PDF Attached

I will be out of the office through the rest of this week attending a biofuel conference.

Indonesia plans to lift their export ban on palm oil on Monday. Export sales were mostly within expectations. Oilseeds bounced today on demand, while grains fell due to the weaker wheat market which saw follow-through selling. The weather outlook for the US Great Plains improved with northern areas drying down starting this weekend favoring spring planting progress.

![]()

World Weather Inc.

WEATHER EVENTS AND FEATURES TO WATCH

- No crop damaging cold conditions occurred this morning in Brazil’s grain, coffee, citrus or sugarcane areas

- Low temperatures were mostly in the 40s Fahrenheit

- Temperatures in southern Brazil will be a little cooler over the next two mornings with frost expected Friday and Saturday in Parana and areas farther to the south in Rio Grande do Sul

- Coffee, citrus and sugarcane areas are not expecting any damaging frost or freeze conditions, but extreme lows will slip to 35-39 (+2 to +4C) Fahrenheit in the traditionally coolest areas

- Dryness will continue in Safrinha corn and cotton areas from Mato Grosso into Goias where yields have fallen because of dryness this season

- Other Safrinha crops have experienced mostly good weather and little change is likely

- Argentina will continue dry for ten days, but the GFS has hinted at some rain for May 29-June2 in some winter wheat areas and if that verifies it would be a boon to the nation’s planting outlook

- Western Argentina continues too dry for ideal planting conditions

- Wheat is mostly planted from late May and June

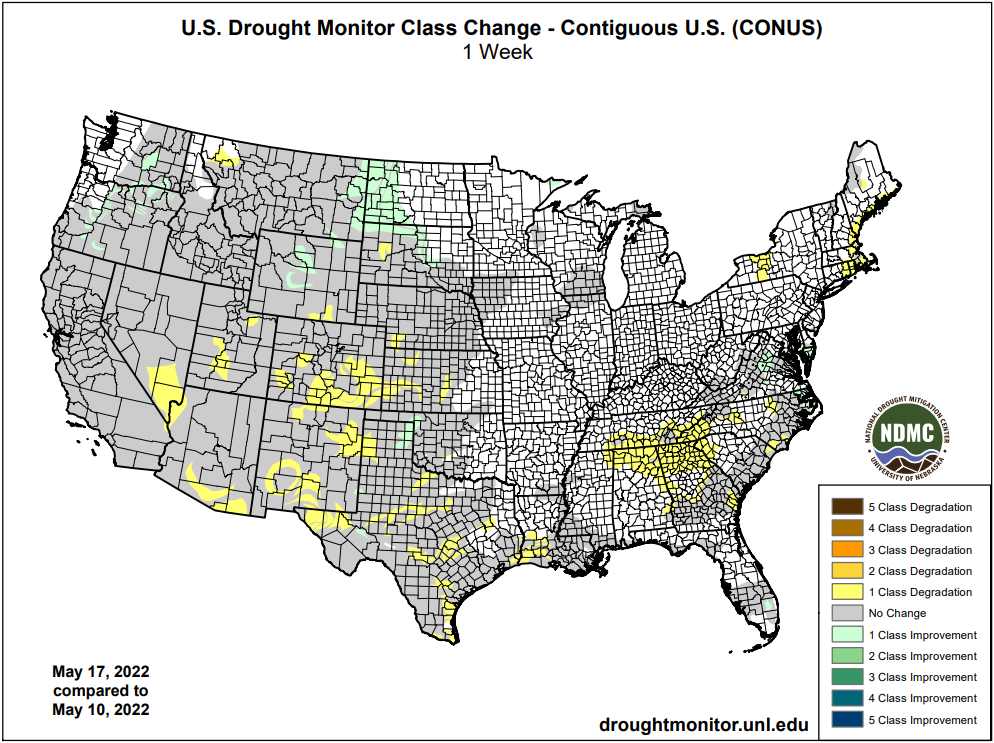

- U.S. northern Plains and Canada’s eastern Prairies will receive additional rain into Friday morning, but the frequency and significance of rain for the weekend through much of next week will be much less than it has been which may translate into an “opportunity” for improved topsoil conditions and “eventually” some fieldwork

