PDF Attached

Attached

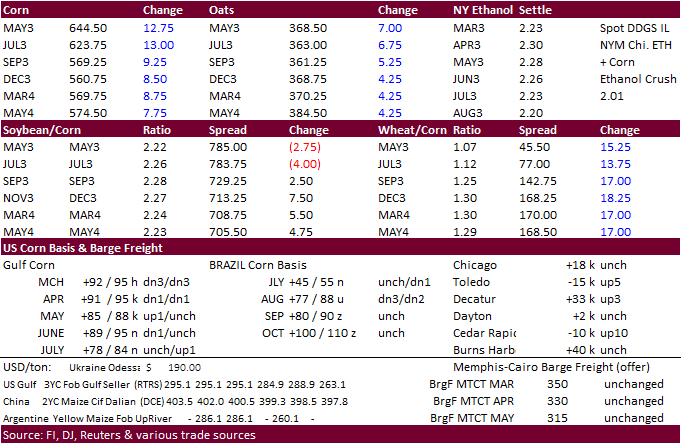

are Bloomberg trade estimates for the March 31 USDA report. USD was very strong, WTI crude trimmed earlier declines, and US equities pared losses, by the time US agriculture markets closed. Grains started and ended the day higher on Black Sea exportable supply

concerns and short covering. Russia export headlines spilled over into the soybean oil market, triggering short covering in the soybean complex.

The selloff earlier in the week for the soybean complex was overdone, INO. Private exporters reported sales of 204,000 metric tons of corn for delivery to China during the 2022/2023 marketing year.

Fund

estimates of this evening

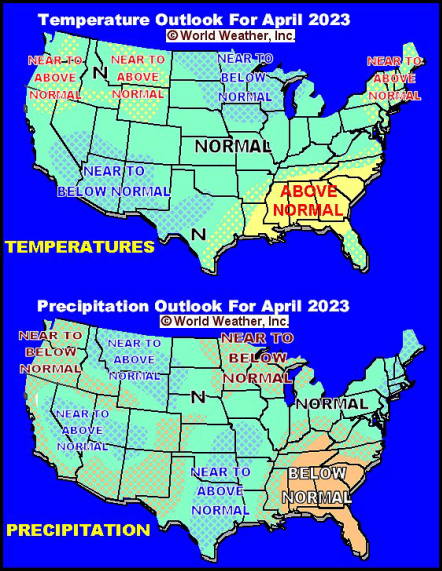

Weather

World

Weather Inc.

-

Pakistan

and northern India will be impacted by rain over the next few days raising concern for winter wheat quality and perhaps a few other crops -

The

moisture will be welcome, though, for early cotton planting that occurs in April and May -

North

Africa is still advertised to be dry or mostly dry during the next ten days

-

Crop

moisture stress is high in the drier areas of Tunisia, interior northeastern and northwestern Algeria and in a few Morocco locations -

Production

cuts will be greatest in Tunisia this year relative to that of last year -

Flood

potentials remain high for the Red River Basin of the North and the upper Mississippi River basin in April when significant warming occurs to induce aggressive snowmelt

-

Planting

delays are possible in both of these areas this spring because of the anticipated flood water -

Additional

rain and snow will move through the region during the second half of next week resulting in another 0.25 to 0.75 inch of moisture with several inches of additional snow likely in the north -

Much

less precipitation is expected in the Red River Basin of the North through the first part of next week coming week while temperatures continue quite cold relative to normal -

The

drier conditions will be welcome, but until warmer weather arrives and the region’s deep snowpack melts there will not be much celebrating over the drier weather.

-

U.S.

lower Midwest, Delta and southeastern states will be wetter biased over the next ten days resulting in delays to spring planting and general fieldwork -

Southwestern

U.S. hard red winter wheat areas are unlikely to get much precipitation during the next ten days -

Central

portions of the Plains (i.e., Nebraska, northern Kansas and northeastern Colorado) will get some rain and snow into the weekend offering some short term benefits to topsoil moisture -

West

Texas precipitation potentials are very low for the next ten days -

South

Texas and the Texas Coastal Bend region may get some rain next week, but confidence is low -

World

Weather, Inc.’s Trend Model along with the CFS and GFS Ensemble models are all hinting at improved Texas and Oklahoma rainfall during April -

California’s

heavier precipitation events should be winding down, although light precipitation may continue to come and go periodically -

Flooding

in California later this spring could be significant in a few areas as water reservoirs reach full capacity warranting a spillage of water through dams as mountain snow melt reaches the storage facilities -

Canada’s

Prairies will continue drier than usual especially in the interior southwest where there is need for significant precipitation this spring in order to support planting and early crop development.

