PDF Attached

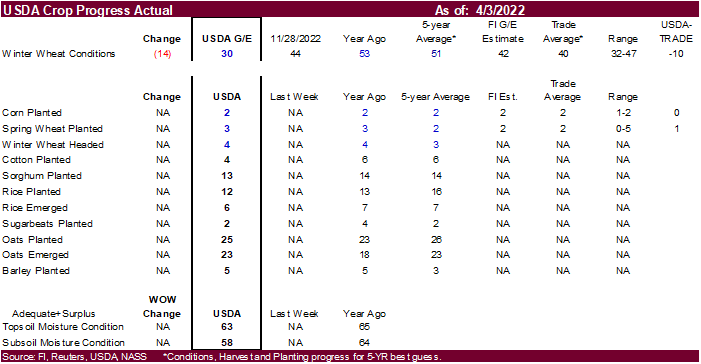

Wheat

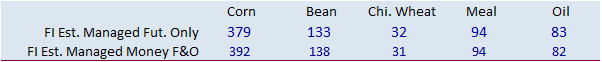

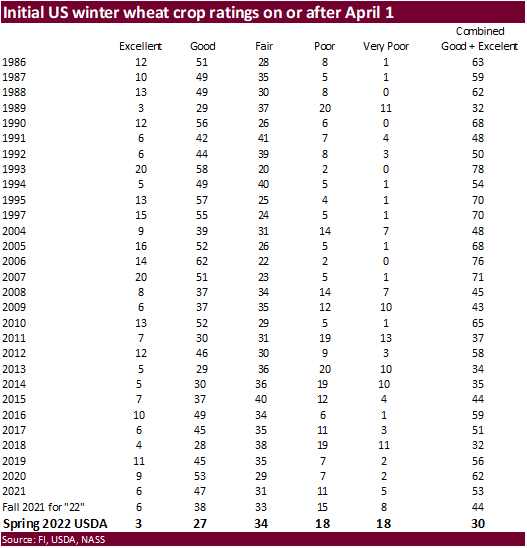

is called 20-30 higher, corn up 4-7, soybeans up 6-11. US corn plantings 2 percent and spring wheat 3 percent, at and one point above expectations, respectively. Initial 2022 US winter wheat conditions were reported 3 percent excellent and 27 good. Very poor

at 18 percent for winter wheat is concerning but a good soaking for the Great Plains can turn that around.

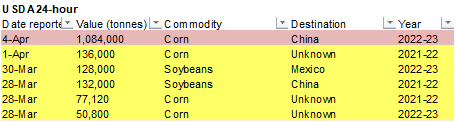

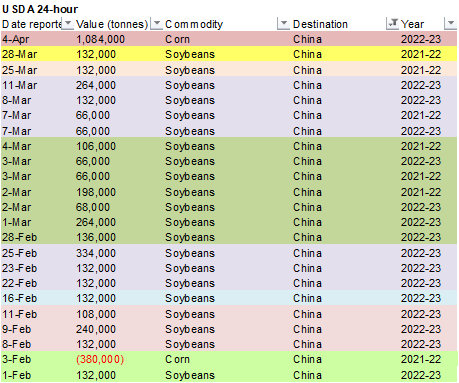

Private

exporters reported sales of 1,084,000 metric tons of corn for delivery to China. Of the total, 676,000 metric tons is for delivery during the 2021/2022 marketing year and 408,000 metric tons is for delivery during the 2022/2023 marketing year.

Higher

trade in CBOT agriculture futures today from ongoing Black Sea concerns and higher outside related commodities. Global wheat demand is strong. Bear spreading was in focus for wheat and soybeans while bull spreading hit the corn market despite USDA announcing

