PDF Attached

Calls:

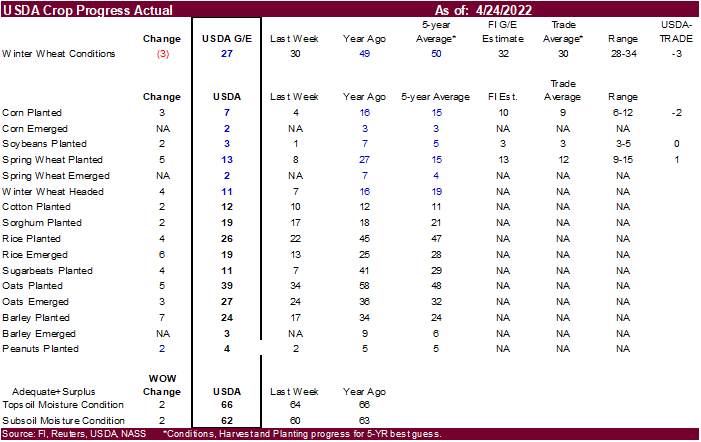

corn 1-3 higher, wheat 3-5 higher, soybeans 2-5 higher. US corn planting progress is running behind average and US winter wheat conditions dropped an unexpected 3 points. We attached out initial 2022 US wheat by class estimates.

EXPORTERS

SELL 330,000 METRIC TONS OF SOYBEANS FOR DELIVERY TO CHINA -USDA. OF THE 330,000, 66,000 METRIC TONS IS FOR DELIVERY DURING THE 2021/2022 AND 264,000 METRIC TONS IS FOR DELIVERY DURING THE 2022/2023 -USDA

EXPORTERS

SELL 204,000 METRIC TONS OF SOYBEANS FOR DELIVERY TO CHINA DURING THE 2022/2023 MARKETING YEAR -USDA

CME

will change limits effective May 1

https://www.cmegroup.com/content/dam/cmegroup/notices/ser/2022/04/SER-8977.pdf

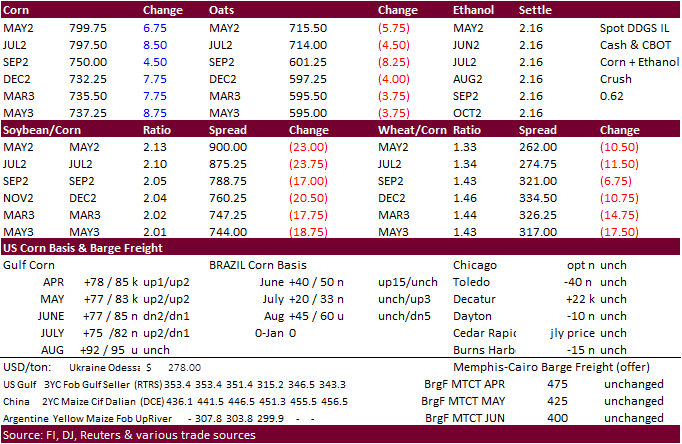

Corn

revised higher to 50 cents

Soybeans

higher to $1.15

Wheat

reduced to 70 cents

The

USDA 24-hour sales failed to attract buying in the soybean futures market. A selloff in commodities coupled with a higher USD likely weighed on the soybean complex. Back month soybean oil managed to climb higher despite Indonesia revising their ban on exports

of cooking oil. They will allow exports of crude palm oil. Palm oil reached a six week high before that announcement. Corn rallied in part to a US weather forecast calling for cool temperatures this workweek. Wheat was mixed.

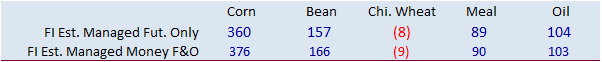

Funds

were active sellers for the Chicago wheat market.

