PDF Attached

Our

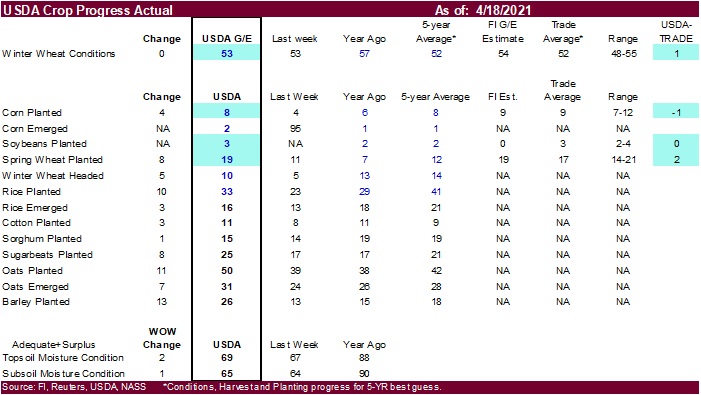

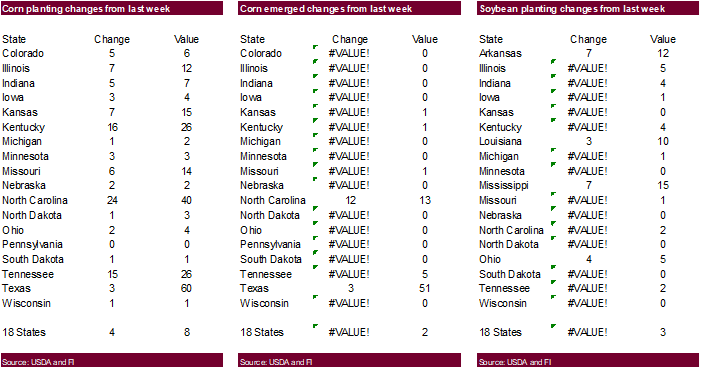

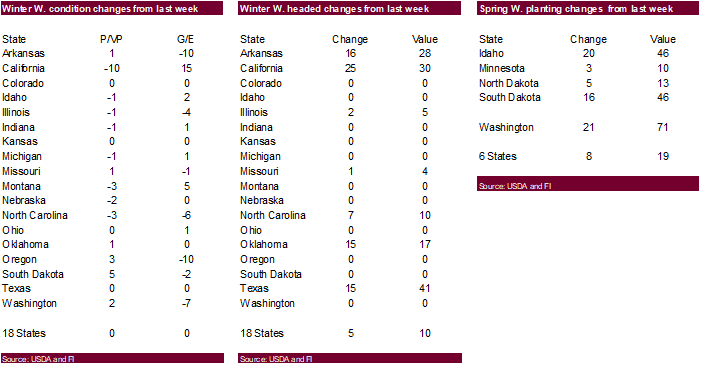

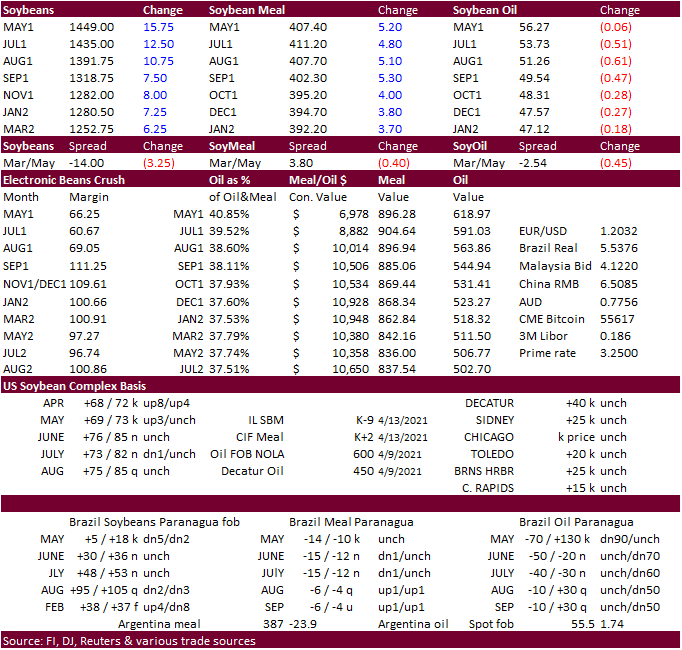

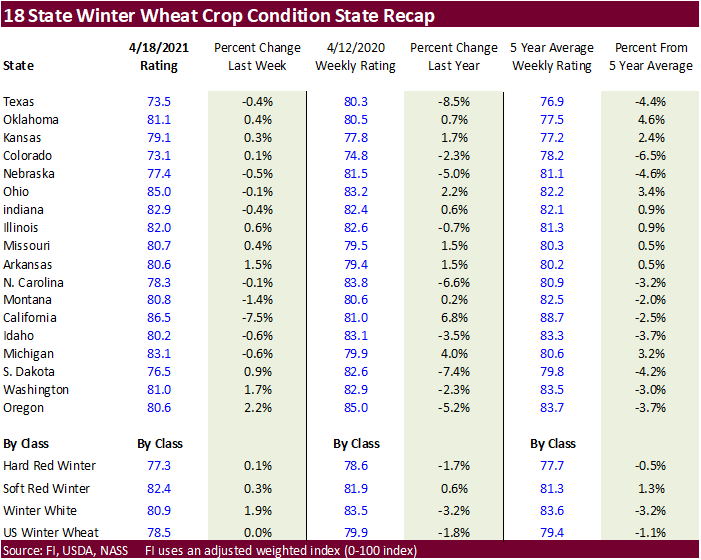

US soybean complex tables are attached. Brazil and US weather concerns supported corn, soybeans and most wheat contracts. SBO fell due to a reversal in product spreading amid weaker offshore values. $14.60 is not out of reach for nearby soybeans. US wheat

