PDF Attached

The

soybean complex and grains ended lower. The soybean products pressured soybeans. May crush fell to a fresh contract low and settled at $1.04. It was over $2.00 a few weeks ago. Meal led the complex lower as Argentina is expected to roll out details for the

soybean dollar on Wednesday. Corn started and ended lower mainly on profit taking. Wheat traded two-sided and ended lower in part to weakness in corn and soybeans.

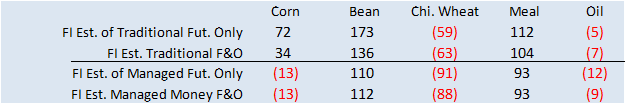

Fund

estimates as of April 4

Severe

weather for the central US is expected to occur tonight into Wednesday.

World

Weather Inc.

MOST

IMPORTANT WEATHER OF THE DAY

-

New

snowstorm in U.S. Northern Plains and upper Midwest has begun and it will continue through Wednesday raising the potential for severe flooding in the Red River Basin later this month -

New

snowfall will vary from 6 to 14 inches from South Dakota to northern Minnesota and southeastern Manitoba with a few amounts to 20 inches

-

Serious

precautions should now be taken in flood prone areas of the Red River Basin to minimize damage when the snow melts -

Snow

water equivalents today vary from 4.00 to nearly 10.00 inches across the Red River Basin, a part of the Missouri River Basin in North Dakota and in the uppermost Mississippi River Basin and especially the western Great Lakes region -

The

rate in which snow melts will determine the seriousness of flooding and that in conjunction with new precipitation will determine whether or not the region will be faced with prevent plant conditions this spring -

Warming

is likely in the next ten days to two weeks with the April 9-15 period possibly warming above normal -

Moisture

totals this week will vary from 0.50 to 1.75 inches -

Next

week’s U.S. Midwest drier and warmer weather will be very important for early season fieldwork to begin.

-

Warming

temperatures will help to accelerate drying rates between rain events -

Negative

phase of PDO remains strong and is likely to return a southwest flow pattern to the central parts of the U.S. later this month -

Until

other weather patterns kick in this scenario may play out frequently resulting in wet weather in the western United States with a cooler bias to temperatures -

Warmer

biased weather may impact the eastern U.S. with rain expected to be lightest in the southeastern states and lower eastern Midwest after this first week of the outlook -

U.S.

hard red winter wheat areas will be dry biased for the coming week to ten days -

There

is potential for frontal systems to pass through the region during the middle and latter part of this month which may trigger lines of showers and thunderstorms -

Resulting

rainfall will be greatest in the east, but at least some rain should fall in the high Plains region as well, but the volume of rain there will not be enough to seriously improve drought conditions

-

A

severe thunderstorm outbreak is possible in the Midwest, Delta and areas west through Arkansas to eastern Oklahoma today and Wednesday -

Numerous

reports of hail, damaging and tornadoes are expected from areas near the Mississippi River Valley into the heart of the Midwest and Tennessee River Basin

-

As

reported on Friday, March 24, by World Weather, Inc. years that start off with a near record pace of tornado reports usually continue to follow that pace during the spring and Friday’s severe weather and that expected Tuesday will continue to show verification

on that study -

Canada’s

Prairies will continue missing significant precipitation events in the coming week, but may get a few brief periods of rain and snow during the middle and latter part of this month -

No

drought busting precipitation events are expected, but relief from dryness and a little topsoil moisture improvement is expected

-

These

changes are still ten days away -

California’s

break from stormy weather is expected to last no more than ten days with a return of rain and mountain snowfall possible a little later this month -

Flood

potentials are high for rivers and streams that run from the Sierra Nevada to the coast -

Precipitation

will occur in the U.S. Pacific Northwest periodically later this week into next week and the light moisture will be good in raising topsoil moisture after lighter than usual precipitation bias in the Yakima Valley and neighboring areas -

West

Texas cotton, corn, sorghum and wheat production areas continue much too dry and frequent bouts of high wind have occurred and will continue to occur resulting in blowing dust -

Some

rain potential will improve later this month, but a big general soaking of moisture is unlikely -

U.S.

