PDF Attached

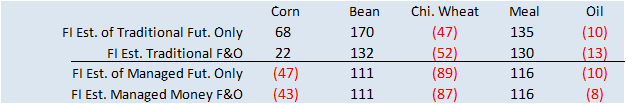

Positioning

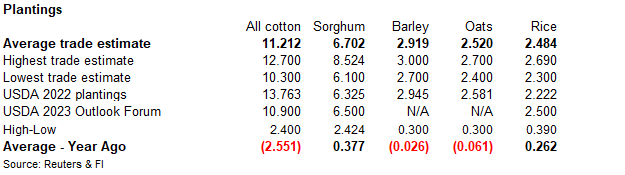

was seen ahead of the USDA report on Friday.

Fund

estimates as of March 30

World

Weather Inc.

-

As

expected, the GFS and ECMWF models took back much of the precipitation advertised for the second week of the outlook overnight -

Wednesday’s

forecast for rain in the region was unlikely to verify and the changes overnight are a great correction -

Strong

wind speeds continue to plague the drought stricken areas of the southwestern U.S. Plains resulting in blowing dust. More of that is expected over the next week as strong storm systems evolve and pass to the north -

Northern

India will receive additional over the next few days along with parts of northern Pakistan resulting in more concern over grain and oilseed quality -

Spain

will remain drier biased for an extended period of time along with Morocco and northwestern Algeria -

Rain

is expected in northeastern Algeria and Tunisia late in the weekend into early next week improving topsoil briefly, but follow up moisture will still be needed -

Western

CIS and most of Europe outside of the Iberian Peninsula will be wet biased for the next two weeks -

Some

areas of excessive moisture will be expected to expand during this period of time -

Rain

in the North China Plain and Yellow River Basin is still expected late this weekend into early next week and the end result should be very good for future winter and spring crop development -

Rapeseed,

rice and some early corn production areas in southern China are too wet, but will get a chance to dry down a little before the next round of greater rain arrives this weekend and continues into next week -

Brazil’s

center south crop areas are drying out and the trend may continue for another week before showers and thunderstorms return -

Dryness

is going to be closely monitored since the summer monsoon pattern should abate soon -

Southern

Argentina will continue dry biased for nearly a week before rain develops and brings a new round of favorable rain -

U.S.

west-central and southwestern Plains drought will remain unabated in the next two weeks -

Dryness

in West Texas will prevail for the next ten days -

Most

of interior southern Texas is still dry, but rain Tuesday night into Wednesday morning in the lower Rio Grande Valley was impressive with 1.00 to 3.00 inches falling near the river and into northeastern Mexico

Two

more storms are slated for the northeastern U.S. Great Plains and upper Midwest during the coming week; the first occurs tonight into Friday and the second occur during mid-week next week

-

Both

systems are advertised to be aggressive producing rain and snow through the heavily snow covered areas of the Red and upper Mississippi River Basins

-

The

additional moisture/snow will add to the region’s potential flood event expected to begin in April

-

Temperatures

in the northern U.S. Plains and Canada’s Prairies will become less significantly cold over the next week to ten days, although some impressive nighttime temperatures are expected periodically in this first week of the outlook -

U.S.

Delta, Tennessee River Basin and parts of the lower Midwest will be wet enough or too wet to advance planting in a significant manner during the next two ten days to two weeks -

Planting

delays are under way and will continue for a while -

Mountain

snowpack in California is still more than double the norm for this time of year and water reservoirs in the state are already above historical averages raising the potential for flooding this spring as the significant snowmelt raises water reservoir levels

to full capacity warranting and significant spillage of water down the various river systems -

Irrigated

fruit, vegetable and other crops will likely yield better in 2023 than they did in 2022 because of improved water supply -

Mexico

drought will continue into April, although there will be some periodic opportunity for rain in eastern parts of the nation starting at mid-week this week and lasting into next week -

Canada’s

Prairies will continue drier than usual this week especially in the interior southwest where there is need for significant precipitation this spring in order to support planting and early crop development.

