PDF Attached

Lower

trade in soybeans and higher trade in back month corn contracts on spreading. The US will see wet and cool temperatures this week slowing corn plantings. We think it’s too early to talk about a good shift from corn to soybean plantings. Slowing demand for

US soybeans and products weighted on the complex. Wheat ended lower from rain forecast for the Great Plains but uncertainty over the Black Sea grain export deal pared some losses for the Chicago contracts.

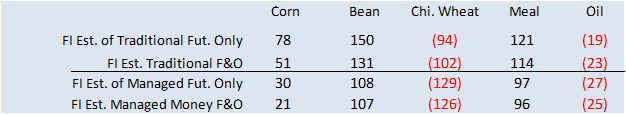

Fund

estimates as of April 25

Weather

World

Weather Inc.

WEATHER

TO WATCH

-

China’s

moisture profile in key crop areas is looking very good with well-timed precipitation of late in the Yellow River Basin and a part of the North China Plain -

It

has been a little wet south of the Yangtze River with some damage suspected from recent bouts of flash flooding -

Spring

planting prospects are very good with little change expected into the first half of May -

Xinjiang,

China has cooled off once again, but warming is expected for a little while in the latter part of this week and into the weekend -

Cotton,

corn and a host of other crops produced in the province need persistent warm temperatures with a few infrequent bouts of rain -

Another

bout of cooling is expected late in the weekend and early next week -

Yunnan,

China is still in a drought with little rain expected -

This

has impacted early season corn and rice as well as some sugarcane and other crops -

No

relief is expected for a while -

China’s

Meteorological Agency has declared a drought in the Northeastern Provinces, but soil moisture is not far from normal, and some rain is expected -

India’s

scattered showers expected over the next couple of weeks will result in a little greater than usual rainfall and that will prove disruptive to winter crop maturation and harvest progress -

Drier

weather may be needed to protect unharvested winter crop quality -

Northern

Kazakhstan and southern parts of Russia’s eastern New Lands will need rain soon after a bout of dry and warm weather occurs in the next ten days -

No

area is considered to be too dry today and the drier and warmer conditions should prove ideal for the planting of sunseed, spring wheat and other crops -

North

Africa, Portugal and Spain are still dealing with drought -

Irrigated

crops are performing fine, but there is concern over water supply -

Dryland

crops need moisture to protect production and crop quality -

Most

other areas in Europe and the western CIS have favorable soil moisture and a good crop prospect for spring 2023 -

Middle

East crop conditions vary greatly with Turkey having the best soil moisture while Syria and Afghanistan have the greatest need of moisture -

U.S.

hard red winter wheat areas will get needed rain today into Friday -

Most

areas will get rain by Thursday with Tuesday and Wednesday wettest -

Areas

from Colorado to the heart of Oklahoma and north-central Texas will be wettest with rainfall of 0.75 to 2.00 inches resulting and a few local totals of 2.00 to 3.00 inches -

Southern

Kansas and northern Oklahoma will be wettest -

Nebraska

and northeastern wheat areas of Kansas will be driest -

Rainfall

in the Texas Panhandle will vary from 0.50 to 1.50 inches in the northeast half of the region while amounts in the southwest will vary up to 0.50 inch

-

Wheat

development and yield potentials will improve following the rain, although some of the driest unirrigated fields have already lost production potential that cannot be recovered -

Summer

crop planting conditions should improve following the storm -

Light

rain and drizzle will impact the region Friday with another trace to 0.50 inch resulting -

Follow

up showers will occur briefly in the first week of May -

West

Texas will get some relief from dryness this week, but mostly in the rolling Plains where rainfall of 0.50 to 1.50 inches are expected -

Most

of the High and Low Plains will miss out on significant rain, although a trace to 0.25 inch is expected with a few local totals to 0.65 inch possible in the northeastern low Plains -

Rainfall

potentials may improve for the high Plains region in the first week of May, but a general soaking does not seem very likely -

U.S.

Delta and southeastern states will see alternating periods of rain and sunshine over the next two weeks supporting fieldwork and crop development -

U.S.

