Selected

trend yield grid for 2021 US production

Weather

Next

7 days

World

Weather, Inc.

WEATHER

TO WATCH THIS WEEK

- Frost

occurred in southwestern Argentina overnight with little to no impact on unharvested crops

- Frost

is expected again Wednesday morning over southern Buenos Aires with a couple of extreme lows near freezing, but the impact should be similar - Hard

freezes occurred from Saskatchewan into North Dakota overnight with extreme lows in the middle and upper teens to the 20s - No

permanent damage was done to most crops, although perhaps a few of the earliest emerged spring crops might have been negatively impacted - Most

of the cold will moderate over the next couple of nights, but additional frost and a few light freezes are expected as far south as northern Iowa and northern and western Nebraska - The

impact of this will be mostly minimal - South

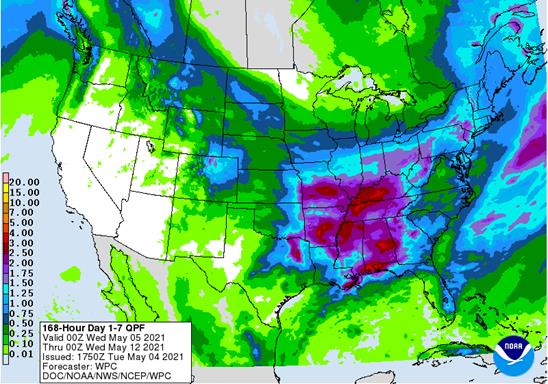

Dakota to Alberta and Montana will receive some welcome rain Friday into the weekend - Rainfall

of 0.20 to 0.80 inch and local totals to 1.25 inches is possible - Showers

of a more limited significance are possible today in a part of the same region - Drought

remains a concern for the heart of Saskatchewan, east-central Alberta and central and southern Manitoba, Canada - Rain

is not likely in these areas – at least not significantly – for the next ten days - Lower

U.S. Midwest, Delta and Tennessee River Basin will be frequented by rain too often during the next ten days limiting field progress, although some will take place - Drier

and warmer weather is needed to induce the best environment - Recent

corn planting progress in the U.S. has been substantial, but the planting pace will slow with the more active weather in parts of the Midwest during the coming week to ten days

- U.S.

hard red winter wheat production areas will receive a good mix of weather during the next two weeks, but rain volumes will be light in the west-central and southwestern Plains leaving an ongoing need for greater rain - Showers

in the southwestern U.S. Plains Monday produced 0.05 to 0.56 inch of rain with local totals to 0.73 inch

- Areas

from southwestern Kansas into the Texas Panhandle benefited most from the rain along with a few areas in western Oklahoma - West

Texas rain chances will be best Friday into Saturday when scattered thundershowers develop

- Resulting

rainfall will be a little too light for a lasting impact on the region - Another

chance for rain will evolve during mid-week next week - Dryness

will remain a concern for the next two weeks, despite recent rain and that which is forthcoming - South

Texas rain chances may improve next week, but the area will continue drier biased for much of the next ten days - U.S.

southeastern states will experience a greater amount of rain during the coming ten days than previously advertised which may slow field progress for a while - Far

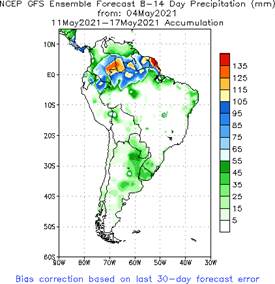

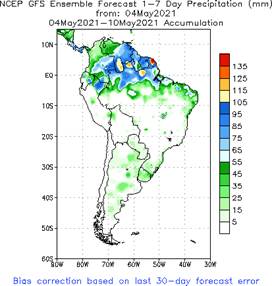

western U.S. weather will continue drier biased for an extended period of time. - Brazil

is facing another ten days to two weeks of dry weather in its Safrinha corn and cotton areas along with its sugarcane, coffee and citrus areas - Most

of the drying is normal for this time of year, but soil conditions are already quite dry and reproducing and filling Safrinha crops will suffer enough stress to hurt production - Brazil

rainfall will be mostly confined to the far northern fringes of crop country and in Rio Grande do Sul for the coming ten days - Crops

in Rio Grande will benefit greatly from alternating periods of rain and sunshine - Argentina

rainfall overnight and that expected into Wednesday will be sufficient to maintain moisture abundance for late season crop development - Argentina

will be dry Thursday through Monday with another chance for rain during mid-week next week