-

Precipitation

is expected to increase during April with some of that possible during mid-week next week as a storm system threatens the southeast -

West-central

Africa precipitation will be erratically distributed over the next few days, but it may increase next week -

Recent

precipitation has been erratic with some areas getting plenty of rain and others need more -

Rain

is expected periodically throughout the next couple of weeks with most areas getting at least some rain -

Some

of the rain will be locally heavy -

Eastern

Australia rainfall will occur periodically over the next ten days improving soil moisture for some areas and disrupting fieldwork in other areas.

-

The

change will be good for a few late season crops, but drier weather may be needed to protect early maturing cotton in the open boll stage -

Central

America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days -

Net

drying is likely in portions of Honduras and Nicaragua -

South

Africa crop weather has been very good this year, although portions of the nation are drying out now and the trend may continue for a while -

Early

season maturation and harvesting should go well -

Late

season crops will need some beneficial moisture later this season -

Rain

prospects are fair over the next ten days, but the precipitation should be erratic and often lighter than usual -

Southeastern

Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away -

Turkey

will receive frequent bouts of rain over the next ten days bolstering soil moisture for wheat development and rice and cotton planting -

Portions

of the nation are already wet after recent rain and mountain snow -

Other

spring planting will benefit from the coming moisture boost -

Other

areas in the Middle East will experience lighter and less frequent rain for a while -

Improving

soil moisture throughout the Middle East is improving rice and cotton planting prospects (among other crops) and winter wheat conditions are improving -

Philippines

rainfall will be light to locally moderate most days through the coming week

-

Weather

conditions in the next ten days should be mostly good for the nation, although the south may eventually turn quite wet -

Indonesia

and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying -

Mainland

areas of Southeast Asia will experience a general boost in precipitation this week and next week which is normal at this time of year.

-

Recent

temperatures have been heating up while it has been dry and that, too, is typical of this time of year ahead of the coming monsoon season -

Eastern

Africa precipitation is expected to scatter daily from Tanzania to Ethiopia over the next ten days -

The

moisture will be good for ongoing crop development -

Today’s

Southern Oscillation Index was -1.71 and it was expected to move erratically lower over the coming week

Source:

World Weather, INC.

Bloomberg

Ag calendar

Thursday,

March 30:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - USDA

hogs & pigs inventory, 3pm - HOLIDAY:

India

Friday,

March 31:

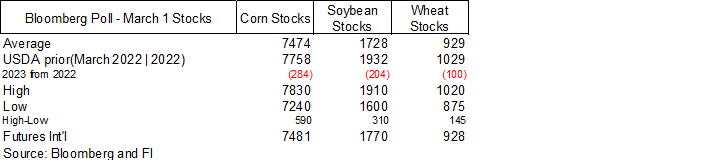

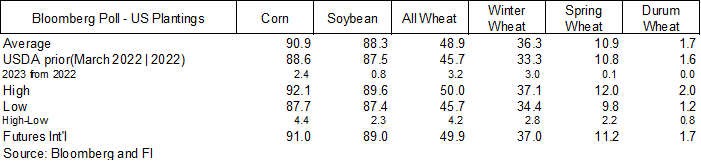

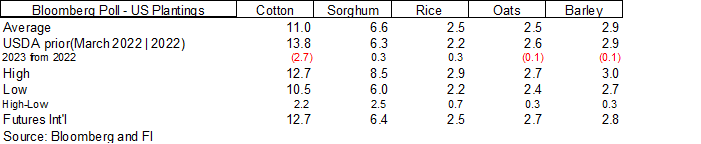

- US

prospective planting data for several crops, including corn, soybeans, wheat, cotton, barley and rice, noon - USDA’s

quarterly stockpiles data for corn, soybeans, wheat, barley and sorghum - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Malaysia’s

March palm oil export data - US

agricultural prices paid and received, 3pm

Source:

Bloomberg and FI

USDA

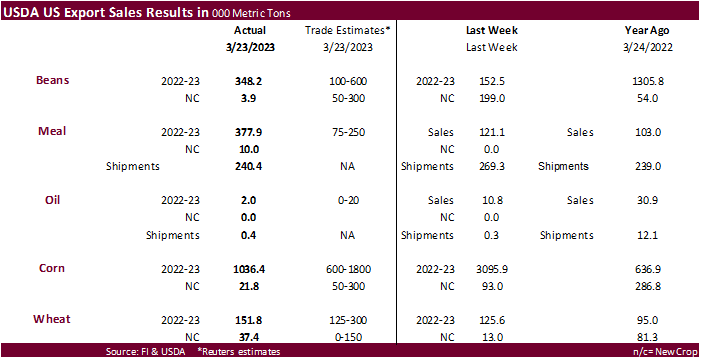

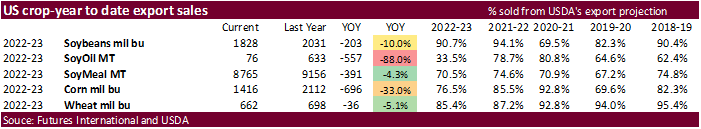

export sales

Soybean

meal sales were good and soybeans within expectations. SBO sales were low. Corn export sales were within expectations and wheat was poor.

102

Counterparties Take $2.272 Tln At Fed Reverse Repo Op. (prev $2.265 Tln, 104 Bids)

US

Initial Jobless Claims Mar 25: 198K (est 196K; prev 191K)

US

Continuing Claims Mar 18: 1689K (est 1700K; prev 1694K)

US

GDP Annualized (Q/Q) Q4 T: 2.6% (est 2.7%; prev 2.7%)

US

Personal Consumption Q4 T: 1.0% (est 1.4%; prev 1.4%)

US

GDP Price Index Q4 T: 3.9% (est 3.9%; prev 3.9%)

US

Core PCE (Q/Q) Q4 T: 4.4% (est 4.3%; prev 4.3%)

Canadian

Payroll Employment Change – SEPH Jan: 71.1K (prev 91.4K)

US

EIA NatGas Storage Change (BCF) 24-Mar: -47 (est -54; prev -72)

–

Salt Dome Cavern NatGas Stocks Change (BCF): 0 (prev -4)

·

Comment is light due to travelling.

·

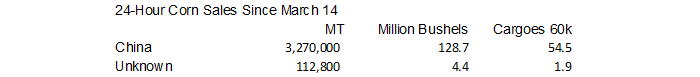

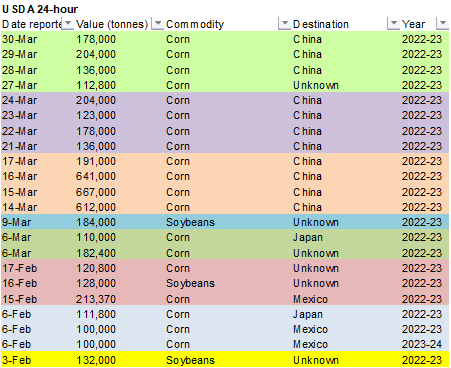

China bought more US corn per USDA 24-H sales.

·

One day before the USDA March 31 reports, corn futures trended higher during the morning session, near a one-month high basis the May contract. Positioning was noted today. But prices trended lower on positioning.

·

We think China bought at least 4.5MMT of corn from the US, above rumors last week of 3.5 MMT.

·

Reuters – Argentina’s grains inspectors union URGARA said it will launch a strike starting after midnight on Thursday in protest over the harm high inflation is having on their salaries. URGARA is an association of grain technicians

who analyze grains held in storehouses and loaded on ships, so their strike could affect the country’s grain trade. Argentina is the world’s leading exporter of soybean oil and meal, and the third-largest exporter of corn.

US

MARCH 1 2023 ALL HOGS 100 PCT OF YR AGO (TRADE ESTIMATE 100.2 PCT) – USDA

US

MARCH 1 2023 HOGS KEPT FOR BREEDING 100 PCT (TRADE ESTIMATE 100.5 PCT)-USDA

US

MARCH 1 2023 HOGS KEPT FOR MARKETING 100 PCT (TRADE ESTIMATE 100.2 PCT)-USDA

Export

developments.

