PDF Attached

WTI

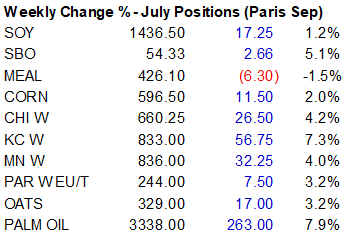

crude was up $2.76, USD 12 points lower and US equities sharply higher. US jobs reported was supportive. CBOT agriculture markets ended mostly higher (back month meal was lower) on follow through short covering. Product spreading limited grain in nearby meal.

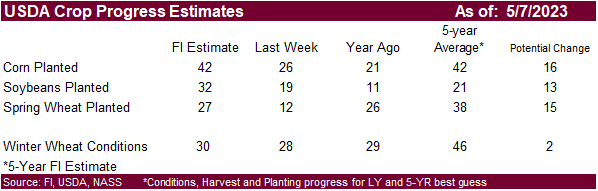

US wheat areas have rain in the forecast through at least mid-next week. We look for an improvement of 2 points for the G/E categories for winter wheat when updated on Monday.

The

US weather forecast improved a touch from that of Thursday. Funds are holding a much larger short position in corn than expected. Trade estimates for USDA will be out as early as mid-Monday.

Fund

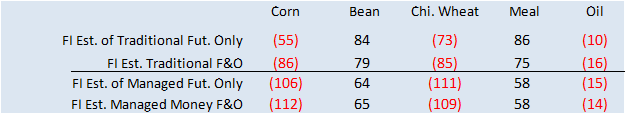

estimates as of May 5

WEATHER

TO WATCH

-

Not

many changes around the world today -

Rain

has begun from Cordoba, Argentina to Entre Rios and Uruguay this morning and it will increase so that rain totals of 0.50 to 1.50 inches results with local totals over 2.00 inches in northern Cordoba -

There

are already a few amounts over 1.25 inches noted in northern Cordoba through 1230 GMT -

Not

much other rain is likely in Argentina crop areas during the coming week to ten days, other than a few sporadic showers infrequently -

