Quieter

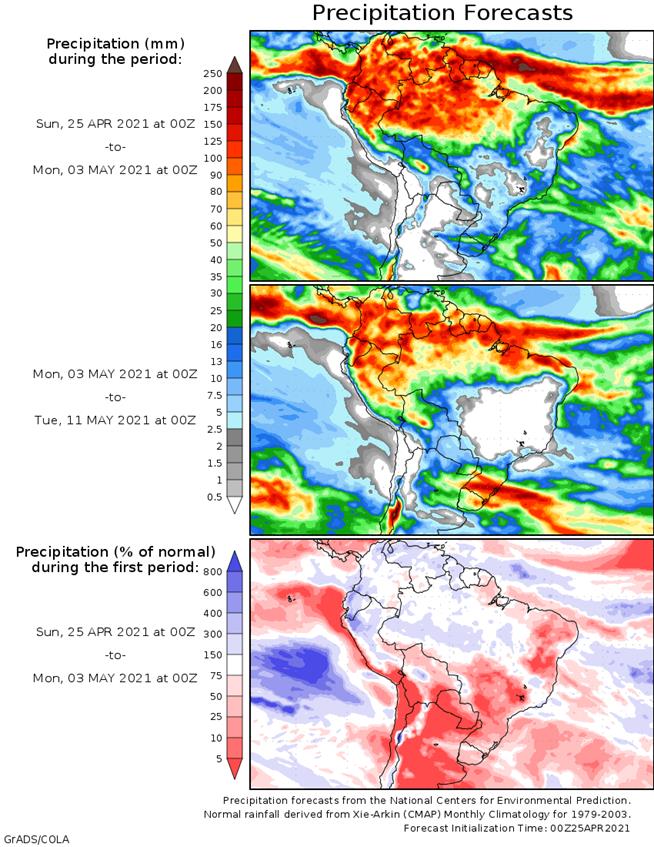

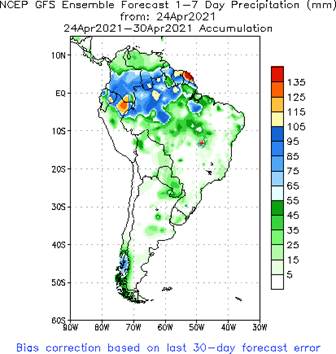

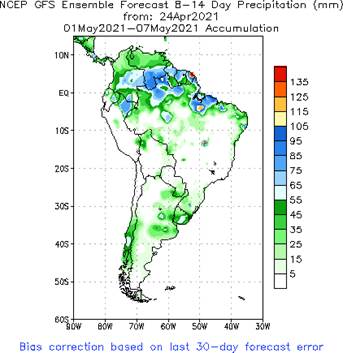

but choppy session Friday to end a wild week. There was no record fund position in corn as of last Tuesday. Tuesday StatsCan Canadian plantings will be released. SA looks dry over the next two weeks, IMO, per Sunday morning NCEP/GFS forecasts. US cattle

placements were less than expected.

WASHINGTON,

April 23, 2021—Private exporters reported to the U.S. Department of Agriculture the follow activity:

-

Export

sales of 336,000 metric tons of corn for delivery to unknown destinations during the 2021/2022 marketing year; -

Export

sales of 136,680 metric tons of corn for delivery to Guatemala during the 2021/2022 marketing year; and -

Export

sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

CME

margin changes via Reuters-

- CME

RAISES CORN FUTURES (C) MAINTENANCE MARGINS BY 13.3% TO $1,700 PER CONTRACT FROM $1,500 FOR MAY 2021 - CME

RAISES CRUDE OIL FUTURE NYMEX (CL) MAINTENANCE MARGINS BY 3.9% TO $5,300 PER CONTRACT FROM $5,100 FOR JUNE 2021 - CME

RAISES SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 14.2% TO $3,825 PER CONTRACT FROM $3,350 FOR MAY 2021 - SAYS

INITIAL MARGIN RATES ARE 110% OF MAINTENANCE MARGIN RATES - SAYS

RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON APRIL 23, 2021

MINNEAPOLIS

GRAIN EXCHANGE (MGEX):