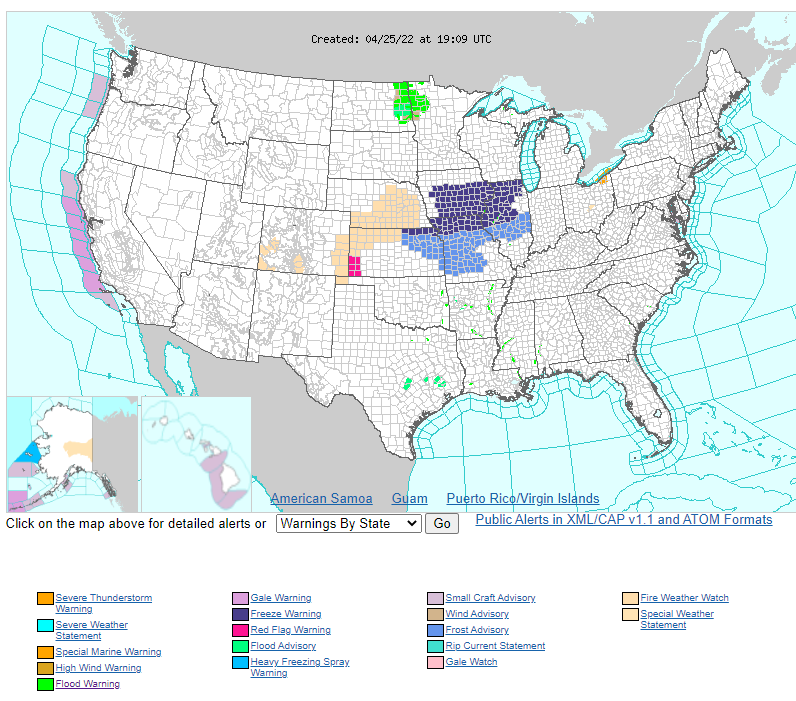

Weather

WEATHER

EVENTS AND FEATURES TO WATCH

- Interest

in the U.S. will be focused on several issues today - More

wet weather is expected in the northern U.S. Plains and Canada’s southeastern Prairies late this week and into the weekend and possibly again during the middle part of next week

- Southwestern

U.S. hard red winter wheat areas are advertised to be drier than usual through the next two weeks - Weekend

showers in Kansas and south-central Oklahoma were welcome, but not nearly enough to improve the majority of U.S. hard red winter wheat production potentials outside of the areas most impacted

- Today’s

outlook is wetter for Nebraska and northeastern Colorado and northwestern Kansas during the latter part of this week and into the weekend relative to that advertised in Sunday’s model runs - Western

U.S. Corn Belt crop areas will get enough rain in the next two weeks to improve planting moisture and remove concern over dryness for the start of the planting season - Eastern

U.S. Midwest crop areas are experienced improved field conditions during the weekend due to warmer temperatures and limited rainfall and this trend will last for a while longer this week - A

change back to wetter weather next week will bring a new period of planting delays which may encourage more aggressive planting this week - U.S.

Midwest and northern Plains temperatures are expected to be a little cooler biased during much of the two week forecast which may slow fieldwork and drying rates between storm systems - U.S.

southeastern states will experience net drying for a while, despite some showers infrequently - The

environment will be great for planting and early crop development, but a greater need for rain should evolve in time - California’s

Sierra Nevada will not receive any additional precipitation for a while - Center

west, center south and northeastern Brazil will continue to experience dry and warm weather over the next ten days resulting in more drying in Safrinha corn and cotton areas - Topsoil

moisture was rated very short in Mato Grosso Friday while subsoil moisture was marginally adequate to slightly short - Soil

conditions will be very short in May without timely rainfall and that could cost the crop some potential yield - Wet

weather in Argentina, Uruguay and southern Brazil will be closely monitored; drier weather will be needed soon to improve late season crop maturation and harvest conditions - Western

Argentina will be drying out, but the need for moisture will be low until wheat planting begins in mid- to late-May and June

WEATHER

DETAILS

- U.S.

hard red winter wheat areas received scattered weekend thunderstorms - Resulting

rainfall was sporadic, but a few areas in western Kansas received 0.25 to 0.75 inch of rain and local totals near 1.00 inch - Heavy

rain fell over a few counties in south-central Oklahoma where 1.00 to more than 3.00 inches resulted, but the area impacted was not large - Temperatures

heated up across the central and eastern United States during the weekend with extremes in the 80s Fahrenheit from the central and southern Plains into the Midwest and southeastern states - Several

extreme highs in the 90s occurred in the drought-stricken areas of the high Plains.

