PDF Attached does not include daily estimate of funds.

In

a light volume trade, US CBOT agriculture futures were lower as traders assessed Ukraine/Russia developments. Negotiating teams are planning to meet in Turkey this week.

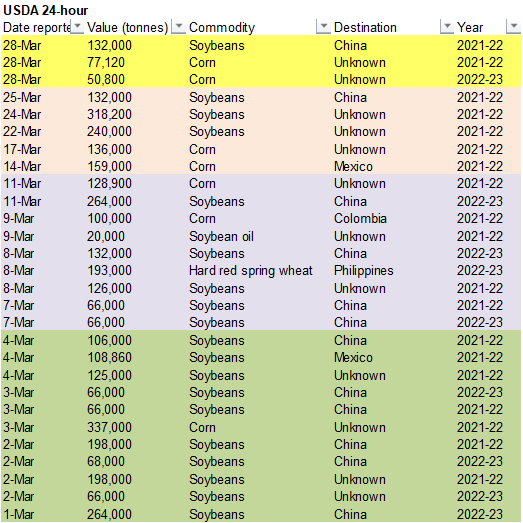

Private

exporters reported the following activity:

-132,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year

-127,920

metric tons of corn for delivery to unknown destinations. Of the total, 77,120 metric tons is for delivery during the 2021/2022 marketing year and 50,800 metric tons is for delivery during the 2022/2023 marketing year.

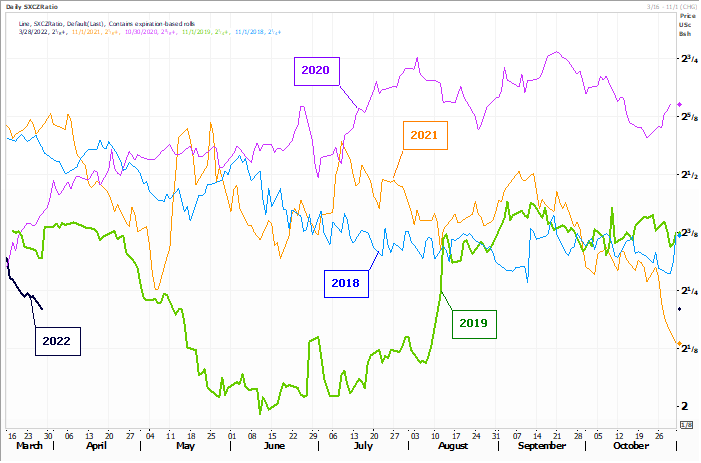

SX/CZ

ratio was under a large amount of pressure today

WEATHER

EVENTS AND FEATURES TO WATCH

- Cooler

weather in Europe and the eastern parts of North America may be linked to the latest Stratospheric Warming event that is under way. - Expected

additional changes in the forecast over the next two weeks that may allow these colder biases to persist

- There

may also be some impressive amounts of snow accumulating in parts of western Russia over the next week that may contribute to spring flooding - Southern

Europe will trend wetter because of the colder bias - Limited

precipitation is expected in the High Plains region of the United States, including areas from western Texas through eastern Colorado and western Kansas to Montana and the western Dakotas during the next two weeks

- Totally

dry weather is unlikely, but most of the precipitation advertised is unlikely to bolster soil moisture enough to counter evaporation - Temperatures

will be slightly warmer than usual - Precipitation

in eastern hard red winter wheat areas will be sufficient to maintain a good outlook for crop development in the next few weeks - U.S.

Midwest, Delta and southeastern states will receive some periodic precipitation while temperatures are a little cooler biased this week resulting in some limited field progress - Drier

and warmer weather is needed for aggressive drying, planting and early crop development - Rain

will be most likely this week Tuesday night into Thursday with nearly all areas being impacted at one time or another - Amounts

will vary from 0.50 inch to 2.00 inches - Some

greater amounts are expected in the Midwest - A

follow up weather system is expected during the weekend producing 0.20 to 0.75 inch of rain and local amounts over 1.00 inch

- Missouri

and Illinois will be wettest along with areas from the lower Delta into the southeastern states - This

event may diminish in future model runs - A

couple of additional weather systems may impact the Midwest, Delta and southeastern states next week keeping the ground wet and temperatures cool enough to restrict drying rates at times.

