PDF Attached

Active

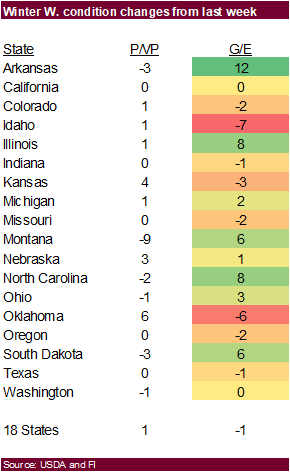

trade today (options) despite many countries on holiday. The weather outlook for the US western Great Plains lifted KC type wheat higher (dry), lending support to Chicago and MN type wheat. Soybeans were mixed with bear spreading in focus. Note the Goldman

Roll started today. Meal ended lower and soybean oil mixed. Corn was remarkably higher bias nearby position after an earlier two-sided trade. US wheat conditions deteriorated, signaling a higher trade for wheat for tonight.

World

Weather Inc.

-

DRY

AREAS -

Spain

Portugal and most of North Africa – no relief for at least 10 days -

Lower

Danube River Basin has had some relief, but more rain is needed -

Yunnan,

China and immediate neighboring areas are too dry for corn, rice, sugarcane and other crops -

Mainland

areas of Southeast Asia are still receiving below normal rainfall with little change expected -

Interior

eastern Australia, though at this time of year that dryness is not of much concern -

Southern

Australia soil moisture is low, but for this time of year that is not a problem and there has been some occasional light rain recently with more expected -

South

Africa dryness is not unusual at this time of year and will support summer crop maturation and harvesting -

Argentina

continues to have large areas that are still drier than usual, but for this time of year that is of little interest -

Brazil’s

center south has dried down recently, but weekend rain brought some relief, and more is expected -

Northeastern

Brazil is the driest region -

Cotton

areas from Mali to northern Ivory Coast will need greater rain soon -

Southwestern

Canada’s Prairies and the northwestern U.S. Plains are still much too dry -

U.S.

west-central through the southwestern Plains are still too dry with little change likely; this includes both winter wheat areas and cotton, corn and sorghum areas -

Mexico

remains in a drought, though eastern parts of the nation will get some periodic rain -

WET

AREAS -

U.S.

southeastern states and lower Delta are too wet -

U.S.

Red River Basin of the North is seeing rapid snowmelt resulting in flood conditions later this week

-

Portions

of Indonesia/Malaysia are plenty wet, but will gradually dry down in future weeks -

OSCILLATORS

-

Southern

Oscillation Index bottomed out slightly below zero last week and it should move erratically this week -

Today’s

Index was -1.45 and it was expected to move erratically higher for a while this week

-

Arctic

Oscillation, North Atlantic Oscillation are neutral -

Pacific

Decadal Oscillation (PDO) is still strongly negative with no significant changes noted in this past week – based on new data this morning.

-

Cooler

weather is being advertised for the U.S. Midwest and a part of the Great Plains, Delta and southeastern states next week -

Frost

and freezes might occur, but it is too soon to predict the intensity or breadth of the cold airmass expected -

This

event will need to be closely monitored after this week’s very warm to hot weather since winter crop development will expand and some recently planted corn either has or soon will be emerging -

A

tropical cyclone may form east southeast of the Philippines this week and it will be closely monitored for possible influence on the archipelago later this week -

The

storm was 323 miles southeast of northeastern Samar Island at 1300 GMT today moving west northwesterly

-

Some

intensification and organizing is expected to occur early this week -

The

system could impact Samar and Luzon Island during mid-week this week with some very heavy rain and gusty surface wind

-

Flooding

is possible as well -

Tropical

cyclone 18S was 220 miles north northwest of Darwin, Western Australia at 1300 GMT today moving southwesterly while producing 50 mph sustained wind speeds -

The

system will become better defined and intensify early this week before moving inland over the central North coast of Western Australia during the second half of the week