-

Argentina’s

greatest rainfall Thursday shifted to the northwest impacting Santiago del Estero and Salta more than any other crop area -

Favorable

drying occurred in most other areas -

Argentina

will see additional bouts of rain in the central and north through the next ten days and southern areas should turn wetter again in the last days of March and early April -

Crop

improvements are occurring, although production recover is unlikely except in a few of the late soybeans and peanut crops -

Brazil

rainfall has become sporadic and light allowing much of the nation to dry out in favor of all kinds of fieldwork.

-

Late

season soybean harvesting should be advancing swiftly -

Northwestern

Russia continues to experience snowmelt and significant runoff -

Rain

is expected to develop during the weekend and last through most of next week resulting in some significant additional runoff that may worsen flooding that may already be under way -

China

rainfall over the next ten days will be greatest in the southern half of the Yangtze River Basin and southern coastal provinces benefiting rapeseed development and early season rice planting -

Additional

rain totals of 3.00 to 8.00 inches may occur near and south of the Yangtze River reaching into Guangdong, Fujian and Zhejiang -

Limited

precipitation in the lower Yellow River Basin and North China Plain will leave some wheat areas in need or greater precipitation especially in April -

Cool

temperatures are expected in eastern China over the next several days which may help to slow drying rates in winter wheat areas of the north and conserve soil moisture in the south -

Warming

is expected next week and into the following weekend -

Northeastern

Europe will turn cooler next week, and precipitation will increase in the north and west-central parts of the continent as well

-

Eastern

Spain will remain one of the driest areas in the continent for a while and temperatures will be warmer than usual throughout the next ten days possibly threatening dryland winter crops and some of the planting of spring crops -

West-central

Africa precipitation will be erratically distributed over the next few days, but it may next week -

Recent

precipitation has been lighter than usual and temperatures warmer biased raising some concern over crop development -

Rain

later this week into next week will be very important for coffee, cocoa, rice and sugarcane -

Australia

rainfall resumed recently near and east of the Great Dividing Range and it will continue into next week

-

Temperatures

will continue warmer than usual this week and then trend a little cooler this weekend and next week – at least in eastern crop areas -

The

bulk of summer crop areas are located farther inland and should not be seriously impacted by much rain -

Mexico

is still dealing with a winter drought and there is need for precipitation to support corn, sorghum and cotton in unirrigated areas -

There

is also need for moisture in some citrus and sugarcane areas, although the situation for these two crops is not critical outside of the far northeast part of the nation -

Central

America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days -

Net

drying is likely in Honduras and Nicaragua -

Drought

continues a concern in Canada’s southwestern Prairies -

Some

snow fell earlier this month in a part of the drought region, but snow water equivalents were not great enough to offer a tremendous improvement, although some benefit did occur as the snow melted -

Not

much precipitation of significance will occur in the dry areas over the next week, although some light precipitation will be possible infrequently -

Greater

precipitation may occur in the last days of March and early April -

South

Africa crop weather has been very good this year, although the nation is drying out now -

Early

season maturation and harvesting should go well -

Late

season crops will need some beneficial moisture later this season -

Rain

prospects on fair over the next ten days, but the precipitation should be erratic and often lighter than usual -

Southeastern

Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away -

Turkey

will receive frequent bouts of rain over the next ten days bolstering soil moisture for wheat development and rice and cotton planting -

Portions

of the nation are already wet after weekend rain and mountain snow -

Other

spring planting will benefit from the coming moisture boost -

Other

areas in the Middle East will also experience a boost in precipitation -

Syria,

northern Iraq and much of Iran will receive significant rainfall as will some areas in Afghanistan and northern Pakistan -

