PDF Attached

FOMC

Hikes By 25Bps; Target Range Stands At 5.00% – 5.25%

–

Interest Rate On Reserves Balances Raised By 25Bps To 5.15%

WTI

crude oil was down sharply again, back below $70/barrel. The USD was off more than 56 points by late afternoon trading. Attached is out updated US acreage table.

Black

Sea tensions sent wheat and corn higher today. Russia accused Ukraine of drone attack on Kremlin, a couple days before the two countries are going to sit down and talk about the Black Sea grain export deal. Russia will also hold talks with United Nations officials

in Moscow on the same date. Soybeans rallied late to close higher. Meal fell and soybean oil recovered. The US weather forecast improved from that of Tuesday. The lower Great plains will see rain through the end of the week. The southwestern areas of the

Midwest will be wet Thursday before moving into the south central areas Friday.

Fund

estimates as of May 3

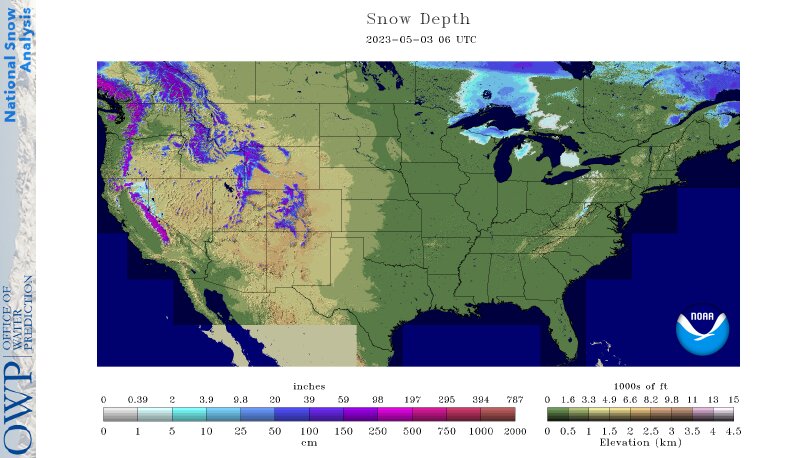

US

snowpack is receding for the northern US and a problem for some California producers with risk of flooding from upcoming Sierra runoff.

WEATHER

TO WATCH

-

Drought

in Alberta and western Saskatchewan is unlikely to abate during the next two weeks, despite a few showers possible

-

Unusual

warmth occurred in central Alberta Monday and Tuesday with an extreme highs of 86 and 84 Fahrenheit respectively; many temperatures were in the 70s and lower 80s

-

The

heat will continue into Thursday with some of the warmest conditions shifting into western Saskatchewan

-

Drought

will continue in Spain, Portugal and northwestern Africa through the coming week and perhaps longer; although, some rain will fall in northeastern Algeria and northern Tunisia briefly next week

-

Northern

Kazakhstan and southern parts of Russia’s eastern New Lands will continue dry and warm for another week, but some relief may come along in the May 10-16 period.

-

Dryness

has been supporting aggressive spring planting and does not (yet) pose much of a threat to long term crop development unless than pattern resumes later this month or this summer -

U.S.

Midwest weather will improve with drier and warmer conditions through Thursday

-

Rain

will develop in the lower Midwest Friday into Saturday with 0.40 to 1.50 inches resulting -

Alternating

periods of rain and sunshine are expected through next week in all of the Midwest favoring spring fieldwork and early season crop development -

West

Texas cotton, corn and sorghum areas received some welcome rain overnight with 0.05 to 0.30 inch common and local totals of 0.40 to 1.03 inches

-

Additional

showers and thunderstorms are expected today and tonight, again this weekend and more next week -

The

precipitation will be sporadic and mostly light -

Warm

temperatures will induce strong evaporation and drying rate resulting in limited relief from drought -

Atmospheric

moisture will be increasing and that will help to set the stage for better rainfall later this month -

