PDF Attached

USDA:

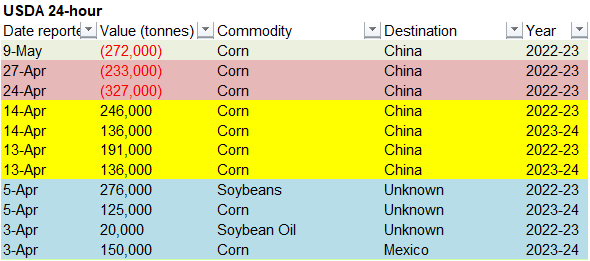

Private exporters reported the cancellation of sales of 272,000 metric tons of corn for delivery to China during the 2022/2023 marketing year.

USD

was higher by 22 points and WTI crude oil was up 41 cents. Rapid US planting progress and improving US weather along with export demand concerns sent US ags lower. Most of the US will see rain one time or another this week, lighter bias the west-central Plains.

Texas will see most rain over the next 7 days. There is a change of two light frost events next week for parts of the Northern Plains and Midwest. Brazil’s corn area will dry down this week.

A

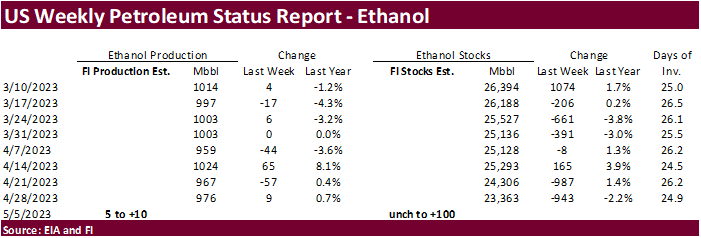

Bloomberg poll looks for weekly US ethanol production to be up 11,000 thousand barrels to 987k (980-997 range) from the previous week and stocks up 152,000 barrels to 23.515 million.

StatsCan

Canadian March 31 stocks were seen supportive for wheat and canola, but other factors today influenced price movement.

Fund

estimates as of May 9

WEATHER

TO WATCH

-

Northern

U.S. Plains will trend wetter later this week and into the early weekend -

Significant

rain is expected, but it may be greatest in the driest areas of the western Dakotas rather than the wetter areas in the eastern Dakotas and Minnesota -

Rainfall

of 1.00 to 3.00 inches may impact some of these western areas -

Rainfall

in the eastern Dakotas and Minnesota will range from 0.50 to 1.50 inches -

The

moisture will interfere with the region’s much needed drying trend and further delay farming activity -

Recent

rain in central Alberta, Canada has been good for spring planting of especially after the previous bout of hot and dry weather -

More

heat and dryness is coming later this week and into next week making the rain even more important -

East-central

Alberta, west-central Saskatchewan and areas to the north in Saskatchewan have been missing recent rain and will continue doing so

-

Net

drying will continue in these areas and there will also be a return of warm weather this weekend into next week that will accelerate drying and raise more worry about crop development potential in the driest areas -

U.S.

central Plains rainfall is expected to continue erratically and lighter than usual maintaining concern for winter wheat and some early summer crops -

Rain

will fall in many areas, but amounts will be light for much of western Kansas, southeastern Colorado and immediate neighboring areas -

Torrential

rain is expected in a part of central Texas this weekend resulting in serious flooding -

The

area impacted will be a minor corn and sorghum production region, but the impact will still be significant especially in any urban location that gets involved -

West

Texas will receive significant rain Friday through Sunday with a little more into Monday -

Rainfall

of 0.50 to 1.50 inches is expected in the high Plains region while 1.00 to 3.00 inches occurs in eastern portions of the region including the Rolling Plains -

Follow

up rain after this weekend is expected the be limited -

Aggressive

planting of corn, sorghum and cotton is expected If the forecast verifies -

Western

and central Mexico will continue in the midst of drought while rain falls periodically in the eastern and southern parts of the nation into the next ten days -

Seasonal

rains usually begin in southern Mexico during May and early June before advancing northward during the balance of June and early July -

Ontario

and Quebec will continue in a milder than usual temperature regime for a while and that may lead to slower planting of corn and soybeans that usually begins after May 15 -

