PDF Attached

Under

the 24-hour reporting system, USDA reported private exporters sold 132,000 tons of soybeans for delivery to unknown destinations during the 2023-24 marketing year. Officials have not reached an agreement over the Black Sea grain export deal, but some are

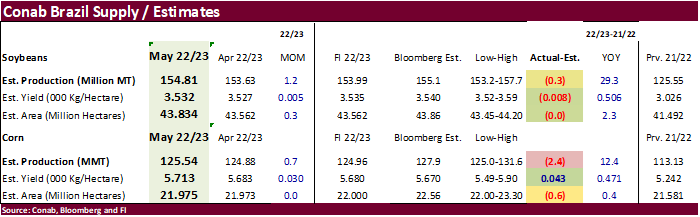

optimistic a two-month extension will be reached. Negotiations will continue tomorrow. Brazil Conab raised their production estimates for soybeans and corn, although both below expectations. Soybeans gave back most of their gains headed into the close (old

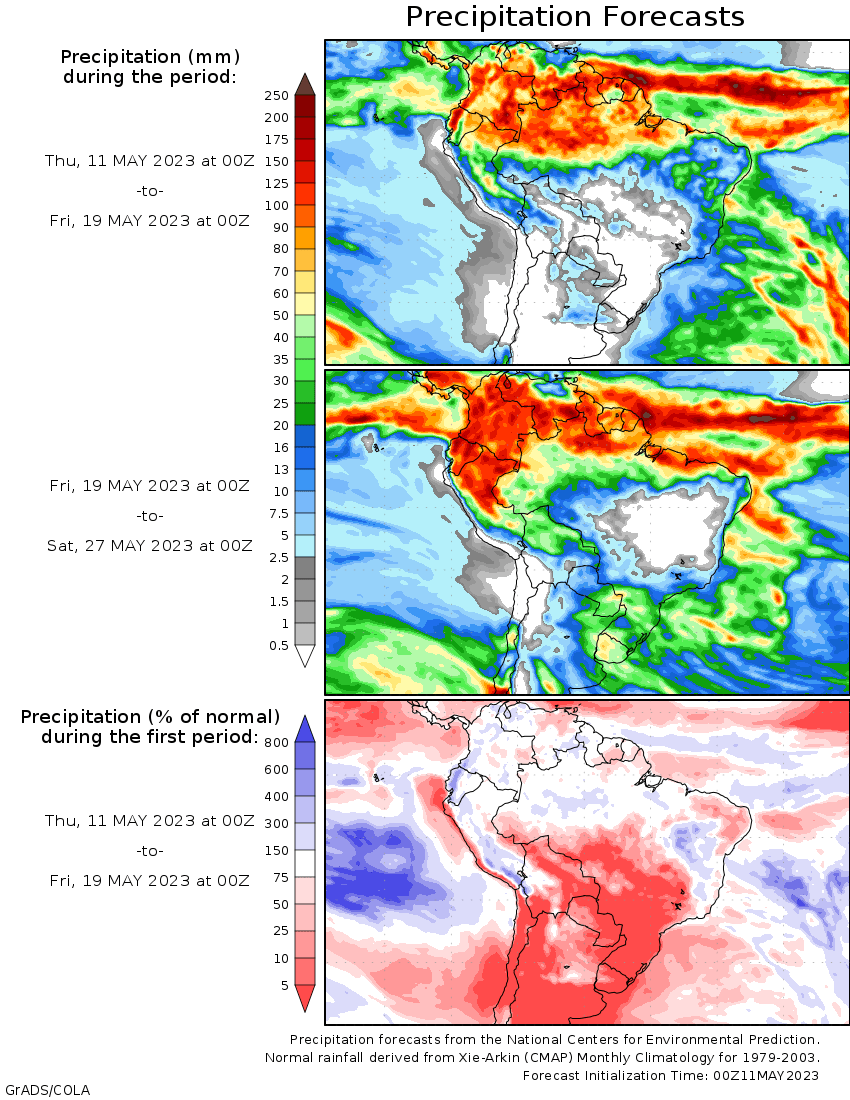

crop higher and new-crop lower). Soybean meal held while soybean oil fell on product spreading. Grains fell on favorable North American weather and prospects for large 2023-24 supplies. Rain will fall across West Texas through the weekend, improving topsoil

moisture but don’t discount local flooding. The northern US Plains will trend wetter through the weekend. The central US Great Plains will see net drying to some light rain. Weather is favorable for much of the Midwest, but a couple light frost events may

occur bias north over the next week. Brazil will remain dry over the next 10-14 days. Europe will experience heavy rain and flooding during the coming week from Italy into the eastern Adriatic Sea region.

Fund

estimates as of May 11

![]()

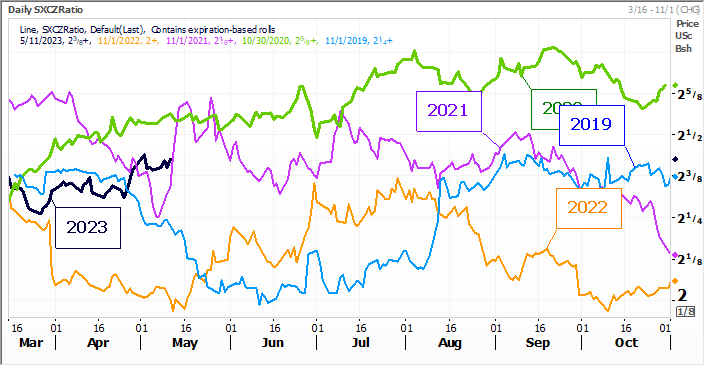

November

soybeans/December corn

The

US CPC sees a 90 percent change for El Nino persisting into winter after a neutral transition overt the next couple of months.

https://www.cpc.ncep.noaa.gov/products/analysis_monitoring/enso_advisory/index.shtml

WEATHER

TO WATCH

-

Beneficial

rain was received in northwestern Kansas, east-central Colorado and southwestern Nebraska late Wednesday into this morning with several areas getting more than 1.00 inch and a few in northwestern Kansas getting more than 2.00 inches -

U.S.

hard red winter wheat areas will receive waves of rain during the coming week, through portions of Kansas may not get enough to counter evaporation resulting in more crop stress later this month -

The

greatest rain is expected from northeastern Colorado and northwestern Kansas into southwestern Nebraska where enough will fall to saturate the topsoil and possibly induce localized areas of brief flooding -

The

ground is so dry, though, any flooding would dissipate quickly -

Rain

could become heavy in a part of the Texas Panhandle, and it may fall a little late in the season for wheat, but it will be perfect for corn, sorghum and cotton planting -