Delta and southeastern states will be wet biased later this week and early in the weekend and then the area will dry down and heat up for a while -

Southeastern

Canada’s crop areas are favorably moist with little change likely -

China’s

upper Yellow River Basin and central parts of Inner Mongolia received 0.60 to nearly 3.00 inches of rain Sunday night into Monday and moved east across a big part of east-central China Monday into this morning producing another 0.35 to nearly 2.00 inches in

the central Yellow River Basin -

The

moisture will shift to the east today passing through the lower Yellow River Basin and into the North China Plain and a part of the Northeast Provinces today and Wednesday

-

Another

0.30 to 1.50 inches is expected in areas to the east today and Wednesday -

All

of the rain will bolster soil moisture for use by wheat and other winter and spring crops -

Spring

planting will likely advance swiftly once the topsoil begins to firm -

China’s

Yangtze River Basin will receive waves of rain during the next ten days -

Rain

totals of 1.00 to 6.00 inches will occur by late this weekend inducing some local flooding -

Some

rain already began impacting the region overnight -

India

and Pakistan will see much drier weather over the next two weeks -

A

few showers will occur, but the potential impact on winter crops will be low -

Recent

rain will support aggressive early season cotton planting -

Wheat

will benefit greatly from the change -

Yunnan,

China is too dry and needs moisture for early season corn and rice as well as other crops -

Dryness

will continue in the province cutting into rice and corn planting and production potential as well as some other crops -

Southern

Argentina, Uruguay and southern Rio Grande do Sul, Brazil are unlikely to receive much precipitation in the next week

-

The

drier bias will support crop maturation and harvest progress -

Scattered

showers and thunderstorms will develop in the following weekend -

Center

south Brazil will experience increasing rainfall later this week into next week

-

The

moisture will help to saturate the topsoil once again in support of Safrinha and other late season crops -

A

part of the region has been drying out recently and this will help to reverse the trend and saturate the soil again before seasonal rains end later this month -

Northern

and central Argentina precipitation during the next ten days will be sufficient to maintain favorable late season crop development, but it may also interfere with early season summer crop maturation and harvest progress -

A

tropical cyclone may form east southeast of the Philippines late this week and will be closely monitored for possible influence on the archipelago this weekend or next week -

The

latest computer forecast model runs keep the storm over open water well to the east of the nation through most of next week -

Southeast

Asia rainfall will continue favorably distributed for the next ten days to two weeks; this is true for Indonesia, Philippines and Malaysia as well as the maintain crop areas -

Mainland

areas will not receive as much rain as usual -

March

was notably drier biased -

Eastern

Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops -

Turkey

will be the wettest Middle East nation in the coming week while net drying occurs in other areas -

Recent

precipitation has been good for wheat development and rice and cotton planting -

Spain

will continue dry biased for at least another week and possibly for 8-9 days -

Portions

of North Africa received rain Sunday and Monday – mostly in northeastern Algeria and far northern Tunisia -

Improving

topsoil moisture should improve crop development, but most other areas in northern Africa are still too dry and in need of rain -

Western

Europe will be drier biased over the coming week while Eastern Europe is sufficiently wet to bolster topsoil moisture -

Southeastern

Europe rain has brought relief to drought stricken areas in the past 24 hours and more rain is expected today -

Relief

from drought is occurring in the lower Danube River Basin and parts of Romania -

Some

delay to fieldwork is expected -

Western

CIS weather is advertised to be not as wet this week in western Russia and the Baltic States as suggested last week, but wetter in Ukraine, southern Belarus and western parts of Russia’s Southern Region -

