PDF Attached

Inflation

concerns, higher outside energy markets and ongoing fund buying drove agriculture prices higher. New crop soybeans and corn gained on old crop. Wheat was higher from ongoing Black Sea concerns and Egypt in for wheat (they passed last two import tenders). US

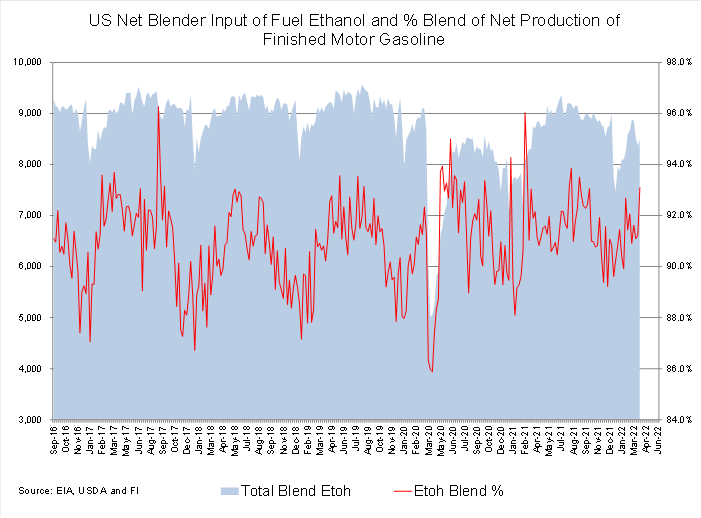

CPI was up 1.2% from the previous month (highest month over month since 2005). Year over year was up 8.5% (highest in 41 years). The US White House Administration granted E15 ethanol blending, at least for the summer driving months. We see no changes to the

US corn balance sheet over the next couple of months but long term, if this stands, we will increase our US corn for ethanol use.

WEATHER

EVENTS AND FEATURES TO WATCH

- Excessive

rain fell in southern Nata, South Africa Monday and early today with more than 11.00 inches reported in several areas.

- The

additional rainfall occurred over already saturated ground and in an area where flooding has occurred a couple of other times during the summer growing season. - Damage

was greatest in urban areas, but some agricultural areas nearly also suffered from the excessive rain event - Argentina

is moving into a full week of dry biased weather - Temperatures

will be seasonable - Next

week’s weather will trend a little wetter and cooler - Rain

is expected in the second half of the week and it may disfavor the northwest - Late

season crops will benefit most from the moisture - Temperatures

will be a little frosty again early next week, but early indications suggest damage potentials would not be any greater than that which occurred in last week’s frost event - Additional

significant rain fell overnight in western Parana, southern Mato Grosso do Sul and southern Paraguay after beginning in those areas earlier this week - Rainfall

varied 1.34 to more than 2.00 inches in the region and most of that occurred over saturated soil - Brazil’s

rain today will be greatest in Parana, southern Mato Grosso do Sul and eastern Paraguay where 0.40 to nearly 2.00 inches will result again.

- The

precipitation will shift northward Wednesday and Thursday passing briefly through the drier areas of Mato Grosso do Sul, Mato Grosso and southern Goias offering temporary relief.

- Rainfall

of 0.25 to 0.75 inch and a few amounts over 1.00 inch are expected - The

moisture will be welcome after recent drying, but more will be needed to protect subsoil moisture for use during the dry season which is beginning to evolve - Late

season crops reproduce in late April and May making the next few weeks very important to Safrinha corn and cotton - Additional

timely rain will be needed - Brazil’s

center west, center south and interior far south will be dry after Wednesday and Thursday’s rain event for at least a week and maybe 10 days. - Some

partial relief to dryness is expected in Mato Grosso do Sul, northern Mato Grosso, Bahia and northern Minas Gerais, but moisture deficits will remain - North

America’s blizzard is beginning to evolve today, but the worst conditions are expected tonight and Wednesday from North Dakota to Manitoba and western parts of Ontario - Snow

accumulations of 8 to 20 inches are expected with local totals of 20-25 inches possible - Livestock

stress will be quite high with some concern over animal health - The

storm will be serious enough to threaten the older animals, especially if they slip and fall in the snow - Newborn

calves will have to be protected from the snow and wind to prevent death - Some

road closures are likely - Power

Outages are also expected - Flood

potentials will rise once again following this event due to saturated field conditions, already high river and stream flows and additional precipitation periodically - Western

U.S. hard red winter wheat areas will remain dry or mostly dry through the next ten days - Some

computer forecast models have suggested a rising precipitation potential might occur after day ten, but World Weather, Inc. has its doubts - West

and South Texas will be dry for ten days - A

few showers of limited significance are expected in April 23-27, but confidence is low - California’s

Sierra Nevada will receive two brief bouts of precipitation this week; one today and the other Thursday into Saturday, but resulting moisture will not be great enough to seriously bolster snowpack or change spring runoff potentials - Most

of the southwestern United States will continue dry over the next two weeks - U.S.