Europe

will experience heavy rain and flooding during the coming week from Italy into the eastern Adriatic Sea region where some damage to crops and property may result -

Some

replanting of spring and summer crops may be needed in a few areas, but it should not be widespread -

Northeastern

Algeria and northern Tunisia reported rain Monday and more will occur periodically over the next week

-

The

moisture boost will be helpful for the latest maturing crops -

No

relief is expected to the drought stricken areas of Morocco or northwestern Algeria -

Eastern

parts of Thailand, Cambodia, Vietnam and Laos experienced some much needed cooling Monday due to showers and thunderstorms that evolved -

Excessive

heat and dryness occurred during the weekend stressing livestock and unirrigated crops throughout the region -

Additional

rain is expected over the next several days offering more relief from the hottest and driest conditions -

A

tropical cyclone will evolve Wednesday or Thursday in the Bay of Bengal before moving into northwestern Myanmar this weekend -

Torrential

rain, strong wind and flooding will accompany the storm inland -

Northwestern

Myanmar, southeastern Bangladesh will be most impacted and “some” damage to rice and sugarcane may result -

India

weather is expected to be mostly normal over the next ten days with a few pre-monsoonal showers and thunderstorms expected in the south and extreme east while most other areas are dry -

Indonesia/Malaysia

weather is still favorably wet through the next ten days -

Recent

rainfall was most significant in Indonesia and Malaysia while the Philippines dried down for a while -

This

trend may be perpetuated over the next couple of weeks -

Drought

in Yunnan, China will finally be eased late this week and into the weekend as moderate rain finally falls -

Rice,

corn and sugarcane among other crops will benefit, though it has been dry enough for a long enough period of time for production to be hurt -

Additional

rain will be needed -

China’s

greatest rain over the next ten days will be in the southwest where 2.00 to 6.00 inches and locally more than 8.00 inches will result -

Some

flooding is expected -

Rapeseed

areas will see less frequent and less significant rain which may help stop the damage that has occurred recently from excessive rainfall and flooding -

Xinjiang,

China was unusually cool during the weekend and only warmed slightly Monday -

High

temperatures Monday were in the 50s Fahrenheit in northeastern cotton and corn areas while in the 60s and 70s in western parts of the province where much of the cotton is produced -

Summer

crop conditions are not very good because of the cool start to the planting season; both cotton and corn need much warmer weather -

Xinjiang,

China temperatures will trend warmer during the middle to latter part of this week with temperatures returning to normal by the weekend

-

Some

forecast models have suggested warmer than usual temperatures are possible this weekend into next week

-

Northwestern

Kazakhstan and neighboring southern areas of Russia’s eastern New Lands will get some rain this week with 1.00 to nearly 2.50 inches possible in a few areas, but most of the precipitation will be lighter leaving some need for more moisture -

A

close watch on this region is warranted because of decreasing topsoil moisture recently and additional warm and dry biased weather that may eventually return later this month -

Other

western CIS crop areas are expected to benefit from alternating periods of rain and sunshine during the next week to ten days -

Argentina

will experience limited rainfall and warmer biased weather for much of the coming week to ten days -

Summer

crop maturation and harvesting will advance normally -

Rio

Grande do Sul, Brazil received additional rainfall Monday, but will now experience some welcome drier biased weather for a while -

Recent

moisture was good for late season crops, but the state is plenty wet now and needs to dry down for a while -

Rain

is expected in Bahia and Tocantins during mid- to late-week this week causing a disruption to farming activity; including the harvest of cotton, sugarcane and coffee -

Most

of the rain is not likely to be heavy -

West-central

Africa will continue to experience periodic rainfall over the next two weeks maintaining a mostly good environment for coffee, cocoa, rice and sugarcane -

Mali

and Burkina Faso rainfall will remain lighter than usual, although some welcome precipitation is expected that will raise topsoil moisture.

-

East-central

Africa rainfall will continue periodic and mostly in a beneficial manner to support rice, coffee, cocoa, sugarcane and other crops -

South

Africa will dry down for the next few days before the next wave of rain evolves Saturday through Tuesday of next week

-

The

rain will be good for winter wheat planting and establishment in the west, but it will slow summer crop maturation and harvest progress.