Sufficient

moisture is expected throughout the western CIS to maintain a good prospect for winter and spring crops throughout the region -

Drying

in western Russia will be great for improving topsoil moisture for spring fieldwork – many areas are too dry -

West-central

Africa rainfall is expected periodically in the next two weeks to support ongoing coffee, cocoa, rice and sugarcane development -

A

boost in rainfall is needed in cotton production areas to support the best planting environment -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Limited

rainfall in eastern Australia will be great for summer crop maturation and harvesting -

A

boost in precipitation will be needed in southern Australia in the next few weeks to support wheat, barley and canola planting -

The

outlook is favorable -

South

Africa weather will be mostly good over the next two weeks with a mix of rain and sun supporting corn, sorghum, sunseed, soybeans, rice, cotton, citrus sugarcane and other crops -

Rainfall

will be limited in this first week of the outlook and then increase this weekend and next week -

Production

potentials are high and late summer weather is mostly very good -

Mexico

drought will continue this month, although there will be some periodic opportunity for rain in eastern parts of the nation through much of the next ten days -

Central

America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days -

Net

drying is likely in portions of Honduras and Nicaragua -

Southeastern

Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away -

Today’s

Southern Oscillation Index was -4.13 and it was expected to move erratically lower over the next few days

Source:

World Weather, INC.

Bloomberg

Ag calendar

Tuesday,

April 4:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - Purdue

Agriculture Sentiment, 9:30am - HOLIDAY:

India

Wednesday,

April 5:

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysia’s

April 1-5 palm oil export data - HOLIDAY:

China, Hong Kong

Thursday,

April 6:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - New

Zealand commodity prices - HOLIDAY:

Argentina, Thailand

Friday,

April 7:

- FAO

World Food Price Index, grains report - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Good

Friday holiday in several countries

Source:

Bloomberg and FI

Macros

103

Counterparties Take $2.219 Tln At Fed Reverse Repo Op. (prev $2.221 Tln, 101 Bids)

Canadian

Building Permits (M/M) Feb: 8.6% (est 2.0%; prev -4.0%)

US

Factory Orders (M/M) Feb: -0.7% (est -0.5%; prev R -2.1%)

–

Factory Orders Ex-Trans (M/M): -0.3% (est 0.0%; prev R 0.8%)

US

Durable Goods Orders (M/M) Feb F: -1.0% (est -1.0%; prev -1.0%)

–

Durable Ex-Transportation (M/M): -0.1% (est 0.0%; prev 0.0%)

–

Cap Goods Orders Nondef Ex Air (M/M): -0.1% (prev 0.2%)

–

Cap Goods Ship Nondef Ex Air (M/M): -0.1% (prev 0.0%)

US

JOLTS Job Openings Feb: 9.931M (est 10.500M; prev R 10.563M)

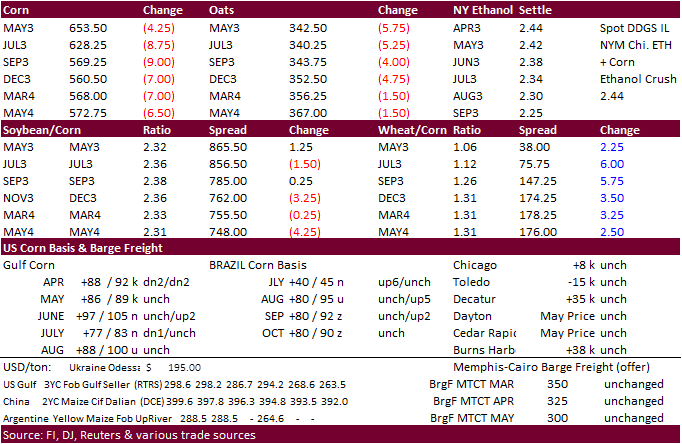

Corn

·

Corn traded lower from the onset from fund selling and profit taking. Widespread commodity selling in the agriculture markets added to the negative undertone. The CK/CZ firmed today. Thoughts behind it could be related to the

recent strong export developments and South American hedging. Negative US jobs data sent US stocks lower and prompted some outside commodity fund selling.

