PDF Attached

CME

Margin changes:

RAISES

SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 7.2% TO $4,100 PER CONTRACT FROM $3,825 FOR MAY 2021

SAYS

INITIAL MARGIN RATES ARE 110% OF MAINTENANCE MARGIN RATES

SAYS

RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON APRIL 30, 2021

Reminder:

CME is resetting price limits for grain, soybean complex and lumber futures on May 2. For example, corn to 40 cents, soybeans to 1.00, wheat to 45.

https://www.cmegroup.com/content/dam/cmegroup/notices/ser/2021/04/SER-8761.pdf

![]()

Mixed

trade across the agriculture space.

The

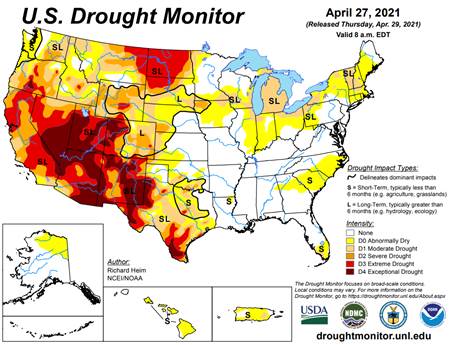

US Drought Monitor as of April 27, percent of crop areas experiencing drought vs. previous week:

- Corn

22 vs. 17 - Soybeans

19 vs. 16 - Durum

93 vs. 92 - Spring

wheat 82 vs. 78 - Winter

wheat 39 vs. 34

Next

7 days

World

Weather, Inc.

CHANGES

OVERNIGHT

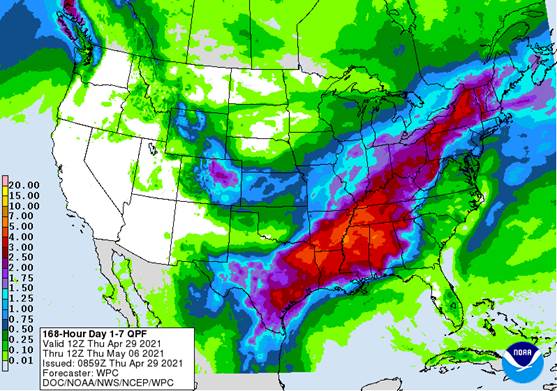

- U.S.

Delta will be wet over this coming week with three disturbances in seven days saturating the ground and inducing some new flooding - Greater

rain was advertised in South Texas and the Texas Coastal Bend Friday into the weekend than suggested Wednesday - Portions

of the dryland region of West Texas received rain overnight with the Garden City COOP reporting 1.68 inches - Super

cell thunderstorms near San Antonio, Texas overnight produced large hail and damaging wind impacting cropland and some personal property - Heavy

rain fell from south-central Texas to Missouri where 1.00 to 3.00 inches and local totals over 5.00 inches resulted overnight - West

Texas will receive some additional rain today in the south and again this weekend in the southeastern fringes of cotton country - U.S.

Central Plains will get some needed rain early next week - U.S.

Midwest weather will be mixed favorably with periods of rain and sunshine and seasonable temperatures

- Greater

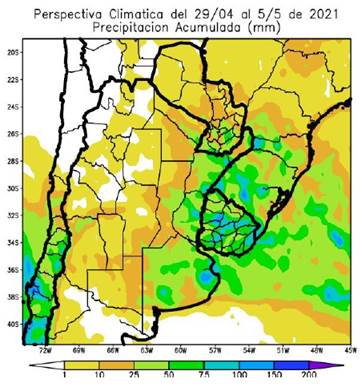

rain was advertised in Canada’s Prairies for late next week and into the following weekend, but confidence was low - Brazil

weather changed little overnight with a dry bias to prevail for ten days to two weeks in Safrinha corn and sugarcane country

MOST

IMPORTANT WEATHER IN THE WORLD

- Brazil’s

Safrinha corn areas are still not likely to get more than sporadic light showers over the next ten days to two weeks - Any

moisture that falls will be welcome, but with daily high temperatures in the upper 70s and 80s in the south and 80s and lower to a few middle 90s in the north it will not be difficult to see net drying

- Dryness

in the soil is more significant than it should be at this time of year keeping the pressure on for production since May is not usually a very wet month - Argentina’s

weather will be favorably mixed over the next two weeks - Soil

moisture is well rated for late season summer grain and oilseed development - Rain

will be confined to late this weekend and early next week and just enough will fall to keep harvest progress a little slow and to maintain moisture abundance - The

precipitation will be greatest in the east - U.S.

corn and soybean production areas will see alternating periods of rain and sunshine causing some periodic disruption to fieldwork - Locally

heavy rain is expected today into Thursday from southeastern Missouri into southern Indiana and parts of western Kentucky where local flooding is expected - No

prolonged rainy weather is expected and temperatures will be warm enough to help dry out some of the well-draining fields relatively quickly Harvest progress should advance favorably. Northwestern parts of the Corn Belt need greater volumes of rain - Virginia

and the Carolinas are too dry today, but will receive some rain early next week after the recent model runs have removed rain for this weekend

- Texas

Blacklands and lower U.S. Delta will experience a good mix of weather during the next ten days to two weeks - Southern

