PDF Attached

OPEC+

may cut crude oil production (see macro section).

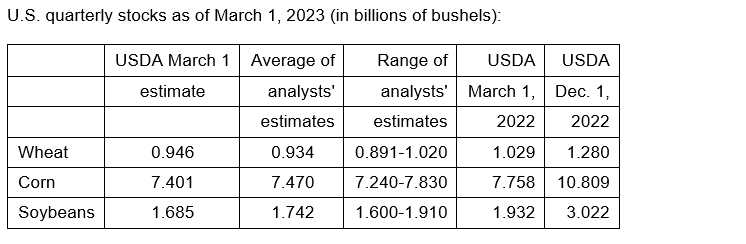

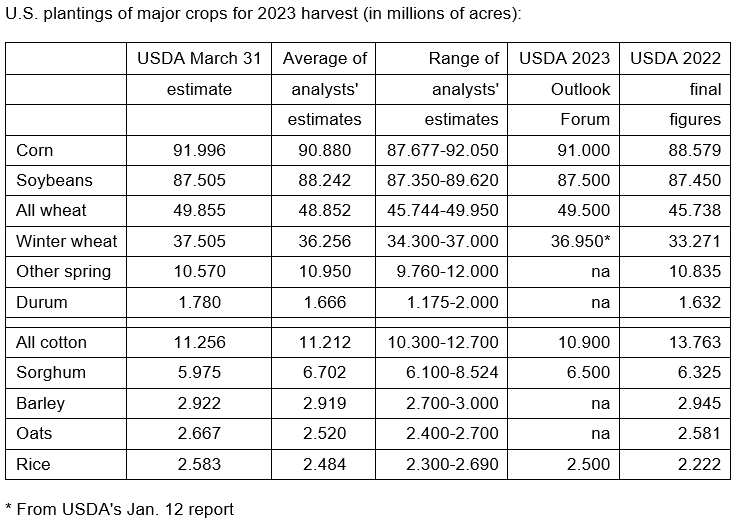

USDA

reported a bullish soybean March 1 stocks estimate and 2023 soybean planted area. The stocks estimate for soybeans could suggest a lower than expected 2022 US production, but the trade needs to wait until the end of September to see if USDA downward revises

output. Corn stocks coming in below expectations indicate less corn feed for the 2022-23 crop year, and USDA next month may lower the corn residual by 50-75 million bushels. US corn acres were well above an average trade guess and warranted the bull spreading

with nearby soybeans climbing 31 cents (spill over). All wheat stocks were reported slightly higher than trade expectations. All wheat plantings were above expectations led by winter wheat and durum. Higher protein wheat ended higher. Our trade estimate vs.

actual and new-crop price change historical table is attached. Also attached is our US 2023 updated planted area for selected crops that show the 15 crop total came in below our expectations but were likely above what the trade was looking for. Going forward,

we see the total US crop area trending lower. USDA tends to report a large March US 15-crop figure then work down from that throughout the crop year. There is still time to switch from corn to soybeans. USDA may report spring and corn planting progress Monday

afternoon (1-2 percent for both).