- RAISES

HARD RED SPRING (HRSW) WHEAT FUTURES MAINTENANCE MARGINS TO $1,900 PER CONTRACT FROM $1,400 FOR MAY, JULY 2021 - SAYS

CHANGES EFFECTIVE AT CLOSE OF BUSINESS ON FRIDAY, APRIL 23, 2021

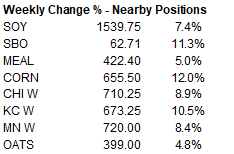

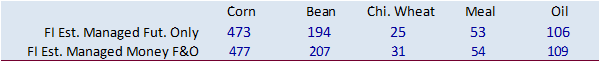

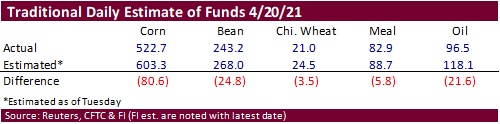

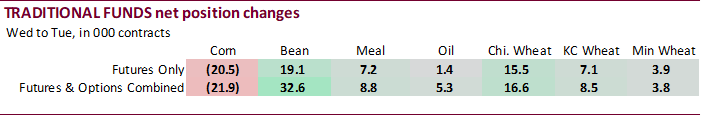

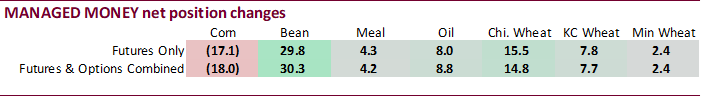

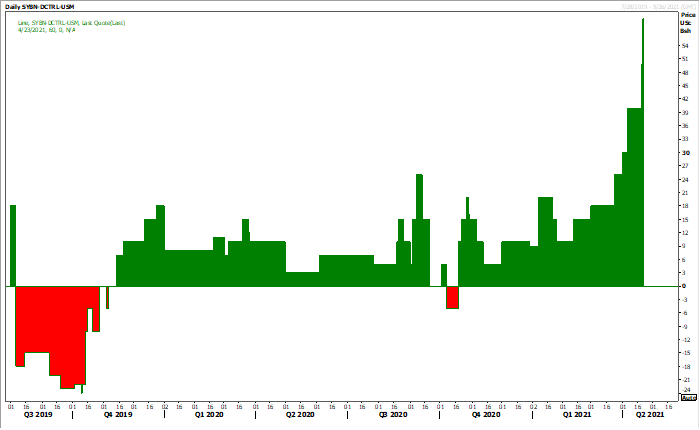

Managed

money estimates as of Friday afternoon

Corn

managed money futures and options were not a record as the trade missed the corn buying by a large amount.