- Stormy weather will resume shortly thereafter

- Delayed planting has started to threaten production and drier weather is needed immediately to get crops planted

- Southwestern Canada’s Prairies will get some needed moisture today into Friday morning and possibly again briefly next week

- The moisture is needed most in east-central and southern Alberta and west-central and southwestern Saskatchewan

- The moisture expected will be light, but extremely important for crop germination, emergence and establishment

- U.S. corn and soybean areas of the Midwest will see a good mix of rain and sunshine through early next week and again late this month into early June

- Abundant rain may occur for a little while during mid- to late-week next week that might cause greater disruption to fieldwork

- Planting progress may be a slowed at times by precipitation

- U.S. Delta and southeastern states will see a good mix of rain and sunshine during the next two weeks

- West Texas rainfall will develop Monday into Wednesday of next week with 0.50 to 1.50 inches expected with a few amounts over 2.00 inches in the Low Plains and especially the Rolling Plains

- Dryland cotton, corn, sorghum and peanut areas in West Texas need rain immediately or there will be some potential for a notable cut in production if rain has not occurred prior to June 15.

- Drier weather will occur again late next week with follow up showers possible in the following weekend and/or into the early days of June

- Texas Blacklands, Coastal Bend and some South Texas crop areas may experience some needed moisture next week

- Heavy rainfall is expected in the Blacklands and upper coast where multiple inches will fall during mid-week next week

- Local flooding is expected

- There is also a risk of severe thunderstorms producing hail, damaging wind and possible tornadoes

- The precipitation will improve topsoil moisture for better crop development after recent hot and dry conditions

- Ontario and Quebec weather will be mostly well mixed for spring and summer crop planting and winter crop development

- U.S. Pacific Northwest crops need greater precipitation to improve dryland crop development potentials

- Rain in Europe is advertised to be supportive of “some” relief to recent drying in northeastern France and Germany, but limited rain in other areas of western Europe may leave pockets of dryness around that could threaten production if not relieved soon

- Some of the Balkan Countries will also experience greater drying and a rising need for rain

- Western and northern Russia will continue to receive timely rainfall that will maintain moisture abundance and be good for crop development

- Ukraine weather will remain mostly good, although there has been “some” recent drying

- The outlook favors timely rainfall and a good environment for most crops to develop in

- Northern Kazakhstan will receive timely rainfall over the next ten days to maintain a favorable spring planting outlook

- East-central China will continue in a drying mode that may stress unirrigated crops in the North China Plain for another week to ten days

- Some computer forecast models have suggested a little relief may occur to a part of this region in the second week of the outlook, but confidence is low

- Southern India, southern Myanmar, other portions of mainland Southeast Asia and the northwestern Philippines will receive frequent rain this weekend through all of next week resulting in a rising potential for flooding.

- This precipitation is associated with a strong southwest monsoon flow

- The lower coast of Myanmar will receive 10-20 inches of rain over the next ten days beginning this weekend

- A tropical cyclone “may” evolve in South China Sea next week and could bring a risk of heavy rain, flooding and windy conditions to portions of Taiwan and/or Luzon Island, Philippines

- Australia precipitation will be restricted through the weekend allowing autumn planting of wheat, barley and canola to advance along with the harvest of cotton and sorghum

- A wetter second week of the forecast will slow fieldwork, but improve winter crop emergence and establishment potentials

- Rain in South Africa over the next few days will disrupt fieldwork, but the moisture will be ideal for wheat, barley and canola planting and establishment

- Drier weather will return next week favoring fieldwork once again

- West-central Africa rainfall during the next ten days will be favorable for coffee, cocoa, sugarcane, rice and cotton

- There is need for greater rainfall farther north in cotton areas where recent rain has been a little restrictive at times

- East-central Africa rainfall will be most significant in southwestern Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania begins to dry down seasonably

- North Africa weather will be mostly dry and warm for wheat and barley maturation and harvest progress