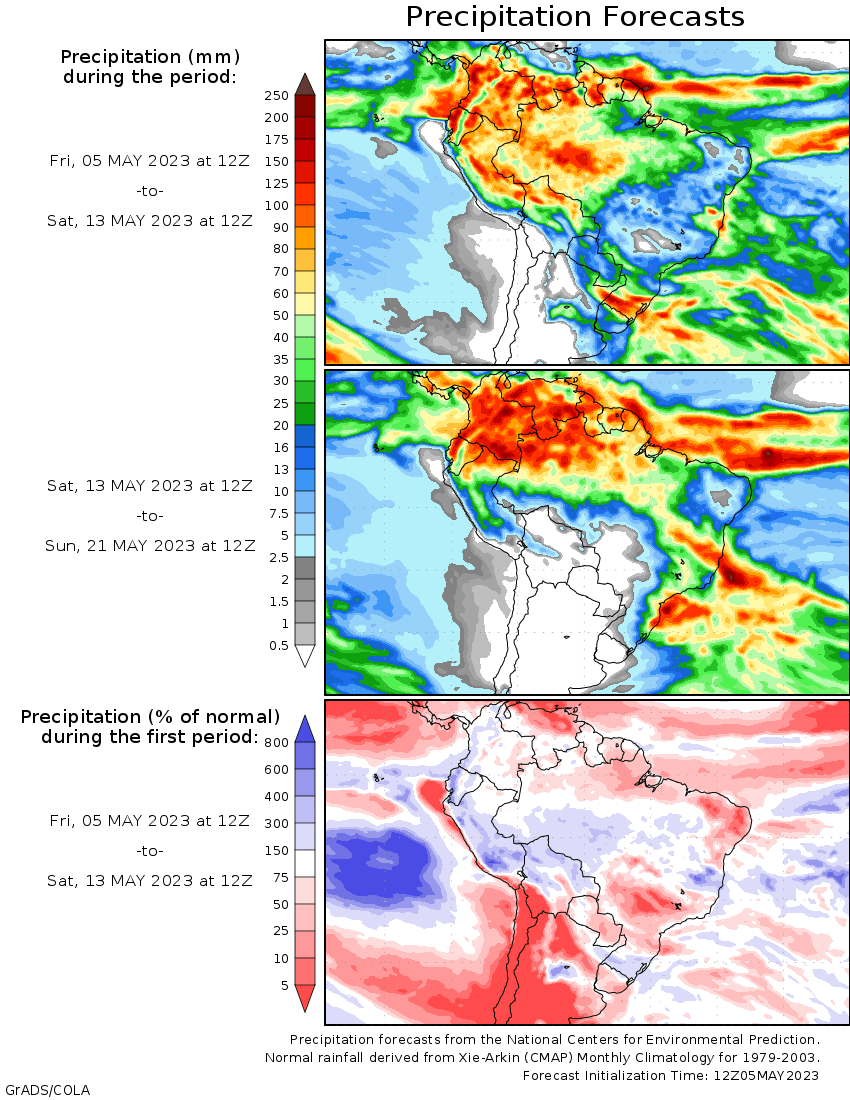

Brazil’s

center south and center west crop areas will steadily dry down over the next ten days to two weeks

-

Safrinha

crop conditions will remain favorable, although topsoil moisture is going to be depleted soon in parts of Mato Grosso and Goias raising the need for rain late this month and in early June for late planted crops -

Subsoil

moisture will carry on normal crop development for the next couple of weeks -

Rio

Grande do Sul, Brazil and Paraguay will be plenty wet during the coming week with a few areas possibly getting a little too much moisture -

Coffee,

citrus and sugarcane in Brazil are maturing favorably with some early harvesting already under way -

Coffee

and citrus production should be high this year while sugarcane yields may be off a little bit because of too much rain at times in the heart of the production region and late season dryness in the minor areas of the north -

Spain,

Portugal and North Africa will continue to dry down over the next week -

Some

rain is predicted for northeastern Algeria and northern Tunisia a week from now, but it is still questionable how significant that rain will be -

Drought

has already cut into production from all three of these regions -

Central

Europe will be plenty wet if not a little too wet in the coming week, though no harm will come to crops -

Cold

weather will continue to impact northeastern Europe over the next week with the next coldest period of time coming up late this week into early next week

-

No

crop damage is likely except possibly to flowering fruit trees -

Northern

Kazakhstan and southern parts of Russia’s eastern New Lands will get some rain to ease dryness next week, but some of the medium range computer forecast models have suggested another ridge of high pressure is possible near and shortly after mid-month that

could return the drying trend -

Relief

from dryness will not be uniform, but any precipitation will be welcome -

Topsoil

moisture is running a little short, but subsoil moisture is still favorable -

The

drier bias has been great for advancing spring fieldwork, but another round of warm and dry weather may prove to be stressful if significant rain does not fall first -

India

weather has trended drier and warmer and this will prevail through mid-month -

The

change will induce some beneficial improvement for crops and harvest progress after too much rain fell last weekend and earlier this week -

All

of eastern China will get rain at one time or another through the next ten days, although the Northeast Provinces will see the lightest precipitation

-

A

little too much rain may fall in the rapeseed areas of the Yangtze River Basin and areas to the south where crop maturation and harvesting could be threatened by frequent rain -

The

Yellow River Basin and North China Plain will see the best weather for winter crop development and for the planting of spring and summer crops -

Xinjiang,

China continues to suffer from a cooler than usual spring -

Northeastern

areas will remain quite cool with frequent showers and drizzle through the weekend and then slowly improving conditions next week

-

Western

Xinjiang, where most of the cotton is produced, will seed cool and dry conditions through the weekend and then slowly warming next week back to a more normal temperature regime -

Summer

crop conditions are not very good because of the cool start to the planting season -

Canada’s

Southwestern Prairies will continue drought stricken through the next two weeks, despite a few showers periodically -

Canada’s

eastern and far western Prairies may experience some planting delay because of periodic rainfall, although the impact will be low -