Central

and West Texas will be significant in this coming week -

Flooding

rain is expected in south-central parts of the state where multiple inches of rain are expected some of which will occur over a short period of time causing flood conditions -

West

Texas rainfall will vary from 0.50 to 1.50 inches near the New Mexico border and 1.00 to 2.00 inches in the Low Plains with 2.00 to 3.00 inches and possibly more in the Rolling Plains and a part of the southeastern Texas Panhandle -

Western

North Dakota, much of South Dakota and eastern Montana will benefit greatly from the general rain event expected tonight into the weekend -

Rain

totals of 1.00 to 3.00 inches will improve soil moisture for better planting, germination and emergence, though there will be some planting delay because of the moisture -

Eastern

North Dakota and Minnesota will get 0.50 to 1.50 inches except in southern Minnesota where 1.00 to 2.50 inches will result -

This

moisture will add to the planting delays that have already been present in recent weeks -

Lower

and eastern U.S. Midwest will continue to see lighter than usual rain, but soil moisture is nearly ideal and crop progress will continue to advance around the precipitation -

U.S.

southeastern states will experience a good mix of rain and sunshine with fieldwork accelerating as the rain frequency continues less than that of earlier this season -

U.S.

Delta will continue plenty moist over the next two weeks -

California

precipitation will be restricted for a while -

Central

Washington is quite dry and would benefit from some rain. In the meantime, temperatures will be quite warm to hot this weekend into next week add some heat stress to the drier bias in the region -

Southeastern

Canada’s Prairies will receive some significant rain tonight into Sunday with 1.00 to 3.00 inches from southeastern most Saskatchewan into southern Manitoba -

Field

working delays are likely for a little while after the rain ends -

Western

Saskatchewan and eastern Alberta will continue dry for at least another week and temperatures will rise well above normal once again especially late this weekend into early next week -

Concern

over crop emergence and establishment will continue until significant rain falls; there is some potential for crop failure in those areas where the crop germinates and emerges without significant rain and with minimal subsoil moisture -

Ontario

and Quebec, Canada weather should be mostly good over the next ten days with a mix of rain and sunshine and mostly seasonable temperatures

-

South-central

Europe will experience frequent rain and some flooding during the coming week from Italy into the eastern Adriatic Sea region where some damage to crops and property may result -

Some

replanting of spring and summer crops may be needed in a few areas, but it should not be widespread -

Northeastern

Algeria and northern Tunisia will receive periodic rain into Monday -

The

moisture boost will continue helpful for the latest maturing crops, but much of the precipitation will fall a little too late in the season for big changes in production -

No

relief is expected to the drought stricken areas of Morocco or northwestern Algeria, although rain is advertised for those areas in the second week of the two-week outlook -

Eastern

parts of Thailand, Cambodia, Vietnam and Laos experienced some additional needed cooling and rainfall Wednesday after hot and dry conditions occurred last weekend -

Additional

rain is expected over the next several days offering more relief from the hottest and driest conditions -

Tropical

Cyclone Mocha evolved in the Bay of Bengal overnight -

Torrential

rain, strong wind and flooding will accompany the storm inland through northwestern Myanmar, southeastern Bangladesh where “some” damage to rice and sugarcane may result -

India

weather is expected to be mostly normal over the next ten days with a few pre-monsoonal showers and thunderstorms expected in the south and extreme east while most other areas are dry -

Indonesia/Malaysia

weather is still favorably wet through the next ten days -

Recent

rainfall was most significant in Indonesia and Malaysia while the Philippines dried down for a while -

This

trend may be perpetuated over the next couple of weeks -

Drought

in Yunnan, China will finally be eased into the weekend as moderate rain finally falls -

Rice,

corn and sugarcane among other crops will benefit, though it has been dry enough for a long enough period of time for production to be hurt -

Additional

rain will be needed -

China’s

greatest rain over the next ten days will be near and south of the Yangtze River, including the southwest where 2.00 to 6.00 inches and locally more than 8.00 inches will result -

Some

flooding is expected -

Rapeseed

areas will see less frequent and less significant rain which may help stop the damage that has occurred recently from excessive rainfall and flooding -

Xinjiang,

China is slowly warming after an unusually cool conditions earlier this week and especially last weekend -

High

temperatures Wednesday were in the 70s in the bulk of cotton and corn areas, although there were some 60-degree Fahrenheit highs in the northeast -

Summer

crop conditions are not very good because of the cool start to the planting season; both cotton and corn need much warmer weather -

Xinjiang,

China temperatures will trend warmer during the balance of this week with temperatures returning to normal this weekend

-

Some

forecast models have suggested warmer than usual temperatures are possible this weekend into next week

-

Northwestern

Kazakhstan and neighboring southern areas of Russia’s eastern New Lands will get some rain the remainder of this week with 0.50 to nearly 1.50 inches possible in a few areas, but most of the precipitation will be lighter leaving some need for more moisture -

A

close watch on this region is warranted because of decreasing topsoil moisture recently and additional warm and dry biased weather that may eventually return later this month -

Other

western CIS crop areas are expected to benefit from alternating periods of rain and sunshine during the next week to ten days -

Some

net drying is expected in northwestern Russia, the Baltic States and northeastern Belarus -

Beneficial

rain is expected in the southern Ural Mountains region, northwestern Kazakhstan and immediate neighboring areas of Russia’s southern eastern New Lands over the next few days -

This

rain will restore favorable topsoil moisture conditions after recent drying -

Argentina

will experience limited rainfall and warmer biased weather for much of the coming week

-

Summer

crop maturation and harvesting will advance normally -

Rain

is possible late next week and into the following weekend -

Greater

precipitation is needed to improve wheat planting prospects -

Rio

Grande do Sul, Brazil will now experience some welcome drier biased weather for a while -

Recent

moisture was good for late season crops, but the state is plenty wet now and needs to dry down for a while -

Rain

should return at the end of next week or in the following weekend -

Rain

is expected in Bahia, northern Minas Gerais and Tocantins during balance of this week causing a disruption to farming activity; including the harvest of cotton, sugarcane and coffee -

Most

of the rain is not likely to be heavy and no damage will result -

West-central

Africa will continue to experience periodic rainfall over the next two weeks maintaining a mostly good environment for coffee, cocoa, rice and sugarcane -

Mali

and Burkina Faso rainfall will remain lighter than usual, although some welcome precipitation is expected that will raise topsoil moisture.

-

East-central

Africa rainfall will continue periodic and mostly in a beneficial manner to support rice, coffee, cocoa, sugarcane and other crops -

South

Africa will dry down for the next few days before the next wave of rain evolves Saturday through Tuesday of next week

-

The

rain will be good for winter wheat planting and establishment in the west, but it will slow summer crop maturation and harvest progress.

