PDF Attached

Private

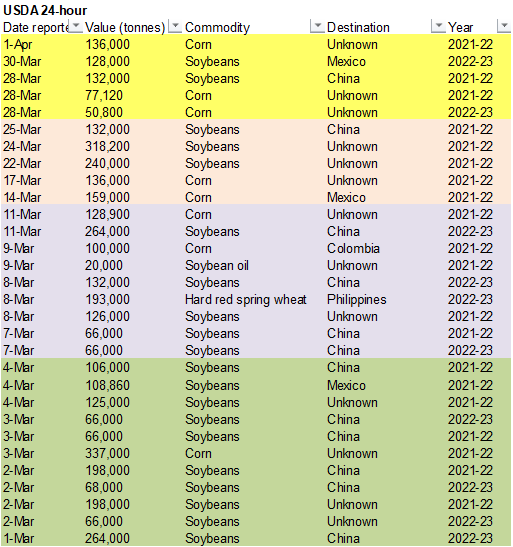

exporters reported sales of 136,000 metric tons of corn for delivery to unknown destinations during the 2021/2022 marketing year.

Soybeans

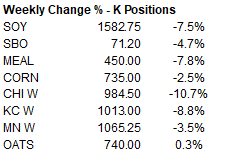

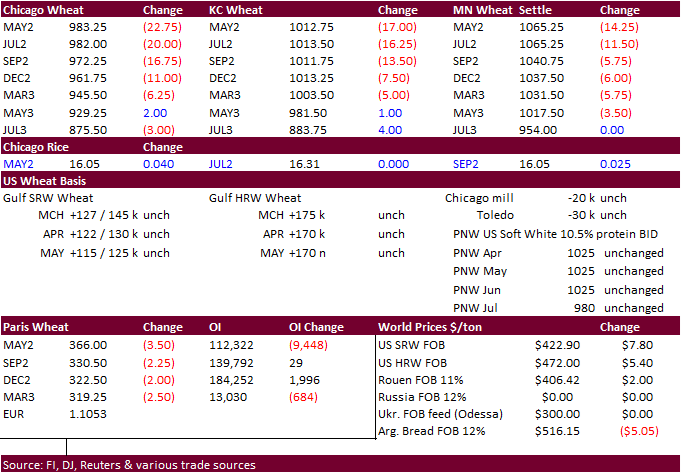

ended sharply lower, meal lower, and soybean oil higher as traders continue to piece together data from the USDA reports. Corn ended mixed with nearby lower and back months higher. Wheat finished the week lower, and nearby Chicago was down nearly 11 percent.

WEATHER

EVENTS AND FEATURES TO WATCH

- Not

many changes were noted overnight around the world - Additional

heavy rain fell in along the central Vietnam coast Wednesday as Tropical Depression 01W moved up the coast and enhanced the northeast monsoon flow.

- Another

7.00 inches of rain fell after a previous day of excessive moisture occurred Wednesday

- Two

days of precipitation along the coast may have caused some flooding - The

disturbance left over from the now dissipated tropical system could produce some additional rain Vietnam this weekend - No

serious changes occurred to the U.S. outlook overnight - The

Midwest, Delta and Tennessee River Basin will have a tough time getting significant drying time over the next ten days - Light

rain events will continue to come and go, but temperatures may not be very conducive of quick drying which may delay fieldwork for a while longer - Temperatures

will be warm enough in the lower Delta to induce some faster drying, but the northern Delta, Tennessee River Basin and lower Midwest will stay wet for a while - Western

parts of the U.S. hard red winter wheat production region will receive limited precipitation over the next ten days - West

and South Texas will also continue dry for the next ten days - California

will get limited precipitation over the next week to ten days - Canada’s

southwestern Prairies and a part of the northwestern U.S. Plains will have a chance to get “some” precipitation in the second week of the forecast, but until then precipitation prospects of significance are not very good - U.S.

Southeastern States will see a good mix of precipitation and sunshine over the next two weeks.

