PDF Attached

As

we learned last week, most CME/CBOT pits are now permanently closed. Video link provided takes us back what they used to look like.

https://www.youtube.com/watch?v=a25jc54YFzo

Last

7 days

World

Weather, Inc.

MOST

IMPORTANT WEATHER IN THE WORLD

- Tropical

cyclone 1A is developing off the lower west coast of India and promises to become a significant tropical cyclone this weekend and early next week before moving inland during mid-week next week over western Gujarat and/or southeastern Pakistan - Property

damage is expected along with some loss of early season summer crops and unharvested winter crops - Agricultural

losses are expected to be low and there is plenty of time to replant some crops

- Winter

crop harvesting should be quite advanced across some of the threatened production areas - Some

frost and freezes occurred this morning in minor crop areas of far southern and extreme northeastern Rio Grande do Sul into southeastern Santa Catarina - The

cold missed all of the most important crop areas and should have had a minimal impact - Canada’s

eastern Prairies are not likely to see much significant rainfall over the coming week, although a few sporadic showers will continue to tease some of the region with minimal amounts of moisture - Alberta

and far western Saskatchewan have some potential to receive meaningful rain late next week into the following weekend, but there is plenty of time for the advertised storm to change

- Temperatures

will turn very warm to hot in the eastern Canada Prairies during the late weekend through early half of next week - The

northern U.S. Plains are not expecting very much “meaningful” rain over the next week and concern over drought will expand this late weekend into early next week as temperatures rise over 80 degrees Fahrenheit - U.S.

Upper Midwest will have some potential for rainfall late next week and into the following weekend; until then the region will stay mostly dry - Frequent

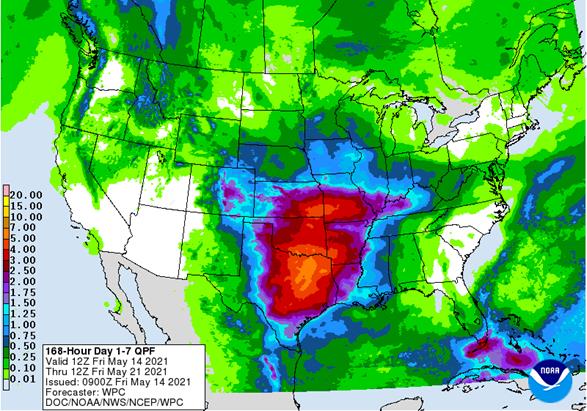

rain will fall in the central and southern U.S. Plains during the coming week to ten days possibly inducing some flooding over time.

- Eastern

Kansas, Missouri, Oklahoma, the Texas Blacklands, the northwestern U.S. Delta and the lower most Midwest will be wettest

- Excessive

rain is expected in a part of Oklahoma and southeastern Kansas wheat production areas

- Wheat

conditions will stay mostly good, but drier weather will be needed soon after this period to protect crops from wet weather disease and a threat to early maturing crop quality - West

Texas rain potentials are still looking very good over the coming week - Scattered

showers and thunderstorms will begin tonight night and be most significant Saturday night into Sunday until early to mid-week next week when the most generalized rainfall is expected - Good

coverage is anticipated by this time next week with sufficient rain to improve planting moisture in much of the region - The

intensity and coverage of rain has been reduced today, although all areas will get rain - The

storm system in the central and southern Plains, Missouri and Arkansas may rob some of the moisture from falling in West Texas especially near the New Mexico border where rain amounts will be lightest - Cotton,

corn, rice, soybean and sorghum areas of central and southern Texas will benefit from rain during the next ten days, although some local flooding may evolve - U.S.

southeastern states will experience net drying during the coming week to ten days - Southern

Georgia, northern Florida, southeastern Alabama and South

Carolina will be included in the driest conditions - Good

field working opportunities will remain, but the ground is expected to eventually become a bit too dry - U.S.