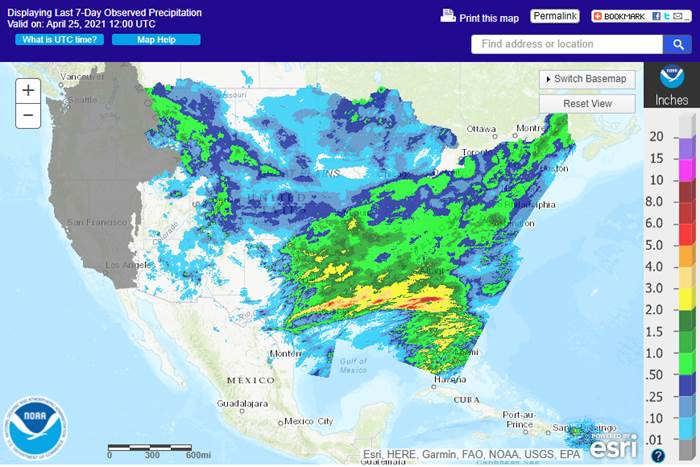

Next

7 days

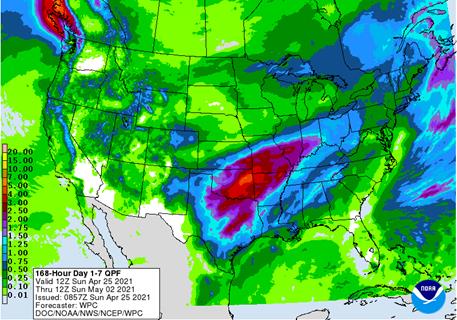

FRIDAY’S

MOST IMPORTANT ISSUES

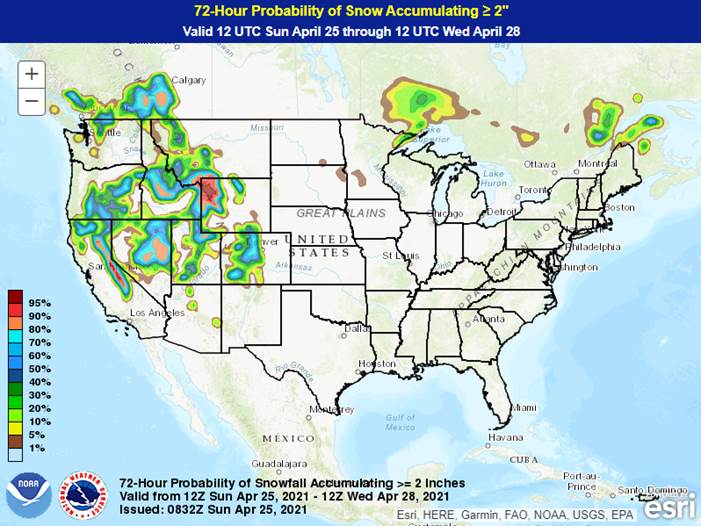

- Freezes

this morning occurred mostly in crop areas of North Carolina, Virginia and areas north into the eastern Midwest with little to no impact compared to that of other days this week - Brazil

dryness outlook has not changed greatly - Mato

Grosso and western and northern Mato Grosso do Sul Safrinha crops will stay in the best shape, but will dry down after Monday - Most

other Safrinha crop areas will continue to experience net drying and the long-term outlook is stressful for reproduction and filling - Argentina’s

weather still looks favorable with rain winding down tonight and Saturday and then a week of net drying - U.S.

central Midwest, Delta and southeastern Plains will see a severe weather outbreak Tuesday into Thursday - Significant

rainfall is expected during mid-week next week in the central Midwest and Delta, but good field working conditions will precede the event and sometime of improved field conditions will follow before the next rain event comes along - World

Weather, Inc. believes the precipitation pattern in the Midwest will be well timed for favorable field progress, despite the advertised heavy rain event next week in central areas - Very

warm to hot temperatures will occur briefly from the central and southern Plains into the Midwest Sunday into Tuesday - Highs

in the upper 70s and 80s with extremes near and over 90 in the central and southern Plains

- Cooling

will follow next week storm in the Midwest, Plains and Delta, but the cool off will not be nearly as significant as that of this week - Warming

returns to the Plains April 30 and it expands into the Midwest during the first week of May - Rain

will fall in West Texas May 3-4 offering some relief from dryness and will briefly improve topsoil moisture for spring planting, but much more rain will be needed - Northern

Plains and Canada’s Prairies will get rain in May and concern about dryness in those areas should be reduced, although it is questionable as to how much relief will occur to dryness in the subsoil - Today’s

forecast models do not offer significant precipitation in these areas through day 10 and it is questionable how much relief will occur in Days 11-15 - Rain