- Frost

and freezes are still possible the U.S. Mid-South and southeastern states at the end of next week or into the following weekend - This

might raise the potential for some crop damage to winter wheat and any early planted and emerged corn, but it is too soon to determine how cold it will be and how far to the south - Conditions

are not ideal for a notable freeze, but temperatures will be well below average for a few days - The

situation should be closely monitored, though - Southwestern

and west-central Argentina will received restricted rainfall during the next ten days, although not necessarily completely dry - The

environment is not likely to be a problem since soil moisture will be conserved by mild to cool temperatures - Northeastern

Argentina, southern Brazil and southern Paraguay will get frequent waves of rain this weekend through April 12 resulting in too much moisture for some crop areas - River

and stream flows have already increased; including the Parana river where barge traffic has been increasing with the recent harvest - Local

flooding is possible next week, but the rain should be spaced out enough to prevent a serious flood from occurring - Brazil

coffee, sugarcane and minor grain and oilseed production areas form central Minas Gerais to Bahia continues to dry out, but the impact should be low - Coffee

quality might decrease in some minor unirrigated production areas - Sugarcane

sucrose will increase and there may be some stunting of late season cane development, but the sucrose changes should leave production unimpacted - Most

other crop areas in Brazil will experience timely rainfall to support Safrinha crops and late full season crops develop well - Soil

moisture is abundant outside of the northeast corner of the nation leaving crops to develop well - Central

Europe to west-central Russia will be wetter biased for a while during the coming week - Some

heavy snow is expected from southern Germany through northwestern Ukraine and southeastern Belarus to the Ural Mountains - The

snow might contribute to spring flooding since the moisture content will be high in the snow and the ground is suspected of being wet beneath the snow - Europe

and northwestern Russia temperatures will be cooler than usual over the coming week with some warming expected in western Europe during the second week of the outlook - Northwestern

Africa and southwestern parts of Europe will continue to receive periodic precipitation that will serve winter wheat, barley and some spring crops well - Additional

precipitation is predicted for the Russian New Lands during the weekend and especially next week - The

moisture will be ideal for spring planting - Most

of the precipitation is now advertised to stay north of the Kazakhstan border - India’s

harvest weather will be very good over the next couple of weeks - Precipitation

will be limited to sporadic showers in the far south and more generalized rain in the Eastern States

- Southeastern

China will be dry biased for much of the coming week to ten days - The

break from rainy weather will be ideal for rapeseed development and early season corn and rice planting throughout the south - Improvements

to many crops and field working conditions are likely - Temperatures

will trend warmer, as well - Northern

wheat areas of China will experience some warmer weather next week that may stimulate some greater crop development potential - Mexico’s

dryness and drought have been expanding this winter due to poor precipitation resulting from persistent La Nina - The

region will continue lacking precipitation for an expected period of time - Eastern

and southern Mexico will remain seasonably dry this week and will only receive light rainfall next week - Southeast

Asia rainfall will continue frequent and abundant - No

area in the mainland areas, Philippines, Indonesia or Malaysia are expected to be too dry - Too

much rain may impact northeastern Philippines next week - East-central

Africa rainfall will continue greatest in Tanzania, although parts of Uganda and Kenya will get rain periodically as well.

- Ethiopia

rainfall should be most sporadic and light - West-central

Africa rainfall will continue periodically and sufficient to support coffee and cocoa development - Rainfall

so far this month has been a little sporadic, but no area has been seriously dry biased - Pockets

in Ivory Coast and western Ghana have received less than usual rain, but crop development has advanced well

- North

Africa rainfall will be greatest today and Thursday with some follow up showers early to mid-week next week in Morocco and northern Algeria - Crop

conditions will improve as a result of the rain - Western

Australia will continue to receive brief periods of rain through the weekend, although much of it be light and sporadic - The

additional moisture will further boaster topsoil moisture for use in the autumn wheat, barley and canola planting season that begins in late April - Eastern

Australia precipitation is expected to be limited the remainder of this week bringing on a better environment for cotton in the open boll stage of development - The

drier weather will also be good for early season planting which begins soon - Irrigated

late season sorghum and other crops will continue to develop favorably - Some

of the dryland crop that is still immature still needs greater moisture - Rain

is expected briefly during the weekend and early part of next week, but it should not seriously harm fiber quality, although any rain is not welcome at this time of year - South

Africa rainfall over the next couple of weeks will periodic and sufficient enough to support late season crop development while the impact on mature crops should be low outside of some brief harvest delays - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Today’s

