PDF Attached

Wide

trading range today for the soybean complex and grains. Short covering, bottom picking and positioning ahead of the USDA reports supported most markets. Outside markets such as WTI crude oil lent support. Look for a choppy trade through Thursday. Friday is

USDA report day.

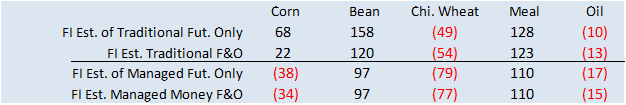

Fund

estimates as of March 27

Weather

World

Weather Inc.

-

A

band of heavy rainfall occurred overnight last night from central Louisiana through central Mississippi, central Alabama and central Georgia ending in central South Carolina

-

Amounts

ranged from 2.00 to more than 5.43 inches with a few totals over 7.00 inches resulting in some flooding

-

This

band of heavy rain was also a part of the severe weather outbreak that occurred Saturday into Sunday -

Nebraska,

northern Kansas and northeastern Colorado received snow and rain during the weekend

-

Most

of the precipitation was light varying from a few hundredths of an inch to 0.20 inch; however, northwestern Kansas, northeastern Colorado and southern Nebraska wheat areas received 0.15 to 0.45 inch of moisture with local totals as great as 0.95 inch in southwestern

Nebraska -

Snowfall

ranged from 2 to 10 inches most of which occurred from northeastern Colorado and northwestern Kansas through southern and east-central Nebraska -

Central

Oklahoma reported moisture totals to 0.10 inch with a local total of 0.33 inch on the eastern most fringe of wheat country -

The

southwestern Plains were dry -

Heavy

snow also fell from east-central Iowa and northwestern Illinois to eastern Wisconsin and northern Michigan Friday into Saturday with 21 inches at Kimberley, Wisconsin and 5 to 17 inches common -

Cold

air will be over the northern and central U.S. Plains this week with freezes from the Texas Panhandle into Canada with readings in the positive and negative single digits Fahrenheit likely in the far northern Plains where normal low temperatures should be

in the 20s at this time of year. -

Extreme

lows Wednesday morning may drop to near -10 Fahrenheit as far south as northern and eastern North Dakota -

North-central

United States (northern Plains and upper Midwest) will remain much colder than usual for the next ten days -

Some

warming is expected Thursday and again during the weekend that may induce a little snowmelt -

Temperatures

will also be cooler than usual in the western United States during most of this period

-

The

southeastern United States will experience waves of warm weather -

U.S.

southwestern Plains; including West Texas, the Texas Panhandle, southwestern Kansas and southeastern Colorado (the southwestern hard red winter wheat region) are unlikely to receive significant rain in the next ten days -

U.S.

rainfall is still advertised to be frequent in the Midwest, Delta and interior southeastern states during the next ten days -

The

environment will not support fieldwork very well and some drier and warmer weather may be needed soon to get farmers into their fields during the ideal planting time -

Flood

potentials remain very high in the upper Midwest and Red River Basin during April as warmer temperatures and rain combine to melt snow and create some significant runoff.

-

A

frequent succession of weather systems will return to the northeastern Plains and upper Midwest late this week and continue into next week -

The

first large storm may impact South Dakota and portions of both Minnesota and southeastern North Dakota late this week with significant rain and snow

-

North

Dakota, Montana and northwestern Minnesota will not see nearly as much precipitation as the above areas -

A

second storm is possible early to mid-week next week -

Dryness

in the interior U.S. Pacific Northwest will remain while snow impacts the mountainous region surrounding the Yakima Valley and north-central Oregon -

South

Texas, the Texas Blacklands and the Texas Coastal Bend region will get some rain later this week into next week

-

California’s

heavier precipitation events should be over , although light precipitation events will continue to come and go periodically -

Flooding

in California later this spring could be significant in a few areas as water reservoirs reach full capacity warranting a spillage of water through dams as mountain snowmelt reaches the storage facilities -

Canada’s

Prairies will continue drier than usual this week especially in the interior southwest where there is need for significant precipitation this spring in order to support planting and early crop development.