- Significant

rain and snow fell in the northern Plains during the weekend - Moisture

totals of 1.00 to 2.79 inches occurred from the western Dakotas through northern Minnesota while 0.08 to 0.80 inch occurred in eastern Montana with one report of 1.12 inches.

- Snow

accumulations ranged from 6 to 18 inches from extreme eastern Montana and northeastern Wyoming through the western Dakotas - The

area of greatest snow was narrow and lighter than advertised late last week - Snow

was still falling Sunday afternoon in the central and eastern portions of North Dakota and occurring sporadically in eastern South Dakota - Strong

wind speeds accompanied the snow resulting in significant blowing and drifting of snow - Rain

and snow in southeastern Canada’s Prairies was also significant during the weekend - Southern

Manitoba reported 1.00 to 2.50 inches of moisture with a few greater amounts suspected.

- Snow

accumulations in southeastern Saskatchewan varied up to 14 inches, but only a few areas were reporting data

- Snowfall

just south of the U.S. border reached 18 inches and similar amounts may have occurred in southeastern Saskatchewan - Moisture

totals in the remainder of southern Saskatchewan and southern Alberta was not more than 0.20 inch with some areas dry - The

bottom line for the northern Plains and southeastern Canada remains the same as that of late last week with too much moisture and snow cover present in southern Manitoba and parts of north-central North Dakota where some flooding either has occurred or soon

will occur when the snow melts. The snowfall in eastern Montana, northeastern Wyoming and western portions of the Dakotas was ideal in easing long term dryness, although the storm shutdown roads and caused much stress to livestock. Some newborn cattle may

have died in the storm, although that assessment has not yet begun. Field working delays are expected in the North Dakota and Manitoba Canada for a while this spring while fieldwork in other areas will improve if precipitation frequency diminishes and temperatures

turn warmer. Another large storm is expected late this workweek into the weekend from Montana to Manitoba and Minnesota. The wet bias will extend farming delays into the second week of May at the minimum.

- U.S.

Midwest early weekend precipitation was confined to the north allowing fieldwork in the south and east - Areas

from Iowa and eastern Minnesota to southern Michigan received 0.60 to 1.55 inches resulted - Rain

impacted the lower Midwest and the eastern Midwest Sunday night into this morning with rainfall to 2.27 inches in southwestern Indiana while varying from 0.20 to 0.77 inch and a few other amounts over 1.00 inch

- Less

frequent and less significant rain will impact the lower eastern U.S. Midwest, Tennessee River Basin and southeastern states this week, but rain will return next week to slow farming activity once again - Improved

spring planting conditions are expected for a brief period of time this week and farmers would be wise to take full advantage of the break from wet weather - Temperatures

will be mild to warm over the next ten days keeping the region’s drying rates a little slow, but the environment should still be good for farming activity - West

Texas corn, cotton and sorghum areas are expected to be dry and mild to warm throughout the next two weeks - Temperatures

will be a little milder than usual today into Tuesday and then warmer during the balance of this week - Rain

is still needed to support spring planting, although cotton planting does not usually begin until May 1 - U.S.

southeastern states precipitation is advertised to be limited over the next ten days supporting aggressive planting and general fieldwork progress while leading to a firmer ground - South

Texas will get showers and thunderstorms later today and Tuesday and again “possibly” for a little while next week - Temperatures

will cool down Tuesday while reaching into the 80s and some 90s many other days during the next couple of weeks - California’s

