With PDF Attached

Old

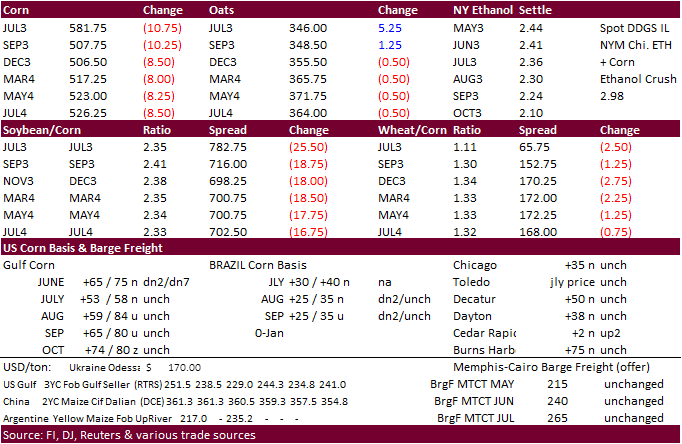

school thought? “Turnaround Tuesday”. CBOT grains and the soybean complex traded lower. Trading was slow in part to a US biofuel conference that started today and favorable US weather as traders relook at supplies. China tossed a wrench into the short-term

agriculture bull machine by reporting poor April economic data that rippled into their currency valuation against the USD. Some are doubting the covid recovery has positively impacted business efforts after a Monday report that showed a rebound in energy consumption

by that country. China industrial production for April rose by 5.6% year-on-year, below 10.9% expected, and retail sales increased 18.4%, below 21% trade average. China stock composites didn’t tank, a good sign, however, market sentiment remains frail, according

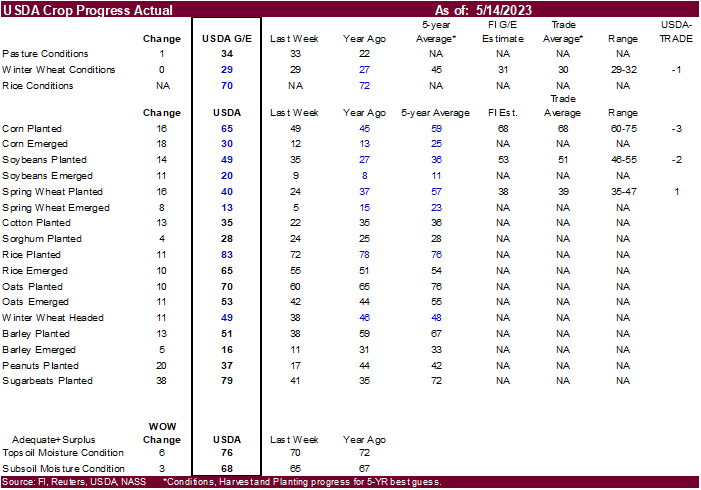

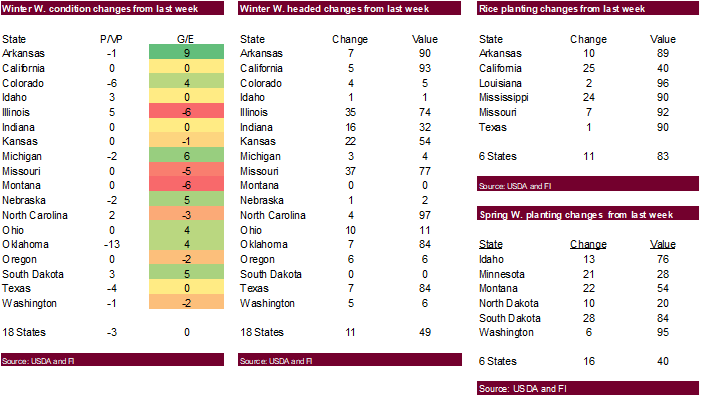

to market reports. US wheat conditions last week were unchanged after a second rainy week for the first “H” of May for parts of the Great Plains, one point below expectations,