-

Precipitation

is expected to increase during April -

Mexico

drought will continue into April, although there will be some periodic opportunity for rain in eastern parts of the nation starting at mid-week this week and lasting into next week -

Argentina

took a break from significant rain during the weekend and that break will continue through Thursday allowing recent moisture to percolate down into the ground -

Late

season, immature, crops will benefit from the recent rain and this week’s sunshine to promote more aggressive crop development -

Most

of the crop improvement will be in a very small portion of the production region.

-

Drier

weather this week will be good for improving early season crop maturation and early season harvest progress -

Argentina

rainfall will begin to ramp up again during the late week and weekend with the greatest rain expected next week

-

Drought

will be eased additionally by next week’s rain and some crop improvement will continue, but the nation’s total production cannot recover very well from the horrific impacts of heat and dryness during much of the growing season -

Good

drying conditions occurred in Brazil during the weekend favoring late season soybean and first season corn harvesting -

Rice

maturation and harvesting advanced as well and some improvement in sugarcane, coffee and citrus development also occurred

-

Early

season wheat planting advanced in parts of the interior southeast -

Brazil

weather over the next two weeks will include scattered showers and thunderstorms -

Much

of the rain will be light and may not counter evaporation very well -

Some

net drying will occur, but most areas will remain favorably moist except northern and eastern Minas Gerais and Espirito Santo to interior Bahia where dryness will prevail -

GFS

model is still trying to increase precipitation during the second week of the outlook -

World

Weather, Inc. does not believe there is much reason to expect monsoon rain to completely withdraw before mid-April -

Abundant

rain is expected in Brazil’s Amazon River Basin as well as Peru, Colombia and surrounding areas -

Far

southern China received heavy rain during the weekend with some flooding suspected -

Rainfall

of 3.50 to nearly 13.22 inches occurred from eastern Guangxi through southern Hunan and Guangdong to southern Zhejiang and Fujian -

Rainfall

diminished northward to the Yangtze River while most other areas in China were dry or mostly dry -

Temperatures

were mild to cool biased -

China’s

rain through this workweek will be mostly limited to areas near and south of the Yangtze River and amounts of 2.00 to 6.00 inches will result with the southern coastal provinces wettest -

Other

areas in China will be dry with a warming trend likely and temperatures rising above normal in a few days -

Additional

flooding may impact a part of the far south -

Some

of the moisture will be good for future rice planting and development, but fieldwork of all kinds will be delayed by the rain -

China’s

southern rain will shift northward impacting many crop areas in east-central and northeastern China during the weekend and more likely next week -

Moisture

totals will be greatest in the Yangtze River Basin, but some welcome moisture may reach the Yellow River Basin and North China Plain for a brief period of time. -

Northern

Pakistan and far northern India received rain during the weekend -

Moisture

totals varied from 0.25 to 1.25 inches -

Wettest

in interior northern Pakistan, Punjab, Haryana, northern Uttar Pradesh and a parts of both Uttarakhand and western Himachal Pradesh

-

A

few amounts reached over 2.00 inches -

Wheat

quality was at risk along with a few other winter crops -

Other

areas in India were either dry or mostly dry -

Northern

India and Pakistan are likely to see another wave of light rain late this week with 0.10 to 0.65 inch of moisture resulting -

That

will be sufficient to keep pressure on wheat and a few other winter crops in the far northern parts of India -

Crops

elsewhere in India should fill and mature normally with some early harvesting under way and it will increase during April and May -

North

Africa is warming up while staying dry -

No

precipitation fell during the weekend and high temperatures were in the 70s and lower 80s -

Heat

and dryness are cutting into production potentials -

Another

week of dry or mostly dry weather is expected before rain chances may improve in a part of the region -

Showers

will be possible next week, but resulting rainfall does not look to be very great leaving a need for greater precipitation, despite a little relief in some areas -

Europe

will experience waves of rain over the next ten days to two weeks -

Eastern

Spain will remain one of the driest areas in the continent for a while and temperatures will be warmer than usual throughout the next ten days possibly threatening dryland winter crops and some of the planting of spring crops -

Abundant

moisture is likely elsewhere with “some” relief to dryness in Romania and the lower Danube River Basin during the second week of the outlook -

West-central

Africa precipitation will be erratically distributed over the next few days, but it may increase next week -

Recent

precipitation has been erratic with some areas getting plenty of rain and others need more -

Rain

is expected periodically throughout the next couple of weeks with most areas getting at least some rain -

Some

of the rain will be locally heavy -

Australia

rain fell in both Western Australia and near and east of the Great Dividing Range during the weekend -