Midwest, Delta and Tennessee River Basin are not expecting excessive rainfall to occur over the next ten days to two weeks, but mild to cool temperatures at times along with saturated soil conditions and brief periods of additional rainfall will maintain poor

planting conditions. - U.S.

southeastern states will be drying down over the next couple of weeks, although some showers and thunderstorms will occur infrequently to temporarily slow the drying process - Montana

and the western Dakotas will get some benefit from today and Wednesday’s snow event

- Topsoil

moisture will be briefly increased - Canada’s

western Prairies are not expected to get much precipitation in the coming week, although there is some potential for light precipitation in the April 20-26 period.

- Ontario

and Quebec will experience routinely occurring precipitation this week maintaining moisture abundance. - Tropical

Storm Megi continued to rain in the central Philippines Monday - Some

flooding has occurred in recent days, but the storm will dissipate today - Lingering

rainfall will keep the central parts of the nation wet with additional rain for a little while - The

storm was still located over the central Visayas Islands where it should dissipate - Typhoon

Malakas, the season’s first typhoon in the western Pacific Ocean poses no threat to land - The

storm will stay away from land throughout this week and will reach its peak intensity during mid-week

- Malakas

may pass to the northwest of the island Iwo To late this week - Europe

will experience less precipitation over the next ten days and a seasonable range of temperatures - Totally

dry weather is not likely, but precipitation should be light and relatively infrequent - The

environment will be very good for fieldwork in time as soil temperatures rise - Western

Russia, Ukraine, Belarus and the Baltic States will experience brief periods of rain and snowfall during the next two weeks and temperatures should average relatively near normal with a slight cooler bias west of the Ural Mountains at times - snow

cover will continue to retreat from western and northern Russia - runoff

from melting snow will continue to keep some areas wet this week, despite more limited precipitation

- North

Africa will experience a favorable mix of rain and sunshine during the next ten days while temperatures are seasonable - India’s

weather will continue mostly dry in the bulk of the nation, but some occasional rain will occur in Kerala, and a few areas in both southern Karnataka and Tamil Nadu with minimal impacts on the region away from the coast - Rain

will also continue frequently from eastern Bangladesh through the Eastern States - West-central

Africa precipitation is expected to be more frequent and more significant over the next ten days to two weeks improving soil moisture for coffee, cocoa, sugarcane, rice and cotton

- East-central

Africa rainfall is expected to slowly increase in Ethiopia, Uganda and southwestern Kenya during the next ten days with next week wettest - The

change will be most welcome in Ethiopia where the dry season is coming to an end - Turkey

will experience a good mix of rain while areas to the southeast from Syria through Iraq are dry and only limited rain is expected in Iran - These

drier areas could experience some hot and dry weather in the next few weeks - China

weather is expected to see typical spring weather over the next two weeks - Rainfall

will be greatest near and south of the Yangtze River - Precipitation

will be sporadic and mostly light in the North China Plain, Yellow River Basin and interior portions of the northeast - Xinjiang,

China precipitation will be mostly confined to the mountains this week and next week

- Temperatures

will be warmer than usual - Australia

precipitation is expected to be mostly limited to coastal areas over the next ten days - The

exception will be in Western Australia where some rain will fall periodically improving topsoil moisture for autumn planting that begins late this month - The

dry-biased environment in eastern Australia will be good for maturing cotton and sorghum as well as their harvests - South

Africa rainfall over the next couple of weeks may be a little too frequent for some early season summer crop maturation and harvest progress - Heavy

rain in Natal should abate after today - Late

season crops will benefit, but there is need drying to accelerate maturation and support harvest progress - Cotton

quality could be compromised - Rain

will fall frequently and abundantly near and north of the Amazon River into Colombia, Venezuela and Ecuador during the next ten days - Rain

will also fall frequently in Peru - Some

flooding could impact a part of the Amazon River System and Colombia in time - Mexico’s

winter dryness and drought have been expanding due to poor precipitation resulting from persistent La Nina - Northern

parts of the nation will continue lacking precipitation for an extended period of time - Eastern

and southern Mexico will be seasonably dry this week and will receive sporadic rainfall of limited significance next week - Central

America precipitation will be greatest in both Panama and Costa Rica - Guatemala

and western Honduras will also get some showers periodically - Rain

elsewhere will be mostly along the Caribbean Sea coast - Southeast

Asia rainfall will continue frequent and abundant - No

area in the mainland areas, Philippines, Indonesia or Malaysia are expected to be too dry - Too

much rain may impact east-central Philippines and a part of the northern Malay Peninsula this week - Today’s

Southern Oscillation Index is +13.37 - The

index will continue strongly positive the remainder of this week and into the weekend.