·

Conab reported Brazil second corn planting progress at 96%, 5 points above the previous week and compares to nearly 100 percent year earlier.

·

The weather forecast for the US calling for improving planting progress bias WCB (temperatures warm this week). But wet conditions and the threat of the large snowpack across the upper northwestern Corn Belt is threatening slow

planting progress that could lead to switching from corn to soybeans.

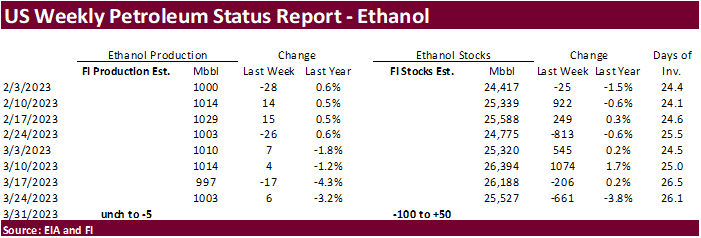

·

A Bloomberg poll looks for weekly US ethanol production to be down 1,000 thousand barrels to 1002k (990-1020 range) from the previous week and stocks down 159,000 barrels to 25.368 million.

Export

developments.

Updated

03/31/23

May

corn $6.00-$7.15

July

corn $5.75-$7.00

·

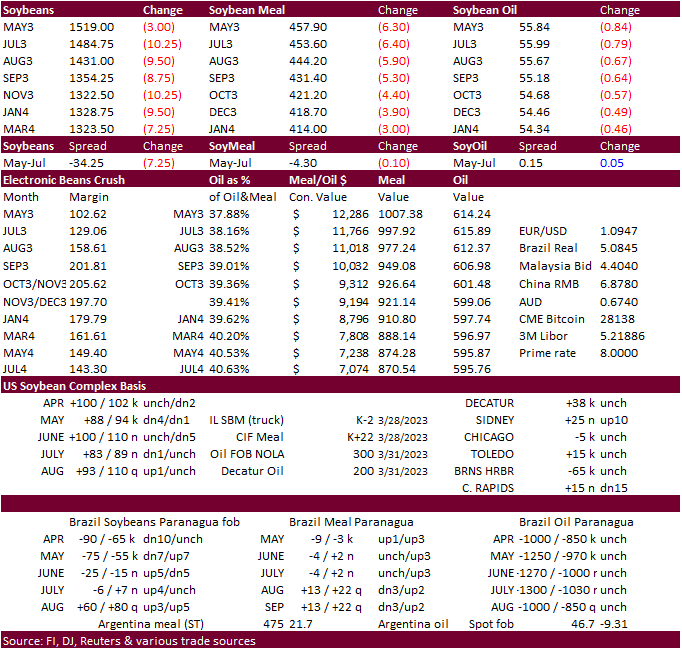

CBOT soybean prices fell led by the back months on profit taking and South American harvest pressure.

·

Soybean oil started the day session mixed, underpinned by the strength in US energy markets, but as those markets pared gains and other commodity markets trended lower, soybean oil sold off, giving up more than 90 points for the

May. July was down 88 points.

·

Soybean meal was sharply lower by $6.80 basis the May contract. Argentina will release details on the new soybean dollar on Wednesday. Argentina’s 1st soybean dollar was set at 200 pesos and Sep 5-30 resulted in 13 MMT sales.

The 2nd & was 230 pesos (around 165 ex rate late Nov) and Nov 28-Dec 31 resulted in 5.1 MMT sales. The third $ was rumored to be set at around 310 pesos. 2023 export campaign for Argentina soybean meal export has a long time to go, but a few estimates

for global trade flows predict Brazil will take over Argentina as the largest global supplier of soybean meal this (Argentina) crop year (April-March). Argentina soybean meal export premiums declined today while Brazil fob appreciated. Brazil fob soybean meal

is the cheapest among the three major exporting countries and about $30 per ton discount to US Gulf fob.