Sierra Nevada mountain snow water equivalency varies from 20% of normal in the south to 37% in central areas and 31% in the north - Precipitation

will be restricted over the next two weeks - Mountain

snowpack in the US. Pacific Northwest is near to slightly above normal in Washington, Idaho and from parts of western Montana into central Wyoming - Snowpack

in southern Oregon through Nevada to Utah, southern Colorado and New Mexico is well below normal - Frost

and freezes occurred in the northern and west-central U.S. Plains this morning and will occur again in a part of the Midwest and central Plains Tuesday morning - The

cold is not likely to cause serious harm to winter crops, but some vegetative damage is expected - Weekend

precipitation was limited in Mato Grosso and Mato Grosso do Sul - The

precipitation forecast was less than expected leaving these areas in a net drying mode - Concern

remains for Mato Grosso where drying is already stressing some crops - Ten

days of dry mostly dry weather is advertised for center west, center south and northeastern Brazil leading to net drying in crop areas throughout region - Dryness

is already an issue for Mato Grosso and in a few northeastern Brazil locations and concern is moderately high over poor soil moisture for Safrinha corn and cotton produced in Mato Grosso and a few immediate neighboring areas - Waves

of rain will impact southern Paraguay, eastern Argentina, Uruguay and far southern Brazil during the next ten days maintaining wet field conditions in those areas - The

region to be impacted will include the south half of Parana and southern Paraguay into Chaco, Santa Fe and eastern Buenos Aires, Argentina

- Fieldwork

will be slowed in these areas and some crop quality concerns will arise over time - Western

Argentina will experience net drying conditions over the next ten days - This

will impact Cordoba more than other provinces, although Santiago del Estero and San Luis will all experience a net decline in soil moisture - Rain

elsewhere in Argentina will support late season summer crops - Western

Argentina will need moisture during May and June to support wheat planting and establishment - Frequent

rain from the Amazon River Basin through Colombia, western Venezuela and Ecuador to parts of Central America will induce local areas of flooding in the next ten days - Europe

precipitation will occur most often from Spain, Portugal and parts of southern France into southern Belarus, central and western Ukraine and parts of western Russia over the next ten days to two weeks

No

heavy rain is expected, but enough will occur to support winter and spring crop development

- Some

disruption to fieldwork will be possible periodically - Temperatures

in Europe and the western CIS are expected to be near to below normal during the next ten days while the eastern CIS New Lands and Kazakhstan are warmer than usual - Parts

of Central Asia will also be quite warm - Western

Commonwealth of Independent States weather will include frequent bouts of rain, drizzle and some snow during the next ten days - Soil

moisture will continue rated adequate to excessive with areas from southern Belarus and northwestern Ukraine into the middle Ural Mountains region wettest and carrying the greatest need for drier weather - Fieldwork

will advance a little slower than usual in some areas because of wet field conditions and some occasional precipitation. Drier and warmer weather would be best in promoting fieldwork, but big changes are not very likely for a while - India

weather will remain normal for this time of year - Bouts

of rain will occur from West Bengal through Bangladesh to the far Eastern States

- Some

showers will also occur in far southern India, but they should be brief and very light

- Harvest

progress should advance well - North

Africa rainfall over the next ten days will be greatest in northern Algeria and northern Tunisia where some areas will received 2.00 to 4.00 inches of rain while others receive 0.50 to 1.50 inches - Morocco

will be driest with only a few sporadic showers - Conditions

will be good for reproducing and filling winter crops - West-central

Africa rainfall is expected to be frequent over the next ten days maintaining a very good environment for coffee, cocoa, sugarcane, citrus and some cotton - A

boost in rainfall would be welcome in cotton areas - South

Africa rainfall should be a little less frequent and less significant in this coming week to ten days relative to that of last week - The

nation needs net drying to support better summer crop maturation and harvest conditions - Crop

maturation and harvest conditions should improve - China

weekend precipitation was greatest in the southeast impacting areas from the Yangtze River Basin southward to the coast.

- Some

locally heavy rainfall occurred with 2.00 to nearly 8.00 inches occurring in a few areas

- One

location in Guangdong reported nearly 10.00 inches - Local

flooding resulted, but most crop areas did not get excessive moisture - China

weather is expected to be relatively normal for this time of year, during the next ten days to two weeks - Rain

frequency will be greatest near and south of the Yangtze River - Precipitation

in the Yellow River Basin and North China Plain will be most limited and net drying is expected, but that is not unusual for this time of year - Heilongjiang

will also be wetter biased with precipitation both early this week and again during the weekend - Soil

temperatures are warm enough to plant spring wheat and sugarbeets in the northeast of China and warm enough for some corn planting across east-central parts of the nation. Fieldwork should advance around anticipated rainfall.