Texas

Blacklands, Coastal Bend and to a lesser degree South Texas will have opportunity for generalized rain during the coming ten days favoring long term crop development -

Some

of this rain will reach into Louisiana favoring sugarcane and rice areas for rain as well -

Red

River Basin of the North moisture profile will remain abundant to excessive for a little while longer due to rain expected Friday that will linger through early next week resulting in 0.30 to 1.00 inch of moisture is expected with local totals to 1.50 inches

falls over the already moist topsoil -

River

flooding continues along the upper half of the Mississippi and in the Red River Basin of the North and this process will continue through much of this month -

Prevent

plant is still a possibility for a part of these region’s and in Manitoba Canada, but much will be determined by rainfall that occurs later this month and in June -

A

significant break from rain is needed along with warm temperatures to get fields in better shape for planting -

U.S.

Delta will be plenty moist over the next ten days keeping some farming activity a little slow -

U.S.

southeastern states will see alternating periods of rain and sunshine through the next two weeks maintaining good crop development conditions, but slowing fieldwork at times -

Argentina’s

drier bias will continue over the next ten days maintaining a good summer crop maturation and harvest outlook, but a big boost in soil moisture is needed for winter wheat planting -

Wheat

planting does not usually begin until late this month and June is the most important month for getting crops planted on time -

Center

south and center west Brazil is drying down, but that is normal for this time of year -

Concern

remains over long term soil moisture for the late planted corn -

Rain

will be needed in late May and early June to support the very latest planted crops through reproduction and filling -

Coffee,

citrus and sugarcane in Brazil are maturing favorably with some early harvesting already under way -

Coffee

and citrus production should be high this year while sugarcane yields may be off a little bit because of too much rain at times in the heart of the production region and late season dryness in the minor areas of the north -

Cold

weather will continue to impact northeastern Europe over the next week with the next coldest period of time coming up late this week into early next week

-

No

crop damage is likely except possibly to flowering fruit trees -

Europe

and the western CIS will receive frequent bouts of rain during the next ten days resulting in favorable soil moisture -

This

does not include the Iberian Peninsula or the eastern CIS New Lands where dryness is an ongoing concern -

India’s

weather will continue unsettled over the next ten days and additional waves of rain will impact various parts of the nation, but big soakings of rain like that of this past weekend are not expected to occur again.

-

The

far north and extreme south will be wettest at least for a while -

Field

working delays have occurred and some of the wettest areas have been suffering from quality declines -

Western

Australia has a very good opportunity for rain this weekend and again next week -

The

two rain events should bolster topsoil moisture for improved wheat, barley and canola planting, emergence and establishment -

Other

areas in Australia will continue to experience favorable weather for summer crop harvesting and winter crop planting -

All

of eastern China’s agricultural areas will receive rain at one time or another during the next two weeks. -

East-central

and southeastern parts of the nation will be wettest, but the rain will be spread out enough to limit the incidence of flooding -

Crop

conditions should stay mostly favorable, although less rain is needed in rapeseed areas to protect crop quality as the crop matures and is harvested -

Northeast

China will be driest -

Xinjiang,

China continues to battle periods of cool weather and needs to warm up and be consistently warm to support cotton, corn and other crop development.

-

Some

warming is expected over the next few days, but a new surge of cool air is expected late this weekend and next week dropping temperatures back to the 70s and lower 80s Fahrenheit in the key crop areas of the west -

Much

cooler conditions are expected in the far northeast -

Mainland

areas of Southeast Asia are getting more routinely occurring showers and thunderstorms, but resulting rainfall has continued to be lighter than usual

-

Monsoonal

precipitation usually begins in the south late this month -

Indonesia

and Malaysia will continue to experience frequent bouts of rain over the next ten days – no area is expected to become too dry or excessively wet -

Philippines

rainfall will be timely, but there is need for greater rain in the north -

Middle

East soil moisture is greatest in Turkey, but there is need for more moisture in areas to the south and east -

The

environment is not critical, but cotton and rice would benefit from greater rain and improved soil moisture -

Wheat

production was mostly good this year -

South

Africa rainfall will be infrequent and light enough over the next ten days to support most late season crop needs while allowing some harvest progress to continue -

Cotton

areas from southern Mali to Burkina Faso need significant rain to support cotton planting and establishment in unirrigated areas -

Some

showers are possible during the second week of the forecast -

Drought

continues in central and western Mexico while recent rain in the east has improved crop and field conditions -

East-central

Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was 0.33 and it should move erratically over the next several days

Source:

World Weather, INC.