Excessive

heat in the western Prairies of Canada this week raised soil temperatures and accelerated drying, but the environment was very good for aggressive planting in areas that are not seriously drought stricken -

Extreme

highs in the 80s and a few lower 90s Fahrenheit were noted in the past few days -

The

warmest weather has occurred in central Alberta impacting areas as far to the north as Edmonton, Whitecourt, Vegreville and Lloydminster -

Cooling

is expected this weekend -

Ontario

and Quebec, Canada have been quite cool this week and rainy at times too -

Drier

and warmer weather is needed to induce a better environment for wheat development and spring planting that often begins around mid-month -

Warming

is expected soon -

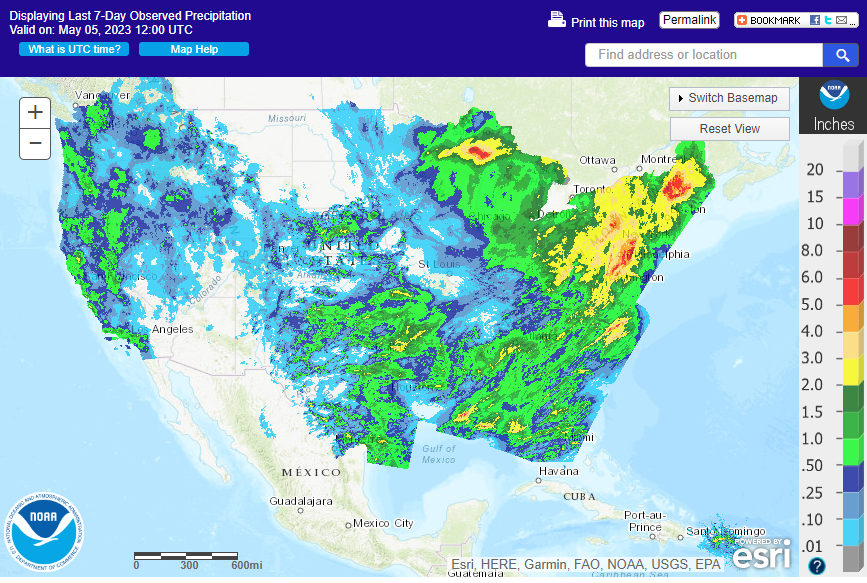

Most

U.S. crop areas from the Pacific Northwest to the Atlantic coast, including all of the Plains, will get rain at one time or another during the next week to ten days -

The

moisture will interfere with some planting, but the long term outlook should be mostly good -

Planting

delays are most concerning in the northeastern U.S. Plains, upper Midwest and neighboring areas of eastern Canada’s Prairies where fieldwork has been limited by cool and moist conditions this spring -

Poor

drying conditions are expected until near mid-month -

The

lower and eastern Midwest and southeastern states will experience the best mix of weather with fieldwork and crop development advancing most favorably in those areas -

West-central

and southwestern parts of the high Plains region will not get much rain until mid- to late-week next week and the moisture that falls will be brief, although beneficial -

West

Texas will also get some rain Tuesday into Wednesday of next week and then more significantly in the following weekend -

U.S.

Delta will be a little wet along with the Texas Blacklands, Coastal Bend and South Texas – mostly during the middle and latter part of next week, although some rain will fall sooner than that

-

U.S.

southern Plains, lower Midwest and Delta will become much warmer this weekend and early next week with daily high temperatures in the 80s and lower 90s Fahrenheit -

Some

hotter temperatures are expected in interior southern Texas -

River

flooding continues along the upper half of the Mississippi and in the Red River Basin of the North and this process will continue through much of this month -

Prevent

plant is still a possibility for a part of these region’s and in Manitoba Canada, but much will be determined by rainfall that occurs later this month and in June -

A

significant break from rain is needed along with warm temperatures to get fields in better shape for planting -

California

will receive some rain and mountain snowfall during the coming week maintaining a strong potential for flooding as snow melts in the mountains and then new rain and snow fall -

Western

and southern Australia will receive showers in the coming week, but interior crop areas will remain drier biased -

