei -

Central

parts of Inner Mongolia and portions of the northern Yellow River Basin may become influenced by the drier bias over time, though conditions today are still very good in those areas -

Xinjiang,

China remains too cold in the northeast for ideal corn or cotton development -

Western

parts of Xinjiang where much of the cotton is produced, has had a few days of very warm temperatures with highs in the upper 80s and lower to a few middle 90s Fahrenheit -

The

heat has begun to improve crops in the west and the warmer conditions should prevail for a while -

Some

cooling is expected in western cotton areas this weekend and next week -

India

weather is quite favorable for this time of year with pre-monsoonal showers occurring in the south and east while drying occurs in many other areas supporting good harvest conditions -

Rainfall

was increased in northern India for next week, but some of the precipitation advertised may be overdone on today’s forecast models -

Russia’s

eastern New Lands may slowly dry down over the next ten days, but crop conditions should remain mostly favorable during this period of time -

Western

Russia and eastern Ukraine will experience timely rainfall during the next ten days supporting good crop conditions -

Philippines

and western Indonesia soil moisture firmed up a little during the past week due to more infrequent and light rainfall -

The

region is expecting to get more significant rain in this coming week -

Western

and northern Alberta, Canada will receive significant rain early next week and that will bolster soil moisture after recent hot and dry weather -

The

rain will greatly improve soil moisture, although at the expense of fieldwork for a little while.

-

Drought

remains serious in east-central and interior southern Alberta and western Saskatchewan with no rain and waves of heat likely in this first week of the outlook -

Rain

in northern and western Alberta is not likely to reach the drought areas -

South

Africa weather will be trending drier in the coming week -

Summer

crop harvesting and winter crop planting will advance swiftly in the next two weeks with some need for greater rain in western wheat areas -

West

Africa weather continues to generate timely rainfall for coffee, cocoa, sugarcane and rice -

Rainfall

in the most recent 30 days was a little lighter than usual in southeastern Nigeria and western Cameroon as well as from northern Ivory Coast into southwestern Burkina Faso impacting cotton areas -

Crop

conditions should remain mostly good, although the drier areas would benefit from greater rain -

East-central

Africa rainfall has been favorable for coffee, cocoa and other crops in recent weeks with little change likely -

Central

Asia cotton and other crop weather has been relatively good this year with adequate irrigation water and some timely rainfall reported -

The

favorable environment will continue -

Mexico

rainfall is expected to steadily increase over the central and eastern parts of the nation during the next ten days improving soil moisture for future planting of summer crops

-

Western

Mexico will continue quite dry -

Central

America rainfall is expected to be erratic, although mostly favorable during the next two weeks -

Tropical

Cyclone Fabien in the Indian Ocean poses no threat to land -

Other

tropical cyclones are expected to develop next week well east of the Philippines and possibly in the South China Sea -

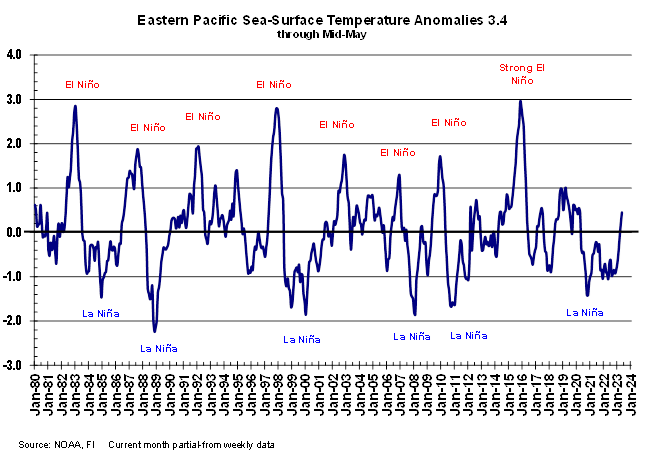

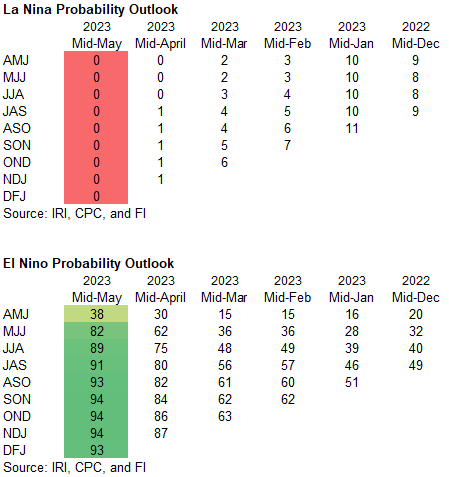

Today’s

Southern Oscillation Index was -7.13 and it should move erratically lower over the next several days

Source:

World Weather, INC.

