PDF Attached

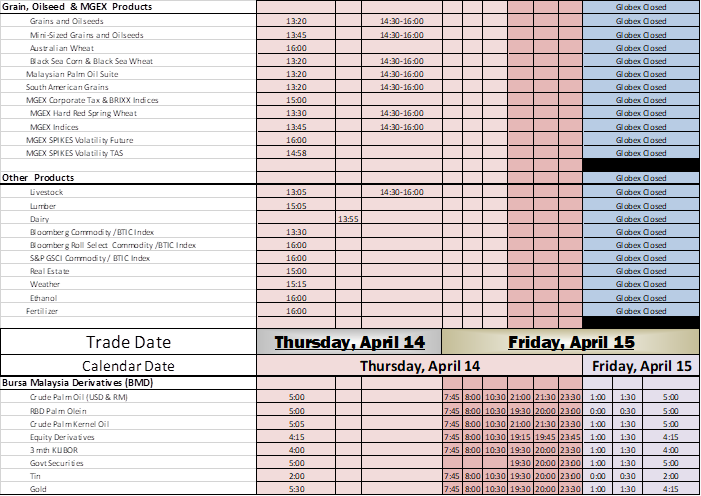

Private

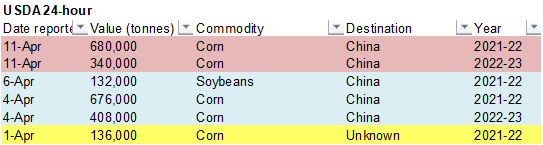

exporters reported sales of 1,020,000 metric tons of corn for delivery to China. Of the total, 680,000 metric tons is for delivery during the 2021/2022 marketing year and 340,000 metric tons is for delivery during the 2022/2023 marketing year.

Short

trading week. US and many other countries are on holiday Friday. CFTC COT will be released that day, and China and Malaysian derivative markets will be open (palm oil, for example). Many ICE markets will be closed.

The

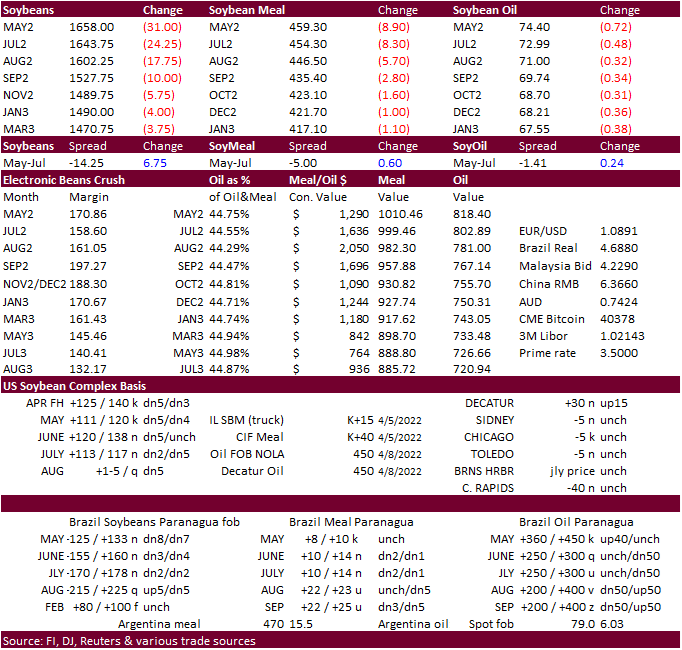

Ukraine/Russia situation sent wheat higher, lending support to back month corn. Nearby corn fell, along with weakens in nearby soybeans. Russia is sending additional personal to Ukraine. The CBOT soybean complex was lower (bear spreading), meal lower, and

soybean oil lower. WTI crude oil was trading lower but turned higher.

