PDF Attached do not include daily estimate of funds. FI export sales estimates attached.

News

headlines over the talks between Ukraine and Russia today sent wheat and other commodities sharply lower early but many markets rebounded from ongoing concerns Russia will not withdraw troops from Ukraine anytime soon. Russia promised to scale down military

operations but it does not appear a ceasefire was reached.

WEATHER

EVENTS AND FEATURES TO WATCH

- No

major changes occurred overnight - U.S.

Midwest, Delta and Tennessee River Basin will continue to receive frequent precipitation and the region’s mild to cool temperatures will keep evaporation rates low so that the wet bias already in place remains for a while - Expect

planting delays from the lower Midwest into the Delta and Tennessee River Basin this spring - Dryness

will remain a concern for West and South Texas where little to no rain is expected for the next ten days to two weeks and the ground is already critically dry - California’s

rain Monday favored the central and lower coast more than the Sierra Nevada resulting in short term soil moisture increases, but no long-term drought relief - Runoff

from mountain snowpack is expected to be below normal this spring and summer leaving water reservoir levels below normal and keeping water restrictions on for the foreseeable future - U.S.

high Plains region will continue dry biased for the next couple of weeks, although a few showers may impact a part of the region - The

dry region runs from western Texas to Montana and the western most Dakotas - U.S.

northwestern Plains and southwestern Canada’s Prairies remain in a serious drought with little relief expected over the next few weeks. - U.S.

Pacific Northwest precipitation continues below normal with little change likely for a while - Flooding

in U.S. is mostly confined to parts of the Red River Basin in the North, the Midwest and Delta with most of it rated minor to moderate.

- Cool

weather will continue to come and go frequently in eastern North America and across Europe during the next ten days to two weeks - Winter

crop development will be slower than usual because of cool weather - Snow

and rain will accumulate significantly from central Europe through west-central Russia and northwestern Ukraine during the next week to ten days - Livestock

stress and travel delays are expected because of the snow - Melting

snow later this spring may induce flooding in at least a part of western Russia as significant snow accumulation melts while the ground is saturated and rivers and streams are running high - Cool

weather will restrict snow melt during the next ten days delaying the potential flood event until later this spring - The

combination of new precipitation and moisture abundance will maintain wet field conditions in many areas - There

is need for drier and warmer weather especially in April when spring planting occurs in many areas.

- Heavy

snow will fall from western Ukraine and southeastern Belarus to the Ural Mountains with accumulations of 4 to 15 inches and possibly more - this

may lead to more flooding in April as the snow melts over saturated soil - Mexico’s

dryness and drought have been expanding this winter due to poor precipitation resulting from persistent La Nina - The

region will continue lacking precipitation for an expected period of time - Eastern

and southern Mexico will remain seasonably dry this week and will only receive light rainfall next week - Argentina

rainfall over the next ten days to two weeks will be restricted to east-central and northeastern parts of the nation - Sufficient

rain will fall in these areas to maintain moisture abundance - Net

drying is expected in western Argentina - Soil

moisture is sufficient to carry on normal crop, despite limited new moisture - Temperatures

will be near to below normal this week - Bahia

and the northern two-thirds of Minas Gerais will continue dry biased for the next ten days to two weeks - The

region is already considered to be too dry and moisture stress for minor corn, soybean, sugarcane and coffee areas is rising

- moisture

stress may lead to some negative impact on late season crops - Most

other areas in Brazil will get rain over the next ten days to two weeks with some of it likely to be excessive.

- Tonight,

and Wednesday of this week and again Sunday and Monday will be the two wettest periods in the south, although a third period of rain April 7-9 will perpetuate the wet bias - Drier

weather will be needed from northeastern Argentina through Rio Grande do Sul and southern Paraguay to southern and eastern Mato Grosso do Sul, Parana and southwestern Sao Paulo to protect late season crop development - Temperatures

will be near normal with a slight cooler bias in the wetter areas - Safrinha

crops will have plenty of moisture going through much of April this year, but the wetter areas will need drying to promote harvesting of full season crops and to limit any crop quality declines because of too much moisture.