Western

Australia needs greater rainfall to improve wheat, barley and canola planting and establishment conditions -

Southeastern

Australia is plenty moist for winter crop planting and early emergence, but greater rain is still needed for some areas -

Summer

crop harvesting in east-central Australia is advancing well with little change likely -

A

tropical cyclone may evolve in the Bay of Bengal this weekend and may threaten Myanmar sugarcane and rice production potentials -

Mainland

areas of Southeast Asia are getting more routinely occurring showers and thunderstorms, but resulting rainfall has continued to be lighter than usual

-

Monsoonal

precipitation usually begins in the south late this month -

Indonesia

and Malaysia will continue to experience frequent bouts of rain over the next ten days – no area is expected to become too dry or excessively wet -

Philippines

rainfall will be timely, but there is need for greater rain in the north -

Middle

East soil moisture is greatest in Turkey, but there is need for more moisture in areas to the south and east -

The

environment is not critical, but cotton and rice would benefit from greater rain and improved soil moisture -

Wheat

production was mostly good this year -

South

Africa rainfall will be infrequent and light enough over the next ten days to support most late season crop needs while allowing some harvest progress to continue -

Today’s

forecast is a little wetter than that of Wednesday for eastern parts of the nation -

Cotton

areas from southern Mali to Burkina Faso need significant rain to support cotton planting and establishment in unirrigated areas -

Some

showers are possible during the second week of the forecast -

Drought

continues in central and western Mexico while recent rain in the east has improved crop and field conditions -

East-central

Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was 0.52 and it should move erratically over the next several days

Source:

World Weather, INC.

Friday,

May 5:

- FAO

World Food Price Index - April

U.S. jobs report - Malaysia’s

May 1-5 palm oil export data - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Japan, South Korea, Thailand

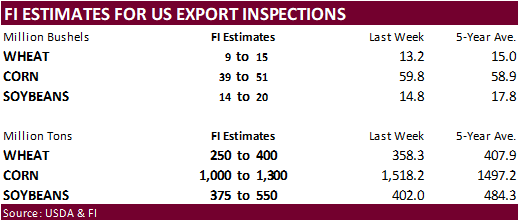

Monday,

May 8:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

winter wheat condition, 4pm - US

planting data for corn, cotton, spring wheat and soybeans, 4pm - HOLIDAY:

UK, France

Tuesday,

May 9:

- Canada’s

StatCan to release wheat, soybean, canola and barley reserves data - China’s

first batch of April trade data, including soybean, edible oil, rubber and meat imports

Wednesday,

May 10:

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysian

Palm Oil Board’s data for May output, exports and stockpiles - Malaysia’s

May 1-10 palm oil exports - Sugar

production and cane crush data by Brazil’s Unica (tentative)

Thursday,

May 11:

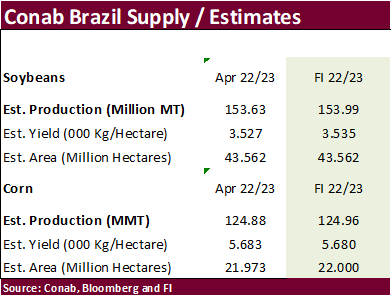

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Brazil’s

Conab issues production, area and yield data for corn and soybeans - New

Zealand Food Prices - EARNINGS:

GrainCorp

Friday,

May 12:

- USDA’s

World Agricultural Supply and Demand Estimates (WASDE), 12pm eastern - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report

Source:

Bloomberg and FI

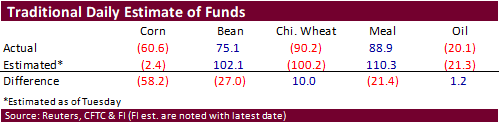

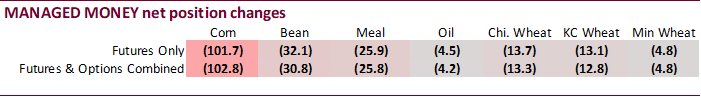

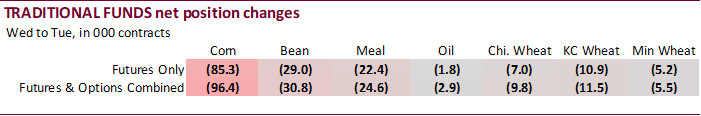

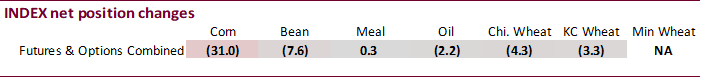

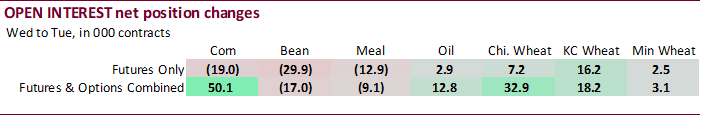

Money

managers and traditional funds sold a much larger amount of corn than the trade expected. Funds missed the net short position by 58,200 contracts. The money manager position was also well off. Funds sold more than expected soybeans and soybean meal and were

a little less short for soybean oil. The funds short covering over the past three sessions is not surprising given the sharp increase in the short position for corn for the week ending May 2. Look for additional short covering next week if bullish headlines

develop.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

-153,429 -64,099 285,294 -30,973 -78,324 88,335

Soybeans

36,874 -22,009 123,910 -7,603 -131,445 28,158

Soyoil

-43,883 -1,553 96,808 -2,167 -51,706 3,624

CBOT

wheat -108,099 -7,737 68,887 -4,303 30,535 12,534

KCBT

wheat -20,269 -8,264 37,214 -3,263 -17,371 8,599

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

-118,146 -102,849 245,054 7,289 -99,053 82,375

Soybeans

56,373 -30,835 99,873 4,952 -140,220 24,408

Soymeal

60,557 -25,816 93,808 1,979 -187,706 24,025

Soyoil

-23,734 -4,179 102,298 -4,795 -75,648 7,582

CBOT

wheat -126,324 -13,311 66,626 -760 27,064 11,070

KCBT

wheat -5,464 -12,835 31,510 -1,207 -18,336 9,755

MGEX

wheat -8,206 -4,796 902 -79 1,658 2,604

———- ———- ———- ———- ———- ———-

Total

wheat -139,994 -30,942 99,038 -2,046 10,386 23,429

Live

cattle 107,551 518 50,737 853 -168,949 -1,545

Feeder

cattle 14,587 1,378 810 -472 -4,375 -319

Lean

hogs -6,823 13,839 46,994 -591 -36,371 -7,942

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

25,685 6,449 -53,540 6,736 1,619,667 50,130

Soybeans

13,313 22 -29,340 1,454 733,018 -16,995

Soymeal

16,975 1,177 16,368 -1,365 473,433 -9,139

Soyoil

-1,699 1,296 -1,218 96 508,660 12,772

CBOT

wheat 23,958 3,496 8,677 -494 462,482 32,903

KCBT

wheat -8,136 1,360 425 2,928 202,728 18,250

MGEX

wheat 2,435 -670 3,211 2,941 58,032 3,060

———- ———- ———- ———- ———- ———-

Total

wheat 18,257 4,186 12,313 5,375 723,242 54,213

Live

cattle 27,789 1,905 -17,128 -1,731 426,486 -1,253

Feeder

cattle 1,184 -827 -12,206 241 77,686 -1,100

Lean

hogs -5,604 -2,115 1,805 -3,191 309,981 5,780

101

Counterparties Take $2.207 Tln At Fed Reverse Repo Op. (prev $2.242 Tln, 101 Bids)

US

Change In Nonfarm Payrolls Apr: 253K (est 185K; prev 236K)

US

Unemployment Rate Apr: 3.4% (est 3.6%; prev 3.5%)

US

Average Hourly Earnings (M/M) Apr: 0.5% (est 0.3%; prev 0.3%)

US

Average Hourly Earnings (Y/Y) Apr: 4.4% (est 4.2%; prev 4.2%)

