PDF Attached

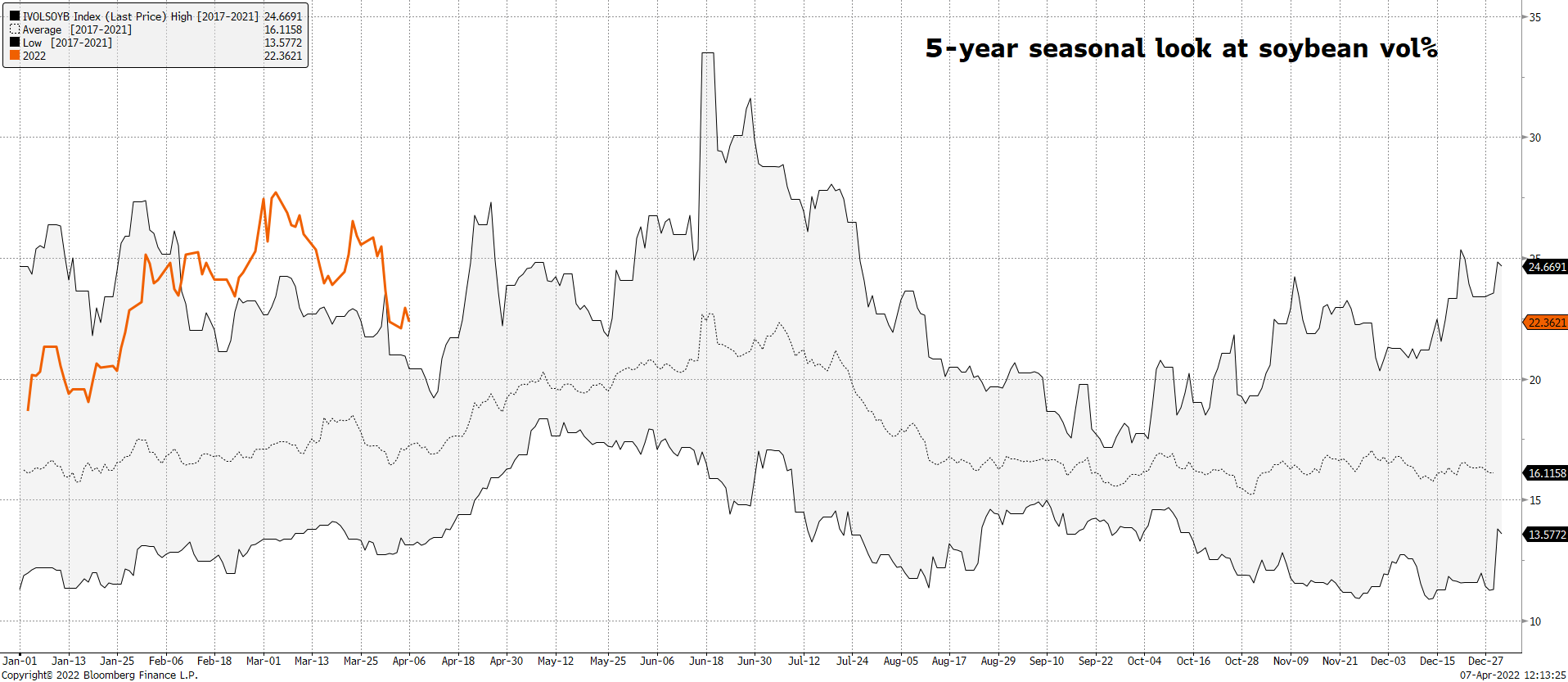

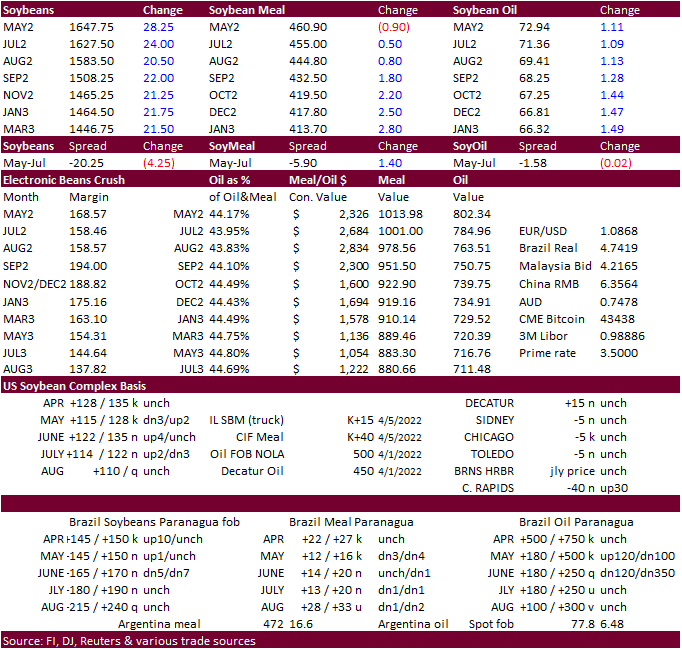

Bear

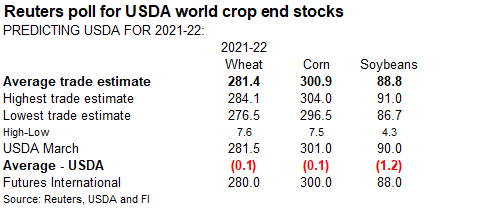

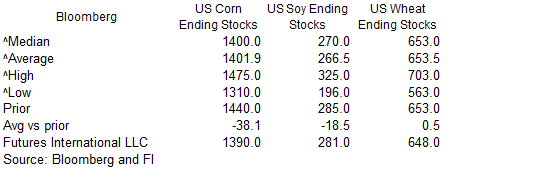

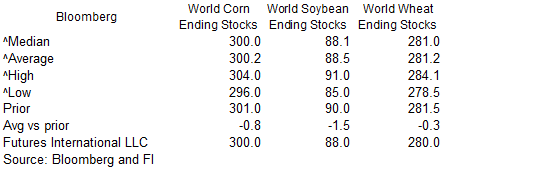

spreading was a feature for many of the CBOT agriculture markets. WTI crude oil was lower at around 1 pm CT and the USD higher. We saw a higher trade for soybeans from a lower than estimated Brazil production estimate. Meal was lower in part to long liquidation

ahead of a major index commodity fund roll. Soybean oil rebounded from a reversal in product spreading. Corn was higher following soybeans while wheat was lower after good rains soaked some key winter wheat areas earlier in the week.