-

Australia

rainfall during the coming week will be greatest in winter crop areas near to the coast.

-

Moisture

totals will be light and a boost in rainfall will continue to be needed in interior Western Australia, interior South Australia and western New South Wales -

Greater

rain is needed in some interior crop areas -

Central

Asia cotton and other crop planting has advanced relatively well his year with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was -3.62 and it should move lower over the next several days

Source:

World Weather, INC.

Thursday,

May 11:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Brazil’s

Conab issues production, area and yield data for corn and soybeans - New

Zealand Food Prices - EARNINGS:

GrainCorp

Friday,

May 12:

- USDA’s

World Agricultural Supply and Demand Estimates (WASDE), 12pm eastern - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report

Source:

Bloomberg and FI

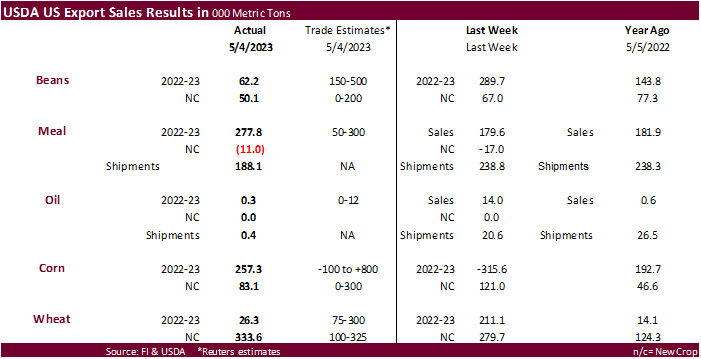

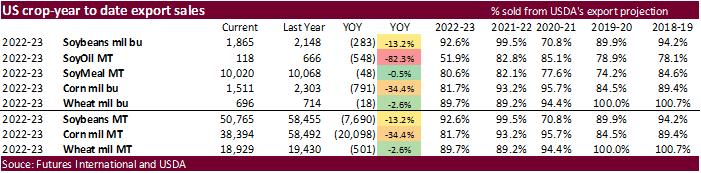

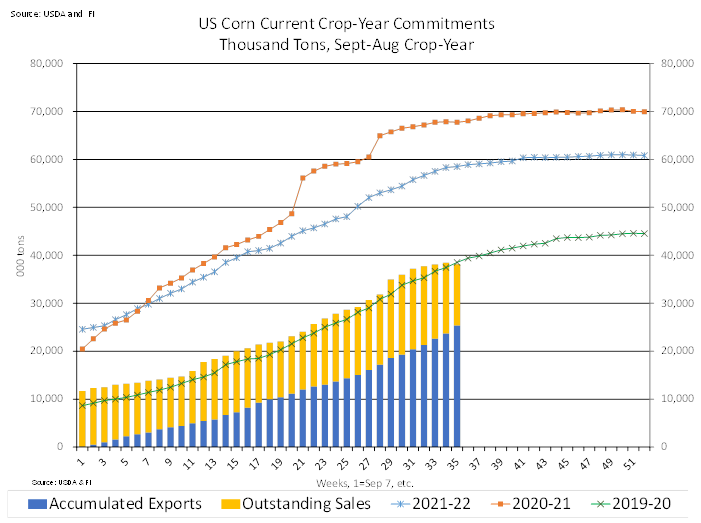

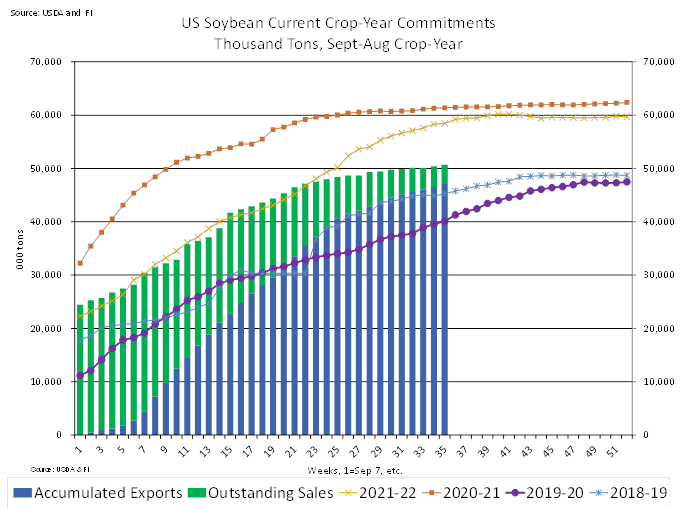

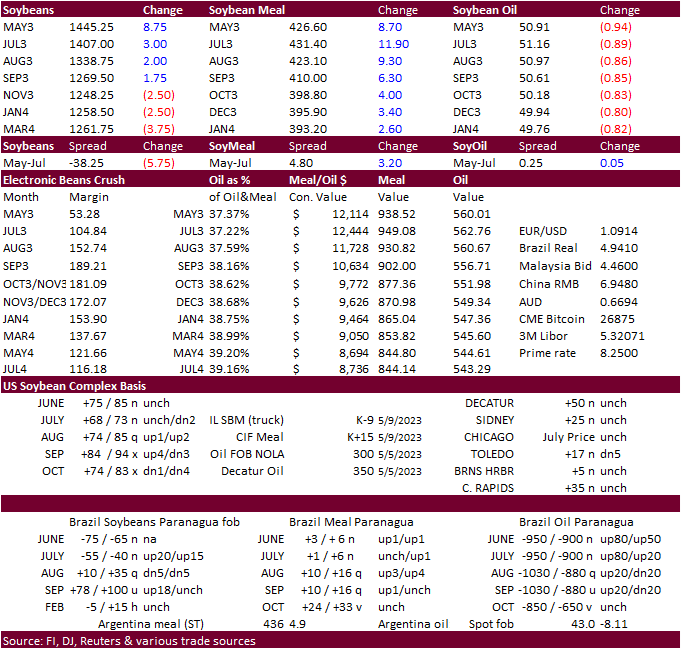

USDA

export sales were poor for soybeans, soybean oil and all-wheat. Soybean meal and corn export sales were within expectations. Soybean export sales for 2022-23 included net reductions for unknown destinations of 120,200 tons. Soybean meal export sales included

increases for Vietnam, Romania, and Canada, but also included net reductions for a few central American countries. Soybean oil sales were only 300 tons. Corn export sales for 2022-23 included net reductions for unknown destinations of 129,400 tons. All-wheat

sales were a marketing year low for 2022-23.