- Australia

weekend precipitation was limited, although there were reports of excessive rain in the Cape York Peninsula and in some areas southward to around the Cairns, Queensland region - Flooding

did occur in northeastern Queensland impacting some sugarcane - Most

of wheat, barley and canola areas were dry and good harvest weather occurred in cotton and sorghum areas - Rain

will overspread most of Queensland and northern New South Wales early this week inducing some delay to summer crop harvesting, but bolstering soil moisture for future winter crop planting - Western

Queensland fringe crop areas may get 2.00 to more than 4.00 inches of moisture while the far southeastern corner of the state gets less than 0.60 inch - North-central

New South Wales will receive 1.00 to 2.50 inches of rain while the northeast gets less than 0.50 inch - Portions

of Kazakhstan have need for more moisture and the region should be closely monitored for dryness later this growing season - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - Turkey,

northern Iran and Afghanistan will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines while a little erratic in the mainland crop areas during the next ten days - Overall,

crop conditions will remain favorable - A

developing tropical cyclone is expected over the Philippines during the middle part of this week that will evolve into a tropical storm later in the week in the South China Sea

- Some

heavy rainfall is likely in the Philippines during mid-week as the disturbance pushes through central areas - The

tropical cyclone could move across Luzon island or Taiwan early next week after becoming better organized in the South China Sea this weekend - Eastern

Mexico will receive rain early to mid-week this week increasing soil moisture in many areas - Western

areas will be dry biased - Central

America precipitation will slowly expand northward in the next few weeks - the

moisture will be good for most crops - Today’s

Southern Oscillation Index was +17.27 and it should slowly level off this week and begin moving a little erratically

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- Statistics

Canada publishes report on seeded area for wheat, barley and canola - MARS

monthly report on EU crop conditions - Geneva

Sugar Conference, day 1 - EU

weekly grain, oilseed import and export data - EARNINGS:

ADM

Wednesday,

April 27:

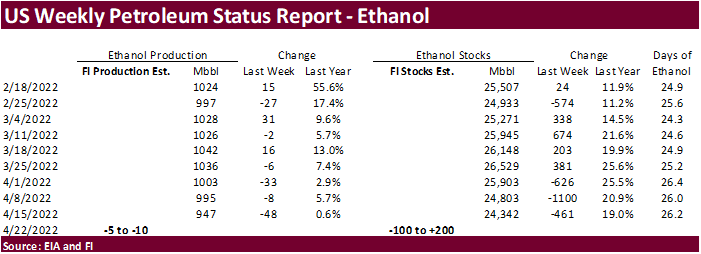

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Geneva

Sugar Conference, day 2 - EARNINGS:

Bunge, Pilgrim’s Pride

Thursday,

April 28:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

Conab releases production numbers for sugar, cane and ethanol (tentative)

Friday,

April 29:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Vietnam’s

General Statistics Office releases coffee, rice and rubber export data - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Japan, Indonesia

Source:

Bloomberg and FI

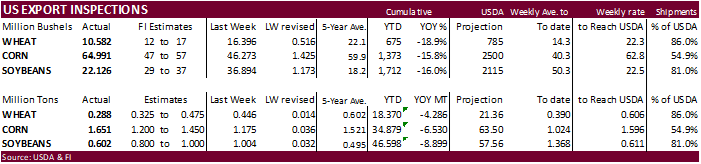

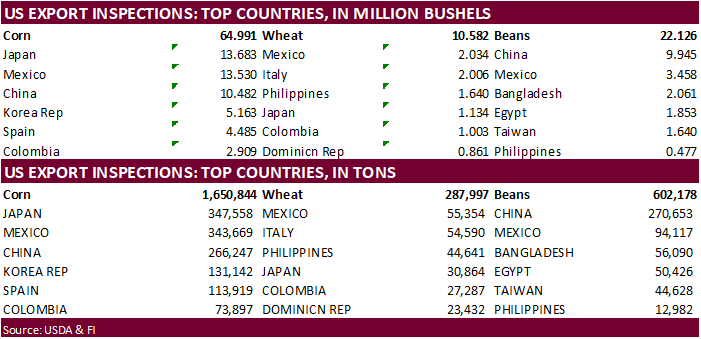

USDA

inspections versus Reuters trade range

Wheat

287,997 versus 300000-475000 range

Corn

1,650,844 versus 1000000-1500000 range

Soybeans

602,178 versus 600000-1075000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 21, 2022