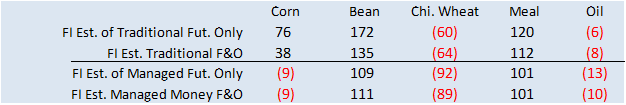

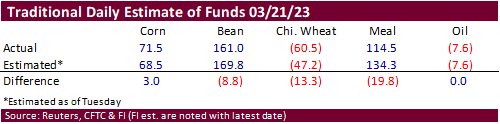

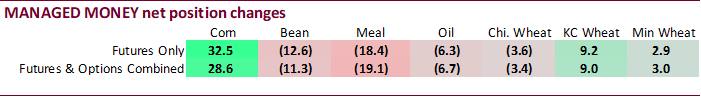

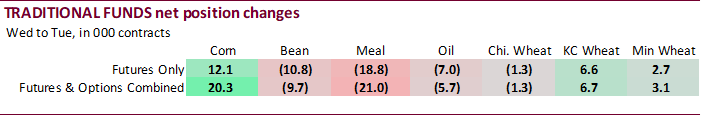

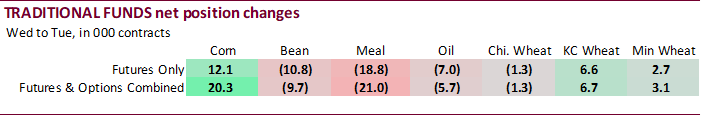

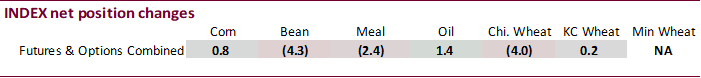

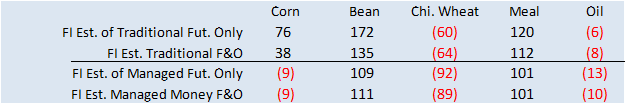

Fund

estimates as of March 31

World

Weather Inc.

-

DRY

AREAS TO WATCH -

Spain,

North Africa, the lower Danube River Basin, Yunnan (China), U.S. western high Plains, the Yakima Valley of Washington and north-central Oregon, Mexico, southwestern Canada’s Prairies an interior eastern and southern Australia (although these areas should get

moisture in the autumn) -

WET

AREAS TO WATCH -

U.S.

Red River Basin of the North, Northern Mississippi River Basin, California, U.S. Delta and Tennessee River Basin, southern Manitoba (Canada), northwestern Russia, China’s Yangtze River Basin and portions of Indonesia and Malaysia -

PACIFIC

DECADAL OSCILLATION (PDO) -

Remains

strong and expected to continue strong, although some weakening is likely over time -

ENSO

CONDITIONS -

Neutral

ENSO conditions are prevalent today, although the footprint of the past three years of La Nina is lingering so that many La Nina related weather anomalies are still prevailing -

El

Nino development is likely later this year -

Southern

Oscillation Index today was -2.07 and it was expected to move erratically lower over the coming week

MOST

IMPORTANT WEATHER OF THE DAY

-

U.S.

southwestern Plains may experience some showers late next week and into the following weekend, but resulting precipitation is unlikely to be enough to seriously change topsoil moisture -

06z

GFS model run was too wet around April 10 and will not verify -

Central

U.S. hard red winter wheat production areas are advertised to be drier biased for the next ten days -

Warm

weather Thursday stimulated faster drying especially with strong wind speeds -

Temperatures

will be bounce around for a while in this first week of the outlook and then may become more consistently warm in the second week of April -

Unusual

cold in Canada’s Prairies and the western and north-central United States will abate after this first week of the outlook -

There

will be lingering coolness in the snow covered areas in the north-central states in the second week, but enough warming is expected to induce some snowmelt -

U.S.

Delta and southeastern states are being plagued by too much rain and soggy field conditions -

This

trend will continue for the next ten days resulting in limited fieldwork -

Drier

and warmer weather must evolve soon to get fieldwork back on track especially in the Delta and Tennessee River Basin -

U.S.

lower Midwest will experience waves of rain in the coming ten days keeping the ground saturated or nearly saturated which may lead to some delay in the start of spring planting -

Texas

Blacklands, Coastal Bend and a part of South Texas will get some rain next week and into the following weekend to benefit corn, sorghum and cotton planting -

California’s

succession of storms will be diminishing for a while and warming will slowly start to the snowmelt season -

Runoff

this year will be significant when temperatures heat up significantly resulting in the need to release water through the state’s dams which may lead to flooding of some agricultural land near important rivers and streams

-

Canada’s

Prairies will not likely see an abundance of precipitation for a while and temperatures will trend warmer after next week -

The

environment should begin melting snow more consistently, but the drier areas that do not have much snow on the ground will only dry out additionally during the period

-

The

Yakima Valley of Washington and north-central Oregon are drier than usual this year and that trend will continue over the next ten days.