US

Initial Jobless Claims May 6: 264K (est 245K; prev 242K)

US

Continuing Claims Apr 29: 1813K (est 1820K; prev 1805K)

US

PPI Final Demand (M/M) Apr: 0.2% (est 0.3%; prev -0.5%)

US

PPI Ex Food And Energy (M/M) Apr: 0.2% (est 0.2%; prev -0.1%)

US

PPI Final Demand (Y/Y) Apr: 2.3% (est 2.5%; prev 2.7%)

US

PPI Ex Food And Energy (Y/Y) Apr: 3.2% (est 3.3%; prev 3.4%)

Bank

of England raised rates by 25 points.

·

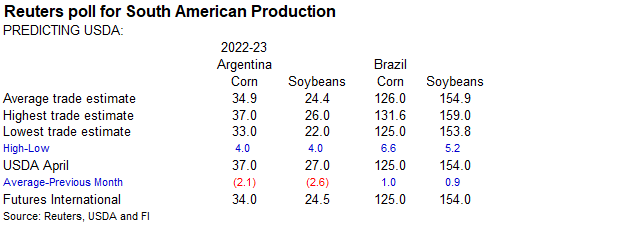

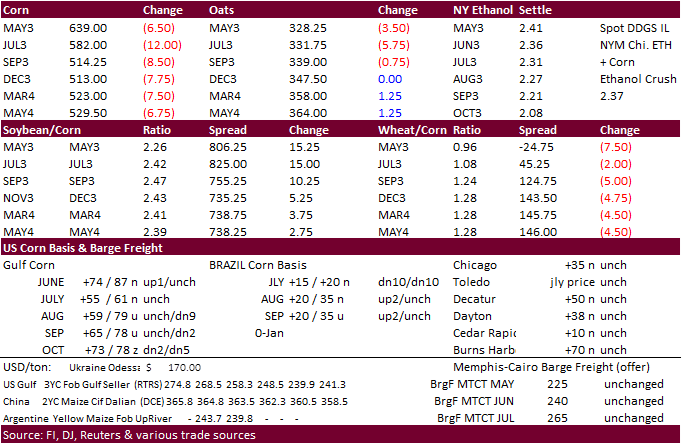

CBOT corn traded

lower a day ahead of the USDA report on favorable US weather and a lager Brazil corn crop projected by Conab. Conab increased their Brazilian crop production estimates (beans and corn), with all corn production at 125.54 million tons. USDA export sales were

poor relative for this time of year.

·

The Supreme Court upheld California’s Prop 12 Law that would restrict the sale of pork that is produced by breeding pigs that are kept in a space less than 24 square feet. Since California nearly relies on the rest of the country

for pork supplies, this could affect about three fourths of US pig producers. Since most of the meat sold is from a combination of several different producers, it will be hard to track the origin of the meat. Some estimate it may cost the industry up to $350

million, in turn driving up finished prices for the entire country.

·

The Rosario Grains exchange left its estimate of the Argentina corn crop unchanged at 32 million tons and compares to 51 million tons last season. About 21 percent of Argentina’s corn crop had been collected as of earlier this

week.

·

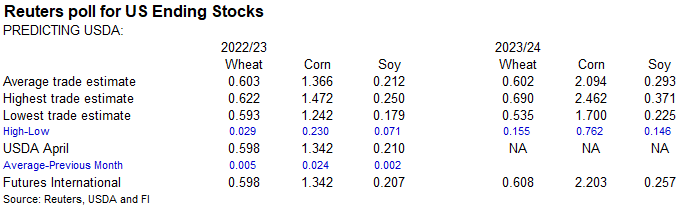

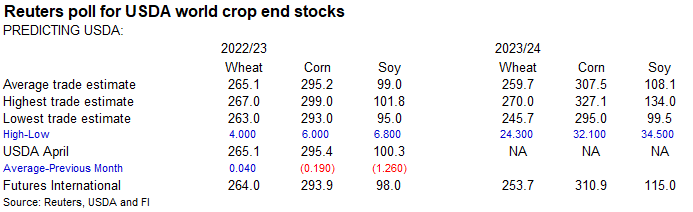

USDA could lower 2022-23 US corn exports on Friday by up to 50 million bushels. A Reuters trade average for 2022-23 corn stocks has a 25 million bushel reduction, on average.

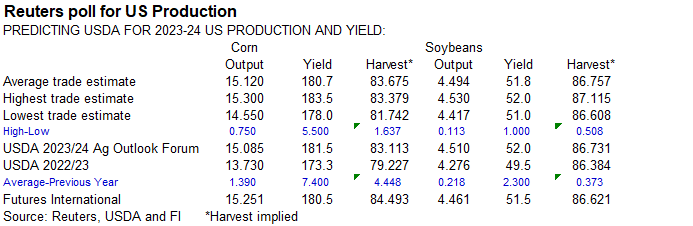

A

Reuters trade estimate for 2023 US corn production is 15.120 billion bushels, 1.390 billion above 2022-23. Global 2023-24 corn stocks are projected to be up 12.3 million tons from 2022-23 and soybeans could end up 9.0 million tons above last year.

·

The USDA Broiler Report showed eggs set in the US up slightly and chicks placed down 1 percent. Cumulative placements from the week ending January 7, 2023, through May 6, 2023, for the United States were 3.36 billion. Cumulative

placements were up slightly from the same period a year earlier.

Export

developments.

-

South

Korea’s MFG Group bought 133,000 tons of feed corn from South America. First consignment of 67,000 tons was bought at an estimated $264.27 a ton c&f for shipment from South America between Aug. 6 and Aug. 25. Second consignment of 66,000 tons was bought at

an estimated $265.49 a ton c&f with shipment from South America between Aug. 14 and Sept. 2.

-

South

Korea’s NOFI group passed on 69,000 tons of corn, optional origin, for arrival around October 10. Offers were above $264.27/ton c&f.

