PDF Attached

World

Weather Inc.

-

Thailand

continues to receive less than usual pre-monsoonal precipitation raising some concern over sugarcane, rice and corn development -

Some

increase in precipitation is expected in this next ten days, although grater rain may still be required -

Australia

sugarcane production areas have also experienced less than usual rainfall in recent weeks and months -

The

drier than usual bias will likely continue for an extended period of time -

Spain

and Portugal as well as North Africa crop areas will continue to be drier than usual over the next ten days, although a few showers will be possible -

Argentina

rainfall will continue lighter than usual through the next two weeks resulting in a very good environment for summer crop maturation and harvest progress -

Some

periodic rain is anticipated, but the disruptions to fieldwork will be brief and no harm will come to summer crop conditions -

Brazil

weather will continue to be favorable over the next two weeks -

Timely

rainfall is expected in Mato Grosso during the next week to ten days favoring Safrinha cotton and corn development -

Soil

moisture elsewhere will be sufficient to carry on normal crop development in areas where corn, rice, sugarcane, coffee and citrus is still developing -

Winter

crop planting should advance swiftly -

U.S.

hard red winter wheat areas will get welcome rainfall during the next ten days -

Three

waves of rain will bring moisture to all of the production region. -

0.50

to 1.50 inches will be common with amounts of 1.50 to nearly 3.00 inches possible in eastern parts of central Kansas and central Oklahoma by the end of this month -

The

greatest amounts may not be widespread, but all of the moisture will be good for improved wheat development and for the planting and emergence of summer crops -

U.S.

Northeastern Plains and Upper Midwest crop areas will continue to deal with flooding for a while and the current storm system in the region will diminish from west to east later today and Saturday -

Another

upper level low pressure center will bring cloudiness, periods of rain and some wet snow late next week and into the following weekend -

After

this system passes the upper Midwest and northeastern Plains, as well as eastern Canada’s Prairies will see less precipitation and warmer temperatures – at least for a while -

U.S.

Delta is expecting more rain today and then additional moisture during mid-week next week and possibly again in the following weekend -

The

moisture will occur often enough to slow some fieldwork, but some field progress will occur around the moisture

-

U.S.

southeastern states will experience a good mix of rain and sunshine over the next ten days -

Cold

temperatures in the north half of the U.S. Plains and Midwest this weekend will not induce any serious harm to winter crops and most early emerging summer crops may not be seriously impacted -

However,

some of the early emerged corn fields may not perform well for a while due to cool temperatures that will dominate the next couple of weeks -

California

and the southwestern desert region will be dry and warm for an extended period of time -

Brief

periods of rain and mountain snow will impact the U.S. Pacific Northwest during the coming week followed by drier biased weather in the last week of this month -

U.S.

temperatures will be colder than usual over a bit part of the nation during this first week of the outlook and then the cooler bias will shift to the east allowing the western states to trend warmer -

Early

May temperatures are advertised to be much closer to normal -

Drought

will continue in the southwestern Canadian Prairies, although a few brief bouts of very light precipitation are expected -

Western

Canada’s Prairies will warm up nicely next week resulting in aggressive fieldwork due to limited precipitation -

Planting

will increase across much of Alberta, despite ongoing dryness in parts of the east-central and interior south -

However,

additional delays in planting are probable for the areas with the absolute worst moisture profile in east-central and interior southern Alberta -

Eastern

Canada’s Prairies will experience more snow today and then drier weather through the first half of next week -

A

new storm system may generate additional wet weather late next week and into the following weekend further delaying the opportunity for spring fieldwork -

India’s

weather will be favorable in this first week of the outlook, but the second week forecast could end up wet and stormy with cooler than usual temperatures -

There

is time for this forecast to change, but the situation needs to be closely monitored because of the potential wet and stormy conditions would have on unharvested winter crops

-

Northern

Kazakhstan and western portions of the eastern Russia New Lands are expecting drier and warmer biased weather beginning next week and lasting for a week to perhaps ten days -

The

drying bias will firm the soil and warm it in support of spring planting -

Timely

rain will become imperative for crops once they are planted due to lower soil moisture that is expected to be prevailing at that time -

Most

of Europe and the western CIS outside of the Iberian Peninsula and parts of the Russian New Lands are experiencing favorable crop weather with little change likely for a while -

Temperatures

will continue near to above normal in southwestern Europe and over portions of the western CIS with cool conditions in between