US

Change In Private Payrolls Apr: 230K (est 160K; prev 189K)

US

Change In Manufacturing Payrolls Apr: 11K (est -5K; prev -1K)

US

Average Weekly Hours All Employees Apr: 34.4 (est 34.4; prev 34.4)

US

Labour Force Participation Rate Apr: 62.6% (est 62.6%; prev 62.6%)

US

Underemployment Rate Apr: 6.6% (prev 6.7%)

Canadian

Net Change In Employment Apr: 41.4K (est 20.0K; prev 34.7K)

Canadian

Unemployment Rate Apr: 5.0% (est 5.1%; prev 5.0%)

Canadian

Hourly Wage Rate Permanent Employees (Y/Y) Apr: 5.2% (est 4.8%; prev 5.2%)

Canadian

Participation Rate Apr: 65.6% (prev 65.6%)

Canadian

Full Time Employment Change Apr: -6.2K (prev 18.8K)

Canadian

Part Time Employment Change Apr: 47.6K (prev 15.9K)

·

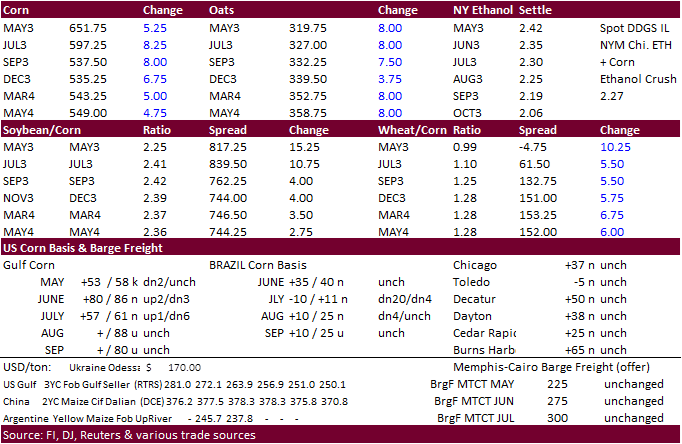

CBOT

corn futures ended higher and were up for the third consecutive day on short covering and rising Black Sea tensions.

CFTC reported a much larger than expected net short position for managed money (futures and options) as of May 2. Additional short covering next week should not be ruled out.

·

No decision was reached over the Black Sea grain deal. Today’s talks were technical in nature and negotiations are expected to start early next week.

·

French corn plantings reached 59 percent as of May 1, up from 44 percent previous week. Weather remains good.

·

AgriCensus noted 55,000 tons of South African corn arrived in China, a rare delivery. The volume was most China ever imported from South Africa (37,800 tons were imported over the years). Cofco had a ceremony for the occasion.

Reuters noted China bought a total of 108,000 tons of corn from South Africa and it was exported between March 25 and April 14.

·

(Bloomberg Intelligence) — China’s pork prices could recover on falling slaughter rates as elevated soybean meal prices discourage farmers from fattening pigs. Pork might revisit the top of its price range before 2019’s African

swine fever outbreak, which could lift WH Group’s China pork income. Soybean meal demand might weaken.

Export

developments.

-

Algeria

seeks up to 140,000 tons of corn for May through August shipment. Late last week they bought an undisclosed amount of milling wheat.