Wednesday,

May 3:

- EIA

weekly US ethanol inventories, production, 10:30am - HOLIDAY:

China,

Japan, Vietnam

Thursday,

May 4:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - New

Zealand Commodity Price - HOLIDAY:

Japan, Malaysia, Thailand, Bangladesh

Friday,

May 5:

- FAO

World Food Price Index - Malaysia’s

May 1-5 palm oil export data - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Japan, South Korea, Thailand

Source:

Bloomberg and FI

Macros

FOMC

Hikes By 25Bps; Target Range Stands At 5.00% – 5.25%

–

Interest Rate On Reserves Balances Raised By 25Bps To 5.15%

US

MBA Mortgage Applications Apr 28: -1.2% (prev 3.7%)

US

30-Yr MBA Mortgage Rate Apr 28: 6.50% (prev 6.55%)

US

ADP Employment Change Apr: 296K (est 148K; prevR 142K)

US

ISM Services Index Apr: 51.9 (est 51.8; prev 51.2)

–

Prices Paid: 59.6 (prev 59.5)

–

Employment: 50.8 (prev 51.3)

–

New Order: 56.1 (prev 52.2)

102

Counterparties Take $2.258 Tln At Fed Reverse Repo Op. (prev $2.267 Tln, 102 Bids)

·

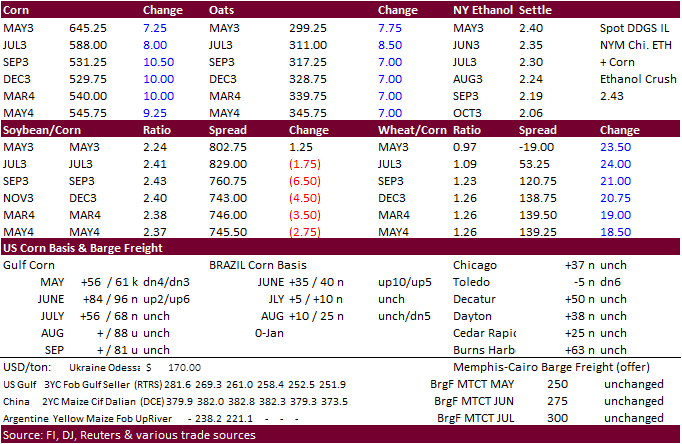

CBOT

corn futures traded two-sided, ending higher bias back months on renewed Black Sea grain deal concerns. It was lower earlier from sharply lower WTI crude oil. WTI closed the late session $3.45 lower.

·

US producer selling was slow for corn and soybeans today. Basis was mostly steady.

·

Brazil see rain over the next week, benefiting second corn crop development.

·

China is back from holiday Thursday.

·

The USDA Broiler report showed eggs set in the US down slightly and chicks placed down slightly. Cumulative placements from the week ending January 7, 2023, through April 29, 2023 for the United States were 3.17 billion. Cumulative

placements were up slightly from the same period a year earlier.