- Flooding

in U.S. is mostly confined to parts of the Red River Basin in the North, the Midwest and Delta with most of it rated minor to moderate.

- U.S.

northern Plains and upper Midwest will receive additional snow and rain Tuesday and Wednesday adding to the runoff from recent melting snow raising river and stream flows additionally - U.S.

weekend precipitation was limited with light rain noted in the eastern Midwest with moisture totals varying up to 0.15 inch most often with a few greater amounts downwind from the Great Lakes - Highest

afternoon temperatures were in the 40s and 50s across the Midwest, but the southern Plains experienced 80- and 90-degree highs and the northern Plains noted highs in the 30s and 40s northeast and 40s and 50s southwest - Lowest

temperatures were in the negative and positive single digits in northern Minnesota and positive single digits and teens in neighboring areas of the northern Plains and western Great Lakes region. - Freezes

occurred southward into parts of hard red winter wheat country and into most of the Midwest.

- California

is expecting additional rain and mountain snow today - Resulting

precipitation will not change the bottom line for drought or mountain snowpack and runoff potential - As

of March 25 Snowpack was 39% of normal in the northern Sierra Nevada, 49% of normal in central areas and 48% of normal in the south - Water

storage varies from 49-67% of historical averages away from the Sierra Nevada and from 57-95% near the mountains - West

and South Texas precipitation is still advertised to be limited during the next ten days, although there is a little more shower activity suggested for a few areas

- The

impact of rain on water supply soil moisture will be minimal. - Mexico’s

dryness and drought have been expanding this winter due to poor precipitation resulting from persistent La Nina - The

region will continue lacking precipitation for an expected period of time - Eastern

and southern Mexico will remain seasonably dry this week and will only receive light rainfall next week - Argentina

rainfall over the next ten days to two weeks will be restricted to east-central and northeastern parts of the nation - Sufficient

rain will fall in these areas to maintain moisture abundance - Net

drying is expected in the southwest half of Argentina - Soil

moisture is sufficient to carry on normal crop, despite limited new moisture - Temperatures

will be near normal this week - Bahia

and the northern two-thirds of Minas Gerais will continue dry biased for the next ten days to two weeks - The

region is already considered to be too dry and moisture stress for minor corn, soybean, sugarcane and coffee areas is rising

- moisture

stress may lead to some negative impact on late season crops - Most

other areas in Brazil will get rain over the next ten days to two weeks with some of it likely to be excessive.

- Wednesday

of this week and again from Saturday through Monday, April 4 will be the two wettest periods, although a third period of rain April 5-8 will perpetuate the wet bias - Drier

weather is needed from northeastern Argentina through Rio Grande do Sul and southern Paraguay to southern and eastern Mato Grosso do Sul, Parana and southwestern Sao Paulo to protect late season crop development - Temperatures

will be near normal with a slight cooler bias in the wetter areas - Safrinha

crops will have plenty of moisture going through much of April this year, but the wetter areas will need drying to promote harvesting of full season crops and to limit any crop quality declines because of too much moisture.

- China

precipitation during the weekend was mostly light, but widespread from the Korean Peninsula through the southern Yellow River Basin and southward to the coastal provinces.

- China’s

precipitation in the east-central and southeastern provinces will be less frequent and less significant this week and especially next week allowing the ground to firm up - This

change will improve spring planting and early season winter and spring crop development - Europe

precipitation during the weekend continued limited while temperatures were mild to warm.

- Europe

weather is expected to slowly trend a little wetter with some timely rainfall expected over time that should hale improve early season farming activity and crop development - Russia,

Ukraine, Belarus and Baltic States will experience a more active precipitation pattern during the next two weeks

- The

combination of new precipitation and moisture abundance will maintain wet field conditions in many areas - There

is need for drier and warmer weather especially in April when spring planting occurs in many areas.