- The

bottom line will be very good for late season crops, although a little less rain might be best for late season summer crop maturation and harvest progress - The

moisture will be good for winter wheat planting late this month and in June - Another

period of drying will occur late next week through May 17. - Europe

will receive waves of rain this week across some of the central and north improving topsoil moisture in some areas after recent drying - Southern

Europe will be drier this week - Temperatures

will be cooler than usual in the north and near to above normal in the south - Next

week’s weather will be wetter from northern Spain and Portugal through France to Poland, Slovakia and Hungary while a little drier farther to the north - Temperatures

will also be a little warmer in the north next week while cooler in the wetter areas - Several

waves of rain will impact western Russia, Belarus, the Baltic States and in a few areas of northwestern Ukraine during the coming ten days maintaining wet field conditions

- Farming

activity will remain restricted in these areas with rising concern over delayed spring planting - Good

field progress will occur farther to the south where much less precipitation is expected, and temperatures will be more seasonable - Temperatures

will be cooler than usual in the wetter areas of the northwest. - Eastern

Russia New Lands will experience a dry and warm bias through the next two weeks - The

environment will eventually be great for spring planting - North

China Plain weather will be limited on precipitation for the next couple of weeks and temperatures will be warming - A

steady decline in soil moisture is expected with temperatures trending warmer

- A

rising need for rain is expected later this month - Excellent

planting progress is anticipated for a while until dryness becomes more of an issue - Northeastern

China will experience frequent rain and mild to cool weather over the next week resulting in farming delays, but soil moisture will be bolstered for use later this spring - Southern

China rain will fall abundantly and frequently over the next couple of weeks limiting some farming activity and keeping the region saturated or nearly saturated - Some

local flooding will be possible at times - Western

Australia will receive waves of rain through mid-week this week while other areas are mostly dry

- The

moisture will support some early season wheat, barley and canola planting, but follow up moisture will be needed - A

few sporadic showers may occur in other areas, but resulting rainfall will not likely be very great except in the Great Dividing Range of the east

- Temperatures

will be near to above average - Western

Australia started to receive rain Monday with moisture totals to 0.39 inch through dawn today - Rain

also fell in New South Wales and Victoria with rainfall to 0.62 inch - The

exception was in coastal areas of central Victoria where very heavy rain fell and possibly resulted in local flooding - More

than 4.00 inches of rain occurred near the coast - South

Africa will receive some late season showers again Friday through the weekend and into early next week

- Next

week will trend drier once again - The

environment will be good for harvesting and late season crop maturation - Production

this year has been very good for nearly all crops - Winter

wheat and barley planting should benefit from the moisture, although rain will soon be needed in the west - India

weather will remain good for winter crop maturation and harvest progress, although showers will continue periodically in some areas - Southern

India will be wetter than usual over the next couple of weeks and rain will also fall frequently from Bangladesh into the far Eastern States - Delays

to harvest progress will be greatest in the south - Showers

in northern India will not be great enough to be much of a factor to crop maturation or harvesting - No

tropical cyclones are present in the world today - Southern

Oscillation Index is mostly neutral at +0.06 and the index is expected to slip a little lower over the next couple of the days, but stay mostly in a narrow range - Mexico

drought will continue during the next two weeks, although scattered showers will occur periodically in the east and far south with the south wettest.