Some

rain fell in southeastern Queensland as well -

Moisture

totals varied from 0.15 to 0.79 inch with local totals over 1.00 inch -

Australia

rainfall will be limited for a while this week, but it will increase in the east next week

-

The

change will be good for a few late season crops, but drier weather may be needed to protect early maturing cotton in the open boll stage -

Central

America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days -

Net

drying is likely in portions of Honduras and Nicaragua -

South

Africa crop weather has been very good this year, although portions of the nation are drying out now and the trend may continue for a while -

Early

season maturation and harvesting should go well -

Late

season crops will need some beneficial moisture later this season -

Rain

prospects are fair over the next ten days, but the precipitation should be erratic and often lighter than usual -

Southeastern

Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away -

Turkey

will receive frequent bouts of rain over the next ten days bolstering soil moisture for wheat development and rice and cotton planting -

Portions

of the nation are already wet after recent rain and mountain snow -

Other

spring planting will benefit from the coming moisture boost -

Other

areas in the Middle East have been experiencing a boost in precipitation -

This

week’s precipitation will be greatest in Turkey, Iraq and western Iran -

Improving

soil moisture throughout the Middle East is improving rice and cotton planting prospects (among other crops) and winter wheat conditions are improving -

Philippines

rainfall will be light to locally moderate most days through the coming week

-

Weather

conditions in the next ten days should be mostly good for the nation, although the south may eventually turn quite wet -

Indonesia

and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying -

Mainland

areas of Southeast Asia will experience a general boost in precipitation this week and next week which is normal at this time of year.

-

Recent

temperatures have been heating up while it has been dry and that, too, is typical of this time of year ahead of the coming monsoon season -

Eastern

Africa precipitation is expected to scatter daily from Tanzania to Ethiopia over the next ten days -

The

moisture will be good for ongoing crop development -

Today’s

Southern Oscillation Index was -0.03 and it was expected to move erratically over the coming week

Source:

World Weather, INC.

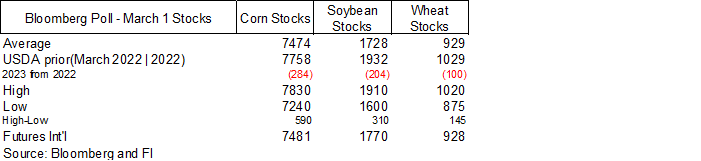

Bloomberg

Ag calendar

Monday,

March 27:

- USDA

export inspections – corn, soybeans, wheat, 11am

Tuesday,

March 28:

- EU

weekly grain, oilseed import and export data

Wednesday,

March 29:

- EIA

weekly US ethanol inventories, production, 10:30am - Coffee,

rice and rubber exports from Vietnam

Thursday,

March 30:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - USDA

hogs & pigs inventory, 3pm - HOLIDAY:

India

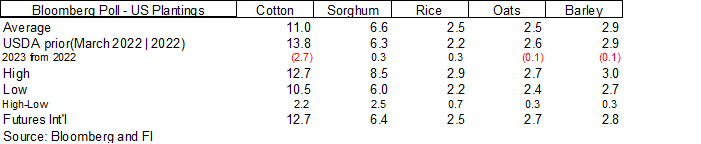

Friday,

March 31:

- US

prospective planting data for several crops, including corn, soybeans, wheat, cotton, barley and rice, noon - USDA’s

quarterly stockpiles data for corn, soybeans, wheat, barley and sorghum - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Malaysia’s

March palm oil export data - US

agricultural prices paid and received, 3pm

Source:

Bloomberg and FI

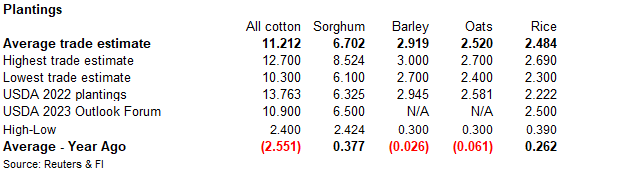

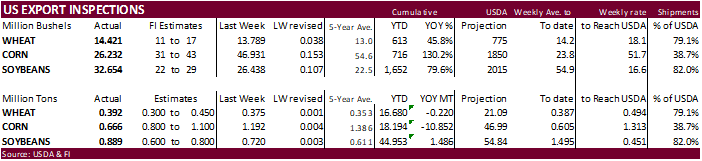

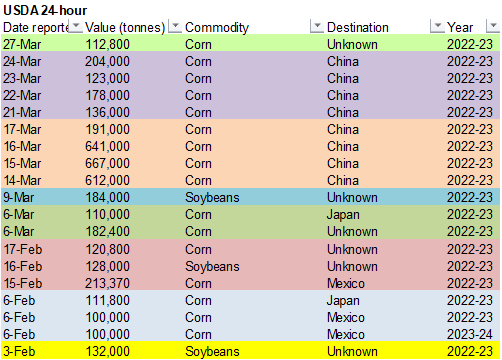

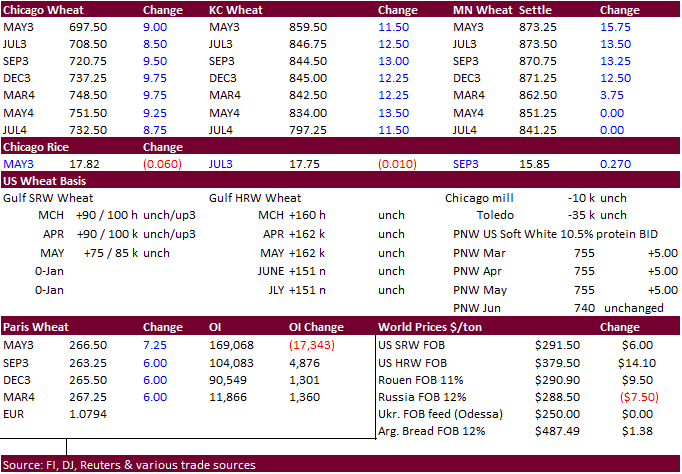

USDA

inspections versus Reuters trade range

Wheat

392,484 versus 200000-45000 range

Corn

666,325 versus 700000-1400000 range

Soybeans

888,707 versus 250000-900000 range

RAINS INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAR 23, 2023

-- METRIC TONS --

--------------------------------------------------------------------------

CURRENT PREVIOUS

----------- WEEK ENDING ---------- MARKET YEAR MARKET YEAR

GRAIN 03/23/2023 03/16/2023 03/24/2022 TO DATE TO DATE

BARLEY 0 0 0 2,154 10,010

CORN 666,325 1,192,093 1,614,664 18,193,644 29,045,431

FLAXSEED 0 0 0 200 324

MIXED 0 0 0 0 0

OATS 0 0 0 6,486 400

RYE 0 0 0 0 0

SORGHUM 176,695 94,495 343,476 1,091,357 4,167,293

SOYBEANS 888,707 719,532 631,604 44,953,271 43,467,619

SUNFLOWER 0 0 0 2,408 532

WHEAT 392,484 375,271 343,773 16,679,539 16,899,828

Total 2,124,211 2,381,391 2,933,517 80,929,059 93,591,437

--------------------------------------------------------------------------

CROP MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED; SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES WATERWAY SHIPMENTS TO CANADA.

Goldman

Sees 35% Odds Of Us Recession In 12-Mths, Up From 25%

98

Counterparties Take $2.220 Tln At Fed Reverse Repo Op. (prev $2.218 Tln, 100 Bids)

