PDF Attached

Very

choppy, two-sided trade. USDA announced 101,600 tons of corn sold to unknown. Lack of direction triggered liquidation, but every time prices moved lower there was someone to buy it, for most contracts. Most contracts settled lower. CBOT crush appreciated.

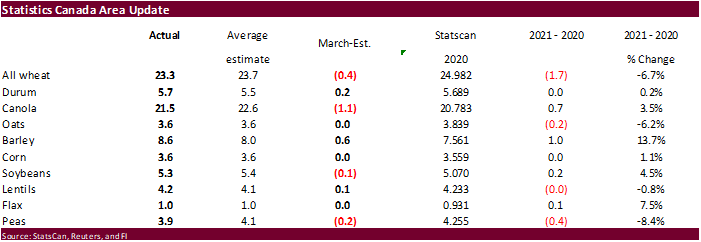

Bull spreading was a major feature. Fundamentals have not changed: Brazil second crop corn, adverse weather, and inflation. StatsCan reported friendly wheat and canola Canada planting estimates. Egypt passed on wheat and SK bought corn. Other news was

light. Most commodities hit fresh multi year highs before trending lower.

Next

7 days

- Brazil’s

Safrinha corn areas are still not likely to get more than sporadic light showers over the next ten days to two weeks - Any

moisture that falls will be welcome, but with daily high temperatures in the upper 70s and 80s it will not be difficult to see net drying

- No

excessive heat is expected and that will help crops deal with low soil moisture a little better, but dryness in the soil is more significant than it should be at this time of year keeping the pressure on for production since May is not usually a very wet month - Argentina’s

weather will be favorably mixed over the next two weeks - Soil

moisture is well rated for late season summer grain and oilseed development - Rain

will be confined to late this weekend and early next week and just enough will fall to keep harvest progress a little slow and to maintain moisture abundance - The

precipitation will be greatest in the east - U.S.

corn and soybean production areas will see alternating periods of rain and sunshine causing some periodic disruption to fieldwork - No

prolonged rainy weather is expected and temperatures will be warm enough to help dry out some of the well-draining fields relatively quickly - Harvest

progress should advance favorably - Today’s

forecast models are generating greater rainfall in the drier biased areas of southern Minnesota, northern Iowa and southwestern Wisconsin over the coming ten days - Some

of this increase is likely overdone, but any rain that impacts the region will be welcome - Heavy

rain continues advertised for areas from eastern Oklahoma and north-central Texas to the lower Ohio River Valley and the northern Delta Wednesday into Thursday - Some

local flooding is expected - Delays

to fieldwork are anticipated as well - Virginia

and the Carolinas are too dry today, but will receive some rain Friday into Saturday offering some temporary relief

- Rainfall

of 0.20 to 0.75 inch and local totals 1.20 inches will be possible - West

Texas high Plains will not get much rain during the next ten days. - The

Rolling Plains may receive some moderate to heavy rainfall of 0.50 to 2.00 inches tonight and Wednesday - Some

of this rain may reach into the West Texas Low Plains region with 0.25 to 0.75 inch of rain and local totals over 1.00 inch - The

next opportunity for rain in West Texas may not occur until May 10-11 - South

Texas will continue missing significant rain with parts of the region getting no more than 0.50 inch over the next ten days - Texas

Blacklands and lower U.S. Delta will experience a good mix of weather during the next ten days to two weeks - Southern

Georgia, southern Alabama and northern Florida will be drying down for a while after excessive rainfall earlier this month - U.S.

northern Plains and Canada’s Prairies will get some periodic precipitation, but no generalized rainfall for a while - The

need for greater rain is tremendous in drought stricken areas - Western

Australia is advertised to be a little wetter in the coming week with some rain in the south part of the state Wednesday into Thursday and another chance for showers in much of the Sunday into Tuesday - The

moisture will improve topsoil moisture for autumn planting of wheat, barley and canola - Western

Russia, Belarus and parts of Ukraine are still too wet and need to dry down - Ten

days of frequent precipitation and cool biased weather is expected with the first week of the outlook wettest

- Fieldwork

will remain on hold in these areas and new crop development will be sluggish - No

tropical cyclones are present in the world today - ENSO

outlook continues to suggest neutral conditions through mid-summer and a possible tendency toward La Nina late this calendar year - Southern

Oscillation Index is mostly neutral at +.10 and the index is expected to waver in a narrow range for a while - Canada

Prairies will be dry biased this week in the south and a little warmer than usual.