-

Excessive

soil moisture and some flooding evolved recently near and south of China’s Yangtze River and additional precipitation is forthcoming -

Damage

may have occurred to some rapeseed, rice and other crops in the region, although most of the impact should have been localized -

Xinjiang,

China has turned warmer in recent days improving cotton, corn and other spring and summer crop planting conditions -

Northeast

parts of the province will see waves of rain and cooler weather over the next two weeks while weather in western production areas are mostly dry and warm, although not quite as warm as usual -

Yunnan,

China is too dry and needs moisture for early season corn and rice as well as other crops -

The

province and neighboring areas are considered to be in a drought -

Dryness

will continue in the province cutting into rice and corn planting and production potential as well as some other crops -

Ontario

and Quebec, Canada soil temperatures warmed in favor or new wheat development recently, but cooling is expected in the coming week to ten days that will shut down new crop development and lower soil temperatures -

Middle

East rainfall is expected most often in Turkey while most other areas receive only infrequent showers

-

Cotton

and rice planting have benefitted from recent rain -

Winter

crops will fill favorably, but drier weather may soon be needed to protect grain quality -

Australia

precipitation has been limited recently, but rain will evolve in the south next week to moisten the topsoil once again and allow better planting and emergence conditions.

-

Favorable

summer crop maturation and harvest progress is expected in the east-central parts of the nation

-

Western

Australia is the state to watch for possible drying in the next few weeks, although southern areas will get a little rain early next week -

South

Africa precipitation should be restricted for a while favoring summer crop maturation and harvest progress -

Mainland

areas of Southeast Asia are still in need of greater rain, although the situation is not critical

-

Poor

pre-monsoonal shower and thunderstorm activity has been occurring in many areas and improved rainfall will soon be needed -

This

is impacting some early season sugarcane, rice and coffee development as well as other crops -

Thailand

is among the drier areas -

Some

improved rainfall is expected over the coming week -

Indonesia

and Malaysia weather has been lighter than usual due to the negative phase of Madden Julian Oscillation, but a change is expected that will allow improving rainfall to evolve gradually over the next week to ten days -

Cotton

areas from Mali to Burkina Faso have not seen a normal start to the rainy season this year; rain is needed to support planting -

Some

rain will fall in the second week of the outlook especially in Burkina Faso -

Other

west-central Africa coffee and cocoa production areas will receive routinely occurring showers and thunderstorms

-

East-central

Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops -

Mexico

remains in a drought, though eastern and far southern parts of the nation will get some periodic rain -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was -0.95 and it should move notably lower over the next few days.

Source:

World Weather, INC.