- Next

week will be wetter than this week favoring the east half of the nation - Xinjiang

China’s cotton areas turned a little cooler Monday with no rain - Temperatures

will trend warmer again for the next couple of days and then cool off briefly Friday into Saturday and the heat up one more time before cooling again early to mid-week next week - Not

much rain is expected - Crop

development and additional planting are occurring favorably - North

Africa rainfall will receive erratic rainfall this week favoring Algeria and Tunisia where crop conditions will be good or getting better. Northwestern Algeria will see the lightest rain - Morocco

is not likely to see nearly as much rain and may experience net drying, but crops are in the best shape in northern Morocco and drying should not induce any harm.

- Southwestern

Morocco is still too dry, though - Temperatures

are trending warmer than usual - West-central

Africa will a mix of rain and sunshine during the next ten days - Crop

conditions will stay good - East-central

Africa rainfall has been erratic in recent weeks and a boost in rainfall is coming to Kenya, Ethiopia and northern Tanzania during the coming week - Southeast

Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks - Greater

rain is needed in the northern and western Philippines and in southern parts of central Vietnam and other mainland crop areas - New

Zealand precipitation for the next two weeks will be lighter than usual in North Island and eastern parts of South Island while moderate to heavy rain occurs long the west coast of South Island possibly inducing some flooding - Temperatures

were near to above average

Source:

World Weather, Inc.

Wednesday,

May 5:

- EIA

weekly U.S. ethanol inventories, production - Malaysia

May 1-5 palm oil export data - New

Zealand Commodity Price - HOLIDAY:

Japan, China

Thursday,

May 6:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

May 7:

- China

customs publishes trade data, including imports of soy, edible oils, meat and rubber - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - CNGOIC

monthly report on Chinese grains & oilseeds - Canada’s

Statcan to issue wheat, canola, barley and durum stockpile data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Macro

YELLEN

SAYS RATES MAY HAVE TO RISE TO STOP ECONOMY OVERHEATING

YELLEN

SAYS REALLOCATION MAY RESULT IN SOME SMALL INCREASES IN INTEREST RATES

US

Trade Balance (USD) Mar: -74.4B (est -74.3B; prevR -70.5B; prev -71.1B)

Canadian

International Merchandise Trade Mar: -1.14B (est 0.55B; prev 1.04B)

Canadian

Building Permits (M/M) Mar: 5.7% (est 1.5%; prevR 3.1%; prev 2.1%)

US

Crude Oil Exports Fell To 2.61Mln B/D In March (Vs 2.65Mln B/D In Feb) – US Census

Crude-oil

production from OPEC members declined by 50,000 barrels per day in April, according to the latest Bloomberg survey.

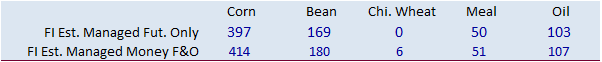

- CBOT

corn

was higher on bull spreading (does not include May) on same fundamentals and inflation story. Strong US corn exports for the month of March added to the bullish undertone. High cash prices, tight inventories, and Brazilian weather continues to support prices.

Some might have been eyeing the CFTC fund positions as there is still some room to the upside for managed money to add long positions. Recall there were no record long position posted as of last Tuesday.

- Although

the May position already traded above $7.00, the “most active” July contract reached above 2013 for the first time since 2013. We could see $7.50 before rationing hits domestic end users. Meanwhile ethanol plants are still bidding on corn as prices for the

fuel have been creeping higher. - US

corn exports during March were a record 373 million bushels, above the previous record set in May 2018. February 2021 corn exports were 248 million bushels and March 2020 were 182 million. We were using 2.800 billion bushels prior to US trade data, well

above 2.675 billion USDA has for April. However, based on latest weekly April inspections data, we raised our estimate by 50 million to 2.850 billion. April US corn exports could end up about 10 percent lower than March. Next week USDA should release its

monthly inspections report that will give us a better indication for April US corn exports.