Forecasters

predict 19 hurricanes will strike this season

https://www.audacy.com/news/forecasters-predict-19-hurricanes-will-strike-this-season

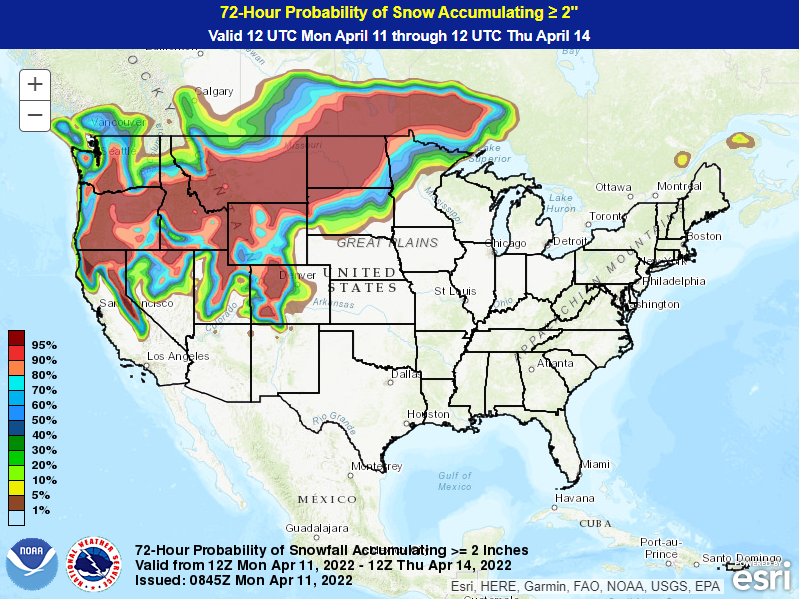

MN

type wheat did not keep up with Chicago and KC type wheat futures today, in part to precipitation forecast for the northern Great Plains this week.

WEATHER

EVENTS AND FEATURES TO WATCH

- Northern

U.S. Plains, upper U.S. Midwest and southeastern Canada’s Prairies will be impacted by a major winter-like storm this week producing blizzard conditions and resulting in travel delays and a serious risk to livestock - The

storm is expected tonight into Thursday impacting most areas from Montana and northeastern Wyoming to Minnesota, southern Manitoba, Canada and possibly the extreme southeastern corner of Saskatchewan (Tuesday and Wednesday will be stormiest)

- Moisture

totals will vary from 0.20 to 0.75 inch in Montana – away from the Canada border – and 0.50 to 1.50 inches with a few areas getting close to 2.00 inches in the eastern Dakotas, Minnesota and Manitoba

- Snowfall

will vary from 4 to 10 inches in southeastern Montana and northwestern South Dakota while 8 to 20 inches occur across North Dakota, northern Minnesota and southern Manitoba - Some

areas from eastern North Dakota to northern Minnesota and southern Manitoba, Canada will get 20-30 inches of snow - Extreme

Blizzard conditions could threaten livestock and travel will be delayed

- Areas

from the Missouri River Valley in North Dakota to Manitoba will be most impacted by this storm. - Flooding

will worsen on some rivers and streams in the Red River Basin because of rain and melting snow over saturated land and some rivers and streams are still in flood following the recent snow melt.

- U.S.

Delta, lower Midwest and Tennessee River Basin are still expecting periods of rain this week, although temperatures will be warmer for a little while early this week allowing some areas a chance to dry down more aggressively - Pockets

of net drying are still possible (especially early this week), but many areas will get just enough rain to limit drying rates and field progress - The

greatest rainfall will occur as a cold front moves through the region Wednesday into Thursday at which an outbreak of some severe thunderstorms is expected - Rainfall

by Thursday will vary from 0.05 to 0.60 inch from southeastern Missouri to the Great Lakes region while 0.50 to 1.50 inches and a few totals over 2.00 inches are expected from the Delta to parts of Indiana

- Temperatures

will be in the 60s today before rising back to the 70s Tuesday and Wednesday before cooling occurs late this week

- U.S.

Midwest and Delta weather next week will also be active with frequent disturbances bringing waves of rain periodically - Warming

is needed to perpetuate better drying rates on the days when no rain is falling - The

frequency of rainfall, however light, will still be a little too much for the best drying conditions.