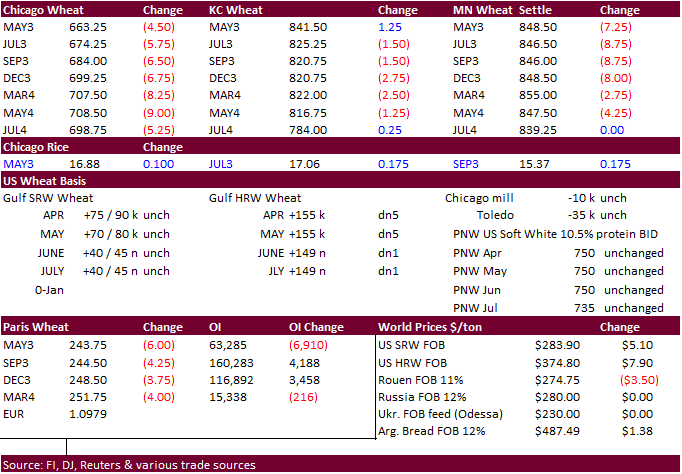

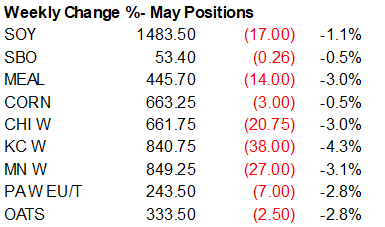

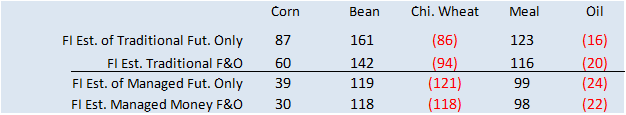

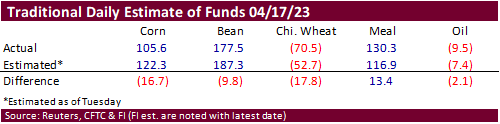

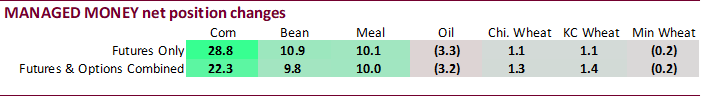

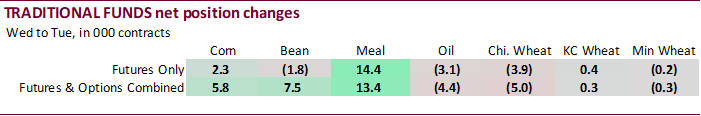

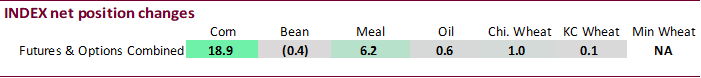

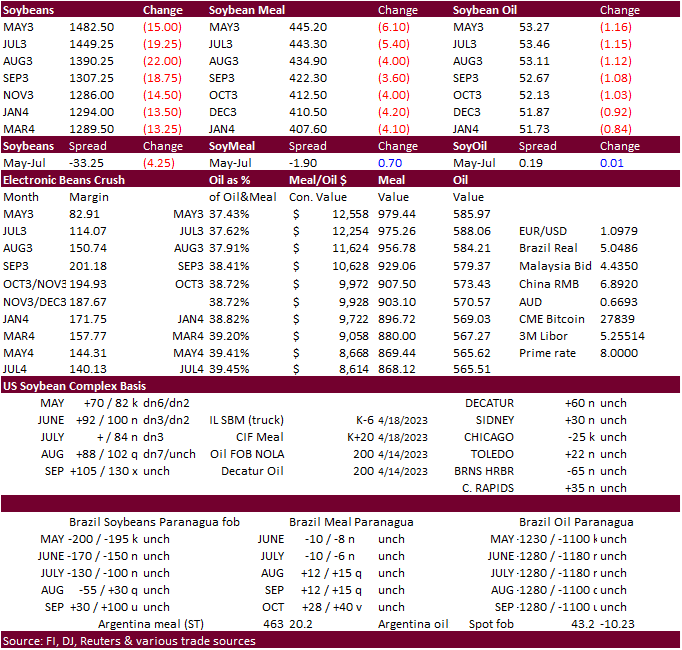

Funds

were less long for corn, soybeans and soybean oil while less short than expected for wheat and more short than expected for soybean oil. We don’t see a price impact from the weekly COT report.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

-19,230 -8,733 317,840 18,850 -236,128 -8,846

Soybeans

111,256 9,265 137,204 -408 -217,618 -11,967

Soyoil

-37,354 -3,996 103,727 606 -69,760 -1,105

CBOT

wheat -89,421 -5,625 75,110 1,049 7,783 3,657

KCBT

wheat -10,309 -109 42,485 70 -31,986 148

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

49,434 22,322 230,409 3,251 -246,614 -7,769

Soybeans

134,782 9,761 87,061 -2,446 -214,706 -8,166

Soymeal

105,682 10,003 90,575 314 -233,755 -12,609

Soyoil

-15,743 -3,178 108,008 2,168 -97,036 -2,275

CBOT

wheat -102,983 1,264 65,252 1,619 6,463 2,496

KCBT

wheat 10,591 1,362 32,860 -321 -34,172 176

MGEX

wheat 38 -207 1,226 19 -6,311 -296

———- ———- ———- ———- ———- ———-

Total

wheat -92,354 2,419 99,338 1,317 -34,020 2,376

Live

cattle 104,341 12,319 47,710 -367 -164,550 -10,817

Feeder

cattle 11,012 2,670 1,263 81 -3,455 -1,610

Lean

hogs -24,570 -20 46,875 36 -24,179 231

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

29,253 -16,534 -62,483 -1,270 1,690,262 9,235

Soybeans

23,705 -2,260 -30,843 3,111 856,008 -26,737

Soymeal

17,807 3,370 19,691 -1,077 504,548 18,616

Soyoil

1,384 -1,210 3,387 4,495 523,252 -4,880

CBOT

wheat 24,738 -6,296 6,529 918 458,928 -10,164

KCBT

wheat -9,090 -1,108 -190 -108 190,739 -2,342

MGEX

wheat 3,980 -88 1,066 572 61,157 -2,727

———- ———- ———- ———- ———- ———-

Total

wheat 19,628 -7,492 7,405 1,382 710,824 -15,233

Live

cattle 27,711 2,110 -15,210 -3,245 420,483 10,557

Feeder

cattle 2,535 -699 -11,354 -442 74,254 -572

Lean

hogs -4,315 -989 6,189 742 331,978 3,340

Bloomberg

Ag calendar

Monday,

April 24:

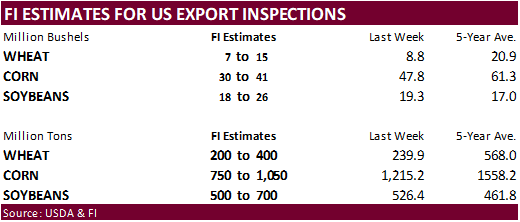

- USDA

export inspections – corn, soybeans, wheat, 11am - US

planting data for corn, cotton, spring wheat and soybeans, 4pm - MARS

monthly report on EU crop conditions - US

winter wheat condition, 4pm - Cane

crush and sugar production data by Brazil’s Unica (tentative) - HOLIDAY:

Malaysia, Indonesia, Pakistan

Tuesday,

April 25:

- Malaysia’s

April 1-25 palm oil export data - Argus

Biofuels & Feedstocks Asia Conference, Singapore, day 1 - Commodity

Trading Week conference, London, day 1 - US

poultry slaughter; cold storage data for beef, pork and poultry, 3pm - HOLIDAY:

Australia, New Zealand, Pakistan, Indonesia

Wednesday,

April 26:

- EIA

weekly US ethanol inventories, production, 10:30am - Euro

Grain Hub Exchange & Forum, Bucharest, Romania, day 1 - Argus

Biofuels & Feedstocks Asia Conference, Singapore, day 2 - Commodity

Trading Week conference, London, day 2 - Canada’s

StatCan to release seeded area data for wheat, barley, canola and soybeans - Brazil’s

Conab to publish cane, sugar and ethanol production data

Thursday,

April 27:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Euro

Grain Hub Exchange & Forum, Bucharest, day 2 - Port

of Rouen data on French grain exports - Argus

Biofuels & Feedstocks Asia Conference, Singapore, day 3

Friday,

April 28:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - Euro

Grain Hub Exchange & Forum, Bucharest, day 3 - FranceAgriMer’s

weekly crop condition report - US

agricultural prices paid, received, 3pm

Saturday,

April 29:

- Vietnam’s

coffee, rice and rubber export data

Source:

Bloomberg and FI

The

CME group lowered margins for SBO, soybeans, corn, Chicago wheat, and KC wheat

https://www.cmegroup.com/notices/clearing/2023/04/Chadv23-130.html

Canada

Retail Sales M/M Feb: -0.2% (est -0.6%, prev 1.4%)

Canada

Retail Sales Fall 1.4% In March – Flash Estimate Stats Canada

Argentina

Central Bank Lifts Rate to 81% as Inflation Jumps – Bloomberg

105

Counterparties Take $2.290 Tln At Fed Reverse Repo Op. (prev $2.277 Tln, 103 Bids)

·

Asian interest for South American corn origin pressured US futures. US Gulf fob as of yesterday was around $276/ton and Brazil $253. SK floated three import tenders over the past 24 hours, all from SA when concluded.

·

There was heavy CBOT option call selling today, bias corn and soybeans.

·

Some speculate the Black Sea grain deal is winding down. Set to expire mid next month, look for major importers to be cautious committing to Black Sea grains under the existing deal.

·

Argentina’s BA Grains Exchange

kept their corn crop estimate at 36 million tons. They estimated harvest progress at 15 percent.

·

Ukraine’s grain exports so far this season amount to 40.6 million tons, down 11 percent from the same period a year ago.

Export

developments.

·

South Korea’s MFG group bought 69,000 tons of animal feed corn from South America at an estimated $266.95 a ton c&f for arrival in South Korea around Sept. 30.

·

South Korea’s Busan section bought 66,000 tons of animal feed corn from South America at an estimated $267.33 a ton c&f for arrival in South Korea around Sept. 30.