![]()

https://www.conab.gov.br/info-agro/safras/graos/boletim-da-safra-de-graos

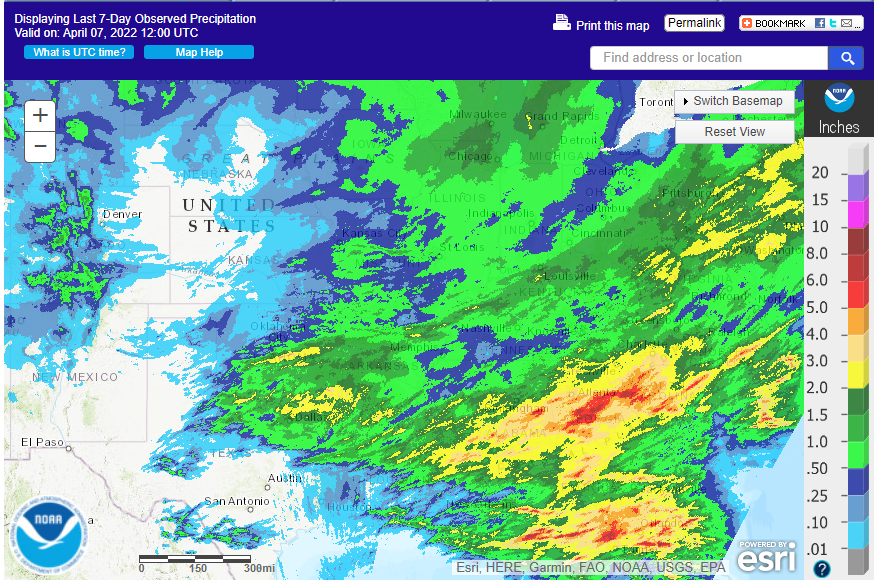

WEATHER

EVENTS AND FEATURES TO WATCH

- Concern

over U.S. spring planting progress will remain for the lower eastern Midwest, Delta and Tennessee River Basin due to bouts of rain and mild to cool temperatures - Some

welcome and significant warming is expected during the late weekend into early next week that will offer a small window for “some” planting - Rain

returns a little too quickly for good field progress - GFS

Ensemble forecast temperatures for the next two weeks suggests another bout or two of colder than usual conditions are likely in the central and interior eastern U.S. in the second week of the outlook - Returning

cooler air will slow down drying rates once again - Far

southeastern U.S. rainfall is expected to diminish greatly from where it has been recently - Florida,

southern Georgia, southeastern Alabama and South Carolina will see less frequent and less significant rainfall during the next two weeks - Fieldwork

will advance swiftly especially after recent rainfall - Western

and southern Texas will continue quite dry in the next seven days with West Texas high Plains likely to continue that way in the second week of the forecast - Some

rain showers may occur briefly in the Low and Rolling Plains of western Texas next week, but resulting rainfall should not be great enough for a lasting increase in soil moisture

- Southern

Texas (i.e. Coastal Bend and interior southern parts of the state) will have a chance for rain in the second half of next week and continuing into the following weekend - No

general soaking is likely, but there will be some increase in topsoil moisture to benefit dryland cotton, corn and sorghum - Western

portions of U.S. hard red winter wheat production areas will continue with little to no rainfall over the next two weeks - The

longer range outlook keeps this region in a direr than usual mode for a while longer - U.S.

northwestern Plains may get some beneficial rain and/or snow during mid-week next week.

- The

moisture could greatly improve topsoil moisture for better spring planting conditions - A

second storm system “may” evolve during the following weekend favoring southeastern Montana into South Dakota and southern North Dakota - If

both storm systems occur as advertised spring planting conditions for oats and other early season crops should improve - Southwestern

Canada’s Prairies will see some sporadic rain and snowfall over the next ten days maintaining worry over drought status and spring planting prospects - World

Weather, Inc. is expecting a general improving trend for the region from late spring through summer. - U.S.

Pacific Northwest will experience some increasing precipitation in the next two weeks and that could translate into better spring planting and dryland planting potentials - California’s

Sierra Nevada will get some snow and rain Monday into Tuesday of next week and gain April 15-16. - The

precipitation should prove to be helpful for spring runoff, but mountain snowpack and snow water equivalency will remain well below average - Brazil

weather will continue too wet in the interior far south into early next week, but rainfall after that should be more limited and sufficient warming should occur to induce better crop and field working conditions - Mato

Grosso and Mato Grosso do Sul will experience net drying into early next week

- Timely

rainfall during mid- to late-week next week should increase topsoil moisture for a short bout of time - Net

drying will resume in the second weekend of the two week outlook - Brazil’s

monsoon moisture will be withdrawing from the central and southern crop areas of the nation next week

- The

occurrence is considered to be normal - Safrinha

and late season summer crops will rely on subsoil moisture for continued summer crop development - The

outlook for Safrinha crops remains very good through mid-April and probably in late month as well, despite seasonal drying over time - Argentina

will experience a good mix of weather during the next two weeks. - Late

season crops will continue to have favorable soil moisture to support crops throughout the next two weeks - Europe

is expected to turn briefly drier and a little warmer next week which may help reverse the recent trend of wet and cool biased conditions - The

change should help get soil temperatures to rise again after this week’s recent bouts of frost and freezes

- Fieldwork

and early season crop development may be a little behind normal after this recent bout of cool and wet weather - A

new bout of cooler than usual temperatures and rainfall may evolve after mid-month - Russia

weather is likely to remain quite active with frequent bouts of rain and snow in the west and north while the Southern Region is a little drier biased for a while - Melting

snow and frequent bouts of new rain and snow have many northwestern crop areas in the nation very wet - Flood

potentials are high and drier weather is needed to avoid a more serious bout of flooding - Russia’s

southern region will get some welcome precipitation during mid-week next week - Rain

will fall frequently and abundantly near and north of the Amazon River into Colombia, Venezuela and Ecuador during the next ten days - Rain

will also fall frequently in Peru - Some

flooding could impact a part of the Amazon River System and Colombia in time - Temperatures

in South America will be near to above normal over the coming week and then cooler in central and southern Argentina and southern Brazil next week - Two

tropical cyclones are predicted in the Eastern Hemisphere late this week and one will bring the risk of flooding and high wind speeds to the Philippines - Two

storms will develop late this week - One

in the South China Sea - One

in the southwestern Pacific Ocean east of the Philippines - A

third disturbance is expected in the Bay of Bengal during the weekend, but it seems to have lost its support for development - The

South China Sea and Pacific Ocean storms will reach maturity at about the same time late in this coming weekend and early next week - The

largest storm will be over open water in the Pacific Ocean and should not threaten land - There

may actually be two storms in the Pacific Ocean, but both events are expected to move away from the Philippines and Asia without having influence on land - The

storm in the South China sea may impact the central or northern Philippines during the middle to later part of next week resulting in some flooding rain, but confidence on when and where landfall occurs is not high - The

disturbance in the Bay of Bengal is not advertised to threaten land, but it should be closely monitored - Quebec

and Ontario, Canada weather will be active over the next ten days producing frequent rain and keeping temperatures mild to cool - Northwestern

Africa and southwestern parts of Europe have turned drier, but more rain is expected during the middle to latter part of next week - The

moisture will be greatest in northern Morocco, northeastern Algeria and northern Tunisia.