- China’s

precipitation in the east-central and southeastern provinces will be less frequent and less significant this week after Wednesday and especially next week allowing the ground to firm up - This

change will improve spring planting and early season winter and spring crop development - India

rainfall will be confined to a few far southern crop areas and in the far Eastern States during the next two weeks while most other areas are dry and warm biased - Temperatures

will be near to above normal – warmest relative to normal in the north - Good

winter crop maturation and harvest conditions are expected - Southeast

Asia rainfall will continue frequent and abundant - No

area in the mainland areas, Philippines, Indonesia or Malaysia are expected to be too dry - Too

much rain may impact northeastern Philippines late this weekend into next week - East-central

Africa rainfall will continue greatest in Tanzania, although parts of Uganda and Kenya will get rain periodically as well.

- Ethiopia

rainfall should be most sporadic and light - West-central

Africa rainfall will continue periodically and sufficient to support coffee and cocoa development - Rainfall

so far this month has been a little sporadic, but no area has been seriously dry biased - Pockets

in Ivory Coast and western Ghana have received less than usual rain, but crop development has advanced well

- North

Africa rainfall will be greatest Tuesday through Thursday of this week and again early to mid-week next week in Morocco and northwestern Algeria - Crop

conditions will improve as a result of the rain - Australia

reported rain in both the eastern and western most crop areas during the weekend and again Monday.

- Flooding

rain occurred along the Pacific Coast near the Queensland and New South Wales border where excessive rain reaching over 12.00 inches resulted - This

same region flooded earlier this month - Western

Australia rain totals Monday varied from 0.05 to 1.07 inches - The

precipitation was associated with the remnants of tropical cyclone Charlotte that dissipated last week - Western

Australia will continue to receive periods of rain through the weekend, although much of it will now become light and sporadic - The

additional moisture will further boaster topsoil moisture for use in the autumn wheat, barley and canola planting season that begins in late April - Eastern

Australia precipitation is expected to become quite limited the remainder of this week bringing on a better environment for cotton in the open boll stage of development - The

drier weather will also be good for early season planting which begins soon - Irrigated

late season sorghum and other crops will continue to develop favorably - Some

of the dryland crop that is still immature still needs greater moisture - South

Africa rainfall over the next couple of weeks will be less frequent and less significant resulting in a very good environment for early season crop maturation and harvesting - some

timely rainfall in April will prove to be beneficial for late season crops only if it is brief and light - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Today’s

Southern Oscillation Index is +12.49 - The

index will move lower over the next seven days - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

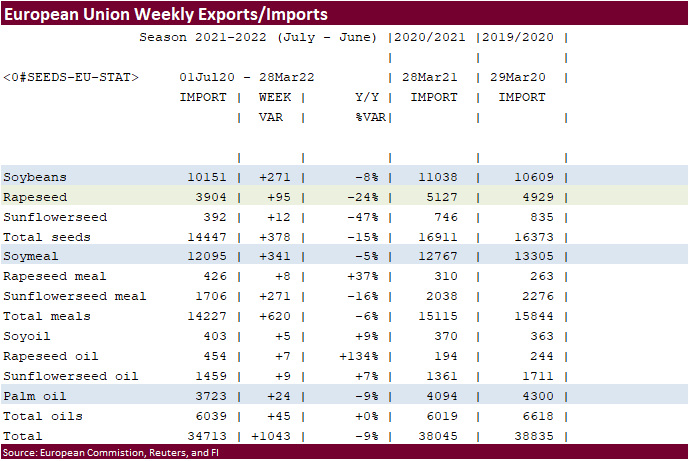

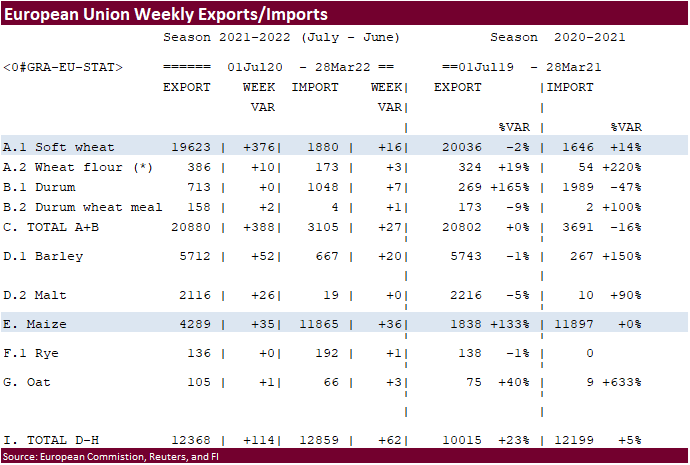

- EU

weekly grain, oilseed import and export data - Vietnam’s

General Statistics Department releases March export data for coffee, rice and rubber