Updated

05/02/23

July

corn $5.00-$6.50

December

corn $4.75-$6.50

·

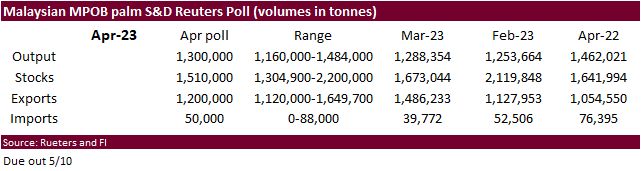

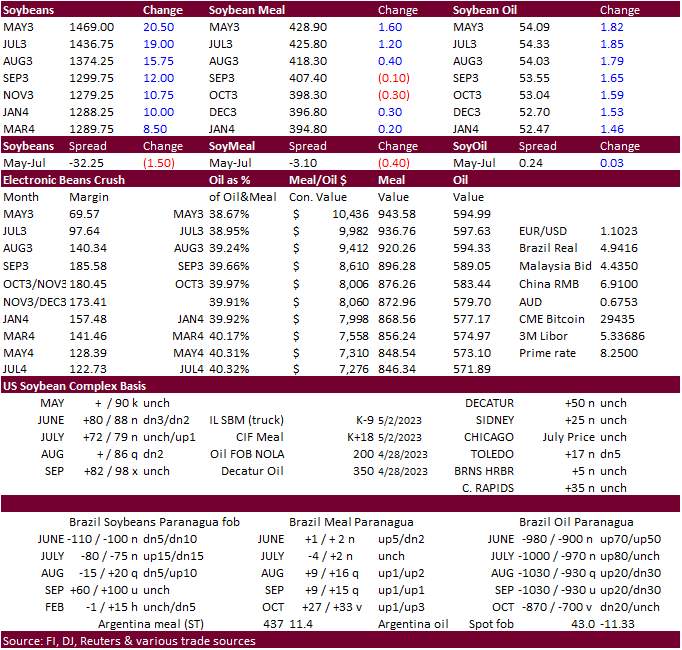

Soybeans ended sharply higher led by soybean oil on positioning ahead of the weekend and a rally in palm oil futures. Meal ended mixed on product spreading. Prior to the session, week to date soybean oil was lagging appreciation

against other competing vegetable oil markets, such as the week to date change in SA fob SBO and palm oil futures.

This

morning offshore values were leading SBO higher by about 81 points this morning (13 higher for the week to date) and meal $0.20 short ton lower ($0.20 lower for the week).

·

News was light.

·

There was a CME South American soybean block trade of 184 November lots (25,000 tons per lot) today. That might be the largest we have ever seen.

·

The Brazilian real in cash was below 5 again and this may slow farmer selling.

·

Argentina soybean and corn crop conditions fell one point each last week. The BA grains exchange warned of another downward reduction to the soybean and corn crop, currently forecast at 22.5 and 36.0 million tons, respectively.

·

(Reuters) – Ukraine, a leading European oilseeds grower, is likely to harvest up to 3.6 million tons of rapeseed in 2023, up from about 3.2 million tons in 2022, the APK-Inform agriculture consultancy said on Friday. A report

by the consultancy said that the larger harvested area was the main reason for the higher projection. Farmers sowed a record 1.5 million hectares of rapeseed last year, but about 17% of the area was not harvested owing to the Russian invasion.

·

Polls for Malaysian April ending stocks call for a 11-month low.

·

Palm oil futures gained 7.8% for the week. Malaysia palm futures increased 176 ringgit to 3601, and cash increased $47.50 to $877.50/ton.

Export

Developments

-

Algeria

seeks up to 70,000 tons of soybean meal for June through July 15 shipment.

Updated

05/05/23

Soybeans

– July $13.75-$15.25,

November $12.00-$15.00

Soybean

meal – July $375-$475,

December $325-$500

Soybean

oil – July 50-56,

December 48-58

·

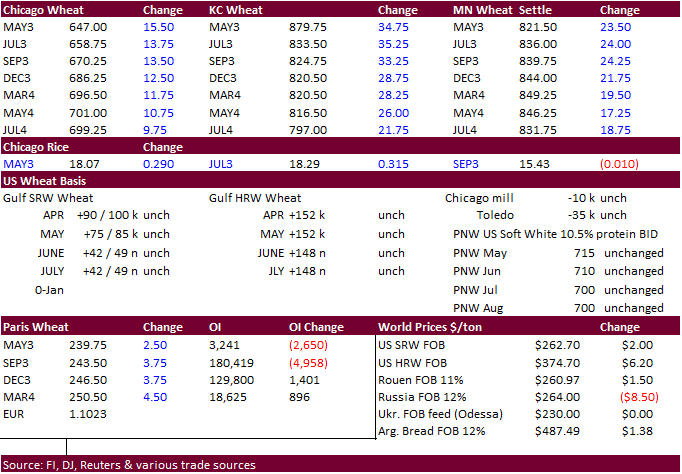

US wheat futures ended higher as Black Sea grain export deal talks began today. No decision was reached, as expected. Talks will resume early next week. Geopolitical tensions remain high after Russia accused the US that they were

behind the Kremlin drone strike.