Southern Oscillation Index is +11.96 - The

index will move erratically over the next ten days - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Australia

Commodity Index - USDA

soybean crush, DDGS output, corn for ethanol, 3pm - FranceAgriMer

weekly update on crop conditions

Sunday,

April 3:

- Egypt’s

government this month started a local procurement program to buy wheat from its domestic harvest to counter expected shortages of supply from Ukraine

Monday,

April 4:

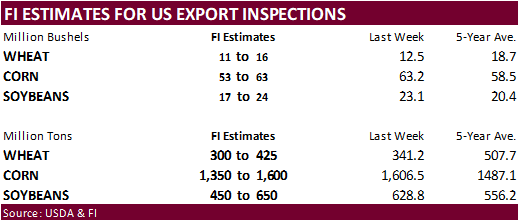

- USDA

export inspections – corn, soybeans, wheat, 11am - Responsible

Sourcing and Ethical Trade Forum, April 4-5, London - Ivory

Coast cocoa arrivals - HOLIDAY:

China

Tuesday,

April 5:

- U.S.

crop progress and planting data for corn and cotton; winter wheat condition, 4pm - EU

weekly grain, oilseed import and export data - Malaysia’s

April 1-5 palm oil export data - Purdue

Agriculture Sentiment, 9:30am - New

Zealand global dairy trade auction - HOLIDAY:

China, Hong Kong

Wednesday,

April 6:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - New

Zealand Commodity Price - HOLIDAY:

Thailand

Thursday,

April 7:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Vietnam’s

customs department releases coffee, rice and rubber export data for March - Brazil’s

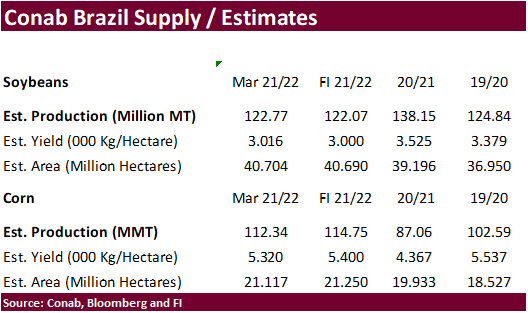

Conab releases data on area, yield and output of corn and soybeans

Friday,

April 8:

- FAO

World Food Price Index - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Selected

Brazil commodity exports

Commodity

March 2022 March 2021

CRUDE

OIL (TNS) 5,457,667 6,425,257

IRON

ORE (TNS) 28,782,651 28,331,899

SOYBEANS

(TNS) 12,308,982 12,693,892

CORN

(TNS) 14,278 292,013

GREEN

COFFEE(TNS) 203,112 241,605

SUGAR

(TNS) 1,443,921 1,970,225

BEEF

(TNS) 169,406 133,821

POULTRY

(TNS) 384,969 366,505

PULP

(TNS) 1,574,748 1,448,271

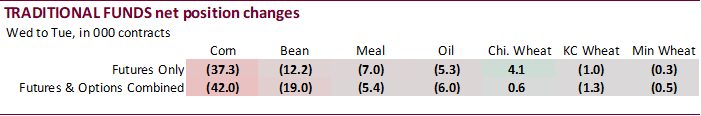

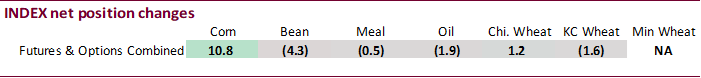

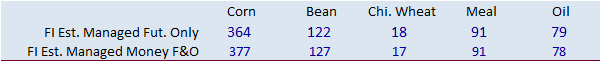

The

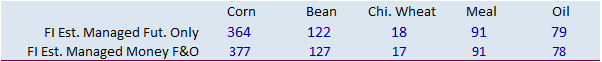

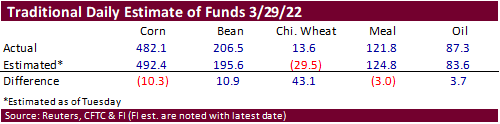

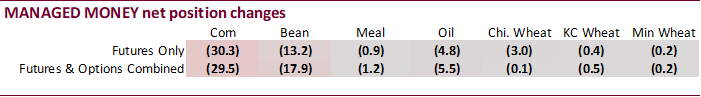

net long index fund position for the combined Chicago wheat, KC wheat, corn, oats, soybeans, meal and soybean oil were again a record, at 1.175 million contracts, up from 1.171 million previous week. Traditional funds reduced long positions as of last Tuesday.

