Higher

trade in CBOT agriculture futures led by wheat after USDA reported a much lower than expected combined good/excellent winter wheat condition. Black Sea concerns continue to underpin the market. Meal gained on soybean oil.

WEATHER

EVENTS AND FEATURES TO WATCH

- Next

week’s weather in the central and eastern U.S. should get interesting as a large ridge of high pressure heats up the eastern half of the nation and broad region of low pressure comes into the western states bringing a notable pool of cool air - The two

air masses will clash with an outbreak of severe thunderstorms probable around mid-week next week

- Some

very heavy rain and flooding may accompany the event in the Midwest - Warming

that occurs ahead of the rain event may provide a few days of better drying in the Midwest and “some” fieldwork might be possible ahead of the new rain event - U.S.

Midwest, Delta and Tennessee River Basin areas are too wet today and will likely stay that way into the early weekend, despite only light bouts of rain during the weekend - Brief

periods of rain and drizzle are expected during the balance of this week, but especially from Wednesday into Saturday - No

excessive rain is likely, but the ground is already too wet and drying rates will be poor for a while - Cool

temperatures will limit drying and fieldwork will likely be on hold while the cool and drizzly weather impacts the region Wednesday into Saturday - There

is still some risk of frost and light freezes in the md-south and southeastern states this weekend, but no strong surface high pressure center is expected and that should spare the region from crop damaging conditions - A

mini-blizzard may occur briefly form Manitoba into Minnesota Wednesday into Thursday of this week as a region of heavy snow evolves around a deep low pressure center over the upper Midwest - Travel

will be hampered in some areas and a little stress to livestock is probable, - Snow

and rain will fall in western Saskatchewan and along Alberta, Canada border today and early Wednesday.

- Moisture

totals of 0.05 to 0.60 inch will be possible offering the region its first significant precipitation event in a very long time - Drought

has dominated the area and more precipitation will be needed, but the moisture will be celebrated across the region - Alberta’s

drought region will not see much relief outside of the Saskatchewan border region - Western

U.S. hard red winter wheat areas will be drier than usual over the next two weeks leaving unirrigated crops in declining condition - West

and South Texas precipitation will be minimal during the next full week - A

line of thunderstorms might impact a part of West Texas during mid-week, but most likely the precipitation will stay east of key cotton production areas - California

precipitation is possible Sunday into Monday of next week, but amounts and coverage in the mountains will not be enough to seriously change drought conditions or spring runoff potentials - Warming

will impact the eastern United States next week after late week and weekend cooling occurs in the central and eastern states - Next

week’s temperatures will be notably colder than usual in the north-central U.S. and Canada’s Prairies while temperatures become warmer than usual in the northeastern and east-central parts of the nation - Southern

Brazil, southern Paraguay and a few northeastern Argentina crop areas will receive waves of rain during the next week to eight or nine days maintaining wet field conditions - Runoff

will continue to raise the Parana River water levels reducing barge restrictions - The

moisture will delay some fieldwork; including some harvesting - The

greatest rain will fall north of Rio Grande do Sul’s rice harvest area, although there will be some periodic harvest delay there as well - Some

crop conditions may deteriorate - Restricted

rain in Mato Grosso do Sul and southern Mato Grosso will continue for another week to eight or nine days allowing the topsoil to firm, but Safrinha crops will remain rated favorably and will feast upon favorable subsoil moisture - A

frontal system may bring some relief after April 14, but that is a long way out in the forecast and the situation will be closely monitored - A

cold surge expected in Argentina at that time should be sufficient in pushing a mid-latitude frontal system far enough to the north to bring back some relief to the drying region - Make

sure to note that today’s soil is saturated in this region and subsoil moisture will still be good ten days from now while the topsoil firms - Northeast

Brazil will continue dry biased for the next ten days resulting in more crop stress in Bahia, northern Minas Gerais

This

may include a few coffee areas of northern Cerrado Mineiro, but Zona de Mata may get some welcome moisture late this week and into the weekend

