PDF Attached

Private

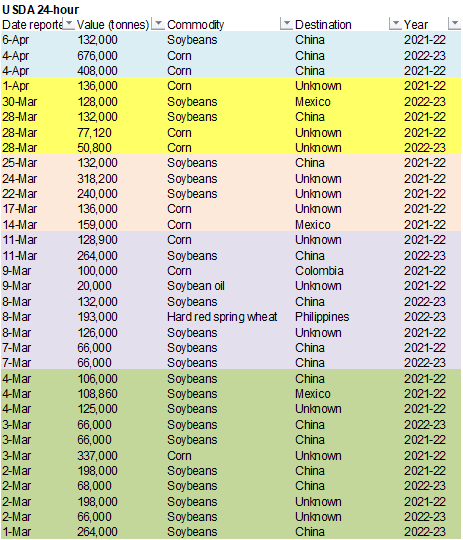

exporters reported sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

There

is not much to report. The trade was looking at light profit taking early but some grain markets rebounded from fluctuations in outside related markets and US weather concerns. News was very light despite China coming back from holiday. Rains have settled

in across the dry areas of eastern and northern Texas.

![]()

Weather

WEATHER

EVENTS AND FEATURES TO WATCH

- Europe

weather is expected to turn drier and a little warmer next week which may help reverse the recent trend of wet and cool biased conditions - The

change should help get soil temperatures to rise again after this week’s recent bouts of frost and freezes

- Fieldwork

and early season crop development may be a little behind normal after this recent bout of cool and wet weather - Russia

weather is likely to improve during the second week of the two week forecast as well - Melting

snow and frequent bouts of new rain and snow have many northwestern crop areas in the nation very wet - Flood

potentials are high and next week’s decrease in precipitation will help reduce some of the severity of flooding.

- Southern

Brazil, southern Paraguay and a few northeastern Argentina crop areas will receive waves of rain during the next week to eight days maintaining wet field conditions - Runoff

will continue to raise the Parana River water levels reducing barge restrictions - The

moisture will delay some fieldwork; including some harvesting - The

greatest rain will fall north of Rio Grande do Sul’s rice harvest area which may spare that crop from quality issues - Some

crop conditions in the wettest areas may deteriorate - Restricted

rain in Mato Grosso do Sul and southern Mato Grosso will continue for another week allowing the topsoil to firm, but Safrinha crops will remain rated favorably and will feast upon favorable subsoil moisture - A

frontal system may bring some relief after April 14, but that is a long way out in the forecast and the situation will be closely monitored - A

cold surge expected in Argentina at that time should be sufficient in pushing a mid-latitude frontal system far enough to the north to bring back some rain to the drying region - Make

sure to note that today’s soil is saturated in this region and subsoil moisture will still be good a week from now while the topsoil firms - As

long as rain falls in the second or third weeks of the outlook there is not much reason to be concerned about the current drying trend - Northeast

Brazil will continue dry biased for the next ten days resulting in more crop stress in Bahia, northern Minas Gerais

This

may include a few coffee areas of northern Cerrado Mineiro, but Zona de Mata may get some welcome moisture late this week and into the weekend

- Rain

will fall frequently and abundantly near and north of the Amazon River into Colombia, Venezuela and Ecuador during the next ten days - Rain

will also fall frequently in Peru - Some

flooding could impact a part of the Amazon River System in time - Much

of Argentina will get rain at one time or another during the next ten days, although there will be some pockets that are not impacted significantly - Warm

temperatures this week will accelerate drying rates, but much cooler conditions are likely next week and that will conserve moisture through slower evaporation and some rain will accompany the cool down - Temperatures

in South America will be near to above normal over the coming week and then cooler in central and southern Argentina and southern Brazil next week - U.S.

hard red winter wheat production areas will continue drying out in the west during the next couple of weeks while some periodic rain is expected in the east - West

Texas and South Texas will continue dry over the coming week - A

few showers could evolve briefly in the Low or Rolling Plains during early to mid-week next week, but no drought busting rain is expected anytime soon - South

Texas and especially the Texas Coastal Bend may get some needed rain in the second half of next week and into the following weekend

- Texas

Blacklands, U.S. Delta and Tennessee River Basin areas will see frequent rainfall in the next couple of weeks resulting in slower than usual fieldwork - U.S.