·

South Korea’s NOFI group bought an estimated 137,000 tons of feed corn, all optional origin, at an estimated $267.98/ton c&f. One cargo is for arrival around September 30 and second around October 5.

Updated

04/21/23

May

corn $6.45-$6.90

July

corn $5.75-$7.00

·

The CBOT soybean complex traded lower for the third consecutive day from slowing US exports (and Brazil shipping lineup showing soybeans bound for US) and improving weather particularly US Midwest – replenishing soil moisture

levels ahead of the bulk of planting season. May soybeans could test $14.50/bu by mid next week if US planting progress picks up and Brazilian sales increase. Concerns over China demand of soybeans may also pull prices lower next week.

·

US east coast end users have bought Brazil soybeans, at an unusually early time for any crop year. 79k tons of Brazilian soybean are on the shipping lineup, set for nearby sail from the port of Santarem, Brazil. US ECB soybean

supplies have been tight for months and rail costs to the eastern seaboard end users is not logistically favorable from the Midwest, at the moment, making purchases of cheaper Brazilian fob soybeans attractive. Soybean and Corn Advisory noted a $2.00 per bushel

discount between Brazil and US. Local east coast elevators and producers might be wishing this is not to become a norm.

·

ADM plant explosion at West Decatur plant in central IL. Spreads should be monitored. Details are lacking.

·

https://newschannel20.com/news/local/crews-respond-to-explosion-at-adm-plant-three-injured

·

Higher WTI crude oil was limiting losses for soybean oil, but the market crashed mid-morning on fund selling and lower soybean meal.

·

First Notice Day deliveries for the CBOT agriculture contracts is rapidly approaching. We see no soybean or soybean meal deliveries. There could be light corn and soybean oil contracts put out there. Chicago wheat may end up in

the 100 to 300 contract range.

·

China March soybean imports:

-

US

4.83MMT (3.37MMT year ago) -

Brazil

1.67 (off 43% year ago) -

Total

6.85MMT (up 8% from March 2022)

·

Argentina Central Bank Lifts Rate to 81% as Inflation Jumps – Bloomberg.

·

Argentina’s BA Grains Exchange lowered their soybean crop estimate to 22.5 million tons from 25 million previously, citing lower yields. About 17 percent of the crop had been collected.

·

Malaysia was on holiday today and will be on holiday the 24th.

Export

Developments

-

None

reported.

Updated

04/21/23

Soybeans

– May $14.50-$15.00, November

$12.25-$15.00

Soybean

meal – May $475-$460, December

$325-$500

Soybean

oil – May 52.50-54.00,

December

49-58

Wheat

·

US wheat futures traded two-sided, ending lower after on technical buying dried, and weakness in corn. Not much news was released Friday to sustain the earlier support.

·

Romania will not ban Ukraine grain imports and will wait for the EU to make a decision to help control the influx of Ukraine ag product imports that have made their way int eastern European countries.

·

Grain transit from Ukraine into Poland resumed, and Hungary’s feed & industrial end users now oppose the ban on Ukraine grain imports.

·

Ukraine has 1 million hectares of spring crops planted, a good start. The AgMin looks for a 1.4 million hectare decrease to 10.2 million this year, primarily in war.

·

September Paris wheat futures were lower by 4.75 euros to 243.50 euros per ton, lowest since March 2022.

·

French soft wheat crop conditions as of April 17 fell one point to 93% good/excellent from previous week and compares to 91 percent year ago.

·

TASS. The duty on wheat exports from Russia will amount to 5,678.9 rubles ($69.34) per metric ton from April 19 to 25, 2023, according to the Ministry of Agriculture. The duty on the export of barley will be 2,496 rubles ($30.48)

and for corn – 3,215.8 rubles ($39.3) per metric ton, the Ministry said.

·

IKAR: Russia wheat production 84 MMT and exports at 41 MMT.

Export

Developments.

·

China plans to sell 40,000 tons of wheat from state reserves on April 26.

·

Jordan seeks 120,000 tons of optional origin wheat on May 2.

·

Jordan seeks 120,000 tons of feed barley May 3 for October through FH November shipment.

Rice/Other

·

Brazil 2023/24 Coffee Sales 23% Done as of April 17: Safras (Bloomberg)

Updated

04/21/23

KC

– May $8.25-9.00

MN

– May

$8.40-$9.00

#non-promo