They were less long than expected for corn and meal and much more long than expected for Chicago wheat.

As

of Friday afternoon:

Macros

European

Gas Buyers Have At Least 2 Weeks To Pay In Roubles, Says Kremlin – FT

US

Change In Nonfarm Payrolls Mar: 431K (est 490K; prev 678K)

US

Unemployment Rate Mar: 3.6% (est 3.7%; prev 3.8%)

US

Average Hourly Earnings (Y/Y) Mar: 5.6% (est 5.5%; prev 5.1%)

US

Average Hourly Earnings (M/M) Mar: 0.4% (est 0.4%; prev 0.0%)

US

Change In Private Payrolls Mar: 426K (est 495K; prev 654K)

US

Change In Manufacturing Payrolls Mar: 38K (est 32K; prev 36K)

US

Average Weekly Hours All Employees Mar: 34.6 (est 34.7; prev 34.7)

US

Labour Force Participation Rate Mar: 62.4% (est 62.4%; prev 62.3%)

US

Underemployment Rate Mar: 6.9% (prev 7.2%)

US

ISM Manufacturing Mar: 57.1 (est 59.0; prev 58.6)

–

Prices Paid: 87.1 (est 80.0; prev 75.6)

–

New Orders: 53.8 (est 58.5; prev 61.7)

–

Employment: 56.3 (est 53.1; prev 52.9)

US

Construction Spending (M/M) Feb: 0.5% (est 1.0%; prev R 1.6%)

77

Counterparties Take $1.666 Tln At Fed Reverse Repo Op (prev $1.872 Tln, 100 Bids)

·

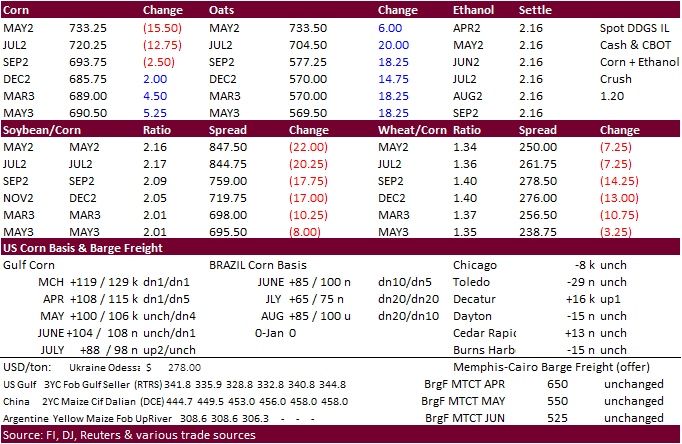

US corn futures ended lower in the front three month contracts and higher in the back months, in part to follow through bear spreading after the USDA reported smaller than expected 2022 plantings. December corn hit a new contract

high today. May corn ended 13.75 cents lower, and December was up 4.25 cents. Positioning was noted. There was some chatter China might be in soon for spot corn, but this has been talked about for months. USDA reported an old crop corn sale to unknown destinations.

·

We like SX over CZ over the medium term. New crop SX appears to be “cheap” relative to December corn and we think the drop in the SX/CZ ratio was overdone. The strength in corn futures late this week may have bought back some

acres across the Midwest. Southeast, where a number of corn acres were lost, are likely set. Plantings have already begun in the SE and Delta.

·

News is fairly light. WTI is lower in the front months, higher in the back months. USD was higher.

·

StoneX: 118.6 million tons for Brazil’s corn crop, up from 116.1 previous.

·

Safras: Brazil corn 118.15 MMT. Second crop 84.58 million tons.

·

US corn planting progress if initially released on Monday could be reported at 2 percent complete. One percent is the 5-year average.

·

The Buenos Aires grains exchange warned early frosts could further damage corn and soybeans. The exchange estimates soybean production at 42 million tons and corn at 49 million tons.