-

A

boost in precipitation would be good for unirrigated winter and spring crop areas, although there is no crisis -

Southern

Argentina will continue to dry out over the next ten days, but sufficient subsoil moisture in some areas will carry on favorable crop development -

Central

and northern Argentina will experience frequent precipitation over the next ten days resulting in a bolstering of topsoil moisture and possibly some disruption to early season grain and oilseed harvesting -

Open

boll cotton may experience some discoloring as well -

Brazil

weather is still perceived as being mostly very good -

Recent

drying in center south crop areas has been promoting fieldwork; including the late harvest of soybeans -

Rain

is expected to begin again in the second week of the forecast and that should help replenish topsoil moisture in support of Safrinha crop development -

Northern

India will receive additional showers this weekend bringing down crop quality in many winter wheat and other crop areas in the north -

Crop

quality declines have been ongoing in some of the far north in the past couple of weeks -

Europe

and the western CIS will continue in an active weather pattern for a while with frequent bouts of rain expected that will keep soil moisture adequate to abundant -

Some

excessive soil moisture is expected to continue especially in western Russia, the Baltic States, Belarus and western Ukraine -

Planting

delays may evolve later this spring in drying does not evolve, but there is plenty of time for that -

Russia’s

Southern Region, Kazakhstan and eastern Ukraine weather is expected to remain mostly very good for winter crops and for the planting of spring crops -

China’s

North China Plain will receive some much needed rain this weekend lifting soil moisture for improved winter wheat development and in support of spring planting -

China’s

rapeseed region will experience an abundance of rain again next week, but the region will dry down for a few days first -

Too

much rain occurred for a while in this past week and drying was needed -

Yunnan,

China is too dry and needs moisture for early season corn and rice as well as other crops -

Indonesia,

Malaysia and Philippines rainfall will continue abundant for another week to ten days, but may trend a little drier in the following ten days -

Mainland

areas of Southeast Asia are experiencing a favorable environment for pre-monsoonal precipitation -

East-central

Africa rainfall will continue to fall abundantly and will likely be more than sufficient to maintain coffee and cocoa crop needs -

West-central

Africa rainfall will continue scattered frequently, but some days will be wetter than others -

Most

of the region’s coffee, cocoa, sugarcane and rice will benefit from the rain that does fall, but a few areas will need greater volumes of it -

Cotton

areas will need greater rain soon -

South

Africa weather will remain well mixed for support of corn, sorghum, sunseed, soybeans, rice, cotton, citrus sugarcane and other crops -

Production

potentials are high late summer weather is mostly very good -

Eastern

Australia rainfall will be sporadic favoring easternmost cotton and sorghum areas -

Western

and southern Australia would benefit from increasing rainfall during April to raise soil moisture for the start of autumn planting -

Mexico

drought will continue into April, although there will be some periodic opportunity for rain in eastern parts of the nation starting at mid-week this week and lasting into next week -

Central

America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days -

Net

drying is likely in portions of Honduras and Nicaragua -

Southeastern

Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away -

Turkey

will receive frequent bouts of rain over the next ten days bolstering soil moisture for wheat development and rice and cotton planting -

Portions

of the nation are already wet after recent rain and mountain snow -

Other

spring planting will benefit from the coming moisture boost -

Other

areas in the Middle East will experience lighter and less frequent rain for a while

Source:

World Weather, INC.

Bloomberg

Ag calendar

Monday,

April 3:

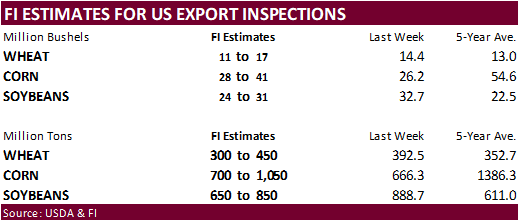

- USDA

export inspections – corn, soybeans, wheat, 11am - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - US

planting data for corn, cotton, spring wheat and soybeans, 4pm - US

crop condition data for winter wheat, 4pm

Tuesday,

April 4:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - Purdue

Agriculture Sentiment, 9:30am - HOLIDAY:

India

Wednesday,

April 5:

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysia’s

April 1-5 palm oil export data - HOLIDAY:

China, Hong Kong

Thursday,

April 6:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - New

Zealand commodity prices - HOLIDAY:

Argentina, Thailand

Friday,

April 7:

- FAO

World Food Price Index, grains report - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Good

Friday holiday in several countries

Source:

Bloomberg and FI

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

-31,469 21,329 282,504 770 -191,463 -27,730

Soybeans

87,169 -7,824 124,092 -4,349 -176,311 11,130

Soyoil

-31,620 -6,010 102,345 1,353 -70,954 3,933

CBOT

wheat -77,553 2,582 76,441 -4,006 -207 1,602

KCBT

wheat -12,675 5,992 44,669 193 -28,556 -5,853

================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

-13,288 28,607 228,874 2,186 -203,547 -28,097

Soybeans

99,522 -11,265 90,611 -1,946 -180,065 10,617

Soymeal

96,129 -19,085 86,984 -254 -211,867 21,037

Soyoil

-12,459 -6,743 107,498 1,179 -97,791 3,830

CBOT

wheat -89,873 -3,374 62,752 -187 1,392 1,701

KCBT

wheat 237 8,997 35,786 -369 -30,595 -5,964

MGEX

wheat 420 3,044 1,376 71 -3,633 -3,000

———- ———- ———- ———- ———- ———-

Total

wheat -89,216 8,667 99,914 -485 -32,836 -7,263

Live

cattle 62,631 -1,117 43,611 -329 -123,388 890

Feeder

cattle 6,687 -454 1,614 -120 -2,528 -524

Lean

hogs -22,483 -5,908 46,526 -1,091 -23,793 6,291

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

47,532 -8,327 -59,572 5,630 1,670,838 -19,991

Soybeans

24,881 1,550 -34,949 1,044 886,818 19,028

Soymeal

10,759 -1,938 17,994 241 466,859 -14,753

Soyoil

2,524 1,010 228 723 506,284 9,827

CBOT

wheat 24,412 2,037 1,318 -179 446,151 -8,640

KCBT

wheat -1,987 -2,333 -3,439 -332 188,039 -551

MGEX

wheat 2,458 29 -621 -144 64,799 4,416

———- ———- ———- ———- ———- ———-

Total

wheat 24,883 -267 -2,742 -655 698,989 -4,775

Live

cattle 22,306 -1,220 -5,159 1,778 387,092 -9,194

Feeder

cattle 3,565 678 -9,338 420 79,004 2,388

Lean

hogs -2,870 901 2,621 -192 313,667 2,809

April

2 (Reuters) – Saudi Arabia and other OPEC+ oil producers on Sunday announced further cuts in their production amounting to around 1.16 million barrels per day in a surprise move that analysts said would cause an immediate rise in prices. The development comes

a day before a virtual meeting of an OPEC+ ministerial panel, which includes Saudi Arabia and Russia, and which had been expected to stick to 2 million bpd of cuts already in place until the end of 2023.

US

Personal Income Feb: 0.3% (est 0.2%; prev 0.6%)

US

Personal Spending Feb: 0.2% (est 0.3%; prev 1.8%)

US

Real Personal Spending Feb: -0.1% (est -0.1%; prev 1.1%)

US

PCE Core Deflator (M/M) Feb: 0.3% (est 0.4%; prevR 0.5%)

US

PCE Core Deflator (Y/Y) Feb: 4.6% (est 4.7%; prev 4.7%)

US

PCE Deflator (M/M) Feb: 0.3% (est 0.3%; prev 0.6%)

US

PCE Deflator (Y/Y) Feb: 5.0% (est 5.1%; prevR 5.3%)

US

Univ. Of Michigan Sentiment Mar F: 62.0 (est 63.3; prev 63.4)

–

Current Conditions: 66.3 (est 66.4; prev 66.4)

–

Expectations: 59.2 (est 61.4; prev 61.5)

–

1-Year Inflation: 3.6% (est 3.8%; prev 3.8%)

–

5-10 Year Inflation: 2.9% (est 2.8%; prev 2.8%)

Canadian

GDP (M/M) Jan: 0.5% (est 0.4%; prev -0.1%)

Canadian

GDP (Y/Y) Jan: 3.0% (est 2.9%; prev 2.3%)