-

Australia

rainfall during the coming week will be greatest in winter crop areas near to the coast.

-

Moisture

totals will be light and a boost in rainfall will continue to be needed in interior Western Australia, interior South Australia and western New South Wales -

Drought

continues in central and western Mexico while recent rain in the east has improved crop and field conditions -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was -1.98 and it should move erratically lower over the next several days

Source:

World Weather, INC.

Tuesday,

May 9:

- Canada’s

StatsCan to release wheat, soybean, canola and barley reserves data - China’s

first batch of April trade data, including soybean, edible oil, rubber and meat imports

Wednesday,

May 10:

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysian

Palm Oil Board’s data for May output, exports and stockpiles - Malaysia’s

May 1-10 palm oil exports - Sugar

production and cane crush data by Brazil’s Unica (tentative)

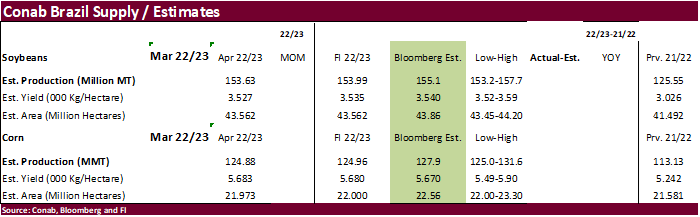

Thursday,

May 11:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Brazil’s

Conab issues production, area and yield data for corn and soybeans - New

Zealand Food Prices - EARNINGS:

GrainCorp

Friday,

May 12:

- USDA’s

World Agricultural Supply and Demand Estimates (WASDE), 12pm eastern - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report

Source:

Bloomberg and FI

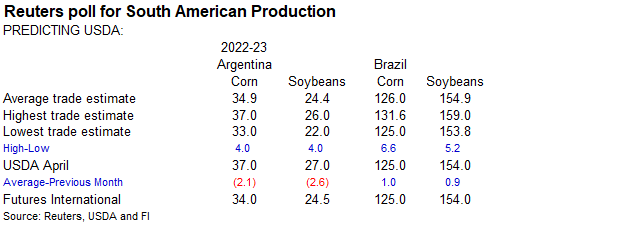

Soybean

and Corn Advisory

2022/23

Brazil Soy Estimate Increased 1.0 mt to 154.0 Million Tons

2022/23

Brazil Corn Estimate Increased 1.0 mt to 124.0 Million Tons

2022/23

Argentina Soybean Estimate Unchanged at 23.0 Million Tons

2022/23

Argentina Corn Estimate Unchanged at 35.0 Million Tons

100

Counterparties Take $2.223 Tln At Fed Reverse Repo Op. (prev $2.218 Tln, 104 Bids)

EIA

STEO Current Yr Crude F’cast (Bpd) May: 12.53 (prev 12.54)

–

Forward Yr Crude F’cast (Bpd): 12.69 (prev 12.75)

–

Current Yr Dry NatGas F’cast (Bcf/d): 101.09 (prev 100.87)

–

Forward Yr Dry NatGas F’cast (Bcf/d): 101.24 (prev 101.58)

US

EIA Raises Forecast For 2023 World Oil Demand Growth By 120K Bpd, Now Sees 1.56 Mln Bpd Y/Y Increase

–

Cuts Forecast For 2024 World Oil Demand Growth By 130K Bpd, Now Sees 1.72 Mln Bpd Y/Y Increase

–

U.S. Crude Output To Rise 640K Bpd To 12.53 Mln Bpd In 2023 (Vs Rise Of 660K Bpd Forecast Last Month)

U.S.