Midwest will see a favorable pattern of sun and rain during the next two weeks allowing summer crop planting to advance, although soil temperatures will remain below average restricting drying rates at times -

Cool

soil temperatures and periods of rain will restrict new crop development and may further leave reason to delay planting a little longer -

Improved

weather is expected late in the first week of May with warmer temperatures expected -

U.S.

temperatures in the Midwest and Plains will be cooler than usual during the next ten days with some of the coolness lingering in the east through the balance of the second week ending May 9 -

Warming

is expected in the western United States this week with some of that warmer than usual weather reaching the Great Plains late next week -

Canada’s

Prairies will be cooler than usual this week with rain, drizzle and some wet snow likely in the east

-

The

precipitation will be light, but when added to the runoff from recent snow it will raise the potential for serious flooding in the lower Red River Basin -

Drier

and warmer weather is needed and some of that should evolve during the second week of the two-week outlook -

East-central

and interior southern Alberta and west-central Saskatchewan, Canada will remain too dry for most of the two week forecast period -

Ontario

and Quebec wheat, corn and soybean areas will be cooler than usual during the next ten days with waves of rain -

The

moisture will slow fieldwork and warming in the region will also be slow to evolve -

California

and the southwestern desert areas will be dry and warmer than usual during the coming week -

Australia

precipitation has been limited recently, but showers will evolve in the south this week to moisten the topsoil once again and allow better planting and emergence conditions in some areas, but not all

-

Favorable

summer crop maturation and harvest progress is expected in the east-central parts of the nation through Friday of this week with some disruption expected next week -

Western

Australia is the state to watch for possible drying in the next few weeks -

Southern

Australia will get a little rain this week supporting planting of wheat, barley and canola, though more rain will be needed -

Australia

sugarcane production areas have experienced less than usual rainfall in recent weeks and months -

A

lighter than usual precipitation bias will continue for an extended period of time, although it will not be completely dry -

Argentina

rainfall will continue lighter than usual through the next ten days to two weeks resulting in a very good environment for summer crop maturation and harvest progress -

Some

periodic rain is anticipated, but the disruptions to fieldwork will be brief and no harm will come to summer crop conditions -