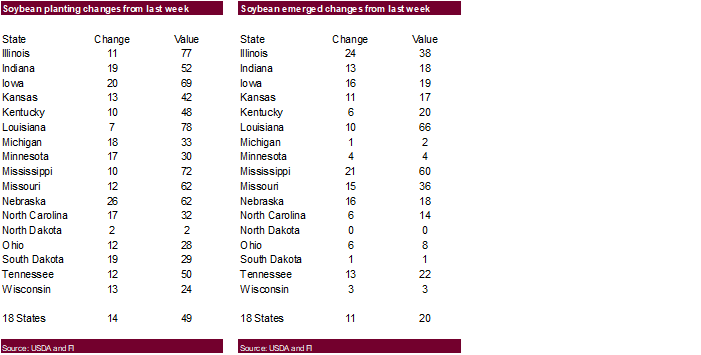

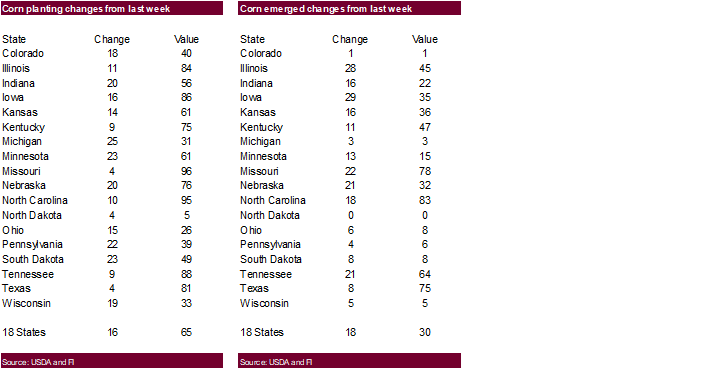

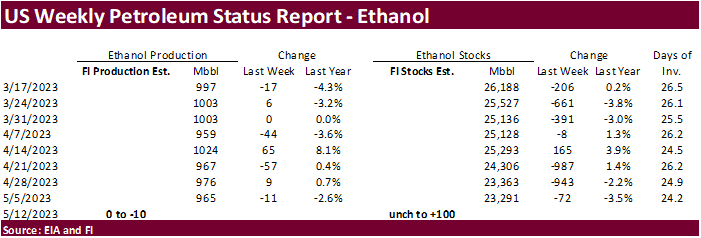

while summer (US) planting progress is moving along at a rapid pace for corn and soybeans across the US Midwest. Ironically echoes an Argentina crop year production cycle. A Bloomberg poll looks for weekly US ethanol production to be up 16,000 thousand barrels

to 981k (960-995 range) from the previous week and stocks up 45,000 barrels to 23.291 million.