Georgia, southern Alabama and northern Florida will be drying down for a while after excessive rainfall earlier this month - U.S.

northern Plains and Canada’s Prairies will get some periodic precipitation, but no generalized rainfall for a while - The

need for greater rain is tremendous in drought stricken areas - Western

Russia, Belarus and parts of Ukraine are still too wet and need to dry down - A

week to ten days of frequent precipitation and cool biased weather is expected with the first week of the outlook wettest

- Fieldwork

will remain on hold in these areas and new crop development will be sluggish - No

tropical cyclones are present in the world today - Southern

Oscillation Index is mostly neutral at +.55 and the index is expected to waver in a narrow range for a while - Canada

Prairies will receive some sporadic precipitation during the coming week with no serious improvements in long term dryness - Mexico

drought will continue during the next two weeks, although scattered showers will occur periodically near the east coast and in the far south; a few areas may be a little wetter than usual - Europe

has been dry recently in the northwestern half of the continent especially in the North Sea region and from France into the heart of Germany - Precipitation

is expected over the next week to ten days fixing some of the dryness and improving spring planting and early season crop development potentials - China

rainfall in the coming ten days will be greatest near and south of the Yangtze River and in a few areas in the Northeast Provinces - Many

other areas will experience net drying which should be good for fieldwork - Early

season winter crop development will advance favorably - Less

rain in some rapeseed areas will bring on improved crop conditions, but additional drying is needed in the south to improve those crops and support planting of summer coarse grain and oilseed crops as well as rice - Xinjiang

China’s cotton areas trended warmer again Wednesday - Warming

will continue through the end of this week - Not

much rain will fall this week, but some will occur in the northeast Friday into Saturday ahead of another shot of cooler air - Main

cotton areas in southern and western parts of Xinjiang’s crop region will see high temperatures in the 80s and a few extremes over 90 later this week - India

weather will be good for winter crop maturation and harvesting over the next two weeks, despite a few showers from time to time - North

Africa rainfall will be erratic and light for a while with northern Morocco wettest - Temperatures

are trending warmer - West-central

Africa rainfall is expected to increase over the next two weeks bringing additional beneficial rain

- A

favorable mix of rain and sunshine has been occurring recently and the trend will continue with some increase in precipitation expected

- East-central

Africa rainfall has been erratic in recent weeks and a boost in rainfall would be welcome in Kenya and Ethiopia - The

coming week of rain will be below average in northeastern Tanzania and Kenya and near to above average elsewhere - Southeast

Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks - Greater

rain is needed in the northern and western Philippines and in parts of Vietnam and other mainland crop areas - South

Africa precipitation is expected late this week into the weekend favoring the central and southeast - The

moisture will be good for late season crops while delaying some harvest progress

- Drier

weather will return next week - New

Zealand precipitation for the next two weeks will be lighter than usual and temperatures near to below average

Source:

World Weather, Inc.

Thursday,

April 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - International

Grains Council monthly report - HOLIDAY:

Japan, Malaysia

Friday,

April 30:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

agricultural prices paid, received - Malaysia’s

April 1-30 palm oil export data - FranceAgriMer

weekly update on crop conditions - Holiday:

Vietnam

Monday,

May 3:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – corn, wheat, cotton; winter wheat condition, 4pm - EU

weekly grain, oilseed import and export data - U.S.

corn for ethanol, soybean crush, DDGS production, 3pm - Honduras,

Costa Rica monthly coffee exports - International

Cotton Advisory Committee updates world supply and demand outlook - Australia

Commodity Index - Ivory

Coast cocoa arrivals - HOLIDAY:

U.K., Japan, China, Vietnam, Thailand

Tuesday,

May 4:

- Purdue

Agriculture Sentiment - New

Zealand global dairy trade auction - EARNINGS:

Bunge, Andersons, Minerva - HOLIDAY:

Japan, China, Thailand

Wednesday,

May 5:

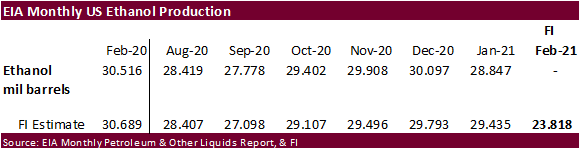

- EIA

weekly U.S. ethanol inventories, production - Malaysia

May 1-5 palm oil export data - New

Zealand Commodity Price - HOLIDAY:

Japan, China

Thursday,

May 6:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

May 7:

- China

customs publishes trade data, including imports of soy, edible oils, meat and rubber - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - CNGOIC

monthly report on Chinese grains & oilseeds - Canada’s

Statcan to issue wheat, canola, barley and durum stockpile data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Corn,