southeastern states will see a good mix of rain and sunshine over the next week and then could turn drier and warmer in the April 14-20 period - Poor

drying conditions are expected in the U.S. Midwest, Delta and Tennessee River Basin over the coming week to ten days - Field

working delays are likely - Snow

and blowing snow in the upper U.S. Midwest, eastern Dakotas and Manitoba today and Thursday will slow travel, induce more runoff and maintain a favorable outlook for planting moisture later this month and in early May - Western

Saskatchewan and extreme eastern Alberta received up to 0.40 inch of moisture during the day Tuesday - The

moisture will help improve early season fieldwork; including some early planting of peas and possibly lentils and other early season crops. Much greater precipitation is needed, and Alberta remains quite dry in the central and south - Infrequent

bouts of erratic rain and some snow will impact U.S. northwestern Plains and southwestern Canada’s Prairies during the next two weeks - Drought

busting precipitation is unlikely - California

will continue pressed for rain, but not much is expected through the weekend - Some

rain may evolve briefly next week - U.S.

Pacific Northwest needs greater rain in the key crop valleys of Washington, Oregon and Idaho - Three

tropical cyclones are predicted in the Eastern Hemisphere late this week and two of them will bring the risk of flooding and high wind speeds to Myanmar and the Philippines - Two

storms will develop late this week - One

in the South China Sea - One

in the southwestern Pacific Ocean east of the Philippines - A

third storm is possible in the Bay of Bengal during the weekend, but it seems to be smaller in size and less likely to evolve as previously advertised - The

South China Sea and Pacific Ocean storms will reach maturity at about the same time late in this coming weekend and early next week - The

largest storm will be over open water in the Pacific Ocean and should not threaten land - The

storm in the South China sea may impact Luzon Island, Philippines during the middle part of next week resulting in torrential rain and flooding, but landfall is too far out in time to have much confidence in the timing and location of landfall

- The

storm in the Bay of Bengal may bring rain to the India coast, but is more likely to turn to the east northeast in time to spare India, but possibly impact Myanmar - This

landfall is late next week and too far out in time to have much confidence - Quebec

and Ontario, Canada weather will be active over the next ten days producing frequent rain and keeping temperatures mild to cool - Northwestern

Africa and southwestern parts of Europe will turn drier for a few days, but more rain is expected during the middle to latter part of next week - The

moisture will be greatest in northern Morocco, but most areas will get at least some rain periodically - Greater

rain may soon be needed in Tunisia and northeastern Algeria - India’s

harvest weather will be very good over the next couple of weeks - Precipitation

will be limited to sporadic showers in the far south and more generalized rain in the far Eastern States

- Southeastern

China will be dry biased through the weekend - The

break from rainy weather has already been great and the continued trend will further improve rapeseed development and early season corn and rice planting conditions throughout the south - Improvements

to many crops and field working conditions are likely - Temperatures

will trend warmer, as well - Northern

wheat areas of China will experience some warmer weather this week that may stimulate some greater crop development potential - Rain

is expected early next week briefly to help stimulate greater winter crop development - Mexico’s

winter dryness and drought have been expanding due to poor precipitation resulting from persistent La Nina - The

region will continue lacking precipitation for an expected period of time - Eastern

and southern Mexico will be seasonably dry this week and will only receive sporadic rainfall of limited significance this weekend and next week - Southeast

Asia rainfall will continue frequent and abundant - No

area in the mainland areas, Philippines, Indonesia or Malaysia are expected to be too dry - Too

much rain may impact east-central Philippines and a part of the northern Malay Peninsula this week - Some

heavy rain was already noted Tuesday in the central Malay Peninsula - East-central

Africa rainfall will continue greatest in Tanzania, although parts of Uganda and Kenya will get rain periodically as well.

- Ethiopia

rainfall should be most sporadic and light until next week when some increase is expected - West-central

Africa rainfall will continue periodically and sufficient to support coffee and cocoa development - Rainfall

so far this month has been a little sporadic, but no area has been seriously dry biased - Pockets

in Ivory Coast and western Ghana have received less than usual rain, but crop development has advanced well

- Rain

frequency and intensity should increase in many areas this weekend through all of next week - Western

Australia is trending drier this week after abundant rain last week - Winter

crop planting is still a few weeks away and some rain will be needed again before planting begins - Eastern

Australia precipitation is expected to be slowly increase Wednesday into Friday with New South Wales wetter than Queensland - Irrigated

late season sorghum and other crops will continue to develop favorably - Some

of the dryland crop that is still immature still needs greater moisture - Rain

expected briefly later in this next week should not seriously harm fiber quality in open boll cotton, although any rain is not welcome at this time of year - South