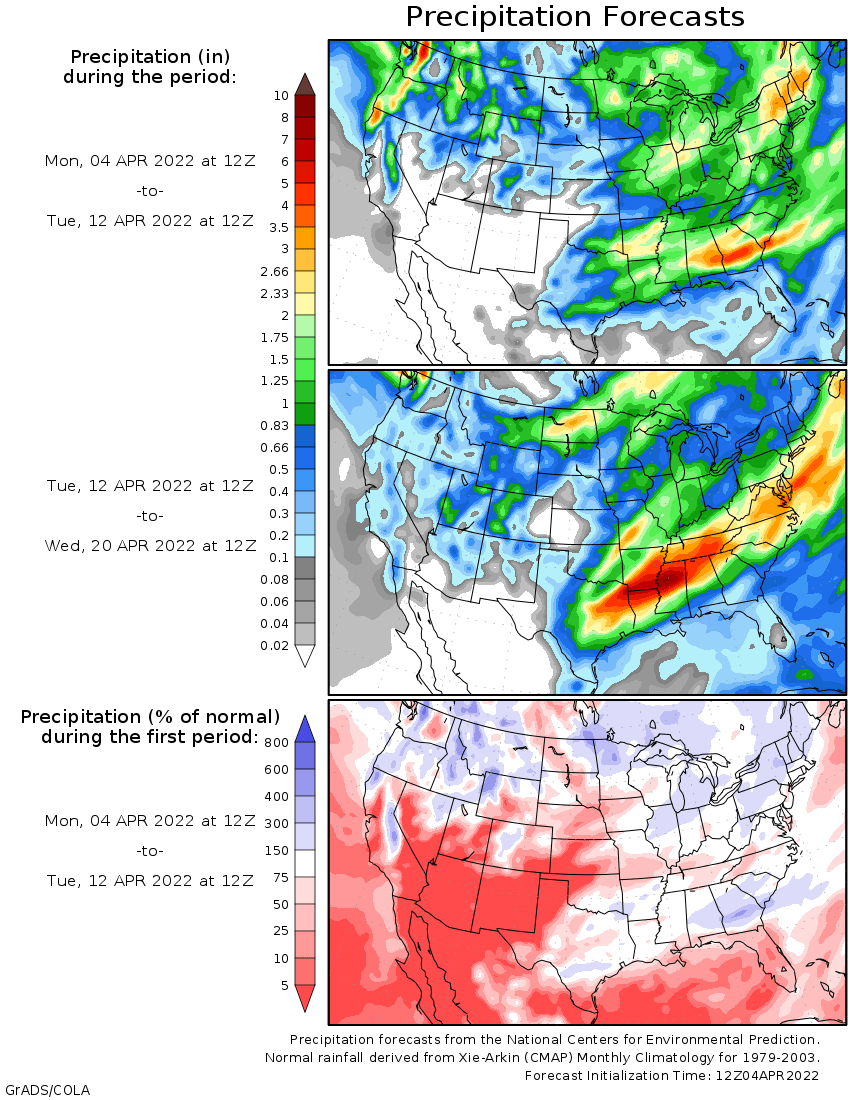

another bird flu outbreak. Egypt could be in soon for wheat. May crush settled around $1.9425, up 3.75 cents. US weather looks dry over the next 10 days for the central and part of the upper Great Plains. The EU is looking to add more sanctions against Russia.

China started buying new-crop US corn with over 1 million tons announced by USDA.

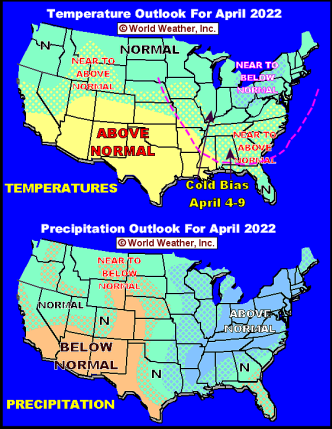

Source:

World Weather Inc.

Source:

World Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

- Very

little precipitation is expected across the high Plains region from Western Texas to western Nebraska over the next ten days - Waves

of precipitation are expected in the eastern parts of hard red winter wheat country - Some

rain is expected in the southeastern parts of wheat country today, but resulting rainfall will be light varying from 0.30 to 1.00 inch and a few amounts to 1.50 inches favoring central Oklahoma - A

few more showers are expected in northern and eastern fringes of crop country during the middle part of next week - California

is expected to be dry over the coming week, but may experience a little mountain rain and snow next week

- Confidence

is low - Water

supply concerns are mounting - U.S.