Updated

03/21/23

May

corn $5.85-$6.75

July

corn $5.75-$7.00

·

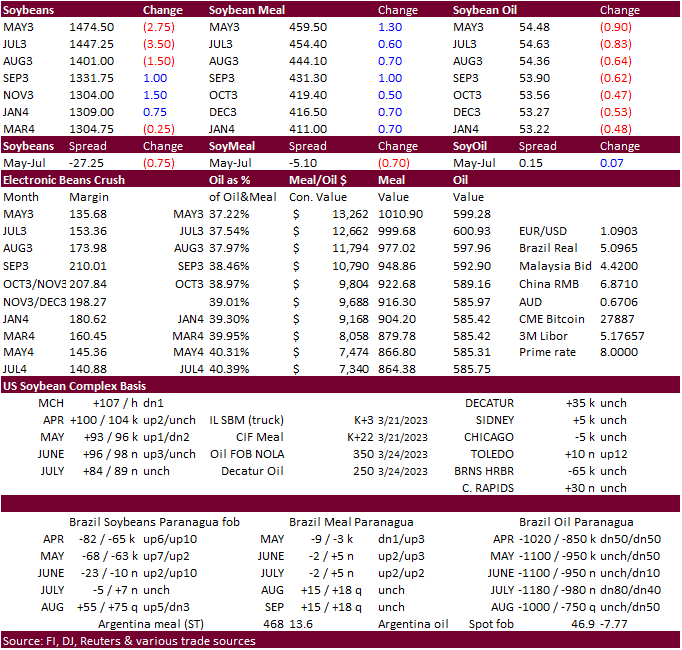

US soybeans traded two-sided, ending lower pre report day. Some of the focus has shifted over to US 2023 soybean plantings. Last week corn was on deck. But a bid in soybeans was short lived from technical selling; Soybean meal

was seeing bull spreading on Argentina concerns. Crush down there has been slow due to lack of producer selling. Soybean oil ended lower on funds pressure.

·

Argentina could now import up to 10 million tons of soybeans this year, according to a local analytical group, up from 8 million estimated earlier this month. Brazil may supply about 50 percent of the imports.

·

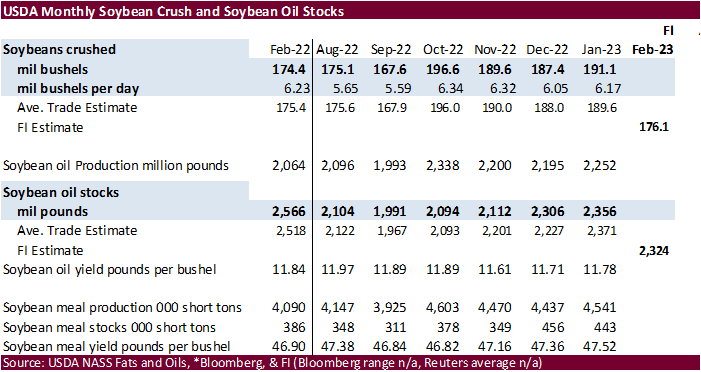

Analyst average for the USDA’s fats and oils report on Monday are for crush at 175.7 million bushels and ending stocks for oil at 2.339 billion pounds.

U

of I: Overview of the Production Capacity of U.S. Renewable Diesel Plants for 2023 and Beyond

Gerveni,

M., T. Hubbs and S. Irwin. “Overview of the Production Capacity of U.S. Renewable Diesel Plants for 2023 and Beyond.” farmdoc daily (13):57, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 29, 2023.

Export

Developments

·

None reported

Updated

03/28/23

Soybeans

– May $13.75-$15.00

Soybean

meal – May $375-$450

Soybean

oil – May 51.50-56.50

·

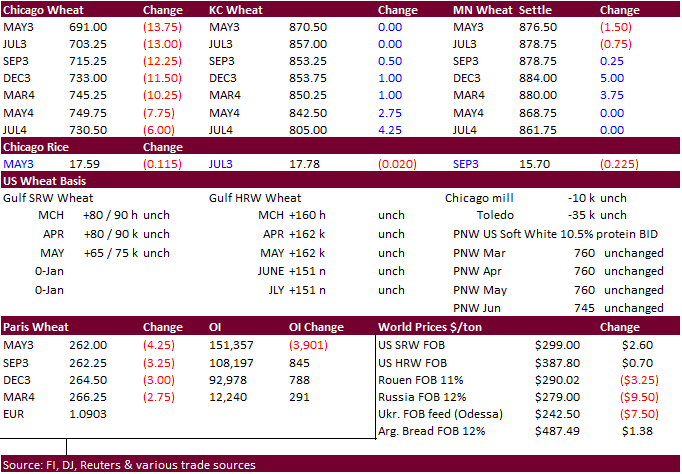

US wheat futures traded higher, ending lower from late session fund selling.