Pacific Northwest unirrigated winter crop areas are still being stressed by dryness and there is no significant relief coming anytime soon - California,

the Great Basin and most of the southwestern desert states will be dry through the next ten days - Southeast

Canada corn, soybean and wheat production areas are favorably moist and poised for good field progress and crop development this year - Brazil’s

Safrinha crop areas will receive no meaningful rainfall through next Friday morning and then scattered showers will occur in many areas May 21-23 with resulting rainfall mostly under 0.50 inch - Additional

showers are possible after May 23 in Brazil’s corn country, but confidence is low - The

European continent will continue wet over the next ten days - Spain

and Portugal will be the only drier biased countries - Russia’s

New Lands are continuing to dry out and this will become a market interest soon as the regions turns warmer than usual and becomes a little too dry

- The

area includes the southern Ural Mountains region, northern Kazakhstan and neighboring areas to the north in Russia’s southeastern New Lands and perhaps also impacting eastern portions of the lower Volga River Basin - This

region is not too dry today and is expected to see aggressive spring planting and early crop development until the soil becomes too dry - Mainland

areas of Southeast Asia and Luzon Island, Philippines still need greater rain - West

Africa will receive lighter than usual rainfall for a while in the coming week - A

boost in precipitation is needed, but unlikely for a while - Australia

will be dry over the next ten days - Rain

is needed to support better wheat, barley and canola planting conditions - Argentina

weather will remain favorable for its harvest - Restricted

rainfall and seasonable temperatures are expected in the next ten days - China

rainfall in the Yangtze River Basin will be excessive in the coming week to ten days resulting in some flooding

- The

rain is spread out over multiple days and flooding should not be nearly as serious as that of last year - Some

excessive rain has already been reported in random locations in the interior southern parts of China over the past several days - Portions

of China’s North China Plain and Yellow River Basin will receive some needed rain through Saturday and into early Sunday easing dryness that has evolved recently and restoring favorable crop and field conditions in both winter and spring production areas - Hebei,

Liaoning and Shandong will not receive nearly as much rain as other areas and will have a growing need for precipitation during the balance of this month - Shanxi,

Henan and a few neighboring areas will be wettest - Northeastern

China will continue to experience periodic rainfall that will keep spring planting moving along a little sluggishly for a while - Xinjiang

China’s cotton areas will be cooler than usual through the weekend and again late next week - The

environment will be poor for degree day accumulations - Showers

are expected today and Saturday, although most of the precipitation will be key very light - Temperatures

will cool to the upper 50s and 60s in the northeast followed by lows in the middle and upper 30s into the 40s Saturday

- Cooling

in the southwest will force high temperatures to the 60s and 70s briefly through Saturday - Warming

will occur early to mid-week next week with temperatures returning closer to normal - Another

bout of cooling is expected late next week - The

cool weather is slowing crop development and there is some concern over the overall condition of crops because of so much cool weather this spring - Mexico

drought remains quite serious, but there is some rain and thunderstorms advertised for southern and eastern parts of the nation during the next two weeks - The

precipitation will begin erratically and then increase over time this week and then decrease again next week - Water

supply is quite low and winter crops in a few areas have not performed well - The

moisture will help improve planting, emergence and establishment conditions for most summer crops in the wetter areas, but the west-central and northwest parts of the nation will continue quite dry.

- Australia

precipitation will be restricted over the coming week, although some showers are now being suggested for late next week and into the following weekend - Temperatures

will be close to normal in the east and warmer than usual in the west - The

bottom line supports aggressive planting in Western Australia where significant rain fell last week, but most other areas will wait on significant rain to bolster soil moisture for improved autumn planting and germination conditions in unirrigated areas

- South

Africa will not receive much rain in the coming two weeks favoring summer crop maturation and harvest progress - Winter

crop planting is under way and additional rain would be welcome for that purpose - Temperatures

will be warmer than usual - India

winter crop harvesting has advanced well in the dry areas, but some rain has hindered fieldwork in a few areas - Rain

will diminish over the next few days as the tropical cyclone moves northward off the west coast.