corporate bankruptcy filings highest since 2010 https://tmsnrt.rs/44AkswS

·

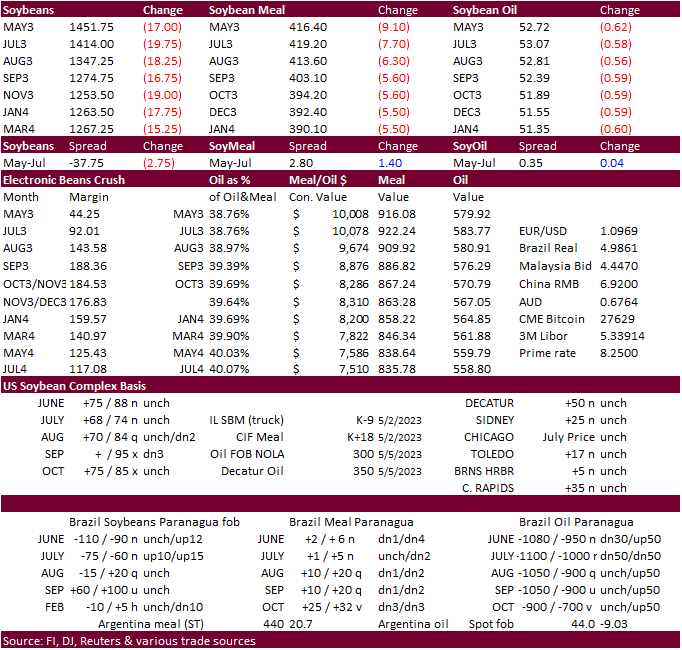

Corn was

sharply lower on good fund selling of about 10,000 contracts. July fell 11.75 cents and December 11.50 cents. China cancelled corn purchases. Prices started the day lower after USDA confirmed rapid US planting progress last week and Algeria passing on their

import tender for 140,000 tons of corn. On top of that, the trade expects large US and world production estimates by USDA along with an increase in US stocks for 2023-24. US weather looks good over the next two weeks but there is a chance for two light frost

events next week for parts of the Northern Plains and Midwest.

-

USDA

under the 24-hour system reported private exporters cancelled 272,000 tons of 2022-23 corn for China . 832,000 tons has been canceled by China since late April.

-

The

UN has 5 million tons of Ukraine corn penciled in destined for China. For Brazil, corn commitments to China reached around 2 million tons as of last month. Brazil aims to export 5 million tons of corn to China this year. Note South Africa shipped about 100,000

tons of corn to China. US exports to China as of early May reached nearly 5.1 million tons with another 2.8 million outstanding after today’s cancellation. Counting up US total commitments, Brazil & Ukraine expectations for China bound corn shipments, and

South Africa arrivals, that adds up to around 18 million tons. For reference, China’s CASDE has 2022-23 corn imports at 18 million tons, same as USDA.

-

Ukraine

grain shipments have significantly slowed this week in part to lack of inspections.

·

49 percent of the US corn crop had been planted, one point above expectations, up 23 percentage points from previous week and compares to 21 percent year ago and 42 percent average.

·

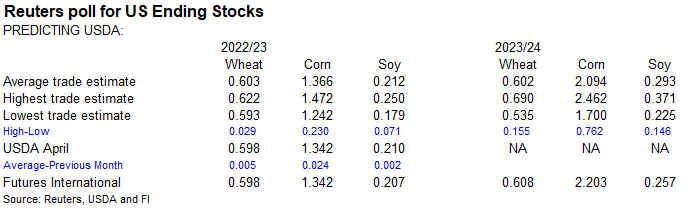

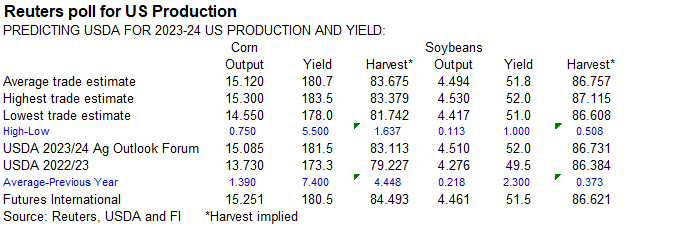

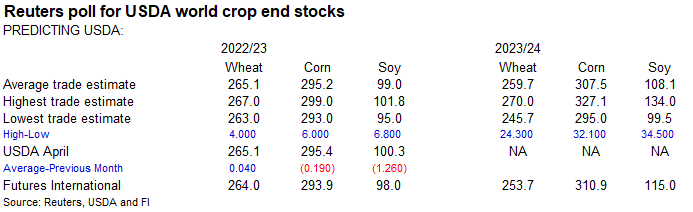

A Reuters trade estimate for US corn production is 15.120 billion bushels, 1.390 billion above 2022-23. Global 2023-24 corn stocks are projected to be up 12.3 million tons from 2022-23 and soybeans could end up 9.0 million tons

above last year.