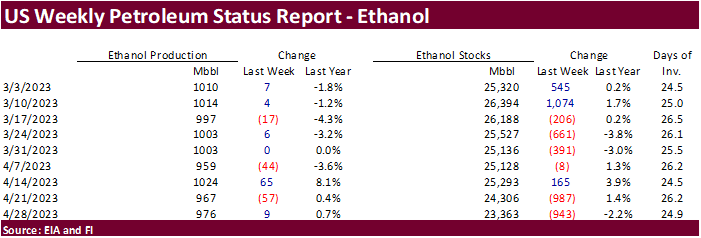

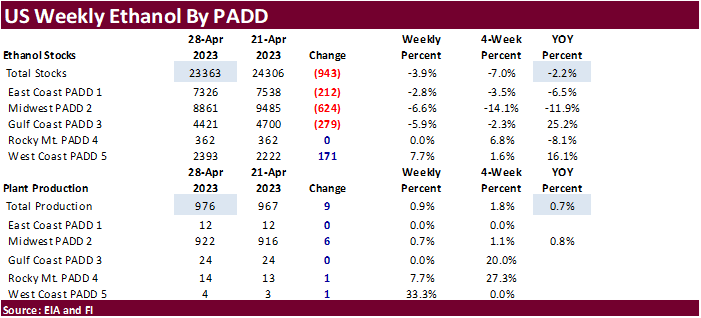

Weekly

ethanol production increased 9,000 barrels per day to 976,000 barrels and stocks fell a large 943,000 barrels to 23.363 million barrels.

For comparison, a Bloomberg poll looked for weekly US ethanol production to be down 4,000 thousand barrels and stocks up 117,000 barrels. Production is down on average 7,000 barrels over the past four weeks. Stocks are lowest since December

2. US gasoline stocks were up 1.74 million barrels to 222.9 million. US gasoline demand fell 893,000 barrels to 8.618 million.

US

DoE Crude Oil Inventories (W/W) 28-Apr: -1.281M (est -500K; prev -5.054M)

–

Distillate Inventories: -1.190M (est -800K; prev -577K)

–

Cushing OK Crude Inventories: +541K (prev +319K)

–

Gasoline Inventories: +1.742M (est -1.500M; prev -2.408M)

–

Refinery Utilization: -0.60% (est 0.55%; prev 0.30%)

EIA:

US Crude Stocks In SPR Fell In Latest Week To Lowest Since Oct. 1983

Export

developments.

·

None reported

Updated

05/02/23

July

corn $5.00-$6.50

December

corn $4.75-$6.50

·

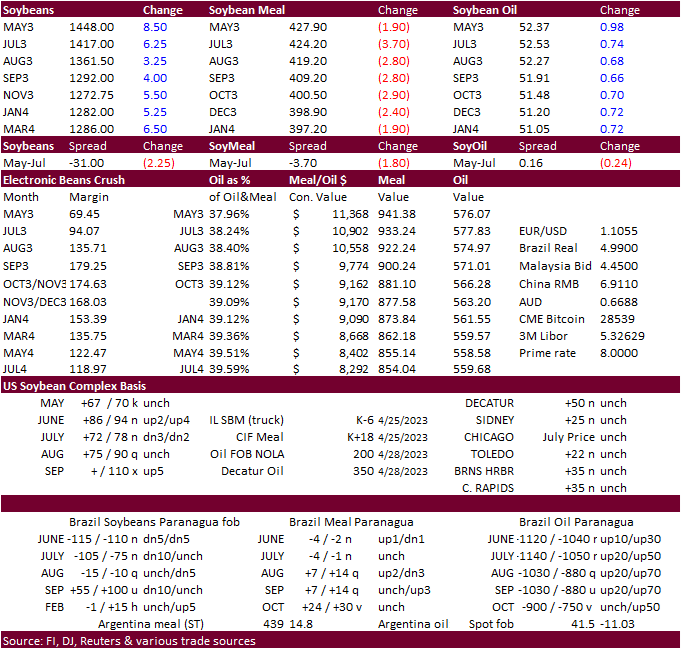

Soybeans rallied to close higher after trading much of the day lower. Soybean meal fell and soybean oil recovered. Soybeans earlier hit a 7-month low. Much of the focus today was on Black Sea news headlines and short covering.

·

July soybean meal settled below its 200-day MA of $427.00.