We

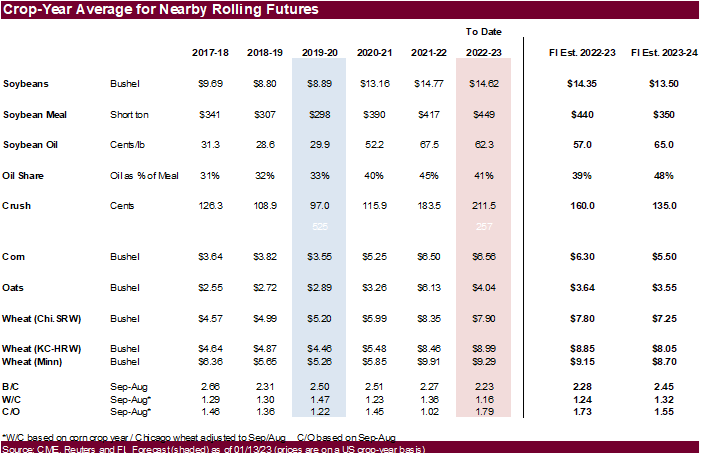

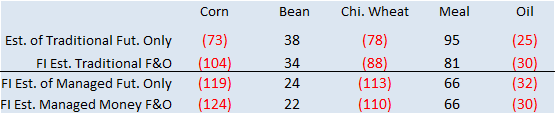

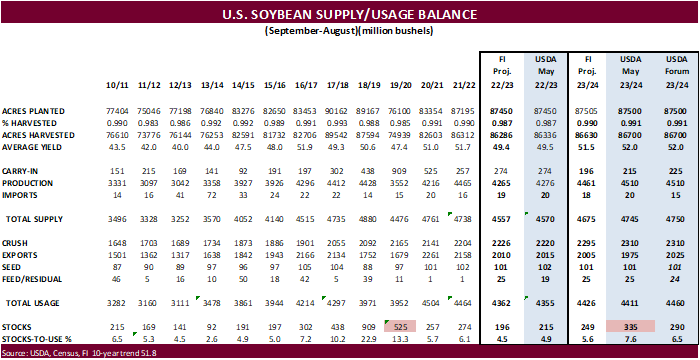

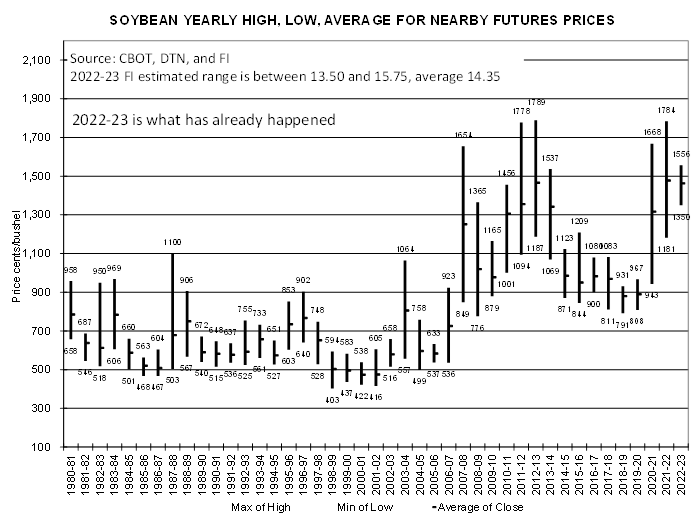

have a bias to soon lower(our 2023-24 crop year price outlooks if NA weather remains favorable. Current estimates below. Note the 2019-20 crop year when weather was mostly favorable. Below is our

previous price 2023-24 forecast.

Brazil’s

weather forecast is ideal for early corn second crop corn harvest progress.

WEATHER

TO WATCH

-

Frost

and Freezes in North America over the next week will have no permanent impact on crops -

Ontario

and Quebec will be coldest Wednesday and again this weekend with lows in the 20s and 30s Fahrenheit -

Parts

of Canada’s eastern Prairies will see frost and a few light freezes Thursday and Friday with no permanent impact on crops -

Patches

of soft frost cannot be ruled out in North Dakota or northern Minnesota Friday either, although the impact will be minimal -

Canada’s

Prairies may experience some increase in rainfall during the middle to latter part of next week, although confidence is low on how significant the moisture will be in the drought region -

Any

rain would be welcome -

Drought

remains serious in east-central and interior southern Alberta and western Saskatchewan with no rain and waves of heat likely in this first week of the outlook -

U.S.

hard red winter wheat areas of Kansas, southeastern Colorado, the Texas Panhandle and Oklahoma will have a good chance for scattered showers and thunderstorms Thursday into Friday with a few showers beginning Wednesday night

-

Rainfall

of 0.30 to 0.90 inch and local totals over 1.25 inches will be possible -

Scattered

showers and thunderstorms may resume during the weekend and continue periodically through the last days of May -

Northern

U.S. Plains, Canada’s Prairies and much of the northwestern U.S. Corn and Soybean Belt will be drier biased over this first week of the outlook -

U.S.

crop weather in general over the next ten days to two weeks will be favorably mixed providing time for planting and moisture for emergence and establishment -

This

includes most of the Midwest, the Great Plains, Delta and southeastern states -

U.S.

temperatures in the coming week will be very warm in the far western states and near normal in much of the central and east, although the southwestern Plains will be cooler biased for a while -

Warmer

biased temperatures are likely many key crop areas except in the southwestern Plains next week -