Africa rainfall over the next couple of weeks will be periodic and sufficient enough to support late season crop development while the impact on mature crops should be low outside of some brief harvest delays - There

is a little concern over early maturing cotton fiber quality - Today’s

Southern Oscillation Index is +11.38 - The

index will continue moving higher for the next few days - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

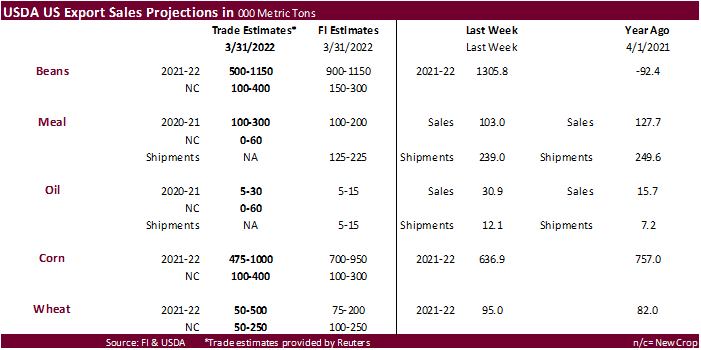

- EIA

weekly U.S. ethanol inventories, production, 10:30am - New

Zealand Commodity Price - HOLIDAY:

Thailand

Thursday,

April 7:

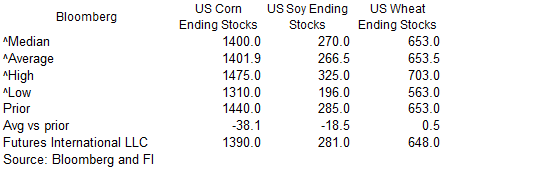

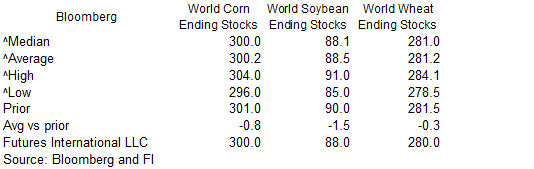

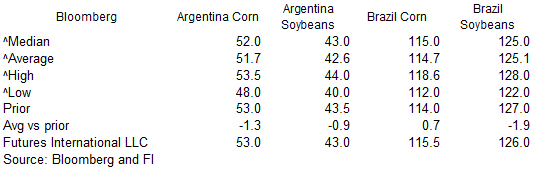

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Vietnam’s

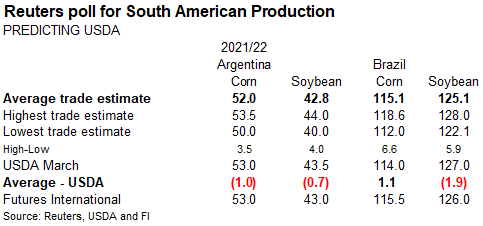

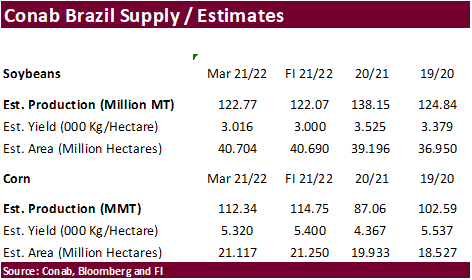

customs department releases coffee, rice and rubber export data for March - Brazil’s

Conab releases data on area, yield and output of corn and soybeans

Friday,

April 8:

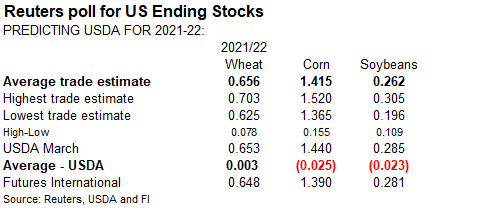

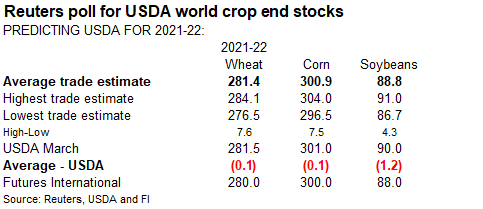

- FAO

World Food Price Index - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Macros

86

Counterparties Take $1.731 Tln at Fed Reverse Repo Op (prev $1.711 Tln, 86 Bids)