conditions were unchanged from the previous week and planting progress was slow for corn & cotton. Soybean planting progress was as expected.

After

the close…IHS Markit – Brazil second corn crop 79.45MMT vs, 85MMT previous. 104MMT total vs. 108.6MMT previous.

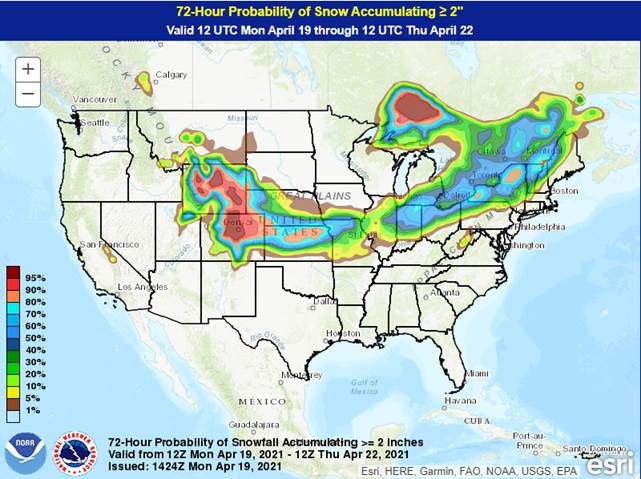

US

snow probability next 72 hours

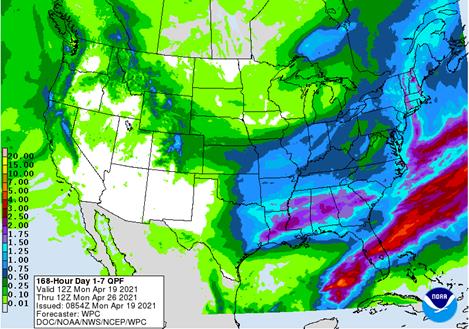

Next

7 days

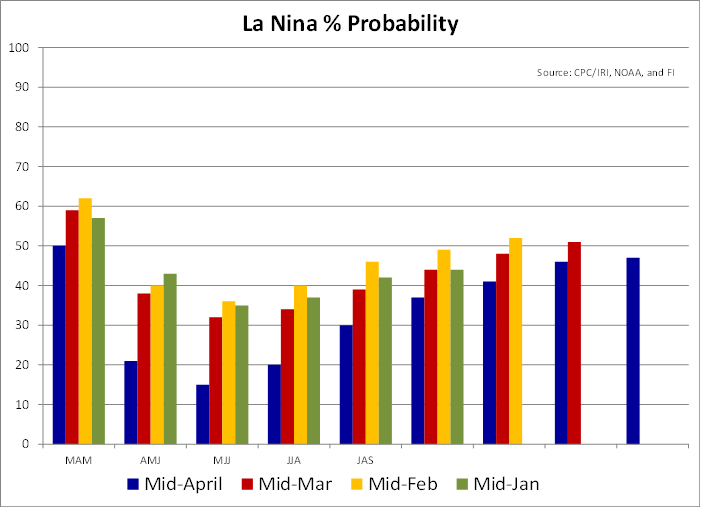

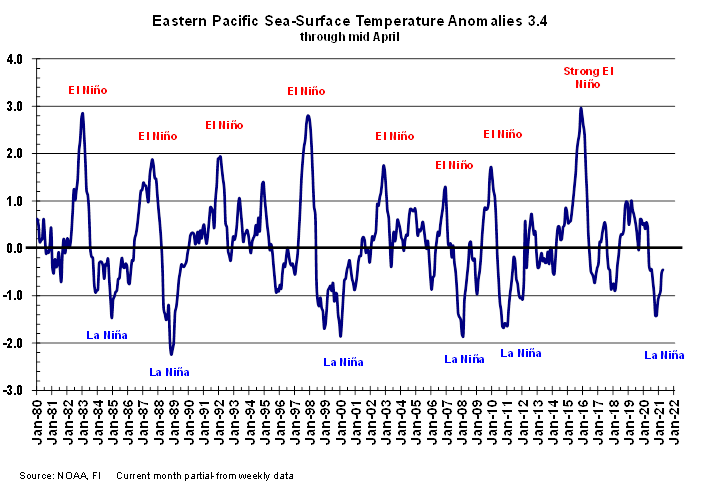

Recent

SST update shows La Nina weakening

World

Weather Inc.