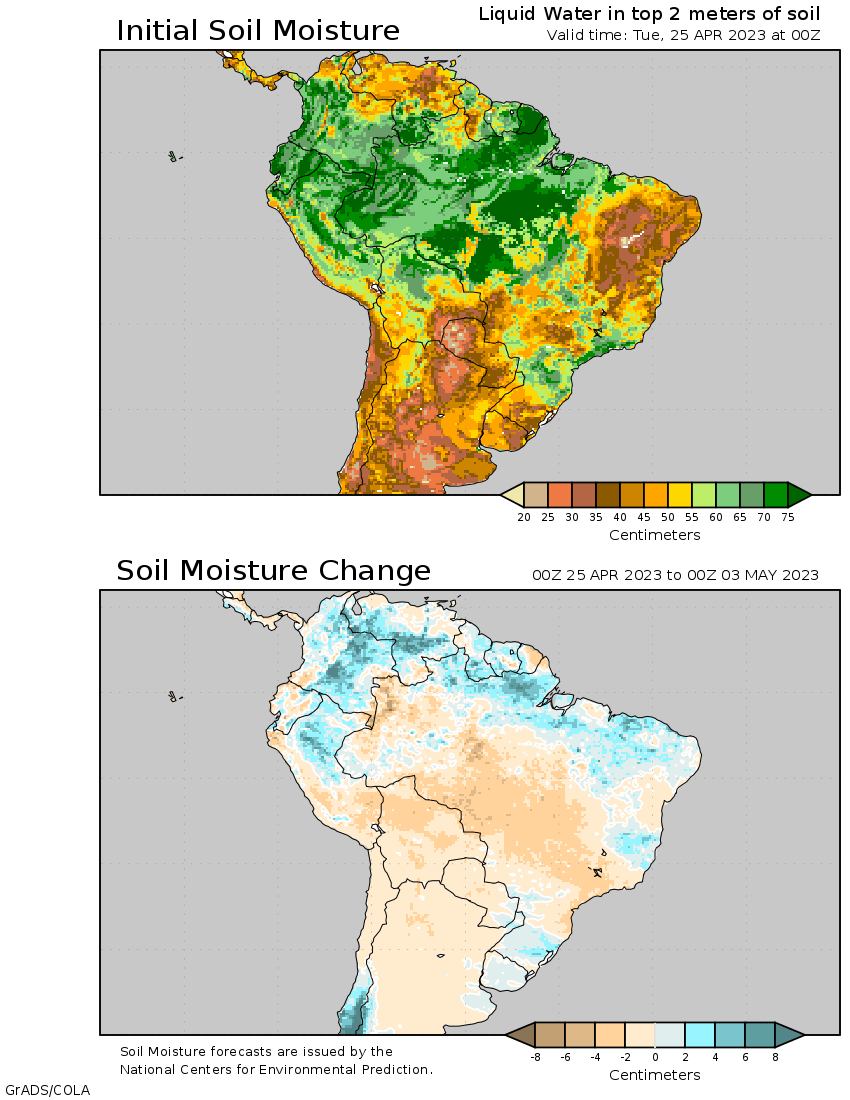

Brazil

weather will continue to be favorable over the next two weeks -

Timely

rainfall is expected in many areas favoring Safrinha corn and cotton -

Soil

moisture should be sufficient to carry on normal crop development in areas where corn, rice, sugarcane, coffee and citrus are still developing -

Winter

crop planting should advance swiftly -

South

Africa precipitation should be restricted for a while favoring summer crop maturation and harvest progress -

Cotton

areas from Mali to Burkina Faso have not seen a normal start to the rainy season this year; rain is needed to support planting -

Other

west-central Africa coffee and cocoa production areas will receive routinely occurring showers and thunderstorms

-

East-central

Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops -

Much

of Mexico remains in a drought, though eastern and far southern parts of the nation will get some periodic rain improving crop and field working conditions -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was -3.21 and it should continue to move lower over the next few days.

Source:

World Weather, INC.

Bloomberg

Ag calendar

Wednesday,

April 26:

- EIA

weekly US ethanol inventories, production, 10:30am - Euro

Grain Hub Exchange & Forum, Bucharest, Romania, day 1 - Argus

Biofuels & Feedstocks Asia Conference, Singapore, day 2 - Commodity

Trading Week conference, London, day 2 - Canada’s

StatsCan to release seeded area data for wheat, barley, canola and soybeans - Brazil’s

Conab to publish cane, sugar and ethanol production data

Thursday,

April 27:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Euro

Grain Hub Exchange & Forum, Bucharest, day 2 - Port

of Rouen data on French grain exports - Argus

Biofuels & Feedstocks Asia Conference, Singapore, day 3

Friday,

April 28:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - Euro

Grain Hub Exchange & Forum, Bucharest, day 3 - FranceAgriMer’s

weekly crop condition report - US

agricultural prices paid, received, 3pm

Saturday,

April 29:

- Vietnam’s

coffee, rice and rubber export data

Source:

Bloomberg and FI

CME

Resetting of Price Limits for Grain, Oilseed and Lumber Futures

SBO

from 40.50 to 40.00

Soybeans

to $1.00 to $1.05

Crush

from $2.155 to $2.150

Corn

unchanged at $0.45

KC

$0.65 to $0.60

Oats

$0.30 to $0.35

Effective

Sunday, April 30, 2023 for trade date Monday, May 1, 2023, The Board of Trade of the City of Chicago, Inc. (“CBOT”) and Chicago Mercantile Exchange Inc. (“CME”) (collectively, “the Exchanges”) will reset price limits for grain, oilseed, and lumber futures.

This is the first of the two price limit resets in 2023 that is stipulated by the variable price limits mechanism pursuant to each product’s respective Rulebook Chapter, as linked below.

https://www.cmegroup.com/content/dam/cmegroup/notices/ser/2023/04/SER-9190.pdf

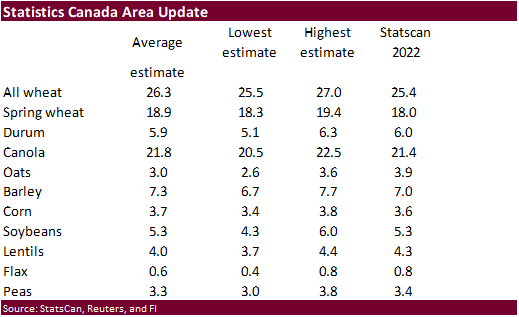

StatsCan

will be out Wednesday morning. Estimates below for planting estimates

Macros

US

Philadelphia Fed Non-Manufacturing Activity Apr: -22.8 (prev -12.8)

US

FHFA House Price Index (M/M) Feb: 0.5% (est -0.2%; prev 0.2%)