·

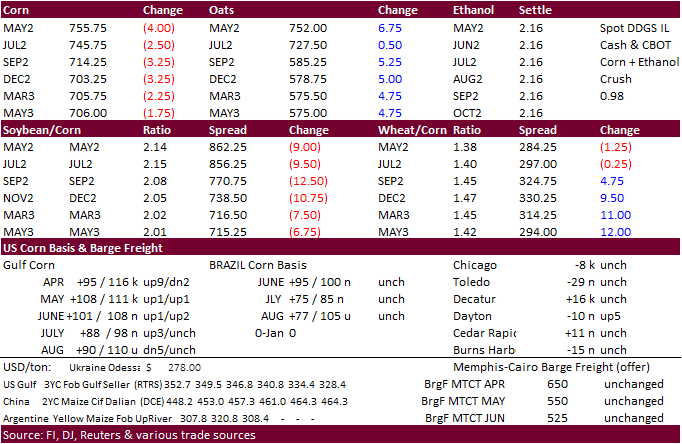

US corn futures traded two-sided in a light trade, settling lower bias old crop on the defensive. News was very light, and it seems today energy markets were driving grain trading today.

·

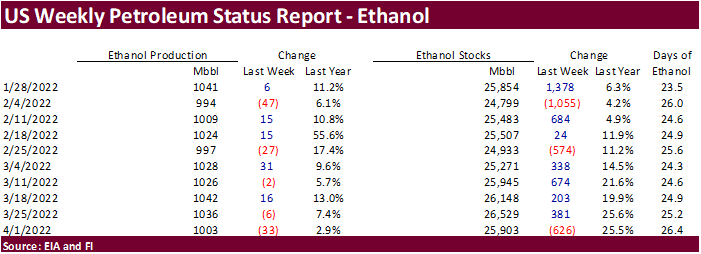

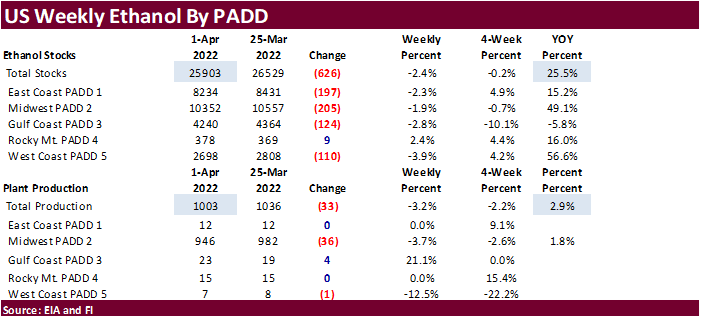

Weekly US ethanol production was off a more than expected 33,000 barrels (traders looked for down 11k) to 1.003 million from the previous week and stocks down a large 626,000 barrels to 25.903 million (traders were looking for

an increase of 96k). US ethanol production rebounded about 10 percent from this time year ago and is about 1.3 percent above this time two years ago, when pandemic started to impact demand. US gasoline stocks are down 2 million barrels from the previous week

at 236.8 million barrels and demand for gasoline is down 2.5% from year ago. Ethanol blended into finished motor gasoline was a large 93.1 percent, up from 91.2% previous week.

Export

developments.

·

None reported

Updated

4/5/22

May

corn is seen in a $7.10 and $8.10 range

December

corn is seen in a wide $5.50-$8.00 range

·

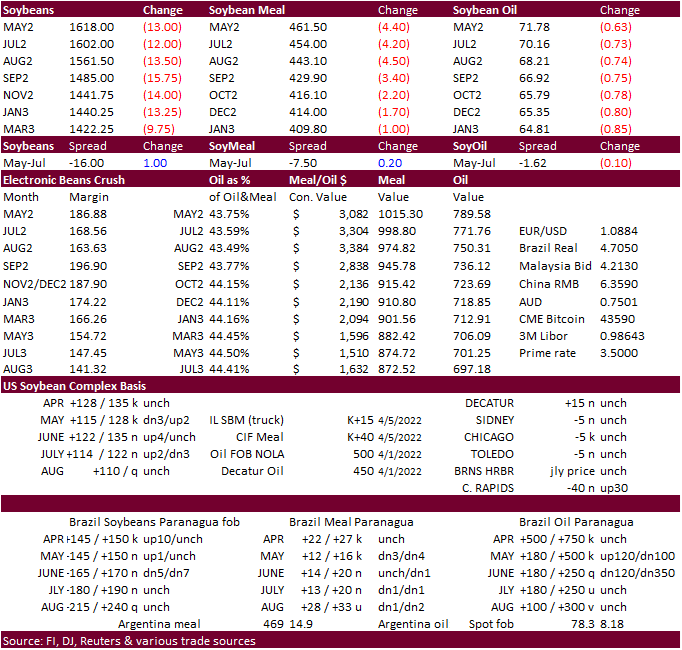

The CBOT soybean complex traded higher earlier but sank following a selloff in WTI crude oil.