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/21/2022 04/14/2022 04/22/2021 TO DATE TO DATE

BARLEY

0 0 24 10,083 32,644

CORN

1,650,844 1,175,398 1,954,012 34,878,754 41,408,942

FLAXSEED

0 0 0 324 509

MIXED

0 0 0 0 0

OATS

0 100 0 600 6,514

RYE

0 0 0 0 0

SORGHUM

168,777 323,467 182,614 5,088,673 5,384,871

SOYBEANS

602,178 1,004,103 284,564 46,598,182 55,497,621

SUNFLOWER

384 336 0 1,972 0

WHEAT

287,997 446,225 581,087 18,369,608 22,655,897

Total

2,710,180 2,949,629 3,002,301 104,948,196 124,986,998

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Due

out April 26

82

Counterparties Take $1.784 Tln At Fed Reverse Repo Op (prev $1.765 Tln, 81 Bids)

·

CBOT corn ended 7.25-10.50 cents higher on robust USDA export inspections, higher than expected US cattle placements as reported by USDA on Friday, and slow US planting progress. A sharply lower WTI crude oil (Shanghai lockdowns),

higher USD and lower soybeans limited gains. The funds bought an estimated net 7,000 corn contracts.

·

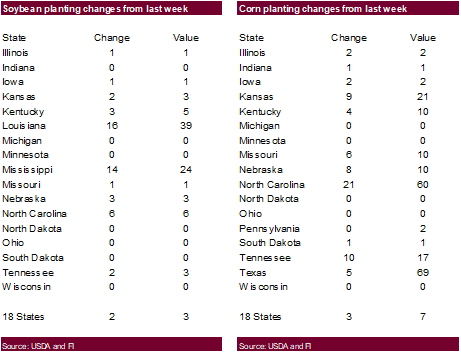

US corn planting progress improved by a less than expected figure, currently 7 percent and compares to 16 percent last year and 15 percent average. Traders were looking for 9 percent complete.

·

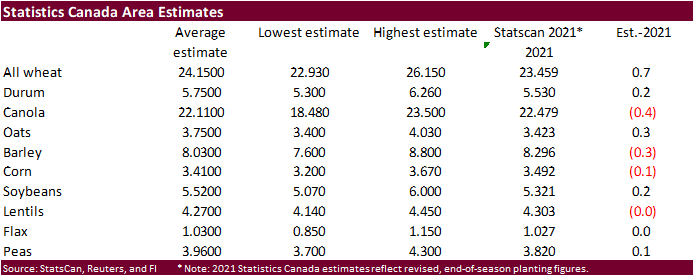

StatsCan prospective plantings are due out on Tuesday, and we look for a good shift from corn acres to other commodities. Trade estimates are above the corn section.

·

USDA US corn export inspections as of April 21, 2022, were 1,650,844 tons, above a range of trade expectations, above 1,175,398 tons previous week and compares to 1,954,012 tons year ago. Major countries included Japan for 347,558

tons, Mexico for 343,669 tons, and China for 266,247 tons.

·

CME group is raising corn and soybean limits this weekend.

https://www.cmegroup.com/content/dam/cmegroup/notices/ser/2022/04/SER-8977.pdf

Export

developments.