- India’s

harvest weather will be very good over the next couple of weeks - Precipitation

will be limited to sporadic showers in the far south and more generalized rain in the far Eastern States

- Southeastern

China will be dry biased through the weekend - The

break from rainy weather has already been great and the continued trend will further improve rapeseed development and early season corn and rice planting conditions throughout the south - Improvements

to many crops and field working conditions are likely - Temperatures

will trend warmer, as well - Alternating

periods of rain and sunshine are expected next week through April 20. - Northern

wheat areas of China will experience some warmer weather this week that may stimulate some greater crop development potential - Rain

is expected early next week briefly to help stimulate greater winter crop development - Mexico’s

winter dryness and drought have been expanding due to poor precipitation resulting from persistent La Nina - The

region will continue lacking precipitation for an expected period of time - Eastern

and southern Mexico will be seasonably dry this week and will only receive sporadic rainfall of limited significance this weekend and next week - Southeast

Asia rainfall will continue frequent and abundant - No

area in the mainland areas, Philippines, Indonesia or Malaysia are expected to be too dry - Too

much rain may impact east-central Philippines and a part of the northern Malay Peninsula this week - Some

heavy rain was already noted Tuesday in the central Malay Peninsula - East-central

Africa rainfall will continue greatest in Tanzania, although parts of Uganda and Kenya will get rain periodically as well.

- Ethiopia

rainfall should be most sporadic and light until next week when some increase is expected - West-central

Africa rainfall will continue periodically and sufficient to support coffee and cocoa development - Rainfall

so far this month has been a little sporadic, but no area has been seriously dry biased - Pockets

in Ivory Coast and western Ghana have received less than usual rain, but crop development has advanced well

- Rain

frequency and intensity should increase in many areas this weekend through all of next week - Western

Australia is trending drier this week after abundant rain last week - Winter

crop planting is still a few weeks away and some rain will be needed again before planting begins - Eastern

Australia precipitation is expected to be slowly increase today into Friday with New South Wales wetter than Queensland through the weekend

- Irrigated

late season sorghum and other crops will continue to develop favorably - Some

of the dryland crop that is still immature still needs greater moisture - Rain

should not seriously harm fiber quality in open boll cotton, although any rain is not welcome at this time of year - Drier

weather is expected next week and it should prevail for a week - South

Africa rainfall over the next couple of weeks will be periodic and sufficient enough to support late season crop development while the impact on mature crops should be to slow harvest progress and raise a little crop quality concern for cotton - Today’s

Southern Oscillation Index is +11.60 - The

index will continue moving higher for the next few days - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- FAO

World Food Price Index - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Macros

85

Counterparties Take $1.734 Tln At Fed Reverse Repo Op (prev $1.731 Tln, 86 Bids)

US

Initial Jobless Claims Apr 2: 166K (est 200K; prev 202K)

US

Continuing Claims Mar 26: 1523K (est 1302K; prev 1307K)

·

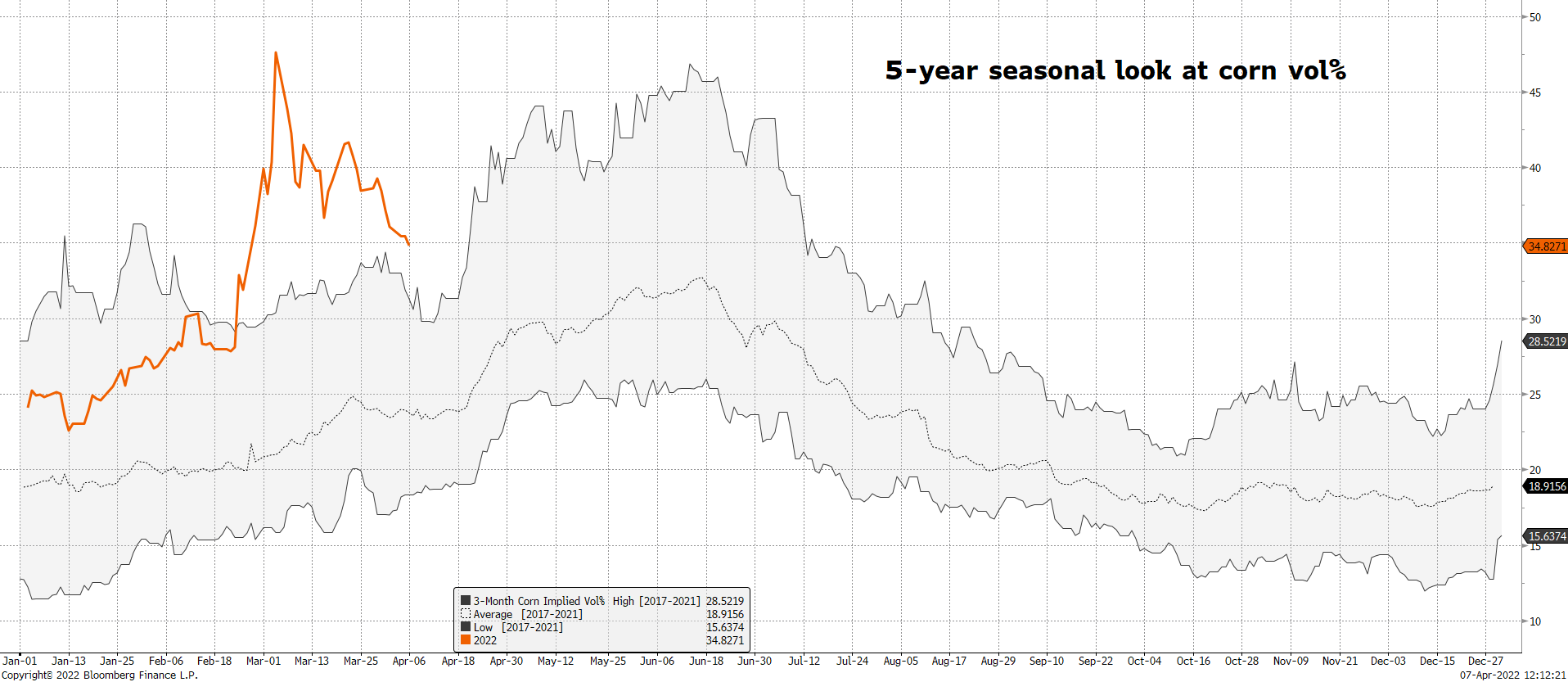

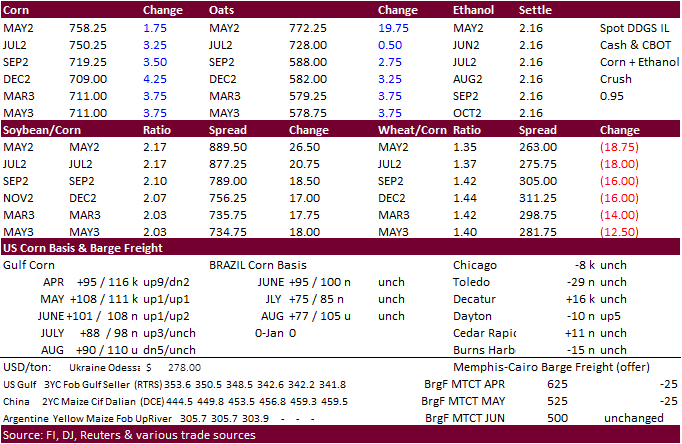

US corn futures started lower on favorable US planting progress and welcome precipitation across the eastern Corn Belt but turned higher after soybeans made another leg higher.