Friday,

May 19:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - US

Cattle on Feed, 3pm

Saturday,

May 20:

- China’s

3rd batch of April trade data, including country breakdowns for energy and commodities

Monday,

May 22:

- Monthly

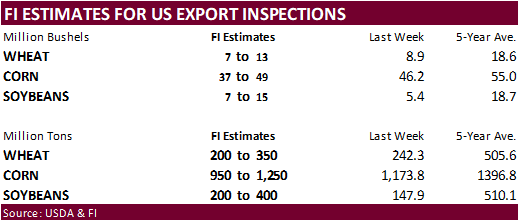

MARS report on EU crop conditions - USDA

export inspections – corn, soybeans, wheat, 11am - US

winter wheat condition, 4pm - US

planting data for corn, cotton, spring wheat and soybeans, 4pm - Holiday:

Canada

Tuesday,

May 23:

- EU

weekly grain, oilseed import and export data - Cane

crush and sugar production data by Brazil’s Unica (tentative)

Wednesday,

May 24:

- EIA

weekly US ethanol inventories, production, 10:30am - US

cold storage data for beef, pork and poultry - EARNINGS:

Sime Darby Plantation

Thursday,

May 25:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Malaysia’s

May 1-25 palm oil exports - US

poultry slaughter, red meat output, 3pm - EARNINGS:

IOI - HOLIDAY:

Argentina

Friday,

May 26:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - EARNINGS:

Select Harvests - HOLIDAY:

Hong Kong

Source:

Bloomberg and FI

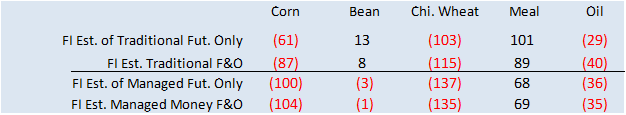

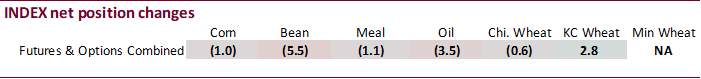

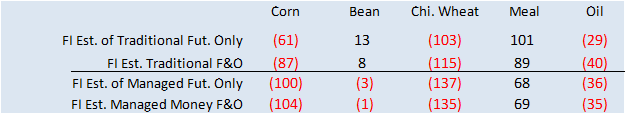

Funds

were less long than expected for corn and more long for soybean meal.