Wednesday,

March 30:

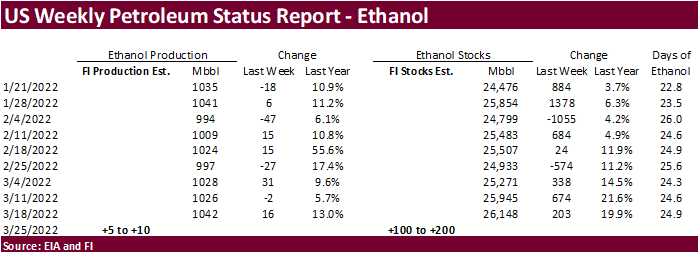

- EIA

weekly U.S. ethanol inventories, production, 10:30am - USDA

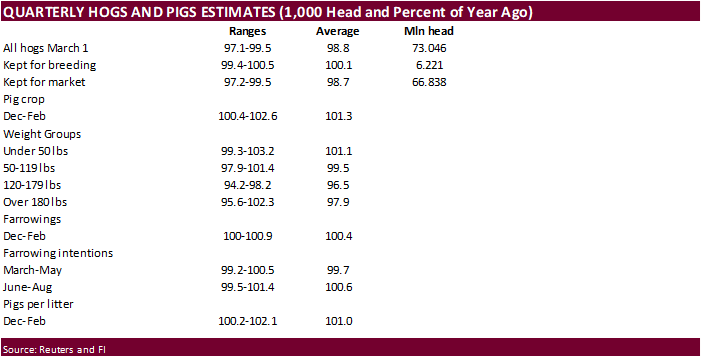

hogs and pigs inventory, 3pm

Thursday,

March 31:

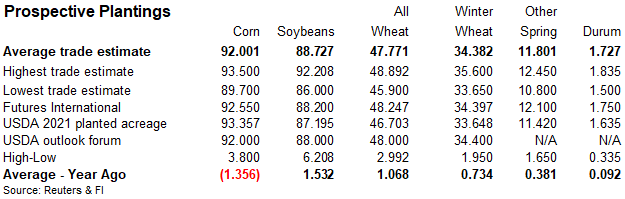

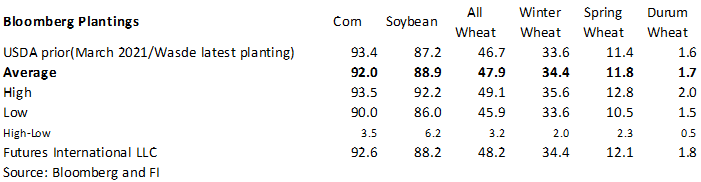

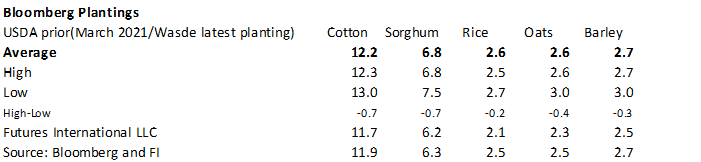

- U.S.

annual acreage prospective planting data for various farm commodities, including wheat, barley, corn, cotton, soybeans and sunflower, noon - USDA

quarterly stockpile data for wheat, barley, corn, oats, soybeans and sorghum, noon - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - U.S.

agricultural prices paid, 3pm - Malaysia’s

March palm oil export data

Friday,

April 1:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Australia

Commodity Index - USDA

soybean crush, DDGS output, corn for ethanol, 3pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

