PDF Attached

World

Weather Inc.

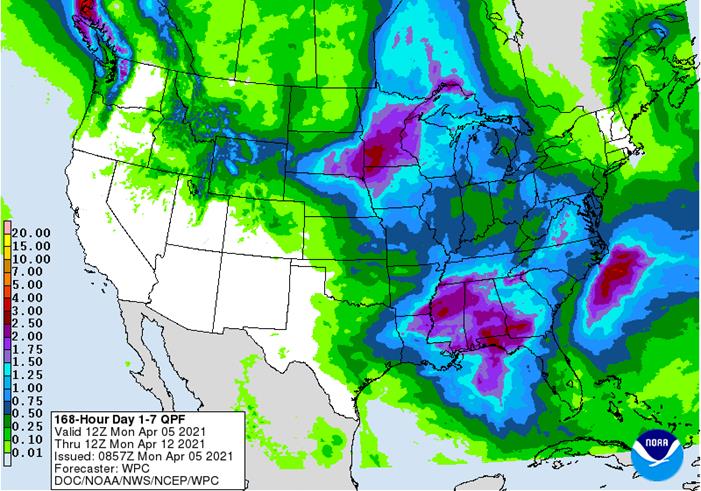

UNITED

STATES

- Western

hard red winter wheat areas and crop areas south into West Texas will remain dry next ten days - Central

Washington into Oregon unirrigated winter crop areas will continue dry next ten days - South

and West Texas cotton, corn and sorghum areas will continue dry next ten days to two weeks - Upper

U.S. Midwest will receive plenty of moisture this week - Areas

from South Dakota and northern and eastern Nebraska to Michigan will receive enough rain to moisten the ground favorably - Second

storm system in the northern Plains and upper Midwest next week may be a little overdone, but there is potential for more precipitation in the region - World

Weather, Inc. believes this event may come a little later than advertised - A

good distribution of precipitation is advertised for the lower Midwest, Delta and southeastern states in the sense of producing a good mix of rain and sunshine during the next two weeks supporting fieldwork and crop development - Northwestern

U.S. Plains will continue to stay dry biased along with neighboring areas of Canada’s Prairies, despite a few showers

ARGENTINA

- Rain

Wednesday through Saturday will be sufficient in restoring favorable topsoil moisture after recent drying - Subsoil

moisture is still fine - Long

term crop outlook is still very good - Drying

is expected late this weekend through much of next week

BRAZIL

- Interior

southern parts of Brazil will be drying down additional in the coming week

- Mato

Grosso do Sul, Parana, Sao Paulo and parts of Minas Gerais will be drying out along with Tocantins and Bahia - Drying

in some of these areas will raise greater concern over declining topsoil moisture - Drying

in Bahia is great for cotton and other crop maturation and harvesting - Poor

rainfall in Safrinha corn areas of interior southern Brazil will be a concern especially in areas that planted in wet fields where root systems may be short

- Well

timed rainfall is expected in Mato Grosso and Goias during the next ten days to two weeks supporting Safrinha crops

REST

OF WORLD

- Tropical

Cyclone Seroja will reach the central Western Australia Coast south of Shark Bay and north of Geraldton this weekend and early next week bringing a disruption to port activity and then bringing needed moisture in Western Australia’s wheat, barley and canola

country after the storm moves inland - Western

Europe is drying down, but warmer weather during the weekend was good - Russia

still has snow on the ground in much of the west and north, but greening is beginning in Ukraine and Russia’s Southern region

Source:

World Weather inc.

Bloomberg

Ag Calendar

Monday,

April 5:

- USDA

export inspections – corn, soybeans, wheat, 11am - EU

weekly grain, oilseed import and export data - ICE

Futures Europe’s weekly commitments of traders report for week ended March 30, publication at noon London time (delayed from April 2 because of Good Friday holiday) - Malaysian

Palm Oil Council’s Pointers seminar (April 5-11) - U.S.

cotton plantings, winter wheat condition - HOLIDAY:

Easter Monday holiday in several countries

Tuesday,

April 6:

- Purdue

Agriculture Sentiment - New

Zealand global dairy trade auction - HOLIDAY:

Hong Kong, Thailand

Wednesday,

April 7:

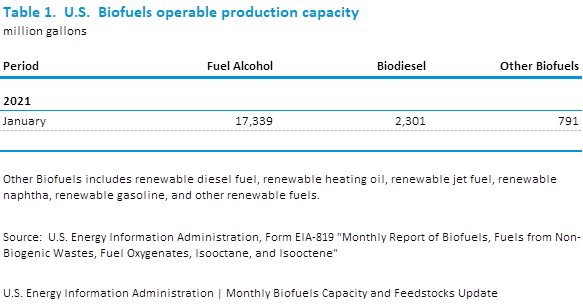

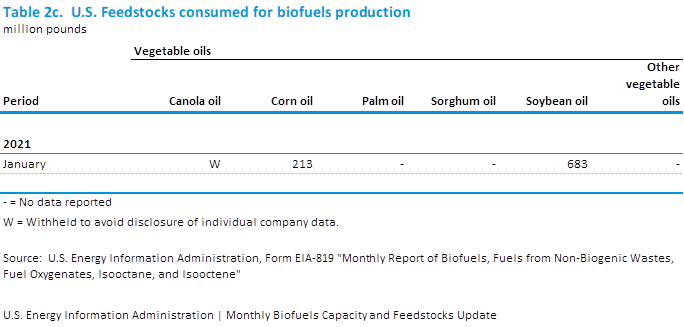

- EIA

weekly U.S. ethanol inventories, production - ANZ

Commodity Price

Thursday,

April 8:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

CNGOIC to publish soybean and corn reports - Conab’s

data on yield, area and output of corn and soybeans in Brazil - Port

of Rouen data on French grain exports

Friday,

April 9:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Acreage

via trade:

IHS Markit plans to adopt most of USDA’s US acreage projections, with exception to soybeans (89.8) and corn (93.6). We are using 92.5 million acres for corn and 89.2 million for soybeans. USDA is at 91.144 and 87,600 million, respectively.

Some

changes to our 2020-21 US balance sheets: 3 balance sheets attached

-

Soybeans

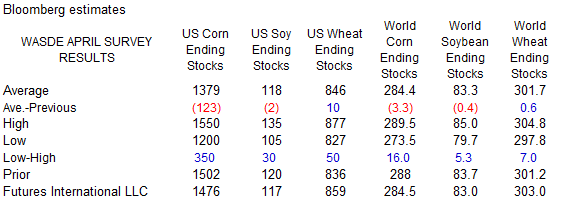

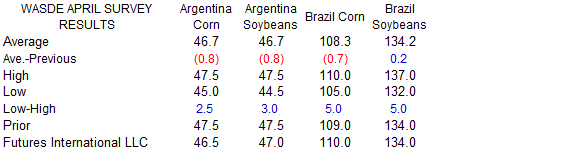

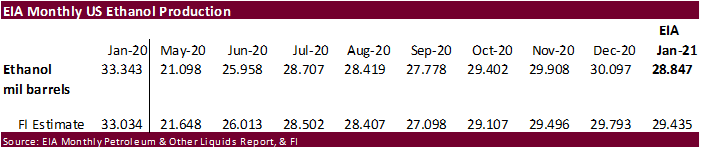

– crush lowered to 2.190, exports lowered 15 to 2.285. We think USDA is underestimating the 2020 US soybean crop production by 20 mil bu. We see the USDA lowering the carryout on Friday to 117.

-

Corn

– Ethanol lowered by 40m to 4.940, feed lowered 50 to 5.550. We see the USDA lowering the carryout to only 1.476 (think USDA will take eth down 25, feed down 75, exports up 125…conservative as shipments need to increase).

-

Wheat

– 2021 production seen rising to 1.901 billion vs. our previous forecast of 1.891, 2020-21 exports down from 980 to 965 and feed down to 90 to 120. We see USDA on Friday reporting a 859 carryout.