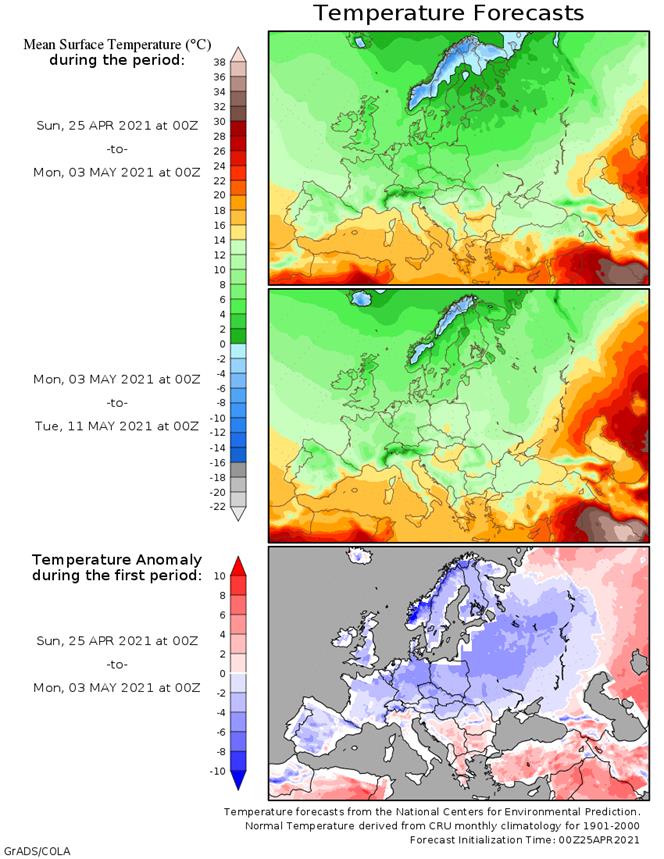

may fall briefly in southwestern Western Australia late next week - Cold

weather in northeastern Xinjiang, China will prevail into the coming week - 06z

GFS advertised greater rain in western parts of South Africa’s summer crop region today - This

event may be overdone - North

Sea region of Europe will continue to see restricted precipitation over the next ten days while other areas in the continent get periodic rain - Western

CIS is still advertised to be wet for much of the coming week to ten days and temperatures will be cool - Field

progress and crop development will be slow - No

changes in the rest of Europe, India or North Africa

Source:

World Weather Inc. & FI

Friday,

April 23:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

Cattle on Feed, Poultry Slaughter 3pm - U.S.

cold storage – pork, beef, poultry

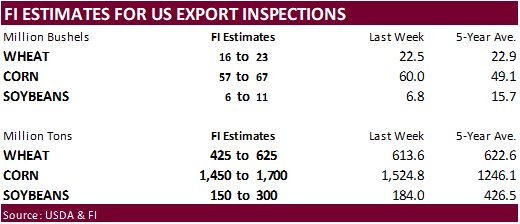

Monday,

April 26:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – corn, wheat, cotton; winter wheat condition, 4pm - Monthly

MARS bulletin on crop conditions in Europe - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Malaysia

April 1-25 palm oil export data from AmSpec, SGS - HOLIDAY:

New Zealand

Tuesday,

April 27:

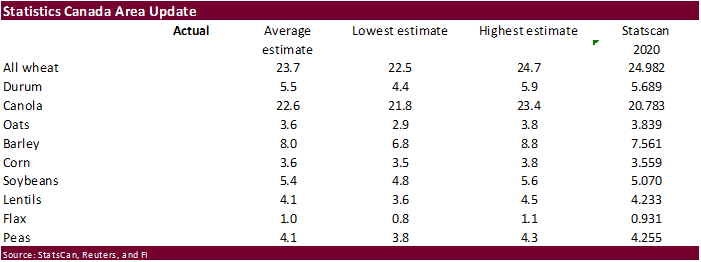

- Canada’s

StatsCan releases data on seeded area for soybeans, barley, canola, wheat and durum

Wednesday,

April 28:

- EIA

weekly U.S. ethanol inventories, production - Brazil’s

Unica publishes data on cane crush and sugar output (tentative)

Thursday,

April 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - International

Grains Council monthly report - HOLIDAY:

Japan, Malaysia

Friday,

April 30:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

agricultural prices paid, received - Malaysia’s

April 1-30 palm oil export data - FranceAgriMer

weekly update on crop conditions - Holiday:

Vietnam

Source:

Bloomberg and FI

Due

out Tuesday April 27

Macro

Canada

March Factory Sales Most Likely Rose By 3.5% – StatsCan Flash Estimate

US

Markit Manufacturing PMI Apr P: 60.6 (est 61.0; prev 59.1)

–

Services PMI: 63.1 (est 61.5; prev 60.4)

–

Composite PMI: 62.2 (prev 59.7)