soybeans, SBO and Chicago wheat full carry are @ zero percent

USDA

export sales

·

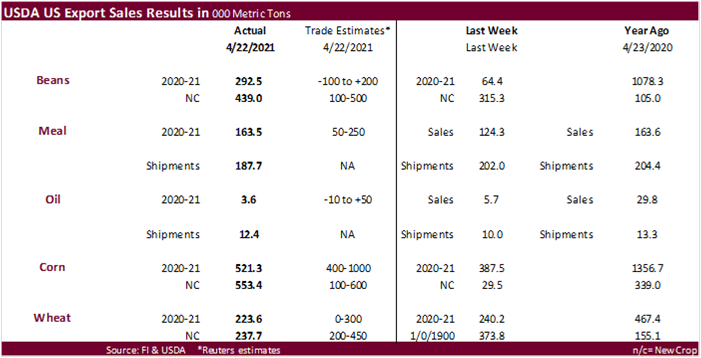

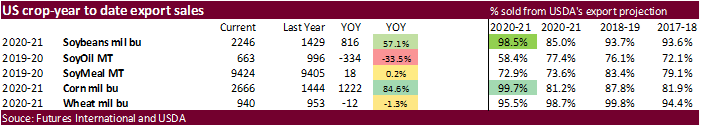

USDA export sales for soybeans of 292,500 and 439,000 tons new-crop were near the upper end of a range of expectations, combined. China took an old crop soybean cargo, and 198,000 tons new-crop.

·

Soybean meal sales and soybean oil were within expectations while shipments were ok.

·

USDA corn export sales were good, with sales for both crop years above one million tons. Usual buyers booked the corn. China was largely absent. Export sales for sorghum were 107,200 tons with

increases reported for China (243,200 MT, including 136,000 MT switched from unknown destinations and decreases of 6,400 MT). Pork export sales were 35,600 tons with Mexico primary buyer.

·

All-wheat export sales were within expectations but new-crop crop of 237,700 tons decline from 373,800 tons previous week.

US

Initial Jobless Claims Apr 24: 553K (est 540K; prevR 566K; prev 547K)

US

Continuing Claims Apr 17: 3660K (est 3590K; prevR 3651K; prev 3674K)

US

GDP Annualized (Q/Q) Q1 A: 6.4% (est 6.7%; prev 4.3%)

US

Personal Consumption Q1 A: 10.7% (est 10.5%; prev 2.3%)

US

GDP Price Index Q1 A: 4.1% (est 2.6%; prev 2.0%)

US

Core PCE (Q/Q) Q1 A: 2.3% (est 2.4%; prev 1.3%)

- CBOT

corn

was mixed most of the day with May and July higher, and back months lower from profit taking and normalizing US weather allowing 2021 US plantings progress to pick up this week. SK bought more optional origin corn, likely SA origin, bringing last half April

buying to at least three quarters of million tons. USDA export sales were seen slightly supportive.

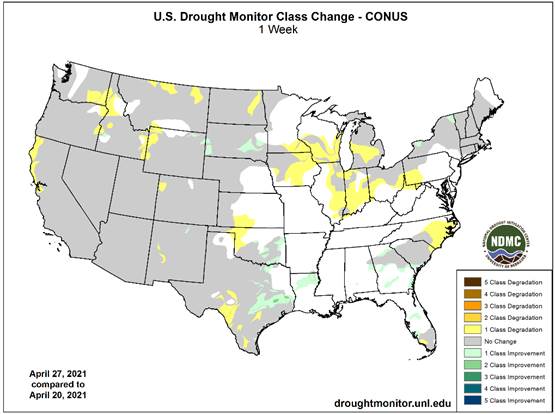

- Drought

last week expanded across the upper Midwest and a small portion of the central Great Plains. D1 expanded across Lower Michigan and the state as a whole showed 30% experiencing topsoil moisture that is short to very short (dry to very dry), an increase of

17% from the previous week, according to the Drought Monitor. The statistics increased to 34% in Iowa, 25% in Minnesota, and 21% in Wisconsin. USDA statistics revealed 46% of South Carolina’s topsoil was short or very short.

- The

US Drought Monitor as of April 27 shows 22 percent of the US corn crop area experiencing drought, up from 17 percent previous week.

- The

corn crop across the US Delta looks good. Last week we heard producers down south were applying more than normal amounts of fertilizer in attempt to maximize yields. Early corn harvesting this year should benefit producers due to robust demand.

- State

of Parana updated their crop estimates today and second corn was estimated at 12.230 million tons, above 11.885 million in 19/20, but below Conab’s latest estimate of 13.484 million tons.

- South

Africa 2020-21 corn crop was estimated by the Crop Estimates Committee (CEC) at 16.095 million tons (8.934 million white and 7.162 million tons yellow), below a Reuters average of 16.349 million tons and up from the 15.300 million tons harvested last season.

USDA is at 17 million tons. - The

IGC lowered its global corn production for 2021-22 by one million tons to 1.192 billion tons and left its wheat crop unchanged at 790 million tons for 2021-22. They dropped US corn production to 379.5 million tons from 384 million. USDA will release initial

estimates for new-crop on May 12. - China

reported a new ASF outbreak in Inner Mongolia, tenth outbreak this year. 343 out of the 432 pigs at a farm perished. Northern China has seen the most recent cases of the disease.

- On

Thursday, the funds sold an estimated net 3,000 corn contracts. - Friday

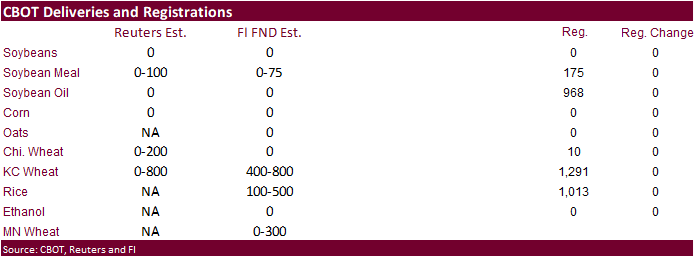

is First Notice Day, and we don’t look for corn deliveries.