- Some

progress is expected in the planting of corn and rice, but drier and warmer weather will be needed for a while - Chilly

temperatures were noted Sunday morning in the southeastern United States with 30-degree readings in many areas north of Florida - A

few reports of frost and freezes were received from northern Georgia and northeastern Alabama into South Carolina and areas north into Virginia and the lower Midwest - Some

minor crop damage may have occurred, but most of the cold should not have had much impact - Southeastern

U.S. rainfall will be minimal this week allowing soil conditions to dry out and planting to increase - Some

brief rainfall is expected Thursday into Friday with some follow up rainfall early to mid-week next week - The

mix of weather will be ideal for winter crop development and spring planting and emergence

- Temperatures

will slowly warm with 70s and 80s Fahrenheit likely this week - Western

U.S. hard red winter wheat areas are unlikely to receive significant rainfall during the next two weeks - Temperatures

will be very warm to hot and again Tuesday after cooling off briefly today following Sunday’s very warm conditions - High

temperatures Tuesday will be in the 80s and 90s accelerating drying rates across the region

- Cooling

will return more seasonable temperatures for Wednesday into Saturday with highs in the 40s and 50s in the north and 60s and lower 70s in the south - Western

parts of U.S. hard red winter wheat will experience strong wind speeds and low humidity today and especially Tuesday afternoon accelerating the region’s plight to low soil moisture.

- California’s

Sierra Nevada will receive two brief bouts of precipitation this week; one today and the other Thursday into Saturday, but resulting moisture will not be great enough to seriously bolster snowpack or change spring runoff potentials - Most

of the southwestern United States will continue dry over the next two weeks - West

Texas should be dry for the next ten days and probably for two weeks - South

Texas precipitation will be limited over the next ten days with areas near and south of Corpus Christi getting less than 0.50 inch of moisture, but areas farther north through the upper coastal area will get some greater rainfall - The

greatest potential for rain in South Texas will occur next week - Canada’s

western Prairies are not expected to get much precipitation in the coming ten days - Ontario

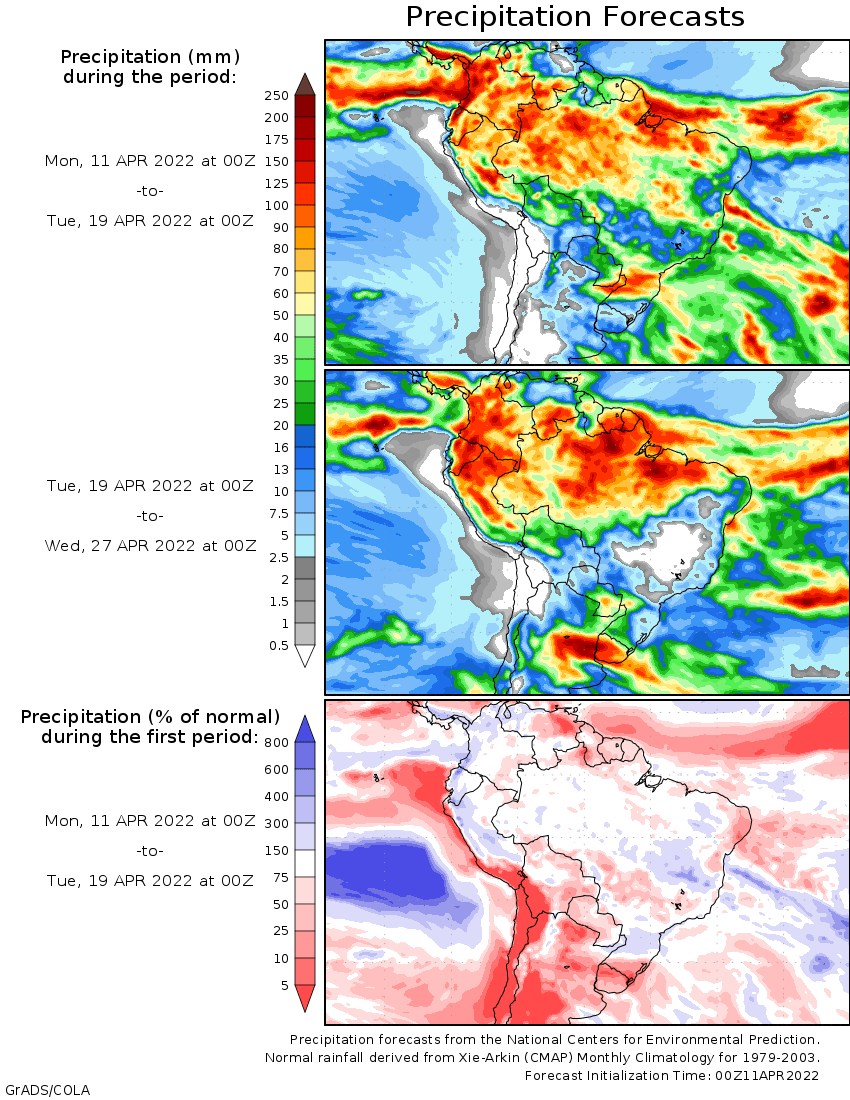

and Quebec will experience routinely occurring precipitation this week maintaining moisture abundance. - Argentina’s