·

With the rally in wheat, we again adjusted our trade ranges for the July position.

·

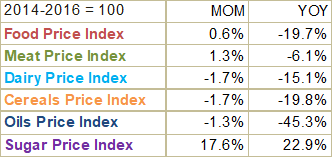

FOA’s food price index for the month of April was up for the first time in a year.

·

Ukraine shipments out of the Black Sea are slowing ahead of the expiration of the safe corridor deal. Arrival of ships dropped to two from three per day this week. Meanwhile 40 to 60 ships have been unable to leave due to tight

restrictions.

·

42.5 million tons of grain had been exported from Ukraine as of May 5 (46.2MMT year ago), including 14.6 million tons of wheat, 25.1 million tons of corn and about 2.5 million tons of barley

·

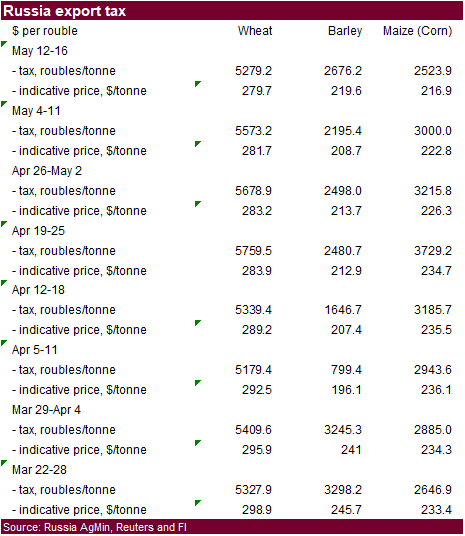

Russia’s wheat export tax is set to increase 5.3% for the week of May 12-16 (table below).

·

French soft wheat conditions as of May 1 fell one point to 93% from the previous week and compare to 89 percent year ago.

·

September Paris wheat futures were 3.75 euros higher at 244 euros. It traded two-sided today. For the week September was up 3.2%.

·

The FAO Food Price Index averaged 127.2 points in April 2023, up 0.8 points (0.6 percent) from March and nearly 20 percent below last year. Peak was 159.7 as of March 2022. The April increase was due in large part to the rise

in the sugar price index and minor uptick in the meat price index. Cereals, dairy and vegetable oil prices declined from March.

Export

Developments.

·

Tunisia bought 100,000 tons of durum wheat and 75,000 tons of feed barley. Shipment for durum is between June 5 and July 15 and barley between June 10 and July 15. Earlier the lowest

offer for durum wheat was $379.19/ton c&f and barely at $254/ton c&f.

·

Taiwan bought 52,225 tons of US wheat for June 21-July 5 shipment.

-

34,475

tons of U.S. PNW dark northern spring wheat of a minimum 14.5% protein content at an estimated $338.77 a ton FOB. -

11,875

tons of hard red winter wheat of a minimum 12.5% protein content at $338.06 a ton FOB -

5,875

tons of soft white wheat of a minimum 8.5% and maximum 10% protein at $279.25 a ton FOB. (Reuters)

·

Jordan seeks 120,000 tons of feed barley on May 10 for October 16-31 and November 1-15 shipment.

Rice/Other

·

(Xinhua) — Vietnam’s April rice exports doubled in both value and volume to 574 million U.S. dollars and 1.1 million tons due mainly to significant gains in prices and robust demand, Vietnam News Agency reported on Friday. The

Southeast Asian country posted a 43.6 percent year-on-year increase in its rice shipments in the January-April period to 2.95 million tons, while it recorded a surge of 54.5 percent in export earnings to 1.56 billion dollars in the period, the General Statistics

Office said.

Updated

05/05/23

KC

– July $7.50-8.75

MN

– July

$7.50-9.00

#non-promo