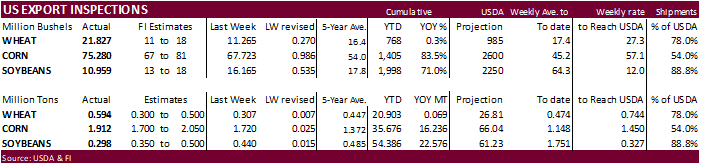

USDA

inspections versus Reuters trade range

Wheat

594,032 versus 300000-555000 range

Corn

1,912,211 versus 1100000-2100000 range

Soybeans

298,252 versus 150000-500000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 01, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/01/2021 03/25/2021 04/02/2020 TO DATE TO DATE

BARLEY

100 1,497 0 32,620 30,499

CORN

1,912,211 1,720,251 1,279,364 35,676,394 19,439,980

FLAXSEED

0 0 0 509 520

MIXED

0 0 0 0 0

OATS

100 399 0 3,691 3,243

RYE

0 0 0 0 0

SORGHUM

165,647 244,739 9,160 4,612,580 1,787,116

SOYBEANS

298,252 439,930 301,111 54,385,688 31,809,227

SUNFLOWER

0 0 0 0 0

WHEAT

594,032 306,579 350,190 20,902,559 20,833,533

Total

2,970,342 2,713,395 1,939,825 115,614,041 73,904,118

————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macro

US

ISM Services Index (Mar): 63.7 (est 59, prev 55.3)

US

Factory Orders (Feb): -0.8% (est -0.5%, prev 2.6%)

Factory

Orders Ex Trans (Feb): -0.6% (est -1.1%, prev 1.7%)

Durable

Goods Orders (FebF): -1.2% (est -1.1%, prev -1.1%)

Durables

Ex Transportation (FebF): -0.9% (est -0.9%, prev -0.9%)

Cap

Goods Orders Nondef Ex Air (FebF): -0.9% (prev -0.8%)

Cap

Goods Ship ondef Ex Air (FebF): -1.1% (prev -1.0%)

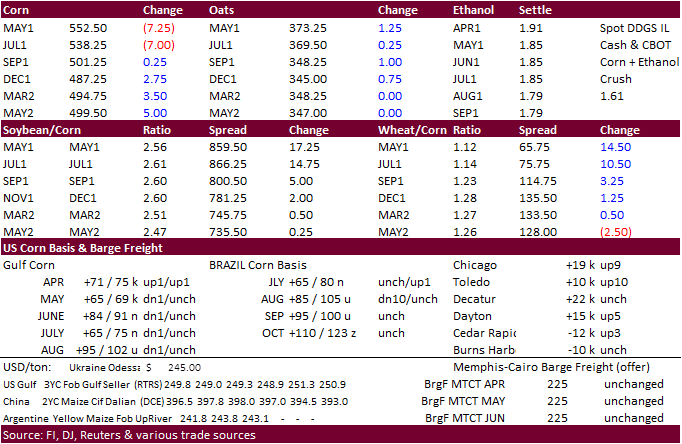

- CBOT

corn traded near an 8-year high before bear spreading dragged the front months lower. May corn found support at its 20-day MA of $5.4925. Follow through spreading from the lower than expected US new-crop corn area lifted December 4 cents higher. May fell

6.50 cents. Sharply lower WTI crude oil added to the negative undertone in spot corn. US weather looks good for fieldwork activity this week, but some rain events will occur that could slow plantings across the Delta, SE, and lower Midwest.

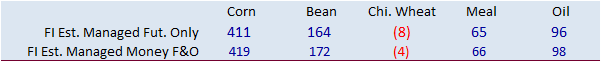

- Funds

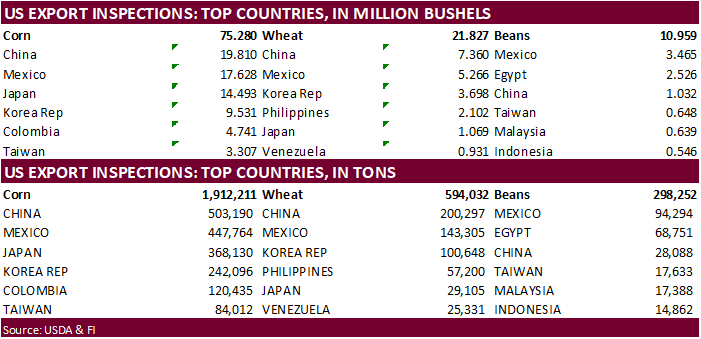

on Monday sold an estimated net 8,000 corn contracts. - USDA

US corn export inspections as of April 01, 2021 were 1,912,211 tons, within a range of trade expectations, above 1,720,251 tons previous week and compares to 1,279,364 tons year ago. Major countries included China for 503,190 tons, Mexico for 447,764 tons,

and Japan for 368,130 tons. - Ukrainian

corn exports fell by 25% in the first half of the 2020-21 October-September season to 15.9 million tons (APK-Inform). Ukraine exported 6 million tons of corn to China, 5.0 million tons to the European Union, 1.7 million tons to Egypt and 3.2 million tons

to other destinations. - China

reported an outbreak of African swine fever in Xinjiang region – AgMin

Export

developments.