·

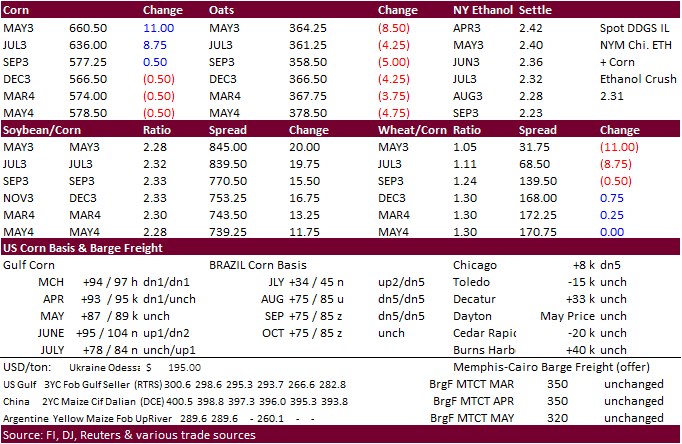

Corn futures rallied for old crop and ended slightly lower for new crop after nearby soybeans supported the May through September contracts and a larger than expected US corn area kept new-crop contracts on the defensive. May

corn ended 11 cents higher and December down 0.50 cent. US corn stocks as of March 1 were lowest in 9 years. Plantings are expected to increase 4 percent from last year.

·

CME hogs for the back month contracts were higher Friday after USDA reported a lows sows figure Thursday.

·

Safras & Mercado: Brazil center-south corn production at 23.7 MMT, up from 21.9 MMT previous and 21.9 MMT last season.

·

Ukraine planted 500,000 hectares of spring grains as of late last week. The grain area could decline 12 percent from 2022.

·

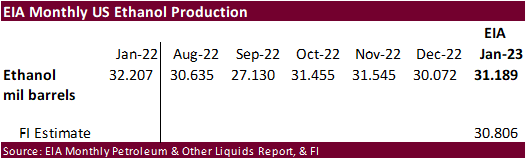

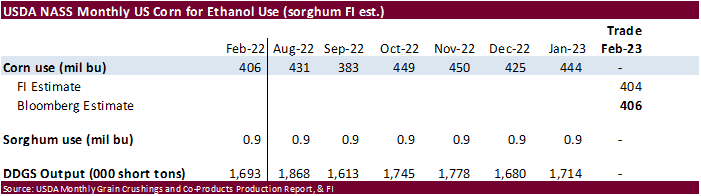

We kept our corn for ethanol use unchanged at 5.225 billion, 25 million below USDA.

Export

developments.