Export

developments.

- South

Korea’s KFA Busan bought about 63,000 tons of optional origin corn at an estimated $318.48 a ton c&f for arrival in South Korea around Aug. 10. - South

Korea’s KFA Incheon bought 133,000 tons optional origin corn with one cargo at an estimated $305.73 a ton c&f for arrival around Oct. 20 and a second cargo at an estimated $302.93 a ton c&f for arrival around Oct. 30.

Updated

4/26/21

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.00-$6.50 range.

Soybeans

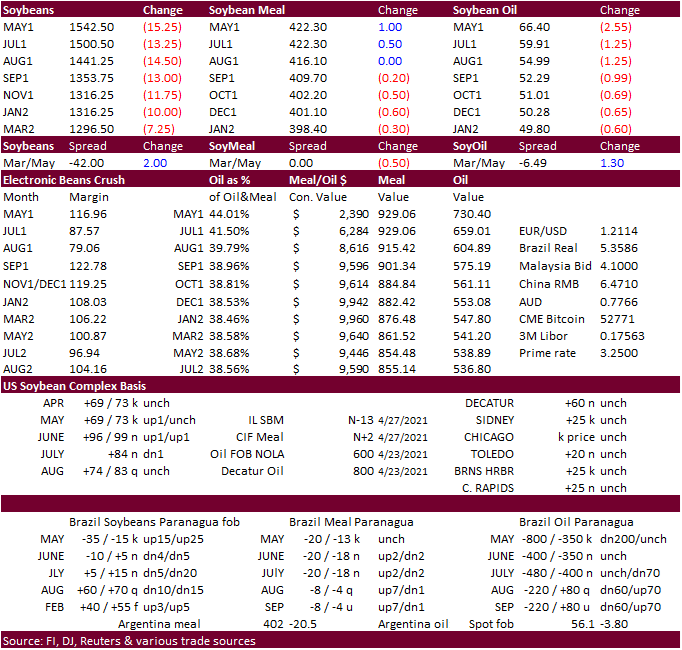

- CBOT

soybeans traded two sided but a huge reversal in soybean oil dragged soybeans lower. July soybeans fell 11.50 cents, July soybean meal $1.20 higher and July soybean oil 127 points lower. High prices of grains and product spreading was supporting nearby meal

prices. CBOT July crush traded in a wide range ended near 88 cents. Rationing will need to take place from keeping the US carryout to fall below 100 million bushels, but at 15 beans, the carryout appears trading below 80 million rather than USDA’s 120 million.

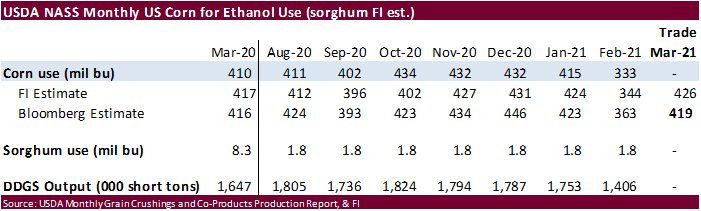

We look for a relatively strong crush reported by NASS for the month of March (estimates below). Processor downtime during April could shave off 3-5 percent off the US daily crush rate from March.

Malaysia

was closed for holiday. - Funds

on Thursday sold an estimated net 9,000 soybean contracts, bought 1,000 soybean meal and sold 6,000 soybean oil.

- We

heard Brazil soybean basis was 5 to 20 cents lower for position through Sep on talk over potential Jun/Jul washout requests by China importers. This could be good for US soybean exporters if they can source the soybeans.

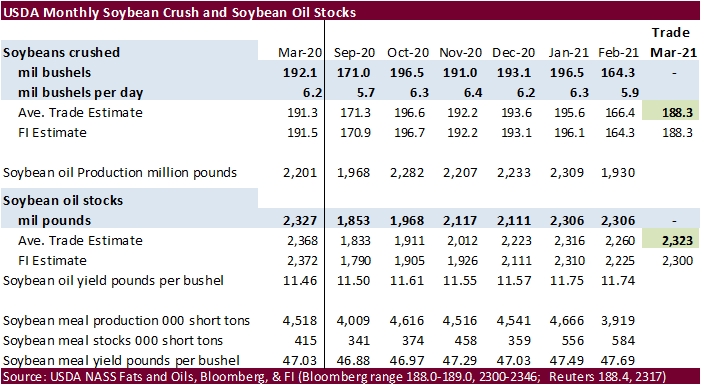

- A

Reuters poll calls for the March crush to be reported near 188.4 million bushels (5.94 mil bu per day), up from 164.3 million in February (5.87 mil/d) and below 192.1 million in March 2020 (5.85 million/day). Soybean oil stocks were estimated at 2.317 billion

pounds, up from 2.306 million in February and below 2.327 billion at the end of March 2020.

- The

US Drought Monitor as of April 27 shows 19 percent of the US soybean crop area experiencing drought, up from 16 percent previous week.

- Drier

weather for Argentina should boost harvest progress.