Updated

05/02/23

July

corn $5.00-$6.50

December

corn $4.75-$6.50

·

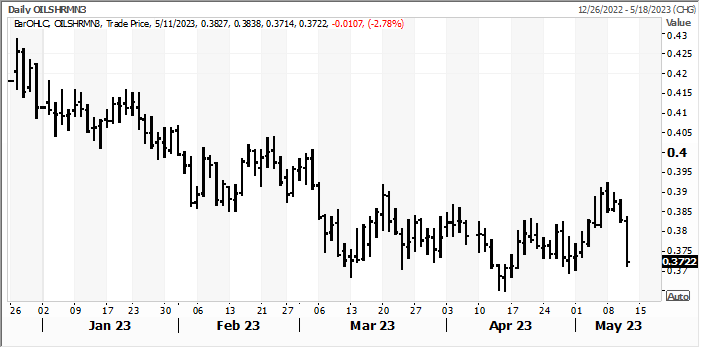

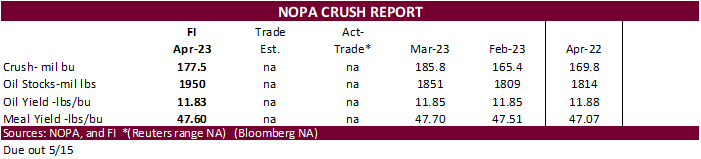

Good USDA export sales for soybean meal and poor sales for soybean oil triggered meal/oil spreading. Soybeans traded in a wide range, ending higher for old crop and lower new. Much of the gains in soybeans were given up near the

close. Soybeans were

lower early on good US weather and lower products but reversed for old crop following the bull spreads in meal. Both old and new crop soybeans gained on corn (also spreading). USDA soybean meal export sales are on trach to reach USDA’s 13.7 million short

ton estimate.

·

Conab increased their Brazilian crop production estimates, with soybeans at 154.81 million tons.

·

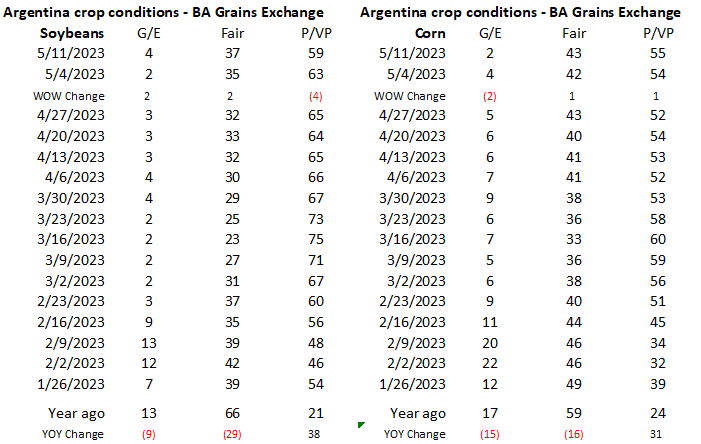

The Rosario Grains exchange lowered its estimate for 2022-23 Argentina soybean production by 6.5% to 21.5 million tons from 23 million tons previous (42.2MMT year earlier), citing frosts in February and drought conditions. Harvest

progress was reported at 54% of the projected 16 million hectares (39.5 million acres) planted.

·

Yesterday the Buenos Aires Grains Exchange warned the El Niño event will unlikely yield heavy rains across Argentina’s main growing areas the next planting season (beginning early September).

·

China’s National Food and Strategic Reserves Administration stated they plan to diversify (expand) origin points for importing soybeans. No details were provided.

·

A Reuters trade estimate for US 2023-24 soybean production is 4.494 billion, up 218 million from a year ago. World soybean stocks were projected at 108.1 million tons, up 9 million from USDA’s current 2022-23 estimate.

·

India will allow duty-free imports of soybean oil and sunflower oil, retroactive before March 31, until the end of June, after several cargoes were stuck at ports over the rule decision made earlier this year. Several importers

delayed offloading cargoes until they got clarification from the government if the vegetable oils qualified for the exemption that ended March 31. Other vegetable oils were already in transit.

University

of Illinois: The Biodiesel Profitability Squeeze

Gerveni,

M., T. Hubbs and S. Irwin. “The Biodiesel Profitability Squeeze.” farmdoc daily (13):85, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 10, 2023.

https://farmdocdaily.illinois.edu/2023/05/the-biodiesel-profitability-squeeze.html

July

Soybean oil share collapsed today

Export

Developments

-

Egypt’s

GASC bought 12,000 tons of soybean oil and 22,000 tons of sunflower oil. Lowest offer earlier for soybean oil was $1,075 per ton (30,000) and sunflower oil at $1,000 per ton (10,000), for June 25 through July 10 arrival. They are also in for local vegetable

oils. -

Under

the 24-hour reporting system, USDA reported private exporters sold 132,000 tons of soybeans for delivery to unknown destinations during the 2023-24 marketing year. -

South

Korea’s NOFI group bought an estimated 60,000 tons of soybean meal out of 120,000 tons sought. 45,000 tons bought at an estimated outright price of $518.50 a ton c&f and another 15,000 tons “at a premium over Chicago soymeal futures”. Arrival was set for around

September 15. The second consignment was set for arrival around Oct. 15 but there was no confirmation they purchased it.

-

USDA

seeks 120 tons of packaged vegetable oil for various export programs on May 16 for June 16-July 5 shipment.

Updated

05/05/23

Soybeans

– July $13.75-$15.25, November $12.00-$15.00

Soybean

meal – July $375-$475, December $325-$500

Soybean

oil – July 50-56,

December 48-58

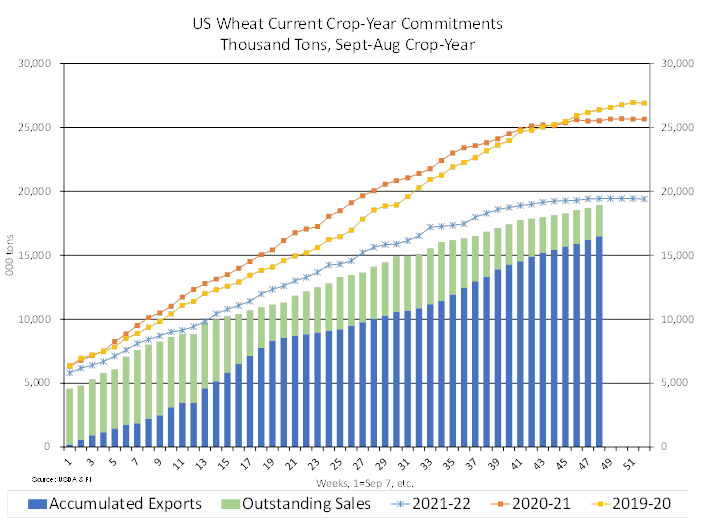

Wheat

·

Rain will fall across West Texas through the weekend, improving topsoil moisture but don’t discount local flooding. The northern US Plains will trend wetter through the weekend.

·

US wheat export sales were a marketing year low. Commitments stand at 695.5 million bushels, well below USDA’s 775 million bushel estimate, but that does not include wheat products. Adding up the recent inspections, we lowered

our crop year wheat export estimate to 765 million bushels from 778 million previous (USDA 775).

·

The Turkish defense ministry mentioned the negotiations over the Black Sea grain-deal have been so far constructive.