- Weather

next week will trend a little wetter with temperatures slightly warmer for a part of the week - Mexico

drought will continue during the next two weeks, although scattered showers will occur periodically near the west coast and in the far south; a few areas may be a little wetter than usual - Europe

has been dry recently in the northwestern half of the continent especially in the North Sea region and from France into the heart of Germany - Precipitation

is expected over the next week to ten days fixing some of the dryness and improving spring planting and early season crop development potentials - Frost

and freezes continued in northeastern parts of the European continent this morning - Improved

planting conditions have resulted from the warming and drier bias in some areas - Rain

in southern and eastern Europe this week will slow farming activity, but some progress will be made around the precipitation - Drying

is needed - China

rainfall in the coming ten days will be greatest near and south of the Yangtze River and in a few areas in the Northeast Provinces - Many

other areas will experience net drying which should be good for fieldwork - Early

season winter crop development will advance favorably - Less

rain in some rapeseed areas will bring on improved crop conditions, but additional drying is needed in the south to improve those crops and support planting of summer coarse grain and oilseed crops as well as rice - Xinjiang

China’s cotton areas experienced more freezing temperatures this morning in the northeast and replanting may be needed in some of the early emerged crop areas - Warming

is likely in Xinjiang through the end of this week - Not

much rain will fall this week, but some will occur in the northeast Friday into Saturday ahead of another shot of cooler air - Main

cotton areas in southern and western parts of Xinjiang’s crop region will see high temperatures in the 80s and a few extremes over 90 later this week - India

weather will be good for winter crop maturation and harvesting over the next two weeks, despite a few showers from time to time - North

Africa rainfall will be erratic and light for a while with northern Morocco wettest - Temperatures

are trending warmer - West-central

Africa rainfall is expected to increase over the next two weeks bringing additional beneficial rain

- A

favorable mix of rain and sunshine has been occurring recently and the trend will continue with some increase in precipitation expected

- East-central

Africa rainfall has been erratic in recent weeks and a boost in rainfall would be welcome in Kenya and Ethiopia - The

coming week of rain will be below average in northeastern Tanzania and Kenya and near to above average elsewhere - Southeast

Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks - Greater

rain is needed in the northern and western Philippines - South

Africa precipitation is expected late this week into the weekend favoring the central and southeast - The

moisture will be good for late season crops while delaying some harvest progress

- Drier

weather will return next week - New

Zealand precipitation for the next two weeks will be lighter than usual and temperatures near to below average

Source:

World Weather Inc. & FI

Wednesday,

April 28:

- EIA

weekly U.S. ethanol inventories, production - Brazil’s

Unica publishes data on cane crush and sugar output (tentative)

Thursday,

April 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - International

Grains Council monthly report - HOLIDAY:

Japan, Malaysia

Friday,

April 30:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

agricultural prices paid, received - Malaysia’s

April 1-30 palm oil export data - FranceAgriMer

weekly update on crop conditions - Holiday:

Vietnam

Source:

Bloomberg and FI

ADM

quarterly profit jumps 76% on agricultural unit boost – Reuters News

US

FHFA House Price Index (M/M) Feb: 0.9% (est 1.0%; prev 1.0%)