·

April India’s palm oil imports fell 30% from a month earlier to 508,000 tons last month, according to a Reuters survey. down from 728,530 tons imported in March, a 14-month low. The average monthly imports stood at 879,000 tons

from November 1 through March. SEA should be out with official data mid-May.

·

China was on holiday, returning Thursday.

USDA

Attaché: EU Oilseeds Annual

Export

Developments

-

None

reported

Updated

04/27/23

Soybeans

– July $13.50-$14.75, November $12.00-$15.00

Soybean

meal – July $375-$500, December $325-$500

Soybean

oil – July 48.50-54.00,

December 48-58

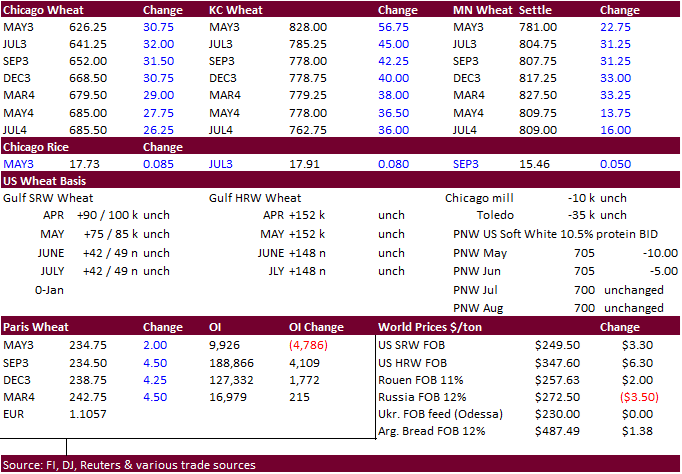

Wheat

·

Black Sea tensions sent wheat higher today. Russia accused Ukraine of drone attack on Kremlin, a couple days before the two countries are going to sit down and talk about the Black Sea grain export deal. Russia will also hold

talks with United Nations officials in Moscow on the same date. Later the Ukraine President mentioned Russia did not appear interested in extending the grain deal.

·

Bottom picking and short covering should be noted. It was a matter of time short traders were to lift profits.

·

September Paris wheat futures was 4.50 euros higher at 235.00 euros, after hitting a multi-month low earlier.

·

JP Morgan processed its 1st grain payment for Russia’s Rosselkhozbank last week, with help by the UN, according to Reuters, and another 40 could be processed, in a follow up story today by the same newswire.

·

Oklahoma’s wheat industry conducted a crop tour and pegged the 2023 yield at 24.6 bushels per acre and production at 54.3 million bushels. That would be the lowest yield and production since 2014. Last year was 28.0 yield and

68.6 million bushel production.

·

Egypt bought 535,00 tons of Russian wheat and 120,000 tons of Romanian origin, at $260 and $250/ton. Late last week Russian 12.5 percent protein wheat was quoted around $265/ton fob, about steady from the previous week.

·

SovEcon: 2022-23 Russia wheat exports are seen at 44.4 million tons and new crop at 43 million tons (large carry in).

·

Ukraine April agriculture exports were 5.3 million tons, down 31 percent from March, lowest in eight months. It included 3.9 million tons of grain and 564,200 tons of vegetable oils.

·

Agritel increased their estimate for the Ukraine wheat estimate to 16.34 million tons from 15.04 million projected back in November for the 2023 year. That compares to 20.5 million tons for 2022.

Export

Developments.

·

Egypt’s GASC bought 655,000 tons of wheat for June 10-30 and/or July 1-20, 2023, shipment. They paid $250 and $260 fob for 535,000 tons Russian and 120,000 tons Romanian origin.

·

Jordan bought about 60,000 ton feed barley for October through FH November shipment.

Rice/Other

·

We are hearing cotton acreage could be smaller than expected for California and far northern Texas growing areas. Might also be down a touch for Arizona.

Updated

05/02/23

KC

– July $7.00-8.25

MN

– July

$7.00-8.50

#non-promo