·

May corn settled 1.25 cents higher and December was up 4.25 cents.

·

Slowing US corn sales and lower wheat likely limited gains.

·

US CIF corn was 2-8 cents softer today for the nearby positions.

·

Fundamentals have little changed.

·

The November soybean / December corn ratio is still near its contract low, currently around 2.06. Some traders earlier this week noted some corn acres were bought back.

·

On Monday we look for USDA to report US corn plantings at 4 percent complete, up from 2 percent as of last Sunday.

·

The US EPA announced decisions on refineries that were seeking exemptions to biofuel blending mandates. 36 petitions were denied for the 2018 compliance year. The EPA will provide 31 of those refineries with another avenue to

seek relief, without purchasing credits to show compliance with the law. Before this announcement, about 69 requests were pending. The refineries will still need to file compliance reports even though they won’t be forced to also submit biofuel credits, according

to a Bloomberg story.

·

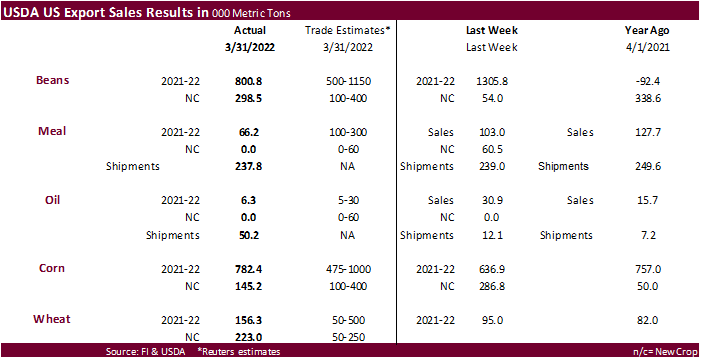

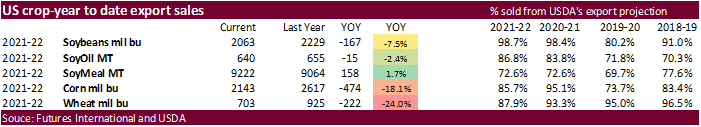

USDA corn export sales were ok, with 782,400 tons reported for 2021-22.

Export

developments.

