PDF Attached

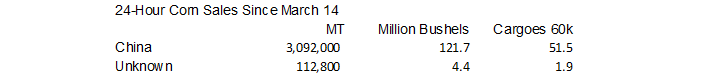

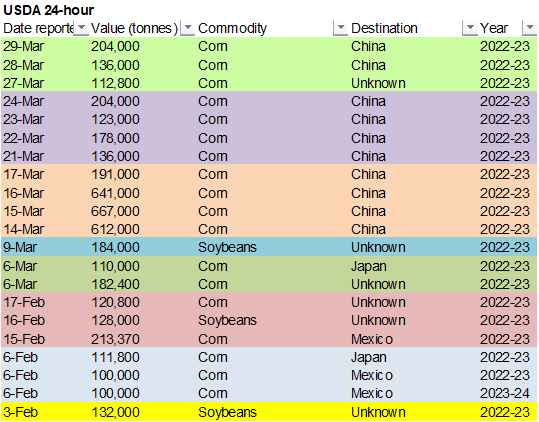

USDA reported private exporters reported sales of 204,000 metric tons of corn for delivery to China during the 2022/2023 marketing year. Grains finished firmer on demand and the news that Cargill said they plan to stop exporting Russian wheat. This comes after Russia earlier suggested a cap on sunflower exports. Soybeans ended higher in the old crop on talk that US will see increased exports due to quality issues in Argentina.

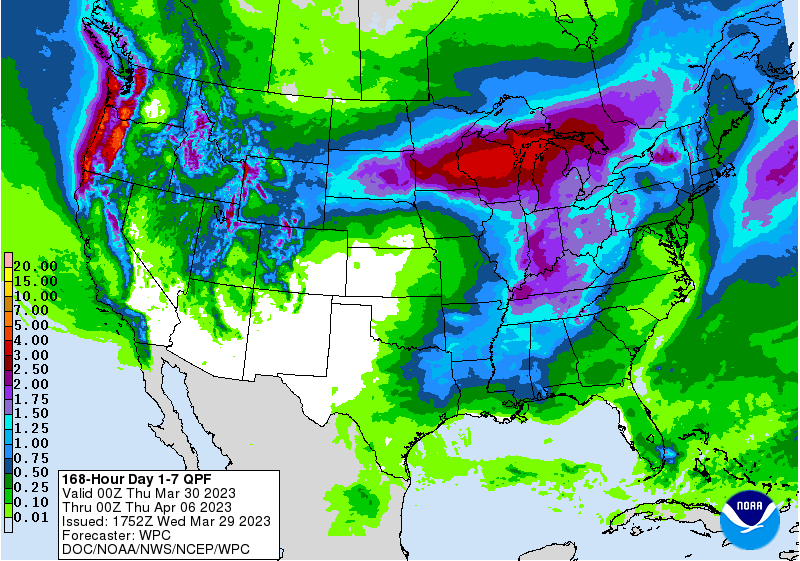

World Weather Inc.

- GFS and ECMWF forecast models are attempting to bring moisture to western Texas and the southwestern hard red winter wheat areas around days nine and ten of the forecast, but confidence in this potential change is low

- World Weather, Inc. does expect rainfall to improve in the high Plains region in April and possibly a part of May and any moisture that occurs will be welcome, but drought busting rain may be hard to come by

- Most west-central and southwestern U.S. Plains crop areas will experience net drying over the next week

- Two more storms are slated for the northeastern U.S. Great Plains and upper Midwest during the coming week; the first occurs Thursday into early Saturday and the second early next week

- Both systems are advertised to be aggressive producing rain and snow through the heavily snow covered areas of the Red and upper Mississippi River Basins

- The additional moisture/snow will add to the region’s potential flood event expected to begin in April

- U.S. northern Plains and upper Midwest recorded record and near record cold temperatures this morning the impact of which was low other than prolonging the agony of this late winter season

- Temperatures fell into the negative teens and negative single digits Fahrenheit in most of the snow covered areas from Missouri River Valley in North Dakota to Minnesota

- Fargo, N.D. fell to -15 while unofficial temperatures nearby to the east slipped below -20 Fahrenheit