- Algeria

seeks 30,000 tons of soybean meal on April 29 for shipment by June 15. - Results

awaited: USDA under the food export program seeks 420 tons of vegetable oils for June 1-30 shipment.

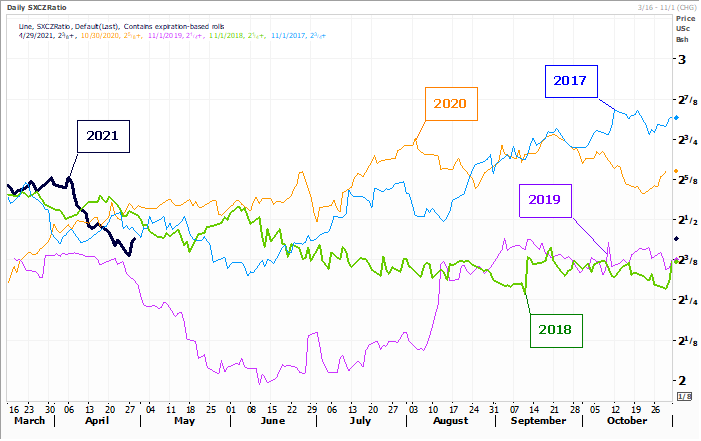

November

soybean/December corn ratio

Source:

Reuters & FI

Updated

4/26/21

July

soybeans are seen in a $14.75-$16.50; November $12.75-$15.00

Soybean

meal – July $400-$460; December $380-$460

Soybean

oil – July 56-70; December 48-60 cent range

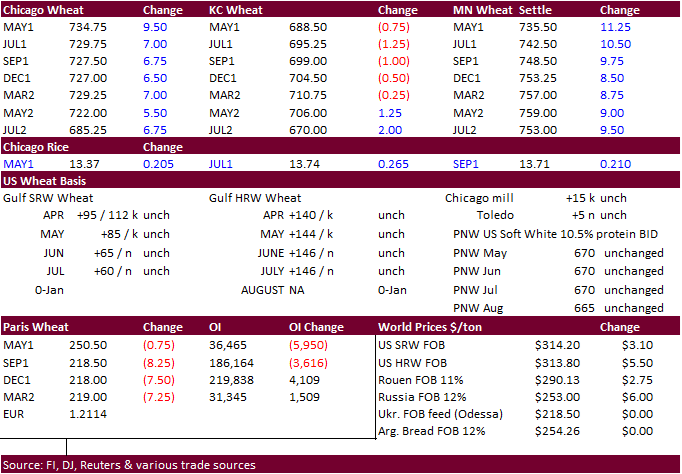

- Most

US wheat futures contracts were higher in Chicago and MN and lower in most KC wheat contracts. US weather for the Great Plains is expected to improve with exception of the northern areas.

- The

US Drought Monitor reported net drying last week for western half of western Texas and Oklahoma. “D0-D4 expanded in southern and southwest Texas and D0 expanded in western Oklahoma. Dry or very dry soils grew in area to 67% of Texas and 29% of Oklahoma, according

to USDA statistics, and 43% of the winter wheat crop in Texas was in poor to very poor condition. In the Midland-Odessa, Texas, area, 2020-2021 had the driest 13-month April-April period on record, and the fourth driest any 13-month period ever (behind 2011

which had the top 3 driest 13-month periods). Falling levels of the Edwards Aquifer triggered water restrictions in several Texas communities, including San Antonio, New Braunfels, and San Marcos.”

https://droughtmonitor.unl.edu/Summary.aspx

- The

US Drought Monitor as of April 27 shows 93 percent of the US durum crop area experiencing drought, up from 92 percent previous week. 82 percent of the US spring wheat crop area is experiencing drought, up from 78 percent previous week. 39 percent of the

US winter wheat crop area experiencing drought, up from 34 percent previous week.

- Ongoing

talk wheat demand for feed increased this month due to the wheat/corn relationship may have underpinned prices.

- Funds

on Thursday bought an estimated net 4,000 CBOT SRW wheat contracts. - September

Paris wheat was down 8.00 at 218.75 euros. - The

European Commission lowered its EU soft wheat production to 124.8 million tons from 126.7 million last month and compares to 2020-21 production of 117.2 million tons.

- Ukrainian

Grain Association estimated the Ukraine wheat crop at 27.7 million tons from 25.3 million previous season, and July 2021 – June 2020 wheat exports at 21 million tons.

- The

Philippines seeks up to 185,000 tons of wheat on May 4 for shipment in June, July and August depending on origin.

- Algeria’s

OAIC bought between 200,000 to 360,000 tons of optional-origin milling wheat at around $316.50 a ton c&f.

- Bangladesh

seeks 50,000 tons of milling wheat on May 6.

Rice/Other

·

Results awaited: Bangladesh delayed their 50,000-ton rice import tender that was set to close April 18, to now April 26.

·

Bangladesh seeks 50,000 tons of rice on May 2.