·

None reported

Updated

4/5/22

May

corn is seen in a $7.10 and $8.10 range

December

corn is seen in a wide $5.50-$8.00 range

·

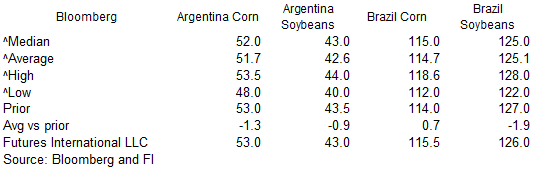

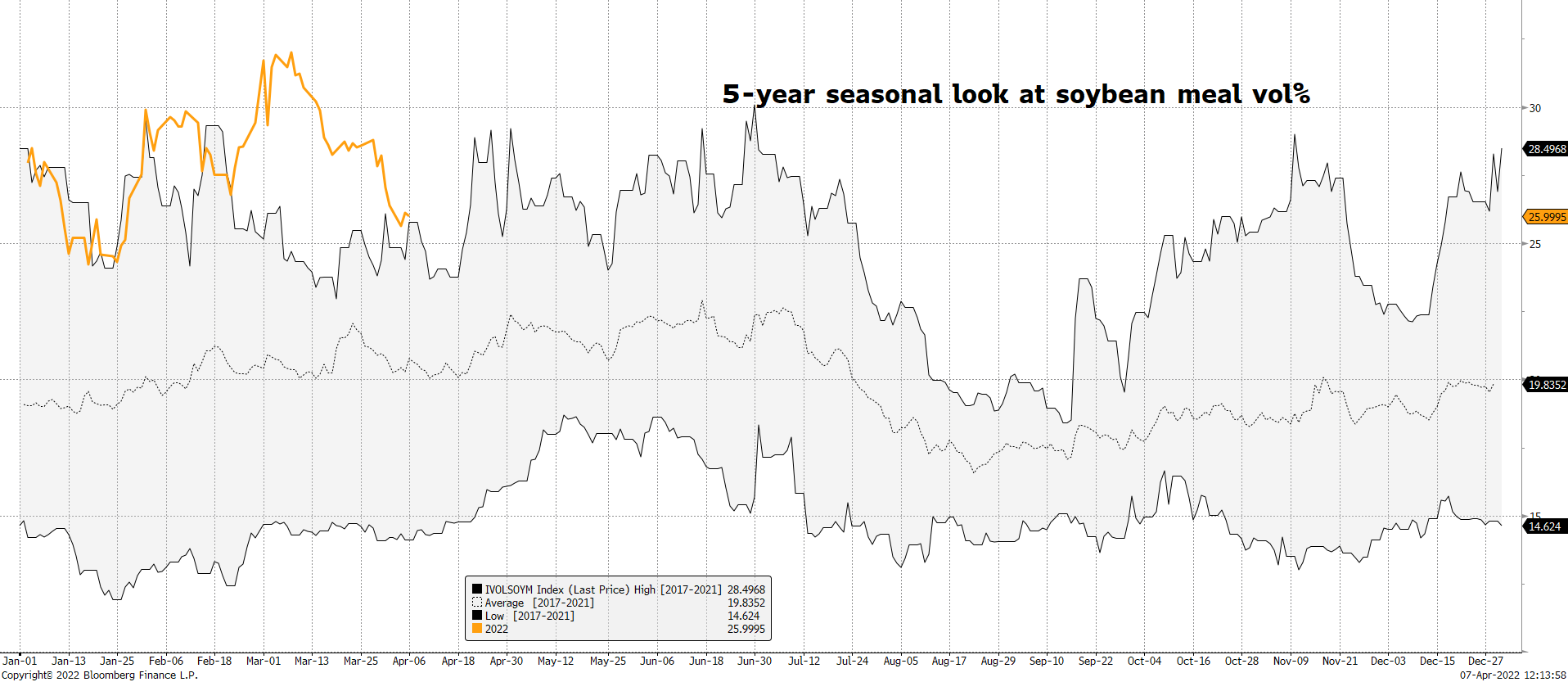

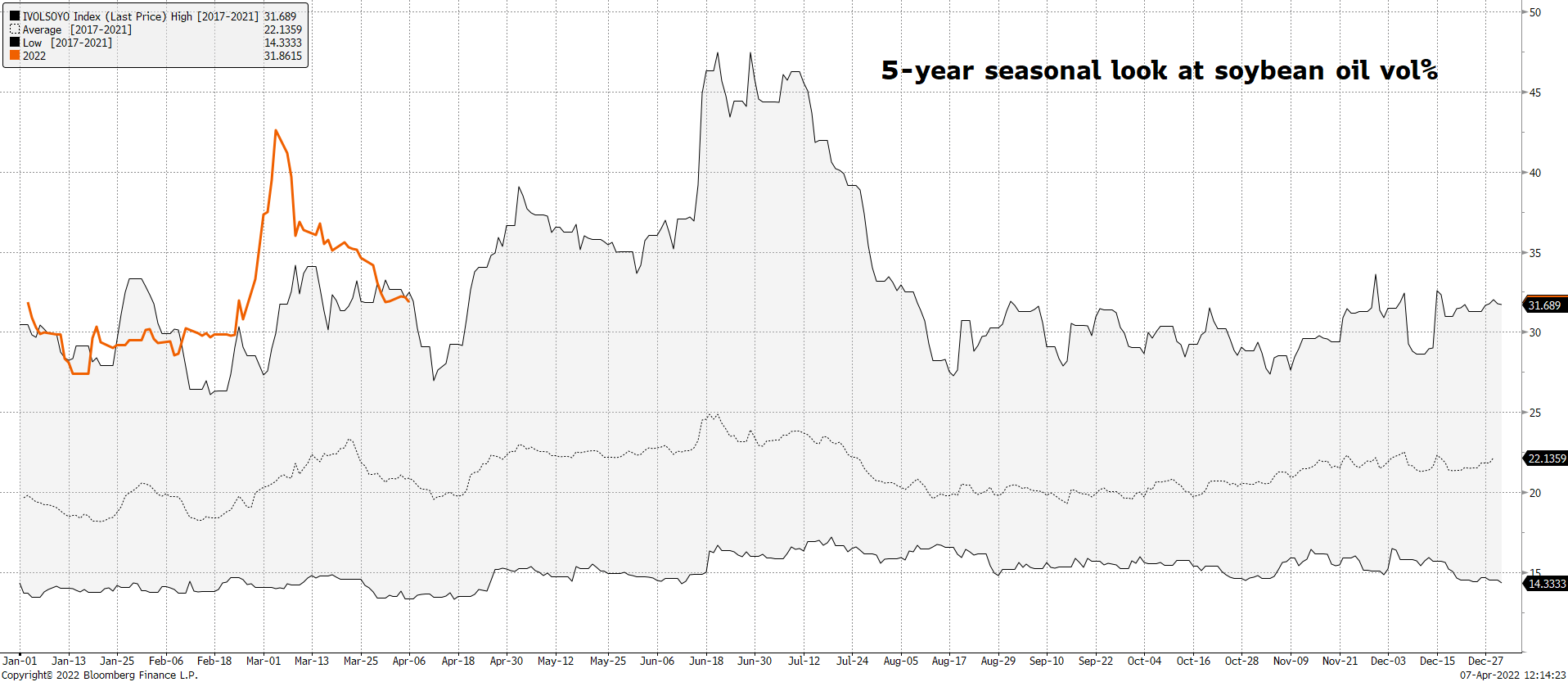

CBOT soybeans were higher from a lower than estimated Brazil soybean production estimate and expectations US export demand for soybeans and products to remain robust over the next several months. We saw a good amount of selling

in soybean meal, in part to long liquidation ahead of index contract rolls. Funds are net long an estimated net 121,800 for soybean meal after today. Soybean oil was higher from a reversal in product spreading. The weakness in spot meal eroded May CBOT crush

margins.

·

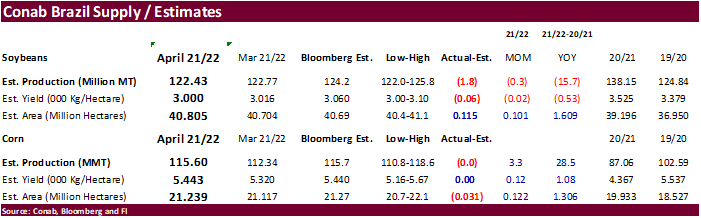

Conab reported Brazil soybean production at 122.4 million tons, 1.8 million below an average trade estimate. The number was expected to increase, but ended up 300,000 tons below the previous month, catching traders off guard.

Year ago, production was around 138 million tons.

·

Argentina’s BA Grains Exchange warned soybean production could fall below their current estimate of 42 million tons due to recent early frost events.

·

US soybean meal basis was mostly flat across the US. CIF slightly eased.

·

Consultancy Datagro noted Brazil soybean sales by producers reached 68.8 million tons out of the 125.1 million production projection, or 55 percent, as of April 1. That percentage would be down from 71.5% year ago. New crop sales

(2022-23) for the upcoming crop (planted this fall) were 6.9%, below 8.4% year ago. That tells us some producers are still making up their mind for new crop plantings.

·

China was to auction off 500,000 tons of imported soybeans today.

- Later

today USDA seeks 2,710 tons of packaged oil for May shipment (May 23-June 13 for plants at posts).