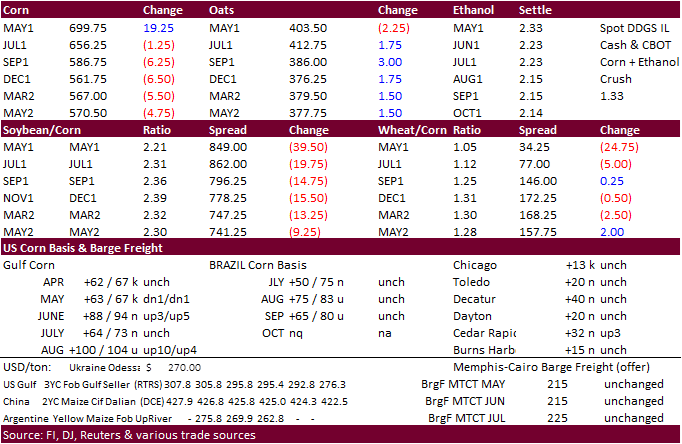

- May

CBOT corn

surpassed $7.00 (last time 2013) early and broke below that level at the start of the day session. Rest of the day it traded above and below that level, ending 15 cents higher but below $7 at $6.9550/bu. May corn is now up 7 consecutive sessions. The back

months traded in a very copy range and were mostly under pressure during the session from bull spreading. July fell 3.0 cents to $6.5450. The K/N spread was extremely active, closing in the modified at 43.50/44.00, up 20.75 cents for the day. Note Friday

is First Notice Day. Ongoing Brazil second crop worries were supporting corn early. Concerns US spring corn plantings are running slow also underpinned prices. But as trading turned choppy, fund selling overtook the CBOT corn back months.

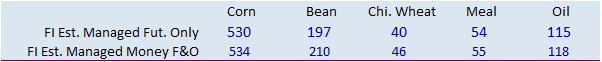

- On

Tuesday sold bought an estimated net 3,000 corn contracts. - Rain

mid this workweek may stall fieldwork progress across the US Midwest, especially the lower Ohio River Valley and northern Delta. Brazil will see net drying over the next ten days before some rain occurs May 6-13.

- Parana,

Brazil, crop conditions dropped to 40 percent good from 62 percent week earlier and are down from 92 percent as of April 5!

- Soybean

and Corn Advisory: 2020/21 Brazil Corn Estimate Lowered 3.0 mt to 100.0 Million. - Also

adding to SA grain crop availability concerns are low water levels that lighten shipments. We are hearing depths for Argentina’s side is ok but Paraguay has issues that may force more trucks to deliver product.

- The

USD was 10 points higher as of 1:30 pm CT. - Ukraine’s

Black Sea ports restricted grain loading operations due to rain, mainly in the Odessa region. - Rosario

Grain Exchange estimated Argentina sorghum production between 3 and 3.5 million tons, well up from 1.8 million tons, with the bulk of the increase likely dedicated for exports.

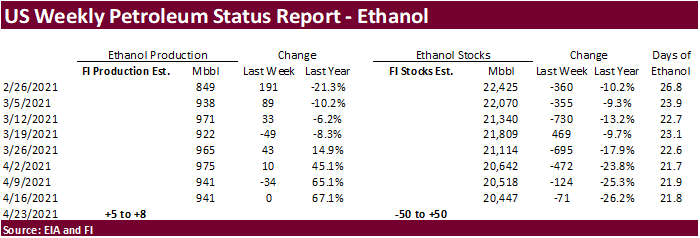

- A

Bloomberg poll looks for weekly US ethanol production to be up 4,000 barrels (938-965 range) from the previous week and stocks down 41,000 barrels to 20.406 million.

Export

developments.

- Private

exporters reported to the U.S. Department of Agriculture export sales of 101,600 tons of corn delivery to unknown destinations. Of the total, 50,800 metric tons is for delivery during the 2020/2021 marketing year and 50,800 metric tons is for delivery during

the 2021/2022 marketing year.

- Taiwan’s

MFIG seeks 65,000 tons of corn on Wednesday for July 9-August 12 shipment, depending on origin.

- South

Korea’s KOCOPIA bought 50,000 tons of corn expected from Ukraine at an estimated $339.88 a ton c&f for arrival around July 20.

Updated

4/26/21

May

corn is seen in a $6.50 and $7.25 range

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.00-$6.50 range.