Midwest, Delta and southeastern states will receive rain and cooler weather this week as a large, slow-moving, trough of low pressure moves across those areas - Temperatures

will be cooler than usual and there is some risk of frost and freezes in Virginia, the Carolinas , northern Georgia, the eastern Midwest, eastern Tennessee and eastern Kentucky during the weekend - Drier

and much warmer weather will then follow during the week next week - Too

much rain will impact the heart of the Midwest, Delta and Tennessee River Basin this week while temperatures become colder biased limiting drying rates

- This

will result in poor drying conditions, too much moisture and some flooding - fieldwork

will be delayed until late this month in all three areas - Concern

will remain over potential planting delays if a more prolonged period of drier and warmer weather does not evolve soon for the central and eastern Midwest, Delta and southeastern states - Warming

will impact the eastern United States next week after late week and weekend cooling occurs in the central and eastern states - Next

week’s temperatures will be notably colder than usual in the north-central U.S. and Canada’s Prairies while temperatures become warmer than usual in the northeastern and east-central parts of the nation - South

Texas, like West Texas, will remain dry or mostly dry over the next ten days and possibly two weeks - This

will leave much concern over dryland cotton, sorghum and corn in South Texas and the Texas Coastal Bend. West Texas has plenty of time to see improved rainfall before planting begins in May.

- A

little rain and snow will fall along the Alberta/Saskatchewan border in Canada this week improving topsoil for a part of the drought stricken region, but much more precipitation will still be needed - U.S.

Mid-South and southeastern states will experience cold temperatures late this week and into the weekend could induce some frost and freezes impacting some of the more advanced winter wheat, but the region is considered to be a minor production area - Fruits

and vegetable crops may be negatively impacted as well - Rain

fell during the weekend in Iowa and other areas east across the northern Midwest and in parts of Oklahoma and northern Texas as well as the Pacific Northwest - Few

areas received more than 0.50 inch, but the moisture was welcome, especially across Iowa - Florida

reported heavy rainfall along the central east coast with Melbourne reporting 5.68 inches – most of which occurred Friday into Saturday. - U.S.

temperatures were mild during the weekend with 40s and 50s Fahrenheit in the afternoons across the Midwest while 70s and 80s occurred in the southern states - Freezes

occurred southward through the Ohio River Valley and from North Dakota to western parts of the Texas Panhandle - Texas

was hotter with highs reaching the 90s Sunday - Southern

Brazil, southern Paraguay and a few northeastern Argentina crop areas will receive waves of rain during the next week to ten days maintaining wet field conditions - Runoff

will continue to raise the Parana River water levels reducing barge restrictions - The

moisture will delay some fieldwork; including some harvesting - The

greatest rain will fall north of Rio Grande do Sul’s rice harvest area, although there will be some periodic harvest delay there as well - Restricted

rain in Mato Grosso do Sul and southern Mato Grosso will continue for ten more days allowing the topsoil to firm, but Safrinha crops will remain rated favorably and will feast upon favorably subsoil moisture - A

frontal system may bring some relief after April 14, but that is a long way out in the forecast and the situation will be closely monitored - A

cold surge expected in Argentina at that time should be sufficient in pushing a mid-latitude frontal system far enough to the north to bring back some relief to the drying region - Make

sure to note that today’s soil is saturated in this region and subsoil moisture will still be good ten days from now while the topsoil firms - Northeast

Brazil will continue dry biased for the next ten days resulting in more crop stress in Bahia, northern Minas Gerais

This

may include a few coffee areas of northern Cerrado Mineiro, but Zona de Mata may get some welcome moisture late this week and into the weekend

- Rain

will fall frequently and abundantly near and north of the Amazon River into Colombia, Venezuela and Ecuador during the next ten days - Rain

will also fall frequently in Peru - Much

of Argentina will get rain at one time or another during the next ten days, although there will be some pockets that are not impacted - Warm

temperatures this week will accelerate drying rates, but much cooler conditions are likely next week and that will conserve moisture through slower evaporation and some rain will accompany the cool down - Temperatures

in South America will be near to above normal over the coming week and then cooler in central and southern Argentina and southern Brazil next week - Excessive

rain fell along the central Vietnam coast late last week and early in the weekend with 4.00 to 16.89 inches of rain resulting from Nha Trang to Hue - Hue

and Da Nang were wettest. The rain actually began Thursday and continued Friday ending Saturday - Flooding

was suspected and some damage to personal property, infrastructure and agriculture was suspected, although not yet confirmed - Heavy

rain and flooding also occurred on the sugar producing islands of Mauritius and Reunion located in the southwestern Indian Ocean.