CME

FedWatch Tool

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

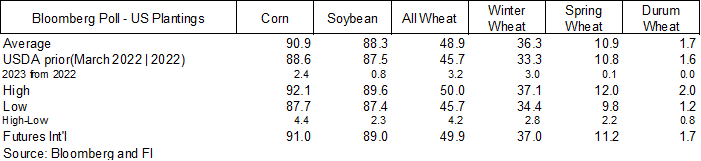

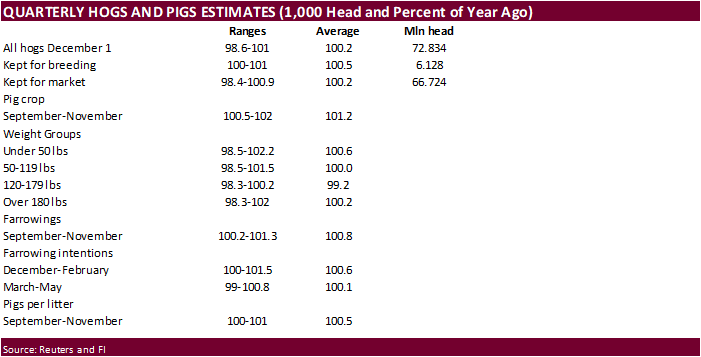

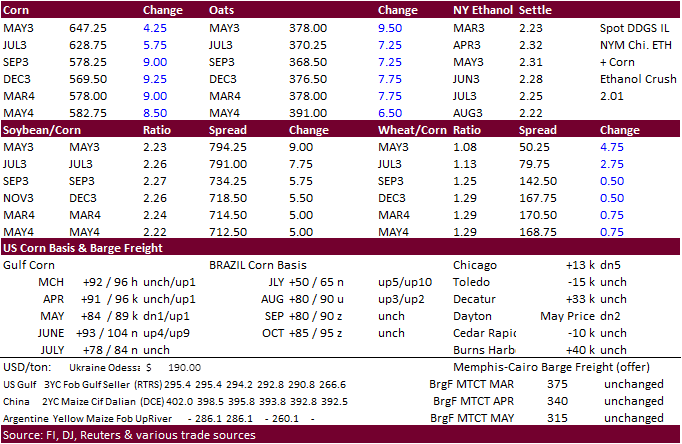

Corn

·

CBOT corn futures traded two-sided, ending on a strong note from light buying after fund selling dried up. Note the latest Commitment of Traders report did show speculators settled down after previous four weeks of heavy selling.

Higher soybeans underpinned corn. Additional USDA corn sales announcement and higher WTI crude oil market helped prices. Look for positioning this week ahead of USDA’s March 31 reports.

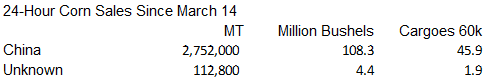

·

USDA reported 112,800 tons of corn sold to unknown. One source said it might be for Japan. US export sales to Japan are below average for this time of year (graph after the text).

·

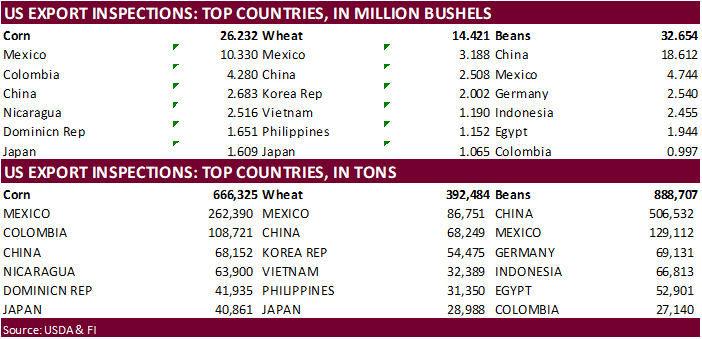

USDA US corn export inspections as of March 23, 2023 were 666,325 tons, below a range of trade expectations, below 1,192,093 tons previous week and compares to 1,614,664 tons year ago. Major countries included Mexico for 262,390

tons, Colombia for 108,721 tons, and China for 68,152 tons.

·

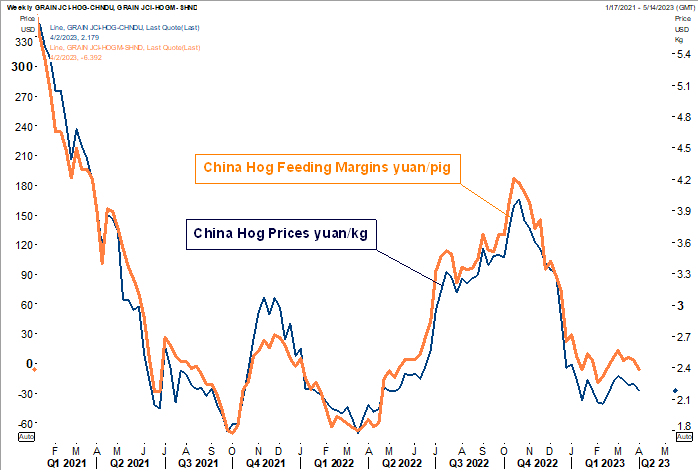

USDA hogs and pigs report is due out on Thursday and a Bloomberg poll sees the US hag herd as of March 1 seen rising 0.4% from a year earlier to 72.97 million head. A Reuters poll see a 0.2% increase. Reuters trade estimates are

below the export development section.