- Normal low temperatures at this time of year are in the +20s

- Well below normal temperatures will continue form southern parts of Canada’s Prairies through the northern U.S. Plains to the Rocky Mountain region, the Great Basin and interior far western states over the next ten days to two weeks

- Seasonal warming will still allow some snowmelt to begin in the northern U.S. Plains during short periods of time in the afternoons

- South Texas and the Texas Coastal Bend rain prospects are good, but only for light showers and a general soaking is still eluding the region raising concern over dryland corn, cotton and sorghum prospects for 2023

- U.S. Delta, Tennessee River Basin and parts of the lower Midwest will be wet enough or too wet to advance planting in a significant manner during the next two ten days to two weeks

- Planting delays are under way and will continue for a while

- Mountain snowpack in California is still more than double the norm for this time of year and water reservoirs in the state are already above historical averages raising the potential for flooding this spring as the significant snowmelt raises water reservoir levels to full capacity warranting and significant spillage of water down the various river systems

- Irrigated fruit, vegetable and other crops will likely yield better in 2023 than they did in 2022 because of improved water supply

- North Africa and eastern Spain are still dry and unlikely to get much rain for through the weekend impacting durum wheat and barley among other crops in unirrigated areas

- Some rain is predicted for northeastern Algeria and Tunisia starting Sunday and continuing early next week

- The moisture will be welcome and could improve some crops after a lengthy dry period

- Other areas in Morocco and northwestern Algeria “may” have some opportunity for a little rain during the second week of April

- Irrigated crops are likely performing well

- Argentina and Brazil forecast weather has not changed today relative to recent past days

- Argentina will experience some increase in precipitation late this week and mostly next week

- In the meantime, fieldwork and crop maturation will advance well

- Brazil will see rain in the south and in the far north maintaining favorable to abundant soil moisture

- Center south Brazil continues to experience net drying which is needed to get the remaining Safrinha crops planted and support additional soybean harvesting

- Abundant rain is expected in Brazil’s Amazon River Basin as well as Peru, Colombia and surrounding areas

- Northern India will receive additional rainfall Thursday into early next week maintaining concern over winter wheat and other crop quality

- Dry and warm weather is needed to expedite crop maturation and harvest progress

- Other areas in India are experiencing favorable weather for this time of year

- Subsurface ocean water temperatures are warming in the eastern equatorial Pacific Ocean supporting the idea that El Nino is coming later this year

- The warming trend is expected to become more aggressive

- China’s North China Plain and Yellow River Basin are still advertised to receive some significant moisture late this weekend into Monday

- The event is far enough out in time to leave room for forecast models to reduce some of the intensity of rain and the situation will be closely monitored

- The moisture would be a boon to wheat and barley development this early spring and could induce better spring planting conditions as well

- China’s southernmost provinces (excepting Yunnan) are excessively wet and need a period of drying time to support early rice planting and other spring planting and fieldwork

- China’s rapeseed crop is rated favorably

- Southwestern China (mostly Yunnan) needs rain for cotton and rice planting

- Europe will experience waves of rain over the next ten days to two weeks

- Eastern Spain will remain one of the driest areas in the continent for a while and temperatures will be warmer than usual throughout the next ten days possibly threatening dryland winter crops and some of the planting of spring crops

- Abundant moisture is likely elsewhere with “some” relief to dryness in Romania and the lower Danube River Basin during the second week of the outlook

- Western CIS crop areas; including Ukraine, Belarus, far western Russia and the Baltic States will experience increasing precipitation and a continuation of wet field conditions for a while

- Some flooding is expected in northern Russia where significant snowmelt is under way

- Mexico drought will continue into April, although there will be some periodic opportunity for rain in eastern parts of the nation starting at mid-week this week and lasting into next week

- Canada’s Prairies will continue drier than usual this week especially in the interior southwest where there is need for significant precipitation this spring in order to support planting and early crop development.

- Precipitation is expected to increase during April

- West-central Africa precipitation will be erratically distributed over the next few days, but it may increase next week

- Recent precipitation has been erratic with some areas getting plenty of rain and others need more

- Rain is expected periodically throughout the next couple of weeks with most areas getting at least some rain

- Some of the rain will be locally heavy

- Eastern Australia rainfall will occur periodically over the next ten days improving soil moisture for some areas and disrupting fieldwork in other areas.