- Turkey will be the only Middle East nation getting rainfall during the next week to ten days

- A boost in rain is needed in many areas, but Syria, Jordan and Iraq have been and will continue driest hurting winter grain production and raising some worry over irrigated cotton and rice development

- Xinjiang, China rainfall will be greatest in the mountains where a boost in water supply for irrigation is expected

- Planting of cotton and corn as well as other crops is well under way and the outlook is favorable for most irrigated areas

- Mexico rainfall is expected to increase in the south and east parts of the nation next week as pre-monsoonal moisture builds up across the nation

- Central America will see periodic rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

- Today’s Southern Oscillation Index was +19.59 and it will remain near its peak intensity for a little while longer, but there is strong evidence for weakening soon

- New Zealand weather will be favorably mixed for a while

Source: World Weather Inc.

Bloomberg Ag Calendar

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- USDA red meat production, 3pm

- International Grains Council’s monthly report

Friday, May 20:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- China’s third batch of April trade data, including soy, corn and pork imports by country

- FranceAgriMer weekly update on crop conditions

- Malaysia’s May 1-20 palm oil export data

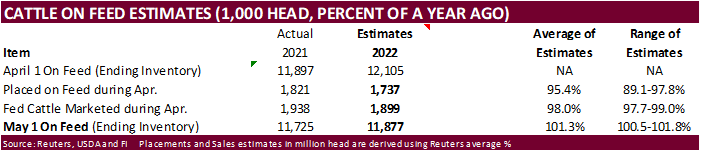

- U.S. cattle on feed

- EARNINGS: IOI Corp

Monday, May 23:

- USDA export inspections – corn, soybeans, wheat, 11am

- MARS monthly EU crop conditions report

- U.S. crop planting data for corn, soybeans, spring wheat and cotton; winter wheat conditions, 4pm

- U.S. cold storage data for beef, pork and poultry, 3pm

- HOLIDAY: Canada

Tuesday, May 24:

- Grain & Maritime Days conference in Istanbul, May 24-25

- Russian Meat & Feed Industry conference in Moscow

- EU weekly grain, oilseed import and export data

- Brazil’s Unica may release cane crush and sugar output data during the week (tentative)

Wednesday, May 25:

- EIA weekly U.S. ethanol inventories, production, 10:30am

- Malaysia’s May 1-25 palm oil export data

- U.S. poultry slaughter, 3pm

- HOLIDAY: Argentina

Thursday, May 26:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- USDA releases World Sugar Markets and Trade outlook

- Russian grain forum starts in Sochi

- HOLIDAY: France, Germany, Indonesia

Friday, May 27:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

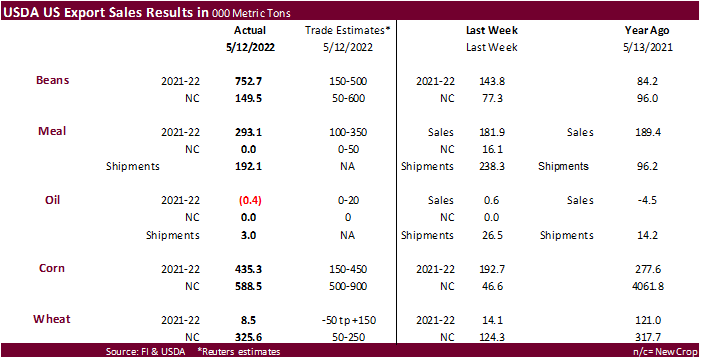

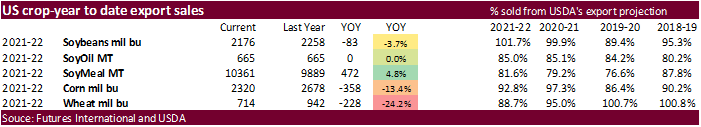

USDA Export Sales

Complex and corn with expectations when combining crop years. Wheat better than expected. China showed up for old crop soybeans.

