PDF Attached

Calls:

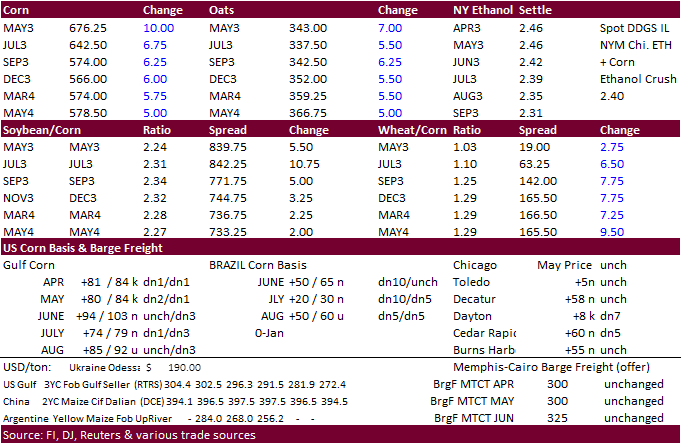

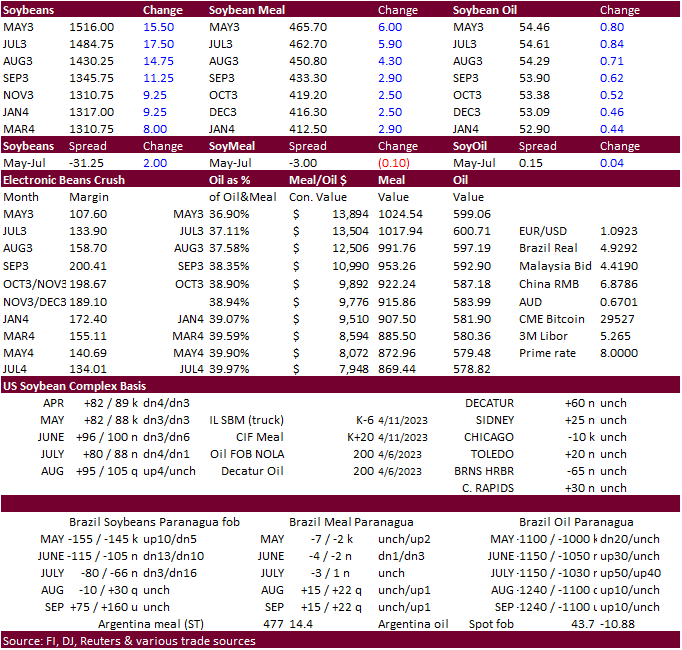

Soybeans

steady to 4 lower. US soybean planting progress off to a great start

Soybean

meal steady to $1.00 lower

Soybean

oil steady

Corn

steady to 2 higher. US plantings fell short of expectations

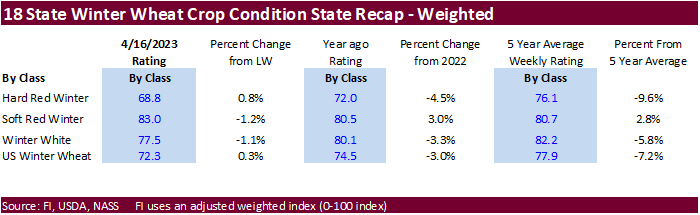

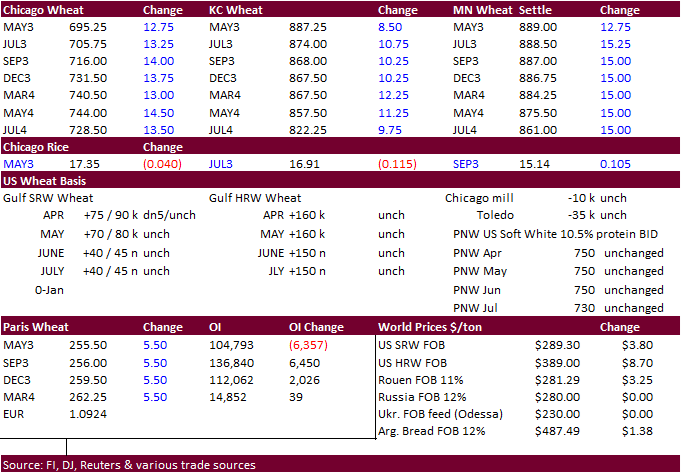

Wheat

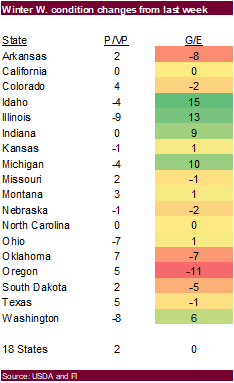

steady. US WW conditions were unchanged

US

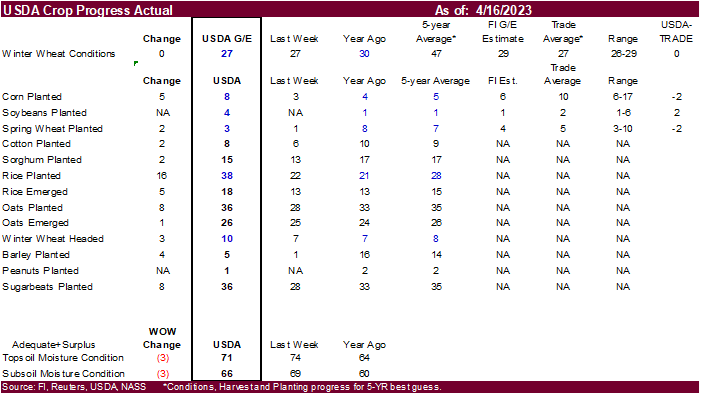

WINTER WHEAT – 27 PCT CONDITION GOOD/EXCELLENT VS 27 PCT WK AGO (30 PCT YR AGO) -USDA

US

CORN – 8 PCT PLANTED VS 3 PCT WK AGO (5 PCT 5-YR AVG) -USDA

US

SOYBEANS – 4 PCT PLANTED (1 PCT YR) (1 PCT 5-YR AVG) -USDA

US

SPRING WHEAT – 3 PCT PLANTED VS 1 PCT WK AGO (7 PCT 5-YR AVG) -USDA

Sharply

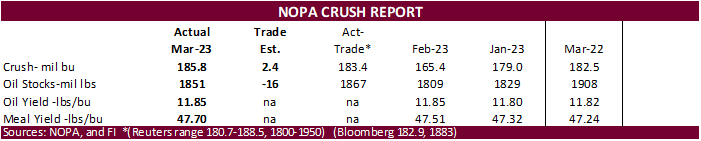

higher trade in all major CBOT agriculture commodities exception nearby rice where profit taking set in. Traders are noting the 6-10 US temperature outlook that calls for very cold temperatures for the Midwest and greater extent upper central US, after a week