-

The

storm may become quite intense Tuesday and Wednesday with landfall expected 150 miles east of Port Hedland Wednesday Night or early Thursday -

The

system needs to be closely monitored for possible impact on Port Hedland

MOST

IMPORTANT WEATHER OF THE DAY

-

Southeastern

U.S. crop areas experienced planting delays during the weekend as heavy rain and some flooding occurred from eastern Texas through the lower Delta to the southeastern states -

Rainfall

of 1.00 to 3.00 inches was common from south-central Louisiana through east-central Mississippi to northern Georgia and from eastern Georgia through the heart of the Carolinas -

Local

rain totals of 3.00 to 4.00 inches occurred in several areas with extremes of 4.34 inches at Rome, Ga. and 4.21 inches near Amite, La.

-

Southern

Texas, the southern Blacklands and Coastal Bend areas all reported light rain during the extended holiday weekend with local rain totals of 1.00 to 2.00-inch amounts occurring from near Laredo, Texas through Loma and Cheapside to near Bellville, Texas -

Other

U.S. crop areas were generally dry, although rain and mountain snow fell from northern California through Washington and parts of western and northern Idaho where crop areas reported up to 0.36 inch with some coastal areas received 1.00 to 1.67 inches of moisture -

Central

U.S. temperatures turned much warmer during the holiday weekend -

Highest

temperatures reached the 70s and a few lower 80s from southern South Dakota and southwestern Minnesota while in the 70s and 80s in the southeastern states and some middle Atlantic Coast States -

Eastern

Midwest temperatures reached the 60s Sunday -

Upper

30- and 40-degree highs occurred in some of the snow covered areas in the Red River Basin of the North with a few readings over 50 degrees from eastern South Dakota through central and northeastern Minnesota inducing rapid snow melt -

High

temperatures in the Pacific Northwest were mostly in the 50s and 60s -

Canada’s

Prairies temperatures warmed into the 30s and 40s in the east and in the 50s and lower 60s in the west during the afternoons followed by lows that were in the single digits and teens in the central and east and 20s and 30s in the west

-

Temperatures

will be seasonable this week and warm in the west and cool southeast next week -

Canada’s

Prairies are not likely to see large volumes of rain or snow for a while, but some will occur along the front range of the mountains in Alberta and there may be some early week moisture from northern Alberta to northern Saskatchewan and late week from southeastern

Saskatchewan to southern Manitoba -

Moisture

totals through April 19 will vary from 0.20 to 0.60 inch in western and northern Alberta and a trace to 0.30 inch elsewhere

-

Driest

in the central Prairies -

West

Texas reported scattered showers during the weekend with a trace to 0.40 inch occurring most often, but the coverage of more than 0.20 inch was not much greater than 25% of cotton, corn or sorghum areas -

The

Low Plains region reported up to 0.76 inch of moisture -

Much

more rain was needed -

West

Texas precipitation is expected to be minimal for the next ten days, although a few showers will occur next week -

U.S.

Delta and southeastern states will take a break from weekend precipitation through the first half of this week, but some additional rainfall of 0.30 to 1.25 inches and local totals over 2.00 inches will be possible after that -

South

Texas, the Texas Blacklands and Coastal Bend will receive additional rain Monday and again late this week into early next week with the latter event most significant -

Rain

totals will vary from 0.30 to 1.50 inches and locally more -

U.S.

hard red winter wheat areas will continue to get restricted precipitation next ten days -

U.S.

temperatures this week will be warmer than usual from the central Plains into the upper and middle Atlantic Coast States this week while near normal from Texas to Georgia and below normal in the Pacific Northwest -

Temperatures

next week will turn colder than usual in the Plains, Midwest, Delta and southeastern states while trending warmer than usual in parts of the far west -

U.S.