- The change will be good for a few late season crops, but drier weather may be needed to protect early maturing cotton in the open boll stage

- Central America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days

- Net drying is likely in portions of Honduras and Nicaragua

- South Africa crop weather has been very good this year, although portions of the nation are drying out now and the trend may continue for a while

- Early season maturation and harvesting should go well

- Late season crops will need some beneficial moisture later this season

- Rain prospects are fair over the next ten days, but the precipitation should be erratic and often lighter than usual

- Southeastern Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away

- Turkey will receive frequent bouts of rain over the next ten days bolstering soil moisture for wheat development and rice and cotton planting

- Portions of the nation are already wet after recent rain and mountain snow

- Other spring planting will benefit from the coming moisture boost

- Other areas in the Middle East will experience lighter and less frequent rain for a while

- Improving soil moisture throughout the Middle East is improving rice and cotton planting prospects (among other crops) and winter wheat conditions are improving

- Philippines rainfall will be light to locally moderate most days through the coming week

- Weather conditions in the next ten days should be mostly good for the nation, although the south may eventually turn quite wet

- Indonesia and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying

- Mainland areas of Southeast Asia will experience a general boost in precipitation this week and next week which is normal at this time of year.

- Recent temperatures have been heating up while it has been dry and that, too, is typical of this time of year ahead of the coming monsoon season

- Eastern Africa precipitation is expected to scatter daily from Tanzania to Ethiopia over the next ten days

- The moisture will be good for ongoing crop development

- Today’s Southern Oscillation Index was -1.47 and it was expected to move erratically over the coming week

Source: World Weather, INC.

Bloomberg Ag calendar

Wednesday, March 29:

- EIA weekly US ethanol inventories, production, 10:30am

- Coffee, rice and rubber exports from Vietnam

Thursday, March 30:

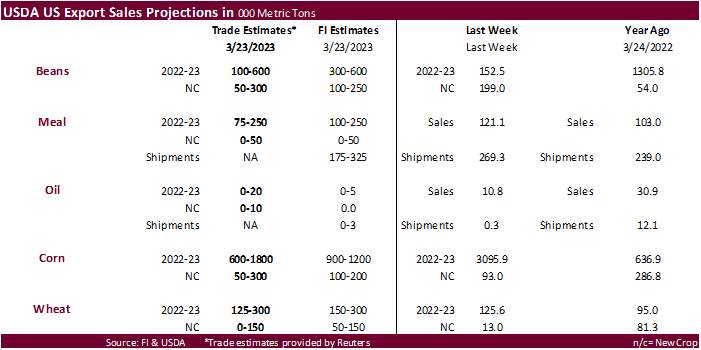

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

- USDA hogs & pigs inventory, 3pm

- HOLIDAY: India

Friday, March 31:

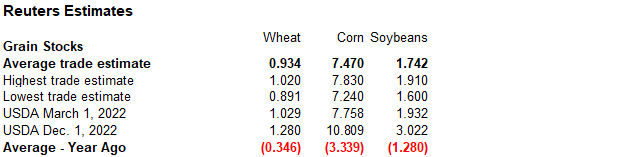

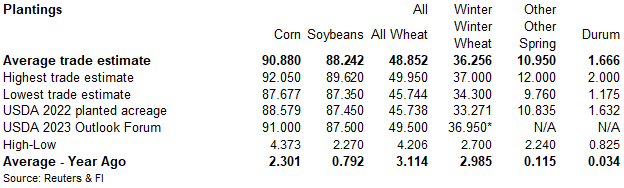

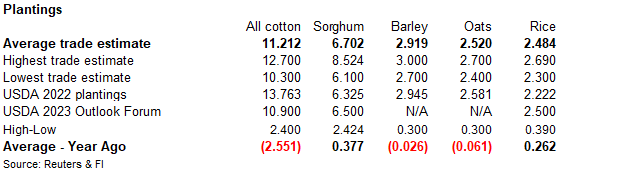

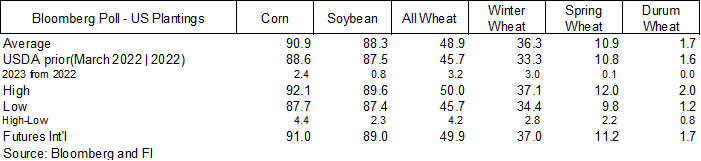

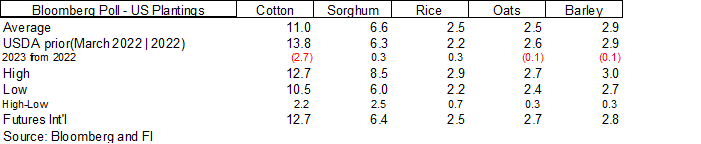

- US prospective planting data for several crops, including corn, soybeans, wheat, cotton, barley and rice, noon