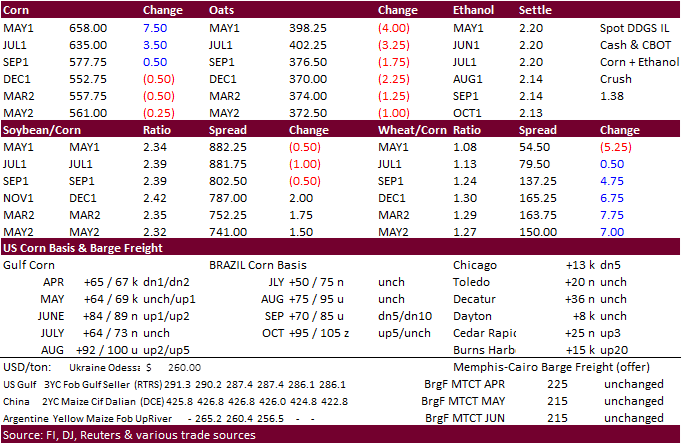

Corn

- CBOT

corn

traded choppy with May and July finishing on a higher note and back months lower. Funds wanting to add to long positions found an opportunity to pick off contracts this morning when futures dipped lower. The USD was 43 weaker as of 1:15 pm CT. Argentina

is again looking at increasing grain export taxes. Three fresh import tenders developed on Friday including SK buying 338,000 tons. It was certainly a wild week, nothing comparable that I can recall, even from the drought scare of 2012. Nearby corn is near

an 8-year high. - Funds

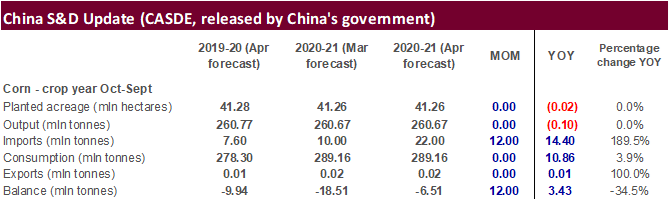

bought an estimated net 8,000 corn contracts. - China

demand for corn should underpin corn prices, even if we see a temporary setback in CBOT corn prices, over the long run. As we saw earlier this week, USDA Attaché estimated 2020-21 China corn imports at 28 million tons, 4 million above USDA official, and well

above 22 million tons forecast by China’s AgMin. China’s AgMin balance shows a corn carryout deficit of 6.5 million tons for 2020-21, so we are in the camp with USDA’s forecast for China corn imports. Working with a 101 to 103 million ton Brazil corn crop

(USDA @ 109MMT) could yield a 32.5-million-ton Brazil export program rather than 39 million tons projected by USDA (256 million bushel difference), and down from 35.23 million tons during 2019-20. A 6.5MMT lower Brazil corn export projection could boost the

US export program further for 2021 by 150 to 200 million bushels.

- There

were rumors of a US animal unit producer buying Argentina corn for US East Coast delivery. They may have concluded three trades this week at an unknown volume. This comes after Brazil bought Argentina corn recently, but timing of shipment will depend on Argentina

availability. Argentina corn harvest is slow at only 17 percent before drying down. Apparently, Argentina’s corn crop has a high moisture content, which may further delay port arrivals.

- Commodity

Weather Group warned Brazil second corn crop drought stress is seen expanding to nearly 60% of the area.

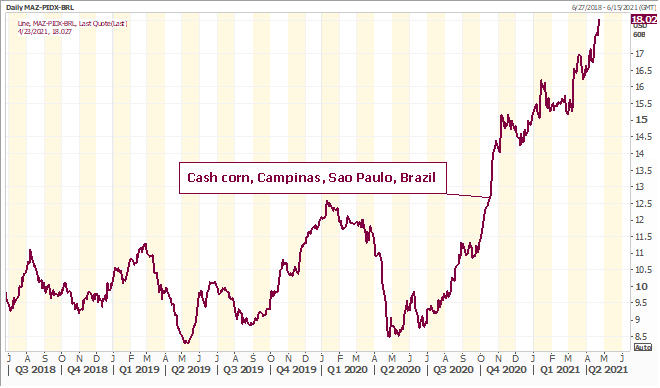

- Brazil’s

meat lobby group said meatpackers are looking at using more wheat for feed as grain prices are getting very expensive.