significant rain of the weekend will advance into interior southern Brazil and southern Paraguay later today and continue into Tuesday - Rain

that impacted northeastern Santa Fe and southeastern Chaco, Argentina into a part of southern Brazil Sunday will move through western and northern Rio Grande do Sul today will impact southern Paraguay, northern Rio Grande do Sul and southern Parana today and

impact parts of Mato Grosso do Sul and Parana Tuesday and Wednesday with some rain reaching into Sao Paulo and southwestern Mato Grosso Wednesday as well.

- The

precipitation will diminish to sporadic showers of light intensity as the moisture moves farther to the northeast late this week - Additional

rain totals of 1.00 to 3.00 inches will be common and a few areas may get 4.00 to nearly 6.00 inches

- This

event will bring welcome relief to drying in Mato Grosso do Sul and “southern” Mato Grosso later this week restoring adequate topsoil moisture and ensuring Safrinha corn and cotton have favorable soil moisture into late April even though dry weather is expected

from late this week into April 22. Rain will return to southern Brazil after April 23.

- Not

all of Mato Grosso, Brazil will get significant rain this week - Central

Mato Grosso to southern Goias will only get 0.20 to 0.60 inch of moisture which may allow for additional drying - Topsoil

conditions in this region were rated slightly short of moisture Friday while subsoil moisture was rated adequate - Greater

rain must fall in this region to ensure the best conditions for Safrinha corn and cotton will continue during late April and especially May when reproduction is most likely - Relief

is expected from dryness in Minas Gerais this week, but parts of Bahia and extreme northern Minas Gerais may prevail stressing minor corn, soybean, coffee and sugarcane areas that are not irrigated - Rain

in Argentina was most significant Saturday night and Sunday from eastern La Pampa and western Buenos Aires through the southern Santa Fe to Entre Rios and central Buenos Aires where rainfall varied from 1.00 to 3.00 inches with local totals over 4.00 inches

- Rain

also fell in northeastern Argentina where up to 2.12 inches of rain resulted.

- Limited

rainfall occurred elsewhere, although thunderstorms were developing today in northeastern Argentina - Argentina

will experience net drying from Tuesday of this week to Tuesday of next week

- Showers

during mid-week next week should be light and brief - Argentina’s

bottom line will remain mostly good, but some pockets of dryness are expected to prevail in west-central crop areas which may accelerate late season crops to maturity faster than usual because of moisture stress. Most crops in the nation are unlikely to be

seriously stressed by the drier biased conditions. Rain will be needed soon in Cordoba and areas east into central Santa Fe.

- Tropical

Storm Megi produced torrential rainfall in Samar and some neighboring islands of east-central Philippines during the weekend. - Rain

totals through 0001 GMT today (Sunday) in Samar ranged from 2.25 to 11.45 inches, but there may have been some greater amounts

- The

storm was still located very near to southern Samar and was expected to produce additional heavy rain while it slowly dissipates and drifts aimlessly in the same region over the next few days - Typhoon

Malakas became the season’s first typhoon between Guam and the Philippines during the weekend.