Red River Basin of the North will experience light precipitation again late Thursday and Friday of this week, but it should not be enough to seriously aggravate flooding from melting snow -

The

remainder of the coming ten days should be limited on precipitation -

California

and the southwestern states should be free of significant precipitation for the next ten days -

Ontario

and Quebec weather should be favorably mixed over the next two weeks -

Argentina

rainfall will be restricted through the first half of this week -

Showers

and thunderstorms will develop in west-central and northern parts of the nation later this week and into the weekend with 0.75 to 2.50 inches of rain resulting -

Interior

southern parts of the nation are not likely to see much moisture over the next ten days -

Argentina

weekend weather was dry except in La Pampa where 0.75 to 2.50 inches resulted -

Temperatures

were warmer than usual -

Brazil

early week weather will be dry in the south and sufficiently moist in the north to support Safrinha and other late season crops -

A

boost in rainfall is expected late this week into next week that will bring moisture to the south and maintain favorable late season crop moisture in the north -

Brazil

weekend rainfall was greatest in southern Goias, southern Minas Gerais and northern Sao Paulo where 1.00 to 2.00 inches resulted with one amounts to 2.75 inches -

Showers

were lighter in most other areas with some net drying in the far south, northeast and center west -

Temperatures

were seasonable -

Europe

weekend precipitation fell lightly from northern France and southeastern England to Belarus, Ukraine and a part of the Balkan Countries where 0.05 to 0.68 inch of moisture resulted.

-

Spain

and Portugal remained dry -

Temperatures

were mild except Spain and Portugal where 70- and 80-degree highs were noted -

Europe

precipitation will continue frequent except in the southwest where dry biased conditions will prevail -

Russia

weekend precipitation was dry biased except in the far southernmost part of Russia’s Southern Region where up 0.88 inch resulted -

Temperatures

were mild -

Western

CIS precipitation will be limited in western and northern Russia, but will occur or evolve periodically from Belarus, the Baltic States and Ukraine into all of Russia’s Southern Region supporting spring planting and early crop development -

Temperatures

will be above normal -

North

Africa continues dry and will see no change for the next ten days with temperatures warmer than usual -

Crop

moisture stress will continue to threaten production of wheat and barley -

India

weekend precipitation was limited to showers in central parts of the nation with erratic amounts resulting -

Most

winter crop areas were unaffected by significant rain, although there were a few exceptions in Maharashtra, northwestern Telangana and Odisha where up to 0.75 inch resulted -

Temperatures

were warm to hot with highs in the 90s to 108 inches Fahrenheit -

India

is expected to remain seasonably very warm to hot with very little precipitation of significance over the next ten days -

Yunnan,

China is too dry and needs moisture for early season corn and rice as well as other crops -

The

province and neighboring areas are considered to be in a drought -

Dryness

will continue in the province cutting into rice and corn planting and production potential as well as some other crops -

Eastern

China weather has been and will continue to be favorably mixed for winter, spring and summer crops over the next two weeks -

The

Yangtze River Basin will be wettest which is not unusual for this time of year -

Precipitation

in the North China Plain and Yellow River Basin will be restricted -

Australia

weekend precipitation was good for future spring planting, although not enough on its own to support early crop development -

Rainfall

varied from 0.35 to 1.57 inches in interior southwestern Western Australia -

Victoria

reported 0.84 to 1.34 inches with a local total of 3.31 inches -

East-central

and far southeastern Queensland reported localized rain totals of 1.34 inches and 2.32 inches respectively while New South Wales crop areas reported 0.12 inch to 0.40 inch with a few amounts to 1.25 inches in the northeast -

South

Australia was driest with rain mostly confined to areas near the Victoria border where up to 1.00 inch resulted -

Temperatures

were seasonably warm -

Eastern

Australia summer crop areas will be dry for the next ten days and rain in the south will be sporadic and mostly light -

Temperatures

will continue warm -

Good

summer crop maturation and harvest weather is expected -

Some

early autumn planting may begin soon if it has not already begun in the south -

Portions

of southern Australia will receive rain in the next ten days with most of it held close to the southern coast -