Macros

• US initial jobless claims and continuing claims data

• Prior report 203K (vs. 195K estimate). Revised to 197K

• Initial jobless claims 218K vs. 200 K estimate

- 4 week moving average initial claims 192.75K vs. 188.5K

• Continuing claims 1.317 M vs. 1.320 million estimate

- 4 week moving average continuing claims 1.385M vs 1.417.5K.

· The International Grains Council lowered its 2022-23 forecast for world corn production to 1.184 billion tons from 1.197 billion.

· Reuters reported that Argentina may raise corn export limits by 5 million tons to 35 million tons citing a source within the AgMin.

· The Baltic Dry Index gained 100 points or 3.1% to 3,289 points, highest since December 2021. Capesize was up 5.3 percent.

· Nepal reported its first outbreak of African swine fever.

· The Delta and much of the US Midwest will see widespread rains over the next week, good for recently planted spring grains.

· Planting progress is moving along nicely for the US WCB but parts of the ECB are well behind normal.

· US generated 1.14 billion ethanol (D6) blending credits in April compared to 1.27 billion in March.

· US Red Meat production fell 3.5% in April and down 0.9% from last year.

April March April

2022 2022 2021 YOY% MOM%

Red Meat Production 4,546 4,979 4,710 -3.5% -8.7%

Beef 2,327 2,506 2,349 -0.9% -7.1%

Pork 2,202 2,456 2,344 -6.1% -10.4%

Cattle slaughter 2,813 3,015 2,852 -1.4% -6.7%

Calf slaughter 28 33 27 2.6% -13.8%

Hog slaughter 10,081 11,250 10,824 -6.9% -10.4%

U of I – Tracking Corn and Soybean Prevent Plant in 2022

Zulauf, C., G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. “Tracking Corn and Soybean Prevent Plant in 2022.” farmdoc daily (12):72, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 18, 2022.

https://farmdocdaily.illinois.edu/2022/05/tracking-corn-and-soybean-prevent-plant-in-2022.html

· South Korea’s NOFI bought 69,000 tons of South American corn at 245.16 cents over the September contract for arrival around August 25.

· Turkey’s TMO seeks 175,000 tons of feed corn on May 26 for shipment between June 7 and June 30.