US

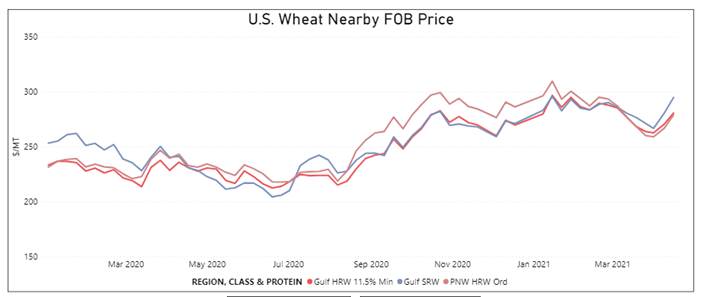

Wheat Associates selected US basis for Gulf and PNW

Updated

4/26/21

July

Chicago wheat is seen in a $6.75-$8.00 range

July

KC wheat is seen in a $6.60-$7.50

July

MN wheat is seen in a $7.15-$8.00

U.S. EXPORT SALES FOR WEEK ENDING 4/22/2021

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

103.8 |

1,097.9 |

1,560.4 |

108.0 |

7,626.7 |

8,264.5 |

86.5 |

731.2 |

|

SRW |

35.3 |

254.6 |

200.2 |

26.3 |

1,555.2 |

2,208.5 |

18.1 |

548.7 |

|

HRS |

60.7 |

1,187.7 |

1,306.3 |

143.9 |

6,553.1 |

6,280.9 |

112.5 |

701.5 |

|

WHITE |

21.4 |

1,083.5 |

874.8 |

270.6 |

5,567.5 |

4,300.7 |

20.5 |

605.5 |

|

DURUM |

2.4 |

72.1 |

133.3 |

0.0 |

594.9 |

802.3 |

0.0 |

5.0 |

|

TOTAL |

223.6 |

3,695.8 |

4,074.9 |

548.7 |

21,897.4 |

21,856.8 |

237.7 |

2,591.9 |

|

BARLEY |

0.3 |

4.4 |

11.1 |

0.4 |

25.1 |

38.8 |

0.0 |

20.2 |

|

CORN |

521.3 |

26,411.4 |

14,045.2 |

1,915.2 |

41,308.2 |

22,633.9 |

553.4 |

2,684.9 |

|

SORGHUM |

107.2 |

1,809.7 |

1,614.2 |

241.2 |

5,348.2 |

1,926.1 |

0.0 |

1,136.0 |

|

SOYBEANS |

292.5 |

5,054.6 |

5,307.5 |

340.4 |

56,064.8 |

33,593.0 |

439.0 |

6,630.6 |

|

SOY MEAL |

163.5 |

2,118.6 |

2,462.4 |

187.7 |

7,304.9 |

6,943.0 |

96.9 |

385.9 |

|

SOY OIL |

3.6 |

93.2 |

317.9 |

12.4 |

569.6 |

678.5 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

24.0 |

311.3 |

298.2 |

32.6 |

1,215.9 |

1,095.3 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

5.3 |

23.2 |

0.0 |

23.5 |

53.4 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

2.9 |

19.4 |

0.2 |

35.4 |

43.4 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

45.6 |

57.8 |

23.1 |

109.2 |

52.7 |

0.0 |

0.0 |

|

L G MLD |

3.1 |

37.4 |

69.3 |

18.5 |

502.2 |

715.3 |

0.0 |

0.0 |

|

M S MLD |

4.8 |

244.3 |

220.4 |

7.7 |

409.8 |

469.9 |

0.0 |

0.0 |

|

TOTAL |

32.2 |

646.7 |

688.2 |

82.0 |

2,296.0 |

2,429.9 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

77.1 |

4,322.0 |

5,608.1 |

341.9 |

10,827.4 |

9,945.8 |

16.3 |

1,673.7 |

|

PIMA |

4.8 |

197.6 |

149.7 |

14.5 |

563.9 |

394.4 |

2.5 |

3.6 |

This

summary is based on reports from exporters for the period April 16-22, 2021.

Wheat: Net

sales of 223,600 metric tons (MT) for 2020/2021 were down 7 percent from the previous week, but up 73 percent from the prior 4-week average. Increases primarily for Mexico (65,400 MT, including decreases of 1,700 MT), Indonesia (58,300 MT, including 55,000

MT switched from unknown destinations and 1,300 MT switched from Malaysia), Yemen (52,200 MT, including 49,000 MT switched from unknown destinations), Nigeria (22,200 MT), and the United Arab Emirates (10,500 MT, including 10,000 MT switched from unknown destinations),

were offset by reductions primarily for Guatemala (2,200 MT) and Malaysia (1,400 MT). For 2021/2022, net sales of 237,700 MT were primarily for the Philippines (92,500 MT), Mexico (54,800 MT), Honduras (29,000 MT), Japan (26,400 MT), and the Dominican Republic

(11,500 MT). Exports of 548,700 MT were down 2 percent from the previous week, but up 14 percent from the prior 4-week average. The destinations were primarily to China (130,400 MT), South Korea (94,200 MT), Japan (71,400 MT), Vietnam (68,400 MT), and Yemen

(52,200 MT).

Optional

Origin Sales: For

2020/2021, new optional origin sales of 18,000 MT were reported for Spain. The current outstanding balance of 53,500 MT is for Spain.