Source:

World Weather Inc.

USDA

Scheduled Release Dates for Agency Reports and Summaries

https://www.usda.gov/media/agency-reports

2022

CME Globex Trading Schedule

https://www.cmegroup.com/tools-information/holiday-calendar.html

Bloomberg

Ag Calendar

- France

Agriculture Ministry report; 2022 crop plantings - EU

weekly grain, oilseed import and export data - U.S.

winter wheat condition, 4pm

Wednesday,

April 13:

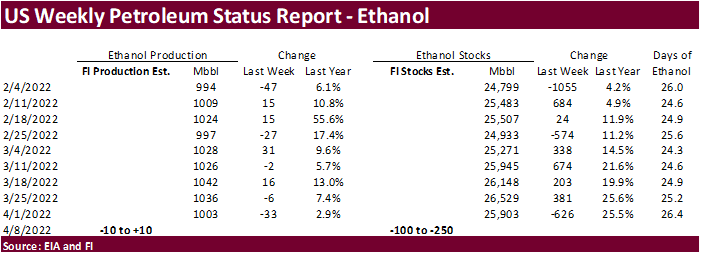

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

first batch of March trade data, incl. soybean, edible oil, rubber and meat imports - FranceAgriMer

report; monthly French grains outlook - New

Zealand food prices - Holiday:

Thailand

Thursday,

April 14:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - May

ICE white sugar contract expiry - HOLIDAY:

Argentina, India, Thailand

Friday,

April 15:

- ICE

Futures Europe weekly commitments of traders report - U.S.

green coffee stockpiles data released by New York-based National Coffee Association - FranceAgriMer

weekly update on crop conditions - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Major markets closed due to Good Friday holiday

Source:

Bloomberg and FI

US

CPI (M/M) Mar: 1.2% (est 1.2%; prev 0.8%)

US

CPI Ex Food And Energy (M/M) Mar: 0.3% (est 0.5%; prev 0.5%)

US

CPI (Y/Y) Mar: 8.5% (est 8.4%; prev 7.9%)

US

CPI Ex Food And Energy (Y/Y) Mar: 6.5% (est 6.6%; prev 6.4%)

US

Real Average Hourly Earning (Y/Y) Mar: -2.7% (prev -2.6%; prevR -2.5%)

US

Real Average Weekly Earnings (Y/Y) Mar: -3.6% (prev -2.3%; prevR -2.2%)

85

Counterparties Take $1.710 Tln At Fed Reverse Repo Op (prev $1.759 Tln, 85 Bids)

·

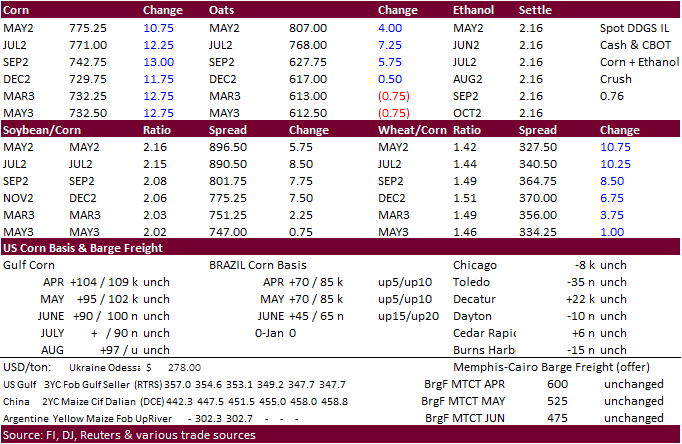

Corn futures were sharply higher following a temporarily summer E15 blend announcement by the White House and higher outside related markets (wheat, soybeans and crude oil). May corn futures are near their all-time contract high

while December made a new high.

·

WTI crude oil (May) was up $6.13 at 1:00 pm CT. Russian oil production and gas output fell to 2020 levels. The WTI market has been choppy so far this week. RBOB was also up sharply.

·

The E15 will be available during the June 1 to Sept. 15 period. We heard RIN prices were unchanged to slightly lower this morning following the announcement, an indication traders expect no immediate impact from this announcement.