- Rain

will fall frequently and abundantly near and north of the Amazon River into Colombia, Venezuela and Ecuador during the next ten days - Rain

will also fall frequently in Peru - Some

flooding could impact a part of the Amazon River System in time - Much

of Argentina will get rain at one time or another during the next ten days, although there will be some pockets that are not impacted significantly - Warm

temperatures this week will accelerate drying rates, but much cooler conditions are likely next week and that will conserve moisture through slower evaporation and some rain will accompany the cool down - Temperatures

in South America will be near to above normal over the coming week and then cooler in central and southern Argentina and southern Brazil next week - Three

tropical cyclones are predicted in the Eastern Hemisphere late this week and two of them will bring the risk of flooding and high wind speeds to Myanmar and the Philippines - The

three storms will develop late this week - One

in the southern Bay of Bengal - One

in the South China Sea - One

in the southwestern Pacific Ocean east of the Philippines - The

three storms will reach maturity at about the same time late in this coming weekend and early next week - The

largest storm will be over open water in the Pacific Ocean and should not threaten land - The

storm in the South China sea may impact Luzon Island, Philippines during the early and middle part of next week resulting in torrential rain and flooding, but landfall is too far out in time leaving the potential for changes in the storm’s predicted path - The

storm in the Bay of Bengal may bring rain to the India coast, but is more likely to turn to the east northeast in time to spare India, but possibly impact Myanmar - This

landfall is late next week and too far out in time to have much confidence - Waves

of rain and snow will impact Europe and the western Commonwealth of Independent States over the next ten days to two weeks - Soil

moisture will be bolstered in many areas and snow covered areas in Russia may run an eventual risk of flooding when snowmelt occurs while frequent bouts of precipitation are continuing. Spring fieldwork could be delayed. - Temperatures

will be near to below average which may limit drying rates between precipitation events and raising the risk of flooding - Warming

and drier weather will eventually be needed in Europe and Russia to melt snow, firm the soil, raise soil temperatures and support planting and early season winter crop development. Flooding will delay fieldwork at times in parts of Russia.

- Quebec

and Ontario, Canada weather will be active over the next ten days producing frequent rain and keeping temperatures mild to cool - Northwestern

Africa and southwestern parts of Europe will get rain today into Wednesday and again early to mid-week next week

- The

moisture will be greatest in northern Morocco, but most areas will get at least some rain periodically - Greater

rain may soon be needed in Tunisia and northeastern Algeria - India’s

harvest weather will be very good over the next couple of weeks - Precipitation

will be limited to sporadic showers in the far south and more generalized rain in the far Eastern States

- Southeastern

China will be dry biased for much of the coming week - The

break from rainy weather will be ideal for rapeseed development and early season corn and rice planting throughout the south - Improvements

to many crops and field working conditions are likely - Temperatures

will trend warmer, as well - Northern

wheat areas of China will experience some warmer weather this week that may stimulate some greater crop development potential - Rain

is expected early next week briefly to help stimulate greater winter crop development - Mexico’s

dryness and drought have been expanding this winter due to poor precipitation resulting from persistent La Nina - The

region will continue lacking precipitation for an expected period of time - Eastern

and southern Mexico will be seasonably dry this week and will only receive sporadic rainfall of limited significance this weekend and next week - Southeast

Asia rainfall will continue frequent and abundant - No

area in the mainland areas, Philippines, Indonesia or Malaysia are expected to be too dry - Too

much rain may impact east-central Philippines and a part of the northern Malay Peninsula this week - East-central

Africa rainfall will continue greatest in Tanzania, although parts of Uganda and Kenya will get rain periodically as well.

- Ethiopia

rainfall should be most sporadic and light until next week when some increase is expected - West-central

Africa rainfall will continue periodically and sufficient to support coffee and cocoa development - Rainfall

so far this month has been a little sporadic, but no area has been seriously dry biased - Pockets

in Ivory Coast and western Ghana have received less than usual rain, but crop development has advanced well

- Rain

frequency and intensity should increase in many areas this weekend through all of next week - Western

Australia will trend drier this week after abundant rain last week - Winter

crop planting is still a few weeks away and some rain will be needed again before planting begins - Eastern

Australia precipitation is expected to be limited today and then increase Wednesday into Friday