of unusual warm temperatures that boosted crop development. Damage to the winter wheat could be minor, but the trade will not know the extent until later in the crop season. NOPA’s soybean crush report came in above trade expectations for soybean and soybean

oil use. Corn ended higher from Black Sea shipping uncertainty and good USDA export inspections.

World

Weather Inc.

RECENT

CHANGES OF SIGNIFICANCE

-

The

biggest issues on traders’ minds may be the pending cold in the U.S. northern and central Plains and Midwest during the coming weekend and early part of next week -

Concern

over U.S. hard red winter wheat dry areas will prevail, although the outlook is trending wetter for the second half of next week into the following weekend when the cold weather abates -

Worry

over North Africa and Spain weather will continue -

Canada’s

southwestern Prairies will remain dry, but a big snowstorm is expected in eastern Saskatchewan and Manitoba Tuesday through Thursday producing heavy snow, closing roadways and inducing a higher risk of more serious flooding on the Red River in southern Manitoba

in May. -

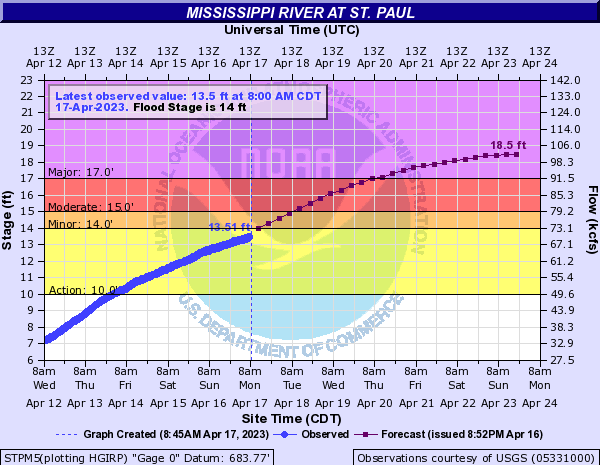

Red

River Basin of the North will continue flooding this week, but the outlook is not nearly as bad as feared – so far -