- None

reported

May

corn is seen in a $5.40 and $6.00 range

July

is seen in a $5.25 and $6.00 range

December

corn is seen in a $3.85-$5.50 range.

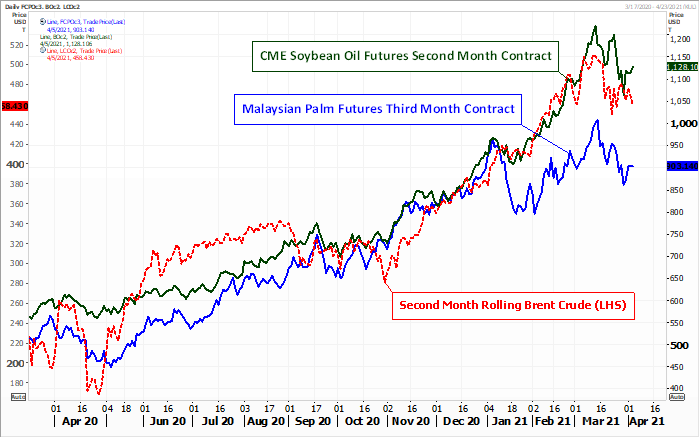

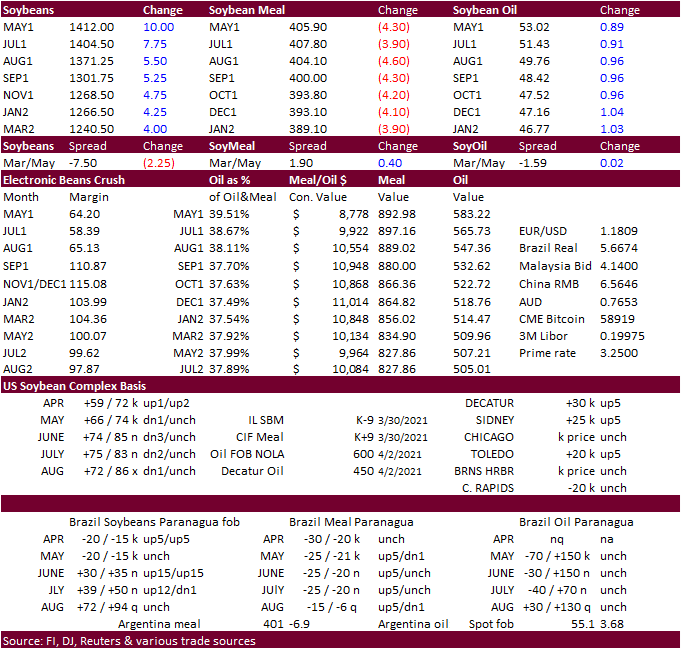

- Soybeans

and soybean oil ended higher and soybean meal lower. May soybeans traded in a narrow trading range near its 20-day MA and finished 10.75 cents higher, May SBM $3.90 lower-finding support its 20-day MA, and May SBO 68 points higher. Many countries were on

holiday so there is little lead from outside markets. Energy markets traded down sharply but this did little to stop the rally in soybean oil. June Malaysian palm futures was down slightly when combining Friday and Monday prices. May canola was up $26.80

or 3.6% to $767.60 per ton. - Funds

on Monday bought an estimated net 5,000 soybean contracts, sold 2,000 soybean meal and bought an estimated 4,000 soybean oil.

- USDA

US soybean export inspections as of April 01, 2021 were 298,252 tons, within a range of trade expectations, below 439,930 tons previous week and compares to 301,111 tons year ago. Major countries included Mexico for 94,294 tons, Egypt for 68,751 tons, and

China for 28,088 tons. - AgRural

reported Brazilian producers harvested 78% of their soybean crop as of last Thursday, down from 83% year ago. Brazils second corn crop was complete.

- Ukrainian

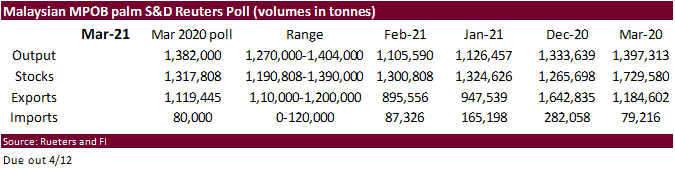

sunflower oil prices decreased by $35 ton over the past week, according to APK-Inform to a range of $1,485 – $1,495 per ton FOB Black Sea from $1,520 – $1,530 a week earlier. Record high was $1,710 and $1,725 per ton FOB in early March. - A

Reuters poll for Malaysia’s palm oil inventories shows March stocks expected to rise 1.3% from February to 1.32 million tons, production to slightly decline, and exports to be up 25% to 1.12 million tons. The Malaysian Palm Oil Board will release the official

data on April 12. - The

Malaysian Palm Oil Council (MPOC) looks for crude palm oil price to average 3,846 ringgit a ton during the first half of the year, peaking at 4,190 ringgit a ton.

Export

Developments

-

The

USDA seeks 540 tons refined veg oil, under the McGovern-Dole Food for Education export program (470 tons in 4-liter cans and 70 tons in 4-liter plastic bottles/cans) on April 6 for May 1-31 (May 16 – Jun 15 for plants at ports) shipment.

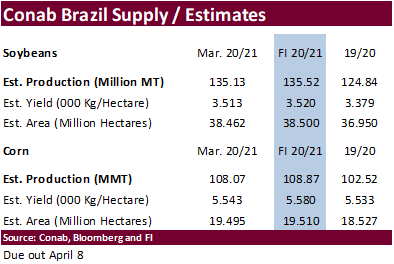

Conab

is due out with April Brazil supply on April 8

May

soybeans are seen in a $13.75 and $15.75 range.

November $10.50-$14.50

May

soymeal is seen in a $395 and $425 range.

December $325-$5.00

May

soybean oil is seen in a 50 and 55 cent range

December 40-60 cent wide range

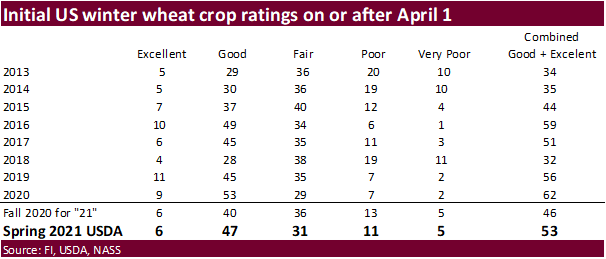

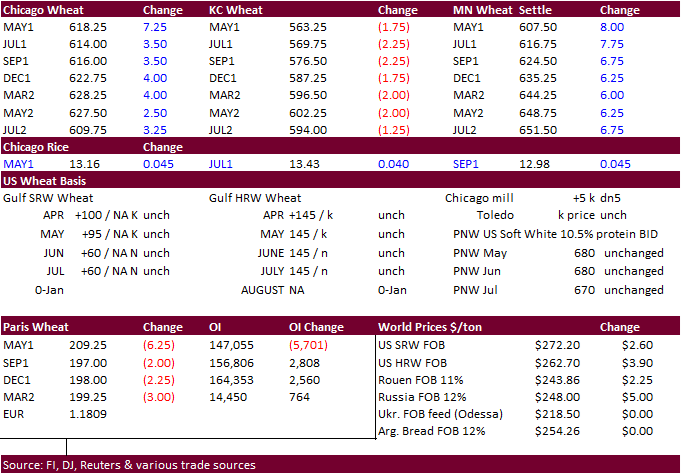

- Chicago

wheat ended

higher (MN higher/KC lower) on fund buying, USDA 24-hour sales, good US all-wheat inspections, and rising concerns over net drying across parts of the US Great Plains and Canadian Prairies. After the close Algeria announced they seek milling wheat. Saudi

Arabia bought 295,000 tons of hard milling wheat at around $269-270/ton. Egypt is in this week for wheat for August 1-10 shipment. Europe is on holiday so there was no trading in Paris wheat.

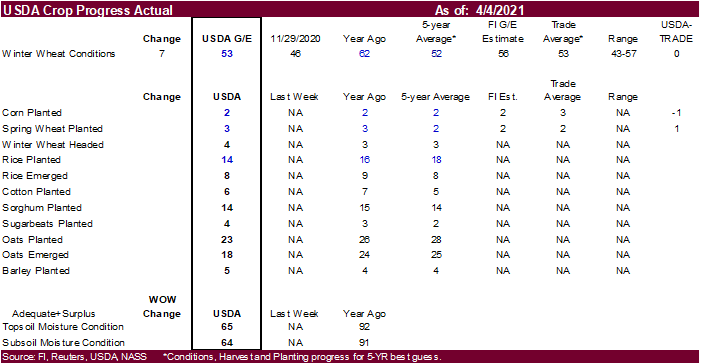

- US

winter wheat conditions were near expectations at 53 percent.

- Funds

on Monday bought an estimated net 5,000 CBOT SRW wheat contracts. - USDA

US all-wheat export inspections as of April 01, 2021 were 594,032 tons, above a range of trade expectations, above 306,579 tons previous week and compares to 350,190 tons year ago. Major countries included China for 200,297 tons, Mexico for 143,305 tons, and

Korea Rep for 100,648 tons. - 80

percent of Russia’s winter crops are in good and satisfactory condition. Russian wheat exports are running 22 percent higher so far this season. Russian 12.5% protein wheat export prices fell $12 last week to $245 a ton FOB – IKAR. SovEcon showed wheat

and barley prices fell by $5 to $248 a ton and $235 a ton, respectively. SovEcon lowered its forecast for Russia’s 2020-21 wheat exports by 0.2 million tons to 38.9 million tons. - Ukraine

grain exports so far this season are running 23 percent below year earlier. They sold 14.4 million tons of wheat, 16.6 million tons of corn and 4.1 million tons of barley. - APK-Inform

reported Ukrainian

wheat export prices fell $9 a ton in the past week. High-quality soft milling wheat decreased to $245-$251 from $254-$260 a ton FOB Black Sea

- Egypt

plans to buy 4 million tons of local wheat in 2021 between April 15 and July 15-Supply Minister. Both wheat and sugar reserves are currently at 3.6 months. Vegetable oil supplies are at 3.7 months and rice until October.

- Last

week China offered 2 million tons of rice from state reserves and sold between 1.4 million and 1.5 million tons of rice at 1,500 yuan ($228.62) a ton, 70% of the total volume. China has also sold close to 5 million tons of rice from reserves this year. Note

sales of wheat from auction reached 25 million tons. - French

soft wheat crop conditions were unchanged for the week ending March 29 at 87 percent from the previous week and compares to 62 percent from year ago. Winter barley conditions declined 1 point to 84 percent from the previous week. Durum dropped 1 point to

91 percent.

- Algeria’s

OAIC seeks optional-origin milling wheat on Wednesday. - Under

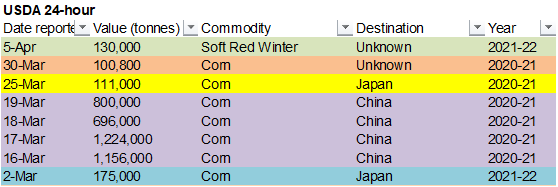

the 24-hour announcement system private exporters sold 130,000 tons of soft red winter wheat for delivery to unknown destinations during the 2021-22 marketing year.

- Egypt

seeks wheat for August 1-10 shipment on Tuesday, April 6, with offers valid for 24 hours.

- Saudi

Arabia’s SAGO bought 295,000 tons of 12.5% protein wheat for arrival during May and June at around $269 to $270/ton.

- Jordan

seeks 120,000 tons of animal feed barley on April 6. - Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Iraq seeks 30,000 tons of rice on April 5, valid until April 8.

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Updated

4/5/21

May Chicago wheat is seen in a $6.00‐$6.65 range

May KC wheat is seen in a $5.50‐$6.00 range

May MN wheat is seen in a $5.90‐$6.40 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.