Argentina

weather is still expected to slowly become more active with waves of timely rain to bolster planting moisture in winter wheat areas

-

The

precipitation will slow late summer crop harvesting, but there will be no quality issues -

Brazil’s

center west and center south crop areas will continue seasonably dry biased over the next ten days -

Safrinha

crops will continue to develop well, although some rain may be needed soon in Mato Grosso and Goias where the topsoil is becoming quite dry and subsoil moisture is in decline -

Early

planted corn and cotton has performed extremely well -

Late

planted Safrinha corn in Sao Paulo, Parana and Mato Grosso do Sul is developing well with little change due to adequate soil moisture -

Portions

of Rio Grande do Sul and Paraguay will get rain next week for late season crops and winter wheat -

Southern

Europe will be plenty wet for a while keeping field progress running a little slow, but long term soil conditions will be good for winter and spring crops

-

Northern

Europe precipitation will be limited over the next ten days and temperatures will trend a little warmer over time -

The

environment will be good for fieldwork and crop development -

Russia,

Ukraine, Belarus and Baltic States will see a good mix of weather during the next ten days favoring fieldwork and normal crop development -

A

few areas in northern Kazakhstan and neighboring areas of Russia would still benefit from greater rain, although recent rain was welcome -

The

region should be closely monitored for drying later this year -

China’s

weather remains favorably mixed in the Northeast, North China Plain and Yellow River Basin -

Some

drought conditions remain in Inner Mongolia and northern Hebei -

Excessive

soil moisture is expected again in areas near and south of the Yangtze River over the next couple of weeks -

The

precipitation may disrupt rapeseed maturation and harvesting -

Some

rapeseed quality declines are possible -

India’s

weather will be normal for this time of year over the balance of this month -

Thailand,

Vietnam, Laos and Cambodia will experience net drying over the next several days and then rain will resume again during the weekend and next week -

The

region would benefit from greater precipitation -

Indonesia

and Malaysia rainfall is becoming more erratic and next week’s precipitation may be light enough to induce net drying

-

Crop

moisture should remain favorable for a while, but developing El Nino conditions will impact these nations soon with lighter than usual rainfall and net drying -

Philippines

weather will be favorably mixed for a while, but a tropical disturbance near the west coast of Luzon may eventually enhance rainfall across the island while other areas experience a more favorable mix of rain and sunshine -

Australia

rainfall will be mostly confined to coastal areas for the next ten days -

Planting

will proceed, but some greater precipitation may be needed in the next few weeks to induce the best possible stands

-

Australia

rainfall Monday in southeastern Queensland and far northeastern New South Wales was good for future wheat and barley emergence and establishment -

Fieldwork

was disrupted in the region briefly, but should accelerate as net drying develops -

South

Africa weather will be trending drier in the coming week to ten days after rain fell Monday and will linger in the northeast today -

Summer

crop harvesting and winter crop planting will advance swiftly in the next two weeks with some need for greater rain in western wheat areas -

West

Africa weather continues to generate timely rainfall for coffee, cocoa, sugarcane and rice -

Rainfall

in the most recent 30 days was a little lighter than usual in southeastern Nigeria and western Cameroon as well as from northern Ivory Coast into southwestern Burkina Faso impacting cotton areas -

Crop

conditions should remain mostly good, although the drier areas would benefit from greater rain -

East-central

Africa rainfall has been favorable for coffee, cocoa and other crops in recent weeks with little change likely -

Central

Asia cotton and other crop weather has been relatively good this year with adequate irrigation water and some timely rainfall reported -

The

favorable environment will continue -

Mexico

rainfall is expected to steadily increase over the next ten days improving soil moisture for future planting of summer crops

-

Western

Mexico will continue quite dry -

Central

America rainfall is expected to be erratic, although mostly favorable during the next two weeks -

Tropical

Cyclone Fabien in the India Ocean poses no threat to land -

Today’s

Southern Oscillation Index was -6.24 and it should move erratically lower over the next several days

Source:

World Weather, INC.