MOST

IMPORTANT WEATHER ISSUES OF THE DAY

- Freezing

temperatures from the northern Texas Panhandle northward into the northern U.S. Plains during the weekend occurred as expected with no permanent impact on winter wheat - Cold

weather in U.S. Central Plains Wednesday will bring frost and freezes to many winter wheat production areas from west Texas through the Texas Panhandle and western Oklahoma into central Oklahoma and central Kansas as well as areas farther to the north - Permanent

damage to jointing and booting wheat in West Texas is possible, but the impact on the nation’s total production should be quite low - Most

of the crop will come through the cold weather with mostly burned vegetative growth, but no long term production impact - Extreme

lows in the middle 20s Fahrenheit will impact a few areas in West Texas while middle and upper 20s impact the central Plains - A

few of the more advanced fields in southern Kansas and Oklahoma may be negatively impacted, but no general losses are expected - U.S.

lower Midwest will also experience frost and freezes during mid- to late-week this week with no permanent damage expected - any

early emerged corn would have its growing point below the soil surface and would likely survive the cold - not

much corn is up, though - wheat

is not advanced enough to be permanently damaged - Northern

Delta, Tennessee River Basin, the Carolinas and Virginia will also experience frost and freezes Thursday and Friday with some damage to fruit trees and “possibly” a few “pockets of wheat and early emerged corn - Permanent

production impacts are expected to be very low, but some impact cannot be ruled out.

- Any

wheat damage will be confined to small areas and mostly in “minor” production regions of the nation making the impact on crops relatively low - Most

of the corn in these areas is not advanced enough to be seriously impacted, but a little replanting might occur in a few areas where planting was completed much earlier

- Cool

weather in U.S. Plains and Midwest this week will slow crop development, but some corn and other crop planting will continue or begin especially late this week after the peak of the cold surge abates.

- U.S.

precipitation this week will occur most significantly through Wednesday along the front range of the Rocky Mountains from Colorado to Montana and from parts of Kansas through Missouri and the lower eastern Midwest to the northeastern states where rain and

snow will produce moisture totals for the week of 0.20 to 0.70 inch with a few amounts over 1.00 inch - More

limited precipitation of less than 0.50 inch will occur to the north - U.S.

Delta and southeastern states will be mostly dry into Friday, but will get rain after that - Waves

of rain are expected in the middle and lower Delta into Georgia, Florida and South Carolina during the weekend with moisture totals of 0.70 to 2.50 inches favoring southern parts of the region - West

and South Texas rainfall is expected to be minimal over the next full week.

- California

gets some needed moisture late this weekend into early next week along with some parts of the Pacific Northwest - Drought

status will continue in the Yakima Valley and central Oregon in unirrigated crop areas through the weekend and into early next week - Southern

California and the southern Great Basin will continue dry - Week

two weather in the United States brings back greater precipitation in the Midwest, Delta and southeastern states keeping all three areas favorably moist for spring crop development, although some disruption to fieldwork is expected - The

eastern Midwest rainfall may be among the lightest - Some

extremely important rain is advertised for Iowa and southern Minnesota during mid-week next week - U.S.

temperatures will be cooler than usual east of the Continent Divide this week with the greatest departures from normal in the central and interior southern Plains through the Ohio River Valley and northern Delta - Temperatures

are warmer than usual to the west of the Continental Divide - Temperatures

next week will be a little warmer in areas east of the continental divide, but mostly near normal - U.S.

weekend precipitation was most significant from Louisiana to northern Florida where 1.40 to 3.57 inches resulted through Sunday night - Rain

also fell across the central Plains with Friday’s snow event winding down Friday night - Moisture

totals varied from 0.10 to 0.41 inch - Snow

totals Friday varied from 3 to 10 inches from northwestern Kansas to western Nebraska, northeastern Colorado, southeastern Wyoming and southwestern South Dakota - Some

of the precipitation reached into Missouri, but most other areas were dry through dawn Sunday, although showers were moving east across the lower Midwest Sunday afternoon - The

bottom line for the United States remains mostly good for spring planting, although there will be some precipitation this week to disrupt field progress. Cold weather may damage some of the winter wheat in the southwestern Plains, northern Delta and North

Carolina and Virginia, but losses should be quite low and mostly held to areas that are not key to U.S. production. Concern about dryness will remain in West and South Texas, a part of the northern Plains, the Pacific Northwest and to some degree a part of

northern and central Iowa to southwestern Wisconsin and southern Minnesota. Most of the dryness concerns will not be serious while temperatures are cool, but as soon as warming comes around at the end of April the situation will be of greater interest.