- The

islands have been impacted by torrential rain multiple times this season due to an active tropical season - Rain

during the weekend came from a tropical low, but the system was not a tropical cyclone - Three

tropical cyclones are predicted in the Eastern Hemisphere this week and two of them will bring the risk of flooding and high wind speeds to Myanmar and the Philippines - The

three storms will develop in the latter part of this week - One

in the southern Bay of Bengal - One

in the South China Sea - One

in the southwestern Pacific Ocean east of the Philippines - A

fourth disturbance will impact the east-central Philippines, but will not be capable of evolving into a tropical cyclone - The

three storms will reach maturity at about the same time late in this coming weekend and early next week - The

largest storm will be over open water in the Pacific Ocean and should not threaten land - The

storm in the South China sea may impact Luzon Island, Philippines during the middle part of next week resulting in torrential rain and flooding, but landfall is too far out in time leaving the potential for changes in the storm’s predicted path - The

storm in the Bay of Bengal may bring rain to the India coast, but is expected to turn to the east northeast in time to spare India, but possibly impact Myanmar - This

landfall is late next week and too far out in time to have much confidence - Waves

of rain and snow will impact Europe and the western Commonwealth of Independent States over the next ten days to two weeks - Soil

moisture will be bolstered in many areas and snow covered areas in Russia may run an eventual risk of flooding when snowmelt occurs while frequent bouts of precipitation are continuing. Spring fieldwork could be delayed. - Temperatures

will be near to below average which may limit drying rates between precipitation events and raising the risk of flooding - Central

and southern Europe and areas from western Ukraine and Belarus to the southern Ural mountains and southern Russia New Lands were wettest during the weekend - Moisture

totals varied from 0.30 to 0.80 inch with a few amounts of 1.00 to 2.00 inches.

- Western

Europe was driest with few areas getting 0.30 inch through Sunday morning. - Northern

Europe and northern Russia were dry biased during the weekend with some cooler than usual conditions - Warming

and drier weather will eventually be needed in Europe and Russia to melt snow, firm the soil, rain soil temperatures and support planting and early season winter crop development. Flooding will delay fieldwork at times in parts of Russia.

- Quebec

and Ontario, Canada weather will be active over the next ten days producing frequent rain and keeping temperatures mild to cool - Northwestern

Africa and southwestern parts of Europe will get rain early to mid-week this week and again next week during the same period of time - The

moisture will be greatest in northern Morocco, but most areas will get at least some rain periodically - India’s

harvest weather will be very good over the next couple of weeks - Precipitation

will be limited to sporadic showers in the far south and more generalized rain in the far Eastern States

- Southeastern

China will be dry biased for much of the coming week - The

break from rainy weather will be ideal for rapeseed development and early season corn and rice planting throughout the south - Improvements

to many crops and field working conditions are likely - Temperatures

will trend warmer, as well - Northern

wheat areas of China will experience some warmer weather this week that may stimulate some greater crop development potential - Rain

is expected late next weekend or early next week briefly to help stimulate greater winter crop development - Mexico’s

dryness and drought have been expanding this winter due to poor precipitation resulting from persistent La Nina - The

region will continue lacking precipitation for an expected period of time - Eastern

and southern Mexico will remain seasonably dry this week and will only receive light rainfall next week - Southeast

Asia rainfall will continue frequent and abundant - No

area in the mainland areas, Philippines, Indonesia or Malaysia are expected to be too dry - Too

much rain may impact east-central Philippines and a part of the northern Malay Peninsula this week - East-central

Africa rainfall will continue greatest in Tanzania, although parts of Uganda and Kenya will get rain periodically as well.