Temperatures

will continue warm -

South

Africa weather will be mostly good over the next two weeks with a mix of rain and sun supporting corn, sorghum, sunseed, soybeans, rice, cotton, citrus sugarcane and other crops -

Rainfall

will be limited in this first week of the outlook and then increase this weekend and next week -

Production

potentials are high and late summer weather is mostly very good -

Mexico

drought will continue this month, although there will be some periodic opportunity for rain in eastern parts of the nation through much of the next ten days -

Central

America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days -

Net

drying is likely in portions of Honduras and Nicaragua -

Southeast

Asia rainfall will continue favorably distributed for the next ten days to two weeks; this is true for Indonesia, Philippines and Malaysia as well as the maintain crop areas -

Mainland

precipitation will be lighter than usual and a boost in rainfall will be needed soon -

March

was notably drier biased -

Rain

intensity in Indonesia and Malaysia is expected to lighten up over time -

West-central

Africa rainfall needs to increase in cotton areas from Mali to northern Ivory Coast and Ghana to support planting -

Periodic

rain elsewhere will be good for coffee, cocoa, sugarcane and rice -

Eastern

Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops -

Turkey,

northern Iraq and northern and western Iran will receive rain in the coming week to ten days while net drying occurs in most other areas

-

Recent

precipitation has been good for wheat development and rice and cotton planting with more of the same was expected

-

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected

Source:

World Weather, INC.

Bloomberg

Ag calendar

Tuesday,

April 11:

- USDA’s

World Agricultural Supply & Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly supply and demand report

Wednesday,

April 12:

- EIA

weekly US ethanol inventories, production, 10:30am - France

agriculture ministry’s 2023 planting estimates

Thursday,

April 13:

- China’s

1st batch of March trade data, including soybean, edible oil, rubber and meat & offal imports - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

CONAB publishes production, area and yield data for corn and soybeans - FranceAgriMer

monthly grains balance sheet - Port

of Rouen data on French grain exports - HOLIDAY:

Thailand

Friday,

April 14:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

India, Thailand

Source:

Bloomberg and FI

Reuters

S&D trade estimates

US

stocks

World

stocks

SA

Production

USDA

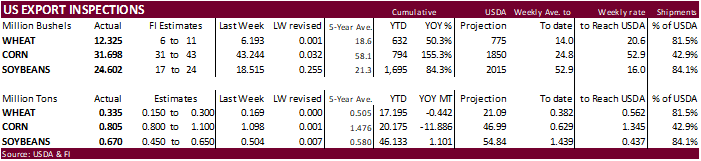

inspections versus Reuters trade range

Wheat

335,444 versus 150000-500000 range

Corn

805,167 versus 600000-1300000 range

Soybeans

669,566 versus 375000-800000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 06, 2023

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/06/2023 03/30/2023 04/07/2022 TO DATE TO DATE

BARLEY

0 0 73 2,154 10,083

CORN

805,167 1,098,461 1,474,547 20,174,710 32,060,540

FLAXSEED

0 0 0 200 324

MIXED

0 0 0 0 0

OATS

0 0 0 6,486 500

RYE

0 0 0 0 0

SORGHUM

90,436 9,920 143,839 1,191,713 4,596,429

SOYBEANS

669,566 503,900 821,064 46,132,515 45,031,020

SUNFLOWER

0 0 528 2,408 1,252

WHEAT

335,444 168,543 419,185 17,194,919 17,637,317

Total

1,900,613 1,780,824 2,859,236 84,705,105 99,337,465

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Bank

Holiday and other Easter celebrations today

US

Change In Nonfarm Payrolls Mar: 236K (est 230K, prev 311K)

Unemployment

Rate Mar: 3.5% (est 3.6%, prev 3.6%)

Average

Hourly Earnings Mar M/M: 0.3% (est 0.3%, prev 0.2%)

Average

Hourly Earnings Mar Y/Y: 4.2% (est 4.3%, prev 4.6%)

US

Change In Manufacturing Payrolls Mar: -1K (est -4K, prevR -1K)