·

Black Sea shipping concerns continue to underpin the market, but the market today was more focused on getting out of positions ahead of the USDA report.

·

IKAR estimated Russian wheat production could decline to 86 million tons from 104.2 million tons for 2022. We look for export restrictions at the back end of the 2023-24 crop year.

Export

Developments.

·

Turkey bought a less than expected 395,000 tons of tons of wheat.

·

China will auction off wheat from state reserves in two batches next week.

Rice/Other

Updated

03/28/23

KC

– May $8.00-9.25

MN

– May

$8.50-$9.50

This summary is based on reports from exporters for the period March 17-23,

2023.

Wheat: Net

sales of 151,700 metric tons (MT) for 2022/2023 were up 21 percent from the previous week, but down 40 percent from the prior 4-week average. Increases primarily for Mexico (67,300 MT), the Philippines (34,400 MT), Colombia (13,400 MT, including decreases

of 2,000 MT), Indonesia (10,000 MT), and the Dominican Republic (10,000 MT), were offset by reductions for unknown destinations (10,200 MT), Vietnam (5,000 MT), and Nicaragua (200 MT). Net sales of 37,400 MT for 2023/2024 were reported for the Dominican Republic

(33,600 MT) and Guatemala (3,800 MT). Exports of 377,500 MT were up 4 percent from the previous week, but down 6 percent from the prior 4-week average. The destinations were primarily to Mexico (71,600 MT), unknown destinations (68,300 MT – late), South Korea

(54,100 MT), Vietnam (33,600 MT), and the Philippines (31,400 MT).

Late Reporting: For

2022/2023, exports of 68,250 MT were late to unknown destinations.

Corn: Net sales of 1,036,400 MT for 2022/2023 were

down 67 percent from the previous week and 34 percent from the prior 4-week average. Increases primarily for China (709,200 MT, including 66,000 MT switched from unknown destinations), Japan (162,900 MT, including 40,500 MT switched from unknown destinations),

Colombia (122,400 MT, including 121,200 MT switched from unknown destinations and decreases of 37,200 MT), Mexico (103,100 MT, including decreases of 7,200 MT), and Costa Rica (53,000 MT, including decreases of 10,500 MT), were offset by reductions for unknown

destinations (231,000 MT), Nicaragua (21,300 MT), and Taiwan (200 MT). Total net sales of 21,800 MT for 2023/2024 were for Mexico. Exports of 668,200 MT were down 52 percent from the previous week and 37 percent from the prior 4-week average. The destinations

were primarily to Mexico (289,000 MT, including 34,800 – late), Colombia (145,300 MT), China (68,300 MT), Japan (40,900 MT), and the Dominican Republic (35,500 MT).

Optional Origin Sales: For

2022/2023, the current outstanding balance of 140,000 MT were for South Korea (100,000 MT) and Egypt (40,000 MT).

Export Adjustments: Accumulated

exports of corn to Mexico were adjusted down 11,285 MT for week ending March 9th. This shipment was reported in error.

Late Reporting: For

2022/2023, exports of 34,827 MT were late to Mexico.

Barley: Total net sales reductions of 400 MT were

for Japan. Exports of 200 MT were to Japan.

Sorghum:

Net sales of 1,900 MT for 2022/2023 were down noticeably from the previous week and down 98 percent from the prior 4-week average. Increases primarily for China (56,900 MT, including 55,000 MT switched from unknown destinations and decreases of 1,800 MT),

were offset by reductions for unknown destinations (55,000 MT). Exports of 176,100 MT–a marketing-year high–were up noticeably from the previous and from the prior 4-week average. The destinations were to China (175,900 MT) and Mexico (200 MT).