- Southern

Oscillation Index is mostly neutral at +5.57 and the index is expected to move higher for a while this weekend - North

Africa rainfall is expected to be minimal over the next ten days - Temperatures

will be warmer than usual - Winter

small grains will be rushed toward maturation faster than usual without much moisture - West-central

Africa will see a mix of rain and sunshine through the coming week. - Temperatures

will be near to above average and rainfall will be below average - A

boost in precipitation will be needed later this month to ensure soil moisture stays as good as possible and crop development continues normally - East-central

Africa rainfall has been erratic in recent weeks and a boost in rainfall is under way in Kenya, Ethiopia and northern Tanzania during the coming week - Southeast

Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks - However,

the mainland areas are reporting below to well below average rainfall recently and a boost in rain is needed in Vietnam’s Central Highlands and neighboring areas

- Greater

rain is also needed in the northern and western Philippines - Sulawesi

also needs a boost in rainfall - Most

of these areas will see improving rainfall May 20-26 with scattered showers and thunderstorms until then

- Luzon

Island, Philippines will be last to get significant rain - New

Zealand precipitation for the next week to ten days will be periodic across North Island and more frequent in western portions of South Island

- Temperatures

will be a little cooler than usual

Source:

World Weather, Inc.

Friday,

May 14:

- ICE

Futures Europe weekly commitments of traders report, 6:30pm London - FranceAgriMer

weekly update on crop conditions - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Indonesia, Malaysia, Dubai

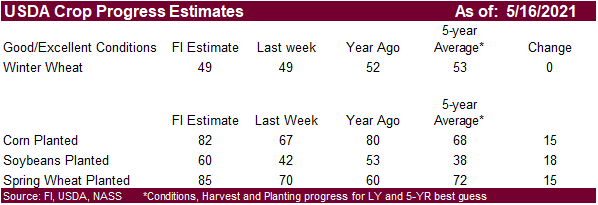

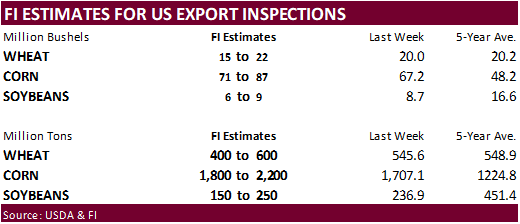

Monday,

May 17:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – soybeans, cotton; winter wheat condition, 4pm - U.S.

Green Coffee Association releases monthly green-coffee stockpiles - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Malaysia

crude palm oil export tax for June (tentative)

Tuesday,

May 18:

- China

customs to publish trade data, including imports of corn, wheat, sugar and cotton - New

Zealand global dairy trade auction - Brazil’s

Conab releases cane, sugar and ethanol production data - International

Sugar Organization and Datagro to hold New York sugar & ethanol conference

Wednesday,

May 19:

- EIA

weekly U.S. ethanol inventories, production - BMO

Farm to Market Conference, day 1 - International

Sugar Organization and Datagro to hold New York sugar & ethanol conference - HOLIDAY:

Hong Kong

Thursday,

May 20:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

customs to release trade data, including country breakdowns for commodities such as soybeans - BMO

Farm to Market Conference, day 2 - Black

Sea Grain conference - Port

of Rouen data on French grain exports - Malaysia

May 1-20 palm oil export data - USDA

total milk, red meat production, 3pm - EARNINGS:

Suedzucker

Friday,

May 21:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Black

Sea Grain conference - U.S.

Cattle on Feed, 3pm

Source:

Bloomberg and FI

IHS

Markit 2021 Plantings:

Corn:

96.8 mil acres, up 3.26 mil from last month and 5.7 mil above USDA

Soybeans:

88.5 mil, down 1.3 mil from prior estimate and 885,000 above USDA

Other

Spring: 11.6 mil, down 130,000 from USDA

Cotton:

11.7 mil, down 355,000 from USDA

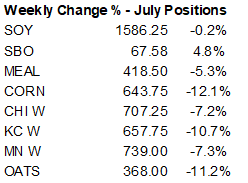

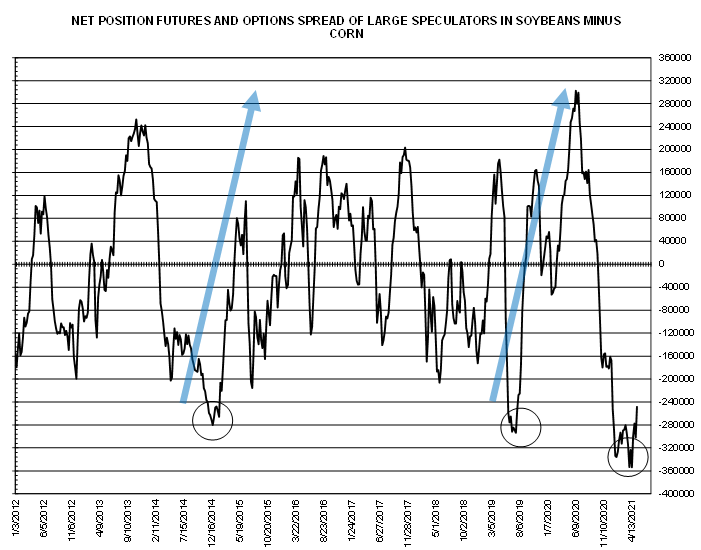

-Trade

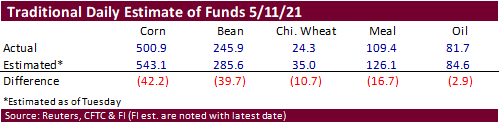

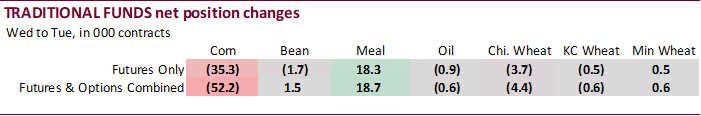

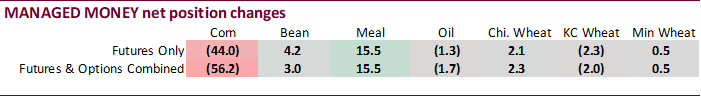

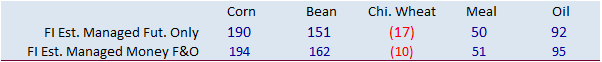

Traditional

funds were much less long than expected for corn, soybeans, wheat and meal.

The

net long position gained over corn by a large amount for the week ending May 11.

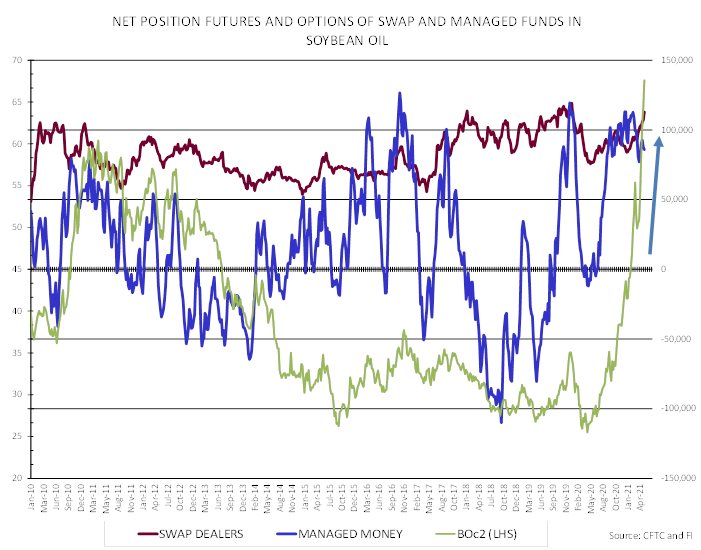

Are

CBOT soybean oil prices getting into a dangerously high territory as the net long position for managed money funds fail to test early January net long highs?