Change

In Private Payrolls Mar: 189K (est 218K, prevR 266K)

Average

Weekly Hours All Employees Mar: 34.4 (est 34.5, prev 34.5)

Labour

Force Participation Rate Mar: 62.6% (est 62.5%, prev 62.5)

Underemployment

Rate Mar: 6.7% (prev 6.8%)

·

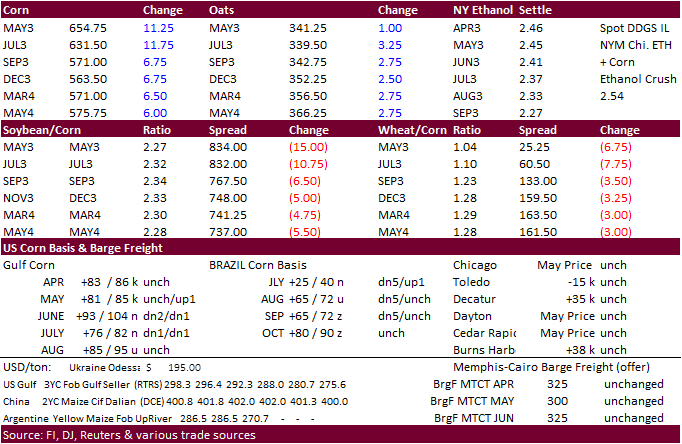

Corn futures rallied bias old crop on Black Sea grain export deal concerns and heavy optional call spreading (upside). News was very light. Funds were buyers of 7,000 contracts.

·

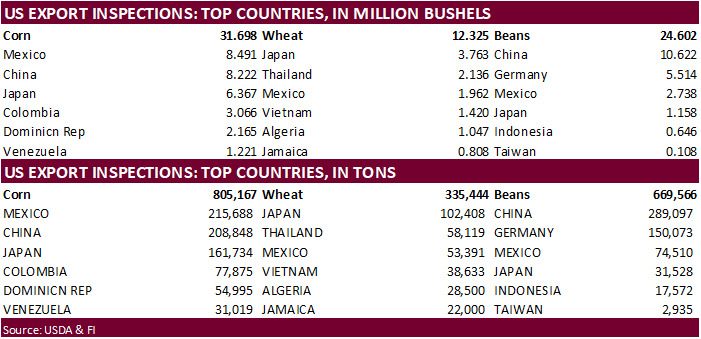

USDA US corn export inspections as of April 06, 2023, were 805,167 tons, within a range of trade expectations, below 1,098,461 tons previous week and compares to 1,474,547 tons year ago. Major countries

included Mexico for 215,688 tons, China for 208,848 tons, and Japan for 161,734 tons.

·

There were 3000+ call spreads done at 6.60-6.80.

·

Note today the first day of the Goldman Roll.

·

Funds are getting back into long positions (corn and soybeans) after USDA surprised the trade little more than a week ago with grain stocks, per CFTC COT.

·

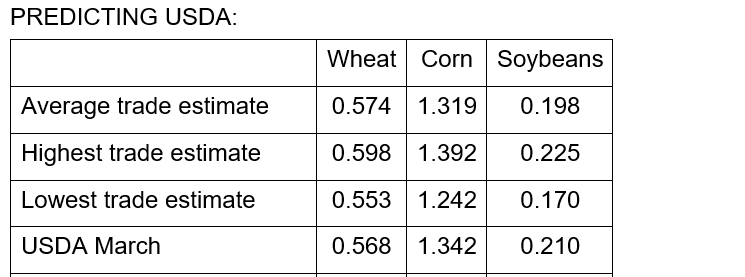

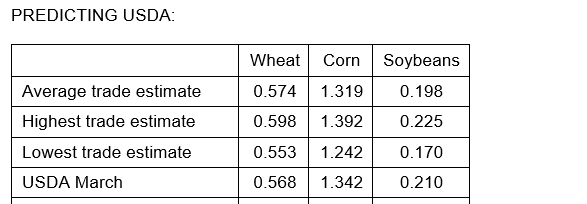

USDA’s report is due out tomorrow. What is interesting is the large range in US corn ending stocks (see above for trade average). Reuters has a 1.242-1.392 billion range.