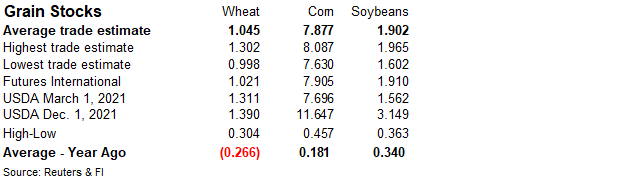

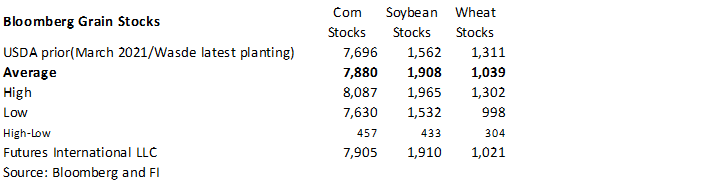

Reuters

trade estimates for USDA

Soybean

and Corn Advisory

Estimated

2022 U.S. Corn Acreage 91.5 mac, Soybeans 88.5 mac

2021/22

Brazil Soybean Estimate Unchanged at 123.0 Million Tons

2021/22

Brazil Corn Estimates Unchanged at 112.0 Million tons

2021/22

Argentina Soybean Estimate Unchanged at 39.0 Million Tons

2021/22

Argentina Corn Estimate Unchanged at 49.0 Million Tons

·

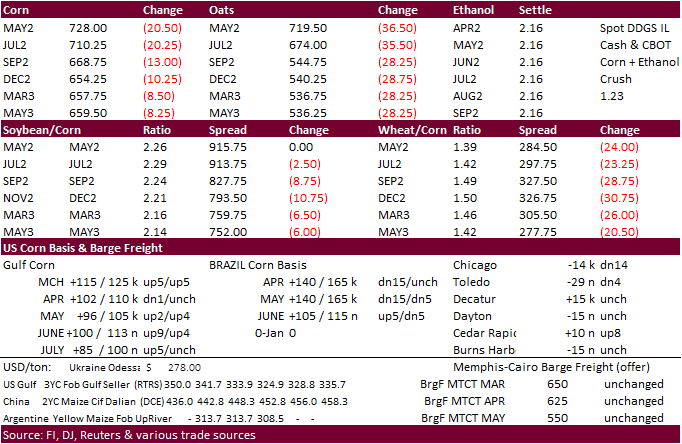

US corn futures traded lower, by limit earlier, before pairing some losses, settling down 22.25 cents basis the May position at $7.2525. Headline trading was the main driver. Ukraine/Russia talks sent mixed signals to the market.

WTI was $1.46 lower by 2 pm CT and USD off 69 points. Turkey bought optional origin corn.

·

May CBOT corn

failed to trade at $7.50 after trading at the level last 18 consecutive session.

·

Texas reported 51 percent of their corn crop planted, above a 5-year average of 46 percent. Corn planting was 51% complete in Louisiana, 5% complete in Mississippi and 2% complete in Arkansas. (Reuters)

·

Fertilizer prices are around a record according to a Bloomberg story, adding to food inflation and leaving some second guessing the size of the US corn planted area.

·

Anec sees Brazil corn exports reaching 103,278 tons for the month of March, down from 110,000 previous.

·

Argentina farmers sold 19.5 million tons of corn for the 2021-22 season, according to AgMin data. That is up 744,000 tons for the week ending March 23. Argentina may produce 49 million tons this season.

·

Ukraine producers late last week started planting on 15-20% of the planned area according to Ukraine.

·

A Bloomberg poll looks for weekly US ethanol production to be down 5,000 barrels to 1.037 million (1.025-1.051 range) from the previous week and stocks up 137,000 barrels to 26.285 million.

EIA:

Crude oil exports from other countries may pass through Russian infrastructure

https://www.eia.gov/todayinenergy/detail.php?id=51838&src=email

Export

developments.

- Turkey’s

TMO bought 100,000 tons of corn out of 300-325k sought for optional origin shipment between April 8 and May 5. They paid $400.87/ton C&F and $407.87/ton.