- Brazil

reported isolated to scattered showers and thunderstorms from eastern and northern Parana and parts of Sao Paulo to Mato Grosso during the weekend - Rainfall

ranged from 1.00 to 3.50 inches in central and a part of northern Mato Grosso while reaching over 1.00 inch in random locations in southwestern Mato Grosso do Sul and eastern Parana - Amounts

elsewhere were no more than 0.62 inch through Sunday morning - Mostly

dry weather with seasonable temperatures occurred elsewhere - Brazil

rainfall is expected to be erratic and lighter than usual in a part of center south and interior southern Brazil, but some rain is expected - Net

drying is likely through April 28 in southeastern Mato Grosso, southern Goias, central and northern Mato Grosso do Sul to Sao Paulo and southern Minas Gerais - Some

beneficial rain will fall in Mato Grosso do Sul, Mato Grosso and Paraguay in the coming weekend and early next week with 0.30 to 0.80 inch and a few 1.00 to 2.00-inch totals possible - Rain

will fall more routinely from central and northern Mato Grosso to Piaui, Tocantins and Bahia throughout the coming week to ten days - A

few showers and thunderstorms will also occur in northern Rio Grande do Sul and Santa Catarina - Monsoonal

rainfall is still seen withdrawing from much of the nation at the end of this month - The

bottom line for Brazil remains mixed with Safrinha corn and cotton benefiting from any rain that falls, but most of the rain that is advertised does not begin until late in the weekend leaving the door open for possible changes to next week’s outlook. World

Weather, Inc. still sees the monsoon ending by the end of this month limiting rainfall for May and raising the potential for threats to production. For areas not receiving much rain the soil will be drying out and with topsoil moisture already rated short

to very short in parts of the production region there will be some concern over crop and field conditions. Routinely occurring rain must occur through May to support the best production potential and that is not foreseen at the moment.

- Argentina

weekend weather was generally dry except in the far south and extreme north where some rain was reported - Amounts

ranged from 0.05 to 0.30 inch with a local total to 0.68 inch in Chaco, Formosa and immediate neighboring areas - Rainfall

from east-central La Pampa to southern Buenos Aires varied from 0.05 to 1.07 inches except Santa Rosa, La Pampa where 2.87 resulted - Dry

and seasonably warm weather occurred elsewhere with highs in the 80s Fahrenheit - Argentina

rain expected late Tuesday night Wednesday into Saturday of this week will set back the nation’s drying trend and disrupt some farming activity.

- Sufficient

rainfall will occur to bolster soil moisture and ensure good moisture abundance for late season corn and especially peanuts and soybeans - Rain

totals will range from 0.75 to 2.00 inches and local totals of 2.00 to 4.00 inches - The

greatest rain will be quite localized and not necessarily in the heart of summer grain or oilseed production areas - Drier

weather expected next week will be welcome, although colder temperatures will slow drying rates keeping some areas abundantly moist which may slow the drying trend

- Argentina’s

bottom line remains good for late season crops, but rain may slow some of the early season harvest and maturation pace. Summer crops will develop favorably, but there is need for drier weather to protect crop quality and to expedite harvest progress. - Typhoon

Surigae was located 308 miles east of Manila, Philippines moving northwesterly at 5 mph while producing maximum sustained wind speeds of 143 mph with gusts to 172 mph - Typhoon

force wind was occurring out 50 miles from the center of the storm while speeds of tropical storm force were occurring out 170 miles - The

storm is very near its peak intensity at 0900 GMT today and will slowly weaken over the next few days - The

storm is expected to stay far enough to the east of the Philippines to minimize its impact to shipping in the western Philippine Sea - Landfall

is not likely, although the storm will pass close enough to some of the northern Islands to produce some rain, windy conditions and rough seas - Crop

damage does not look likely unless the storm turns more to the west - Surigae

will turn to the northeast Tuesday night and Wednesday taking the storm away from most of Southeast Asia and accelerating the storm’s weakening trend - Europe

precipitation will be erratic alight during the coming week with very little likely in the North Sea region or parts of France - Next

week’s weather will trend wetter in the south and east parts of the continent while France, the U.S. and parts of Germany, Belarus and Belgium will experience limited precipitation - Recent

frost and freezes in Europe have induced more damage to fruits and vegetables than to small grains or rapeseed, but these latter crops have been impacted as well - France

and Italy crops have been most impacted by this month’s cold - Temperatures

are expected to moderate in the next two weeks slowly returning more seasonable readings - Western

CIS soil moisture is adequate to abundant and will remain that way with anticipated precipitation during the coming week to ten days - Temperatures

will be seasonably mild to cool at times - China

crop weather during the weekend was wettest in the southwestern agricultural areas and in a few locations in the far northeast with net drying in most other areas.