- The

storm will stay away from land throughout this week and will reach its peak intensity during mid-week

- Malakas

may pass to the northwest of the island Iwo To late this week - Europe

will experience less precipitation over the next ten days and a seasonable range of temperatures - Totally

dry weather is not likely, but precipitation should be light and relatively infrequent - The

environment will be very good for fieldwork in time as soil temperatures rise - Western

Russia, Ukraine, Belarus and the Baltic States will experience brief periods of rain and snowfall during the next two weeks and temperatures should average relatively near normal with a slight cooler bias west of the Ural Mountains at times - snow

cover will continue to retreat from western and northern Russia - runoff

from melting snow will continue to keep some areas wet this week, despite more limited precipitation

- North

Africa will experience a favorable mix of rain and sunshine during the next ten days while temperatures are seasonable - India’s

weather will continue mostly dry in the bulk of the nation, but some occasional rain will occur in Kerala, and a few areas in both southern Karnataka and Tamil Nadu with minimal impacts on the region away from the coast - Rain

will also continue frequently from eastern Bangladesh through the Eastern States - West-central

Africa precipitation is expected to be more frequent and more significant over the next ten days to two weeks improving soil moisture for coffee, cocoa, sugarcane, rice and cotton

- East-central

Africa rainfall is expected to slowly increase in Ethiopia, Uganda and southwestern Kenya during the next ten days with next week wettest - The

change will be most welcome in Ethiopia where the dry season is coming to an end - Turkey

will experience a good mix of rain while areas to the southeast from Syria through Iraq are dry and only limited rain is expected in Iran - These

drier areas could experience some hot and dry weather in the next few weeks - China

weather is expected to see typical spring weather over the next two weeks - Rainfall

will be greatest near and south of the Yangtze River - Precipitation

will be sporadic and mostly light in the North China Plain, Yellow River Basin and interior portions of the northeast - Xinjiang,

China precipitation will be mostly confined to the mountains this week and next week

- Temperatures

will be warmer than usual - Australia

rainfall during the weekend was greatest in central cotton areas of New South Wales and south-central Queensland - Rainfall

ranged from 1.00 to 3.45 inches in the heart of New South Wales cotton areas possibly reducing cotton fiber quality and stringing some fiber out of bolls - Some

strong to severe thunderstorms were possible as well and that might have induced some additional crop damage - Most

of the Queensland rainfall affected only a small part of crop country and the impact was low on crops

- Drying

is needed and expected this week - Australia

precipitation is expected to be mostly limited to coastal areas over the next ten days - The

exception will be in Western Australia where some rain will fall periodically improving topsoil moisture for autumn planting that begins late this month - The

dry-biased environment in eastern Australia will be good for maturing cotton and sorghum as well as their harvests - South

Africa rainfall over the next couple of weeks may be a little too frequent for some early season summer crop maturation and harvest progress - Late

season crops will benefit, but there is need drying to accelerate maturation and support harvest progress - Cotton

quality could be compromised - Rain

will fall frequently and abundantly near and north of the Amazon River into Colombia, Venezuela and Ecuador during the next ten days - Rain

will also fall frequently in Peru - Some

flooding could impact a part of the Amazon River System and Colombia in time - Mexico’s

winter dryness and drought have been expanding due to poor precipitation resulting from persistent La Nina - Northern

parts of the nation will continue lacking precipitation for an extended period of time - Eastern

and southern Mexico will be seasonably dry this week and will receive sporadic rainfall of limited significance next week - Central

America precipitation will be greatest in both Panama and Costa Rica - Guatemala

and western Honduras will also get some showers periodically - Rain

elsewhere will be mostly along the Caribbean Sea coast - Southeast

Asia rainfall will continue frequent and abundant - No

area in the mainland areas, Philippines, Indonesia or Malaysia are expected to be too dry - Too

much rain may impact east-central Philippines and a part of the northern Malay Peninsula this week - Today’s

Southern Oscillation Index is +13.13 - The

index will continue moving higher for a while this week

Source:

World Weather Inc.

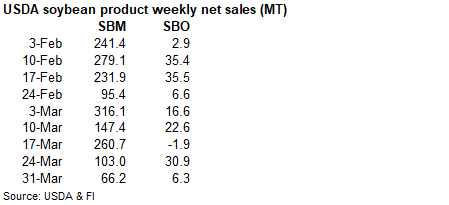

USDA

Scheduled Release Dates for Agency Reports and Summaries

https://www.usda.gov/media/agency-reports

2022

CME Globex Trading Schedule

https://www.cmegroup.com/tools-information/holiday-calendar.html

Bloomberg

Ag Calendar

- USDA

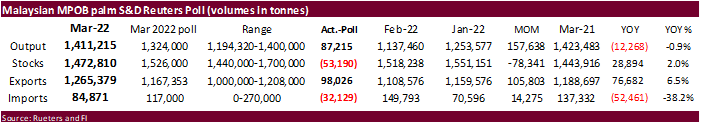

export inspections – corn, soybeans, wheat, 11am - Malaysian

Palm Oil Board’s data for March output, exports and stockpiles - Malaysia’s

April 1-10 palm oil export data - Brazil’s

Unica may release sugar output and cane crush data (tentative) - U.S.