Due

out April 11

Updated

4/5/22

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $430-$500

Soybean

oil – May 69.00-73.50

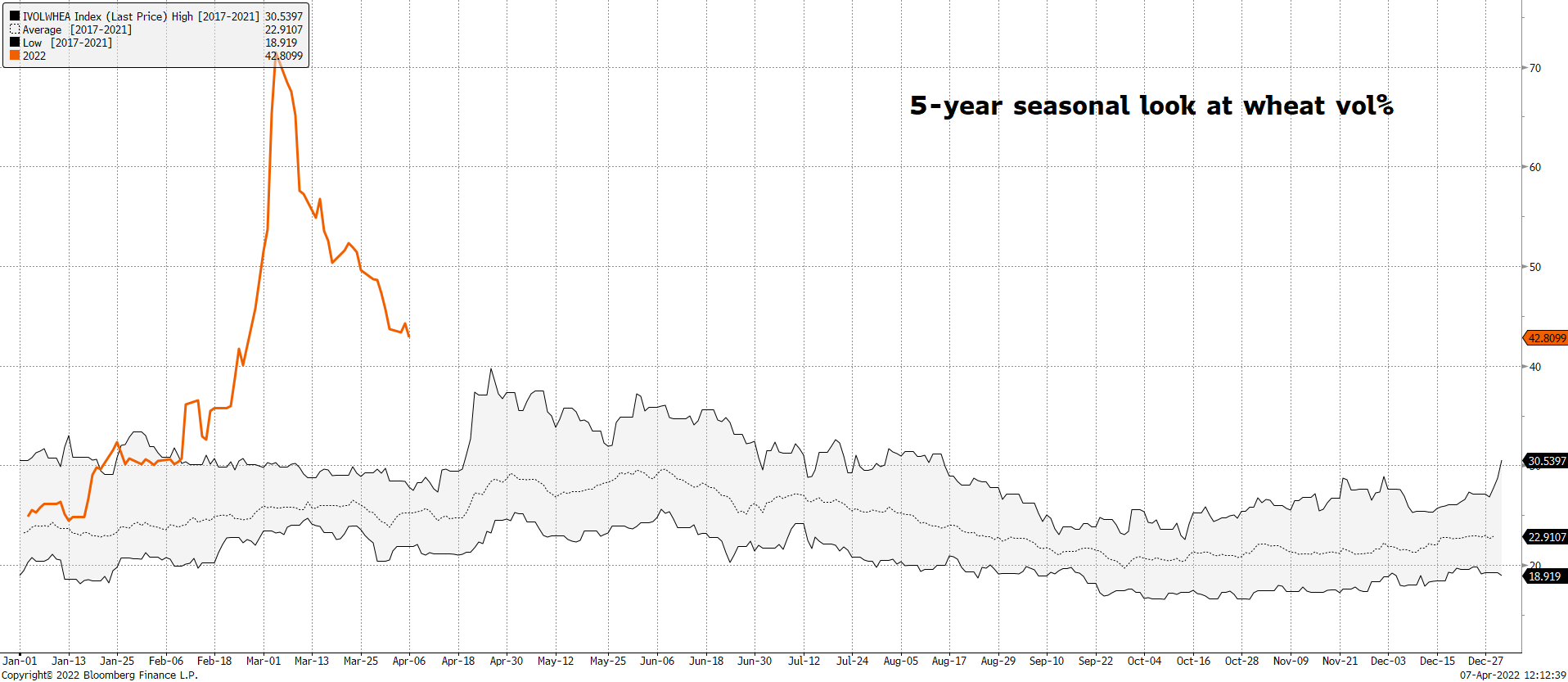

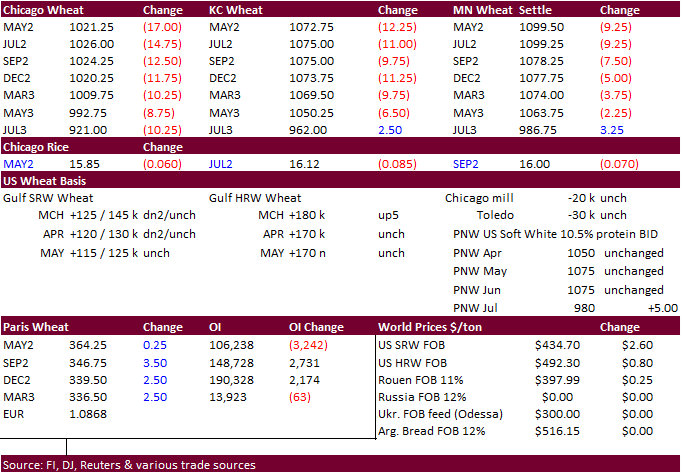

Wheat

·

US wheat futures were lower after rain fell across parts of Texas and some other key winter wheat states earlier this week. The outlook for the US winter wheat area still calls for net drying for the southern Great Plains. But

next week when USDA updates their crop ratings, we look for a one point improvement in the combined good and excellent condition to 31 percent, bias an increase in Midwestern states and Texas.

·

May Paris wheat futures were up 0.25 euro at 363.75 euros.

·

StoneX estimates Brazil will produce a record wheat crop, above 10 million tons, as the planted area was expected to expand nearly 21 percent. We think the drastic switch relates to higher global wheat prices, record fertilizer

inputs, and less dependency on Argentina wheat imports.

Last

7-days

·

The Philippines bought an estimated 50,000 tons of feed wheat for Aug. shipment at about $365 to $370/ton c&f.

·

Jordan seeks 120,000 tons of milling wheat for LH May and/or through July shipment on April 13.

·

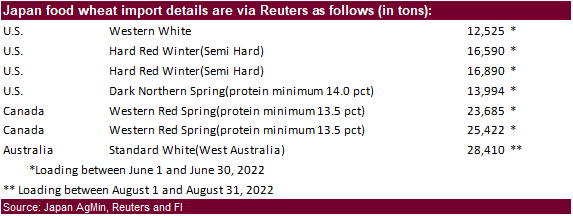

Japan bought 137,516 tons of food wheat this week for June through August loading. Original tender details as follows:

·

Jordan seeks 120,000 tons of feed barley on April 12.

·

Bangladesh seeks 50,000 tons of wheat on April 11 for shipment within 40 days after contract signing.

Rice/Other

·

(Bloomberg) —

•

U.S. 2021-22 cotton ending stocks seen at 3.54m bales, slightly above USDA’s previous est.,

according

to the avg in a Bloomberg survey of nine analysts.