Macro

US

Retail Sales Advance (M/M) Apr: 0.0% (est 1.0%; prevR 10.7%; prev 9.8%)

US

Retail Sales Ex-Autos (M/M) Apr: -0.8% (est 0.6%; prevR 9.0%; prev 8.4%)

US

Retail Sales Ex-Autos, Gas Apr: -0.8% (est 0.3%; prevR 8.9%; prev 8.2%)

US

Retail Sales Control Group Apr: -1.5% (est -0.2%; prevR 7.6%; prev 6.9%)

US

Import Price Index (Y/Y) Apr: 10.6% (est 10.2%; prev 6.9%)

US

Import Price Index (M/M) Apr: 0.7% (est 0.6%; prevR 1.4%; prev 1.2%)

US

Import Price Index Ex-Petroleum (M/M) Apr: 0.7% (est 0.5%; prev 0.9%)

US

Export Price Index (Y/Y) Apr: 14.4% (est 14.0%; prev 9.1%)

US

Export Price Index (M/M) Apr: 0.8% (est 0.8%; prevR 2.4%; prev 2.1%)

Canadian

Manufacturing Sales (M/M) Mar: 3.5% (est 3.3%; prev -1.6%)

Canadian

Wholesale Trade Sales (M/M) Mar: 2.8% (est 1.0%; prev -0.7%)

US

Industrial Production (M/M) Apr: 0.7% (est 0.9%; prev 1.4%)

US

Capacity Utilization Apr: 74.9% (est 75.0%; prev 74.4%)

US

Manufacturing (SIC) Production Apr: 0.4% (est 0.3%; prev 2.7%)

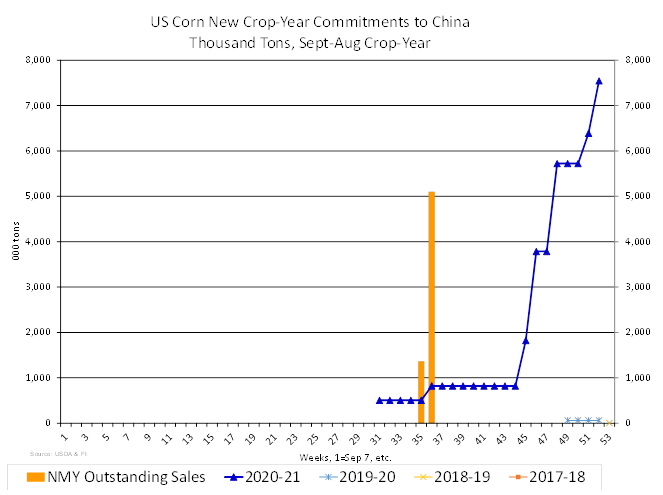

- Corn

futures were in a freefall again during the day session led by the July contract. For the week they declined by most for one week in nearly five years. July fell 12.1% this week and stands at $6.4375, off 31 cents and well off its contract absolute high of

$7.3525 (91.50 cents). July oats dropped 11.2% this week. Funds sold an estimated net 25,000 net corn contracts.

- CBOT

corn attempted to rebound on a lower USD (down 43 by 1:50 pm CT), strength in WTI crude oil (up $1.55) and higher US equities but broke during the early day session after July position started to sell off. A private form estimated the US corn planted area

well above USDA’s March estimate. The US Coast Guard lifted river restriction on Lower Mississippi River near I-40 bridge, according to a news release, but this did little to slow the selling post new flash announcement. As of Friday morning, there were

62 vessels and 1,058 barges in queue. The selling in the July contract was likely related to profit taking in July/December spreads and a pickup in producer movement as 2021 US plantings start to wind down. The absolute high on the

July/December corn spread was $1.26 (May 12) and Friday it was last $1.0225.

- IHS

Markit estimated the US corn planted area at 96.85 million acres, above USDA March of 91.144 million. Using normal abdomen and near trend yield, this estimate, if realized, could add 800 to a billion bushels to supply. We agree the US corn area is too low

and look for June plantings to come in greater than March intentions. Domestic and export demand for corn should be strong for 2021-22, and we believe any access supply realized by USDA could be absorbed by exports, feed and possibly ethanol use, keeping

the US carryout near their working 1.5-billion-bushel estimate. - China

bought 1.36 million tons of new-crop corn per USDA on Friday. So far during the month of May China bought 5.1 million tons of new-crop corn under the 24-hour reporting system.