crop progress and planting data for corn and cotton; spring wheat progress, 4pm - Ivory

Coast cocoa arrivals

Tuesday,

April 12:

- France

Agriculture Ministry report; 2022 crop plantings - EU

weekly grain, oilseed import and export data - U.S.

winter wheat condition, 4pm

Wednesday,

April 13:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

first batch of March trade data, incl. soybean, edible oil, rubber and meat imports - FranceAgriMer

report; monthly French grains outlook - New

Zealand food prices - Holiday:

Thailand

Thursday,

April 14:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - May

ICE white sugar contract expiry - HOLIDAY:

Argentina, India, Thailand

Friday,

April 15:

- ICE

Futures Europe weekly commitments of traders report - U.S.

green coffee stockpiles data released by New York-based National Coffee Association - FranceAgriMer

weekly update on crop conditions - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Major markets closed due to Good Friday holiday

Source:

Bloomberg and FI

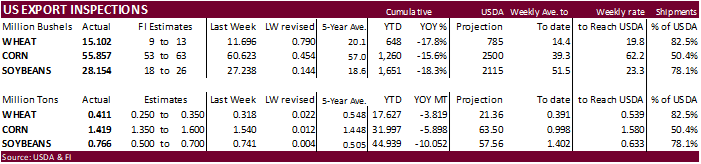

USDA

inspections versus Reuters trade range

Wheat

411,012 versus 250000-450000 range

Corn

1,418,827 versus 1100000-1950000 range

Soybeans

766,232 versus 500000-900000 range

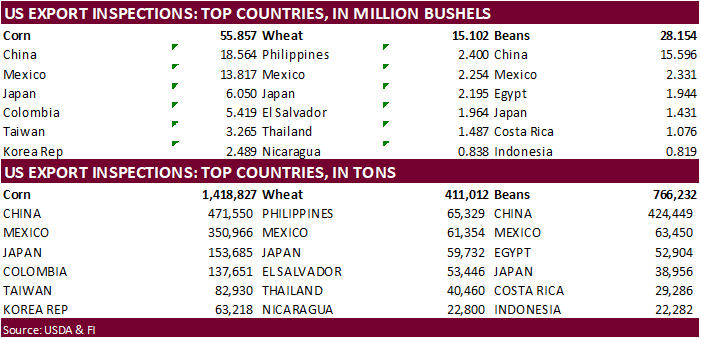

China

was a top taker for corn and soybeans.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 07, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/07/2022 03/31/2022 04/08/2021 TO DATE TO DATE

BARLEY

0 0 0 10,010 32,620

CORN

1,418,827 1,539,901 1,728,498 31,997,183 37,895,663

FLAXSEED

0 0 0 324 509

MIXED

0 0 0 0 0

OATS

0 100 0 500 5,415

RYE

0 0 0 0 0

SORGHUM

143,839 285,297 199,125 4,596,429 4,887,558

SOYBEANS

766,232 741,290 337,159 44,939,126 54,990,992

SUNFLOWER

528 192 0 1,252 0

WHEAT

411,012 318,304 461,368 17,627,141 21,445,745

Total

2,740,438 2,885,084 2,726,150 99,171,965 119,258,502

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

85

Counterparties Take $1.759 Tln At Fed Reverse Repo Op (prev $1.750 Tln, 84 Bids)

·

The Ukraine/Russia situation sent wheat higher, lending support to back month corn. WTI and RBOB was sharply lower. Some speculate the China covid lockdowns are weighing on WTI crude oil, while others noted country releases of

strategic reserves. Charts for that market look bearish. Crude oil has now given up most of the gains seen since Russia’s invasion of Ukraine.

·

Russia is sending additional personal to Ukraine.