- Irrigated

late season sorghum and other crops will continue to develop favorably - Some

of the dryland crop that is still immature still needs greater moisture - Rain

expected briefly later this next week should not seriously harm fiber quality in open boll cotton, although any rain is not welcome at this time of year - South

Africa rainfall over the next couple of weeks will be periodic and sufficient enough to support late season crop development while the impact on mature crops should be low outside of some brief harvest delays - Today’s

Southern Oscillation Index is +10.88 - The

index will move erratically over the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

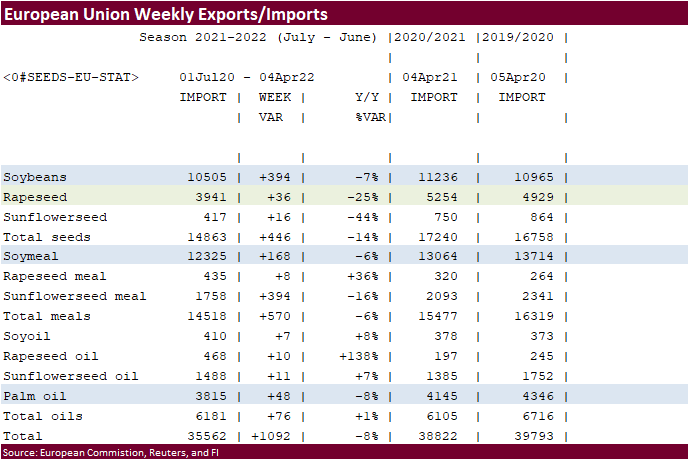

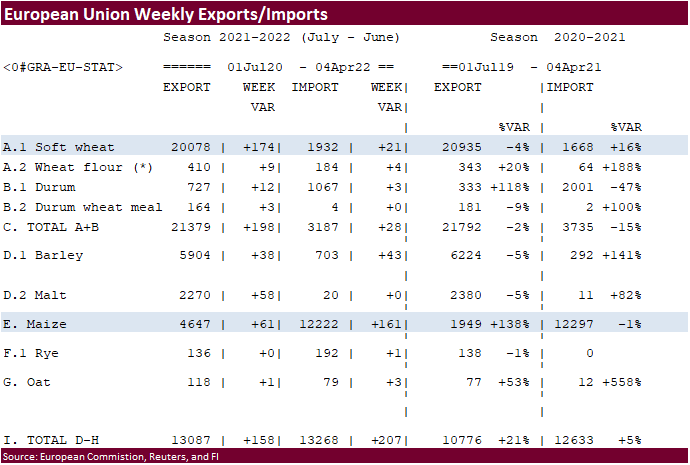

- EU

weekly grain, oilseed import and export data - Malaysia’s

April 1-5 palm oil export data - Purdue

Agriculture Sentiment, 9:30am - New

Zealand global dairy trade auction - HOLIDAY:

China, Hong Kong

Wednesday,

April 6:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - New

Zealand Commodity Price - HOLIDAY:

Thailand

Thursday,

April 7:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Vietnam’s

customs department releases coffee, rice and rubber export data for March - Brazil’s

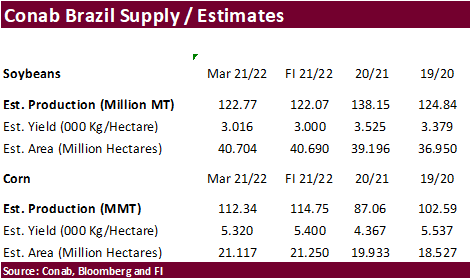

Conab releases data on area, yield and output of corn and soybeans

Friday,

April 8:

- FAO

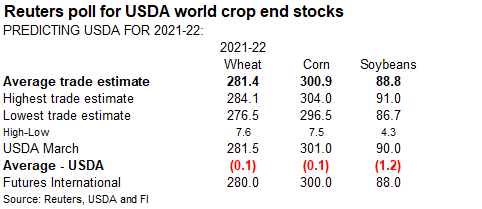

World Food Price Index - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

US

30-Year Fixed Mortgage Crosses 5% For The First Time Since 2011 – CNBC

86

Counterparties Take $1.711 Tln At Fed Reverse Repo Op (prev $1.693 Tln, 81 Bids)

Yesterday

– Shanghai Reports Over 10,000 Covid Infections For First Time

US

Trade Balance Feb: -$89.2Bln (est -$88.56Bln; prev -$89.70Bln)

Canadian

International Merchandise Trade Feb: 2.66Bln (est 3.00Bln; Prev 2.62Bln)

US

Crude Oil Exports Fell To 3.30 Million Barrels Per Day In February (Vs 3.32 Million Bpd In January) – US Census

US

ISM Non-Manufacturing PMI Mar: 58.3 (est 58.5; prev 56.5)

–

Biz Activity: 55.5 (prev 55.1)

–

Employment: 54.0 (prev 48.5)

–

New Orders: 60.1 (prev 56.1)

–

Prices Paid: 83.8 (prev 83.1)

·

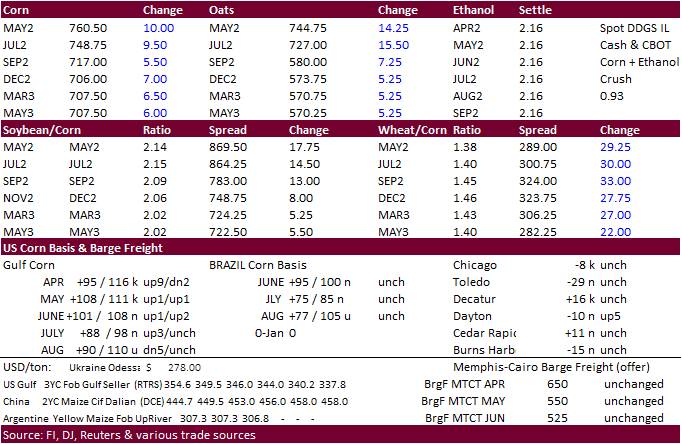

US corn futures traded higher following strength in wheat and US weather concerns for the summer growing season. Some traders are now looking for US corn acres to expand from wheat USDA reported March 31. Note 2 percent of the

US corn area was planted as of Sunday. Long term weather forecasts call for drier than normal conditions for the heart of the US. Yesterday USDA released a dire wheat condition that partially sums up the problem with the current drought situation for the

Great Plains. The ECB will warm up later this week and showers are expected for the ECB and parts of the WCB during the workweek.

·

December corn hit a new contract high of $7.1250 earlier, settling up 7.50 cents to $7.0650.

·

May corn was up 9.25 cents to $7.5975.

·

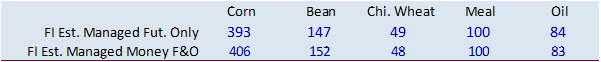

Funds bought an estimated net 14,000 contracts after adding 15,000 on Monday.

·

Argentina producers sold 1.2 million tons of corn for the week ending March 30, compared to 631,000 tons sold during the comparable week year ago. Sales now total 20.7 million tons.

·

A foreign flagged merchant ship near Mariupol in the Black Sea region was hit by a Russian missile. All 12 crew members were able to evacuate.

·

President Vladimir Putin warned that the sanctions by the West will create a global food crisis. He said the higher energy prices combined with a shortage of fertilizers may lead to a global food shortage, especially for poorer

countries.

·

Conab reported about half the Brazil summer corn crop had been collected. Second corn plantings are nearing completion.

·

AgriCensus noted Ukraine was able to rail about 300,000 tons of grain during the month of March, double the amount from February.

·

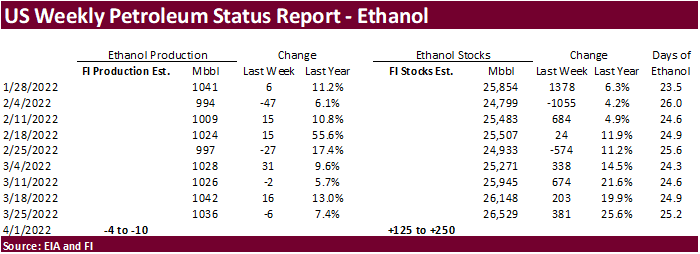

A Bloomberg poll looks for weekly US ethanol production to be down 11,000 barrels to 1.025 million (0.995-1.042 range) from the previous week and stocks up 96,000 barrels to 26.625 million.

Export

developments.

·

None reported

Updated

4/5/22

May

corn is seen in a $7.10

and $8.10 range

December

corn is seen in a wide $5.50-$8.00 range

·

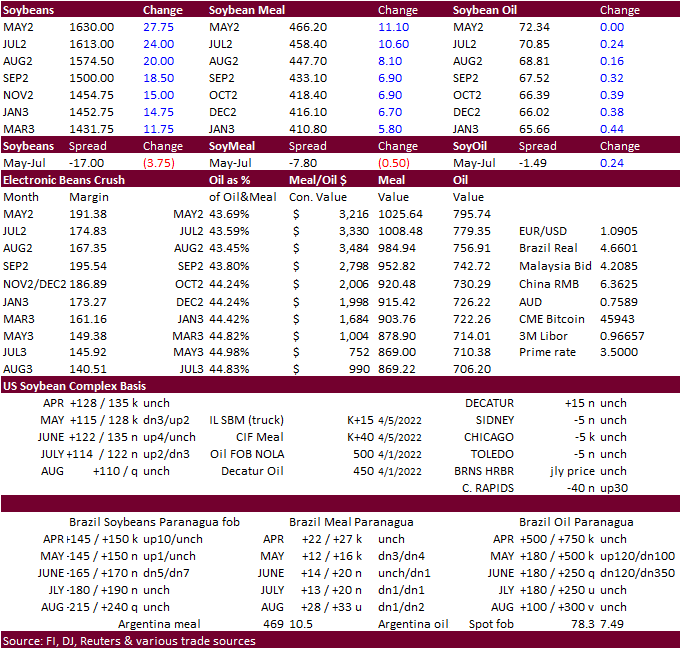

The CBOT soybean complex traded higher on strength in wheat, an Argentina truckers’ union threatening a strike, Black Sea concerns and higher energy markets underpinning global vegetable oils markets. Brazil premiums softened

today in some positions but remain strong. Argentina premiums were largely unchanged. May soybeans were up 28.75 cents, May meal up $10.80 and May soybean oil was up only 7 points (higher back months). Soybean oil sold off after WTI broke (down $1.31 around

1:33 pm CT).

·

May soybeans settled above its 50-day MA.

·

US soybean meal basis was down $5-6 short ton for selected northern IL rail locations, KC, and Fostoria, OH.

·

Funds bought an estimated net 14,000 soybean contracts, bought 6,000 meal and 1,000 soybean oil.

·

Argentina’s national transport federation is demanding the government increase the tariffs on grain producers to reflect the higher costs for fuel. Reuters noted 86% of ag goods carried to ports are trucked and 13 percent is railed.

·

Argentina raised domestic prices for both sugarcane- and corn-based bioethanol. Prices would be set at 73.110 pesos (66 U.S. cents) per liter, from a previous value of 65.420 pesos per liter. Adjusting prices is common.

·

Argentina producers as of March 30 sold 12 million tons of soybeans, down from 13.3 million at this time year ago.

·

Anec sees Brazil soybean exports reaching 11.12 million tons during April. March exports were down 3 percent to 12.3 million tons from year ago.

·

Conab reported 81 percent of the Brazil soybean crop harvested as of April 2, two points above the same time last year. They also mentioned soybean conditions were favorable across the country.

·

China is on holiday, returning Wednesday.

·

China will auction another 500,000 tons of imported soybeans from its reserves on April 7.

- USDA

seeks 2,710 tons of packaged oil on April 7 for May shipment (May 23-June 13 for plants at posts).

Updated

4/5/22

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $430-$500

Soybean

oil – May 69.00-73.50

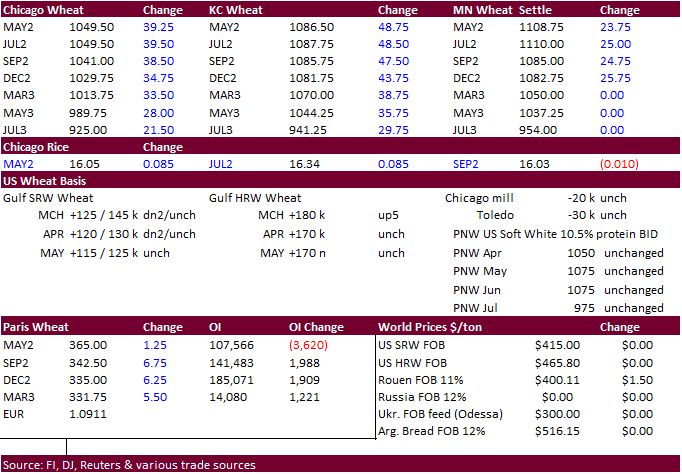

Wheat

·

US wheat futures were sharply higher on Tuesday led by KC after USDA reported winter wheat ratings 10 points below trade expectations. The combined good/excellent at a low 30 percent was also the lowest for this time of year in

our working history. Texas and some surrounding areas will see rain one time or another of the next 7-10 days that could improve conditions, but many other US winter wheat areas will see net drying. We think conditions can only improve from this point going

forward. It’s too early to develop a solid wheat by class production estimate and will likely pick this up later this month after the crop is more established.

·

The western U.S. hard red winter wheat areas will be drier than usual over the next two weeks leaving unirrigated crops in declining condition.

·

Funds bought an estimated net 17,000 Chicago wheat contracts after adding 14,000 on Monday.

·

Global demand is strong with latest import tenders including Japan and the Philippines.

·

May Paris wheat futures were up 1.25 euros at 364.50 euros.

·

The EU Commission estimated the 2022-23 EU soft wheat production at 131.3 million tons, and exports at 40 million tons, up from 32 million tons in 2021-22. Back in February, the EU Commission projected 2021-22 soft wheat production

at 129.8 million tons. The 2022-23 projections appear to be their first estimates.

·

Egypt imported 479,195 tons of wheat during the month of March, up 24 percent from March 2021. Ukraine origin fell 42 percent to 124,500 tons. In 2021, Egypt sourced 80 percent of their imported wheat from Russia and Ukraine.

·

A group representing Ukrainian producers and exports asked the government to end wheat export restriction, arguing that supplies are ample and shipments are key.

·

There was a Reuters story stating Russia is in no rush to expand ruble payments for exports. Unsure if this would make a difference for some importers that have placed sanctions on the country.

·

AKIpress: The Russian government lifted the ban previously imposed on March 14 on the export of wheat and grain crops to the Eurasian Economic Union.

·

Iraq is looking to allocate 2 million tons of wheat for strategic reserves that would last for 6 months.

·

India signed a second agreement with the UN to donate another 100,000 tons of wheat to Afghanistan.

·

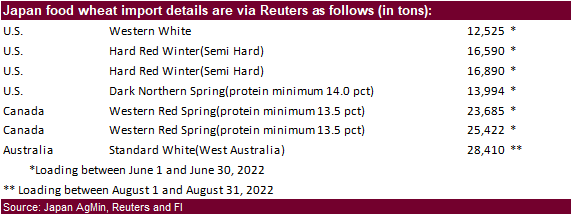

Japan seeks 137,516 tons of food wheat this week for June through August loading.

·

The Philippines are in for at least 50,000 tons of feed wheat and barley on April 6 for July 15 through December shipment.

·

Jordan passed on 120,000 tons of barley.

·

Iraq seeks wheat this week.

·

Jordan seeks 120,000 tons of milling wheat on April 6 for LH May and/or through July shipment.

·

Bangladesh seeks 50,000 tons of wheat on April 11 for shipment within 40 days after contract signing.

Rice/Other

·

Results are awaited on Qatar seeking rice.

·

(Bloomberg) —

•

U.S. 2021-22 cotton ending stocks seen at 3.54m bales, slightly above USDA’s previous est.,

according

to the avg in a Bloomberg survey of nine analysts.

•

Estimates range from 3.2m to 4m bales

•

Global ending stocks seen at 82.64m bales vs 82.57m bales in March

Updated

4/5/22

Chicago

May $9.25

to $12.00 range, December $8.50-$11.00

KC

May $9.25

to $12.00 range, December $8.75-$11.50

MN

May $10.00‐$12.00,

December $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.