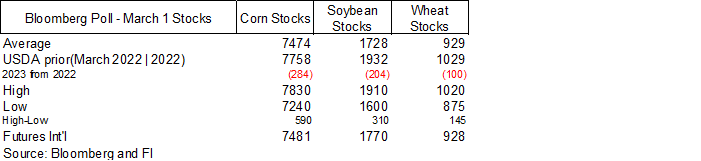

- USDA’s quarterly stockpiles data for corn, soybeans, wheat, barley and sorghum

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop condition report

- Malaysia’s March palm oil export data

- US agricultural prices paid and received, 3pm

Source: Bloomberg and FI

Macros

US Pending Home Sales (M/M) Feb: 0.8% (exp -3.0%; prev 8.1%)

Pending Home Sales NSA (Y/Y) Feb: -21.1% (prev -22.4%)

US Pending Home Sales Unexpectedly Rise To Highest Since August – BBG

US DoE Crude Oil Inventories (W/W) 24-Mar: -7.489M (exp 1.750M; prev 11.17M)

Distillate Inventories: 281K (est -1.550M; prev -3.313M)

Cushing OK Crude Inventories: -1.632M (prev -1.063M)

Gasoline Inventories: -2.904M (exp -2.250M; prev -6.399M)

Refinery Utilization: 1.70% (exp 0.55%; prev 0.40%)

Russian Crude Oil Production Down 300K Bpd In First Three Weeks Of March To 9.78M Bpd – RTRS Sources

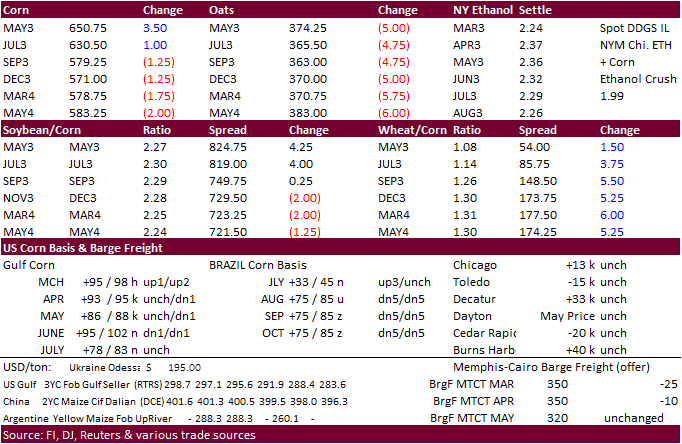

· CBOT corn closed higher following strength in wheat and additional sales to China. The recent 24-hour corn sales have been a surprise for the trade as many though China concluded buying last week.

· USDA reported private exporters reported sales of 204,000 metric tons of corn for delivery to China during the 2022/2023 marketing year.