There is, however, some concern from US domestic end users that compete with ethanol plants over securing corn. Spot corn is currently hard t source across the far western Great Plains for some selected areas.

·

Nothing materially changes over the short term for our US corn for ethanol demand. Long term it could lead to higher corn use but by a minimal 100 million bushels, then 200 million longer term after pipelines adapt.

·

The US already has an ethanol blend rate of over 10 percent, looking at EIA data. E15 could be easily achieved, in our opinion, if blended at the rack.

·

US export demand and outside related news should remain the driver for corn futures over the short term.

Export

developments.

·

South Korea’s NOFI bought 207,000 tons of corn in three consignments for July and August arrival ($377.55-$379.40/ton). Some speculate origin was Brazil.

May

corn is seen in a $7.25 and $8.10 range

December

corn is seen in a wide $5.50-$8.00 range

·

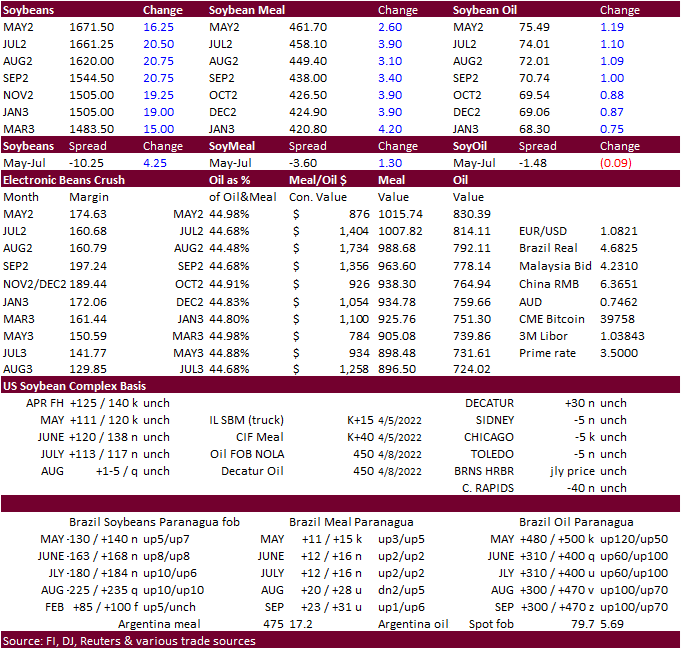

The CBOT soybean complex was higher on follow through fund buying and inflation concerns. Nearby soybean oil rallied with a strong rebound in WTI crude oil.

·

There was chatter the US will allow for canola use for renewable biofuel. It’s already approved for traditional biodiesel.

·

Cargo surveyor SGS reported month to date April 10 Malaysian palm exports at 255,789 tons, 66,965 tons below the same period a month ago or down 20.7%, and 88,250 tons below the same period a year ago or down 25.7%.

·

Indonesia’s 2022 crude palm oil production is estimated at 48.24 million tons, up from 46.85 million tons in 2021, according to the AgMin. (Reuters)

·

June Malaysian palm oil settled 172 ringgit higher to 6,177,

a 3 percent increase.

·

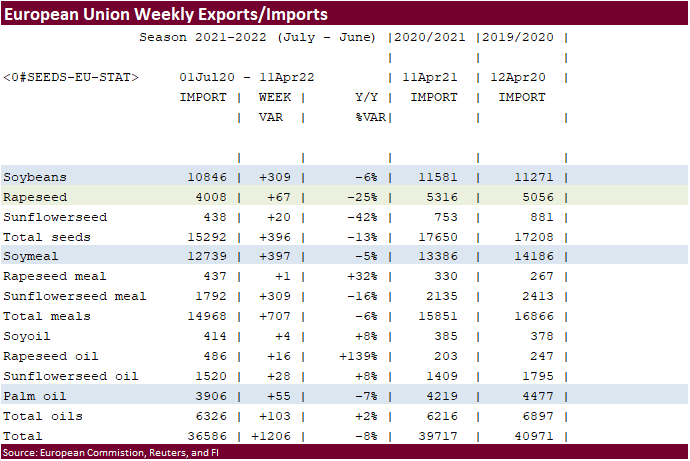

European Union soybean imports so far for the 2021-22 season (July 1, 2021-April 11, 2022) totaled 10.85 million tons, down from 11.58 million tons by the same week in 2020-21.

·

China plans to auction off another 500,000 tons of soybeans later this week.