·

Indonesia reported an outbreak of African swine fever that killed “35,297 pigs in a herd of 285,034 on a farm located on Bulan island was detected on April 1 and confirmed on April 28.” (Reuters)

·

Brazil’s corn area will dry down this week.

·

A Bloomberg poll looks for weekly US ethanol production to be up 11,000 thousand barrels to 987k (980-997 range) from the previous week and stocks up 152,000 barrels to 23.515 million.

Export

developments.

-

USDA

under the 24-hour system reported private exporters cancelled 272,000 tons of 2022-23 corn for China . 832,000 tons has been canceled by China since late April.

-

Algeria

passed on up to 140,000 tons of corn for May through August shipment. -

Taiwan’s

MFIG group seeks up to 65,000 tons of feed corn from the US, Brazil, Argentina, or South Africa on May 10, pegged off the September contract. Shipment is for the July through August period, depending on origin.

-

USDA

seeks 120 tons of packaged vegetable oil for various export programs on May 16 for June 16-July 5 shipment.

Updated

05/02/23

July

corn $5.00-$6.50

December

corn $4.75-$6.50

·

Soybeans traded lower on less than expected China soybean arrivals, a 16-point increase in soybean seeding progress for the US (35 percent complete), and lower soybean meal futures. Algeria passed on 70,000 tons of soybean meal.

The trade looks for USDA on Friday to report a large US and world soybean ending stocks for 2023-24. Soybean oil ended lower. Egypt floated an import tender for vegetable oils. Egypt’s strategic reserves of vegetable oils stand at 3.4 months.

·

StatsCan reported a less than expected March 31 canola stocks which could limit losses for soybeans.

·

A Reuters trade estimate for US 2023-24 soybean production is 4.494 billion, up 218 million from a year ago. World soybean stocks were projected at 108.1 million tons, up 9 million from USDA’s current 2022-23 estimate.

·

China April soybean arrivals were 7.26 million tons, down 10 percent from a year ago. Traders were looking for April imports to end up around 9 million tons. Some cited changes in custom procedures (inspections). Traders are

looking for May arrivals to return to normal at around 9 to 10 million tons. Jan-Apr soybean imports stand at 30.29 million tons, up 6.8% from the same period in 2022.

·

Brazil’s soybean crop is 95.4% harvested, according to Conab.

·

Ukraine’s sunoil producers’ association estimated 2022-23 Sep-Aug sunflower oil production could end up between 4.5-4.7 million tons, and up to 6 million tons for 2023-24.

·

Malaysian palm oil prices traded in a wide range Tuesday and settled higher for the fifth consecutive session.

·

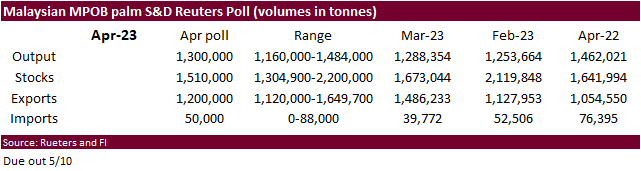

MPOB Malaysian palm oil S&D for April is due out Wednesday. Polls for Malaysian April ending stocks call for a 11-month low.

Export

Developments

-

Egypt

seeks vegetable oils on May 11 for June 25 through July 10 shipment. They are also in for local vegetable oils.

-

China’s

Sinograin sold 11,222 tons of 2021 crop year soybean oil from state reserves, 63 percent of the total offered. 103,601 tons have been sold this year.

-

Algeria

passed on up to 70,000 tons of soybean meal for June through July 15 shipment.

-

USDA

seeks 120 tons of packaged vegetable oil for various export programs on May 16 for June 16-July 5 shipment.