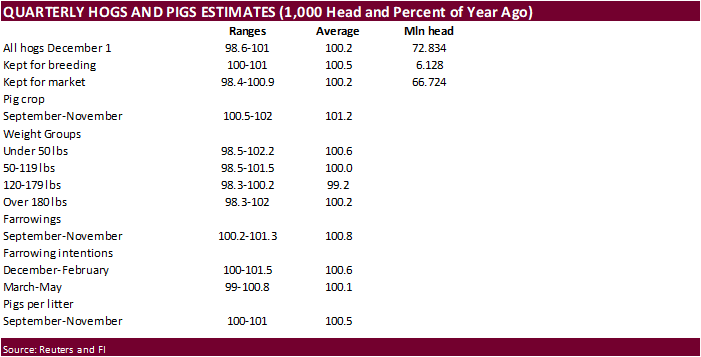

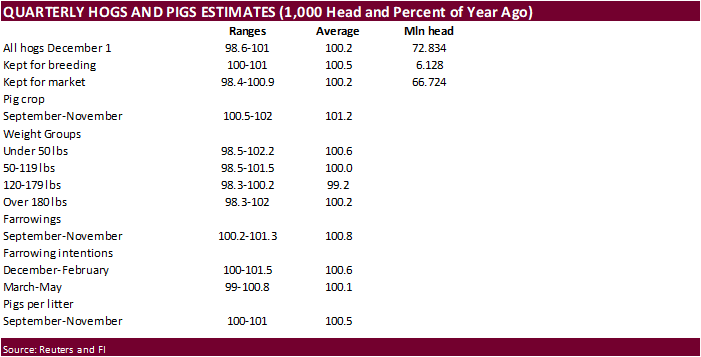

· USDA hogs and pigs report is due out Thursday after the close and a Bloomberg poll sees the US hag herd as of March 1 seen rising 0.4% from a year earlier to 72.97 million head. A Reuters poll see a 0.2% increase. Reuters trade estimates are below the export development section.

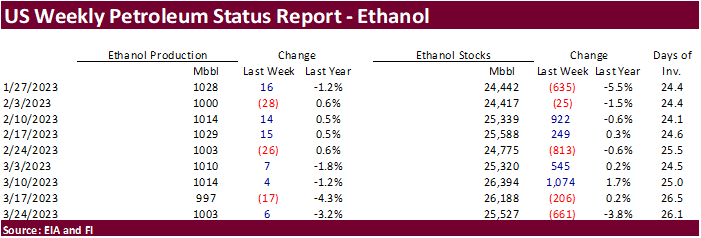

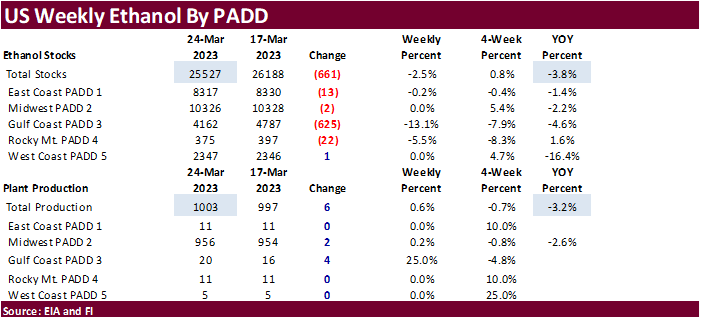

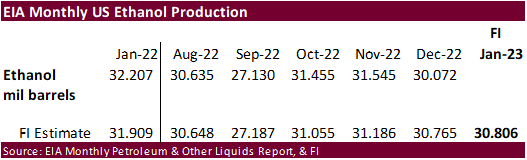

US weekly ethanol production increased 6,000 barrels per day for the week ending March 24 to 1.003 million barrels, and stocks decreased 661,000 barrels to 25.527 million, lowest in a month. For comparison, a Bloomberg poll looked for weekly US ethanol production to be up 4,000 thousand barrels and stocks down 196,000 barrels. Early September to date ethanol production is running 3.8 percent below the same period year earlier. US gasoline stocks decreased for the sixth consecutive week. They were down 2.9 million barrels to 226.7 million. Implied US gasoline demand increased for the third consecutive week to 9.145 million barrels. The ethanol blending rate into finished motor gasoline increased to 91.2 percent from 89.7 percent previous week.

US DoE Crude Oil Inventories (W/W) 24-Mar: -7.489M (exp 1.750M; prev 11.17M)

Distillate Inventories: 281K (est -1.550M; prev -3.313M)

Cushing OK Crude Inventories: -1.632M (prev -1.063M)

Gasoline Inventories: -2.904M (exp -2.250M; prev -6.399M)

Refinery Utilization: 1.70% (exp 0.55%; prev 0.40%)

Export developments.