Export

developments.

Updated

03/31/23

May

corn $6.00-$7.15

July

corn $5.75-$7.00

·

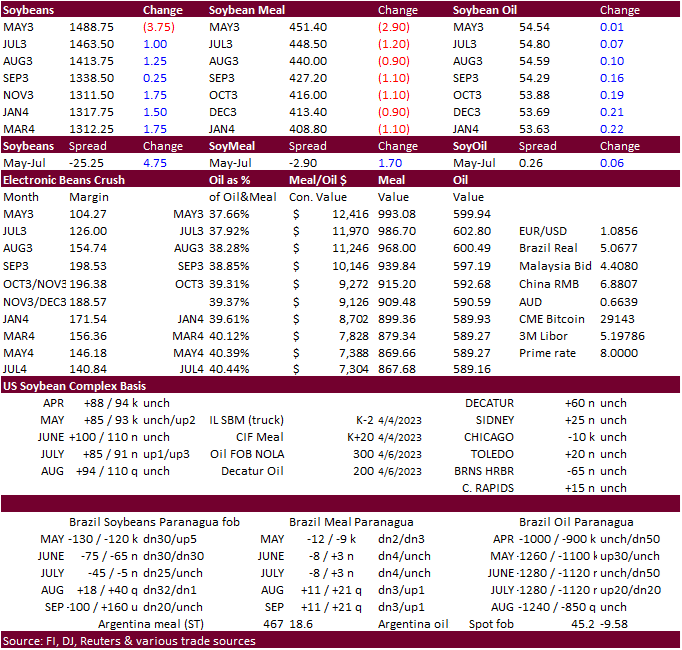

Soybeans ended mixed to lower, meal lower and SBO higher. Funds sold 3,000 soybeans, 2,000 meal and sold 1,000 soybean oil. Bear spreading against May was a feature.

·

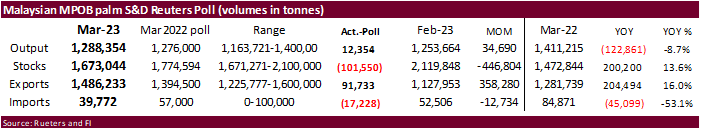

Palm oil futures appreciated overnight from slightly supportive end of March Malaysian palm oil stocks.

·

USDA US soybean export inspections as of April 06, 2023, were 669,566 tons, within a range of trade expectations, above 503,900 tons previous week and compares to 821,064 tons year ago. Major countries

included China for 289,097 tons, Germany for 150,073 tons, and Mexico for 74,510 tons.

·

Brazil harvested 82 percent of their soybean planted area as of last Thursday, up 6 points from the previous week and compares to 84 percent year ago.

·

Indonesia’s crude palm oil reference price will revise to $932.69 per ton for the April 16-30 period, up from $898.29 per ton in the first half of the month. The crude palm oil export tax will be set

at $100 per ton for the period and its levy at $124 per ton.