Corn:

Net sales of 521,300 MT for 2020/2021 were up 35 percent from the previous week, but down 8 percent from the prior 4-week average. Increases primarily for Mexico (296,900 MT, including decreases of 3,600 MT), South Korea (117,100 MT, including 133,000 MT

switched from unknown destinations and decreases of 15,900 MT), Saudi Arabia (89,200 MT, including 80,500 MT switched from unknown destinations), Colombia (71,100 MT, including 41,000 MT switched from unknown destinations and decreases of 12,400 MT), and Egypt

(58,200 MT, including 60,000 MT switched from unknown destinations and decreases of 1,800 MT), were offset by reductions primarily for unknown destinations (318,500 MT). For 2021/2022, net sales of 553,400 MT were primarily for unknown destinations (361,400

MT), Guatemala (136,700 MT), Panama (20,400 MT), and Mexico (20,300 MT). Exports of 1,915,200 MT were up 19 percent from the previous week and 3 percent from the prior 4-week average. The destinations were primarily to China (561,600 MT), Japan (399,500

MT), Mexico (287,400 MT), South Korea (183,800 MT), and Colombia (94,600 MT).

Optional

Origin Sales: For

2020/2021, options were exercised to export 166,400 MT to South Korea (134,000 MT) and the Ukraine (32,400 MT) from other than the United States. The current outstanding balance of 277,400 MT is for unknown destinations (189,500 MT), South Korea (79,000 MT),

and China (8,900 MT).

Barley:

Total net sales of 300 MT for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. Increases were for Taiwan.

Exports of 400 MT were down 20 percent from the previous week and 16 percent from the prior 4-week average. The destinations were Taiwan (200 MT), Canada (100 MT), and Japan (100 MT).

Sorghum:

Net sales of 107,200 MT for 2020/2021 were up noticeably from the previous week, but down 45 percent from the prior 4-week average. Increases reported for China (243,200 MT, including 136,000 MT switched from unknown destinations

and decreases of 6,400 MT), were offset by reductions for unknown destinations (136,000 MT). Exports of 241,200 MT were down 6 percent from the previous week and 39 percent from the prior 4-week average. The destination was China.

Rice:

Net sales of 32,200 MT for 2020/2021 were down 67 percent from the previous week and 37 percent from the prior 4-week average. Increases primarily for Costa Rica (17,500 MT), El Salvador (5,000 MT), Honduras (2,500 MT), Canada (2,300 MT), and the Dominican

Republic (2,200 MT), were offset by reductions for Mexico (900 MT). Exports of 82,000 MT were down 12 percent from the previous week, but up 50 percent from the prior 4-week average. The destinations were primarily to Mexico (25,100 MT), South Korea (23,700

MT), Haiti (15,000 MT), Colombia (9,000 MT), and Canada (3,200 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 292,500 MT for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Mexico (115,300 MT, including decreases of 1,000 MT), China (62,500 MT, including decreases of 5,500 MT), Egypt (51,900

MT, including 48,700 MT switched from unknown destinations), Saudi Arabia (29,200 MT, including 30,000 MT switched from unknown destinations and decreases of 800 MT), and Japan (23,400 MT, including decreases of 1,600 MT), were offset by reductions for unknown

destinations (53,000 MT). For 2021/2022, net sales of 439,000 MT were reported for China (198,000 MT), unknown destinations (186,000 MT), and Pakistan (55,000 MT). Exports of 340,400 MT were up 50 percent from the previous week, but down 6 percent from the

prior 4-week average. The destinations were primarily to Egypt (106,900 MT, including 58,200 MT – late), Mexico (62,100 MT), Japan (55,000 MT), Saudi Arabia (29,200 MT), and Colombia (23,900 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Late

Reporting:

For 2021, exports totaling 58,200 MT of soybeans were reported late to Egypt.

Soybean

Cake and Meal: Net

sales of 163,500 MT for 2020/2021 were up 32 percent from the previous week and 41 percent from the prior 4-week average. Increases primarily for the Philippines (95,400 MT), the Dominican Republic (24,700 MT, including decreases of 800 MT), Canada (11,300

MT, including decreases of 400 MT), El Salvador (8,800 MT, including 9,300 MT switched from Guatemala and decreases of 900 MT), and Panama (6,400 MT), were offset by reductions for Guatemala (9,500 MT). For 2021/2022, net sales of 96,900 MT were for Guatemala

(66,000 MT) and Canada (30,900 MT). Exports of 187,700 MT were down 7 percent from the previous week and 18 percent from the prior 4-week average. The destinations were primarily to the Philippines (47,800 MT), Mexico (37,100 MT), Guatemala (20,000 MT),

Canada (18,300 MT), and Israel (15,500 MT).

Soybean

Oil: Net sales of

3,600 MT for 2020/2021 were down 36 percent from the previous week and 40 percent from the prior 4-week average. Increases primarily for Venezuela (3,000 MT), Canada (1,600 MT), and El Salvador (800 MT), were offset by reductions primarily for Guatemala (1,700

MT). Exports of 12,400 MT were up 25 percent from the previous week and 38 percent from the prior 4-week average. The destinations were primarily to Guatemala (7,600 MT), the Dominican Republic (4,000 MT), Canada (500 MT), and Mexico (200 MT).