- Ethiopia

rainfall should be most sporadic and light until next week when some increase is expected - West-central

Africa rainfall will continue periodically and sufficient to support coffee and cocoa development - Rainfall

so far this month has been a little sporadic, but no area has been seriously dry biased - Pockets

in Ivory Coast and western Ghana have received less than usual rain, but crop development has advanced well

- Western

Australia will trend drier this week after abundant rain last week - Winter

crop planting is still a few weeks away and some rain will be needed again before planting begins - Eastern

Australia precipitation is expected to be limited today and then increase Wednesday into Friday

- Irrigated

late season sorghum and other crops will continue to develop favorably - Some

of the dryland crop that is still immature still needs greater moisture - Rain

expected briefly later this next week should not seriously harm fiber quality in open boll cotton, although any rain is not welcome at this time of year - South

Africa rainfall over the next couple of weeks will be periodic and sufficient enough to support late season crop development while the impact on mature crops should be low outside of some brief harvest delays - Today’s

Southern Oscillation Index is +10.76 - The

index will move erratically over the next week with a gradual drift lower - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

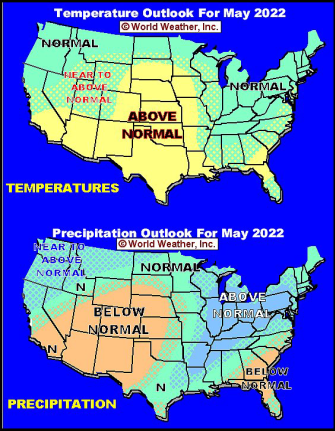

Source:

World Weather Inc.

- USDA

export inspections – corn, soybeans, wheat, 11am - Responsible

Sourcing and Ethical Trade Forum, April 4-5, London - Ivory

Coast cocoa arrivals - HOLIDAY:

China

Tuesday,

April 5:

- U.S.

crop progress and planting data for corn and cotton; winter wheat condition, 4pm - EU

weekly grain, oilseed import and export data - Malaysia’s

April 1-5 palm oil export data - Purdue

Agriculture Sentiment, 9:30am - New

Zealand global dairy trade auction - HOLIDAY:

China, Hong Kong

Wednesday,

April 6:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - New

Zealand Commodity Price - HOLIDAY:

Thailand

Thursday,

April 7:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Vietnam’s

customs department releases coffee, rice and rubber export data for March - Brazil’s

Conab releases data on area, yield and output of corn and soybeans

Friday,

April 8:

- FAO

World Food Price Index - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

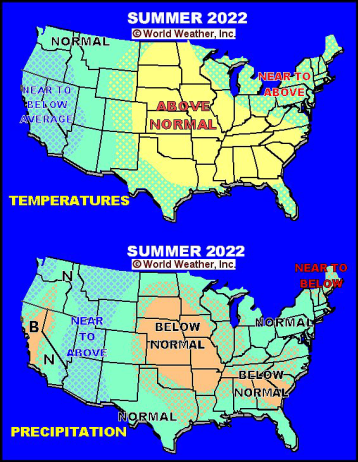

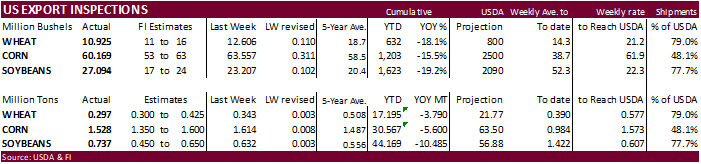

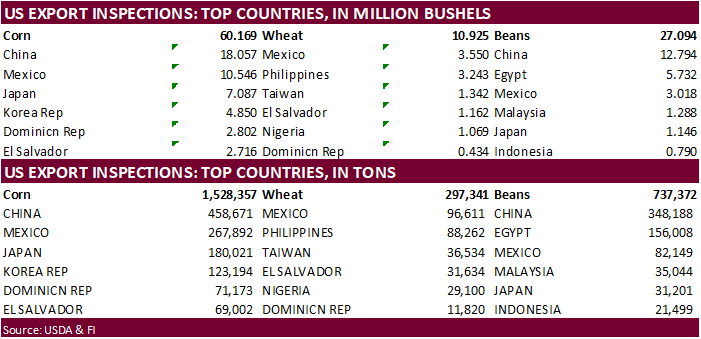

USDA

inspections versus Reuters trade range

Wheat

297,341 versus 250000-550000 range

Corn

1,528,357 versus 800000-1650000 range

Soybeans

737,372 versus 450000-1000000 range

For

second week in a row, China was the highest taker of soybeans and corn. All-wheat was lower than out trade estimates but within a range of a Reuters survey. The report was viewed as neutral for all three major commodities despite lighter total shipments

for this time of year.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAR 31, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 03/31/2022 03/24/2022 04/01/2021 TO DATE TO DATE