·

News was very light.

·

We are watching the soybean 50 day MA average that was tested again on Wednesday, with settlement basis May above it.

·

China after holiday. May soybeans fell 0.4 percent, meal was off 1.4 percent, palm up 1.7 percent and palm up 2.1 percent.

·

Private exporters reported sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

·

China will auction another 500,000 tons of imported soybeans from its reserves on April 7.

- USDA

seeks 2,710 tons of packaged oil on April 7 for May shipment (May 23-June 13 for plants at posts).

Due

out April 11

Updated

4/5/22

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $430-$500

Soybean

oil – May 69.00-73.50

Wheat

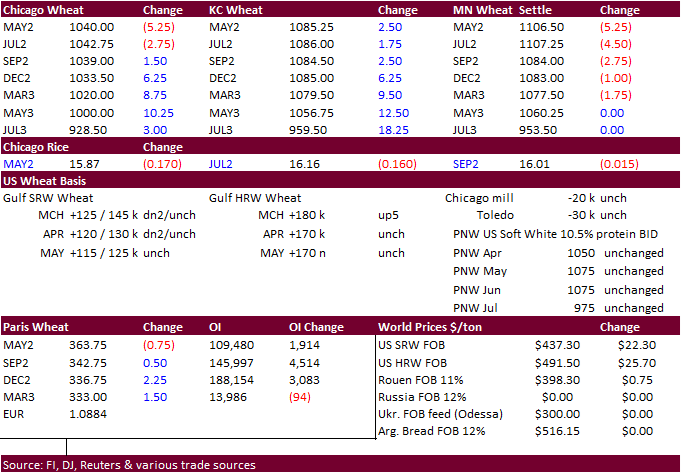

·

US wheat was mixed on some profit taking with funds focused on Chicago wheat. Higher protein wheat basis KC was higher, but MN wheat traded lower to our dismay. Weather concerns supported KC type wheat and fund selling in nearby

Chicago was noted.

·

Kazakhstan plans to impose restrictions on grain and flour exports starting June 15. 1 million tons was noted for wheat and 300,000 tons for flour.

·

May Paris wheat futures were down 0.75 euros at 364 euros. New crop was higher.

·

Reuters: Consultant UkrAgroConsult projected Ukraine’s 2022/2023 wheat production at 19.80 million tons, versus 32.08 million tons last year, due to the ongoing war.

·

Jordan passed on 120,000 tons of milling wheat for LH May and/or through July shipment.

·

Jordan seeks 120,000 tons of feed barley on April 12.

·

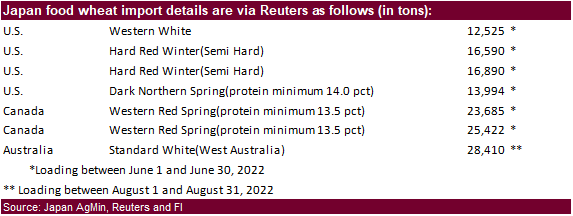

Japan seeks 137,516 tons of food wheat this week for June through August loading.

·

India signed a second agreement with the UN to donate another 100,000 tons of wheat to Afghanistan.

·

The Philippines are in for 50,000 tons of feed wheat on April 6 for July-December shipment.

·

Iraq seeks wheat this week.

·

Bangladesh seeks 50,000 tons of wheat on April 11 for shipment within 40 days after contract signing.

Rice/Other

·

None reported

·

(Bloomberg) —

•

U.S. 2021-22 cotton ending stocks seen at 3.54m bales, slightly above USDA’s previous est.,

according

to the avg in a Bloomberg survey of nine analysts.

•

Estimates range from 3.2m to 4m bales

•

Global ending stocks seen at 82.64m bales vs 82.57m bales in March

Updated

4/5/22

Chicago

May $9.25 to $12.00 range, December $8.50-$11.00

KC

May $9.25 to $12.00 range, December $8.75-$11.50

MN

May $10.00‐$12.00, December $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.