Updated 03/21/23

May corn $5.85-$6.75

July corn $5.75-$7.00

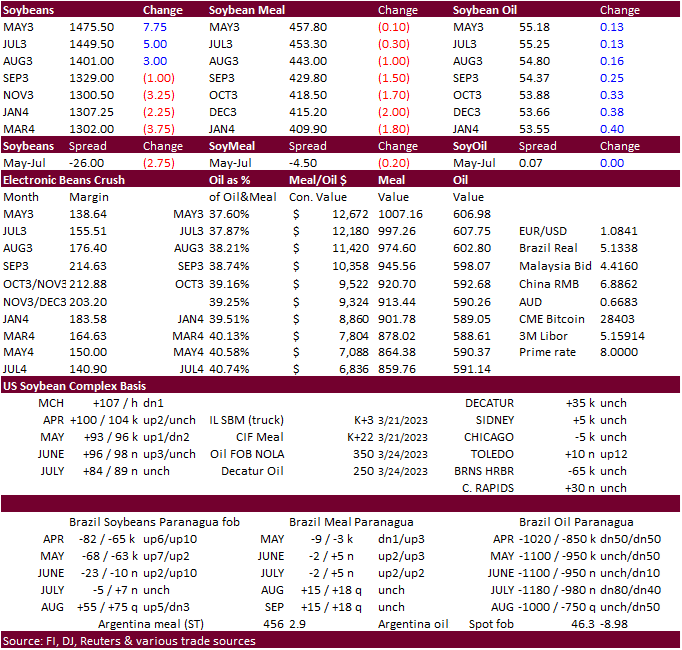

· US soybeans are higher from thoughts that the US will see more export demand from the worsening quality of the Argentine crop. Brazil is keeping busy moving beans at the port. There is even continued talk that the US East Coast is back in for more beans from Brazil.

· There is talk US soybean acres may come in below trade expectations but with the current SX/CZ relationship, the trade average of 88.242 million acres.

· Palm oil futures rose for the third consecutive day.

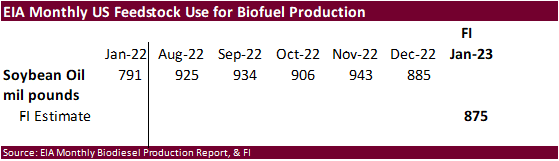

· Analyst average for the USDA’s fats and oils report on Monday are for crush at 175.7 million bushels and endstocks for oil at 2.339 billion pounds.

Updated 03/28/23

Soybeans – May $13.75-$15.00

Soybean meal – May $375-$450

Soybean oil – May 51.50-56.50

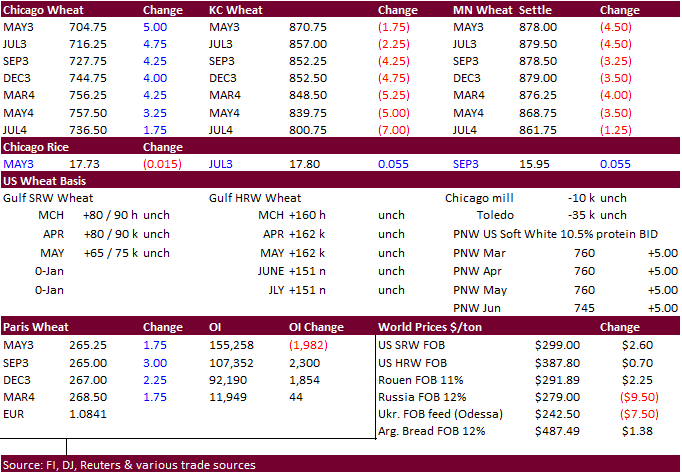

· US wheat futures are higher over Black Sea grain shipping uncertainty. Cargill plans to stop wheat exports out of Russia. Another grain company also announced they were exiting Russian grain exports. Two others already suspended operations in April 2022.

· Volatility and flat price sellers were there to meet the bid in early trading which caused wheat to finish 20 cents off the highs.

· Paris May wheat closed up 4.25 euros at 266.25 per ton.

· EU wheat exports so far this year are up 8.5 percent year over year at 22.7 million tons (20.9 million tons year earlier).

· US will see cold temps across the upper Great Plains over the next few days.

Export Developments.

· China will auction off 140,000 tons of wheat from state reserves on April 6.

· Jordan is getting offers for 120,000 tons of barley.

Rice/Other

Updated 03/28/23

KC – May $8.00-9.25

MN – May $8.50-$9.50

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |