PDF Attached include US cash crush, World STU, and USDA snapshot

USDA’s

report triggered a negative reaction for feedgrains and supportive for oilseeds. Brazil’s Conab reported a higher than expected 2020-21 corn production estimate. China, in their monthly S&D update, estimated new-crop (2021-22) imports for soybeans at 102

million tons (+2 YOY) and corn at 20 million tons (-2MMT YOY).

![]()

Inflation

gage:

US

CPI (Y/Y) Apr: 4.2% (est 3.6%; prev 2.6%)

US

CPI (M/M) Apr: 0.8% (est 0.2%; prev 0.6%)

US

Real Avg Weekly Earnings (Y/Y) Apr: -1.4% (prev 3.9%US CPI Ex Food, Energy (Y/Y) Apr: 3.0% (est 2.3%; prev 1.6%)

US

CPI Ex Food, Energy (M/M) Apr: 0.9% (est 0.3%; prev 0.3%)

-livesquawk

WASHINGTON,

May 12, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 100,000 metric tons of corn for delivery to Mexico. Of the total, 30,000 metric tons is for delivery during the 2020/2021 marketing year and 70,000 metric tons is

for delivery during the 2021/2022 marketing year.

USDA

released their May supply and demand outlook

Reaction:

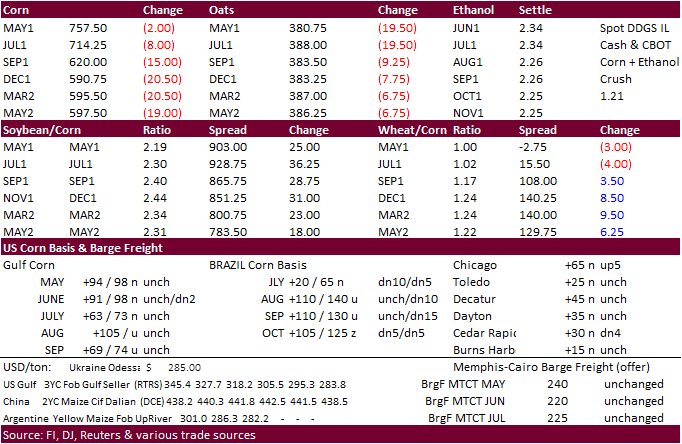

Neutral

to bearish feedgrains, at least for new crop, and neutral to friendly for soybeans. Bottom line is if the US realizes larger soybean and corn plantings when NASS updates the area at the end of June, look for USDA to increase selected demand categories for

those US balance sheets in July. Therefore, we expect new-crop corn and soybean prices to remain above $5 and $12, respectively, through the summer growing season, unless US crop conditions suggest yields well above trend. Old crop prices should continue

to be underpinned on tight global stocks.

USDA

OCE Secretary Briefing

https://www.usda.gov/sites/default/files/documents/may-2021-wasde-lockup-briefing.pdf

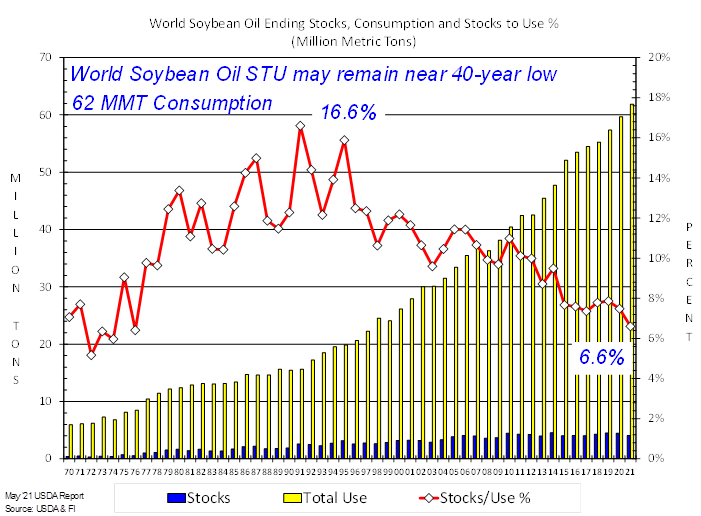

We

remain bullish the soybean complex based on strong global crush demand and China import demand. One figure that stood out was new-crop China corn imports projected at 26 million tons, same as the current crop-year. Note the USDA Attaché put corn imports below

the current year in anticipation of a larger 2021 China corn production.

USDA’s

data dump didn’t really have any other eye-catching surprises, but there were a few notable items that caught the trade off guard. Old and new crop US wheat ending stocks came in 26 and 44 million bushels above expectations, respectively. Old crop US corn

ending stocks were a little tighter than expected but new-crop was reported 163 million bushels above expectations at 1.507 billion, a level that would be “comfortable.” US soybean old and new-crop stocks were reported near expectations.

Looking

new-crop (2021-22) global stocks, USDA looks for the world corn carryout to increase 3.1% from 2020-21, wheat to be near unchanged, and soybeans to increase 5.3% from the current crop-year. As expected, USDA reported very large new-crop South American corn

and soybean production estimates. USDA cut Brazil’s 2020-21 corn production by 7 million tons to 102 million. We are near 98 million tons. For new crop they see Brazil corn production rising to 118 million tons, and that could put a dent in US exports.

USDA looks for new-crop Argentina corn output to increase 4 million tons from this year. China corn production for 2021-22 is expected to increase 7.3 million tons to 268 million but as mentioned above imports are expected to remain strong. USDA looks for

China domestic corn use to increase a modest 5 million tons. We think this is light given their initiative to expand animal unit production and use more corn for ethanol use. For soybeans, USDA sees new-crop Brazil production increasing 5.9% or 8 million

tons to a record 144 million tons, and for Argentina new-crop output to increase 10.6% to 52 million tons. We think if the US export campaign falls short of expectations for 2021-22, much of the balance of what is not exported could be used by crushers as

renewable fuel demand increase. Brazil 2021-22 soybean exports were projected at 93 million tons, up 7 million tons from 2020-21, a good reason to justify for a contraction in new-crop US exports from the current year.

USDA

increased its US hard winter and hard spring ending stocks by 12 million bushels each, increased soft red winter by 8, and lowered white and durum stocks by 11 and 1 million, respectively. USDA looks for new-crop feed wheat to increase 70 million bushels

to 170 million from the current crop year. I think some of the trade was penciling in higher wheat for feed for the current marketing year due to the rise in corn prices but remember most of the wheat that is used for feed occurs during the summer quarter.

US wheat ending stocks, along with the global carryout, is seen comfortable.

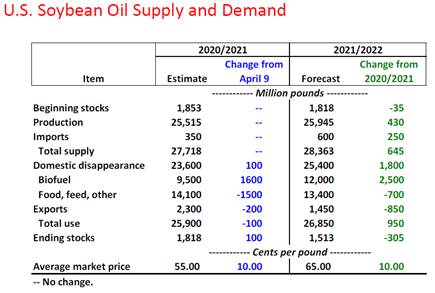

USDA’s

US soybean oil biofuel category indicates strong demand for soybean oil, in part to the emerging renewable biodiesel industry.

World

Weather, Inc.

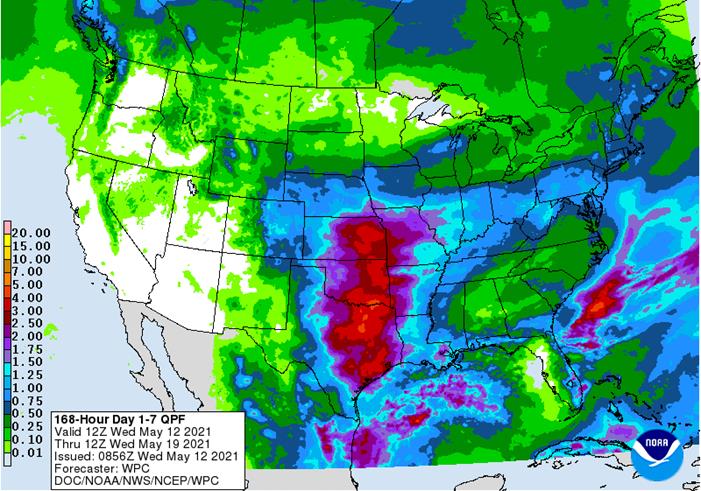

MOST

IMPORTANT WEATHER IN THE WORLD

- Safrinha

corn in Parana received rain overnight with nearly 65% of the production region in the state reporting 0.30 to 1.10 inches which was about as expected - The

moisture will improve short term crop development - Other

Safrinha corn areas were left dry and will not be impacted by this weather system - Some

follow up showers will be possible late this week coming out of Paraguay and passing through southern Mato Grosso do Sul to Sao Paulo and Parana, but rainfall will be less than 0.25 inch

- Today’s

GFS model runs have been suggesting much improved rainfall potential for Mato Grosso do Sul, Parana, Paraguay and immediate neighboring areas after May 21 - Some

of the rain advertised was quite impressive varying in the 2.00- to 4.00-inch range - This

event is much too far out in the forecast period to have confidence and a close watch on future model runs is warranted - For

now, the advertised precipitation seems to be much too great, but some rain in that period of time cannot be ruled out - Argentina’s

weather still looks favorable for crop maturation and harvest progress, although some rain may evolve briefly next week - U.S.

Northern Plains and Canada’s Prairies will continue fighting dryness over the next seven days with only sporadic showers of limited significance expected and seasonable temperatures - U.S.

Northern Plains and Canada rain prospects may improve in the May 20-26 period, although confidence is still low, despite some rising potential for rain in at least some of the drier biased areas - Frequent

rain in the central and southern U.S. Plains, lower Midwest and Delta will keep those areas favorably wet with some areas eventually getting to be a little too wet as time moves along - West

Texas rain potentials are still looking very good next week, but the High Plains may continue to struggle for the greatest rainfall - Some

showers will occur prior to that period of time, but they will be more erratic and light - Cotton,

corn, rice, soybean and sorghum areas of central and southern Texas will benefit from rain during the next ten days - U.S.

Pacific Northwest will continue to deal with dryness during this first week of the outlook and then a part of the region will have opportunity for showers in the May 20-26 period - U.S.

southwestern states and western Mexico will continue drought stricken for an extended period of time - Wet

weather is expected to return to western parts of Russia later this week and into next week after a short term break from rainy weather

- Eastern

Russia New Lands and Kazakhstan spring wheat areas are drying down and will need s some greater rain soon - Southwestern

portions of the region will be driest; including the southern Ural Mountains region, the lower Volga River Basin and areas east into north-central Kazakhstan - China

rainfall in the Yangtze River Basin will become excessive in the coming week to ten days resulting in some flooding

- The

rain is spread out over multiple days and flooding should not be nearly as serious as that of last year - Some

excessive rain has already been reported in random locations in the interior southern parts of China over the past several days - Portions

of China’s North China Plain and Yellow River Basin will receive some needed rain Thursday into Saturday easing dryness that has evolved recently and restoring favorable crop and field conditions in both winter and spring production areas - Hebei,

Liaoning and Shandong will not receive nearly as much rain as other areas and will have a growing need for precipitation during the balance of this month - Shanxi,

Henan and a few neighboring areas will be wettest - Northeastern

China will continue to experience periodic rainfall that will keep spring planting moving along a little sluggishly for a while - Xinjiang

China’s cotton areas will trend cooler and wetter over the balance of this week

- Daily

rainfall will vary from 0.05 to 0.60 inch with a few totals over 1.00 inch, although the greater rainfall will be rare - Temperatures

will cool to the upper 50s and 60s in the northeast followed by lows in the middle and upper 30s into the 40s - Cooling

in the southwest will force high temperatures to the 70s and lows into the 40s after being in the 80s and lower 90s recently - Crop

development and additional planting are occurring favorably. Rain will disrupt some farming operations this week, but fieldwork will occur around the precipitation and the long term benefits of rain will outweigh the disruption to farming activity.

- Mexico

drought remains quite serious, but there is some rain and thunderstorms advertised for southern and eastern parts of the nation during the next two weeks - The

precipitation will begin erratically and then increase over time this week and then decrease again next week - Water

supply is quite low and winter crops in a few areas have not performed well - The

moisture will help improve planting, emergence and establishment conditions for most summer crops in the wetter areas, but the west-central and northwest parts of the nation will continue quite dry.

- Europe

will receive waves of rain this week bolstering soil moisture for many areas including France, Italy, Germany and the U.K. which have been driest - Temperatures

will be near to below average for a while with the west and southeast coldest relative to normal while northeastern Europe is warmest - Some

flooding is possible in the Alps this week and some immediate neighboring crop areas

- Spain

will be driest along with parts of Portugal - Australia

precipitation will be restricted over the coming week to nearly ten days - Temperatures

will be close to normal - Weekend

precipitation was erratic and mostly quite light failing to change soil moisture in a significant manner - The

GFS suggests some rain will fall in Western Australia during the May 20-26 period, but confidence is low on the timing and amounts - The

bottom line supports aggressive planting in Western Australia where significant rain fell last week, but most other areas will wait on significant rain to bolster soil moisture for improved autumn planting and germination conditions in unirrigated areas

- South

Africa will not receive much rain in the coming two weeks favoring summer crop maturation and harvest progress - Winter

crop planting is under way and additional rain would be welcome for that purpose - Temperatures

will be warmer than usual - India

winter crop harvesting has advanced well in the dry areas, but some rain has hindered fieldwork in a few areas - Scattered

showers will occur this week in far northern, southern and extreme eastern India resulting in near to above average amounts of rain - The

moisture coming could disrupt farming activity from time to time, but the greatest rain will be in West Bengal into the far Eastern States and in and small part of southwestern India leaving most other areas to experience a mostly favorable environment for

crops. - No

tropical cyclones are present in the western tropical Pacific Ocean - A

tropical disturbance will evolve in the eastern Arabian Sea Thursday and Friday before moving parallel to the west coast of India for a few days during the weekend and early part of next week - Some

forecast models take the storm into Pakistan next week, but confidence in this is low - Southern

Oscillation Index is mostly neutral at +3.18 and the index is expected to move erratically this week - North

Africa rainfall is expected to be minimal over the next ten days - Temperatures

will be warmer than usual - Winter

small grains will be rushed toward maturation faster than usual without much moisture - West-central

Africa will see an erratic mix of rain and sunshine this week. - Temperatures

will be near to above average and rainfall will be below average - A

boost in precipitation will be needed later this month to ensure soil moisture stays as good as possible and crop development continues normally - East-central

Africa rainfall has been erratic in recent weeks and a boost in rainfall is under way in Kenya, Ethiopia and northern Tanzania during the coming week - Southeast

Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks - However,

the mainland areas are reporting below to well below average rainfall recently and a boost in rain is needed in Vietnam’s Central Highlands and neighboring areas

- Greater

rain is also needed in the northern and western Philippines - Sulawesi

also needs a boost in rainfall - Most

of these areas will see improving rainfall May 20-26 with scattered showers and thunderstorms until then

- Luzon

Island, Philippines will be last to get significant rain - New

Zealand precipitation for the next week to ten days will be frequent across North Island and in western portions of South Island

- Temperatures

will trend cooler with the increasing rainfall

Source:

World Weather, Inc.

Wednesday,

May 12:

- China

farm ministry’s CASDE outlook report - FranceAgriMer

monthly grains report - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - EIA

weekly U.S. ethanol inventories, production - Conab’s

data on yield, area and output of corn and soybeans in Brazil - Brazil’s

Unica data on cane crush and sugar output (tentative)

Thursday,

May 13:

- New

Zealand April food prices, 10:45am local - Port

of Rouen data on French grain exports - USDA

net-export sales for corn, soy, wheat, cotton, pork, beef, 8:30am - HOLIDAY:

Indonesia, Malaysia, Singapore, India, Dubai, France, Germany

Friday,

May 14:

- ICE

Futures Europe weekly commitments of traders report, 6:30pm London - FranceAgriMer

weekly update on crop conditions - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Indonesia, Malaysia, Dubai

Source:

Bloomberg and FI

Macro

US

DoE Crude Oil Inventories (W/W) 07-May: -426K (est -2100K; prev -7990KJ)

–

Distillate Inventories (W/W): -1734K (est -1500K; prev -2896K)

–

Cushing Crude Inventories (W/W): -421K (prev 254K)

–

Gasoline Inventories (W/W): 378K (est 0K; prev 737K)

–

Refinery Utilization (W/W): -0.40% (est 0.40%; prev 1.10%)

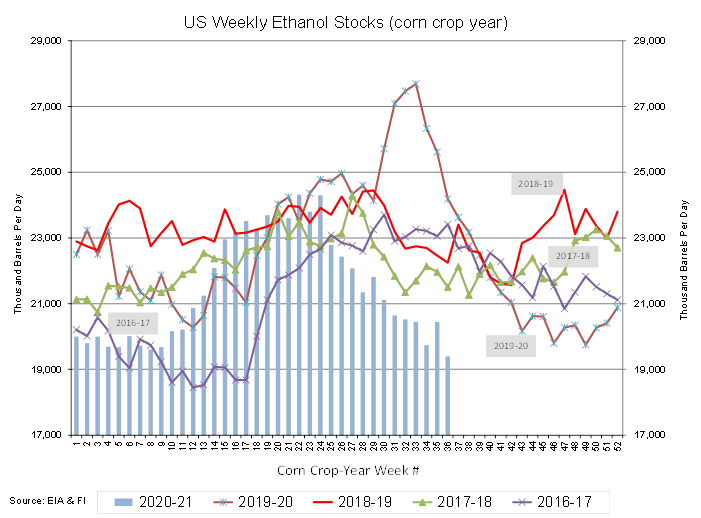

- CBOT

corn started the day session higher in the front months and lower in the back positions and turned lower after USDA reported the new-crop US carryout well above trade expectations (1.5 billion vs. 1.26 expected). Prior to the USDA report, support was partially

derived from friendly weekly ethanol data. Bull spreading was in focus as Brazil’s crop continues to shrink. July corn ended 7.50 cents lower and December new-crop 18.25 cents lower. Adding to the late bearish sentiment was the announcement that the US

Coast Guard closed a section of the Mississippi River near Memphis, to all vessel traffic, due to a crack in a road/bridge. Earlier today there were 16 vessels with a total of 229 barges affected.

- Funds

sold an estimated net 32,000 corn contracts. - USDA

lowered Brazil’s 2020-21 corn production by 7MMT to 102 million tons, and traders expect USDA to lower that projection again next month.

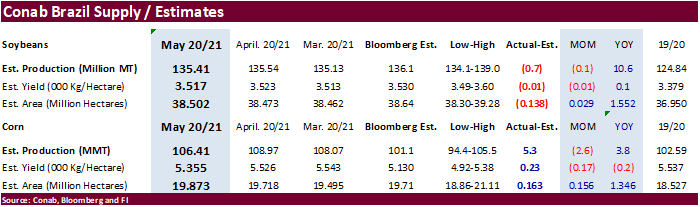

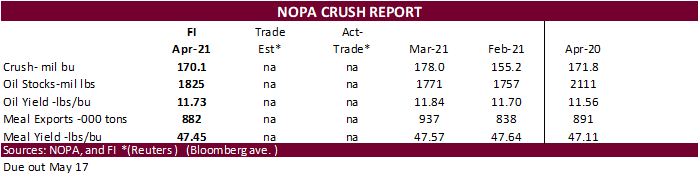

- Brazil’s

Conab reported a higher than expected 2020-21 corn production estimate (see table above). Conab’s 106MMT+ corn estimate was ignored by the trade as many analysts are below 100 million tons. Note Brazil does have a third corn crop, but production is very

small.

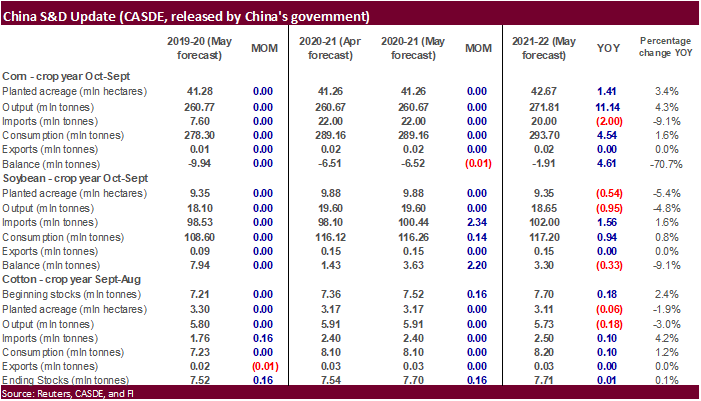

- China,

in their monthly S&D update, estimated new-crop (2021-22) imports for soybeans at 102 million tons (+2 YOY) and corn at 20 million tons (-2MMT YOY).

- The

USD was up about 62 points as of 3:30 pm CT. - Argentina

producer selling for corn is running at 26.3 million tons, 3.4 million tons above the same period a year ago. Concerns the government could soon increase export taxes on grains has left producers scrambling to sell their crop.

- USDA

in its weekly Broiler Report showed eggs set up 7 percent from a year ago and chicks placed up 14 percent. Cumulative placements from the week ending January 9, 2021 through May 8, 2021 for the United States were 3.36 billion. Cumulative placements were

up slightly from the same period a year earlier.

Export

developments.

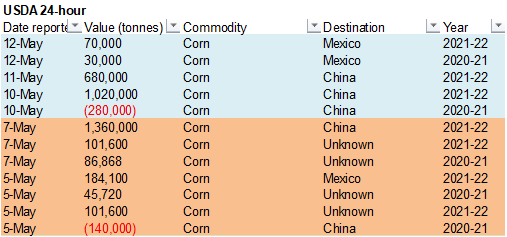

- Under

the 24-hour announcement system, private exporters sold 100,000 tons of corn to Mexico. Of the total, 30,000 metric tons is for delivery during the 2020/2021 marketing year and 70,000 metric tons is for delivery during the 2021/2022 marketing year.

Updated

5/7/21

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.75-$7.00 range.

The

US needs to see a massive crop to pull new-crop futures below $4.00, which could happen for 2022 contracts if the export campaign for Q1 (SON) does not end up a record. Keep an eye on new-crop corn commitments this summer.

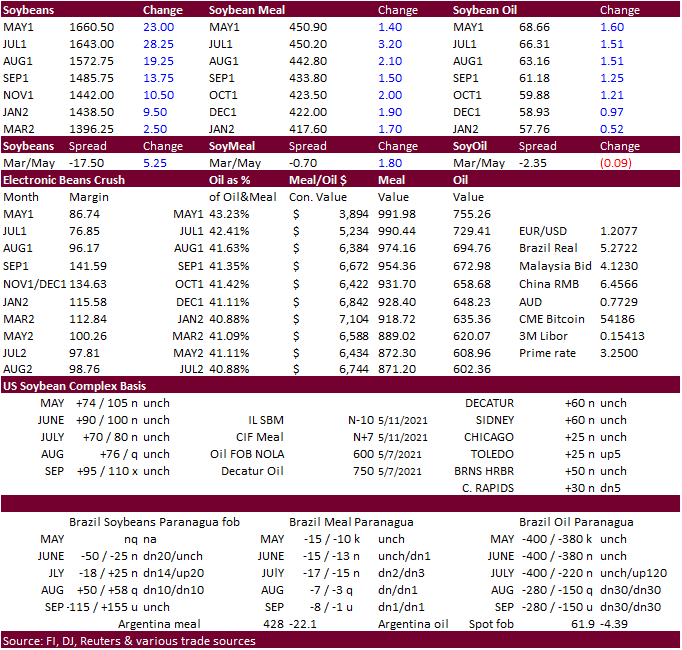

- CBOT

soybeans traded sharply higher, to a fresh 12-year high, on fund buying prior to the USDA report but gains were trimmed after new crop corn and wheat turned lower. Traders were bull spreading soybeans, similar to what they did in corn. Tight US ending stocks

projected for 2021-22 of 140 million bushels countered a bearish South American production outlook. 2020-21 current year stocks were estimated at 120 million bushels. July soybean futures were up 27.75 cents, July meal $1.80 higher and July soybean oil 160

higher. Soybean oil is expected to remain firm this summer as rationing of soybeans takes place, tightening soybean oil supplies that are heavily sought after by biofuel end users.

- Funds

bought an estimated net 10,000 soybeans, 5,000 soybean meal and 7,000 soybean oil.

- US

soybean meal basis eased about $1.00 for selected IN and IL locations. - Ukraine

sunflower oil exports were running at 3.914 million tons in the first seven months of the 2020-21 season. Another 1.5 million tons could be exported by the end of the crop year according to the sunoil producers association.

- Brazil

port workers delayed their planned strike this week over COVID-19 vaccination priority concerns. - Conab

pegged the Brazil soybean crop at 135.4 million tons, down from 135.54 million previously.

- India

April palm oil imports were up 82% from a year earlier to 701,795 tons.

Argentina

producer selling for soybeans were 886,100 tons last week, lifting the total for the season to 17.3 million tons, according to the AgMin. Sales are below the previous season which was running at 21.4 million tons this time last year. The Rosario grains exchange

expects production to end up around 45 million tons, down from 50.7 million tons a year ago.

- On

May 18 USDA seeks a total of 4,770 tons of packaged oil for use in Title II, PL480 and the McGovern-Dole Food for Education export programs. Shipment was set for June 16-July 15 (July 1-31 for plants at ports). - Yesterday

Egypt’s GASC bought 29,000 tons of domestic soyoil and 10,000 tons of international sunflower oil for arrival July 11-31 at $1,590 a ton for payment at sight. The following for domestic soybean oil:

12,000

tons of soyoil at 21,200 EGP/mt (eqv $1,348.60)

10,000

tons of soyoil at 21,200 EGP/mt (eqv $1,348.60)

4,000

tons of soyoil at 21,200 EGP/mt (eqv $1,348.60)

3,000

tons of soyoil at 21,200 EGP/mt (eqv $1,348.60)

Updated

5/11/21

July

soybeans are seen in a $14.75-$16.50; November $12.75-$15.00

Soybean

meal – July $400-$460; December $380-$460

Soybean

oil – July 60-68; December 48-60 cent range

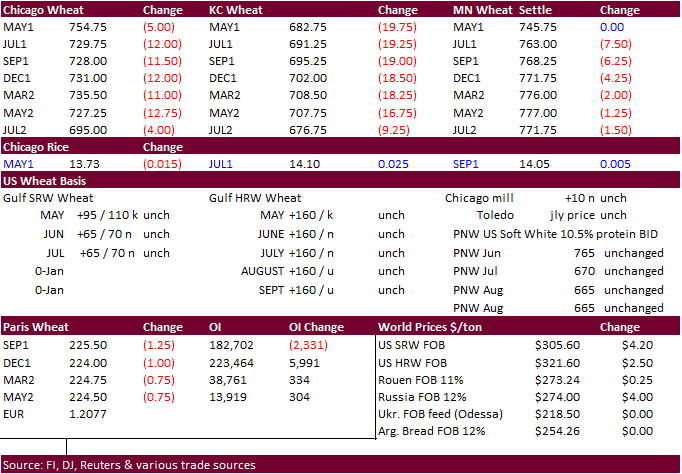

- Most

US wheat futures traded lower ahead and post USDA report. Larger than expected US stocks added to the negative undertone set earlier by technical selling. Spillover weakness from corn also pressured wheat late. July Chicago was down 12 cents, July KC off

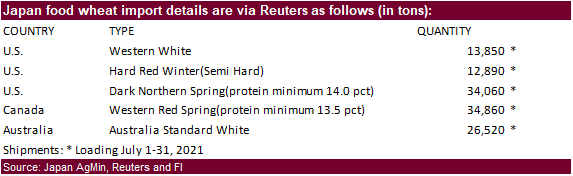

19.75 cents and July MN down 5.0 cents. USDA projected U.S. 2021/22 wheat ending stocks at 774 million bushels, above expectations. USDA also projected a record 2021-22 global wheat production. Japan seeks 80,000 tons of feed wheat and 100,000 tons of feed

barley. - Funds

sold an estimated net 9,000 soft wheat contracts. - Japan

sees an 80% chance of La Nina ending this spring. - September

Paris wheat was down 1.25 euros to 225.50. - Ukrainian

grain exports fell 24.1% to 39.6 million tons so far this season. They included 15.3 million tons of wheat, 19.6 million tons of corn and 4.13 million tons of barley. - FranceAgriMer

lowered its forecast of French soft wheat stocks for 2020-21 to 2.6 million tons from 2.7 million last month, 13 percent below 2019-20.

Export

Developments.

- Japan

seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on May 19 for arrival by October 28.

- Japan

seeks 122,180 tons of food wheat from the US, Canada, and Australia this week.

- Taiwan

Flour Millers’ Association seeks 89,425 tons US milling wheat on May 13. One consignment of 42,505 tons is sought for shipment between July 2 and July 16. A second consignment of 46,920 tons is sought for shipment between July 19 and Aug. 2.

Rice/Other

·

South Korea’s Agro-Fisheries & Food Trade Corp seeks 134,994 tons of rice from Vietnam, China, the United States and Australia, on May 13, for arrival between September 2021 and January 2022.

Updated

5/10/21

July

Chicago wheat is seen in a $6.75-$8.00 range

July

KC wheat is seen in a $6.60-$7.50

July

MN wheat is seen in a $7.25-$8.25

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.