Updated

05/05/23

Soybeans

– July $13.75-$15.25, November $12.00-$15.00

Soybean

meal – July $375-$475, December $325-$500

Soybean

oil – July 50-56,

December 48-58

·

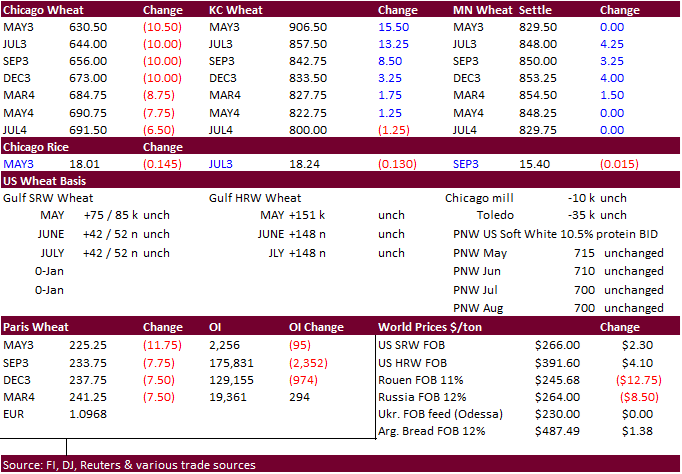

US wheat futures are lower on improving US weather and improvement in US winter wheat ratings. StatsCan reported a less than expected March 31 all-wheat stocks which could limit losses.

·

US winter wheat ratings improved one point to 29 percent and spring wheat seedlings increased a less than expected 12 points to 24 percent, lagging the 5-year average of 38 percent.

·

No inspections of Black Sea inbound, or outbound ships were conducted Sunday or Monday, according to the UN. But inspections resume Tuesday.

·

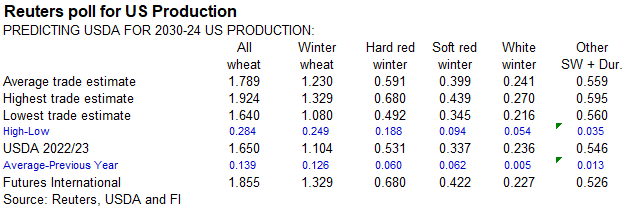

A Reuters trade estimate for US winter wheat production is 1.789 billion bushels, 139 million above 2022-23.

·

Ukraine’s president is calling on the EU to end grain import restrictions.

·

Most of the US will see rain one time or another this week, lighter bias the west-central Plains.

·

September Paris milling wheat officially closed down 7.75 euros, or 3.2%, at 234.00 euros a ton (about $256.37 ton).

Export

Developments.

·

Algeria seeks at least 50,000 tons of soft milling wheat, optional origin, on May 10/11th, for July shipment. Earlier shipment if from SA and/or Australia.

·

Jordan seeks 120,000 tons of feed barley on May 10 for October 16-31 and November 1-15 shipment.

·

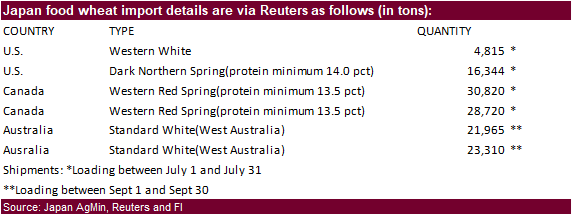

Japan seeks 125,974 tons of milling wheat on Thursday.

Rice/Other

·

(Reuters) – Vietnam’s rice exports in April rose 8.5% from the previous month to 1.04 million tons, government customs data showed on Tuesday. Rice shipments from Vietnam were valued at $545.8 million in the month, up 7.2% from

March, it said.

·

(Bloomberg) — Global 2023-24 ending stocks seen at 90.34m bales, down 1.67m bales from the previous season, according to the avg in a Bloomberg survey of seven analysts.

The range of estimates varied from 86m to 92.76m bales

US 2023-24 ending stocks seen at 4.18m bales vs 4.1m bales last season

USDA’s preliminary est. was for 4m bales, made in February at the annual Outlook Forum

Updated

05/05/23

KC

– July $7.50-8.75

MN

– July

$7.50-9.00

#non-promo