Rice: Net sales of 16,400 MT for 2022/2023 were up

10 percent from the previous week, but down 67 percent from the prior 4-week average. Increases were primarily for Saudi Arabia (8,500 MT), El Salvador (3,500 MT), Mexico (1,800 MT), Canada (1,100 MT), and Jordan (600 MT). Exports of 43,200 MT were up noticeably

from the previous week, but down 25 percent from the prior 4-week average. The destinations were primarily to Colombia (29,100 MT), Saudi Arabia (8,600 MT), Canada (2,500 MT), Mexico (1,300 MT), and Jordan (700 MT).

Soybeans: Net

sales of 348,200 MT for 2022/2023 were up noticeably from the previous week and up 36 percent from the prior 4-week average. Increases primarily for China (153,000 MT, including 132,000 MT switched from unknown destinations), the Netherlands (69,100 MT, including

62,000 MT switched from unknown destinations), Indonesia (67,000 MT, including 55,000 MT switched from unknown destinations), Germany (65,000 MT), and Egypt (64,900 MT, including decreases of 100 MT), were offset by reductions for unknown destinations (212,900

MT). Total net sales of 3,900 MT for 2023/2024 were for Japan. Exports of 1,039,000 MT were up 63 percent from the previous week and 48 percent from the prior 4-week average. The destinations were primarily to China (543,200 MT), Mexico (119,000 MT), Indonesia

(74,100 MT), the Netherlands (69,100 MT), and Germany (65,000 MT).

Optional Origin Sales: For

2022/2023, the current outstanding balance of 300 MT, all South Korea.

Export for Own Account: For

2022/2023, the current exports for own account outstanding balance of 1,600 MT are for Canada (1,500 MT) and Taiwan (100 MT).

Export Adjustments: Accumulated

exports of soybeans to the Netherlands were adjusted down 65,020 MT for week ending March 16th. The correct destination for this shipment is Germany.

Late Reporting: For

2022/2023, net sales totaling 29,698 MT of soybeans were reported late for Taiwan (19,246 MT), Malaysia (5,000 MT), Vietnam (4,422 MT), and Bangladesh (1,030 MT). Exports of 29,230 MT were late to Taiwan (19,246 MT), Malaysia (4,532 MT), Vietnam (4,422 MT),

and Bangladesh (1,000 MT).

Soybean Cake and Meal: Net

sales of 377,900 MT for 2022/2023 were up noticeably from the previous week and up 81 percent from the prior 4-week average. Increases primarily for the Philippines (95,800 MT), Colombia (44,900 MT, including decreases of 1,000 MT), Costa Rica (36,400 MT,

including 4,300 MT switched from Nicaragua, 3,000 MT switched from El Salvador, and decreases of 5,100 MT), Ecuador (33,900 MT), and Canada (32,700 MT), were offset by reductions for Honduras (1,500 MT), Belgium (400 MT), and Madagascar (100 MT). Total net

sales of 10,000 MT for 2023/2024 were for Ireland. Exports of 240,400 MT were down 11 percent from the previous week and 10 percent from the prior 4-week average. The destinations were primarily to the Philippines (47,600 MT), Ecuador (31,900 MT), the Dominican

Republic (28,500 MT), Venezuela (27,500 MT), and Canada (21,100 MT).

Late Reporting: For

2022/2023, net sales totaling 10,661 MT of soybean cake and meal were reported late for Sri Lanka (6,000 MT), Burma (2,000 MT), Qatar (1,000 MT), Indonesia (801 MT), Hong Kong (600 MT), and Liberia (260 MT). Exports of 9,949 MT were late to Sri Lanka (5,484

MT), Burma (1,995 MT), Qatar (997 MT), Indonesia (801 MT), Hong Kong (412 MT), and Liberia (260 MT).

Soybean Oil: Net

sales of 2,000 MT for 2022/2023 were down 82 percent from the previous week and 66 percent from the prior 4-week average. Increases were reported for Mexico (1,500 MT) and Canada (500 MT). Exports of 400 MT were up 13 percent from the previous week, but down

8 percent from the prior 4-week average. The destination was Canada.