Updated

03/31/23

May

corn $6.00-$7.15

July

corn $5.75-$7.00

·

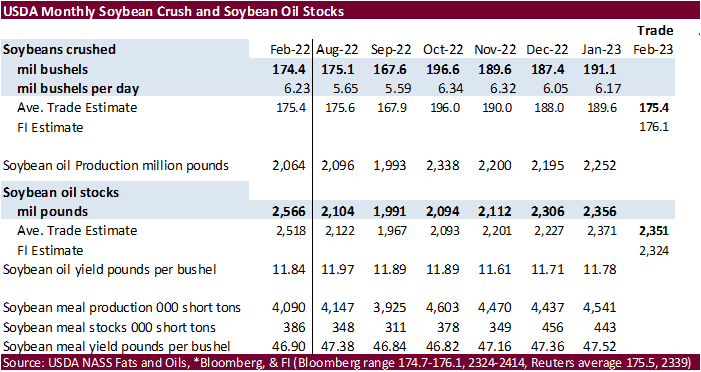

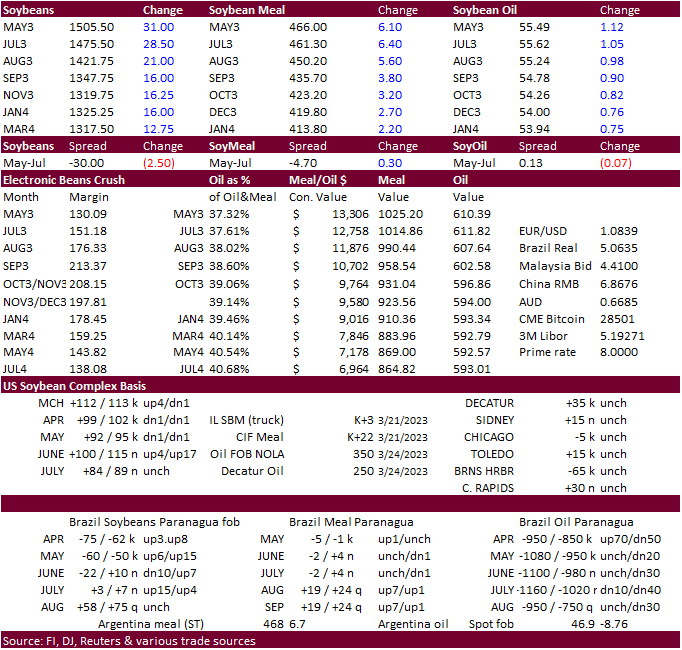

US soybeans rose by nearby May contract on much lower than expected March 1 stocks. New crop was higher on a below average US 2023 soybean planted area. May futures rose above $15 for fist time since March 13. May soybeans ended

the month up 31 cents. The 87.5 million acre estimate is slightly above 2022. Stocks were reported 13 percent below year ago.

·

USDA S&D polls should be out in a few business days.

·

ITS reported March Malaysian palm oil exports up 24 percent from February at 1.438 MMT. AmSpec reported a 32 percent increase to 1.402 MMT.

·

Argentina’s Rosario port strike last week is not expected to have a major impact on grain exports.

·

Argentina’s Buenos Aires grains exchange left booth its soybean and corn production unchanged last week at 25 million tons and 36 million, respectively.

·

More details on Argentina’s new soybean dollar might be released next week. It’s expected to go into effect this month.

·

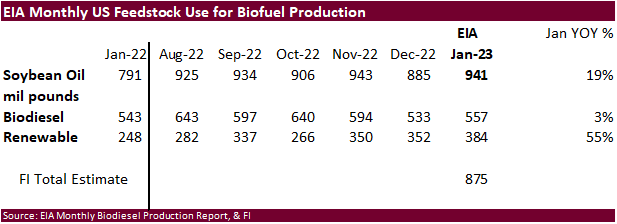

The Argentina announcement initially pressured CBOT meal futures before the USDA report on Friday, but oil share closed higher anyway at the end of the week after EIA’s feedstock update, friendly for SBO.

·

USDA is too low for 2022-23 US soybean oil for biodiesel use.

·

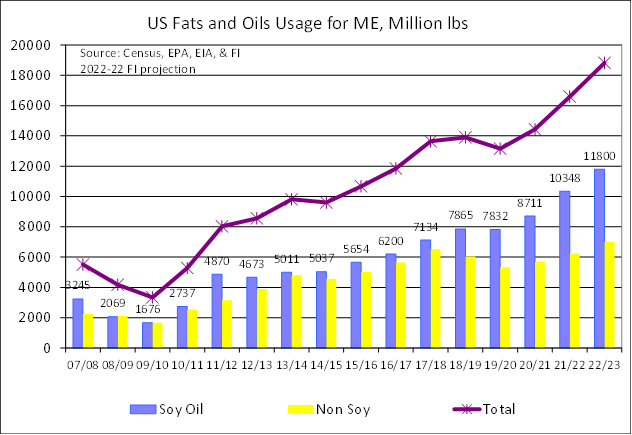

EIA reported January soybean oil for biodiesel use at 557 million pounds and renewable use at 384 million pounds, a 941 million pounds total, up from a combined 885 million for December and 791 million year earlier. Renewable

use of 384 million was up from 352 million for December and 248 million for January 2022. We are 200 million pounds above USDA for total SBO for biodiesel use at 11.8 billion pounds, unchanged from our previous estimate. Graphs attached after text.