Tuesday,

May 16:

- Future

Food Asia 2023 conference in Singapore, day 1 - French

agriculture ministry’s 2023 planting estimates - EU

weekly grain, oilseed import and export data - GrainCom

conference in Geneva, day 2 - New

Zealand dairy trade auction

Wednesday,

May 17:

- EIA

weekly US ethanol inventories, production, 10:30am - Future

Food Asia 2023 conference in Singapore, day 2 - GrainCom

conference in Geneva, day 3

Thursday,

May 18:

- China’s

2nd batch of April trade data, including agricultural imports - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - EARNINGS:

Australian Agricultural Co. - HOLIDAY:

France, Germany, Indonesia

Friday,

May 19:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - US

Cattle on Feed, 3pm

Saturday,

May 20:

- China’s

3rd batch of April trade data, including country breakdowns for energy and commodities

Source:

Bloomberg and FI

Soybean

and Corn Advisory

2022/23

Brazil Soybean Estimate Increased 1.0 mt to 155.0 Million

2022/23

Brazil Corn Estimate Increased 1.0 mt to 125.0 Million

2022/23

Argentina Soybean Estimate Unchanged at 23.0 Million Tons

2022/23

Argentina Corn Estimate Unchanged at 35.0 Million Tons

Macros

101

Counterparties Take $2.203 Tln At Fed Reverse Repo Op. (prev 103 Counterparties, $2.221 Tln)

US

Plans To Buy 3 Million Barrels Of Oil For Emergency Reserve

US

Industrial Production (M/M) Apr: 0.5% (est 0.0%; prevR 0.0%)

US

Capacity Utilization Apr: 79.7% (est 79.7%; prevR 79.4%)

US

Manufacturing (SIC) Production Apr: 1.0% (est 0.1%; prevR -0.8%)

US

Retail Sales Ex Auto (M/M) Apr: 0.4% (est 0.4%; prevR -0.5%)

US

Retail Sales Ex Auto And Gas Apr: 0.6% (est 0.2%; prevR -0.5%)

US

Retail Sales Control Group Apr: 0.7% (est 0.4%; prevR -0.4%)

Canadian

CPI NSA (M/M) Apr: 0.7% (est 0.4%; prev 0.5%)

Canadian

CPI (Y/Y) Apr: 4.4% (est 4.1%; prev 4.3%)

Canadian

CPI Core- Trim (Y/Y) Apr: 4.2% (est 4.1%; prev 4.4%)

Canadian

CPI Core- Median (Y/Y) Apr: 4.2% (est 4.3%; prevR 4.5%)

China

Industrial Production (Y/Y) Apr: 5.6% (est 10.9%; prev 3.9%)

–

Industrial Production YTD (Y/Y) Apr: 3.6% (est 4.9%; prev 3.0%)

China

Retail Sales (Y/Y) Apr: 18.4% (est 21.9%; prev 10.6%)

–

Retail Sales YTD (Y/Y) Apr: 8.5% (est 8.2%; prev 5.8%)

China

Fixed Assets Ex Rural YTD (Y/Y) Apr: 4.7% (est 5.7%; prev 5.1%)

–

Property Investment YTD (Y/Y) Apr: -6.2% (est -5.7%; prev -5.8%)

–

Residential Property Sales YTD (Y/Y) Apr: 11.8% (prev 7.1%)

China

Surveyed Jobless Rate Apr: 5.2% (est 5.3%; prev 5.3%)

China

NBS Economy Report, April 2023 – Full Report

China

Jan-Apr Crude Oil Throughput Up 8.3% Y/Y – Stats Bureau

–

April Crude Oil Throughput Up 18.9% Y/Y

–

April Crude Oil Production Up 1.4% Y/Y

–

Jan-Apr Crude Oil Production Up 1.8% Y/Y

POLL:

ECB To Hike Deposit Rate To 3.75% By End-Q3 Said 37 Of 62 Economists, 20 Said 3.50%, 5 Said 4.00% – RTRS