·

President Vladimir Putin could speak with Turkey’s President “at short notice if needed” regarding the extension of the Ukraine Black Sea grain deal, according to a Reuters story. Russia again stated it will not extend the deal

beyond May 18 unless a list of demands is met. Yesterday Turkey said they thought the deal will be extended at least for two months. Negotiations will continue today.

·

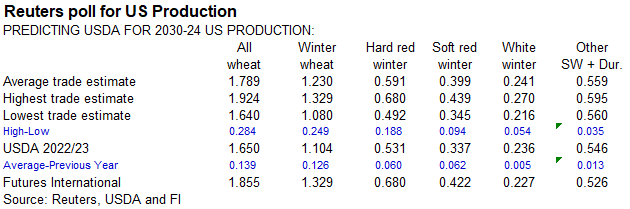

A Reuters trade estimate for 2023 US winter wheat production is 1.789 billion bushels, 139 million above 2022-23.

·

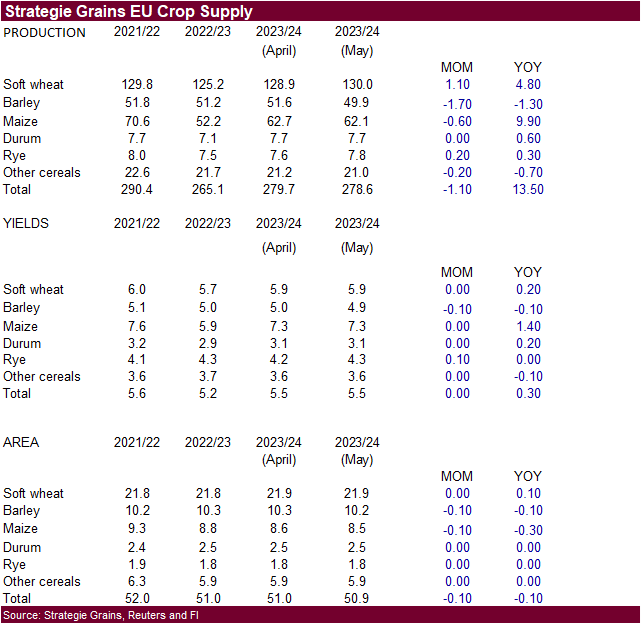

Strategie Grains increased is 2023-24 forecast for EU soft wheat production to 130.0 million tons from 128.9 million in April, 4% above 2022-23 production.

·

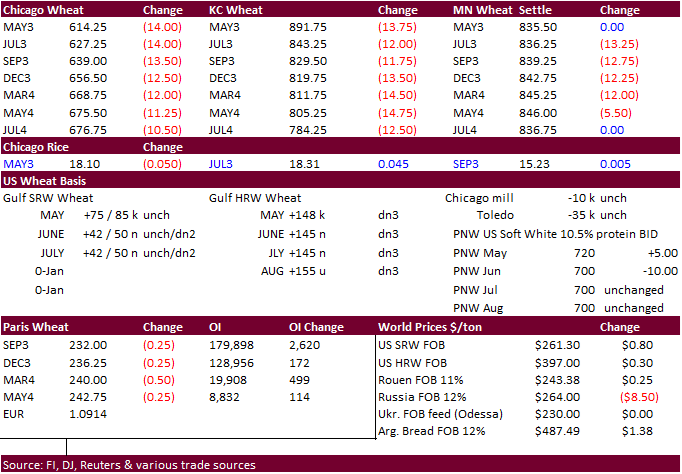

September Paris milling wheat officially closed down 0.25 euro, or 0.1%, at 232.00 euros a ton (about $253.25 ton).

USDA:

Russia Grain and Oilseed Exports Expand

https://www.fas.usda.gov/sites/default/files/2023-05/Russia-IATR-final.pdf

USDA

Attaché: Canada: Grain and Feed Annual

Export

Developments.

·

(Updated) Algeria bought 600,000 to 720,000 tons of soft milling wheat, optional origin, at $275.00-$276.50/ton c&f, for July shipment. Earlier shipment if from SA and/or Australia.

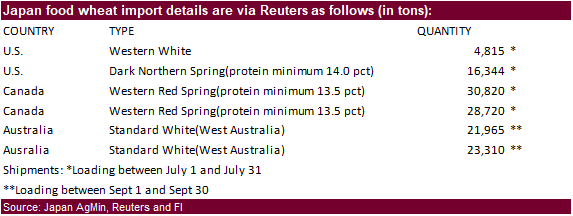

·

Japan bought 125,974 tons of milling wheat on Thursday. Original details as follows:

·

Japan in a SBS import tender seeks 60,000 tons of feed wheat and 20,000 tons of barley on May 17 for arrival in Japan by October 26.

Rice/Other

·

(Reuters) – Prices of rice in major exporter Thailand climbed to about a four-month high this week, while Vietnam rates steadied near their best level in over a year, buoyed by increasing orders mainly from neighboring countries.

Rice output in Asia is set to climb this year as higher prices spur farmers to expand acreage, easing supply concerns after production suffered its first decline in seven years in 2022. The world’s third-largest rice exporter, Vietnam saw a 23.4% jump in shipments

from a year earlier to 1.85 million tons in the first four months of 2023, according to government customs data. They rose 80% from March to 961,608 tons in April.

·

Robusta Hits Fresh 12-Year High on Tight Supply as Exports Fall

·

(Reuters) – India’s cotton exports are set to fall to their lowest level in 18 years in 2022/23 as production lagged behind domestic consumption for the second straight year, a leading trade body said on Thursday. Lower exports

from the world’s biggest producer could support global prices CTc1. It could also lift domestic prices MCOTc1 and weigh on margins of local textile companies.

Updated

05/05/23

KC

– July $7.50-8.75

MN

– July

$7.50-9.00

Export Sales Highlights

This summary is based on reports from exporters for the period April 28 – May 4, 2023.

Wheat: Net sales of 26,300 metric tons (MT) for 2022/2023–a

marketing-year low–were down 88 percent from the previous week and 86 percent from the prior 4-week average. Increases primarily for unknown destinations (17,000 MT), Mexico (10,500 MT, including decreases of 800 MT), Venezuela (5,000 MT), El Salvador (1,400

MT), and Japan (900 MT), were offset by reductions for Honduras (6,000 MT), Guatemala (1,400 MT), Ecuador (1,200 MT), Costa Rica (700 MT), and South Korea (300 MT). Net sales of 333,600 MT for 2023/2024 were primarily for the Philippines (139,000 MT), Mexico

(91,100 MT), unknown destinations (50,000 MT), South Korea (30,000 MT), and Honduras (23,000 MT). Exports of 204,000 MT were down 29 percent from the previous week and 24 percent from the prior 4-week average. The destinations were primarily to Mexico (119,400

MT), Japan (35,200 MT), Ecuador (28,800 MT), Honduras (11,600 MT), and Costa Rica (8,300 MT).