- China’s

sow herd expanded 1.1% in April from the previous month and rebounded 23% over a year earlier. The sow herd in April stood at 97.6% of the end-2017 level, according to Reuters. Newborn piglets up 58.8% from last year. China has 180,000 large pig farms, up

from 161,000 at the beginning of last year, according to the AgMin. - FranceAgriMer

reported the French corn planting progress at 95% complete as of May 10, up from 89% the previous week and 88% a year ago. - Ukraine

planted about 74% percent of their planned corn area, or about 3.9 million tons. Ukraine early spring plantings are near complete with more than 1.9 million hectares sowed as of May 13. The area included 1.33 million hectares of barley, 229,600 hectares

of peas, 186,800 hectares of oats and 174,700 hectares of spring wheat.

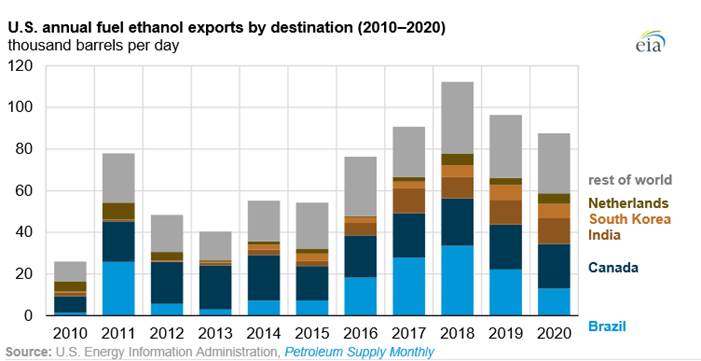

EIA:

In 2020, U.S. exports of fuel ethanol fell for the second consecutive year

https://www.eia.gov/todayinenergy/detail.php?id=47956&src=email

Export

developments.

- We

heard SK importers bought little more than 200,000 tons of corn late this workweek for September arrival.

- Under

the 24-hour announcement system, US exporters sold 1,360,000 tons of corn for delivery to China during the 2021-22 marketing year.

Updated

5/7/21

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.75-$7.00 range.

The

US needs to see a massive crop to pull new-crop futures below $4.00, which could happen for 2022 contracts if the export campaign for Q1 (SON) does not end up a record. Keep an eye on new-crop corn commitments this summer.

- CBOT

soybeans ended

higher in the non-expiring months led by a strong rally in soybean oil. Soybean meal fell on product spreading. For the week July soybean oil was up 4.8%, July soybeans down 0.2%, and July soybean meal off 5.3%.

- CBOT

soybeans were generally higher to start on technical buying and strong world cash prices.

- Funds

were net buyers of only 2,000 soybeans, sellers of 5,000 soybean meal and buyers of 9,000 soybean oil.

- News

was fairly light. - Soybean

meal basis for Chicago rise $3/short ton to 2 under and both Decatur (IL) and Morristown (IN) were up $1 to 3 under.

- The

NOPA report due out early next week indicates a good amount of US crush downtime during the month of April and that should remain the same theme for this month. Rationing is part of the reason for some areas of the US while if crushers can source soybeans

in other areas, they are taking advantage of the good margins. - US

weather looks good for plantings and emergence but some areas across the northern Midwest are in need of rain where drought conditions expanded since the beginning of the month. Rains return to the Delta Monday and Tuesday of next week.

- According

to a Reuters story, Brazil is on track to sell the largest volume of soybeans to the United States since 2014, using Cargonave data. 238,000 tons of Brazil soybeans have been shipped or will be soon shipped.

- Argentina

harvested about 71 percent of their soybean crop – BA Grains Exchange. - Singapore

is headed towards lock down amid COVID-19 cases on the rise, according to news outlets.

- A

Reuters poll calls for the April US soybean crush to end up near 168.7 million bushels, compared 178.0 million during March and down from 171.8 million during April 2020. End of April soybean stocks were estimated at 1.785 billion pounds, up from 1.771 billion

at the end of March but down from 2.111 billion pounds at the end of April 2020. - China

cash crush margins on our analysis were negative 20 cents (negative 4 previous) vs. 214 cents late last week and compares to 77 cents year earlier. We use the imported price of US soybeans which has rocketed higher this week.