Cotton:

Net sales of 281,300 RB for 2022/2023 were down 9 percent from the previous week, but up 37 percent from the prior 4-week average. Increases primarily for China (85,000 RB, including 2,100 RB switched from Singapore), Vietnam (78,200 RB, including 1,800 RB

switched from South Korea), Bangladesh (38,300 RB, including decreases of 200 RB), Pakistan (24,900 RB, including decreases of 3,600 RB), and Turkey (19,000 RB), were offset by reductions primarily for Honduras (2,200 RB), Brazil (2,200 RB), Ecuador (2,200

RB), and Singapore (2,100 RB). Net sales of 12,300 RB for 2023/2024 were reported for India (8,800 RB) and Pakistan (3,500 RB). Exports of 341,000 RB were up 25 percent from the previous week and 31 percent from the prior 4-week average. The destinations were

primarily to Vietnam (97,200 RB), China (67,200 RB), Turkey (40,500 RB), Pakistan (32,500 RB), and Malaysia (13,400 RB). Net sales of Pima totaling 10,100 RB for 2022/2023 were down 40 percent from the previous week, but up 37 percent from the prior 4-week

average. Increases were primarily for Vietnam (4,200 RB, including 1,300 RB switched from China), India (2,300 RB), Pakistan (1,600 RB), Turkey (1,300 RB), and China (500 RB). Exports of 7,400 RB were up 4 percent from the previous week and up noticeably from

the prior 4-week average. The destinations were primarily to Peru (2,900 RB), Egypt (1,300 RB), India (1,000 RB), China (900 RB), and Thailand (600 RB).

Optional Origin Sales: For

2022/2023, the current outstanding balance of 7,300 RB, all Malaysia.

Export for Own Account: For

2022/2023, new exports for own account totaling 22,800 RB were to China (19,700 RB) and Vietnam (3,100 RB). Exports for own account totaling 13,300 RB to Vietnam (12,000 RB) and China (1,300 RB) were applied to new or outstanding sales. The current exports

for own account outstanding balance of 125,200 RB are for China (105,300 RB), Vietnam (7,300 RB), Pakistan (5,000 RB), Turkey (3,700 RB), South Korea (2,400 RB), and India (1,500 RB).

Hides and Skins: Net

sales of 427,900 pieces for 2023 were up 30 percent from the previous week and 26 percent from the prior 4-week average. Increases primarily for China (323,700 whole cattle hides, including decreases of 13,100 pieces), South Korea (50,300 whole cattle hides,

including decreases of 800 pieces), Mexico (46,000 whole cattle hides, including decreases of 2,400 pieces), Brazil (13,500 whole cattle hides, including decreases of 600 pieces), and Thailand (5,300 whole cattle hides, including decreases of 500 pieces),

were offset by reductions primarily for Italy (13,600 pieces). In addition, net sales reductions of 400 kip skins were reported for Japan (200 kip skins) and Canada (200 kip skins). Exports of 437,700 pieces were up 11 percent from the previous week and 1

percent from the prior 4-week average. Whole cattle hides exports were primarily to China (254,000 pieces), Mexico (65,500 pieces), South Korea (62,600 pieces), Brazil (16,100 pieces), and Italy (14,900 pieces). Exports of 2,500 kip skins were to Canada (1,300

kip skins) and Japan (1,200 pieces).

Net sales of 103,600 wet blues for 2023 were down 29 percent from the previous week and 20 percent

from the prior 4-week average. Increases reported for Vietnam (54,300 unsplit), China (37,200 unsplit), Thailand (8,000 unsplit), Taiwan (2,400 unsplit), and Mexico (1,800 grain splits), were offset by reductions for Hong Kong (100 unsplit) and Brazil (100

grain splits). Exports of 89,800 wet blues were down 24 percent from the previous week and 36 percent from the prior 4-week average. The destinations were primarily to Italy (25,300 unsplit), China (19,000 unsplit), Vietnam (18,500 unsplit), Hong Kong (11,300

unsplit), and Thailand (7,700 unsplit). Total net sales of 700 splits were for Taiwan. Exports of 41,700 pounds were to Taiwan.