Corn: Net sales of 257,300 MT for 2022/2023 were down

noticeably from the previous week, but up 11 percent from the prior 4-week average. Increases primarily for Japan (154,500 MT, including 92,100 MT switched from unknown destinations), Mexico (74,800 MT, including decreases of 22,400 MT), South Korea (70,800

MT, including 65,000 MT switched from unknown destinations), Colombia (45,600 MT, including 50,000 MT switched from unknown destinations and decreases of 11,000 MT), and Canada (14,600 MT, including decreases of 200 MT), were offset by reductions for unknown

destinations (129,400 MT) and El Salvador (12,300 MT). Total net sales of 83,100 MT for 2023/2024 were for Mexico. Exports of 1,146,100 MT were down 33 percent from the previous week and 8 percent from the prior 4-week average. The destinations were primarily

to Mexico (389,400 MT), Japan (320,400 MT, including 50,100 MT – late), China (138,200 MT), Colombia (132,500 MT), and South Korea (69,400 MT).

Late Reporting: For 2022/2023, exports of 50,112 MT

of corn were late to Japan.

Barley: No net sales or exports were reported for

the week.

Sorghum: Net sales of 49,100 MT for 2022/2023 were

up noticeably from the previous week and from the prior 4-week average. Increases reported for unknown destinations (53,000 MT), were offset by reductions for China (3,900 MT). Exports of 50,600 MT were down 55 percent from the previous week and 28 percent

from the prior 4-week average. The destination was to China.

Rice: Net sales of 30,600 MT for 2022/2023 were down

34 percent from the previous week and 15 percent from the prior 4-week average. Increases primarily for Honduras (20,000 MT), the Dominican Republic (6,000 MT), Jordan (1,700 MT), Mexico (1,700 MT), and Canada (700 MT), were offset by reductions for Venezuela

(200 MT). Exports of 8,500 MT were down 80 percent from the previous week and from the prior 4-week average. The destinations were primarily to Canada (2,800 MT), Mexico (2,500 MT), Jordan (1,700 MT), Saudi Arabia (600 MT), and the United Kingdom (400 MT).

Soybeans: Net sales of 62,200 MT for 2022/2023 were

down 79 percent from the previous week and 68 percent from the prior 4-week average. Increases primarily for Indonesia (88,800 MT, including 68,000 MT switched from unknown destinations), the Netherlands (57,700 MT, including 62,000 MT switched from unknown

destinations and decreases of 4,300 MT), Japan (52,900 MT, including decreases of 3,100 MT), Colombia (4,700 MT), and Egypt (3,000 MT), were offset by reductions for unknown destinations (120,200 MT), Portugal (23,000 MT), and China (6,000 MT). Net sales of

50,100 MT for 2023/2024 were reported for Portugal (23,000 MT), Mexico (19,100 MT), and China (8,000 MT). Exports of 411,000 MT were down 27 percent from the previous week and 18 percent from the prior 4-week average. The destinations were primarily to Indonesia

(82,600 MT), Mexico (74,300 MT), China (72,300 MT), the Netherlands (57,700 MT), and Japan (42,400 MT).

Optional Origin Sales: For 2022/2023, the current

outstanding balance of 300 MT, all South Korea.

Export for Own Account: For 2022/2023, the current

exports for own account outstanding balance of 1,600 MT are for Canada (1,400 MT) and Taiwan (200 MT).

Late Reporting: For 2022/2023, exports of 3,727 MT

of soybeans were late to Colombia.

Soybean Cake and Meal: Net sales of 277,800 MT for

2022/2023 were up 55 percent from the previous week and 52 percent from the prior 4-week average. Increases primarily for Vietnam (55,000 MT), Romania (40,000 MT), Canada (37,500 MT, including decreases of 7,500 MT), Algeria (35,000 MT), and Morocco (28,000

MT), were offset by reductions for Guatemala (5,800 MT), Costa Rica (1,700 MT), and Colombia (200 MT). Net sales reductions of 11,000 MT for 2023/2024 resulting in increases for Canada (1,000 MT), were more than offset by reductions for Ecuador (12,000 MT).

Exports of 188,100 MT were down 21 percent from the previous week and 19 percent from the prior 4-week average. The destinations were primarily to the Philippines (49,400 MT), Ecuador (32,000 MT), Mexico (31,000 MT), Canada (23,800 MT), and Colombia (12,200

MT).

Soybean Oil: Total net sales of 300 MT for 2022/2023

were down 98 percent from the previous week and 92 percent from the prior 4-week average. Increases were for Canada. Exports of 400 MT were down 98 percent from the previous week and 94 percent from the prior 4-week average. The destination was to Canada.

Cotton: Net sales of 246,800 RB for 2022/2023 were

up 7 percent from the previous week and 56 percent from the prior 4-week average. Increases primarily for China (106,200 RB, including 2,800 RB switched from Singapore), Vietnam (67,100 RB, including 2,000 RB switched from Macau, 200 RB switched from Japan,

100 RB switched from South Korea, and 100 RB switched from Taiwan), Bangladesh (36,000 RB), Turkey (17,600 RB, including decreases of 8,000 RB), and Pakistan (9,200 RB, including decreases of 1,500 RB), were offset by reductions for Singapore (2,800 RB), Macau

(2,000 RB), and Indonesia (1,100 RB). Net sales of 12,800 RB for 2023/2024 reported for Nicaragua (4,400 RB), Peru (3,200 RB), Mexico (3,100 RB), and Turkey (2,200 RB), were offset by reductions for Japan (100 RB). Exports of 331,000 RB were down 20 percent

from the previous week and 8 percent from the prior 4-week average. The destinations were primarily to China (88,900 RB), Turkey (75,200 RB), Vietnam (44,100 RB), Pakistan (30,000 RB), and Bangladesh (25,300 RB). Net sales of Pima totaling 15,200 RB for 2022/2023

were down 38 percent from the previous week and from the prior 4-week average. Increases were reported for India (12,200 RB), Vietnam (1,700 RB, including decreases of 1,300 RB), Djibouti (900 RB), and Pakistan (400 RB). Exports of 20,300 RB were down 18 percent

from the previous week, but up 14 percent from the prior 4-week average. The destinations were primarily to India (7,800 RB), China (7,100 RB), Vietnam (1,300 RB), Egypt (1,300 RB), and Turkey (1,000 RB).