Updated

3/23/22

May

corn is seen in a $6.75 and $8.10 range

December

corn is seen in a wide $5.50-$7.50 range

·

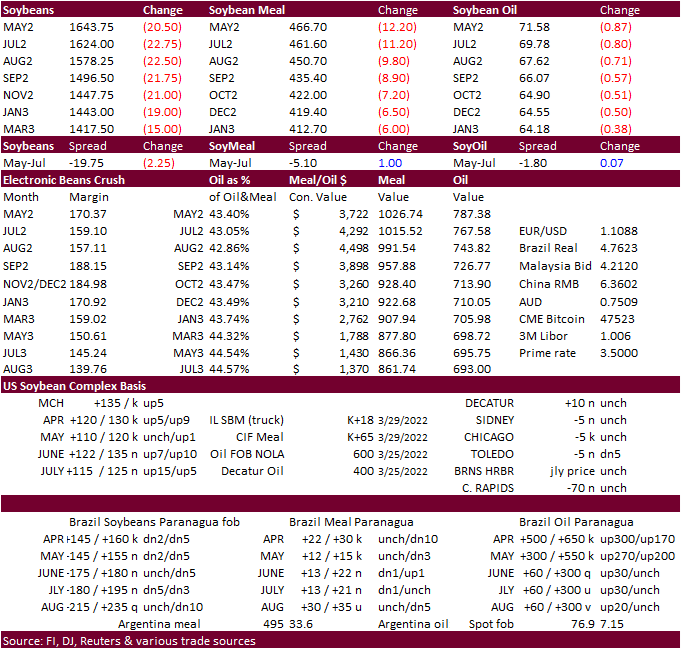

CBOT May

soybeans, meal, and soybean ended lower in another risk off trade, lower outside related commodity markets and ongoing Covid-19 lockdown concerns in China.

·

SX held the 50 DMA.

·

Anec sees Brazil soybean exports reaching 12.957 million tons for the month of March, up from 12.9 million previous.

·

Investment bank Itau BBA expects Brazil 2022-23 soybean plantings to expand only 0.5%, slowest growth rate in more than 15 years. 2021-22 the area was 40.7 million hectares.

·

Argentina farmers sold 11.5 million tons of soybeans for the 2021-22 season, according to AgMin data, for the week ending March 23. That compares to 12.8 million at same period year ago. Argentina may produce 42 million tons this

season.

·

India paid $2,150 per ton CIF for 45,000 tons of Russian sunflower oil, a record price, for April shipment. Before the escalation in the Black Sea, India was buying sunflower oil at around $1,630/ton.

·

Indonesia set its crude palm oil reference price for April at $1,787.5 per ton, up from March’s $1,432.24 per ton.

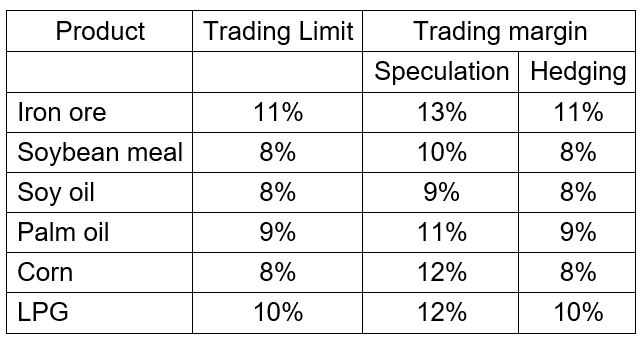

China’s

Dalian Commodity Exchange

will increase raise trading limits and margin requirements on April 6.

Source:

Reuters

·

Turkey seeks 18,000 tons of sunflower oil on Thursday.

·

China plans to sell about 500,000 tons of soybeans on April 1.

- USDA

seeks 2,710 tons of packaged oil on April 7 for May shipment (May 23-June 13 for plants at posts).

- Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4.