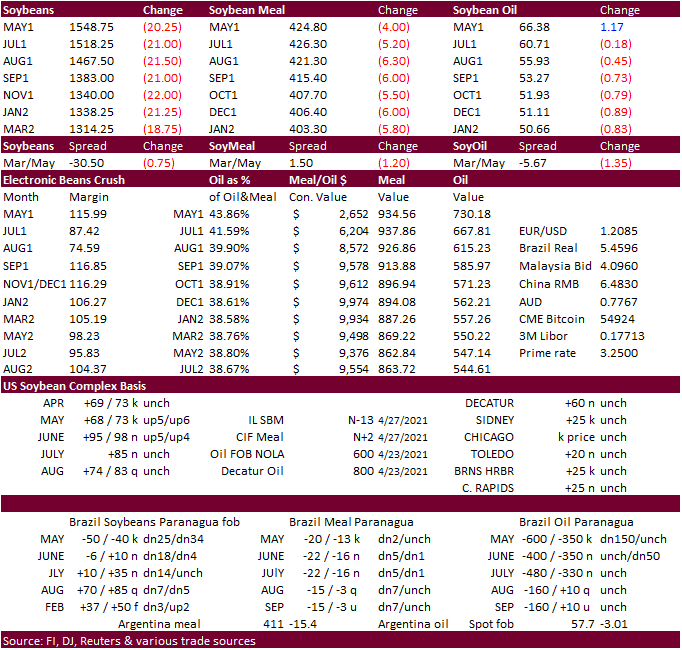

- CBOT

soybeans

basis May ended 19.25 cents higher after hitting their highest level since 2013. The back months for soybeans followed May lower. May SBO was up 124 points (hit a 2008 high) but the back months settled lower (July down 1 point & Aug down 8 & Dec down 68

points). May soybean meal dropped $3.30. and July was down $4.70. Traders saw a very choppy trade after soybeans and soybean oil saw fresh highs overnight. Selling started with profit taking. Some took advantage of the dips but in the end, fund selling

influenced much of the market. May soybean oil was strong all day, in part to very strong US basis levels indicating it’s hard to source SBO. May crush went out at $1.18 and July $88.50. Options were active.

- Funds

on Tuesday sold an estimated net 13,000 soybean contracts, sold 4,000 soybean meal and flat in soybean oil. - Brazil

soybean exports are set to exceed 15 million tons. Official customs data showed Brazil exported 14.6 million tons of soybeans during the first four weeks of April. The previous record for April was last year of 14.9 million tons.

- U.S.

Supreme Court justices heard arguments today for the case HollyFrontier Cheyenne Refining, LLC v. Renewable Fuels Association, concerning the Clean Air Act small refinery exemptions. Reuters note the justices appeared divided in an appeal by three refineries

in Wyoming, Utah and Oklahoma “of a lower court ruling that faulted the U.S. Environmental Protection Agency for giving the companies waivers from the Clean Air Act’s renewable fuel standard requirements.” (Reuters) - US

renewable fuel credits were quoted today at a record high, in part to soybean oil hitting its highest level since 2008. Renewable fuel (D6) credits for 2021 traded at $1.50 each, up from $1.44 in the previous session, traders said. Biomass-based (D4) credits

traded at $1.58 each, up from $1.52 previously. (Reuters) - US

corn and soybean plantings were as expected at 17 and 8 percent, respectively, but corn is lagging its respected 5-year averages by 3 points. Soybeans are running 3 points above average.

- According

to line-up data from shipping agency Cargonave, Argentina will soon ship 31,450 tons of soybeans to the US, presumably Norfolk, VA, where some poultry producers are located.

- Indonesia

raised its crude palm oil reference price tax for May at $1,110 a ton from $1,093.83 in April. Export taxes for crude palm oil in May will be higher at $144 per ton, while export levies for the edible oil will be unchanged at $255 per ton. April crude palm

oil was at $116 per ton.

- Egypt’s

GASC seeks 30,000 tons of soybean oil and 10,000 tons of sunflower oil on April 28 for June 26-July 10 arrival. They are also in for local vegetable oils, 3,000 soybean oil and 1,000 sunflower oil for June26-July 15 arrival.