Optional Origin Sales: For 2022/2023, the current

outstanding balance of 1,100 RB, all Malaysia.

Export for Own Account: For 2022/2023, the current

exports for own account outstanding balance of 109,600 RB are for China (80,300 RB), Vietnam (19,200 RB), Pakistan (5,000 RB), South Korea (2,400 RB), India (1,500 RB), and Turkey (1,200 RB).

Hides and Skins: Net sales of 598,400 pieces for 2023

were up 57 percent from the previous week and 45 percent from the prior 4-week average. Increases primarily for China (424,400 whole cattle hides, including decreases of 20,400 pieces), Mexico (63,800 whole cattle hides, including decreases of 2,800 pieces),

Italy (42,700 whole cattle hides, including decreases of 3,100 pieces), South Korea (40,200 whole cattle hides, including decreases of 200 pieces), and Thailand (18,600 whole cattle hides, including decreases of 700 pieces), were offset by reductions for Brazil

(200 pieces). In addition, total net sales reductions of 1,100 kip skins were for China. Exports of 366,800 pieces were down 1 percent from the previous week and 6 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (225,700

pieces), Mexico (50,900 pieces), South Korea (36,300 pieces), Thailand (15,400 pieces), and Brazil (12,900 pieces).

Net sales of 56,800 wet blues for 2023 were down 64 percent from the previous week and 59 percent from the prior 4-week average. Increases primarily for Vietnam

(26,700 unsplit), Thailand (21,300 unsplit), Brazil (2,700 unsplit and 1,900 grain splits), Mexico (3,300 unsplit), and Japan (1,400 grain splits), were offset by reductions for Hong Kong (300 unsplit) and Italy (100 unsplit). Exports of 119,400 wet blues

were up 41 percent from the previous week and 9 percent from the prior 4-week average. The destinations were primarily to Italy (45,400 unsplit), China (22,000 unsplit), Vietnam (19,900 unsplit), Thailand (14,400 unsplit), and Brazil (11,000 unsplit). Net

sales reductions of 3,900 splits resulting in increases for South Korea (4,600 pounds), were more than offset by reductions for Vietnam (8,400 pounds). Exports of 156,300 pounds were primarily to Vietnam (115,900 pounds).

Beef: Net sales of 16,600 MT for 2023 were down 18

percent from the previous week, but up 16 percent from the prior 4-week average. Increases were primarily for South Korea (4,400 MT, including decreases of 400 MT), Japan (3,700 MT, including decreases of 400 MT), Canada (3,100 MT, including decreases of 200

MT), Mexico (2,100 MT), and Taiwan (1,000 MT, including decreases of 100 MT). Exports of 14,800 MT were down 22 percent from the previous week and 11 percent from the prior 4-week average. The destinations were primarily to South Korea (4,300 MT), Japan (3,100

MT), China (2,100 MT), Canada (1,300 MT), and Mexico (1,300 MT).

Pork: Net sales of 30,000 MT for 2023 were down 39

percent from the previous week and 28 percent from the prior 4-week average. Increases were primarily for Japan (9,900 MT, including decreases of 100 MT), China (5,600 MT, including decreases of 100 MT), Mexico (5,500 MT, including decreases of 300 MT), the

Philippines (1,700 MT), and South Korea (1,300 MT, including decreases of 500 MT). Exports of 36,900 MT were down 4 percent from the previous week and unchanged from the prior 4-week average. The destinations were primarily to Mexico (13,900 MT), Japan (5,600

MT), China (5,400 MT), South Korea (2,700 MT), and Canada (2,000 MT).

U.S. EXPORT SALES FOR WEEK ENDING 5/4/2023

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

10.4 |

482.9 |

750.7 |

93.4 |

4,637.1 |

6,759.3 |

65.7 |

280.9 |

|

SRW |

12.7 |

367.6 |

224.4 |

41.0 |

2,559.7 |

2,651.0 |

65.5 |

653.3 |

|

HRS |

4.3 |

729.1 |

644.1 |

40.1 |

5,023.0 |

4,815.5 |

132.4 |

444.9 |

|

WHITE |

-1.2 |

549.1 |

296.2 |

29.6 |

4,127.3 |

3,092.5 |

70.0 |

209.7 |

|

DURUM |

0.0 |

112.6 |

0.5 |

0.0 |

340.1 |

195.5 |

0.0 |

36.9 |

|

TOTAL |

26.3 |

2,241.3 |

1,916.0 |

204.0 |

16,687.2 |

17,513.8 |

333.6 |

1,625.6 |

|

BARLEY |

0.0 |

3.5 |

5.7 |

0.0 |

8.5 |

14.8 |

0.0 |

6.0 |

|

CORN |

257.3 |

11,876.9 |

16,949.6 |

1,146.1 |

26,516.7 |

41,541.1 |

83.1 |

2,626.4 |

|

SORGHUM |

49.1 |

494.2 |

1,681.2 |

50.6 |

1,149.7 |

5,151.6 |

0.0 |

63.0 |

|

SOYBEANS |

62.2 |

3,285.0 |

10,692.0 |

411.0 |

47,480.7 |

47,763.5 |

50.1 |

1,886.8 |

|

SOY MEAL |

277.8 |

2,580.4 |

2,608.5 |

188.1 |

7,440.0 |

7,459.8 |

-11.0 |

315.4 |

|

SOY OIL |

0.3 |

59.9 |

110.5 |

0.4 |

57.8 |

555.2 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

20.3 |

180.6 |

134.7 |

1.9 |

526.6 |

1,098.1 |

0.0 |

0.0 |

|

M S RGH |

1.5 |

33.7 |

8.6 |

0.3 |

23.3 |

12.3 |

0.0 |

5.0 |

|

L G BRN |

0.1 |

3.6 |

4.0 |

0.5 |

17.0 |

47.8 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

21.2 |

9.9 |

0.1 |

23.7 |

77.4 |

0.0 |

0.0 |

|

L G MLD |

6.3 |

137.2 |

88.5 |

2.4 |

561.8 |

647.5 |

0.0 |

0.0 |

|

M S MLD |

2.4 |

112.7 |

200.6 |

3.3 |

220.7 |

315.0 |

0.0 |

13.0 |

|

TOTAL |

30.6 |

488.9 |

446.2 |

8.5 |

1,373.2 |

2,198.0 |

0.0 |

18.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

246.8 |

3,919.6 |

5,793.8 |

331.0 |

8,579.6 |

8,957.1 |

12.8 |

1,496.1 |

|

PIMA |

15.2 |

89.0 |

108.3 |

20.3 |

208.7 |

361.4 |

0.0 |

4.7 |

#non-promo