•

Estimates range from 3.2m to 4m bales

•

Global ending stocks seen at 82.64m bales vs 82.57m bales in March

Updated

4/5/22

Chicago

May $9.25 to $12.00 range, December $8.50-$11.00

KC

May $9.25 to $12.00 range, December $8.75-$11.50

MN

May $10.00‐$12.00, December $9.00-$11.75

U.S. EXPORT SALES FOR WEEK ENDING 3/31/2022

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

72.5 |

1,451.3 |

1,271.8 |

43.5 |

6,096.0 |

7,276.1 |

13.6 |

404.0 |

|

SRW |

14.7 |

459.0 |

301.3 |

71.8 |

2,314.3 |

1,493.6 |

37.5 |

457.0 |

|

HRS |

57.4 |

934.7 |

1,408.1 |

143.0 |

4,357.4 |

6,140.9 |

118.4 |

491.1 |

|

WHITE |

11.2 |

475.9 |

1,804.2 |

47.7 |

2,864.1 |

4,817.8 |

38.5 |

261.1 |

|

DURUM |

0.4 |

15.5 |

80.1 |

3.9 |

173.9 |

592.1 |

15.0 |

64.4 |

|

TOTAL |

156.3 |

3,336.4 |

4,865.5 |

309.8 |

15,805.7 |

20,320.5 |

223.0 |

1,677.6 |

|

BARLEY |

0.0 |

5.7 |

5.5 |

0.0 |

14.7 |

23.7 |

0.4 |

8.6 |

|

CORN |

782.4 |

20,623.3 |

30,512.1 |

1,633.0 |

33,813.3 |

35,971.0 |

145.2 |

2,570.8 |

|

SORGHUM |

-10.5 |

2,672.0 |

2,396.7 |

236.8 |

4,077.6 |

3,990.3 |

0.0 |

0.0 |

|

SOYBEANS |

800.7 |

11,765.0 |

5,587.3 |

832.8 |

44,377.7 |

55,084.9 |

298.5 |

8,463.3 |

|

SOY MEAL |

66.2 |

2,915.5 |

2,354.9 |

237.8 |

6,306.1 |

6,709.2 |

0.0 |

337.4 |

|

SOY OIL |

6.2 |

142.1 |

115.9 |

50.2 |

497.5 |

539.0 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

-9.1 |

159.3 |

317.2 |

58.9 |

1,000.9 |

1,106.3 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

3.3 |

5.3 |

0.0 |

10.9 |

23.5 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

16.4 |

17.8 |

0.2 |

33.7 |

34.4 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

43.9 |

69.0 |

0.1 |

42.5 |

85.1 |

0.0 |

0.0 |

|

L G MLD |

16.4 |

69.2 |

49.8 |

19.0 |

592.7 |

457.0 |

0.0 |

0.0 |

|

M S MLD |

0.8 |

237.9 |

258.7 |

2.2 |

263.1 |

382.0 |

0.0 |

0.0 |

|

TOTAL |

8.3 |

530.0 |

718.0 |

80.3 |

1,943.7 |

2,088.4 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

62.9 |

7,181.2 |

5,003.7 |

455.5 |

7,078.9 |

9,843.3 |

64.4 |

2,528.5 |

|

PIMA |

6.6 |

150.5 |

233.4 |

12.2 |

294.8 |

513.4 |

7.4 |

30.5 |

This

summary is based on reports from exporters for the period March 25-31, 2022.

Wheat: Net

sales of 156,300 metric tons (MT) for 2021/2022 were up 65 percent from the previous week, but down 11 percent from the prior 4-week average. Increases primarily for Indonesia (55,000 MT), Taiwan (41,700 MT), Italy (20,000 MT), Mexico (18,000 MT, including

decreases of 200 MT), and Thailand (15,100 MT, including 13,000 MT switched from the Philippines and decreases of 400 MT), were offset by reductions primarily for Guatemala (15,000 MT) and the Philippines (9,700 MT). Net sales of 223,000 MT for 2022/2023

were primarily for unknown destinations (75,000 MT), the Philippines (59,500 MT), Mexico (41,000 MT), South Korea (30,000 MT), and the Dominican Republic (10,000 MT). Exports of 309,800 MT were down 11 percent from the previous week and 8 percent from the

prior 4-week average. The destinations were primarily to the Philippines (88,300 MT), Mexico (80,900 MT), Taiwan (36,600 MT), Nigeria (29,100 MT), and Thailand (26,600 MT).

Corn:

Net sales of 782,400 MT for 2021/2022 were up 23 percent from the previous week, but down 44 percent from the prior 4-week average. Increases primarily for Mexico (261,000 MT, including 32,000 MT switched from unknown destinations and decreases of 47,300

MT), Japan (216,000 MT, including 143,100 MT switched from unknown destinations and decreases of 4,100 MT), South Korea (192,100 MT, including 133,000 MT switched from unknown destinations and decreases of 6,100 MT), Saudi Arabia (157,000 MT, including 147,000

MT switched from unknown destinations), and Spain (64,100 MT, including 65,000 MT switched from unknown destinations and decreases of 1,800 MT), were offset by reductions primarily for unknown destinations (199,800 MT). Net sales of 145,200 MT for 2022/2023

were reported for unknown destinations (136,000 MT) and Canada (9,200 MT). Exports of 1,633,000 MT were down 13 percent from the previous week, but up 2 percent from the prior 4-week average. The destinations were primarily to China (458,700 MT), Mexico

(328,100 MT), Japan (180,000 MT), Saudi Arabia (157,000 MT), and South Korea (122,900 MT).

Optional

Origin Sales:

For 2021/2022, new optional origin sales of 67,500 MT were reported for unknown destinations (65,000 MT) and Italy (2,500 MT). Options were exercised to export 65,000 MT to South Korea from other than the United States. The current

outstanding balance of 533,300 MT is for unknown destinations (365,000 MT), South Korea (65,000 MT), Morocco (60,000 MT), Italy (34,300 MT), and Saudi Arabia (9,000 MT). For 2022/2023, new optional origin sales of 2,500 MT were reported for Italy. The current

outstanding balance of 6,400 MT is for Italy.

Barley:

Total net sales of 400 MT for 2021/2022 were down noticeably from the previous week and from the prior 4-week average. The destination was Japan. No exports were reported for the week.

Sorghum:

Total net sales reductions of 10,500 MT for 2021/2022 were down 35 percent from the previous week and down noticeably from the prior 4-week average. The reductions include decreases of 13,100 MT for China. Exports of 236,800 MT were down 30 percent from

the previous week and 11 percent from the prior 4-week average. The destinations were to China (236,300 MT) and Mexico (500 MT).

Rice:

Net sales of 8,300 MT for 2021/2022–a marketing-year low–were down 51 percent from the previous week and 81 percent from the prior 4-week average. Increases primarily for Mexico (13,700 MT), Haiti (7,300 MT), Jordan (4,000 MT), the Dominican Republic (2,000

MT), and Honduras (1,500 MT), were offset by reductions primarily for Colombia (22,000 MT). Exports of 80,300 MT were up noticeably from the previous week and up 98 percent from the prior 4-week average. The destinations were primarily to Mexico (32,700

MT), Colombia (22,300 MT), Haiti (15,300 MT), El Salvador (4,100 MT), and Canada (2,000 MT).

Soybeans:

Net sales of 800,700 MT for 2021/2022 were down 39 percent from the previous week and 38 percent from the prior 4-week average. Increases primarily for China (435,700 MT, including 66,000 MT switched from unknown destinations, decreases of 2,300 MT, and 67,000

MT – late), Egypt (154,000 MT, including 50,000 MT switched from unknown destinations and decreases of 7,100 MT), Canada (73,000 MT), unknown destinations (31,600 MT), and Mexico (29,600 MT, including decreases of 1,700 MT), were offset by reductions for Indonesia

(7,500 MT). Net sales of 298,500 MT for 2022/2023 were reported for Mexico (208,000 MT), unknown destinations (65,000 MT), and Japan (25,500 MT). Exports of 832,800 MT were up 24 percent from the previous week and 20 percent from the prior 4-week average.

The destinations were primarily to China (458,800 MT, including 67,000 MT – late), Egypt (156,000 MT), Mexico (74,300 MT), Japan (36,700 MT), and Indonesia (36,200 MT).

Export

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 3,000 MT, all Canada.

Late

Reporting:

For 2021/2022, net sales and exports totaling 67,000 MT of soybeans were reported late. The destination was China.