Beef: Net sales of 11,300 MT for 2023 were down 40

percent from the previous week and 10 percent from the prior 4-week average. Increases were primarily for Japan (2,700 MT, including decreases of 900 MT), China (2,500 MT, including decreases of 100 MT), Taiwan (1,700 MT, including decreases of 100 MT), South

Korea (1,600 MT, including decreases of 400 MT), and Canada (700 MT). Exports of 16,600 MT were up 23 percent from the previous week and 13 percent from the prior 4-week average. The destinations were primarily to South Korea (5,100 MT), Japan (3,800 MT),

China (2,200 MT), Mexico (1,300 MT), and Taiwan (1,100 MT).

Pork: Net

sales of 30,400 MT for 2023 were down 20 percent from the previous week and 4 percent from the prior 4-week average. Increases were primarily for Mexico (14,600 MT, including decreases of 300 MT), Japan (4,100 MT, including decreases of 300 MT), Australia

(2,200 MT), Canada (1,600 MT, including decreases of 500 MT), and South Korea (1,500 MT, including decreases of 600 MT). Exports of 32,400 MT were up 6 percent from the previous week and 7 percent from the prior 4-week average. The destinations were primarily

to Mexico (12,800 MT), China (4,600 MT), Japan (4,600 MT), South Korea (3,300 MT), and Canada (1,700 MT).

U.S. EXPORT SALES FOR WEEK ENDING 3/23/2023

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

39.5 |

619.3 |

1,422.3 |

117.0 |

4,278.8 |

6,052.5 |

27.2 |

139.6 |

|

SRW |

53.8 |

485.5 |

516.1 |

59.7 |

2,303.9 |

2,242.5 |

10.2 |

392.0 |

|

HRS |

19.5 |

865.7 |

1,020.2 |

78.7 |

4,565.4 |

4,214.4 |

0.0 |

94.9 |

|

WHITE |

38.8 |

689.6 |

512.4 |

121.6 |

3,839.1 |

2,816.5 |

0.0 |

43.2 |

|

DURUM |

0.0 |

77.2 |

19.0 |

0.6 |

291.1 |

170.0 |

0.0 |

36.9 |

|

TOTAL |

151.7 |

2,737.2 |

3,489.9 |

377.5 |

15,278.2 |

15,495.9 |

37.4 |

706.6 |

|

BARLEY |

-0.4 |

3.3 |

5.7 |

0.2 |

8.2 |

14.7 |

0.0 |

6.0 |

|

CORN |

1,036.4 |

16,722.3 |

21,473.8 |

668.2 |

19,243.8 |

32,180.3 |

21.8 |

1,974.2 |

|

SORGHUM |

1.9 |

680.8 |

2,919.3 |

176.1 |

818.8 |

3,840.8 |

0.0 |

63.0 |

|

SOYBEANS |

348.2 |

5,253.3 |

11,797.1 |

1,039.0 |

44,507.6 |

43,488.9 |

3.9 |

1,749.1 |

|

SOY MEAL |

377.9 |

2,803.6 |

3,087.1 |

240.4 |

5,960.9 |

6,068.4 |

10.0 |

274.0 |

|

SOY OIL |

2.0 |

42.9 |

186.0 |

0.4 |

33.1 |

447.3 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

3.5 |

132.8 |

227.2 |

29.1 |

455.2 |

942.0 |

0.0 |

0.0 |

|

M S RGH |

1.0 |

32.3 |

3.3 |

0.0 |

20.6 |

10.9 |

0.0 |

5.0 |

|

L G BRN |

0.0 |

5.0 |

16.4 |

0.2 |

15.1 |

33.6 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

35.7 |

43.9 |

0.1 |

8.9 |

42.5 |

0.0 |

0.0 |

|

L G MLD |

10.0 |

103.0 |

71.9 |

11.7 |

454.0 |

573.6 |

0.0 |

0.0 |

|

M S MLD |

1.8 |

140.9 |

239.2 |

2.2 |

181.3 |

260.9 |

0.0 |

13.0 |

|

TOTAL |

16.4 |

449.8 |

602.0 |

43.2 |

1,135.0 |

1,863.4 |

0.0 |

18.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

281.3 |

4,898.6 |

7,573.8 |

341.0 |

6,561.8 |

6,623.5 |

12.3 |

1,372.3 |

|

PIMA |

10.1 |

58.8 |

156.1 |

7.4 |

115.8 |

282.6 |

0.0 |

3.9 |

#non-promo