Argentina

is still advertised to be drier biased over the next couple of weeks -

Southern

Brazil rain will continue into mid-week and then seasonal rains will diminish greatly in key agricultural areas -

Australia’s

outlook is drier this week after recent rain

WEATHER

TO WATCH

-

Cold

weather is still advertised for the central United States next weekend -

Details

of the cold surge will come into better focus later this week -

Preliminary

expectations suggest frost and freezes will occur southward through Kansas, Missouri, Illinois, Indiana and Ohio with frost and a few light freezes in northern Oklahoma, Northern Arkansas and Kentucky -

Another

surge of cool air may impact the eastern U.S. early next week, but confidence is low in that part of the forecast -

Damage

to winter wheat will be determined by development stage, location and the intensity of the cold expected -

USDA’s

latest crop progress will be released Monday afternoon -

Watch

the southern and central U.S. Plains after the cold abates next week for the “potential” for rain; conditions could become more supportive of rain briefly as the cold abates from the region -

Confidence

is still low, but the “opportunity” for rain could improve at that time -

Northern

U.S. Midwest precipitation events will be sufficient to provide adequate to excessive soil moisture over the next two weeks limiting field progress -

The

cool weather will contribute to the delay in farming activity -

The

lower Midwest is not likely to see nearly as much moisture as the north allowing some fieldwork to advance, although some producers will be worried about the cool weather coming up and may opt to wait on the return of warmer weather before planting -

U.S.

Delta and southeastern states will see a new bout of rain late this week into early next week when cold air is overspreading the Midwest -

Net

drying is expected until then -

U.S.

west-central high Plains region may receive rain and snow briefly as colder air overspreads the region late this week and more likely during the weekend -

California

and the southwestern desert region will be dry biased for the next ten days -

Flooding

in the Red River Basin will steadily become more significant this week, but the flood may not be as severe as it has been in the past due to returning colder temperatures and limited precipitation -

U.S.

weekend precipitation was greatest in the western Corn Belt from Illinois to Wisconsin, Minnesota, Iowa, Kansas and Missouri -

Moisture

totals varied from 0.30 to 1.30 inches with local totals to 1.81 inches near St. Louis, MO and in southwestern Iowa -

Up

to 3-8 inches of snow accumulated in central and eastern Minnesota while up to 22 inches occurred in Wisconsin -

This

was more than expected and adds to the runoff for the upper Mississippi River Basin -

Showers

scattered erratically in the Delta and southeastern states -

Interior

eastern North Carolina, the western Delta and areas along the central Gulf of Mexico coast were wettest with 1.00 to 2.35 inches resulting -

Central

Plains weekend precipitation varied from 0.05 to 0.20 inch except in eastern wheat areas of Kansas where up to 0.86 inch resulted -

Canada’s

Prairies will receive more snow and rain this week as cold air returns to the region -

Snowfall

of 6-15 inches will impact eastern Saskatchewan and Manitoba while 1 to 6 inches occurs in other parts of Saskatchewan -

The

moisture will be greatest in the east and lightest in the southwestern Prairies -

The

moisture will add to spring planting delays along with the cold temperatures

-

Continued

dryness in southern Alberta and western Saskatchewan will remain a big concern through May unless something changes soon.

-

Ontario

and Quebec, Canada heated up during the weekend while experiencing dry weather -

Highest

temperatures reached into the 70s and 80s Fahrenheit -

U.S.

temperatures will turn much warmer in the central states during mid-week this week and in the eastern states late this week ahead of much colder air late this week and during the weekend in the central states and in the eastern states during the late weekend

and early part of next week. -

Argentina

precipitation during the seven days will continue restricted which will be great for summer crop maturation and harvesting, but a boost in rain will be needed prior autumn wheat and barley planting in June -

Some

rain is expected next week, but the impact on harvesting will be low -

Weekend

precipitation was minimal, and temperatures were mild -

Brazil

weekend precipitation was greatest in parts of Mato Grosso and from Minas Gerais and Espirito Santo to Paraguay and northern Rio Grande do Sul -

Rainfall

of 0.20 to 1.00 inch occurred most often with locally more in Espirito Santo and northern Rio de Janeiro -

Brazil’s

summer monsoon is winding down, but some rainfall is expected erratically over the next two weeks some of which will be from mid-latitude frontal systems and not due to the withdrawing monsoon -