- FranceAgriMer

reported French corn planting progress at 41% by April 19 against 18% the prior week.

- South

Africa’s Crop Estimates Committee (CEC) will update their 2020-21 corn production on April 29 and a Reuters trade estimate is at 16.349 million tons, up from 15.922 million tons projected in March and above 15.3 million collected last year.

- Bulgaria

reported a fifth bird flu outbreak at an industrial farm affecting 40,000 laying hens.

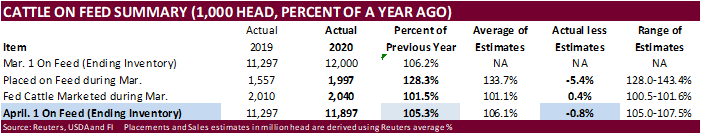

Placements

rose a less than expected 128% as well as April 1 feed of 105%. Placements did rise seasonally, and the less than expected figure should have little impact on grain prices this coming Sunday night. Recall last month placements were reported at the bottom

of a 5-year range.

Export

developments.

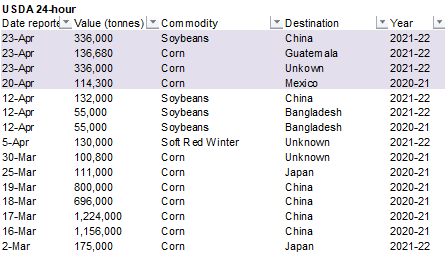

- Under

the 24-hour USDA announcement system, private exporters sold 336,000 tons of corn for delivery to unknown destinations during the 2021-22 marketing year.

- Under

the 24-hour USDA announcement system, private exporters sold 136,680 tons of corn for delivery to Guatemala during the 2021-22 marketing year.

- South

Korea’s NOFI bought about 137,000 tons of corn (2 out of 3 cargoes sought) at $312.30/ton c&f for Aug 15 arrival and $304.29/ton for Aug 25 arrival.

- South

Korea’s KFA bought about 201,000 tons of corn (3 out of 4 cargoes sought) at $305.31/ton c&f for Aug 25 arrival, $304.66/ton for Sep 20 arrival, and $305.31/ton for around Sep 20 arrival.

Updated

4/22/21

May

corn is seen in a $6.10 and $7.00 range

July

is seen in a $5.75 and $6.75 range

December

corn is seen in a $4.00-$6.50 range.

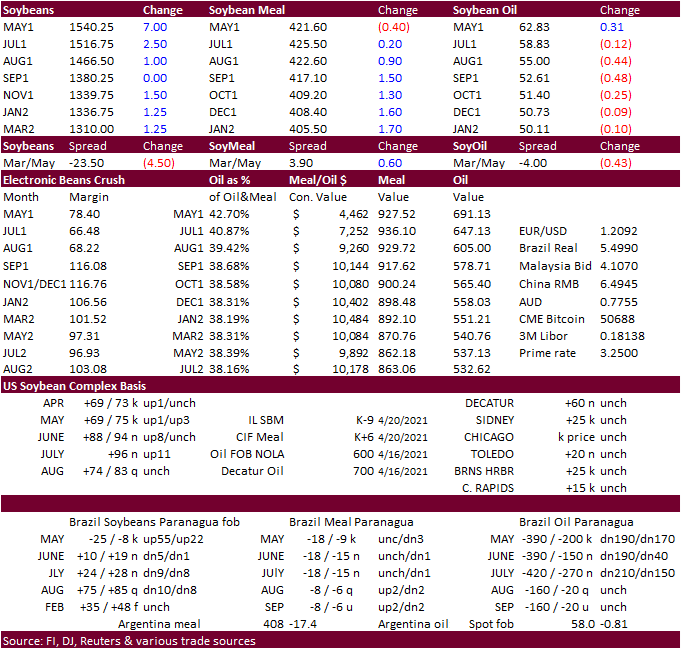

- CBOT

soybeans

traded two-sided in part to profit taking and bottom picking. May ended on a strong note and further widened against new-crop, a sign traders remain bullish over tight old crop US stocks. Meal finished slightly higher and SBO mixed. SBO was up 11.3% this

week. Look for US soybean basis across the Corn Belt to remain very strong. Egypt is in for vegetable oils. Last we heard IL SBO basis was 600 over and Gulf 800 over (up 200 points week over week).