·

Both weaker soybean oil and meal pressured crush margins. With May soybeans firming over the back months, May crush fell 20.75 cents to $1.0200. On March 7th, the session high was $2.25. Cash crush margins are about

$1.00 lower from a month ago for central IL.

·

Conab estimated Brazil soybean harvesting progress at 74.5 percent as of April 1, up 5 points from the previous week and below 81 percent year ago. They are using 151.4 million tons for production. AgRural was at 76 percent as

of last Thursday.

·

StoneX: Brazil soybean crop 157.7 vs. 154.7 previous.

Export

Developments

-

None

reported

Updated

03/31/23

Soybeans

– May $14.25-$15.50, November $12.25-$15.00

Soybean

meal – May $410-$500, December $325-$500

Soybean

oil – May 52.00-58.00,

December 49-58

·

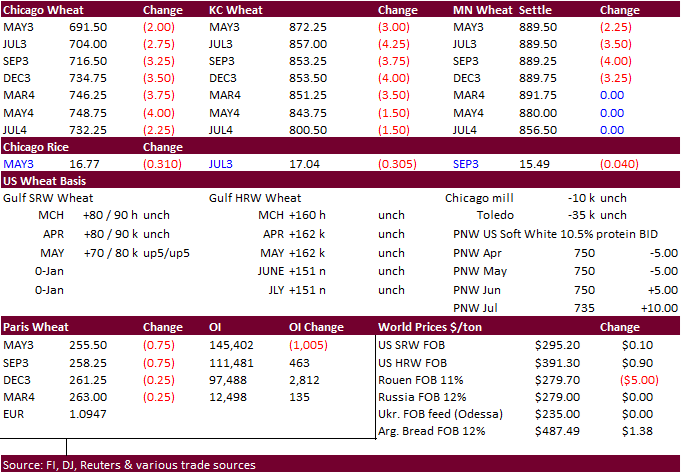

US wheat futures started higher after USDA reported initial spring winter wheat ratings worst since 1996 but prices ended lower on profit taking despite a sharply lower USD (down 52 points as of 2:08 pm CT).

·

Paris May wheat was down 0.75 euro or 0.3% at 255.25 per ton.

·

Canadian wheat areas are very dry, and Commodity Weather Group noted the season is off to its second driest start in 45 years.

·

The USDA Attaché estimated 2023-24 (April-March) wheat production at a large 108 million tons, based on good weather conditions, up from their own 100 million ton projection for 2022-23. However, recall India’s largest producing

states saw unfavorable weather a week ago that included hail. Producers and local government reported crop damage.

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Annual_New%20Delhi_India_IN2023-0025

·

India plans to still procure wheat even if yields come in below government standards after hair and heavy rain damaged the crop late March. India looks to buy 34.15 million tons of wheat this season from producers.

Export

Developments.

·

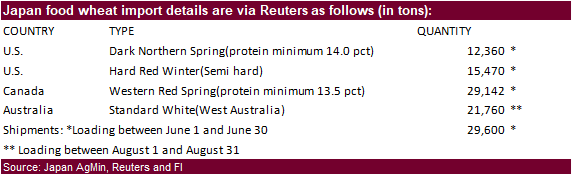

Jordan passed on 120,000 tons of wheat. They are in for barley on Wednesday.

·

Japan in its weekly import tender seeks 78,732 tons of food wheat later this week from the US, Canada and Australia.

Rice/Other

·

India milk imports are surging and at a record high after a disease spread throughout some of the local cattle stock. (lumpy skin disease)

Updated

03/31/23

KC

– May $8.00-9.25

MN

– May

$8.50-$9.50

#non-promo