Rainfall

will be greatest from Mato Grosso do Sul to Parana and Sao Paulo through mid-week this week in association with a cool front -

Net

drying will occur farther to the north and in Rio Grande do Sul -

Southwestern

Europe is still not likely to get much precipitation during the next ten days -

A

few showers will occur, but resulting precipitation will not be enough to counter evaporation -

Rain

is expected in most other areas periodically -

Europe

precipitation during the weekend fell beneficially from the U.K. and France to Belarus and portions of Ukraine as well as the Balkan Countries -

The

moisture helped maintain a favorable soil moisture profile for many areas -

Rain

is still needed in the lower Danube River Basin and in Spain and Portugal -

Temperatures

were mild -

Europe

temperatures will continue near to above normal through the next ten days with southwestern areas driest and warmest -

CIS

precipitation during the weekend was greatest from Ukraine and parts of Belarus through Russia’s Southern Region to parts of Kazakhstan favoring spring crop planting and winter crop development -

CIS

precipitation in the coming week to ten days will be greatest from Belarus and the Baltic States through Ukraine to Russia’s Southern Region maintaining moisture abundance -

Temperatures

will be seasonable -

Spring

planting may be delayed at times, but winter crop development should be normal -

Western

and northern Russia precipitation will be light during the next ten days, but soil moisture will remain favorable -

India

precipitation over the next two weeks is expected to be typical of this time of year with periodic, pre-monsoonal, precipitation expected in the central, west, south and east while some unusually great rain falls from Uttarakhand to Jammu and Kashmir -

China

weather over the next two weeks will include; -

Frequent

rain in the Yangtze River Basin and areas south to the coast -

Some

rapeseed areas may become a little too wet -

Erratic

precipitation in the North China Plain, Yellow River Basin and northeastern provinces through mid-week and then rain will develop in the Yellow River Basin late this week

-

Winter

wheat and early spring planting will benefit from northern China rainfall -

Xinjiang,

China will experience brief periods of light rain and cool air in the northeast through the next two weeks -

Cotton

and corn planting has begun, but mostly in western production areas where it has been warmest -

Northeastern

Xinjiang continues to experience bouts of cold and some additional frost and freezes are expected this week -

Western

Xinjiang will experience the best planting conditions, but temperatures will still be milder than usual -

Yunnan,

China is too dry and needs moisture for early season corn and rice as well as other crops -

The

province and neighboring areas are considered to be in a drought -

Dryness

will continue in the province cutting into rice and corn planting and production potential as well as some other crops -

Middle

East rainfall is expected from Turkey to Iran this week and will be great for winter and spring crops -

Cotton

and rice planting will benefit after the rain passes -

Winter

crops will fill favorably, but drier weather may soon be needed to protect grain quality -

Australia

precipitation will be minimal over the next ten days allowing some early season planting of canola, wheat and barley to begin -

Favorable

summer crop maturation and harvest progress is expected -

Australia

precipitation was greatest in South Australia, southern New South Wales and Victoria during the weekend with 0.43 to 1.14 inches resulting

-

South

Africa was dry during the weekend and very little precipitation is expected over the next ten days -

The

environment will be great for summer crop maturation and harvest progress -

North

Africa will continue too mostly dry along with Spain and Portugal over the next ten days -

Temperatures

will be warmer than usual -

Crop

stress will be expanding raising more concern over wheat and barley production as well as unirrigated spring and summer crops in Spain -

Mainland

areas of Southeast Asia are still in need of greater rain, although the situation is not critical

-

Poor

pre-monsoonal shower and thunderstorm activity has been occurring in many areas and improved rainfall will soon be needed -

This

is impacting some early season sugarcane, rice and coffee development as well as other crops -

Indonesia

and Malaysia weather has been lighter than usual due to the negative phase of Madden Julian Oscillation, and this will continue through the coming week and possibly ten days -

Totally

dry weather is not expected, but rainfall may be lighter and more sporadic than usual -

Cotton

areas from Mali to Burkina Faso have not seen a normal start to the rainy season this year; rain is needed to support planting -

Other

west-central Africa coffee and cocoa production areas will receive routinely occurring showers and thunderstorms

-

East-central

Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops -

Mexico

remains in a drought, though eastern and far southern parts of the nation will get some periodic rain -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was -0.54 and it should move lower over the next several days.

Source:

World Weather, INC.