US

S&P CoreLogic CS 20-City (M/M) SA Feb: 0.06% (est -0.40%; prev -0.43%)

US

S&P CoreLogic CS 20-City (Y/Y) NSA Feb: 0.36% (est -0.10%; prev 2.55%)

US

S&P CoreLogic CS US HPI (Y/Y) NSA Feb: 2.05% (prev 3.79%)

US

New Home Sales Mar: 683K (est 632K; prev R 623K)

–

New Home Sales (M/M): +9.6% (est -1.3%; prev R -3.9%)

–

Median Sale Price (Y/Y) (USD): 449.8K or +3.2% (prev 438.2K or +2.5%)

US

CB Consumer Confidence Apr: 101.3 (est 104.0; prev R 104.0)

–

Present Situation: 151.1 (prev R 148.9)

–

Expectations: 68.1 (prev R 74.0)

US

CB 1-Year Consumer Inflation Rate Expectations Apr: 6.2% (prev 6.3%)

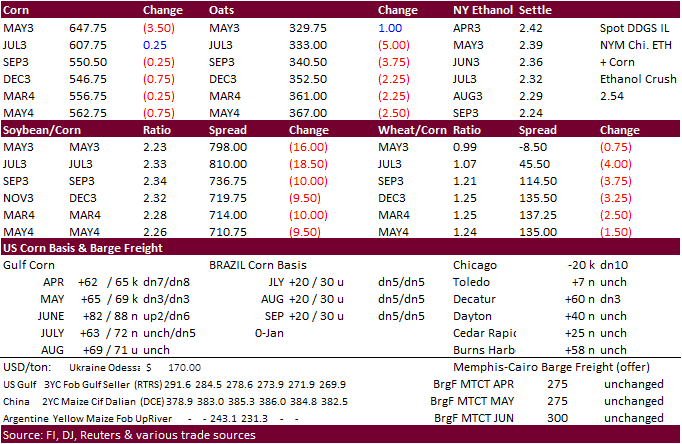

Corn

·

Corn futures stated lower but back month contracts closed higher on spreading against soybeans and slowing US planting progress expected this week. May corn finished lower on positioning. The US weather forecast calls for wet

and cool conditions for the balance of the week.

·

StoneX sees 2023 Brazil hydrous demand at 16.4 billion liters, a 5.4 percent increase. Gasoline demand was seen rising 2.5 percent to 44.1 billion liters.

·

Anec: Brazil April corn exports are projected at 166,552 tons, down from 186,552 previous estimate.

·

Turkey imposed a 130 percent import tariff on some grain imports, including corn and wheat. It will kick in May 1. They are trying to protect local producers.

·

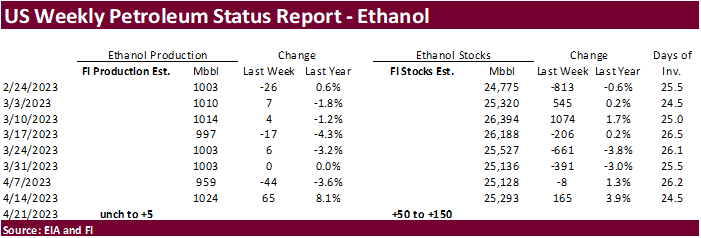

A Bloomberg poll looks for weekly US ethanol production to be down 18,000 thousand barrels to 1006k (970-1034 range) from the previous week and stocks up 18,000 barrels to 25.311 million.

Export

developments.