Export

Developments

·

China’s Sinograin late last week sold 15,003 tons of soybean oil at auction at an average price of CNY 233/ton. They sold 92,379 tons for the year. The 15k represented 38 percent of the total. (AgriCensus)

Updated

03/31/23

Soybeans

– May $14.25-$15.50, November $12.25-$15.00

Soybean

meal – May $410-$500, December $325-$500

Soybean

oil – May 52.00-58.00,

December 49-58

·

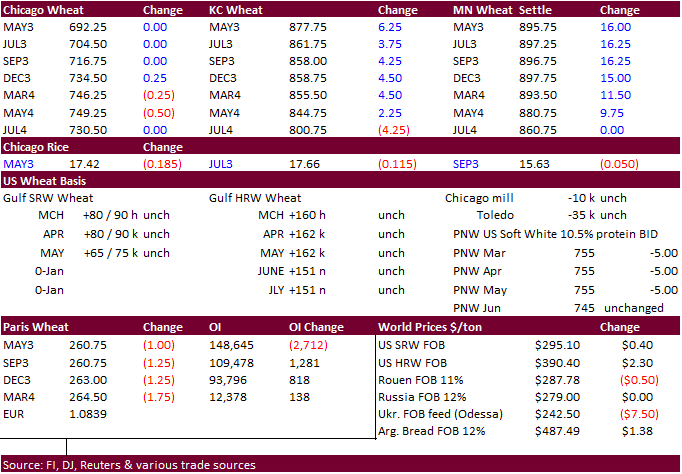

Mixed trade for US wheat futures with nearby contracts for Chicago unchanged and KC and MN higher. USDA reported a higher than expected US winter wheat crop area. All-wheat stocks were near expectations but down 8 percent from

2022. CBOT May Chicago wheat fell 13.25 cents for the month. US all-wheat plantings for 2023 of 49.9 million acres were up 9% from 2022, but spring wheat seedings were down 2 percent from 2022.

·

EU May milling wheat was down 1.00 euro at 260.25.

·

On Thursday the EU Commission raised their estimate of EU soft wheat exports to 36.0 MMT from 32.00 month earlier, which would be up 23 percent from the previous season if realized.

·

Last week’s announcements of two major grain exporting companies either weighing on, and/or exiting the Russian grain trade is leaving many to question whether or not Russia will be able to keep pace of their rapid export program.

·

Turkey said more than 20 percent of their food production was lost from earthquakes. Initial assessment points to $1.3b in damage and $5.1b in losses to the agriculture sector, according to Bloomberg.

·

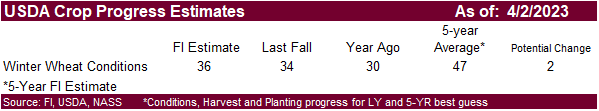

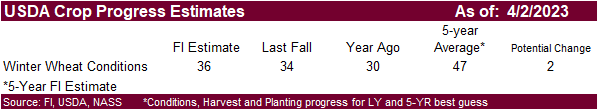

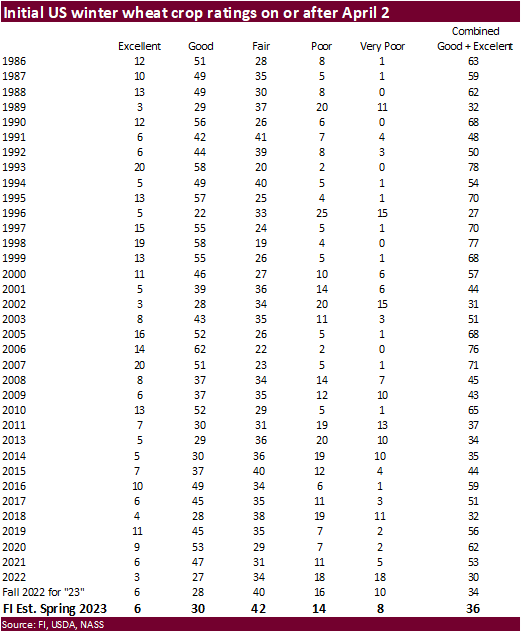

USDA will resume national winter wheat crop ratings Monday, April 3. Our initial estimate for the US combined winter wheat good and excellent categories below. Spring wheat could end up 1-2 percent and corn 1 percent.

Export

Developments.

·

Jordan seeks 120,000 tons of barley on April 4 for Sep and/or Oct shipment.

·

Jordan seeks 120,000 tons of wheat on April 5 for Sep and/or Oct shipment.

·

China will auction off wheat from state reserves in two batches next week.

Rice/Other

·

USDA may report rice planting progress around 8 percent on Monday.

Updated

03/31/23 (no change)

KC

– May $8.00-9.25

MN

– May

$8.50-$9.50

#non-promo