·

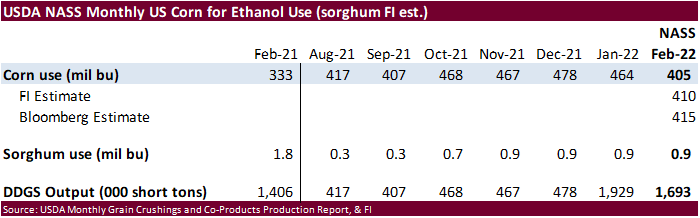

EIA reported February corn for ethanol production at 405 million bushels, 10 million below a Bloomberg poll, down from 464 million from January and well above 333 million year ago (pandemic).

Export

developments.

·

Private exporters reported sales of 136,000 tons of corn for delivery to unknown destinations during the 2021/2022 marketing year.

Updated

3/31/22

May

corn is seen in a $6.75 and $8.10 range

December

corn is seen in a wide $5.50-$8.00 range

·

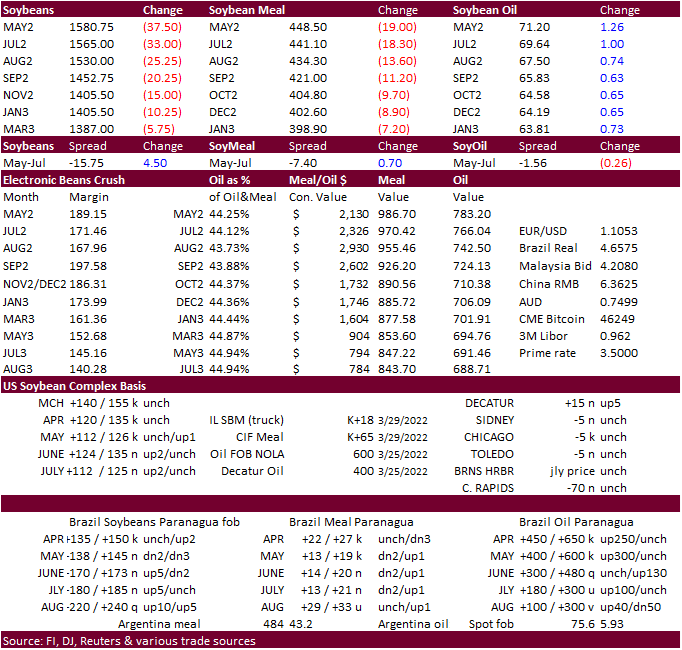

The CBOT soybean complex started mixed with higher meal, lower soybeans and lower soybean oil. Then soybean oil rebounded, sending meal lower by mid-morning. Soybeans saw follow through selling (bear spreading). May soybeans

fell below $16, first time since February 25.

·

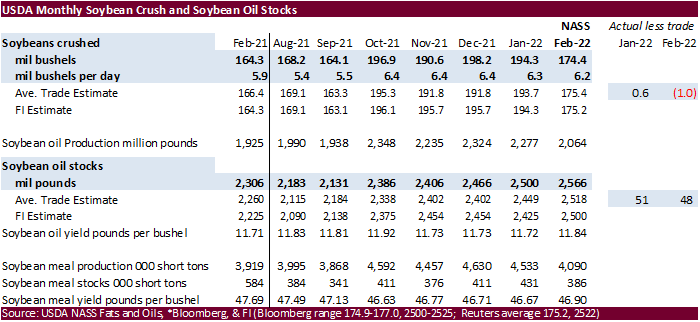

USDA’s February crush was seen as slightly bearish for soybeans and soybeans oil, and neutral for meal.

·

The soybean crop in Brazil’s Rio Grande do Sul was 19% harvested at the end of last month, below 24% year ago and 40% for the 5-year average.

·

StoneX: 122.06 million tons for Brazil soybeans, up from 121.17 previous. 127.17

·

Cargo surveyor SGS reported March Malaysian palm exports at 1,331,400 tons, 89,113 tons above the same period a month ago or up 7.2%, and 85,833 tons above the same period a year ago or up 6.9%.

·

China sold 248,330 tons of 2019 soybeans from reserves out of 501k offered, at an average price of $791/ton, 49 percent of the planned sales.

·

China will auction another 500,000 tons of imported soybeans from its reserves on April 7.

- Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4. - USDA

seeks 2,710 tons of packaged oil on April 7 for May shipment (May 23-June 13 for plants at posts).

Updated

3/31/22

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $430-$500

Soybean

oil – May 68.50-74.00

·

US wheat futures started higher on technical buying and concerns over dryness across the US Great Plains but turned lower late during the day session on positioning. SovEcon increased their estimate for 2021-22 Russia wheat exports

by 400,000 tons to 33.9 million tons. Just a month ago the trade was uncertain any wheat exports would be shipped out of Russia via Black Sea. Bloomberg noted Russia is working on resolving problems to get vessels moving. Some of the wheat is headed to countries

that normally Ukraine would supply.

·

On Monday we look for the initial US winter wheat rating to be reported below its respected five-year average. Combined G/E could end up below 47 percent. 55 percent is 5-year average.

·

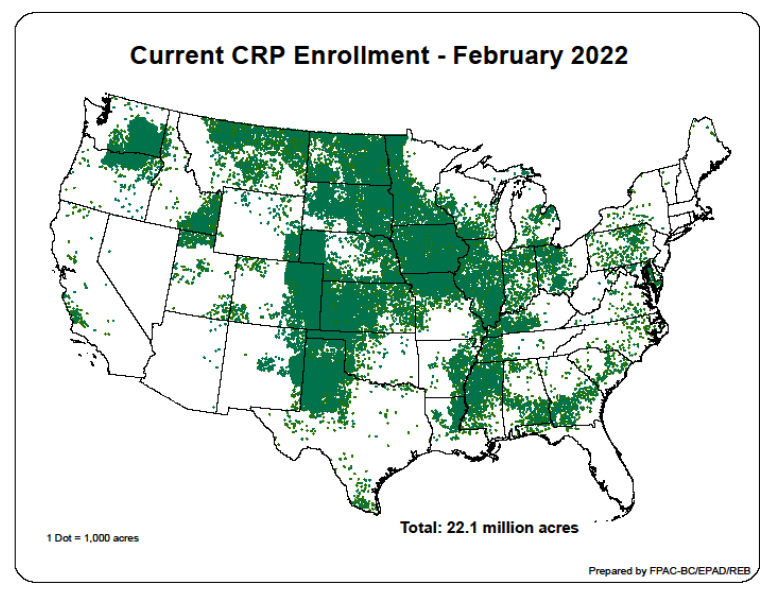

A couple US Senators are calling on the USDA to allow producers to plant on roughly 4 million acres CRP acres out of the 22.1 million acres currently enrolled. The USDA and various environmental groups oppose the program. Even

if they are released, we highly doubt it would boost planted acres for the summer 2022 growing season. Many CRP acres that come out of the program usually take a full year to cultivate before row crops can go in. In addition, some producers may not want to

take additional acres to lack of fertilizer supplies and high input costs.

·

Kazakhstan will limit milling wheat and wheat flour exports from April 15 through June 1 by imposing a 300,000 ton quota on flour and 1 million tons for wheat.

·

Russia will increase its wheat export tax to $96.10/ton for the April 6-12 period, up from $87 from the previous week. Carley will drop from $75.60 to $75.40 per ton and corn will increase from $58.30 to $65.80 per ton.

·

Ukraine planted about 600,000 tons of spring crops out of the 13.4 million hectares

·

FranceAgriMer reported the weekly soft wheat crop ratings at 92 percent, unchanged from the previous week and compares to 87% year ago.

·

May Paris wheat futures were down 3.50 euros to 365.25 euros.

·

Iraq bought 100,000 tons of German wheat at an average price of $570/ton. The deadline for the tender was March 24 and was initially for April through May shipment.

·

Jordan seeks 120,000 tons of feed barley on April 5.

·

Saudi Arabia seeks 355,000 tons of 12.5% protein wheat for Sep-Nov delivery.

·

Bangladesh is in for 50,000 tons of wheat with a deadline of April 4.

Bangladesh

seeks 50,000 tons of wheat on April 11 for shipment within 40 days after contract signing.

Rice/Other

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

Updated

3/31/22

Chicago

May $9.00 to $12.00 range, December $8.50-$11.00

KC

May $9.00 to $12.00 range, December $8.75-$11.50

MN

May $9.75‐$12.00, December $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.