- Heavy

snow will fall from western Ukraine and southeastern Belarus to the Ural Mountains with accumulations of 4 to 15 inches and possibly more - this

may lead to more flooding in April as the snow melts over saturated soil - India

rainfall will be confined to a few far southern crop areas and in the far Eastern States during the next two weeks while most other areas are dry and warm biased - Temperatures

will be near to above normal – warmest relative to normal in the north - Good

winter crop maturation and harvest conditions are expected - Southeast

Asia rainfall will continue frequent and abundant - No

area in the mainland areas, Philippines, Indonesia or Malaysia are expected to be too dry - Too

much rain may impact northeastern Philippines late this weekend into next week - East-central

Africa rainfall will continue greatest in Tanzania, although parts of Uganda and Kenya will get rain periodically as well.

- Ethiopia

rainfall should be most sporadic and light - West-central

Africa rainfall will continue periodically and sufficient to support coffee and cocoa development - Rainfall

so far this month has been a little sporadic, but no area has been seriously dry biased - Pockets

in Ivory Coast and western Ghana have received less than usual rain, but crop development has advanced well

- North

Africa rainfall will be greatest Tuesday through Thursday of this week and again early next week in Morocco and northwestern Algeria - Crop

conditions will improve as a result of the rain - Australia

reported rain in both the east and western most crop areas during the weekend.

- Moisture

totals in Queensland northeastern New South Wales ranged from 0.30 to 1.00 inch most often with a few amounts of 1.00 to 3.25 inches

- Heavier

rainfall occurred along the upper east coast of New South Wales where a few coastal areas reported more than 6.00 inches - Western

Australia rain totals varied from 0.27 to 1.14 inches with local totals approaching 2.00 inches - The

precipitation was associated with the remnants of tropical cyclone Charlotte that dissipated last week - Western

Australia will continue to receive periods of rain through Wednesday of this week before drying down again Thursday - The

additional moisture will further boaster topsoil moisture for use in the autumn wheat, barley and canola planting season that begins in late April - Eastern

Australia precipitation is expected to become quite limited this week bringing on a better environment for cotton in the open boll stage of development - The

drier weather will also be good for early season planting which begins soon - Irrigated

late season sorghum and other crops will continue to develop favorably - Some

of the dryland crop that is still immature still needs greater moisture - South

Africa weather during the weekend brought rain to the northeast, east central and southeastern summer crop areas - Moisture

totals were not much more than 1.00 inch - South

Africa rainfall over the next couple of weeks will be less frequent and less significant resulting in a very good environment for early season crop maturation and harvesting - some

timely rainfall in April will prove to be beneficial for late season crops only if it is brief and light - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Today’s

Southern Oscillation Index is +13.03 - The

index will slowly slip lower over the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

- USDA

export inspections – corn, soybeans, wheat, 11am - Ivory

Coast cocoa arrivals

Tuesday,

March 29:

- EU

weekly grain, oilseed import and export data - Vietnam’s

General Statistics Department releases March export data for coffee, rice and rubber

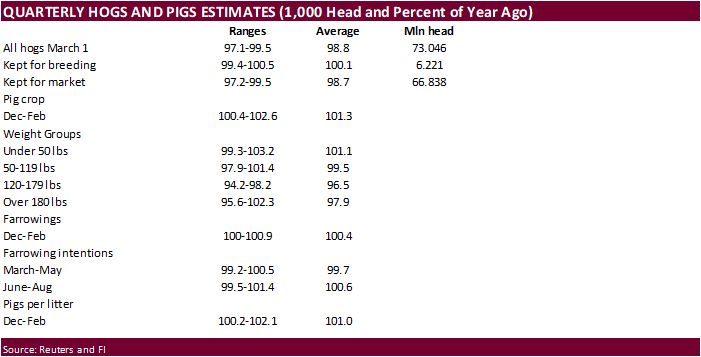

Wednesday,

March 30:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - USDA

hogs and pigs inventory, 3pm

Thursday,

March 31:

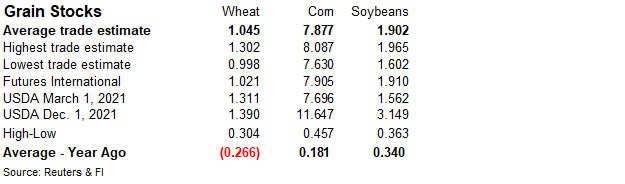

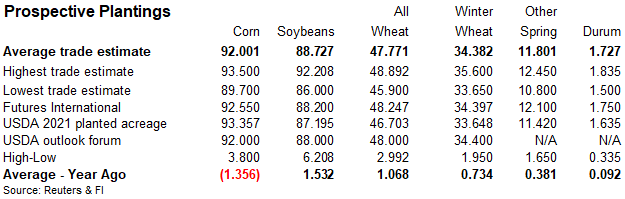

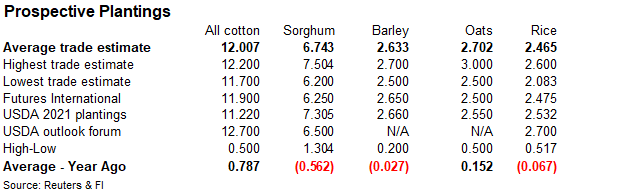

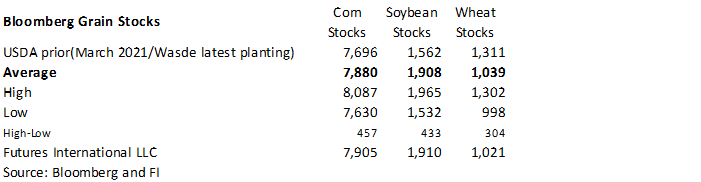

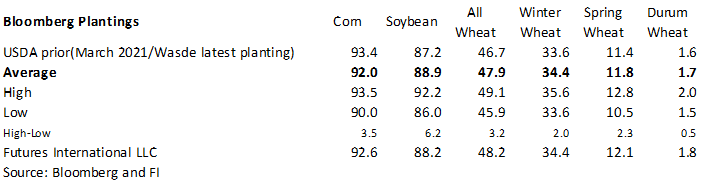

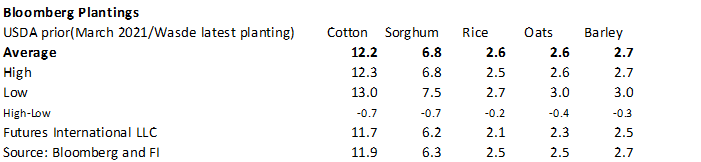

- U.S.

annual acreage prospective planting data for various farm commodities, including wheat, barley, corn, cotton, soybeans and sunflower, noon - USDA

quarterly stockpile data for wheat, barley, corn, oats, soybeans and sorghum, noon - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - U.S.

agricultural prices paid, 3pm - Malaysia’s

March palm oil export data

Friday,

April 1:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Australia

Commodity Index - USDA

soybean crush, DDGS output, corn for ethanol, 3pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

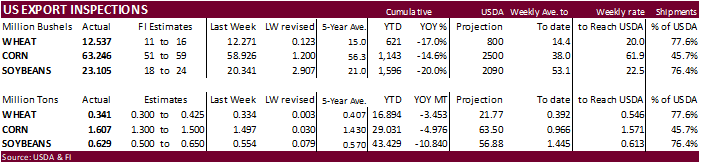

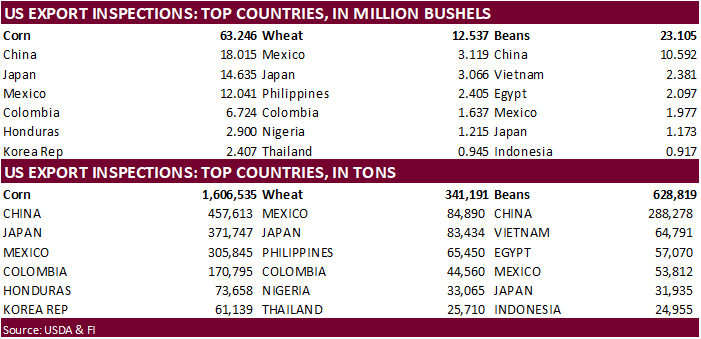

Reuters

trade estimates for USDA

USDA

inspections versus Reuters trade range

Wheat

341,191 versus 300000-500000 range

Corn

1,606,535 versus 1000000-1665000 range

Soybeans

628,819 versus 500000-800000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAR 24, 2022

— METRIC TONS —

—————————————————————————

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 03/24/2022 03/17/2022 03/25/2021 TO DATE TO DATE

BARLEY

0 0 1,497 10,010 32,520

CORN

1,606,535 1,496,798 1,789,432 29,030,547 34,006,675

FLAXSEED

0 0 0 324 509

MIXED

0 0 0 0 0

OATS

0 0 399 400 4,815

RYE

0 0 0 0 0

SORGHUM

342,326 335,599 244,739 4,165,410 4,449,284

SOYBEANS

628,819 553,582 450,807 43,428,819 54,269,171

SUNFLOWER

0 0 0 532 0

WHEAT

341,191 333,970 307,167 16,894,292 20,347,102

Total

2,918,871 2,719,949 2,794,041 93,530,334 113,110,076

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

Wholesale Inventories (M/M) Feb P: 2.1% (est 1.2%; prev 0.8%; prevR 1.0%)

US

Retail Inventories (M/M) Feb: 1.1% (est 1.4%; prev 1.9%)

US

Advance Goods Trade Balance Feb: -$106.6Bln (est -$106.3Bln; prev -$107.6Bln)

(Bloomberg)

— Russia’s ruble extended its run of gains into a sixth day against the dollar

·

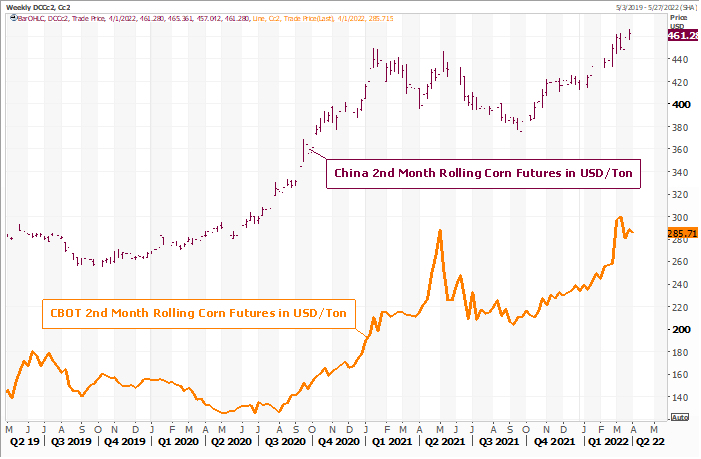

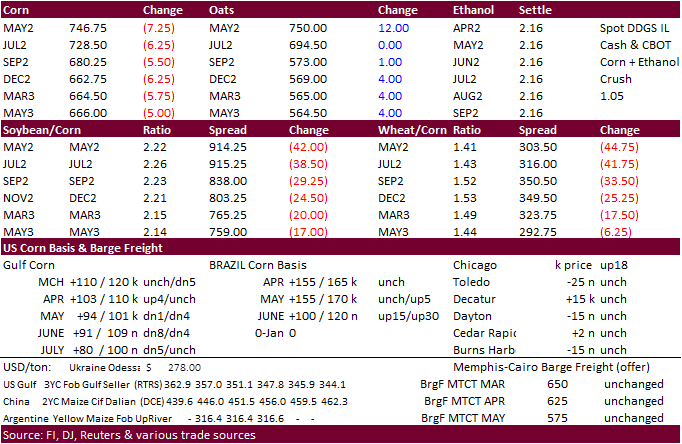

US corn futures traded lower with some light at the end of the tunnel for the Ukraine/Russia situation. Outside commodity markets also pressured corn. WTI crude oil was off more nearly $8.00 when the agriculture markets closed.

May futures lost more ground to other 2022 contracts. It was interesting to see some of the back month 2023 contracts closed higher.

·

Earlier on May CBOT corn

traded at $7.50 for the 18th consecutive session.

·

We read reports over the weekend many Ukraine storage and handling facilities are destroyed so it is unknown how long it will take them to recover. Plantings are also a big uncertainty.

·

Ukraine exported some corn by train to Europe, according to APK-Inform. Prices for buyers from Poland and the Baltic States were $250 to $265 per ton and $275 per ton for Slovakia.

·

South Africa’s Crop Estimates Committee (CEC) estimated the 2021-22 South African corn crop at 14.68 million tons, up slightly from their previous estimate. Yellow was pegged at 7.11 million and white corn at 7.56 million tons.

Year ago, the crop was 16.31 million tons.

·

Bulgaria reported a bird flu outbreak at an industrial farm with over 177,000 laying hens. The town of Asenovgrad is the sixth industrial farm hit by bird flu since late last year.

Export

developments.

- Turkey

bought 300,000 tons of optional origin corn with lowest price at $400.87/ton c&f, and highest at $433.50/ton, for April 8 and May 5 shipment.

- Private

exporters reported the following activity:

-127,920

metric tons of corn for delivery to unknown destinations. Of the total, 77,120 metric tons is for delivery during the 2021/2022 marketing year and 50,800 metric tons is for delivery during the 2022/2023 marketing year.

Source:

Reuters and FI

Updated

3/23/22

May

corn is seen in a $6.75 and $8.10 range

December

corn is seen in a wide $5.50-$7.50 range

·

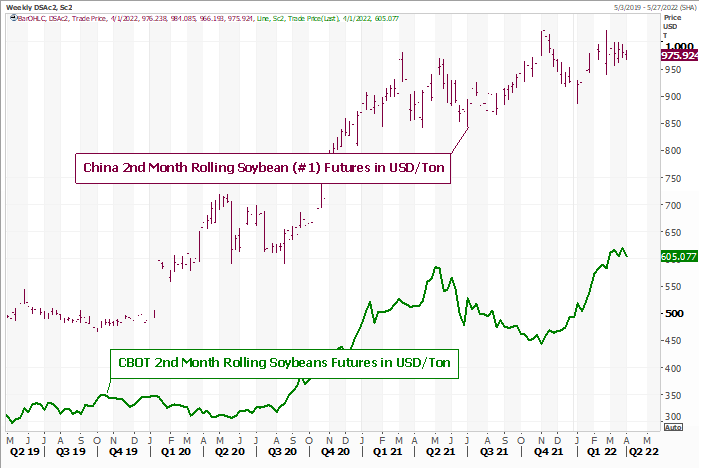

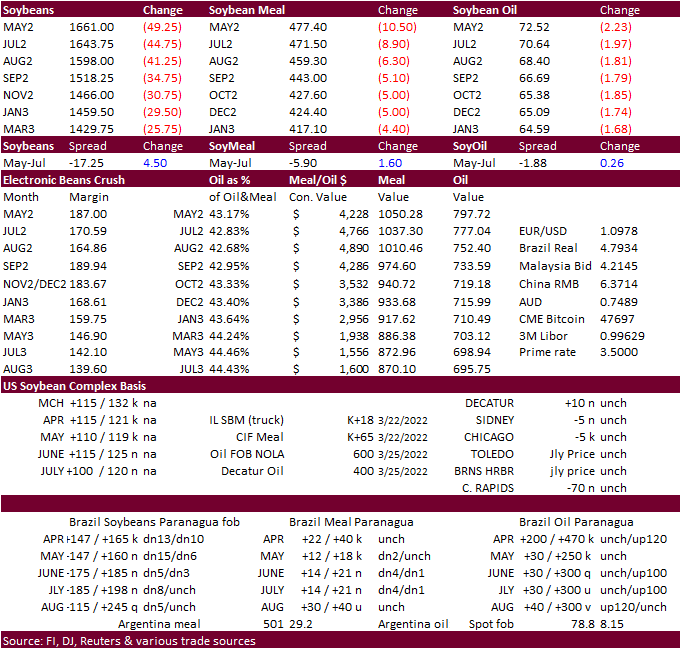

CBOT May

soybeans, meal, and soybean are lower on easing concerns over the Ukraine/Russia situation and Covid-19 lockdown concerns in China. Negotiating teams are planning to meet in Turkey this week. The CBOT crush appreciated after soybeans traded more than 40 cents

lower in the front three contracts.

·

China locked down a large city, Shanghai, over the weekend due to covid, potentially slowing imported soybean unloading’s. 26 million people reside in Shanghai.

·

China plans to sell about 500,000 tons of soybeans on April 1.