Updated

3/29/22

Soybeans

– May $15.50-$17.50 (down 50, down 50)

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$500 (unch, down $20)

Soybean

oil – May 68.50-74.00

(sharply

lower range)

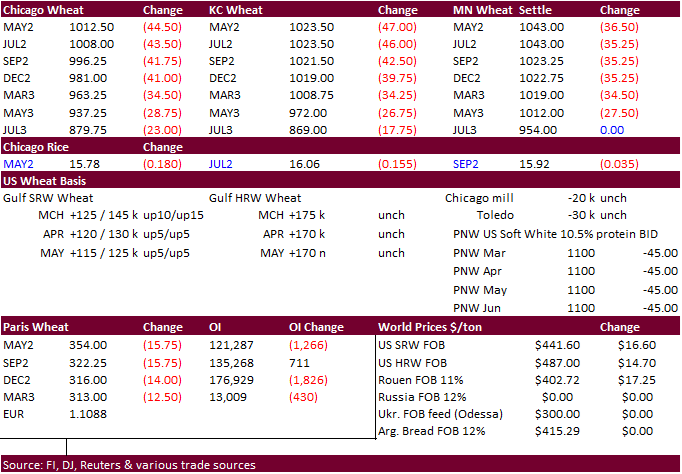

·

Extremely wide trading range in US wheat futures left many traders positioning during the first half of the day session trade. Some wheat contracts reached limit lower. May Chicago hit its lowest level since March 1, with a session

low of $972, $3.9150 off its absolute high of $13.6350 made on March 8.

·

Russia promised to scale down military operations but it does not appear a ceasefire was reached.

·

May Paris milling wheat settled down 12.25 euros, or 3.3%, at 357.50 euros ($396.22) a ton. Earlier it reached its lowest level since March 3.

·

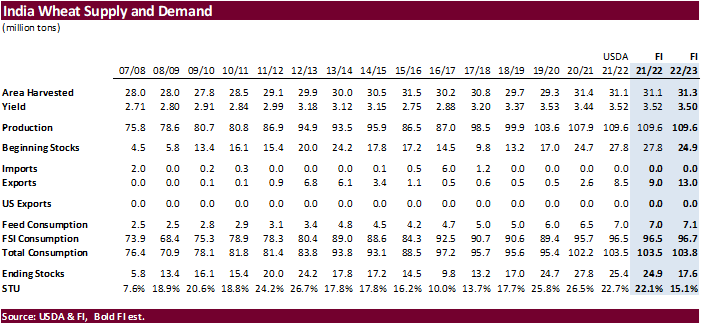

A delegation from Egypt will visit India early April to negotiate (large amount) wheat imports. India is also in talks with China, Turkey, Bosnia, Sudan, Nigeria and Iran. SK bought India wheat recently.

·

Kansas’s winter wheat crop saw a good improvement in combined good/excellent conditions from the previous week to 32 percent from 25 percent. Oklahoma was rated 18 percent, down from 21 percent week earlier and Texas 7 percent,

up one point from last week. CO was rated 11 percent, a decline from 19 percent week earlier. NE was rated 27% versus 36% at the end of February. SD increased 2 points from late February to 26 percent.

·

A Bloomberg article Australia was “pretty well” sold out of wheat for the first half of this year with second half available.

·

Australia’s eastern coastal areas were again hit with heavy rain. La Nina tends to yield above average rainfall for eastern Australia.

·

USDA Attaché sees 2022-23 Egypt’s July-June wheat imports at 11 million tons, down from 12 million tons projected for 2021-22.

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Annual_Cairo_Egypt_EG2022-0009

·

Tunisia seeks 150,000 tons of soft wheat and 100,000 tons of feed barley on Wednesday. The wheat is sought for shipment between April 20 and June 25, depending on origin supplied. The barley is sought for shipment between April

25 and June 25.

·

Algeria seeks 50,000 tons of milling wheat for May and/or June shipment. It might be set to close Wednesday.

·

Taiwan seeks 40,000 tons of US wheat on March 30 for shipment off the PNW during the May 14 and May 28 period.

·

Jordan issued an import tender for 120,000 tons of milling wheat for shipment during May, June, or July on March 31.

·

Results awaited: Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June.

·

Bangladesh is in for 50,000 tons of wheat with a deadline of April 4.

Rice/Other

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

Updated

3/29/22

Chicago

May $9.00 to $12.00 range (down 35, down 50)

KC

May $9.00 to $12.00 range (down 25m down 50)

MN

May $9.75‐$12.00 (down 25, down 100 cents)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.