Updated 5/12/22

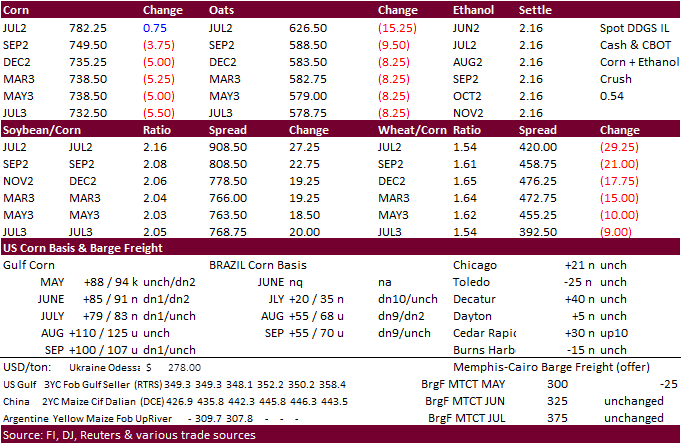

July corn is seen in a $7.50 and $8.75 range

December corn is seen in a wide $5.50-$8.50 range

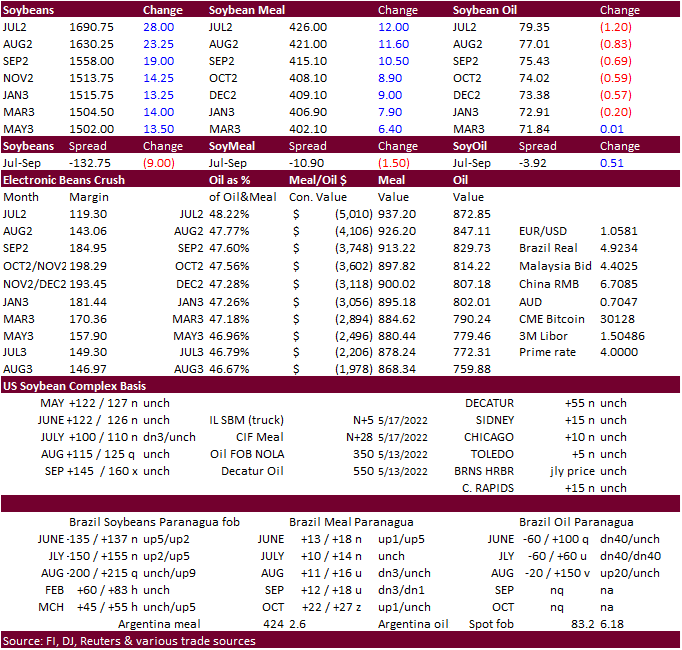

· Soybeans and meal closed higher on technical buying and China returning to the US market for old crop soybeans per USDA export sales report. We also heard China was looking around for quotes this morning for 2021-22 US soybeans.

· Soybean oil finished lower tracking weakness in palm and other related markets after Indonesia decided to lift their export ban on palm oil effective Monday. Widespread protests and economic losses from the export ban pressured the government to reverse their decision. They said domestic supplies have been replenished although domestic prices remain above the government target.

· China removed their restrictions on Canadian canola that has been ongoing for three years, but imports are expected to be minimal for the near term.

· US generated 498 million biodiesel (D4) blending credits in April compared to 490 million in March.

· China plans to sell another 500,000 tons of soybeans from reserves on May 20.