Fund

estimated as of Friday

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

-126,915 17,444 277,531 -960 -92,293 -1,426

Soybeans

3,094 -23,933 119,225 -5,496 -91,166 31,667

Soyoil

-53,776 -23,421 94,488 -3,521 -41,458 26,251

CBOT

wheat -98,382 4,126 71,437 -630 20,038 -4,858

KCBT

wheat -5,366 3,848 42,177 2,848 -33,074 -6,182

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

-91,985 17,657 250,471 3,592 -117,725 -4,503

Soybeans

23,942 -24,517 96,450 -2,002 -97,755 32,167

Soymeal

80,287 18,024 92,366 -1,873 -209,096 -22,207

Soyoil

-36,381 -22,897 110,212 4,831 -69,698 23,149

CBOT

wheat -112,769 4,136 68,212 -437 17,826 -3,266

KCBT

wheat 16,593 9,146 30,720 -217 -34,854 -7,009

MGEX

wheat -4,838 3,480 1,432 63 -1,728 -4,795

———- ———- ———- ———- ———- ———-

Total

wheat -101,014 16,762 100,364 -591 -18,756 -15,070

Live

cattle 100,272 4,994 50,800 197 -164,518 -2,419

Feeder

cattle 14,618 2,252 913 -13 -2,447 340

Lean

hogs -19,398 -1,727 50,651 1,438 -34,221 -2,353

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

17,562 -1,688 -58,324 -15,059 1,754,792 74,617

Soybeans

8,518 -3,411 -31,154 -2,238 815,277 52,611

Soymeal

19,560 4,826 16,884 1,229 519,702 18,178

Soyoil

-4,877 -5,773 746 692 576,435 52,259

CBOT

wheat 19,823 -1,795 6,908 1,362 471,227 9,699

KCBT

wheat -8,720 -1,406 -3,738 -513 210,458 2,604

MGEX

wheat 3,720 809 1,414 443 64,211 4,508

———- ———- ———- ———- ———- ———-

Total

wheat 14,823 -2,392 4,584 1,292 745,896 16,811

Live

cattle 29,120 -653 -15,675 -2,119 397,074 4,088

Feeder

cattle -879 -659 -12,205 -1,920 79,056 3,368

Lean

hogs -615 2,720 3,583 -79 319,469 1,371

Macros

US

Interest Rate Futures Traders Slash Bets On June Fed Hike, Add To Bets On Cuts Later In Year

GOP

Debt Limit Negotiator Graves: Debt Ceiling Talks ‘Are At A Pause’

106

Counterparties Take $2.227 Tln At Fed Reverse Repo Op. (prev 102 Counterparties, $2.238 Tln)

Canadian

Retail Sales (M/M) Mar: -1.4% (est -1.4%; prev -0.2%)

Canadian

Retail Sales Ex Auto (M/M) Mar: -0.3% (est -0.8%; prev -0.7%)

·

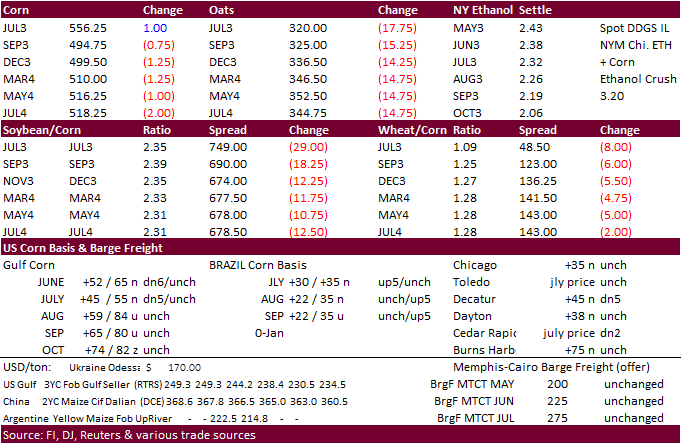

Wide range in corn futures today. CBOT corn

futures

turned lower during the trade after short covering dried. Losses were limited as parts of the US Midwest will remain dry over the next 7-10 days.

·

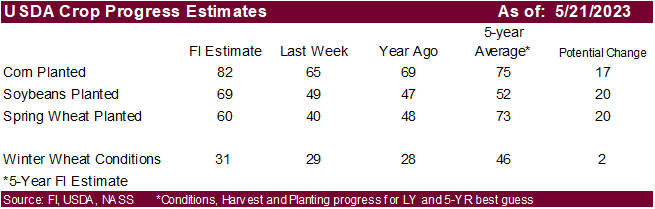

US corn emerged was 30 percent as of last Monday. Initial 2023 US corn crop conditions should be out a week from Monday.

·

The UK is adding on sanctions against Russia (metal exports) and cracking down on illegal Ukraine grain exports.

USDA

Chicken and Eggs report:

April

Egg Production Up 1 Percent

Egg-Type

Chicks Hatched Down 8 Percent

Broiler-Type

Chicks Hatched Down Slightly

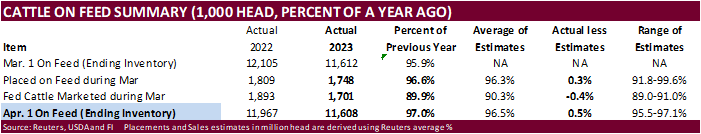

USDA

Cattle on Feed reported showed higher than expected inventories.