- The

USDA under the food export program seeks 420 tons of vegetable oils for June 1-30 shipment.

Updated

4/26/21

May

soybeans are seen in a $15.30-$16.10 range; July $14.75-$16.50; November $12.75-$15.00

May

soymeal is seen in a $415-$440 range; July $400-$460; December $380-$460

May

soybean oil is seen in a 63.50 and 67 cent range; July 56-70; December 48-60 cent range

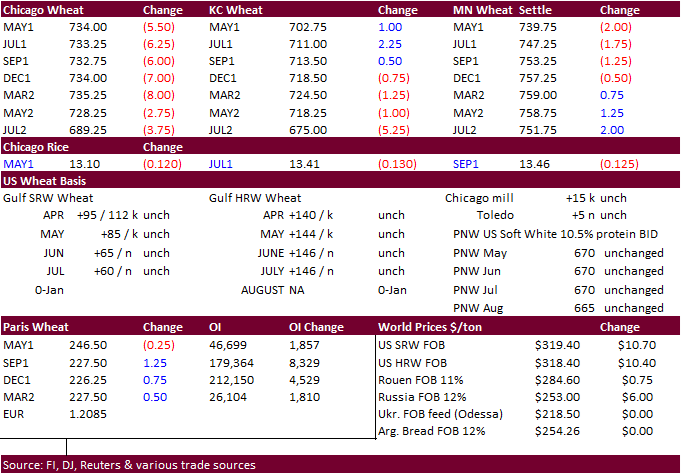

- US

wheat futures were higher to start but turned south shortly after corn broke. Some traders took profits after prices were hovering around 2013 highs. The rest of the session was a very choppy and Chicago ended 1.75-5.75 cents lower, KC mostly 0.25-2.50 cents

higher and MN 0.75-2.75 cents lower. The unexpected 4-point decline in US winter wheat ratings was unable to sustain buying by bull traders.

The

southwest US Plains will be dry biased for the balance of the workweek. There is still some precipitation in the northern U.S. Plains and Canada, but not as much as yesterday, according to World Weather. Midwest weather will be well mixed but there will

be a little too much rain Wednesday into Thursday in the lower Ohio River Valley and northern Delta.

- We

heard Russian wheat, probably a small amount, was sold to Mexico but this is not unusual.

- Egypt

passed on wheat for August 11-20 shipment. Romanian wheat was lowest offered at $268.47/ton.

- There

was additional talk global wheat feed use among major animal unit production countries could increase for the remainder of this year because of high priced grains. China has already been increasing their wheat for feed use. China commitments of US wheat

as of 4/15 total 3.2 million tons vs. 579,477 tons for 2019-21 total commitments. USDA shows China importing 10.5 million tons of wheat in 2020-21 compared to 5.38 million tons in 2019-20 and 3.15 million in 2018-19.

- Funds

on Tuesday sold an estimated net 3,000 CBOT SRW wheat contracts. - September

Paris wheat was up 1.25 at 227.50 euros.

- Egypt

passed on wheat for August 11-20 shipment. Romanian wheat was lowest offered at $268.47/ton.

- Results

awaited: Jordan seeks 120,000 tons of feed barley on April 28 for Oct-Nov shipment.

- Algeria’s

state grains agency OAIC seeks 50,000 tons of wheat on Wednesday, April 28, with offers remaining valid up to Thursday, April 29. - Bangladesh

seeks 50,000 tons of milling wheat on May 6.

Rice/Other

·

Results awaited: Bangladesh delayed their 50,000-ton rice import tender that was set to close April 18, to now April 26.

·

Bangladesh seeks 50,000 tons of rice on May 2.

Updated

4/26/21

May

Chicago wheat is seen in a $6.90‐$7.75 range; July $6.75-$8.00

May

KC wheat is seen in a $6.70‐$7.50 range; July $6.60-$7.50

May

MN wheat is seen in a $7.10‐$7.75 range; July $7.15-$8.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.