Updated 5/17/22

Soybeans – November is seen in a wide $12.75-$16.50 range

Soybean meal – July $350-$450

Soybean oil – July 78-86

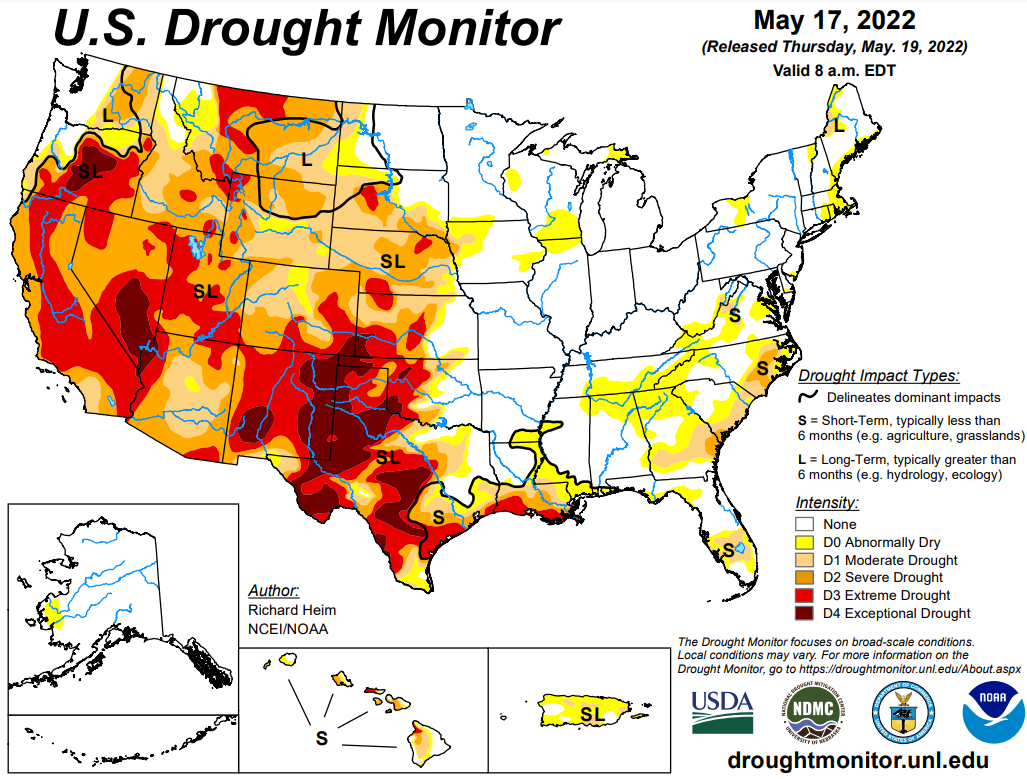

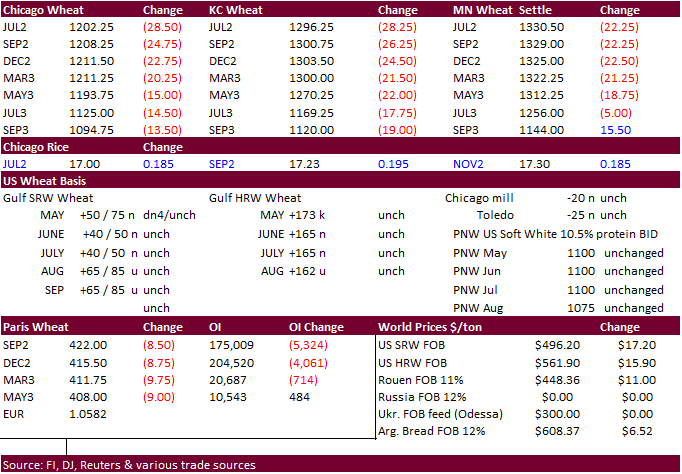

· Wheat futures ended lower on follow-through selling despite a lower USD. Traders were eying a large Russian wheat crop and US weather. The weather outlook for the US Great Plains improved with northern areas drying down starting this weekend favoring spring planting progress.

· The Wheat Quality Council 2022 Hard Red Winter Wheat Tour pegged the average yield at 39.7 bushels per acre, down from 58.1 bushels in 2021 and compares to a five-year average of 47.4 bushels per acre. There was no tour in 2021. (#wheattour22 on Twitter).

· The International Grains Council lowered its 2022-23 forecast for wheat production to 769 million tons from 780 million.

· For their third output update, India estimated wheat production at 106.41 million tons, well below the 2021 bumper crop of 111.32 million tons. An estimated 1.2 million tons of wheat had been shipped as of early May, out of 4 million tons believed to have been contracted. India aims to procure 19.5 million tons of wheat for reserves. They bought 18.1 million tons so far. With 1.4 million tons of wheat left to procure, we could see the government further relax on export restrictions. India is looking at allowing exporters to ship wheat currently trapped at ports.

· Ukraine exports of grain so far during May are down 64 percent from same period year ago.

· Russia would like to see sanctions reviewed if Ukraine grain exports were to be open for shipping per UN’s request this week.

· Morocco said they have enough wheat reserves to last four months.

· September Paris wheat closed down 8.25 euros at 422.25 euros a ton.

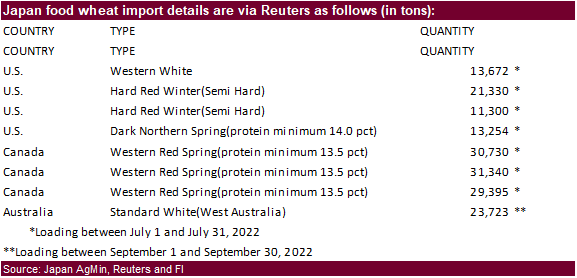

· Japan bought 174,744 tons of food wheat from the US, Canada and Australia. Original details as follows.

· Jordan issued a new import tender for 120,000 tons of wheat set to close May 24 for Aug/Sep shipment.

· Pakistan seeks 500,000 tons of wheat on May 25. Bulk shipment is sought to Pakistan in June to July 2022.

· Bangladesh seeks 50,000 tons of wheat on May 23 for shipment within 40 days of contract signing.

· Jordan seeks on 120,000 tons of barley on May 26 for Aug/Sep shipment.

· Bangladesh seeks 50,000 tons of wheat on May 29 for shipment within 40 days.

Rice/Other

· Egypt’s GASC seeks at least 25,000 tons of white rice for July and August arrival.

Updated 5/17/22

Chicago – July $11.00 to $13.50 range, December $8.50-$12.50

KC – July $12.00 to $14.50 range, December $8.75-$13.50

MN – July $12.00‐$15.00, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.