–

To Hike Deposit Rate By 25 Bps On June 15 To 3.50%, Said All 62 Economists

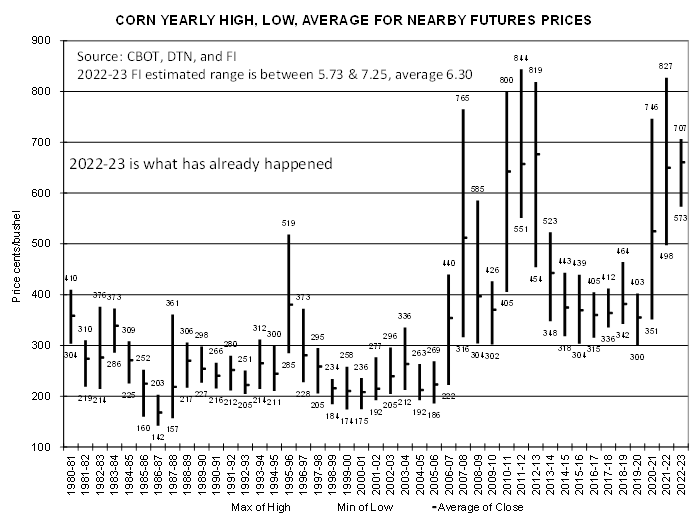

Corn

·

CBOT corn futures

traded lower on favorable US weather and a monstrous upcoming Brazil second corn crop. Rapid US corn planting progress suggests early crop establishment to weather potential dry elements during the NA summer growing season and boost local supplies prior to

the start of the September 1 crop-year. Add that to growing Brail supplies, new-crop global corn stocks as of October 1 could be up significantly from last year, but unclear as EU & Ukraine output may decline from a lower area.

·

Brazil’s weather outlook is mostly dry over the next two weeks, bad for late planted second crop corn but very good for early second crop harvest progress. We are rethinking our 2022-23 US corn export forecast and may lower it

below USDA if more cancellations arise and/or US inspections remain below the average weekly rate to meet USDA’s projection, resulting in a larger carryout, that will contribute to an already large 2023 production. Crop year prices are currently expected to

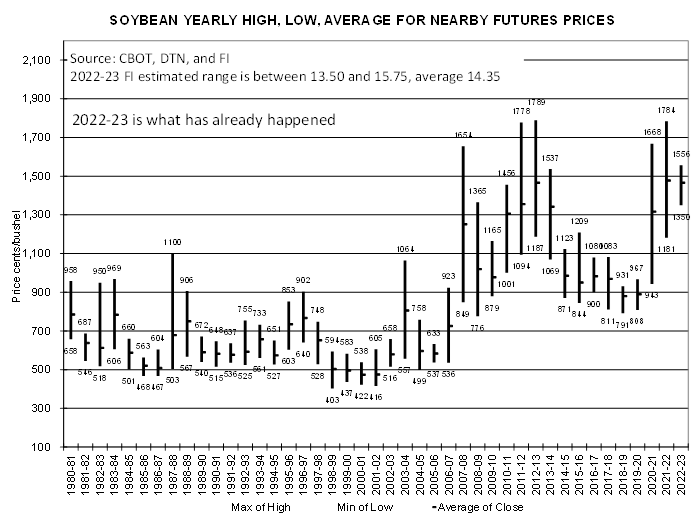

grind lower, IMO. Question remains, where will be the 2023-24 crop year low for corn end up at? 2019-20 for comparison ($3.00-$4.03):

·

The Ukrainian Grain Association (UGA) estimated a 30 percent drop in Ukraine corn exports for 2023-24 to 19 million tons, taking into account a predicted 21.1 million ton harvest, a drop from 27.3 million from last year. The corn

area was already forecast to drop, so this is not surprising.

·

There were no major tender announcements.

·

(Bloomberg) — Exports of most Russian fertilizers are climbing back to pre-war levels just as President Vladimir Putin’s negotiators make removing obstacles to the trade a key priority in talks to extend a Black Sea grain-passage

deal this week.

·

France corn plantings can end up 7.6 percent down from 2022 due to ongoing drought, to 1.25 million hectares.

·

A Bloomberg poll looks for weekly US ethanol production to be up 16,000 thousand barrels to 981k (960-995 range) from the previous week and stocks up 45,000 barrels to 23.291 million.