- Temperatures

were mild to warm stimulating faster drying rates in some areas and greater winter crop development - China

will be wettest in the areas from Sichuan to Guangxi, Guangdong, Fujian and Zhejiang during the next ten days resulting in ongoing saturated soil and local flooding - More

limited precipitation is expected in the North China Plain and Yellow River Basin which is normal for this time of year - Snow

and rain will continue in northeastern parts of China maintaining a favorable moisture profile for spring and summer crop - Temperatures

will be warmer than usual in the north and near to below average in the Yangtze River Basin while near normal in the far south - India’s

weather will be mostly good, although scattered showers will occur periodically to slow some of the winter harvest progress - Rain

is most likely in the far north, extreme east and far south which is not unusual at this time of year - Temperatures

will be near to above normal - Australia

rainfall during the weekend was mostly confined to far northeastern New South Wales and extreme southeastern Queensland where amounts ranged from 0.15 to 0.75 inch - The

moisture was welcome and good for future winter crop planting, but likely disrupted cotton and other summer crop maturation and harvest progress - Australia

will be in a net drying mode for the next ten days supporting good harvest progress in the east while raising the need for moisture in most of the south for future winter wheat, barley and canola planting - Rain

in Queensland Pacific coastal sugarcane areas will be welcome and beneficial to late season crop development

- Mainland

areas of Southeast Asia will experience a net boost in precipitation over the next few weeks that will improve corn planting conditions and maintain an improving trend in sugarcane, rice, cocoa, palm and coffee production areas - Some

beneficial rain fell across parts of this region recently, but southern areas are still dry - Philippines

weather is good for most crops, but a boost in rainfall would be welcome - Typhoon

Surigae should stay far enough to the east to miss the nation’s agricultural and coastal areas

- Indonesia

and Malaysia crop weather is expected to be mostly good for the next ten days to two weeks with most areas getting rain - Southern

areas will be driest - North

Africa rainfall during the weekend was most significant and welcome in northeastern Algeria and northern Tunisia where 0.62 to 1.77 inches resulted - Northwestern

Algeria (where it has been driest in recent weeks) received 0.05 to 0.35 inch leaving need for more rain - Morocco

rainfall was minimal except near the Algeria coastal border where up to 0.20 inch resulted

- All

of the moisture was welcome, but more was needed in the driest areas of Northwestern Algeria and southwestern Morocco

- Temperatures

will be near to above average - West-central

Africa coffee and cocoa weather has been very good recently and that is not likely to change much for a while; some rice and sugarcane has benefited from the pattern as well - Weekend

rainfall varied from 0.15 to 1.30 inches in parts of Ivory Coast and Ghana with greater amounts near the coast and in northwestern portions of coffee country in Ivory Coast where 3.00 to more than 4.00 inches resulted - Rainfall

will be a light and erratic early this week before increasing and becoming more significant late this week and early in the weekend

- Temperatures

will be seasonable - East-central

Africa rainfall has been erratic recently and a boost in precipitation should come to Ethiopia soon while that in Tanzania slowly decreases - South

Africa weather will continue favorable for early maturing summer crops and the development of late season crops - Net

drying is expected except in the southeast where some periodic showers will occur - Good

field progress has been and will continue to occur for early maturing crops - Temperatures

will be warmer than usual and that will dry out the soil relatively quickly - New

Zealand rainfall will be a little erratic and a little lighter than usual in eastern parts of South Island - Temperatures

will be seasonable - Southeastern

Canada will see near to below average precipitation during the next week to ten days and temperatures will trend colder than usual - Mexico

precipitation will continue limited to a few eastern and far southern locations during the next week to ten days - Rain

is needed in many areas - Drought

is prevailing across most of the nation - Southern

Oscillation Index this morning was +0.69 and the index will move in a narrow range for a while

Source:

World Weather Inc. & FI

Monday,

April 19:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – corn, wheat, cotton, 4pm - Boao