Bloomberg

Ag calendar

Tuesday,

April 18:

- China’s

2nd batch of March trade data, including agricultural imports - China’s

first quarter pork output and inventory levels - New

Zealand global dairy trade auction

Wednesday,

April 19:

- EIA

weekly US ethanol inventories, production, 10:30am - Brazil’s

Conab releases cane, sugar and ethanol output data - USDA

total milk production, 3pm - HOLIDAY:

Indonesia, Bangladesh

Thursday,

April 20:

- China’s

3rd batch of March trade data, including country breakdowns for commodities - Malaysia’s

April 1-20 palm oil export data - Cocoa

Association of Asia grinding data for first quarter - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - USDA

red meat production, 3pm - HOLIDAY:

Indonesia

Friday,

April 21:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - US

cattle on feed, 3pm - HOLIDAY:

Brazil, Indonesia

Source:

Bloomberg and FI

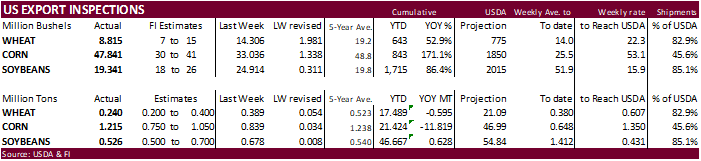

USDA

inspections versus Reuters trade range

Wheat

239,907 versus 200000-400000 range

Corn

1,215,221 versus 700000-1050000 range

Soybeans

526,376 versus 300000-725000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 13, 2023

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/13/2023 04/06/2023 04/14/2022 TO DATE TO DATE

BARLEY

0 0 0 2,154 10,083

CORN

1,215,221 839,165 1,182,821 21,423,929 33,243,361

FLAXSEED

0 0 0 200 324

MIXED

0 0 0 0 0

OATS

0 0 100 6,486 600

RYE

0 0 0 0 0

SORGHUM

57,763 90,631 323,467 1,249,671 4,919,896

SOYBEANS

526,376 678,038 1,008,326 46,667,363 46,039,346

SUNFLOWER

0 0 336 2,408 1,588

WHEAT

239,907 389,345 446,225 17,488,727 18,083,542

Total

2,039,267 1,997,179 2,961,275 86,840,938 102,298,740

—————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

102

Counterparties Take $2.257 Tln At Fed Reverse Repo Op. (prev $2.254 Tln, 104 Bids)

US

Empire Manufacturing Apr: 10.8 (exp -18.0; prev -24.6)

Canadian

Int’l Securities Transactions (CAD) Feb: 4.62B (prev 4.21B)

Canadian

Wholesale Trade Sales (M/M) Feb: -1.7% (exp -1.6%; prev 2.4%; prevR 6.1%)

·

US corn futures ended higher on Black Sea shipping uncertainty, fund buying and very good USDA export inspections. Funds bought an estimated net 7,000 corn contracts. Some cited US corn planting delays which is hard to comprehend

after a nearly six out of seven days of perfect planting weather.

·

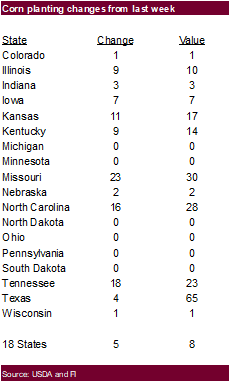

A Reuters range for US corn plantings as of Sunday showed a 6 to 17 point range, average a large 10 percent (9.2 million acres implied from average). That was a wide range for today. 5-year average is 5 percent. USDA ended up

reporting the US corn harvest progress at 8 percent complete, 2 points below expectations. The WCB is a little further along than the ECB.

·

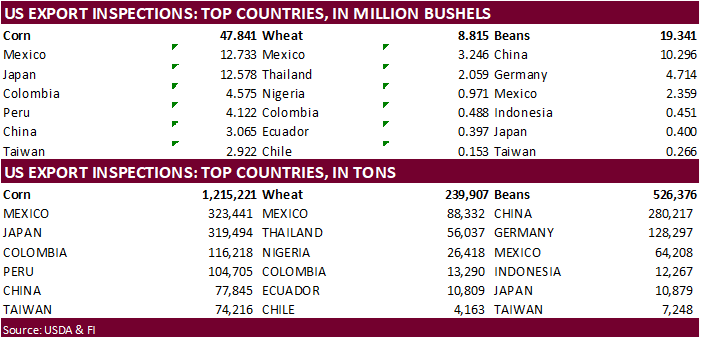

USDA US corn export inspections as of April 13, 2023, were 1,215,221 tons, above a range of trade expectations, above 839,165 tons previous week and compares to 1,182,821 tons year ago. Major countries included Mexico for 323,441

tons, Japan for 319,494 tons, and Colombia for 116,218 tons.