- We

heard China bought a few US soybean cargoes yesterday. Two cargoes showed up under the 24-hour announcement system. Then about midway through the day session, we heard China was inquiring for more soybeans, about the same time CBOT soybean futures rallied.

- Funds

on Friday sold an estimated net 1,000 soybean contracts, flat on soybean meal and sold an estimated 1,000 soybean oil.

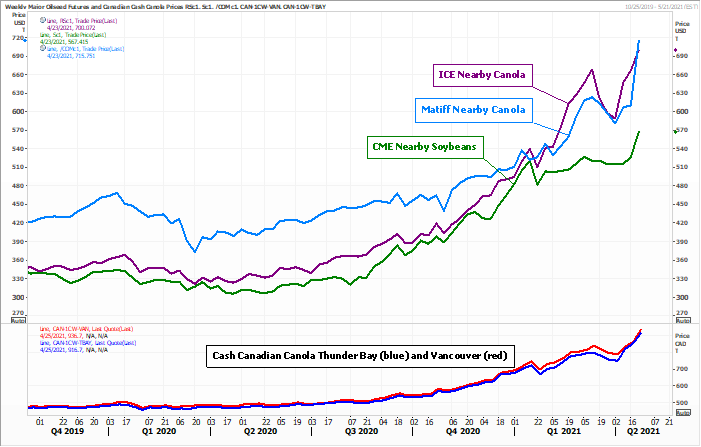

- August

Paris rapeseed was down 1.5% at 501.25 euros. It hit a contract high of 510.25 euros on Thursday. July canola fell $7.50 to $824.20 per ton.

- Cargill

announced plans to build a 1-million-ton annual capacity canola plant in Regina, Saskatchewan.

- We

are hearing canola out of Vancouver is too expensive to export, and domestic prices are around $21/bu, but domestic crushers are still seeing positive margins given high canola oil prices. A 1.0-million-ton carryout might look healthy but historically it

might end up very tight. Attached is our Canada canola balance. - ITS

reported April 1-25 Malaysian palm exports at 1.103 million tons, a 9 percent increase from the same period last month.

- China

cash crush margins on our analysis were 141 (143 previous) cents vs. 175 cents late last week and compares to 177 cents year earlier.

EU

rapeseed vs. Canadian canola and CBOT soybeans, in USD/ton

- Egypt’s

GASC seeks 30,000 tons of soybean oil and 10,000 tons of sunflower oil on April 28 for June 26-July 10 arrival. They are also in for local vegetable oils, 3,000 soybean oil and 1,000 sunflower oil for June26-July 15 arrival.

- The

USDA bought 10,610 tons of bulk crude, degummed soybean oil last Thursday on behalf of the CCC program at $1,549/ton for 8,000 tons and rest at $1,658/ton.

- The

USDA under the food export program seeks 420 tons of vegetable oils for June 1-30 shipment.

- Under

the 24-hour USDA announcement system, private exporters sold 132,000 tons of soybeans for delivery to China during the 2021-22 marketing year.

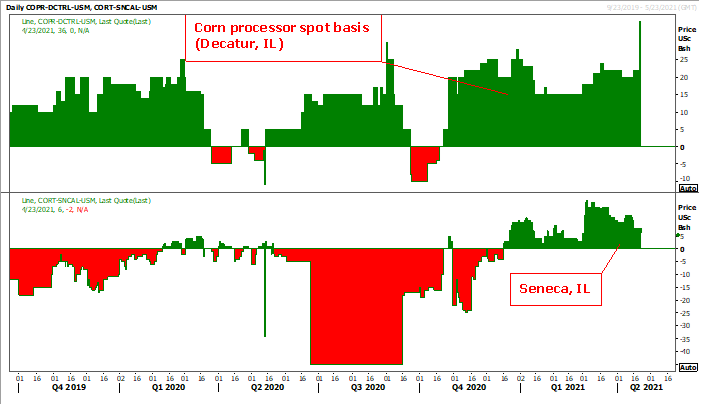

Decatur,

IL soybean basis

Updated

4/22/21

May

soybeans are seen in a $14.75-$15.75 range; July $14.25-$16.50; November $12.75-$15.00