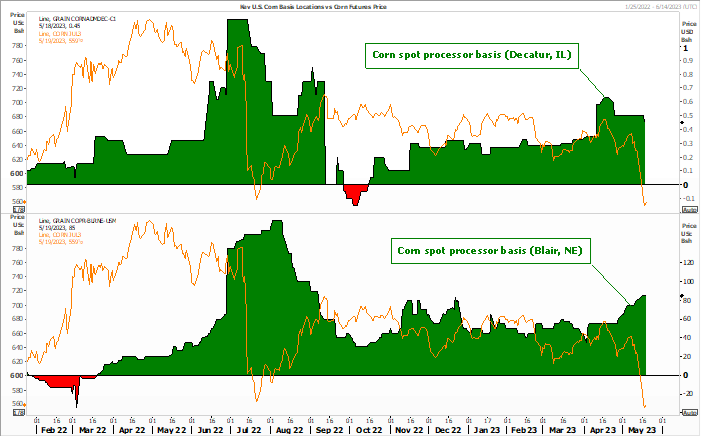

ECB

versus WBC corn spot processor basis versus nearby rolling corn futures

Export

developments.

-

South

Korea’s KFA bought 65,000 tons of South America or South Africa origin corn at $248.76/ton c&f for arrival around October 20. Earlier in the week they bought 68,000 tons of corn at $258.75 for same arrival period.

-

Yesterday

South Korea’s MFG group bought 66,000 tons of South American corn for arrival around October 20 at an estimated $247.69 a ton c&f.

-

Iran

seeks 120,000 tons of South American corn on May 22 for June 1 and July 15 shipment.

July

corn $5.00-$6.50

September

$4.35-$4.45 low end

December

corn $4.25-$6.00

·

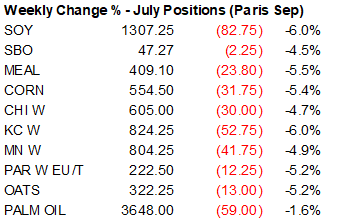

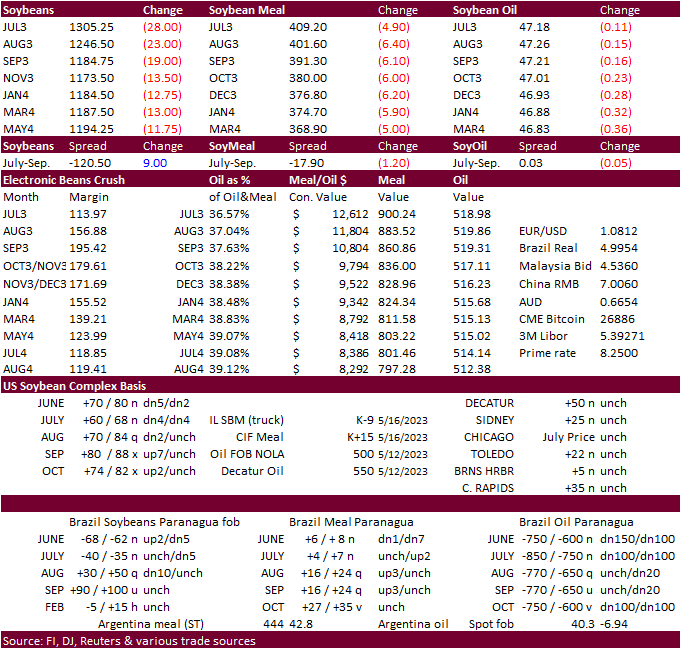

Soybeans attempted to rebound today but negative outside sentiment sent the complex lower. Soybean oil saw limited losses from product spreading against soybean meal, despite a lower trade in WTI crude oil.

·

Soybean export premiums fell this week and US Gulf is now competitive against Brazil for October delivery, by about $10/ton.

·

Palm oil futures snapped a 3-day losing streak on talk of Chinese demand. August futures lost 4.6 percent this week. Prior to the overnight trade, US crude degummed soybean oil fob Gulf widened out yesterday to $323/ton versus

RBD palm oil.

·

Indonesia plans to launch futures trading of CPO on a local exchange by the end of the year. The country aims to have a domestic reference price not only for exporters, but also domestic end users.