·

None reported

Updated

04/25/23

July

corn $5.00-$7.00

December

corn $4.75-$6.50

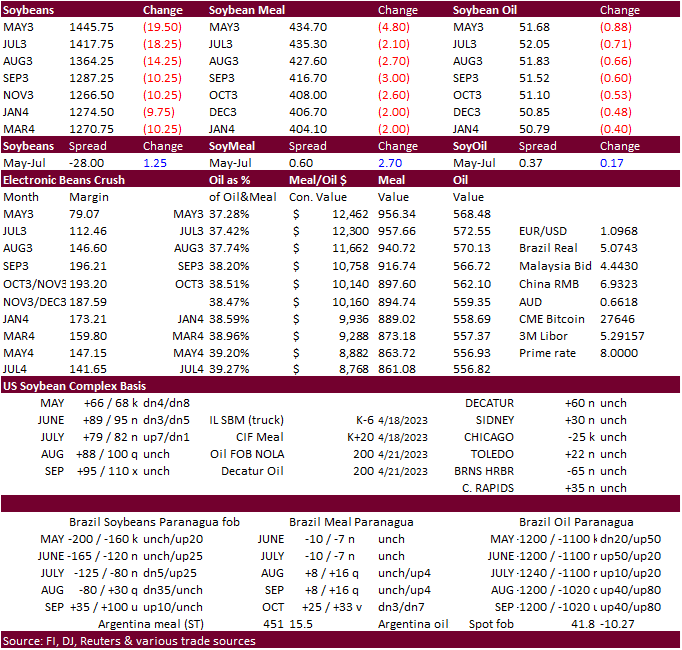

·

Ongoing downward pressure on Brazil cash soybeans from an increase in producer selling again sent US soybean futures lower. We are hearing in some areas there is lack of storage facilities, forcing producers to sell. Oil World

noted April 1-23 Brazil soybean exports reached a record 10.4 million tons, up from 8.3 million tons year earlier.

·

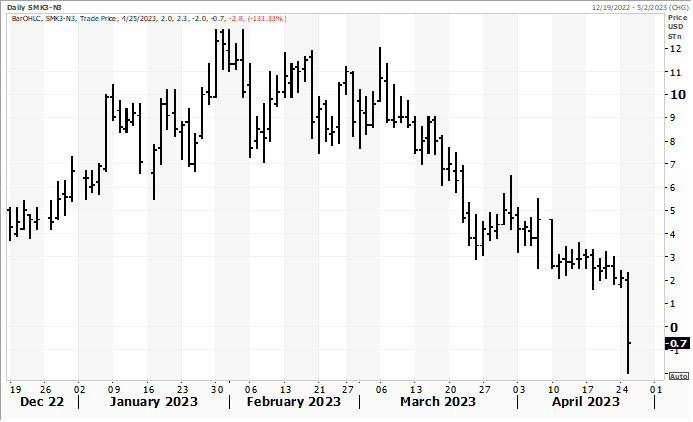

The May soybean meal / July soybean meal spread saw heavy selling today. 600 traded late in the day.

SMK3-N3

·

Anec: Brazil April soybean exports are projected at 14.71 million tons, down from 15.15 million previous estimate. Soybean meal was estimated at 1.9 million tons, down from 2.04 million previously.