·

None reported

Updated

4/22/22

July

corn is seen in a $7.25 and $8.65 range

December

corn is seen in a wide $5.50-$8.50 range (unchanged, up 50 cents high end)

·

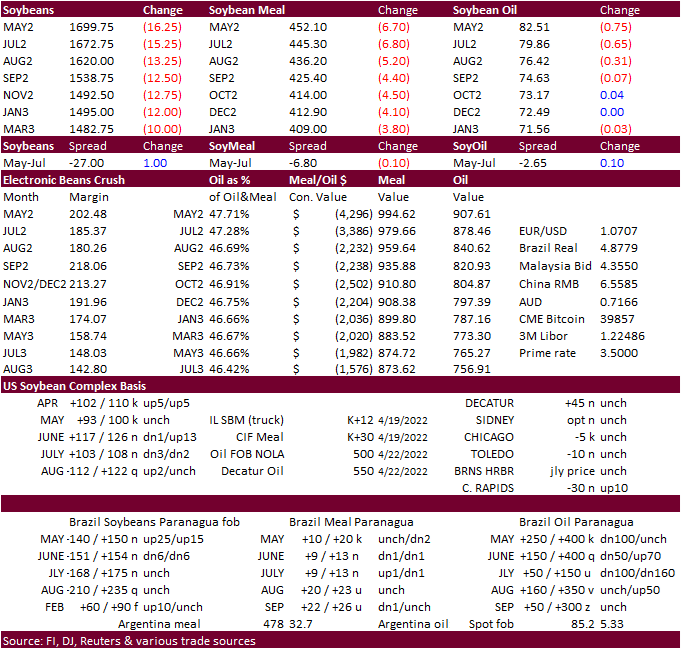

Combination of a sharply lower WTI crude oil market, higher USD, and Indonesia reversing part of its ban on cooking oil exports sent the CBOT complex lower. Soybeans traded lower despite ok export inspections (low end of expectations)

and USDA 24-hour sales. Meal was under pressure throughout the session despite higher than expected US cattle placements reported by USDA on Friday and higher corn futures. Back month soybean oil reversed losses to end higher. The funds sold an estimated net

9,000 soybeans, 4,000 meal and 3,000 soybean oil. Note Egypt and Turkey are in for vegetable oils.

·

Indonesia revised their ban on exports of cooking oil and will allow exports of crude palm oil and some refined bulk products. This was initially seen as bearish global vegetable oil prices. Details are still unclear, but it looks

like India, China and other importing countries can count of Indonesia crude palm oil. Selected refined products may be banned for exports. Domestically finished palm oil products within Indonesia are still scarce.

·

We think the ban will be temporary and lifted before the end of May. In the meantime, look for India and China to import from Malaysia for selected refined products.

·

July soybean oil ended 43 points lower and December up 11 points.

·

Palm oil reached a six week high before that announcement. Malaysian palm oil finished 16 points lower, and cash was $15 lower.

·

AmSpec reported Malaysian 1-25 April palm oil exports at 901,978 tons, down 10.6 percent. ITS reported a 12.3 percent drop to 1.043 million tons.

·

US soybean planting progress was reported by USDA at 3 percent complete, same as an average trade guess and compares to 7 last year and 5 percent average.

·

Egypt’s GASC seeks vegetable oils for June and/or July arrival on Thursday, April 28. A minimum of 30,000 tons of soybean oil and 10,000 tons of sunflower oil, in the international market, is for arrival between June 10 and 30.

Locally they seek 3,000 tons of soybean oil and 2,000 tons of sunflower oil with delivery from June 10 to 30.

·

Turkey seeks 18,000 tons of sunflower oil on April 28 for shipment between May 16 and June 16.

·

South Korea’s NOFI group bought 60,000 tons of optional origin soybean meal (likely SA) at $591.80/ton c&f, slightly less than what they paid in late May.

·

China looks to auction off another 500,000 tons of soybeans April 29.