BARLEY

0 0 100 10,010 32,620

CORN

1,528,357 1,614,419 2,160,490 30,566,812 36,167,165

FLAXSEED

0 0 0 324 509

MIXED

0 0 0 0 0

OATS

100 0 600 500 5,415

RYE

0 0 0 0 0

SORGHUM

283,656 343,476 239,149 4,450,949 4,688,433

SOYBEANS

737,372 631,604 384,662 44,168,976 54,653,833

SUNFLOWER

192 0 0 724 0

WHEAT

297,341 343,087 637,275 17,194,627 20,984,377

Total

2,847,018 2,932,586 3,422,276 96,392,922 116,532,352

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

Factory Orders (M/M) Feb: -0.5% (est -0.6%; prev R 1.5%)

–

Factory Orders Ex-Trans (M/M): 0.4% (est 0.3%; prev R 1.2%)

US

Durable Goods Orders (M/M) Feb F: -2.1% (est -2.2%; prev -2.2%)

–

Durables Ex-Trans: -0.6% (est -0.6%; prev -0.6%)

–

Cap Goods Orders Nondef Ex-Air: -0.2% (prev -0.3%)

–

Cap Goods Ship Nondef Ex-Air: 0.3% (prev 0.5%)

81

Counterparties Take $1.693 Tln At Fed Reverse Repo Op (prev $1.666 Tln, 77 Bids)

·

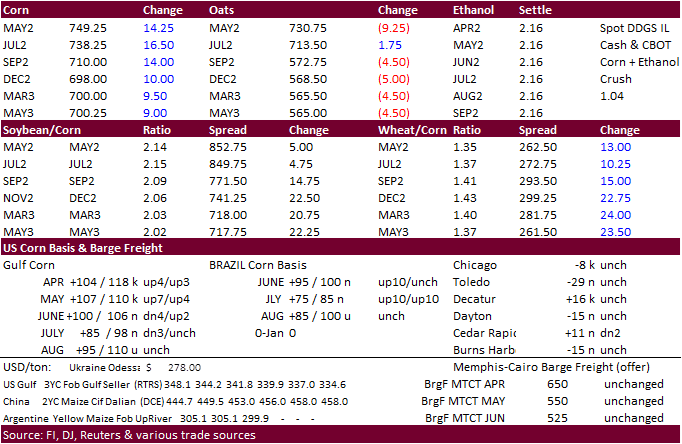

US corn futures were higher Monday on gains in WTI (up about $4.38 mid afternoon) and China buying 2022-23 corn (1.084 million tons) per USDA 24-hour sales. The sale is the largest (new-crop) announcement since May 2021. Inspections

were within expectations. USDA reported another US bird flu outbreak. Spot basis bids for corn firmed at least ethanol plants in Indiana by 3-4 cents.

·

Funds bought an estimated net 15,000 corn contracts.

·

December corn hit a new contract high of $7.0050 earlier.

·

US corn seeding progress was reported by USDA at 2 percent complete, compared to 2 last year and 2 5-year average. Traders looked for 2 percent complete.

·

The Ukraine/Russia situation worsened over the weekend, but talks are still on the table. Look for headline trading this week.

·

USDA US corn export inspections as of March 31, 2022 were 1,528,357 tons, within a range of trade expectations, below 1,614,419 tons previous week and compares to 2,160,490 tons year ago. Major countries included China for 458,671

tons, Mexico for 267,892 tons, and Japan for 180,021 tons.

·

Reuters estimated more than 22 million US chickens and turkeys have been killed since February due to outbreaks of bird flu, not including backyard flocks. USDA on Sunday confirmed an outbreak in Texas, its first case of the year.

In 2015, 50 million US birds were culled due to bird flu.

·

We lowered corn feed use by 50 million for 21-22. 2022-23 corn carry could be very tight if US producers don’t add acres. See attached working US corn balance sheet.

Export

developments.