·

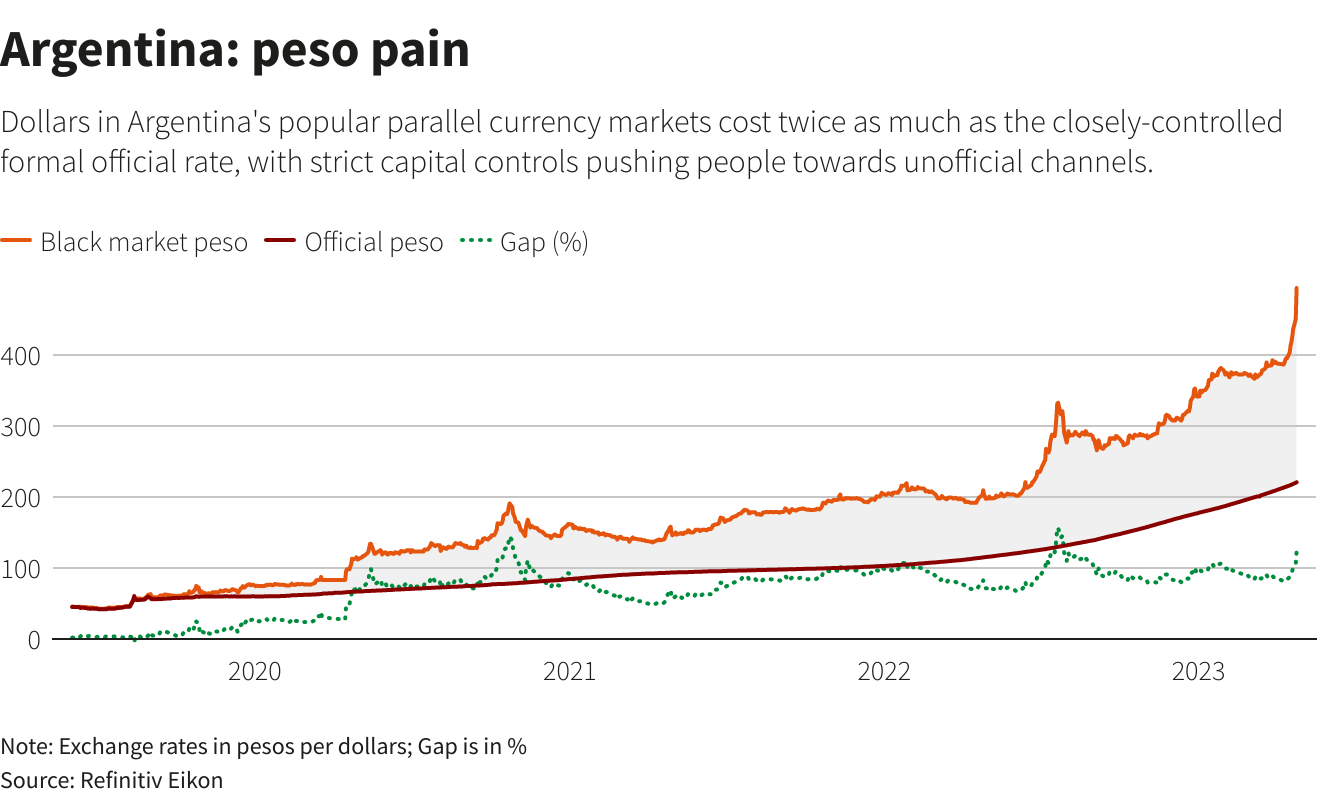

Argentina’s peso hit a record low in the black market of near 500 pesos per USD (460 on Monday), down about 400 from a week ago. The official rate was around 220 pesos. Argentina’s Economy Minister Sergio Massa said the country

would “use all its tools” to combat the rising black peso rate.

·

As expected, the IMF is working with Argentina to strengthen the economy.

·

Argentina truckers ended a strike that began on Monday.

·

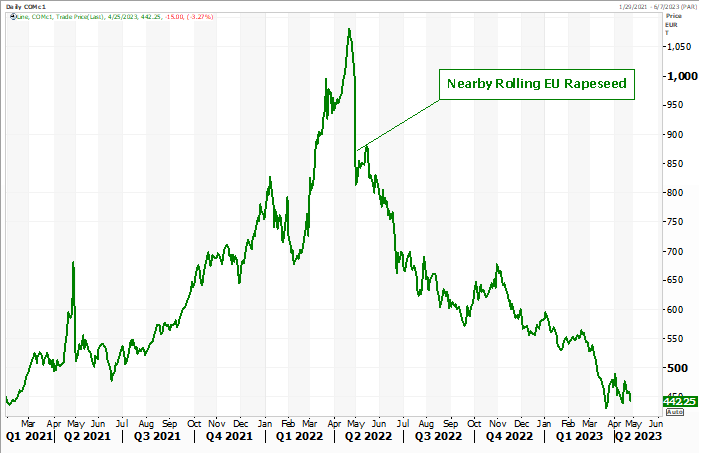

European rapeseed basis August fell around 5 percent earlier, and closed 21.25 euros lower at 438.00 euros, a 4.63% decrease.

·

Malaysian cargo surveyor ITS reported April 1-25 palm oil exports fell 14 percent from the same period last month to 989,658 tons (1.151 million March 1-25). AmSpec reported an 18.4 percent decrease to 927,331 tons.

·

The Malaysian Palm Oil Board sees higher palm oil and product based exports this year to China. China accounted to about 11.2% of Malaysian palm oil exports in 2022.

·

ADM conference call highlights via Reuters:

-EXPECTS

LOWER U.S. CRUSH MARGINS IN Q2, REBOUND IN SECOND HALF OF 2023

-UKRAINIAN

GRAIN SHIP INSPECTIONS HAVE SLOWED IN RECENT WEEKS, BUT REMAINS HOPEFUL THAT FLOWS WILL CONTINUE UNDER EXPORT CORRIDOR DEAL

-WORRIED

THAT PROLONGED UKRAINE-RUSSIA WAR WILL REDUCE CROP PRODUCTION IN BLACK SEA REGION OVER LONG TERM

-SEES

“GREEN SHOOTS” IN ETHANOL ON EXPECTED TIGHTER INVENTORIES, HIGHER EXPORTS AND BLEND RATES

-SPIRITWOOD,

NORTH DAKOTA, SOY CRUSH PLANT REMAINS ON SCHEDULE TO OPEN BY THE 2023 HARVEST

The

Spiritwood, ND, soybean crushing plant, a joint venture with Marathon, is expected to produce 600 million pounds of refined vegetable oil annually. Soybean capacity could end up around 150,000 bushels per day.