Soybean

Cake and Meal:

Net sales of 66,200 MT for 2021/2022 were down 36 percent from the previous week and 68 percent from the prior 4-week average. Increases primarily for Colombia (26,200 MT, including 21,000 MT switched from unknown destinations and decreases of 1,900 MT),

Mexico (16,500 MT), the Dominican Republic (9,500 MT), Japan (7,900 MT), and Jamaica (6,500 MT), were offset by reductions primarily for unknown destinations (21,000 MT) and Guatemala (6,000 MT). Exports of 237,800 MT were unchanged from the previous week,

but up 8 percent from the prior 4-week average. The destinations were primarily to the Philippines (101,200 MT), Colombia (31,200 MT), Mexico (28,200 MT), Guatemala (15,100 MT), and the Dominican Republic (13,900 MT).

Soybean

Oil:

Net sales of 6,200 MT for 2021/2022 were down 80 percent from the previous week and 63 percent from the prior 4-week average. Increases primarily for South Korea (24,000 MT, including 20,000 MT switched from unknown destinations) and Hong Kong (2,000 MT),

were offset by reductions primarily for unknown destinations (20,000 MT). Exports of 50,200 MT–a marketing-year high–were up noticeably from the previous week and from the prior 4-week average. The destinations were primarily to India (31,100 MT), South

Korea (13,000 MT), El Salvador (2,900 MT), Guatemala (2,600 MT), and Canada (400 MT).

Cotton:

Net sales of 62,900 RB for 2021/2022–a marketing-year low–were down 73 percent from the previous week and 80 percent from the prior 4-week average. Increases primarily for Vietnam (42,100 RB, including 1,600 RB switched from China, 900 RB switched from

South Korea, 200 RB switched from Japan, and decreases of 2,500 RB), Turkey (23,700 RB), Colombia (5,600 RB), Japan (5,200 RB, including 400 RB switched from Indonesia and decreases of 300 RB), and India (2,800 RB, including decreases of 8,800 RB), were offset

by reductions primarily for China (23,900 RB) and Pakistan (3,600 RB). Net sales of 64,400 RB for 2022/2023 were primarily for Turkey (26,400 RB), Guatemala (11,400 RB), Mexico (10,400 RB), Vietnam (10,200 RB), and Thailand (2,700 RB). Exports of 455,500

RB–a marketing-year high–were up 38 percent from the previous week and 28 percent from the prior 4-week average. The destinations were primarily to China (171,300 RB), Turkey (75,400 RB), Pakistan (69,600 RB), Vietnam (38,800 RB), and Mexico (20,600 RB).

Net sales of Pima totaling 6,600 RB were down 11 percent from the previous week, but up 13 percent from the prior 4-week average. Increases were primarily for China (4,400 RB), India (1,800 RB), and Indonesia (400 RB). Total net sales of 7,400 RB for 2022/2023

were for India. Exports of 12,200 RB were up 1 percent from the previous week and from the prior 4-week average. The destinations were primarily to India (6,000 RB), Peru (1,800 RB), China (1,300 RB), Thailand (900 RB), and Greece (600 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 57,200 RB is for Vietnam (52,800 RB) and Pakistan (4,400 RB).

Exports

for Own Account: For

2021/2022, the current exports for own account outstanding balance is 100 RB, all Vietnam.

Hides

and Skins:

Net sales of 452,900 pieces for 2022 were up 36 percent from the previous week and 17 percent from the prior 4-week average. Increases primarily for China (219,000 whole cattle hides, including decreases of 17,300 pieces), Thailand (74,900 whole cattle hides,

including decreases of 1,000 pieces), Brazil (47,400 whole cattle hides, including decreases of 400 pieces), Mexico (36,100 whole cattle hides, including decreases of 800 pieces), and South Korea (28,800 whole cattle hides, including decreases of 1,000 pieces),

were offset by reductions for Indonesia (300 pieces). Total net sales of 2,100 calf skins were for Italy. In addition, net sales of 10,800 kip skins were reported for Italy (8,000 kip skins) and Belgium (2,800 kip skins). Exports of 470,300 pieces were down

6 percent from the previous week, but up 1 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (284,000 pieces), South Korea (57,600 pieces), Thailand (46,900 pieces), Mexico (25,900 pieces), and Taiwan (21,500 pieces).

Net

sales of 85,700 wet blues for 2022 were up 8 percent from the previous week, but down 40 percent from the prior 4-week average. Increases reported for Italy (40,400 unsplit and 11,000 grain splits, including decreases of 100 unsplit and 400 grain splits),

Taiwan (13,600 unsplit), the Dominican Republic (12,600 unsplit and 200 grain splits, including decreases of 100 unsplit), and Vietnam (10,400 unsplit, including decreases of 100 unsplit),

were offset by reductions for Brazil (1,100 unsplit), Japan (900 unsplit), and China (500 unsplit). Exports of 203,900 wet blues were up 13 percent from the previous week and 26 percent from the prior 4-week average. The destinations were primarily to Vietnam

(71,300 unsplit), Italy (48,500 unsplit and 18,700 grain splits), China (29,900 unsplit), Hong Kong (17,900 unsplit), and Taiwan (9,300 unsplit). Net sales of 887,500 splits were down 28 percent from the previous week, but up 2 percent from the prior 4-week

average. The destinations were reported for Vietnam (842,800 pounds, including decreases of 100 pounds), China (41,000 pounds), Spain (3,000 pounds), and South Korea (700 pounds). Exports of 732,500 pounds were up 36 percent from the previous week and 61

percent from the prior 4-week average. The destinations were primarily to Vietnam (566,700 pounds) and Spain (85,000 pounds).

Beef:

Net sales of 14,000 MT for 2022 were down 39 percent from the previous week and 43 percent from the prior 4-week average. Increases were primarily for Japan (6,500 MT, including decreases of 400 MT), South Korea (3,900 MT, including decreases of 800 MT),

Mexico (800 MT), Taiwan (700 MT, including decreases of 100 MT), and Hong Kong (500 MT). Exports of 19,300 MT were down 5 percent from the previous week and 18 percent from the prior 4-week average. The destinations were primarily to Japan (5,400 MT), South

Korea (5,400 MT), China (3,400 MT), Taiwan (1,500 MT), and Mexico (900 MT).

Pork:

Net sales of 41,200 MT for 2022 were up 49 percent from the previous week and 44 percent from the prior 4-week average. Increases primarily for Mexico (13,200 MT, including decreases of 300 MT), China (13,000 MT, including decreases of 400 MT), Japan (5,100

MT, including decreases of 600 MT), Colombia (2,300 MT), and South Korea (2,300 MT, including decreases of 1,000 MT), were offset by reductions for Chile (100 MT). Exports of 29,000 MT were down 5 percent from the previous week, but up 2 percent from the

prior 4-week average. The destinations were primarily to Mexico (13,500 MT), Japan (3,800 MT), China (3,600 MT), South Korea (2,300 MT), and Canada (1,400 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.