Updated

4/22/22

Soybeans

– July $16.00-$18.50

Soybeans

– November is seen in a wide $12.75-$16.50 range (unchanged, up $1.00 high end)

Soybean

meal – July $420-$5.20

Soybean

oil – July 75-90

·

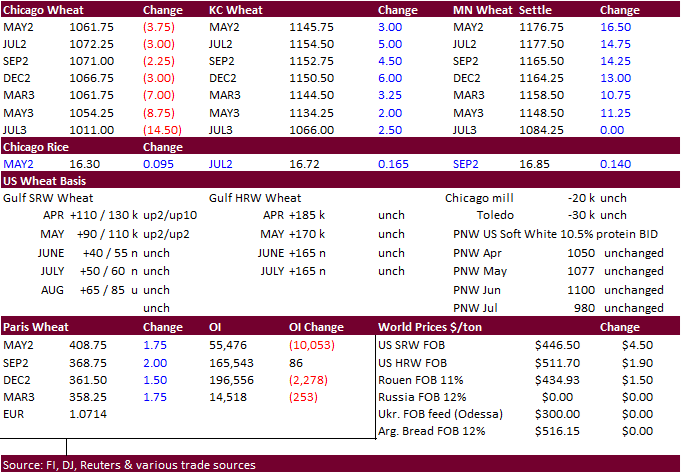

US wheat was

mixed with Chicago lower (fund selling) and KC & MN higher. US weather continues to hamper spring seeding progress for the upper Great Plains (plantings running slightly behind average), and net drying for the far western Great Plains is seen for this week.

The USD was up about 50 points as of 1:52 pm CT. On Tuesday Algeria will be in for wheat.

·

The funds sold an estimated net 4,000 Chicago wheat contracts.

·

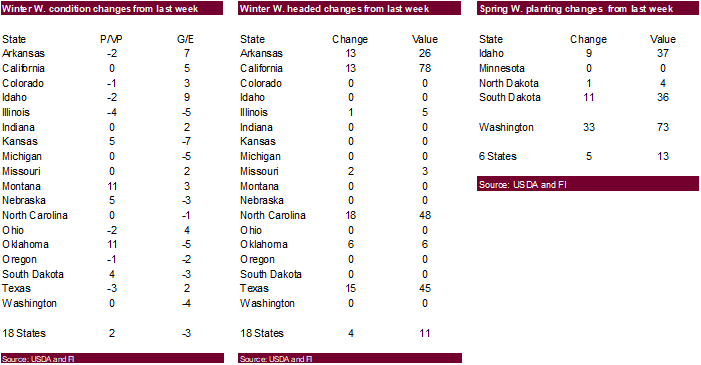

US winter wheat crop conditions dropped an unexpected 3 points to only 27 percent for the combined good and excellent categories, lowest for this week since 1989. The trade was looking for unchanged (30 percent). We were surprised

SRW wheat ratings declined while HRW improved.

·

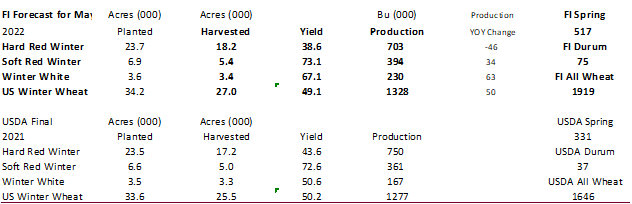

Below are our initial May winter wheat by class production estimates. USDA ag forum was at 1.940 billion for all wheat. Attached is our US all-wheat balance sheet.

·

US spring wheat planting progress was reported at 13 complete, compared to 12 percent trade average, 27 year ago and 15 for the 5-year average.

·

USDA US all-wheat export inspections as of April 21, 2022 were 287,997 tons, below a range of trade expectations, below 446,225 tons previous week and compares to 581,087 tons year ago. Major countries included Mexico for 55,354

tons, Italy for 54,590 tons, and Philippines for 44,641 tons.

·

China ended their weekly wheat reserve auctions. No reason was given but we speculate much of the past reserve sales went to compound feed.

·

September EU wheat futures were 2.00 euros higher at 367.00 euros.

·

Algeria seeks 50,000 tons of wheat on Tuesday for second half of May and June shipment.

·

Jordan seeks 120,000 tons of feed barley on April 26 for Aug and/or Sep shipment.

·

Jordan seeks 120,000 tons of wheat. on April 27 for Jun and/or Aug shipment.

Rice/Other

·

None reported

Updated

4/22/22

Chicago – July $10.50 to

$12.50 range, December $8.50-$12.50

KC – July $10.25 to $12.50

range, December $8.75-$13.50

MN – July $10.75‐$13.00,

December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.