Export

Developments

-

USDA

seeks 860 tons of vegetable oil in 4 liter cans for use in export programs. Shipment was scheduled for Jun 1-30 (June 16 to July 15 for plants located at ports). All offers are due by early May 2.

Updated

04/25/23

Soybeans

– July $13.50-$14.75, November $12.00-$15.00

Soybean

meal – July $375-$500, December $325-$500

Soybean

oil – July 48.50-54.00,

December 49-58

·

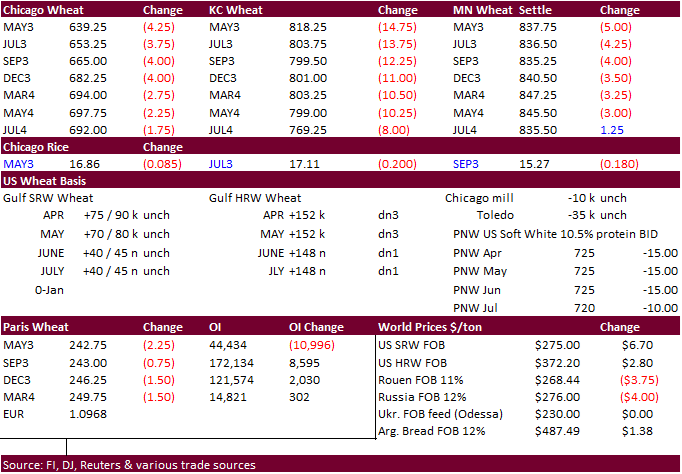

US wheat futures traded lower (Chicago 21-month low). Ongoing Black Sea shipping concerns and poor US winter wheat crop conditions did little to limit losses. The rain event this week for the Great Plains will be important for

winter wheat crop conditions and we may see an improvement when updated next Monday.

·

StatsCan is due out with initial prospective Canadian plantings on Wednesday and the trade is looking for roughly a 5 percent increase for all wheat.

·

EU wheat hit a 19-month low, despite additional negative comments out of Russia over the Black Sea grain export deal.

Russia

again said the Black Sea grain deal is not living up to expectations. Then later,

Russian

Foreign Minister Sergei Lavrov said deal is deadlocked. The Minister cited the same issues Russia has brought up in the past. A temporally restriction for use of the SWIFT banking system could allow Russia’s Agriculture bank resume financing, boosting fertilizer

and grain exports. There are also still problems with insurance.

·

The grain deal is set to expire May 18. If not extended, this could have a major disruption on commodity flows, with largest impact on wheat, corn, sunflowers, sunflower oil, and meal.

·

September Paris milling wheat officially closed down 0.75 euro, or 0.3%, at 242.75 euros a ton (about $266.25/ton).

·

APK-Inform sees Ukraine grain exports falling to 8.8 million tons for 2023-24, down 37 percent from their current season estimate. Overall grain production could end up near 45.6 million tons, down 13 percent, and includes 16.2

MMT wheat, 5.2 MMT barleys and 22.9 MMT corn.

·

Hungary is looking for a Ukraine export ban until the end of 2023.

Export

Developments.

·

Algeria’s OAIC seeks at least 50,000 tons of wheat on Thursday, valid until Friday, for May 16 through July 31 shipment.

·

South Korean flour millers seek 95,000 tons of wheat from the US and/or Australia, on Wednesday, for shipment from the United States for shipment between July 1-July 31 and 50,000 tons from Australia for shipment between Aug.

1-Aug. 31.

·

Tunisia seeks 75,000 tons of soft milling wheat on Wednesday for June 5 and July 5 shipment, optional origin.

·

China plans to sell 40,000 tons of wheat from state reserves on April 26.

·

Jordan seeks 120,000 tons of optional origin wheat on May 2.

·

Jordan seeks 120,000 tons of feed barley May 3 for October through FH November shipment.

Rice/Other

Updated

04/25/23

KC

– July $7.50-8.75

MN

– July

$7.90-9.00

#non-promo