·

We were hearing some western corn end users were having a hard time buying corn, despite near record spot futures prices and basis as high as 30 cents over the May for parts of KS. One theory is that producers are hedging new

crop, locking in potential favorable net returns, thus allowing them to hang onto old crop as an additional hedge.

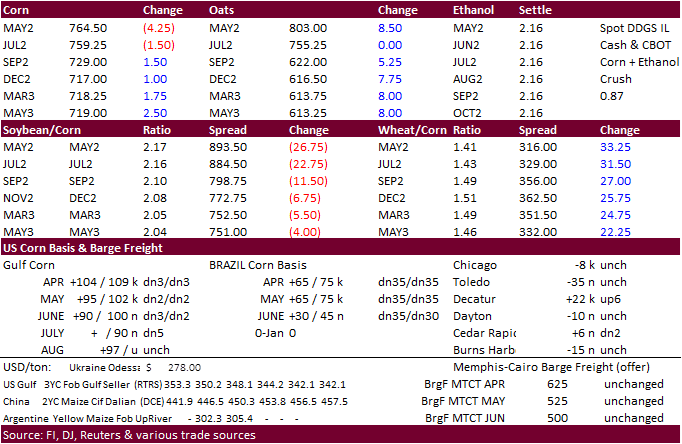

·

December corn hit a new contract high of $7.2225 and was up 6 out of the past 8 days.

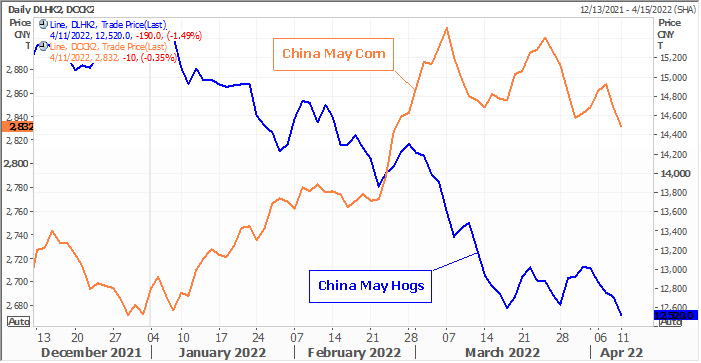

·

China nearby hog futures hit a record low. Covid lockdowns, rising hog inventories (from a year ago), and inflation changing eating habits are likely weighing on prices. China’s producer inflation for March was 8.3% from year-ago,

above expectations.

·

France culled over 13 million poultry bids due to bird flu since the end of November. This is the worst outbreak for France in history.

·

China is pushing for the country to produce their own new seed varieties to boost production.

China

May hogs versus China May corn futures

Source:

Reuters and FI

Export

developments.

·

Private exporters reported sales of 1,020,000 metric tons of corn for delivery to China. Of the total, 680,000 metric tons is for delivery during the 2021/2022 marketing year and 340,000 metric tons is for delivery during the

2022/2023 marketing year.

California

moves closer toward phasing out gas cars

May

corn is seen in a $7.25 and $8.10 range

December

corn is seen in a wide $5.50-$8.00 range

·

The CBOT soybean complex ended up higher. WTI crude oil was trading down about $4.20 at the time early only to turn higher and USD up about 19 points. Argentina and Brazil saw welcome precipitation over the weekend.

·

We heard China bought a couple of US cargoes late last week from the US and about 4 cargoes from Brazil.

·

We like July soybean oil over July soybean meal, over the short term, despite the trucker strike going on in Argentina. July oil share has been trending higher since the beginning of the month, in part to slowing US net export

sales and strong demand for global vegetable oils. The MPOB palm oil data was supportive, in our opinion. Note US soybean oil sales have also slowed but premiums remain strong with Gulf about 450 points over the May, although it did ease from 500 over from

the previous week.

·

Truckers in Argentina started an indefinite strike today over wages. No end date was set. “There are no negotiations currently underway,” according to Federation of Argentine Transporters (FETRA).

·

Argentina offers firmed before the USDA report last week ahead of the official start of the strike, and remain firm, at least as of Monday morning.

·

Palm oil futures are near a two-week high.

·

MPOB reported palm oil stocks at 1.473 million tons, near one year low, and 53,200 tons below expectations. Production was higher than expected but exports coming in 98,000 tons and lower than expected exports trimmed stocks by

78,300 tons from end of February.