·

Brazil’s Abiove lowered their soybean crop production projection for Brazil to 125.3 million tons, a 7.7% decrease from January. They slashed exports by 9.2 million to 77.7 million tons and put crush at a record 48 million tons,

resulting in record meal exports (18.3MMT) and nearly record soybean oil exports (1.7MMT).

·

The EU will see cold temperatures later this week that may impact the rapeseed crop as they begun to flower.

·

Cargo surveyor SGS reported month to date March 25 Malaysian palm exports at 1,030,943 tons, 54,360 tons below the same period a month ago or down 5.0%, and 16,781 tons above the same period a year ago or up 1.7%.

- Private

exporters reported the following activity:

-132,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year

- USDA

seeks 2,710 tons of packaged oil on April 7 for May shipment (May 23-June 13 for plants at posts).

- Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4.

Source:

Reuters and FI

Updated

3/14/22

Soybeans

– May $16.00-$18.00

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$520

·

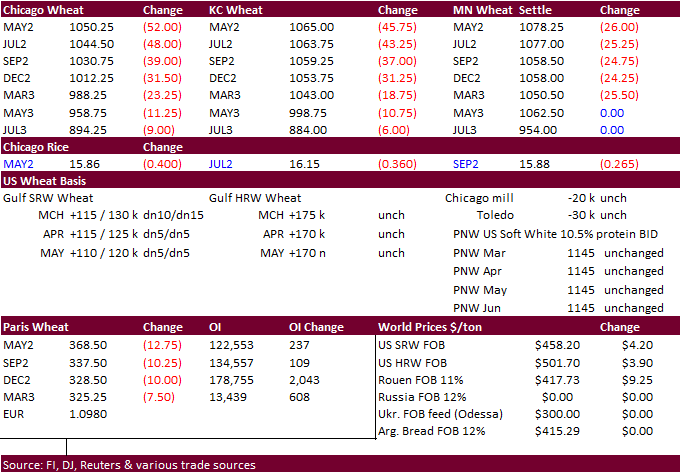

US wheat futures were sharply lower on Ukraine/ Russia headlines and hopes that Black Sea wheat trade will resume in the near future, at least for Ukraine. Russia is still shipping wheat.

·

China sold 546,015 tons of wheat out of auction. The average selling price of the wheat was 2,884 yuan ($453.05) per ton.

·

May Paris wheat futures were down 12.75 euros to 369.75 euros, or 3.3%.

·

Egypt is working with France to ensure wheat supplies.

·

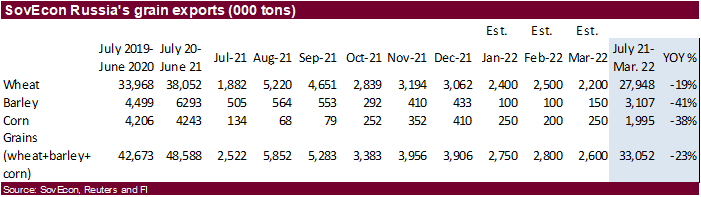

Black Sea wheat flow from Russia was steady last week, according to IKAR. SovEcon said Russia exported 400,000 tons of grains last week compared with 520,000 tons a week earlier. Both IKAR and SovEcon priced 12.5% protein content

wheat at around $390 per ton free on board (FOB).

·

SovEcon upward revised their March Russia wheat export projection to 2.2 million tons from 1.6 million previous.

·

Algeria seeks 50,000 tons of milling wheat for May and/or June shipment. It might be set to close Wednesday.

·

Taiwan seeks 40,000 tons of US wheat on March 30 for shipment off the PNW during the May 14 and May 28 period.

·

Jordan issued an import tender for 120,000 tons of milling wheat for shipment during May, June, or July on March 31.

·

Results awaited: Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June.

·

Bangladesh is in for 50,000 tons of wheat with a deadline of April 4.

Rice/Other

·

US cotton futures hit a decade high on US drought concerns and strong demand from China.

·

China sold 9,727 tons of rice out of auction. The average selling price of the rice was 2,644 yuan ($415.34) per ton.

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

Updated

3/14/22

Chicago

May $9.35 to $12.50 range

KC

May $9.25 to $12.50 range

MN

May $10.00‐$13.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.