Export

developments.

-

None

reported

Bloomberg:

LIVESTOCK SURVEY: US Cattle on Feed Placements Seen Falling 3.8%. April placements onto feedlots seen falling y/y to 1.75m head, according to a Bloomberg survey of ten analysts.

July

corn $5.00-$6.50

December

corn $4.50-$6.50

·

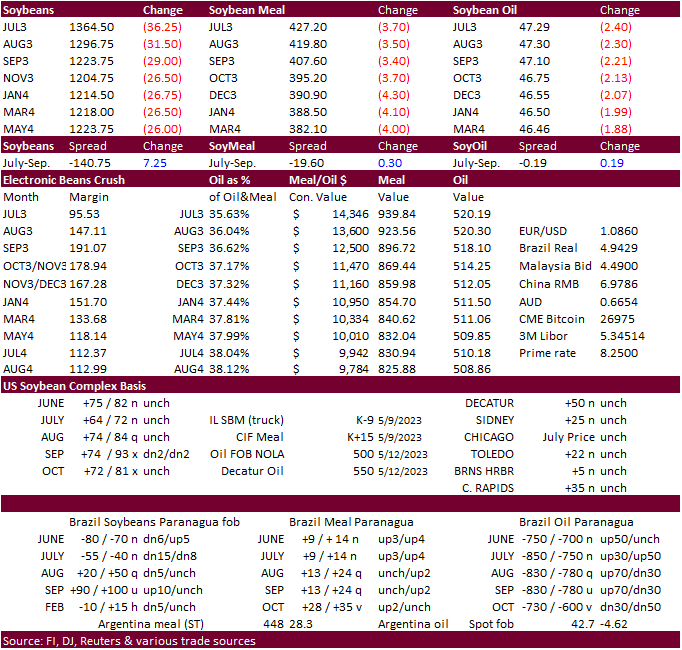

Soybean

futures were lower over China demand concerns, spilling over into product markets

·

NA weather is good for plantings bias both belts.

·

Technical selling should be noted, as many traders were out today. A biofuel conference in Chicago could support SBO futures over meal over the next day, maybe day and half?

·

Watch SBO price movement as US biofuel conference started officially today. Prices tend to trend higher during talks. Conference results – long term bullish oil share, IMO.

·

July 2023 soybeans traded at a July 26, 2022 low.

·

U of I: Janzen, J. “Setting Restrained Expectations for New-Crop Corn and Soybean Prices.” farmdoc daily (13):88, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 15, 2023.

Export

Developments

-

Today

the USDA seeks 120 tons of packaged vegetable oil for various export programs for June 16-July 5 shipment.