·

Private exporters reported sales of 1.084 million tons of corn for delivery to China during the 2022/2023 marketing year.

Updated

3/31/22

May

corn is seen in a $6.75 and $8.10 range

December

corn is seen in a wide $5.50-$8.00 range

·

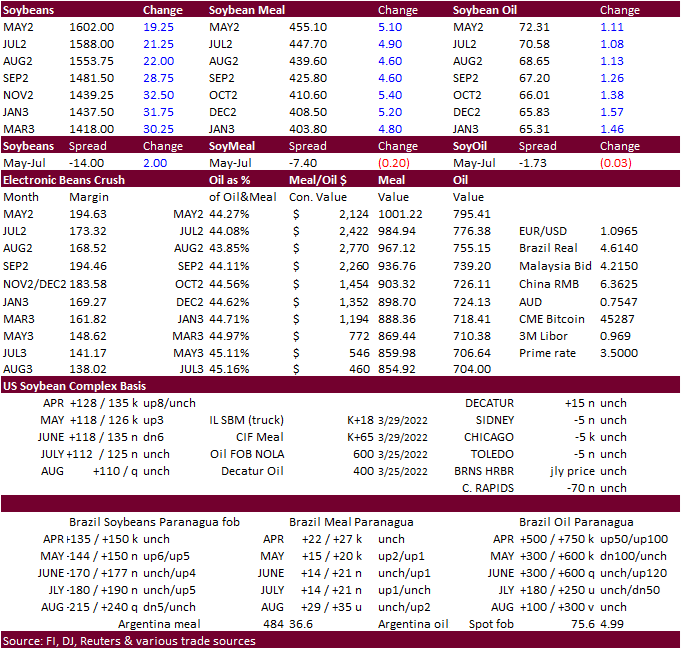

The CBOT soybean complex was higher from world trade shipping concerns, higher outside energy markets and strength in global vegetable oils. Some traders expect demand to increase for US soybeans and products, in part to replacing

oilseeds and sunflower oil that would be normally shipped from Russia and Ukraine. Brazil March soybean exports were 12.3 million tons, down 3.1% from year earlier. Chinese crush margins have been mostly unfavorable during Q1.

·

Funds bought an estimated net 11,000 soybean contracts, bought 3,000 meal and bought 4,000 soybean oil.

·

USDA US soybean export inspections as of March 31, 2022 were 737,372 tons, within a range of trade expectations, above 631,604 tons previous week and compares to 384,662 tons year ago. Major countries included China for 348,188

tons, Egypt for 156,008 tons, and Mexico for 82,149 tons.

·

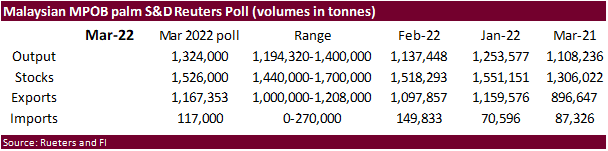

MPOB is due out April 11. Traders look for Malaysian palm oil stocks as of 3/31 to fall to a one year low. On Monday

June

Malaysian palm oil settled 126 ringgit higher to 5,692 (does not include third session). Cash palm was up $25 at $1,515 per ton.

·

China is on holiday, returning Wednesday.

·

AgRural reported 81 percent of the Brazil soybean crop harvested, up 6 points from the previous week and 3 points above year ago while 5 points above a five-year average.

·

China will auction another 500,000 tons of imported soybeans from its reserves on April 7.

- Results

awaited: Qatar seeks to buy 960k cartons of corn oil in a tender closing April 4.

- USDA

seeks 2,710 tons of packaged oil on April 7 for May shipment (May 23-June 13 for plants at posts).