- US

corn plantings came in slightly above trade expectations and should be around 50 percent complete by Wednesday. As a coworker mentioned, it’s not what’s going in the ground but what’s in the bins that matters. As of Sunday, Iowa was at 69%, Minnesota 60%

and Illinois 54% planted. - Funds

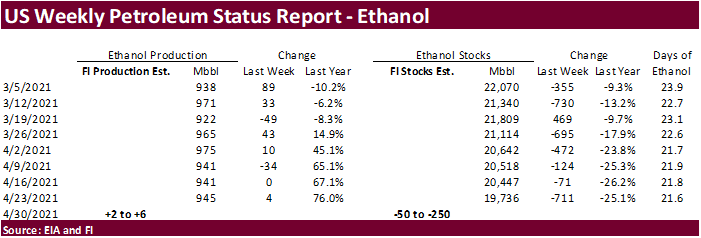

bought an estimated net 23,000 corn contracts. - A

Bloomberg poll looks for weekly US ethanol production to be up 9,000 barrels (949-965 range) from the previous week and stocks down 12,000 barrels to 19.724 million.

Export

developments.

- None

reported

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.00-$6.50 range.

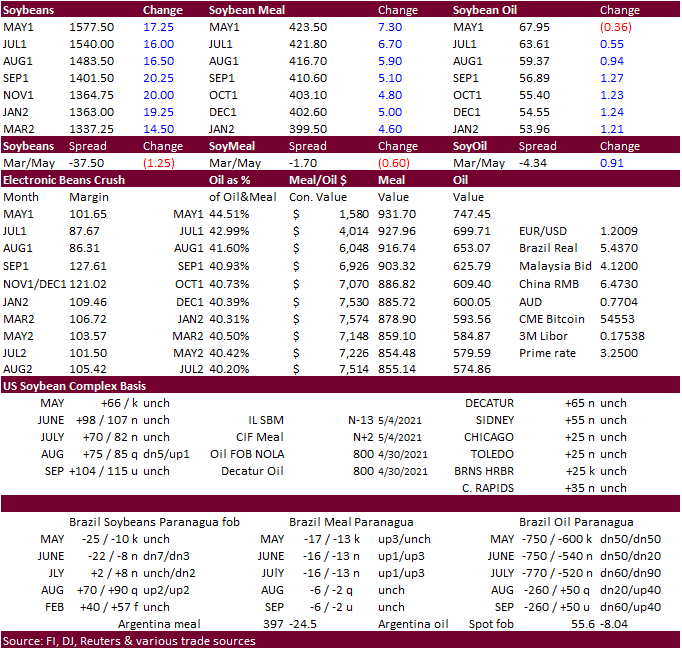

- CBOT

soybeans

started and ended sharply higher despite a higher USD and China on holiday. July ICE canola traded limit higher by $30 or 3.5% to $894 per ton. April Brazil soybean exports were a very good 17.4 million tons, an all-time high, up from 13.5 million for March

and down from 14.8 million from April 2020. Anec sees Brazil May soybean exports slipping to 12 million tons. July SBO hit a fresh record today. Meal was up sharply.

- Some

traders are concerned India demand for palm oil will slow because of the surge in COVID-19 cases but vegetable oil prices in general are very strong across the globe. Soybean oil basis was mixed from the previous week across selected US locations, according

to USDA AMS. Attached is our weekly US soybean cash crush sheet. - March

soybean exports came in at expectations of 84 million bushels. We will keep the export forecast unchanged at 2.285 billion, 5 million above USDA. Imports were 1 million bushels, and we lowered our import forecast by 6 million tons 23 million. Soybean oil

exports were only 156 million pounds, well below our working estimate. We took exports down to 2.550 billion from 2.675 billion previously. Domestic use will likely be upward revised. There were no surprises in meal exports or imports for the month of March.

- Low

river water levels are starting to affect boat loadings along Rosario’s ports.

- A

Bloomberg survey calls for Malaysian palm oil stocks at the end of last month to be at a 5-month high of 1.5 million tons.

- China

will be on holiday through Wednesday for Labor Day. - US

planting progress at 46% complete for corn and 24% for beans is progressing at a rapid pace.