·

Cargo surveyor AmSpec reported Malaysian April 1-10 palm exports at 271,201 tons, compared to 370,492 tons a month ago.

·

Cargo surveyor ITS reported Malaysian palm exports at 278,621 tons, 26 percent below 371,422 tons from the same period a month ago.

·

China plans to auction off another 500,000 tons of soybeans later this week.

Updated

4/8/22

Soybeans

– May $16.00-$17.65

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $440-$490

Soybean

oil – May 70.00-76.50

·

The Ukraine/Russia situation sent wheat higher. Chicago is near a two week high. US conditions went up 2 points, 2 above expectations, but still well below average.

·

MN type wheat did not keep up with Chicago and KC type wheat futures today, in part to precipitation forecast for the northern Great Plains this week. Parts of SRW wheat country will see rains (see maps in weather section).

·

China sold 527,622 tons of wheat late last week from reserves, 95.4 percent of wheat was offered, at an average price of 2,709 yuan per ton, or $425.88//ton.

·

India may see a record 111.32 million ton wheat crop, sixth season in a row that wheat production was near or at record. India’s wheat exports were 7.85 million tons through March, an all-time high.

·

Morocco’s AgMin warned production this year could be 53 percent less than 2021. They tend to have highly variable production cycles. Reuters noted

“Moroccan

farmers have sown 3.5 million hectares with cereals this year, of which 44% was planted with soft wheat, 24% with durum and 32% with barley. Only 21% of plantations were in a good condition and 16% showed average conditions.

·

Ukraine’s grain union announced exports will be allowed to export of 600,000 tons of grain and oilseeds a month. New routes to export grain and oilseeds out of Ukraine are still getting worked out. Before the war, Ukraine exported

up to 6 million tons of grain and oilseed a month.

·

The Ukraine union estimate wheat production could drop 45 percent to 18.2 million tons and corn down 38 percent to 23.1 million.

·

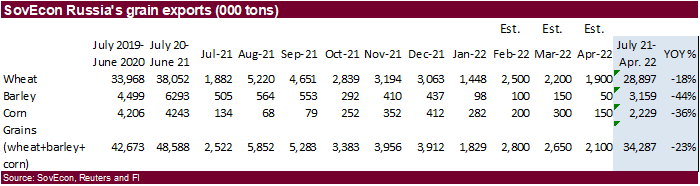

SovEcon estimates Russia’s April exports of wheat, barley and corn at 2.10 million tons, down from 2.65 million tons in March.

·

IKAR reported 12.5% protein Russian wheat export prices at $368/ton fob, about unchanged from the previous week. SovEcon reported $370-$380/ton.

·

This week the US will see a large storm bring heavy snow to the upper Great Plains and risk for threatening weather for the upper Midwest.

·

Russia set their export tax for wheat at $101.40 for the April 13-19 period, up from $96.10 previous.

University

of Illinois: Argentina and Brazil Could Expand Wheat Production Due to the War in Ukraine

Colussi,

J., G. Schnitkey and S. Cabrini. “Argentina and Brazil Could Expand Wheat Production Due to the War in Ukraine.”

farmdoc

daily

(12):48, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 8, 2022.

·

Results are awaited for Bangladesh in for wheat

for

shipment within 40 days after contract signing. Lowest price offer assessed at $399.19 a ton CIF liner out.

·

Algeria floated another import tender for wheat on April 12. The wheat is sought for shipment in several periods from the main supply regions including Europe: May 1-10, May 11-20, May 21-31, June 1-10, June 11-20 and June 21-30.

·

Jordan seeks 120,000 tons of feed barley on April 12.

·

Jordan seeks 120,000 tons of milling wheat for LH May and/or through July shipment on April 13.

Rice/Other

·

US cotton futures traded over 2 percent on Monday on drought concerns for the US.

·

China sold 24,243 tons of rice out of reserves. or 1.33% of the total offered, at 2,634 yuan ($414.09) per ton.

Updated

4/8/22

Chicago May $9.50 to $12.00 range, December $8.50-$11.00

KC May $10.00 to $12.00 range, December $8.75-$11.50

MN May $10.50‐$12.00, December $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.