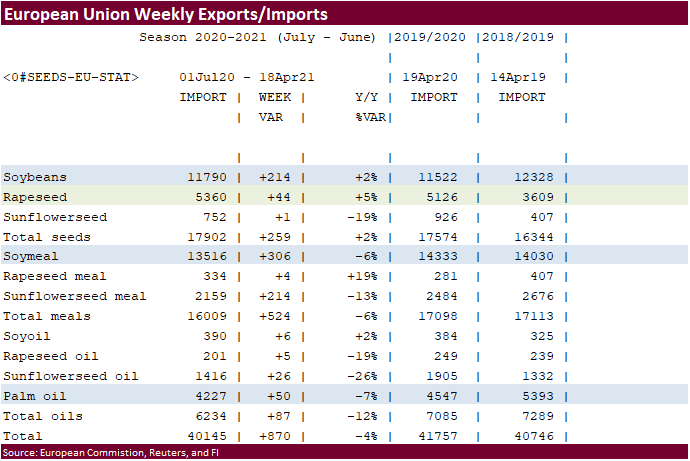

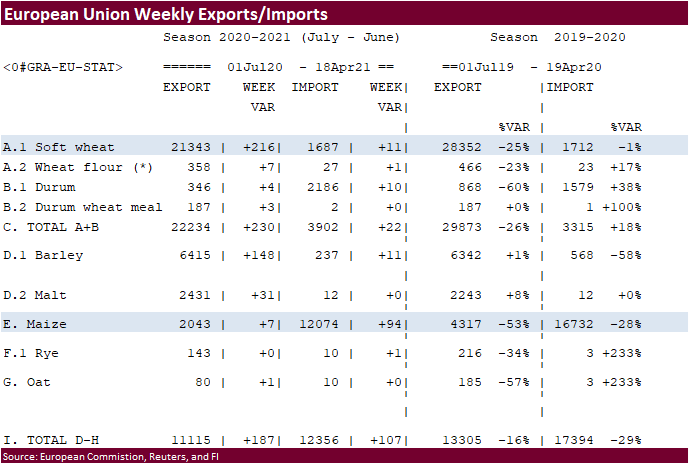

Forum in Hainan, China, day 2 - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals

Tuesday,

April 20:

- China

customs to release trade data, including country breakdowns for commodities such as soybeans - China

farm ministry’s CASDE outlook conference, day 1 - New

Zealand global dairy trade auction - Boao

Forum in Hainan, China, day 3 - Malaysia’s

April 1-20 palm oil export data from SGS - Platts

Agriculture Week conference, day 1 - Brazil’s

Conab releases cane, sugar and ethanol production data (tentative) - AB

Sugar interim results

Wednesday,

April 21:

- EIA

weekly U.S. ethanol inventories, production - China

farm ministry’s CASDE outlook conference, day 2 - Platts

Agriculture Week conference, day 2 - Boao

Forum in Hainan, China, day 4 - USDA

Milk Production, 3pm - HOLIDAY:

Brazil, India

Thursday,

April 22:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Platts

Agriculture Week conference, day 3 - USDA

red meat production - EARNINGS:

Suedzucker, Barry Callebaut

Friday,

April 23:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

Cattle on Feed, Poultry Slaughter 3pm - U.S.

cold storage – pork, beef, poultry

Source:

Bloomberg and FI

China

imports – selected commodities

|

Commodity |

March |

% |

YTD |

% |

|

Corn |

1.93 |

506.8% |

6.73 |

437.8% |

|

Wheat |

440,000 |

-24.3% |

2.92 |

131.2% |

|

Barley |

1.07 |

283.6% |

2.39 |

135.2% |

|

Sorghum |

640,000 |

92.1% |

2.04 |

222.3% |

|

Pork |

460,000 |

16.1% |

1.16 |

22% |

|

Sugar |

200,000 |

137.1% |

1.24 |

205.9% |

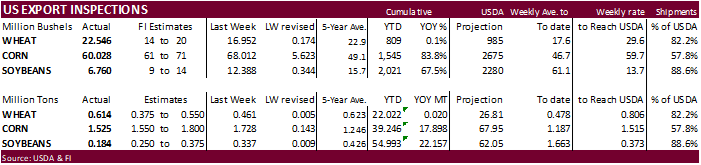

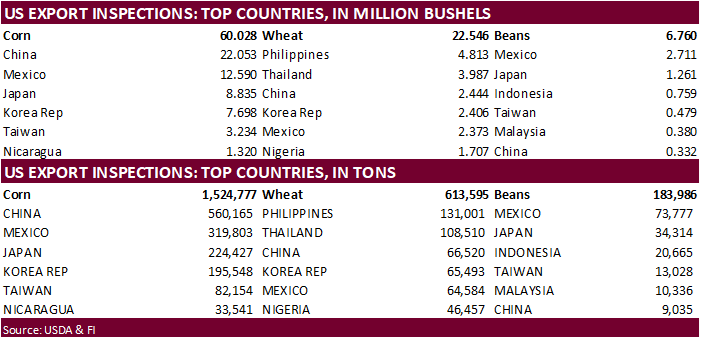

USDA

inspections versus Reuters trade range

Wheat

613,595 versus 250000-550000 range

Corn

1,524,777 versus 1400000-2100000 range

Soybeans

183,986 versus 100000-400000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 15, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/15/2021 04/08/2021 04/16/2020 TO DATE TO DATE

