PDF Attached

Please

note I will be out of the office Thursday and Friday attending a conference.

USDA:

Private exporters reported sales of 229,200 metric tons of soybeans received during the reporting period for delivery to unknown destinations. Of the total, 10,200 metric tons is for delivery during the 2021/2022 marketing year and 219,000 metric tons is

for delivery during the 2022/2023 marketing year.

Widespread

commodity and equity selling hit most markets today. The US Great Plains weather forecast is wetter next week bias the central and southern Great Plains.

WEATHER

EVENTS AND FEATURES TO WATCH

- No

crop damaging cold conditions occurred this morning in Brazil’s grain, coffee, citrus or sugarcane areas - Extreme

lows slipped to the range of 38-45 degrees Fahrenheit - Temperatures

in southern Brazil will trend cooler over the next three mornings with frost expected Friday and Saturday in Parana and areas farther to the south in Rio Grande do Sul - Coffee,

citrus and sugarcane areas are not expecting any damaging frost or freeze conditions, but it will be very chilly, and a few Sul de Minas coffee areas could experience a patch or two of frost during the next few mornings in the traditionally coldest areas - Dryness

will continue in Safrinha corn and cotton areas from Mato Grosso into Goias where yields have fallen because of dryness this season - Other

Safrinha crops have experienced mostly good weather and little change is likely - Argentina

will continue dry for ten days, but the GFS has hinted at some rain for days 11-15 in some winter wheat areas and if that verifies it would be a boon to the nation’s planting outlook - Western

Argentina continues too dry for ideal planting conditions - Wheat

is mostly planted from late May into June - U.S.

northern Plains and Canada’s eastern Prairies will continue to receive rain a little too often and drier weather is needed to promote spring planting of corn, soybeans, sugarbeets, spring wheat, barley, oats, canola and other crops - Delayed

planting has started to threaten production and drier weather is needed immediately to get crops planted

- Southwestern

Canada’s Prairies will get some needed moisture Thursday into Friday and possibly again briefly next week - The

moisture is needed most in east-central and southern Alberta and west-central and southwestern Saskatchewan - The

moisture expected will be light, but extremely important for crop germination, emergence and establishment - U.S.

corn and soybean areas of the Midwest will see a good mix of rain and sunshine over the next two weeks supporting previously planted crops quite well - Planting

progress may be a slowed at times by precipitation - U.S.

Delta and southeastern states will see a good mix of rain and sunshine during the next two weeks

- West

Texas rainfall may develop early next week with the Low Plains and Rolling Plains most favored for the moisture - Dryland

cotton, corn, sorghum and peanut areas in West Texas need rain immediately or there will be some potential for a notable cut in production if rain has not occurred prior to June 15.

- Texas

Blacklands, Coastal Bend and some South Texas crop areas may experience some needed moisture next week

- The

precipitation will improve topsoil moisture for better crop development after recent hot and dry conditions - Ontario

and Quebec weather will be mostly well mixed for spring and summer crop planting and winter crop development - U.S.

Pacific Northwest crops need greater precipitation to improve dryland crop development potentials - Rain

in Europe is advertised to be supportive of “some” relief to recent drying in northeastern France and Germany, but limited rain in other areas of western Europe may leave pockets of dryness around that could threaten production if not relieved soon - Western

and northern Russia will continue to receive timely rainfall that will maintain moisture abundance and be good for crop development - Ukraine

weather will remain mostly good, although there has been “some” recent drying - The

outlook favors timely rainfall and a good environment for most crops to develop in

- East-central

China will continue in a drying mode that may stress unirrigated crops in the North China Plain for another week to ten days - Some

computer forecast models have suggested a little relief may occur to a part of this region in the second week of the outlook, but confidence is low

- Southern

India, southern Myanmar, other portions of mainland Southeast Asia and the northwestern Philippines will receive frequent rain this weekend through all of next week resulting in a rising potential for flooding.

- This

precipitation is associated with a strong southwest monsoon flow - A

tropical cyclone “may” evolve in South China Sea next week and could bring a risk of heavy rain, flooding and windy conditions to portions of Taiwan and/or Luzon Island, Philippines - Australia

precipitation will be restricted through the weekend allowing autumn planting of wheat, barley and canola to advance along with the harvest of cotton and sorghum - A

wetter second week of the forecast will slow fieldwork, but improve winter crop emergence and establishment potentials - Rain

in South Africa over the next few days will disrupt fieldwork, but the moisture will be ideal for wheat, barley and canola planting and establishment - Drier

weather will return next week favoring fieldwork once again - West-central

Africa rainfall during the next ten days will be favorable for coffee, cocoa, sugarcane, rice and cotton

- There

is need for greater rainfall farther north in cotton areas where recent rain has been a little restrictive at times - East-central

Africa rainfall will be most significant in southwestern Ethiopia, southwestern Kenya and Uganda during the next ten days while Tanzania begins to dry down seasonably - North

Africa weather will be dry and warm for wheat and barley maturation and harvest progress - Turkey

will be the only Middle East nation getting rainfall during the next week to ten days - A

boost in rain is needed in many areas, but Syria, Jordan and Iraq have been and will continue driest hurting winter grain production and raising some worry over irrigated cotton and rice development - Xinjiang,

China rainfall will be greatest in the mountains where a boost in water supply for irrigation is expected

- Planting

of cotton and corn as well as other crops is well under way and the outlook is favorable for most irrigated areas - Mexico

rainfall is expected to increase in the south and east parts of the nation next week as pre-monsoonal moisture builds up across the nation - Central

America will see periodic rain in the coming ten days with some of it to become heavy this weekend and next week from Costa Rica into Panama.

- Today’s

Southern Oscillation Index was +19.82 and it is will remain near its peak intensity for a little while longer, but there is strong evidence for weakening soon - New

Zealand weather will trend wetter over the next ten days easing dryness that has recently evolved.

Source:

World Weather Inc.

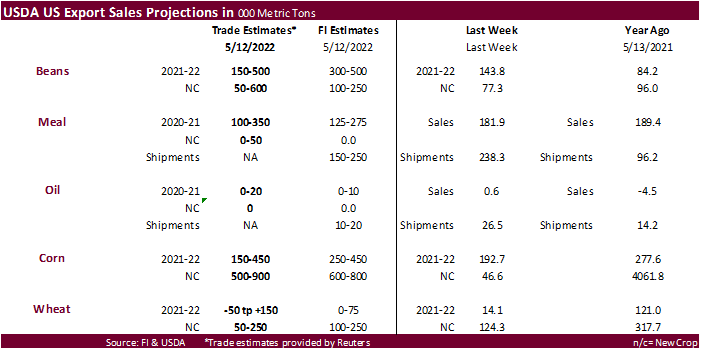

Bloomberg

Ag Calendar

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

second batch of April trade data, incl. corn, wheat, sugar and pork imports - USDA

total milk production, 3pm - HOLIDAY:

Argentina

Thursday,

May 19:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

red meat production, 3pm - International

Grains Council’s monthly report

Friday,

May 20:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

third batch of April trade data, including soy, corn and pork imports by country - FranceAgriMer

weekly update on crop conditions - Malaysia’s

May 1-20 palm oil export data - U.S.

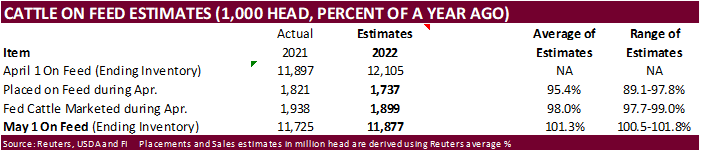

cattle on feed - EARNINGS:

IOI Corp

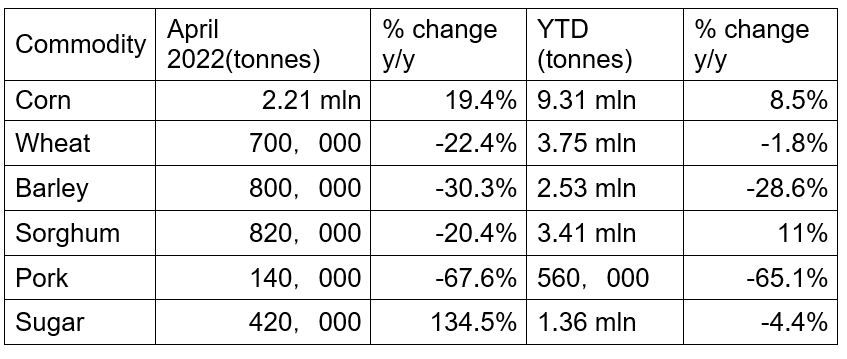

China

selected April commodity imports

Source:

Reuters and FI

Macros

US

Housing Starts Apr: 1724K (est 1756K; prev 1793K)

US

Housing Starts (M/M) Apr: -0.2% (est -2.1%; prev 0.3%)

US

Building Permits Apr: 1819K (est 1814K; prev 1873K; prevR 1870K)

US

Building Permits (M/M) Apr: -3.2% (est -3.0%; prev 0.4%; prevR 0.3%)

Canadian

CPI NSA (M/M) Apr: 0.6% (est 0.5%; prev 1.4%)

Canadian

CPI (Y/Y) Apr: 6.8% (est 6.7%; prev 6.7%)

Canadian

CPI Core Common (Y/Y) Apr: 3.2% (est 2.9%; prev 2.8%; prevR 3.0%)

Canadian

CPI Core Median (Y/Y) Apr: 4.4% (est 3.9%; prev 3.8%; prevR 4.8%)

Canadian

CPI Core Trim (Y/Y) Apr: 5.1% (est 4.7%; prev 4.7%; prevR 4.8%)

US

DoE Crude Oil Inventories (W/W) 13-May: -3394K (est 2000K; prev 8487K)

–

Distillate Inventories: 1235K (est -600K; prev -913K)

–

Cushing OK Crude Inventories: -2403K (prev -587K)

–

Gasoline Inventories: -4779K (est -1400K; prev -3607K)

–

Refinery Utilization: 1.80% (est 0.50%; prev 1.60%)

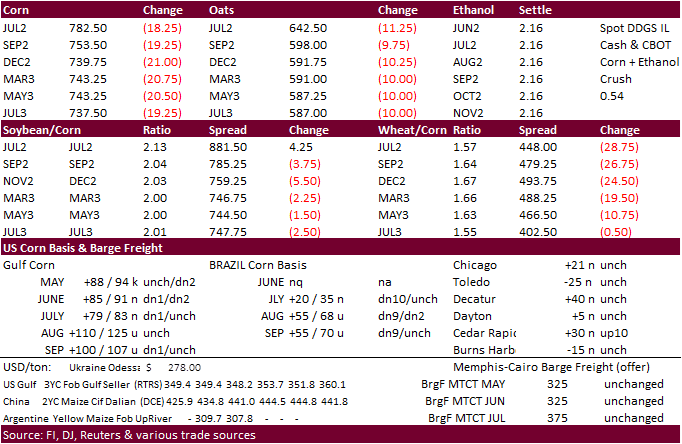

Corn

·

Corn ended 18.75-20.50 cents lower on weakness in wheat and other commodity markets. The major influence was fund selling.

·

There was chatter the EPA is mulling over cutting US biofuel mandates. This may not have an impact on ethanol demand, but the market may see it as a negative influence on corn prices. For biodiesel, production could dip, IMO.

It is a matter of profitability for biodiesel.

·

The Midwest is seeing a current rain even that will briefly slow corn planting progress. Brazil will still see frost events later this week across southern Brazil where some of the corn is still pollinating.

·

China imported 2.21 million tons of corn during the month of April, bringing YTD imports to 9.31 million tons, 8.5% above year earlier.

·

The Baltic Dry Index hit a 5-month high on Wednesday. It was up 94 points to 3,189 points.

·

(Reuters) – “Brazil’s second corn crop is expected to reach 87.6 million tons in the 2021/2022 cycle, down from a previous 92.2 million-ton forecast, a pre-crop tour estimate from agribusiness consultancy Agroconsult showed on

Wednesday.”

·

Canada – Manitoba Crop Report reported seeding progress at about 4% complete, behind the 5-year average of 50% for Week 19.

·

The weekly USDA Broiler Report showed eggs set in the US up 1 percent from a year ago and chicks placed up slightly. Cumulative placements from the week ending January 8, 2022 through May 14, 2022 for the United States were 3.54

billion. Cumulative placements were down slightly from the same period a year earlier.

·

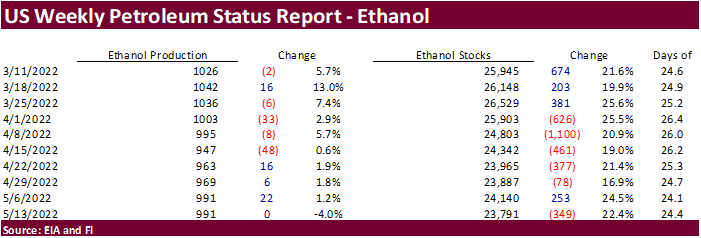

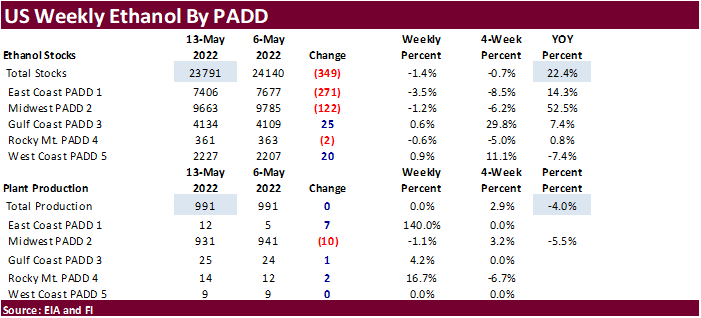

Weekly ethanol production was unchanged, and stocks decreased 349,000 barrels. A Bloomberg poll looked for weekly US ethanol production to be up 4,000 barrels and stocks down 77,000 barrels.

US

DoE Crude Oil Inventories (W/W) 13-May: -3394K (est 2000K; prev 8487K)

–

Distillate Inventories: 1235K (est -600K; prev -913K)

–

Cushing OK Crude Inventories: -2403K (prev -587K)

–

Gasoline Inventories: -4779K (est -1400K; prev -3607K)

–

Refinery Utilization: 1.80% (est 0.50%; prev 1.60%)

·

Turkey’s TMO seeks 175,000 tons of feed corn on May 26 for shipment between June 7 and June 30.

·

Taiwan’s MFIG bought 55,000 tons of South African corn at 248.39 cents over the December contract for shipment between Aug. 16 and Sept. 4.

Updated

5/12/22

July

corn is seen in a $7.50 and $8.75 range

December

corn is seen in a wide $5.50-$8.50 range