Cotton:

Net sales of 77,100 RB for 2020/2021 were down 25 percent from the previous week and 46 percent from the prior 4-week average. Increases primarily for Turkey (20,900 RB), China (15,900 RB, including decreases 6,600 RB), Pakistan (13,400 RB), Vietnam (9,000

RB, including 4,500 RB switched from China, 3,900 RB switched from Hong Kong, and decreases of 17,300 RB), and Mexico (6,000 RB), were offset by reductions for Hong Kong (3,900 RB). For 2021/2022, net sales of 16,300 RB reported for Mexico (11,900 RB), Pakistan

(4,400 RB), Thailand (900 RB), and Turkey (400 RB), were offset by reductions for Vietnam (1,300 RB). Exports of 341,900 RB were up 4 percent from the previous week and 2 percent from the prior 4-week average. Exports were primarily to China (82,100 RB),

Vietnam (72,500 RB), Turkey (47,900 RB), Pakistan (31,700 RB), and Mexico (20,500 RB). Net sales of Pima totaling 4,800 RB were down 28 percent from the previous week and 11 percent from the prior 4-week average. Increases primarily for India (1,500 RB),

Egypt (1,300 RB), Pakistan (900 RB), Peru (900 RB), and Thailand (200 RB), were offset by reductions for Italy (300 RB). For 2021/2022, net sales of 2,500 RB were primarily for Egypt (1,300 RB). Exports of 14,500 RB were down 26 percent from the previous

week and 19 percent from the prior 4-week average. The destinations were primarily to India (5,600 RB), Vietnam (2,700 RB), Egypt (1,700 RB), Turkey (1,300 RB), and China (1,300 RB).

Exports

for Own Account:

For 2020/2021, exports for own account totaling 13,700 RB to China were applied to new or outstanding sales. The current exports for own account outstanding balance of 12,500 RB is for China (7,600 RB), Vietnam (4,500 RB), and Bangladesh (400 RB).

Hides

and Skins:

Net sales of 256,600 pieces for 2021 were down 28 percent from the previous week and 27 percent from the prior 4-week average. Increases primarily for China (90,000 whole cattle hides, including decreases of 14,700 pieces), South Korea (81,800 whole cattle

hides, including decreases of 800 pieces), Mexico (42,800 whole cattle hides, including decreases of 900 pieces), Thailand (18,200 whole cattle hides, including decreases of 600 pieces), and Indonesia (7,700 whole cattle hides), were offset by reductions for

Brazil (100 pieces) and Spain (100 MT). Exports of 450,600 pieces were up 19 percent from the previous week and 16 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (344,200 pieces), South Korea (39,400 pieces), Mexico

(27,900 pieces), Thailand (15,600 pieces), and Taiwan (9,000 pieces).

Net

sales of 324,000 wet blues for 2021 were up noticeably from the previous week and from the prior 4-week average. Increases were primarily for Italy (144,900 unsplit, including decreases of 200 unsplit), Vietnam (99,700 unsplit, including decreases of 200

unsplit), Thailand (39,800 unsplit, including decreases of 200 unsplit), Mexico (20,000 grain splits and 2,600 unsplit), and China (14,900 unsplit). Exports of 151,300 wet blues were up 11 percent from the previous week and 16 percent from the prior 4-week

average. The destinations were primarily to China (54,900 unsplit and 2,300 grain splits), Italy (30,000 unsplit and 4,500 grain splits), Vietnam (26,600 unsplit), Mexico (13,700 grain splits and 4,400 unsplit), and Thailand (10,000 unsplit). Net sales of

1,219,300 splits reported for Vietnam (1,003,800 pounds, including decreases 2,300 pounds), Taiwan (169,800 pounds, including decreases of 2,400 pounds), and China (50,600 pounds, including decreases of 5,000 pounds), were offset by reductions for Italy (4,800

pounds). Exports of 509,200 pounds were to China (169,400 pounds), Vietnam (161,800 pounds), Italy (94,400 pounds), and Taiwan (83,600 pounds).

Beef:

Net

sales of 23,600 MT reported for 2021 were down 4 percent from the previous week, but up 22 percent from the prior 4-week average. Increases were primarily for South Korea (11,700 MT, including decreases of 600 MT), Japan (4,900 MT, including decreases of

600 MT), Mexico (2,000 MT), China (1,900 MT, including decreases of 200 MT), and Hong Kong (600 MT, including decreases of 100 MT).

Exports of 18,700 MT were down 4 percent from the previous week and 2 percent from the prior 4-week average. The destinations were primarily to South Korea (5,900 MT), Japan (4,800 MT), China (3,100 MT), Mexico (1,300 MT),

and Taiwan (1,000 MT).

Pork:

Net

sales of 35,600 MT reported for 2021 were down noticeably from the previous week, but up 59 percent from the prior 4-week average. Increases were primarily for Mexico (16,700 MT, including decreases of 600 MT), Japan (6,800 MT, including decreases of 200

MT), South Korea (5,000 MT, including decreases of 500 MT), China (2,000 MT, including decreases of 1,300 MT), and Honduras (800 MT). Exports of 58,800 MT–a marketing-year high–were up 34 percent from the previous week and 46 percent from the prior 4-week

average. The destinations were primarily to Mexico (30,300 MT, including 17,700 MT – late), China (13,900 MT), Japan (4,100 MT), South Korea (2,300 MT), and Canada (1,900 MT).

Late

Reporting:

For 2021, exports totaling 17,700 MT of pork were reported late to Mexico.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.