- Malaysian

palm oil: (uses settle price).

ON

HOLIDAY

- On

May 18 USDA seeks a total of 4,770 tons of packaged oil for use in Title II, PL480 and the McGovern-Dole Food for Education export programs. Shipment was set for June 16-July 15 (July 1-31 for plants at ports).

Updated

5/14/21

July

soybeans are seen in a $15.00-$16.50 (up 25, unchanged);

November $12.75-$15.00

Soybean

meal – July $400-$460; December $380-$460

Soybean

oil – July 64-70 (up 400, up 200);

December 48-60 cent range

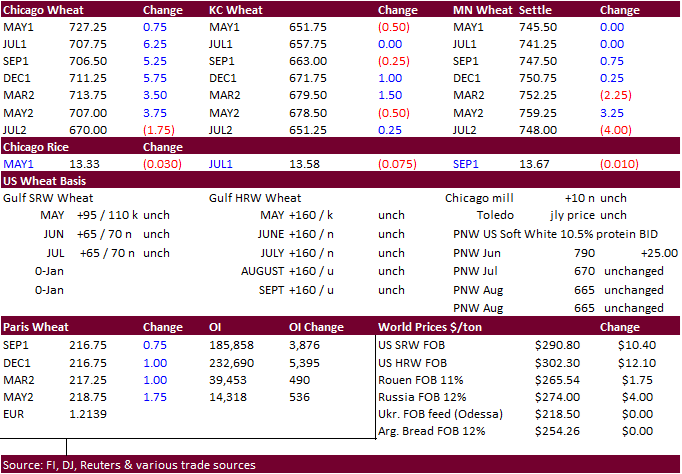

- US

wheat futures started higher on fund buying and some concern over hot temperatures projected over the next 2 weeks across parts of the Black Sea growing areas that are already experiencing some drought conditions. After corn sold off hard, that put pressure

on EU and US wheat prices, with July Chicago wheat ending 5.75 cents higher, July KC unchanged and July MN 0.25 cent lower. The Great Plains are expected to see rain through early next week.

- For

the week, KC July fell more than 10.5 percent.

- Funds

bought an estimated net 3,000 soft red winter wheat contracts. - September

Paris wheat market basis September was up 1.50 euro at $218.00. - French

wheat conditions for the week ended May 10 at 79% good or excellent condition, unchanged from the previous week, according to FranceAgriMer, up from 55% year ago. The winter barley and durum wheat were also unchanged on the week, at 76% and 69% respectively.

Spring barley conditions improved to 85% from 82%. - FranceAgriMer

reported the French corn planting progress at 95% complete as of May 10, up from 89% the previous week and 88% a year ago.

Export

Developments.

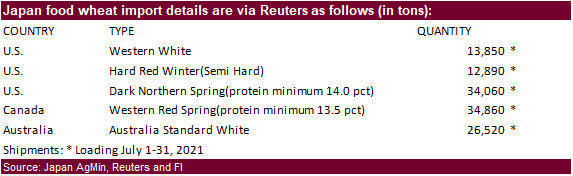

- Japan

bought 122,180 tons of food wheat from the US, Canada, and Australia this week. Original details as follows:

- Results

awaited: Taiwan Flour Millers’ Association seeks 89,425 tons US milling wheat on May 13. One consignment of 42,505 tons is sought for shipment between July 2 and July 16. A second consignment of 46,920 tons is sought for shipment between July 19 and Aug.

2. - Japan

seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on May 19 for arrival by October 28.

Rice/Other

·

Results awaited:

South

Korea’s Agro-Fisheries & Food Trade Corp seeks 134,994 tons of rice from Vietnam, China, the United States and Australia, on May 13, for arrival between September 2021 and January 2022.

Updated

5/14/21

July

Chicago wheat is seen in a $6.60-$8.00 range (down 20, unchanged)

July

KC wheat is seen in a $6.20-$7.25 (down 40, down 25)

July

MN wheat is seen in a $7.25-$8.25

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.