Export

Developments

-

None

reported

Updated

03/31/23

Soybeans

– May $14.25-$15.50, November $12.25-$15.00

Soybean

meal – May $410-$500, December $325-$500

Soybean

oil – May 52.00-58.00,

December 49-58

·

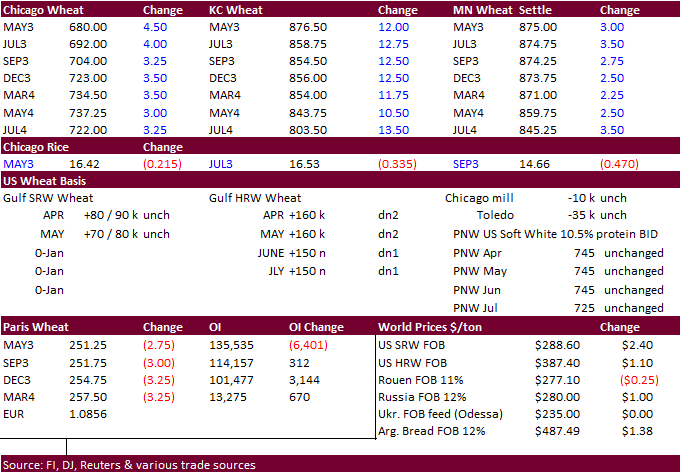

KC wheat led the US markets higher today on US weather concerns and Black Sea tensions. Parts of KS haven’t seen rain in many days. Funds bought 2,000 Chicago wheat contracts.

·

USDA US all-wheat export inspections as of April 06, 2023, were 335,444 tons, within a range of trade expectations, above 168,543 tons previous week and compares to 419,185 tons year ago. Major countries

included Japan for 102,408 tons, Thailand for 58,119 tons, and Mexico for 53,391 tons.

·

Rising Black Sea tensions were supporting US wheat futures earlier. The Ukraine export deal is set to expire in May and Turkey is looking to extend it. Meanwhile Russia would like to broker a deal that

includes fertilizer exports. Reuters: “More than 27 million tons of grain and other foodstuffs have been exported from Ukraine aboard 881 outbound vessels since the Black Sea Grain Initiative began in August, official data shows.” Russia over the weekend said

they may have to work outside the grain deal if the West maintains “obstacles.”

·

The market for Paris May wheat was closed today for holiday.

·

FAO food price index for the month of March fell for the 12th consecutive month to 126.9 points, from 129.7 for February and lowest since July 2021.

·

Ukraine over the long weekend suspended grain exports to Poland after pushback from protests by Poland producers over the influx of Ukraine grain exports. Ukraine will refrain from exporting wheat, corn,

rape seed and sunflower to Poland. Meanwhile, producers in Romania also staged protests, also citing economic damage from cheaper Ukraine grain imports. About 200 farmers protested outside the European Commission’s local headquarters, according to a Reuters

story.

·

Ukraine spring grain sowings reached 620,500 hectares over the weekend. AgMin: As of April 7, it included 126,700 hectares of spring wheat, 376,600 hectares of barley, 73,100 hectares of peas, 41,300

hectares of oats and 200 hectares of millet.

·

Russia is looking at raising their calculation price for the wheat export duty to 17,000 rubles ($212.23) per ton from 15,000 robles per ton. This could slow wheat export shipments for the upcoming crop

year.

·

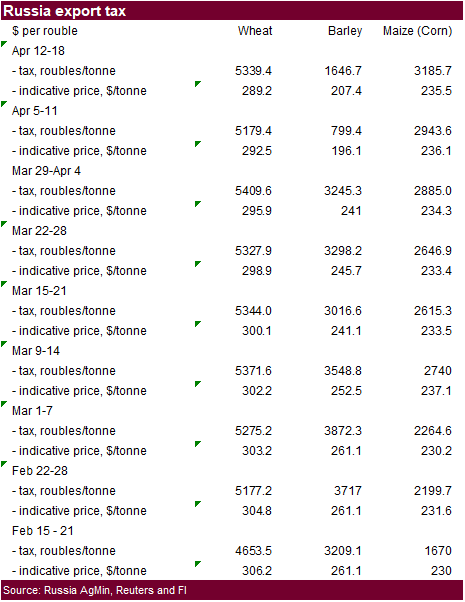

For the April 12-18 period, Russia will increase its wheat export duty by 3.1% to 5339.4 rubles per ton, using an indicative price of $289.20 per ton.

Export

Developments.

·

Japan’s AgMin seeks 60,000 tons of feed wheat and 20,000 tons of feed barley on April 12 for arrival in Japan by September 28.

Rice/Other

Updated

03/31/23

KC

– May $8.00-9.25

MN

– May

$8.50-$9.50

#non-promo