BARLEY

0 0 0 32,620 30,499

CORN

1,524,777 1,727,589 731,272 39,246,220 21,347,766

FLAXSEED

0 0 0 509 520

MIXED

0 0 0 0 0

OATS

599 0 100 4,290 3,343

RYE

0 0 0 0 0

SORGHUM

314,699 199,125 180,858 5,199,906 2,163,366

SOYBEANS

183,986 337,159 551,779 54,993,243 32,836,603

SUNFLOWER

0 0 0 0 0

WHEAT

613,595 461,368 506,217 22,022,357 22,001,923

Total

2,637,656 2,725,241 1,970,226 121,499,145 78,384,020

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

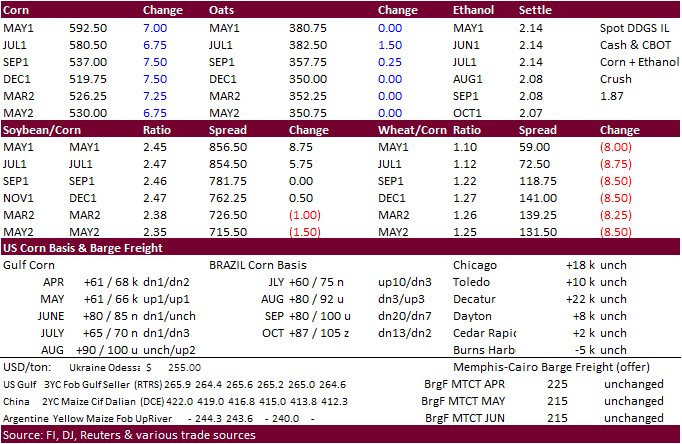

Corn

- CBOT

corn

was higher again on US & Brazil weather concerns. Snow is projected to blanket parts of the central Great Plains and WCB over the next few days, but that should melt by the weekend. Brazil will see limited rain over the next two weeks across the center-west

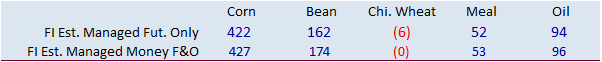

corn growing areas. Brazil temperatures will be hot as well. Traders are bullish US corn exports if crop production estimates for Brazil begin to decline. We were surprised to see no record managed money net long position as of last Tuesday, but this could

be realized if the bull market holds through Tuesday. CBOT May corn is poised to test its $6.00 level this week. A less threatening weather forecast could limit upside in prices. Today the May contract was up 6.50 cents to $5.92/bu.

- IHS

Markit – Brazil second corn crop 79.45MMT vs, 85MMT previous. 104MMT total vs. 108.6MMT previous.

- The

USD was very weak, 46 points, adding to the bullish undertone in commodities.

- Funds

on Monday bought an estimated net 13,000 corn contracts. - China

released selected grain import data and they took in 6.73 million tons of corn during Q1.

- News

was light.

Japan

selected commodity imports

|

Commodity |

|

|

Volume |

Yr/Yr(%) |

Value |

Yr/Yr(%) |

|

Grain |

|

|

2,311,723 |

-1.8 |

87,756 |

15.2 |

|

(from |

|

|

1,733,272 |

52.2 |

57,201 |

77.6 |

|

Soybeans |

|

|

243,705 |

-20.1 |

16,132 |

2.9 |

|

(from |

|

|

216,999 |

-20.3 |

13,959 |

5.1 |

|

Meat |

|

|

240,356 |

4.0 |

116,260 |

-3.1 |

|

(from |

|

|

58,115 |

14.3 |

34,428 |

10.8 |

|

Nonferrous |

|

|

840,000 |

-6.4 |

138,451 |

24.4 |

|

Iron |

|

|

10,094,000 |

20.4 |

128,133 |

57.0 |

|

Nonferrous |

|

|

266,936 |

4.0 |

194,830 |

18.2 |

|

Steel |

|

|

651,242 |

9.2 |

76,655 |

13.9 |

Export

developments.

- None

reported

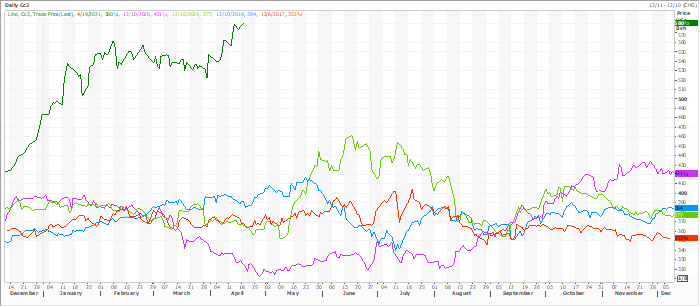

Rolling

second contract corn futures – Seasonal

Source:

Reuters and FI

Updated

4/15/21

May

corn is seen in a $5.70 and $6.10 range

July

is seen in a $5.25 and $5.90 range

December

corn is seen in a $3.85-$5.50 range.

- CBOT

soybeans

ended 9-16.50 cents higher (bull spreading) in part to renewed fund buying. Soybean oil was under the defensive from product spreading and a lower lead by offshore values. A reversal in WTI crude limited losses for soybean oil. Soybean meal was up $5.30

basis the May position. ICE canola was up for the 5th consecutive season. Brazil was 90 percent harvested as of late last week. MG was complete.

- May

soybeans could soon test the $14.60 area. Soybeans have been relatively weak against corn prices and any delays in US spring plantings could underpin soybeans. High today was $14.5450.

- Funds

on Monday bought an estimated net 8,000 soybean contracts, bought 5,000 soybean meal and sold an estimated 1,000 soybean oil.

- APK-Inform

estimated 2021 Ukraine sunflower production at 16.4 million tons, up 15% from last year.

- Ukraine’s

AgMin set a limit for sunflower oil exports for 2020-21 at 5.382 million tons.