- Funds

on Tuesday bought an estimated net 9,000 soybean contracts, bought 4,000 soybean meal and bought 3,000 soybean oil.

EIA

– U.S. imports of biomass-based diesel increased 12% in 2020

U.S.

imports of biomass-based diesel, which include biodiesel and renewable diesel, grew 12% in 2020 to more than 31,000 barrels per day (b/d), increasing for the second consecutive year. Imports of biomass-based diesel increased in 2020 because of growing demand

to meet government renewable fuel programs. U.S. consumption of biomass-based diesel, unlike demand for other fuels, remained relatively unaffected by responses to COVID-19 during 2020.

https://www.eia.gov/todayinenergy/detail.php?id=47816&src=email

- Results

awaited: Algeria

seeks 30,000 tons of soybean meal on April 29 for shipment by June 15. - Results

awaited: Tunisia seeks 27,000 tons of soybean oil and/or rapeseed oil for late June / early July shipment.

Updated

4/26/21

July

soybeans are seen in a $14.75-$16.50; November $12.75-$15.00

Soybean

meal – July $400-$460; December $380-$460

Soybean

oil – July 56-70; December 48-60 cent range

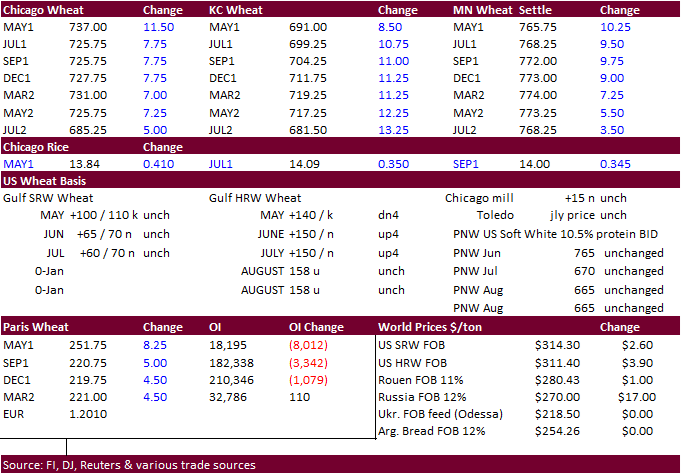

- US

wheat ended higher led by KC type wheat on strength in corn. KC type wheat conditions slightly declined from the previous week while white and SRW wheat improved. The US precipitation forecast calls for net drying across parts of the US Great Plains over

the next week.

- March

US all-wheat exports were 79 million bushels, above expectations, above 67 million for Feb and 67 March 2020. We are using 1.000 billion bushels for US wheat exports (one month to go) versus 996 previous and compares to 985 million for USDA.

- Overnight

Tunisia announced an import tender for 50,000 tons of feed barley and SK is in for 134,994 tons of rice.

- September

Paris wheat was up 4.75 euros to 220.75. - Funds

on Tuesday bought an estimated net 6,000 CBOT SRW wheat contracts. - Argentina

2021-22 wheat production was estimated at 19 million tons, a record, by the BA Grains Exchange. That would be up from 17 million tons this year.

Export

Developments.

- Tunisia

seeks 50,000 tons of optional origin animal feed barley on May 5 for shipment between June 5 and June 20 if from the Black Sea or slightly earlier if form Europe.

- The

Philippines seeks up to 185,000 tons of wheat on May 4 for shipment in June, July and August depending on origin.

- Bangladesh

seeks 50,000 tons of milling wheat on May 6.

Rice/Other

·

Results awaited: Offers low as $407.79/ton – Bangladesh seeks 50,000 tons of rice on May 2.

·

South Korea’s Agro-Fisheries & Food Trade Corp seeks 134,994 tons of rice from Vietnam, China, the United States and Australia, on May 13, for arrival between September 2021 and January 2022.

Updated

4/26/21

July

Chicago wheat is seen in a $6.75-$8.00 range

July

KC wheat is seen in a $6.60-$7.50

July

MN wheat is seen in a $7.15-$8.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.