·

Some people suggested the weakness earlier in the US corn market was due to weaker China hog prices, which may curb China feed demand if inventories decline. China corn futures declined to an August low on Monday.

·

China’s sow herd increased 1.7% for the month of February from a year earlier, according to the AgMin. The herd was 43.4 million sows, 5% above the government target.

Pro

Farmer acreage estimates:

Corn

92.1 million acres

Beans

88.4 m acres

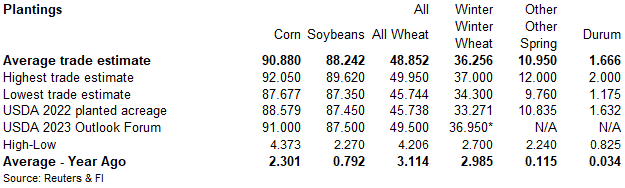

Bloomberg

corn average is 90.9. Low end 87.7 & high end 92.1.

Bloomberg

soybean average is 88.3 with 87.4-89.6 range

EIA:

Renewable generation surpassed coal and nuclear in the U.S. electric power sector in 2022

https://www.eia.gov/todayinenergy/detail.php?id=55960&src=email

Export

developments.

-

USDA

reported private exporters reported sales of 112,800 metric tons of corn for delivery to unknown destinations during the 2022/2023 marketing year.

Updated

03/21/23

May

corn $5.85-$6.75

July

corn $5.75-$7.00

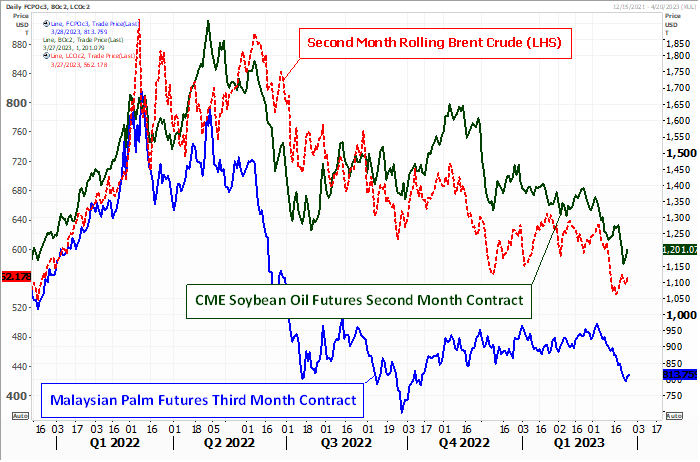

·

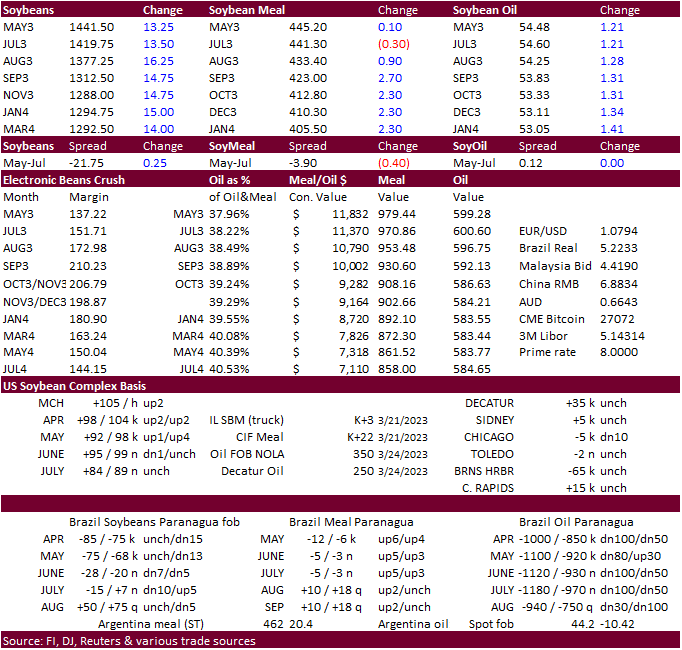

US soybeans rallied from initial strength in soybean oil. Oil share improved but gave up some gains after meal was able to rebound to close mixed in the front months and higher in the back months. There were a good amount of put

spreads just after the market opened this morning. After fund selling dried, soybeans rallied. Soybean inspections were highest since mid-February, and about 10 million bushels above its 5-year average. EU rapeseed prices were 13.00 euros higher at 470.00

bass the May contract. Soybean oil was up little more than 120 points from higher WTI crude oil and palm futures snapping a 7-day losing streak. China soybean products rebounded from trading lower last week.