- Soybean

oil basis (high end) rose last week to levels not seen for years. As of Friday, IL soybean oil basis was around 700 over, up from 450 previous week, ECB 1000 over (up from 475 previous week) and WCB indicative 2000 over, up from 1000. Gulf is around 600

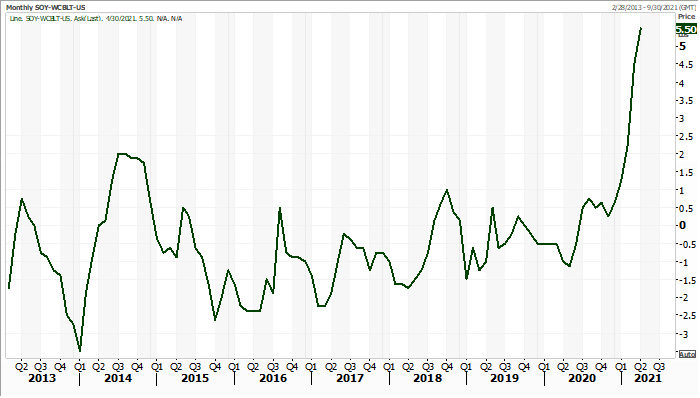

over. Reuters basis for the WCB was last quoted at a much lower value of 550 over, an indication it’s very difficult to get a true figure from the trade. Reuters WCB, monthly chart.

Source:

Reuters and FI

Updated

4/19/21

May

soybeans are seen in a $13.65 and $14.60 range

July $13.00-$14.60 November $10.50-$14.50

May

soymeal is seen in a $385 and $415 range

July $380-$4.40 December $325-$460

May

soybean oil is seen in a 53 and 57.50 cent range (up 150)

July

47.00-56.00 December 42-53 cent wide range (depends on global biodiesel and renewable fuel expansion)

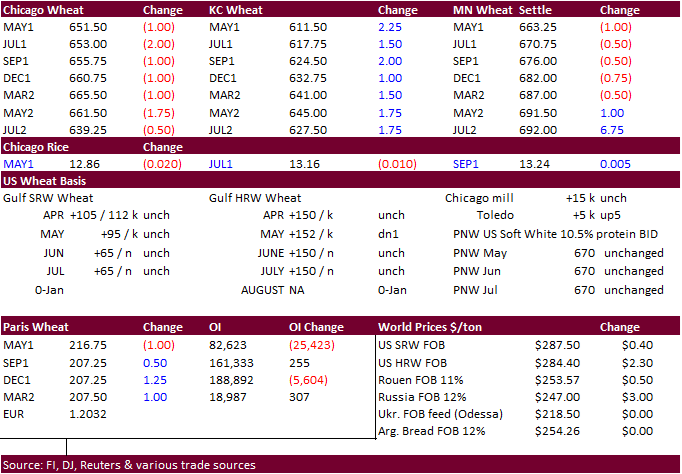

- US

wheat was

higher to start on a sharply lower USD (down 46 as of 3:45 pm CT) and higher corn futures, but nearby Chicago and back months MN closed lower on fund selling.

- Funds

on Monday sold an estimated net 1,000 CBOT SRW wheat contracts. - MN

type wheat could see some price pressure tonight after US white wheat conditions improved from the previous week. USD hit a new 6 week low, following announcements of Digital FX by China, UK etc. - News

over the weekend was light. - China

sold 410,710 tons of wheat out of auction, 10 percent of what was offered at 2,401 yuan per ton. 27MMT has been sold this year versus 56.3MMT offered.

- September

Paris wheat was up 0.25 at 207.00 euros. - A

45,000 ton Romanian wheat cargo is on its way to France, the northern French port of Dunkirk. - France’s

main agriculture areas may not see much rain until early May. - APK-Inform

sees Ukraine’s 2021 grain harvest up 13% to 73.6 million tons, including 27.6 million tons of wheat, 7.97 million tons of barley and 35.71 million tons of corn. Grain exports could reach 54.2 million tons in 2021-22 season from 45.6 million tons in 2020/21. - APK-Inform:

Ukraine wheat prices +$5.00/ton from week earlier to $237-$241 a ton FOB Black Sea port, feed wheat rose by $4 a ton to $232-$237 fob.

- IKAR:

Russian wheat export prices rose $1.00/ton to $248/ton (April) from the previous week.

- Results

awaited: Ethiopia seeks 30,000 tons of wheat on April 16. - Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

- Jordan

seeks 120,000 tons of feed barley on April 21.

Rice/Other

·

Bangladesh delayed their 50,000 ton rice import tender that was set to close April 18, to now April 26.

·

Results awaited:

Mauritius

seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Results awaited: Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Updated

4/19/21

May Chicago wheat is seen in a $6.20‐$6.65 range

July $6.00-$6.80

May KC wheat is seen in a $5.70‐$6.20 range

(US HRW wheat conditions are improving)

July $5.40-$6.25

May MN wheat is seen in a $6.30‐$6.80 range

July $6.20-$7.00 (depends on EU crop damage

and US spring wheat seedings/development)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.