Export

Developments

-

None

reported

Soybeans

– July $12.50-$14.25, November $11.00-$14.50

Soybean

meal – July $375-$475, December $290-$450

Soybean

oil – wide July 42-50 with bias to downside, December 43-53, with bias to upside

Wheat

·

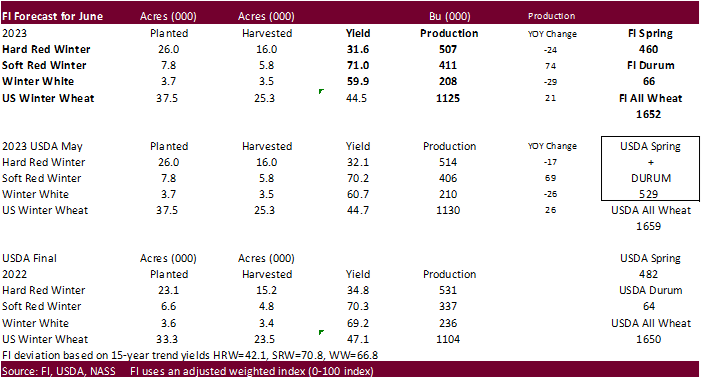

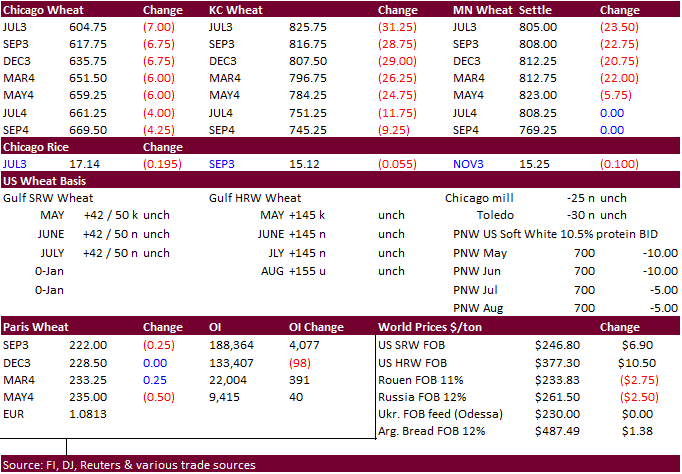

US nearby wheat futures also traded two-sided, but prices became under pressure from widespread commodity and technical selling. The US weather forecast will be favorable for US HRW wheat country over the next 7-10 days. Alberta,

Canada, has a chance for rain next week, but some noted amounts could be questionable. Parts of the northern US Great Plains could see net drying through next week, favorable for spring wheat seeding progress. The central areas of the US will see rain through

this weekend. Argentina’s weather outlook will improve over the next month with rain picking up across the weather growing areas.

·

HRW harvest is off to a slow start in Texas due to rain delays, according to US Wheat Associates.

·

French soft wheat crop ratings as of May 15 fell one point to 93% from 94% from the previous week, above 73% year earlier. Winter barley was 90%, down 2 points.

·

Germany’s national statistics agency sees the 2023 winter wheat area down 1.4% to 2.85 million hectares. The winter rapeseed area grew 7.6% to 1.16 million hectares. Winter barley is up 5.2 percent to 1.27 million.

·

Ukraine may allow Russia to transport ammonia through Ukraine for Black Sea shipment if the grain deal is expanded to include additional Ukraine ports.

·

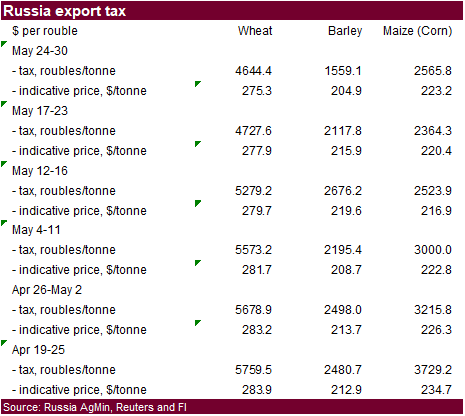

Russia will increase the base price for calculating Russia’s wheat export duty to 17,000 rubles per ton ($218.73) from 15,000 rubles currently. This could boost producer selling.

·

SovEcon raised their estimate of the Russia wheat crop for 2023 to 88 million tons, up from 86.8 million previous.

·

Russia will ban and/or curb imports on foreign seed imports from October 1. They did not provide details.

·

September Paris milling wheat officially closed 0.25 euro lower, or 0.1%, at 222.50 euros a ton (about $240.50 ton).

US

Wheat by class estimates

Export

Developments.

·

None reported

Rice/Other

Chicago

Wheat – July $5.75-$7.30

KC

– July $7.75-9.25

MN

– July $7.50-9.00

September

– same ranges as July

#non-promo