Updated

4/8/22

Soybeans

– May $16.00-$17.65

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $440-$490

Soybean

oil – May 70.00-76.50

·

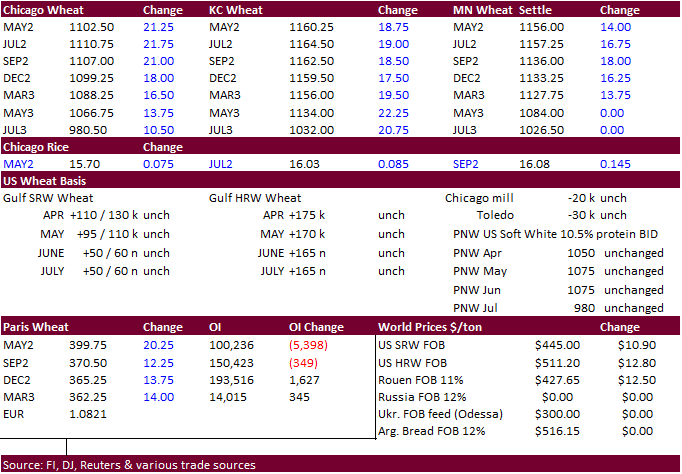

US wheat was higher on follow through fund buying, higher EU wheat futures, concerns over the US and China wheat conditions, and some chatter over improving export demand. Global supply concerns were noted by the news outlets.

It should be noted that South America is planting more wheat and India is exporting a large amount of wheat. We still see US wheat export prices above selected exporting nations. Look for an eventual pause in the US wheat futures rally if US export developments

remain slow.

·

Egypt is in for wheat, and they will accept offers from Russia and Ukraine.

·

May Paris wheat futures were up 20.25 euros at 399.25 euros and December was up 13.75 to 364.50 euros.

·

France’s AgMin pegged the soft wheat area at 4.79 million hectares (million hectares), down 3.9% on 2021 and 0.7% below the average of the past five years.

·

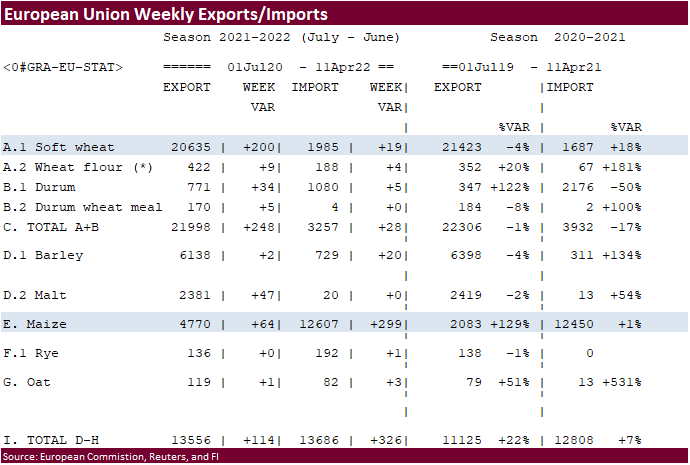

European Union soft wheat exports so far for the 2021-22 season (July 1, 2021-April 11, 2022) totaled 20.63 million tons, down from 21.42 million tons by the same week in 2020-21. EU 2021-22 barley exports reached 6.14 million

tons, against 6.40 million a year ago. Corn imports were at 12.61 million tons, against 12.45 million year ago.

·

Egypt seeks wheat on Wednesday. Shipping

will be from 20-31 May for FOB, and C&F arrival offers will be from 1-15 June. They will accept offers from Ukraine and Russia. Thy pass on their two previous import tenders.

·

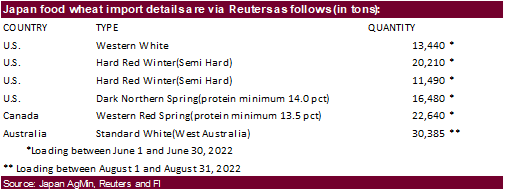

Japan seeks 114,645 tons of food wheat later this week.

·

Jordan passed on 120,000 tons of barley.

·

Results awaited: Algeria floated another import tender for wheat. The wheat is sought for shipment in several periods from the main supply regions including Europe: May 1-10, May 11-20, May 21-31, June 1-10, June 11-20 and June

21-30.

·

Jordan seeks 120,000 tons of milling wheat for LH May and/or through July shipment on April 13.

Rice/Other

·

None reported

Updated

4/12/22

Chicago May

$9.75 to $12.00 range, December $8.50-$11.00

KC May

$10.50 to $12.00 range, December $8.75-$11.50

MN May

$10.75‐$12.00, December $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.