·

The European Commission is pushing back on selected countries banning Ukraine grain imports after Poland and Hungary banned them last week, stating its “not acceptable.” They are looking at options protect local farmers that border

Ukraine. Poland last week said the influx of imports caused economic damage to local producers. Meanwhile two other countries were considering similar measures (Romania and Bulgaria). Separately, Ukraine is considering re-opening grain transit to Poland.

·

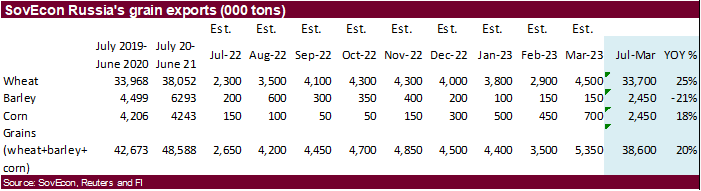

Ukraine warned the Black Sea grain deal is at risk after Russia blocked inspections of some ships in Turkish waters.

·

US lawmakers are back in session this week, and the House Ag committee will meet with the EPA midweek and other hearings will cover the new farm bill.

·

(Bloomberg) — China is spending 10 billion yuan ($1.5 billion) in farmer subsidies to support spring grain planting, the agriculture ministry said. Grain growers, including individuals, family farms and cooperatives, will be

eligible for the funds. Individuals and organizations that provide services for planting, growing and harvesting, will also qualify.

·

China GDP data will be released on Tuesday and if there is any influence on global energy prices from the report, that could spill over into the ag markets.

Export

developments.

·

None reported

Updated

04/11/23

May

corn $6.10-$7.00

July

corn $5.75-$7.00

·

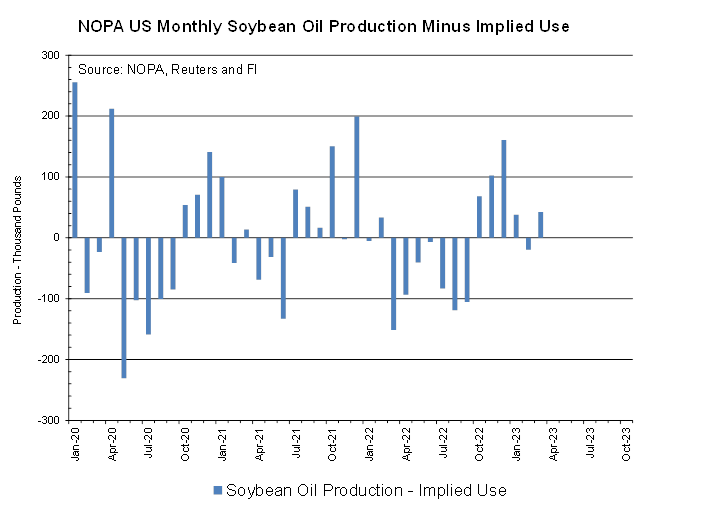

CBOT soybeans traded higher from the onset on fund buying, only to find additional support from a higher than expected US NOPA crush for the month of March (record for the month) and very good implied soybean oil demand likely

stemming from higher than anticipated soybean oil use for renewable fuel. Soybean meal roared back from session lows and soybean oil ended near session highs. CBOT July crush margins were up 4.75 cents to $1.34 on paper. Soybean oil was the highlight earlier

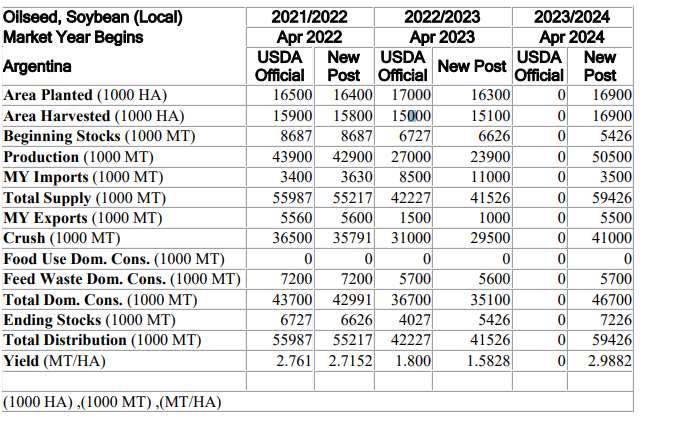

of the two products. Outside competing cash vegetable oil markets firmed, led by palm and EU rapeseed oil. Safe to say Argentina is out of the mix this crop year, at least for soybean exports (trade balance per USDA Attaché). See below export section.