Soybeans

– July $13.50-$15.00, November $11.75-$15.00

Soybean

meal – July $375-$475, December $300-$500

Soybean

oil – July 48-52, December 47-57

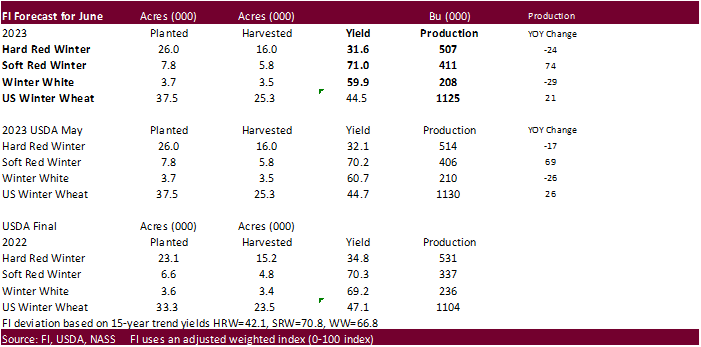

Wheat

·

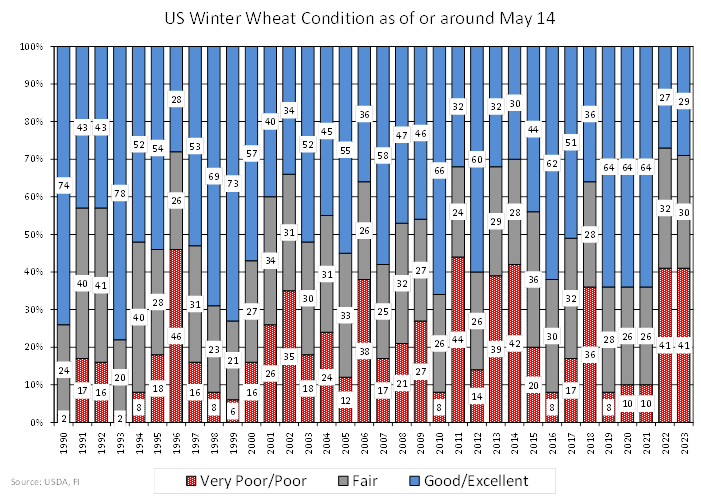

The 2023 Hard Winter Wheat Quality Tour will start to give some insight on the winter wheat crop today, lasting through May 18. The tour will cover Kansas and parts of Oklahoma. KS good/excellent ratings for winter wheat were

only 11 percent as of the first week of May.

·

(Reuters) – The Kremlin said on Tuesday that questions still remained about Russia’s part of the Black Sea grain deal, and that it would have to make a decision about whether to renew it.

·

USDA US all-wheat export inspections as of May 11, 2023, were 242,269 tons, within a range of trade expectations, above 214,538 tons previous week and compares to 348,937 tons year ago. Major countries included Mexico for 49,549

tons, Japan for 48,267 tons, and Philippines for 47,259 tons.

·

This upcoming Friday there might be some light frosts across the Dakota’s.

·

Argentina has an opportunity for rain across their wheat production areas second half of this week into next week. This will be important to monitor as wheat plantings are projected to be down from earlier estimates from ongoing

drought conditions.

·

Indian monsoons may start a little later than average, according to the local state weather office, starting June 4, +/- 4 days. What matters is how much the reservoirs and farmland absurd by early September.

·

USDA US winter wheat conditions have not changed much since the start of the reporting year, but also poor similar to year ago.

Export

Developments.

·

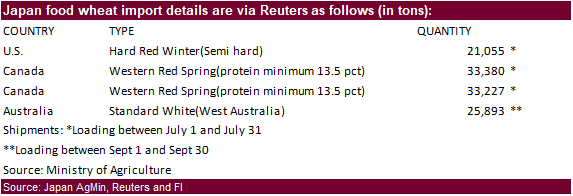

Japan in a SBS import tender seeks 60,000 tons of feed wheat and 20,000 tons of barley on May 17 for arrival in Japan by October 26.

·

Japan seeks 113,555 tons of food wheat on Thursday. Original tender as follows.

Rice/Other

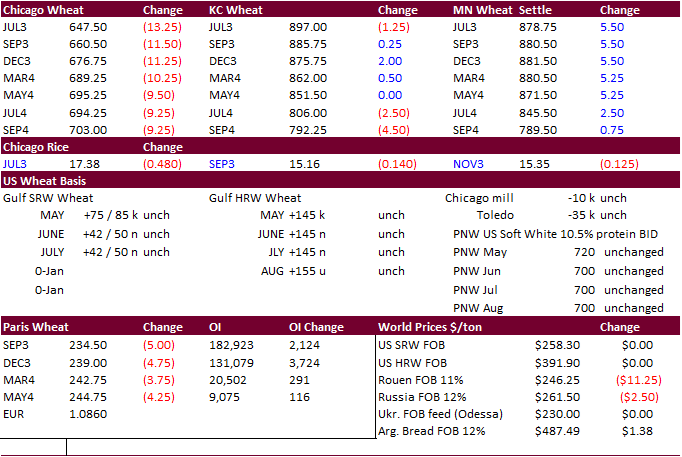

Chicago

Wheat – July $5.75-$7.30 (up 0.25, up 0.25)

KC

– July $7.75-9.25 (up 0.25, up 0.50)

MN

– July $7.50-9.50

(unchanged, up 0.50)

September

– same ranges as July

#non-promo