May

soymeal is seen in a $400-$430 range; July $400-$450; December $380-$460

May

soybean oil is seen in a 60 and 64 cent range; July 55-65; December 46-55 cent range

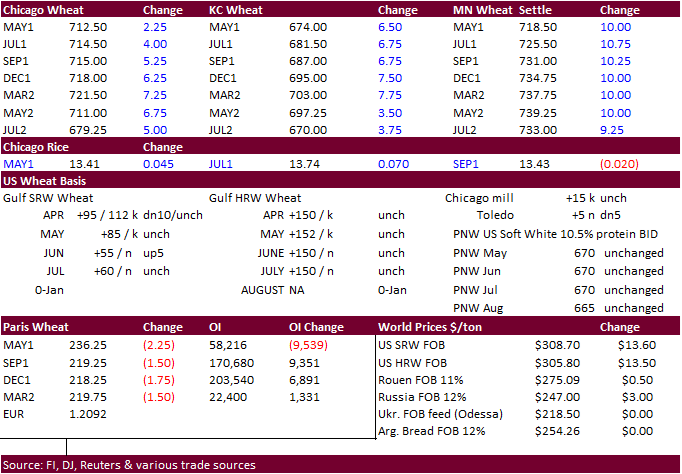

- To

start US wheat futures

were lower Friday with exception of MN, then prices traded choppy to end higher led by MN contracts. Chicago wheat hit its highest level since 2014. A less than expected reduction in French wheat ratings didn’t seem to put much pressure on the main global

wheat markets. For the US, the lower USD paired early losses. Egypt is in for wheat.

- Funds

on Friday bought an estimated net 1,000 CBOT SRW wheat contracts. - Early

Friday we heard that Russian troops were getting pulled off the Ukraine boarder.

- September

milling wheat settled down 1.50 euros, or 0.7%, at 219.25 euros ($264.63) a ton. It was up 6 percent for the week.

- French

wheat conditions as of April 19 fell 1 point to 85% from the previous week and are down 2 points from early April, according to FranceAgriMer. Winter barley fell to 81% from 83%. Durum wheat fell 3 points to 77.

- The

cold spring resulting in winterkill in Russia impacted about 9 to 13 percent of the crops, up from 7 percent from last year, according to a AgriCensus poll. The central regions were hardest hit. Turning over fields to plant spring crops after crop loss is

not that uncommon across the Black Sea. - Ukraine’s

AgMin reported 2.12 million hectares of spring grains as of April 22 were planted, or 28% of the expected 7.6-million-hectare spring area.

USDA

Attaché – Argentina Grain & Feed

Argentina

is expected to produce 20.5 million tons of wheat in 2021-22, up from 17.630 million tons in 2020-21. Corn production is estimated at 50.0 million tons, up from 47 million in 2020-21.

- Egypt

seeks wheat for August 11-20 shipment, on April 27. - Jordan

seeks 120,000 tons of feed barley on April 28 for Oct-Nov shipment. - Ethiopia

saw a few offers for their 430,000-ton wheat import tender. Offers were near $313/ton c&f.

Rice/Other

·

Bangladesh delayed their 50,000-ton rice import tender that was set to close April 18, to now April 26.

·

Bangladesh seeks 50,000 tons of rice on May 2.

Updated

4/22/21

May

Chicago wheat is seen in a $6.75‐$7.50 range; July $6.50-$8.00

May

KC wheat is seen in a $6.25‐$7.30 range; July $6.20-$7.50

May

MN wheat is seen in a $6.85‐$7.50 range; July $6.80-$8.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.