·

Egypt seeks vegetable oils on Wednesday.

·

Funds bought an estimated net 7,000 soybean contracts, 2,000 soybean meal and 3,000 soybean oil.

·

USDA US soybean export inspections as of April 13, 2023, were 526,376 tons, within a range of trade expectations, below 678,038 tons previous week and compares to 1,008,326 tons year ago. Major countries included China for 280,217

tons, Germany for 128,297 tons, and Mexico for 64,208 tons.

·

The USDA Attaché lowered their estimate of the Argentina soybean crop to 23.9MMT (USDA official 27.0MMT). Traders are about between 22 and 24 million tons.

·

Argentina grain inspectors launched a 24-H strike at all the ports in Rosario over taxes and salaries. This is not expected to impact grain flow over the short term.

·

AgRural reported Brazil producers collected 86 percent of the soybean crop as of last Thursday, one point below year ago.

·

Palm oil futures rebounded Monday on bottom picking, weaker ringgit and a draw in stocks reported by Indonesia late last week.

·

Malaysia will keep its crude palm oil export tax unchanged at 8 percent next month, with a reference price of 4,063.58 ringgit ($918.95) per ton.

·

AmSpec reported Malaysian April 1-15 palm oil exports at 497,535 tons, down 33.7% from 750,530 tons reported during the same period month ago. ITS reported a 28.7% decline to 535,905 tons.

Export

Developments

-

Egypt’s

GASC seeks an unspecified amount of international vegetable oils and small amount of domestic supplies of soybean oil and sunflower oil on April 19 for delivery between May 20 and June 15.

USDA

Attaché: Oilseeds Annual

23.9MMT soybean production (USDA official 27.0MMT)

Updated

04/11/23

Soybeans

– May $14.50-$15.25 (upper end near target-crush appreciating), November $12.25-$15.00

Soybean

meal – May $420-$480, December $325-$500

Soybean

oil – May 53.00-57.00,

December 49-58

·

US wheat futures traded in a very wide range, ending the day higher on fund short covering in Chicago and renewed US weather concerns with cold temperatures rolling into the US winter wheat areas over the next 10-14 days. News

wasn’t bullish, IMO, other than renewed US weather concerns. Funds bought an estimated net 8,000 Chicago wheat contracts.

·

US winter wheat ratings were unchanged for the good and excellent conditions but by class HRW improved and SRW and White declined.

·

USDA US all-wheat export inspections as of April 13, 2023, were 239,907 tons, within a range of trade expectations, below 389,345 tons previous week and compares to 446,225 tons year ago. Major countries included Mexico for 88,332

tons, Thailand for 56,037 tons, and Nigeria for 26,418 tons.

·

The US weather outlook for the Great Plains turned a little negative than that of Friday. Precipitation was as expected over the weekend and light snow will fall across the northern growing areas this week. Eastern KS and eastern

NE will see precipitation one time or another Wednesday through Friday.

·

There is still uncertainty over an extension of the Black Sea grain deal set to expire mid next month.

·

StoneX sees the Brazil wheat crop at a record 11.3 million tons, up 300,000 tons from the previous season.

·

India under the World Food Program plans to send 10,000 tons of wheat to Afghanistan.

·

May Paris milling wheat officially closed up 5.50 euros, or 2.22%, at 256.00 euros a ton (about $279.55/ton).

Export

Developments.

·

Jordan seeks 120,000 tons of wheat on April 18 for Oct-FH Nov shipment.

·

Jordan seeks 120,000 tons of feed barley on April 19 for October through November 15 shipment.

·

China will auction off 40,000 tons of wheat on April 19.

Rice/Other

·

South Korea seeks 43,500 tons of rice on April 25 for July 1 and September 30 arrival.

·

Coffee futures hit a 6-month high.

Updated

04/11/23

KC

– May $8.25-9.00

MN

– May

$8.40-$9.00

#non-promo