·

USDA US soybean export inspections as of March 23, 2023 were 888,707 tons, upper end of a range of trade expectations, above 719,532 tons previous week and compares to 631,604 tons year ago. Major countries included China for

506,532 tons, Mexico for 129,112 tons, and Germany for 69,131 tons.

·

AgRural estimated Brazil soybean harvest progress at 70 percent through Thursday, up 8 points from the previous week and compares to 75 percent last year.

·

China was said to have bought a cargo of Brazilian soybeans Monday after picking up three last week. US soybean sales to China have been slow and the season window for fresh sales is narrowing.

·

Indonesia January palm oil exports were 2.95 million tons, up 35.2% from a year ago. Production was 3.89 MMT. Stocks fell to 3.09 MMT from 3.56 MMT at the end of January 2022.

·

Cargo surveyor AmSpec reported Malaysian palm oil exports during the March 1-25 period at 1.137 million tons, up 19.8 percent from the same period previous month.

·

Cargo surveyor ITS reported Malaysian palm oil exports during the March 1-25 period at 1.151 million tons, up 11.4 percent from the same period previous month.

Export

Developments

·

None reported

Updated

03/23/23

Soybeans

– May $13.75-$15.00

Soybean

meal – May $400-$475

Soybean

oil – May 49.50-55.55

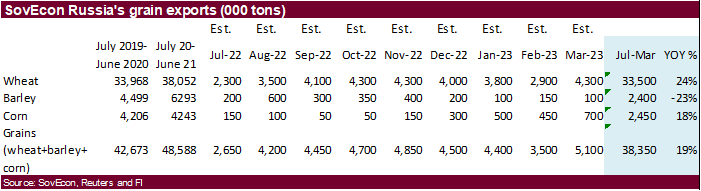

Wheat

·

US wheat futures rallied after trading lower earlier this morning, in part from strong EU wheat and short covering. A reversal in corn and sharply higher soybeans lent support. Some cited uncertainty over Black Sea shipping as

a reason US and EU wheat futures were higher. Although Black Sea news was light over the weekend. Turkey is in for a large amount of wheat tomorrow.

·

US wheat producer selling slowed after prices trended lower this month.

·

USDA US all-wheat export inspections as of March 23, 2023 were 392,484 tons, within a range of trade expectations, above 375,271 tons previous week and compares to 343,773 tons year ago. Major countries included Mexico for 86,751

tons, China for 68,249 tons, and Korea Rep for 54,475 tons.

·

Paris May wheat rallied 7.25 euros to 266.50. Last week it hit a multi month low.

·

Iraq seeks to import 600,000 to 1,000,000 tons of wheat this season after production is expected to hit their 4.0-million-ton objective to ensure food supply.

·

Ukraine grain exports for the week as of March 26 were 804,197 tons, down from 1.08 million tons week earlier.

·

Reuters: Prices for Russian wheat with 12.5% protein content, delivered free on board (FOB) from Black Sea ports, fell $5 to $272 a ton last week, the IKAR agriculture consultancy said.

·

As reported last week, the unfavorable weather across India’s wheat area is still being addressed. Punjab officials said 40 percent of their wheat crop was impacted, an may result in a 15 percent yield loss.

·

Jordan seeks 120,000 tons of wheat on March 28 for Sep-Oct shipment.

·

China plans to auction off 140,000 tons of wheat from state reserves on March 29.

Rice/Other

·

Results awaited: South Korea seeks 121,800 tons of rice, most of it from China.

·

(Reuters) – Indonesia’s food procurement agency (Bulog) will import 2 million tons of rice until December this year, a Bulog official said. Awaluddin Iqbal, Bulog’s corporate secretary said the first phase will see the import

of 500,000 tons. The policy is aimed at stabilizing rice supplies.

Updated

03/21/23

KC

– May $7.60-$8.75

MN

– May

$8.00-$9.50

#non-promo