Updated

3/31/22

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $430-$500

Soybean

oil – May 68.50-74.00

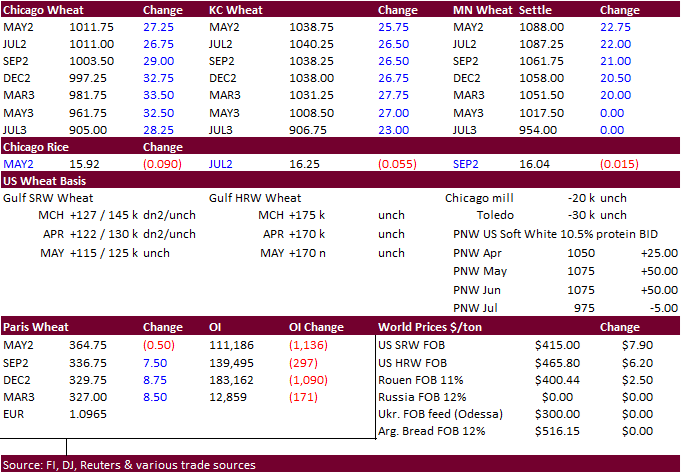

Wheat

·

US winter wheat ratings were rated at only 30 percent for the G/E categories, which should send futures higher tonight.

·

US wheat futures were higher Monday in a quiet and light trade. Strong global demand and higher outside related markets supported US wheat futures while EU wheat closed mixed. There is a consensus US wheat exports may increase

at the expense of Black Sea shipping woes, but figuring that amount is a complete guess. Saudi Arabia bought a larger amount of wheat than expected. Origin is unknown currently, but we did hear it did not include any Canadian wheat. The Saudi import tender

is a reminder several major importing countries might be getting covered before global prices rise further.

·

Funds bought an estimated net 14,000 Chicago wheat contracts.

·

Kazakhstan is considering temporally limiting grain and four exports, another blow for world trade flows if realized.

·

May Paris wheat futures were down 0.50 euro to 363.75 euros.

·

Initial US winter wheat rating was reported a record low 30 percent for the combined good and excellent categories (record for early April), well below 53 percent year ago and 51 percent 5-year average. Traders looked for 40 percent.

This is bullish. But there is still time for the US Great Plains to see a soaking that could improve the crop.

·

Combined TX, OK, KS, CO, & NE winter wheat planted acres make up 60 percent of the US 34.236 million acres total.

·

Spring wheat seeding progress for the US was reported at 3 percent complete, compared to 5 last year and 3 percent for the 5-year average. Traders looked for 2 percent complete.

·

USDA US all-wheat export inspections as of March 31, 2022 were 297,341 tons, within a range of trade expectations, below 343,087 tons previous week and compares to 637,275 tons year ago. Major countries included Mexico for 96,611

tons, Philippines for 88,262 tons, and Taiwan for 36,534 tons.

·

Egypt said they have wheat reserves to last only 2.6 months, less what we would have expected. But that does not include what they seek to procure from local producers. Last month they stated they will have enough wheat to last

through the end of 2022, after securing local wheat. If they do tender soon, they might be in for NA and/or Asian wheat. Note Egypt recently was negotiating with India, so don’t discount that as an origin.

·

Russia continues to ship wheat, with about 421,000 tons reported for the week ending April 3, according to AgriCensus. Destinations included Egypt, Lebanon, and Turkey.

·

India exported about 7.85 million tons of wheat so far during 2021-22. They are looking at a bumper production this year, sixth consecutive surplus if realized.

·

Ukraine increased their grain planted area for 2022, now seen at 13.4 million hectares, 3.5 million less than last year.

·

Uzbekistan plans to buy up to 600,000 t of grain for state stockpiles.

·

Saudi Arabia bought 625,000 tons of 12.5% protein wheat (355,000 tons sought) for Sep-Nov delivery. The average price was $422.47/ton. Origins offered included EU, Black Sea, NA, SA, and Australia.

·

Last week Iraq bought 100,000 tons of German wheat at an average price of $570/ton. The deadline for the tender was March 24 and was initially for April through May shipment.

·

Iraq again seeks wheat this week.

·

Results awaited: Lowest offer $406.83/ton. Bangladesh is in for 50,000 tons of wheat with a deadline of April 4.

Bangladesh

seeks 50,000 tons of wheat on April 11 for shipment within 40 days after contract signing.

·

Jordan seeks 120,000 tons of milling wheat on April 6 for LH May and/or through July shipment.

·

Jordan seeks 120,000 tons of feed barley on April 5.

Rice/Other

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

Updated

3/31/22

Chicago

May $9.00 to $12.00 range, December $8.50-$11.00

KC

May $9.00 to $12.00 range, December $8.75-$11.50

MN

May $9.75‐$12.00, December $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.