Improving

soil moisture throughout the Middle East is improving rice and cotton planting prospects (among other crops) and winter wheat conditions are improving -

Philippines

rainfall will be light to locally moderate most days through the coming week

-

Weather

conditions in the next ten days should be mostly good for the nation, although the south may eventually turn quite wet -

Indonesia

and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying -

Mainland

areas of Southeast Asia will receive very little rain of significance through Sunday, but a notable boost in rain may occur in the last days of this month -

Eastern

Africa precipitation is expected to scatter from Tanzania to Ethiopia over the next ten days -

The

moisture will be good for ongoing crop development -

Today’s

Southern Oscillation Index was 0.08 and it was expected to move erratically over the coming week

Source:

World Weather, INC.

Source:

World Weather, INC.

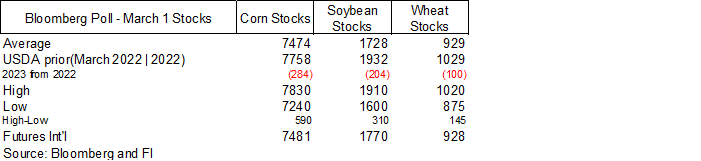

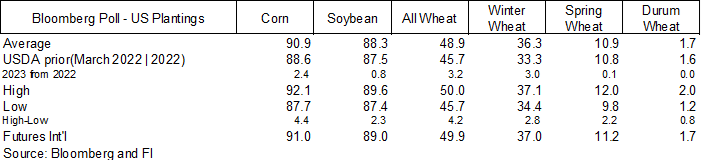

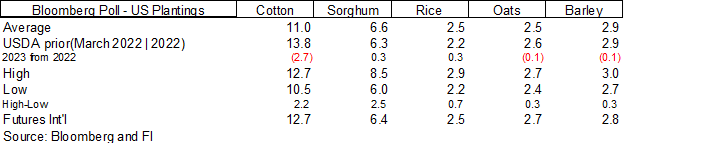

Bloomberg

Ag calendar

Friday,

March 24:

- Marine

Insurance London conference - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop conditions reports - US

poultry slaughter - HOLIDAY:

Argentina

Monday,

March 27:

- USDA

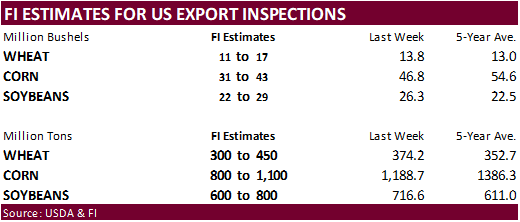

export inspections – corn, soybeans, wheat, 11am

Tuesday,

March 28:

- EU

weekly grain, oilseed import and export data

Wednesday,

March 29:

- EIA

weekly US ethanol inventories, production, 10:30am - Coffee,

rice and rubber exports from Vietnam

Thursday,

March 30:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - USDA

hogs & pigs inventory, 3pm - HOLIDAY:

India

Friday,

March 31:

- US

prospective planting data for several crops, including corn, soybeans, wheat, cotton, barley and rice, noon - USDA’s

quarterly stockpiles data for corn, soybeans, wheat, barley and sorghum - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Malaysia’s

March palm oil export data - US

agricultural prices paid and received, 3pm

Source:

Bloomberg and FI

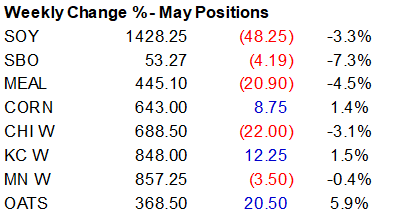

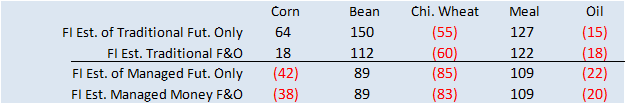

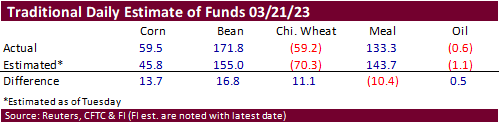

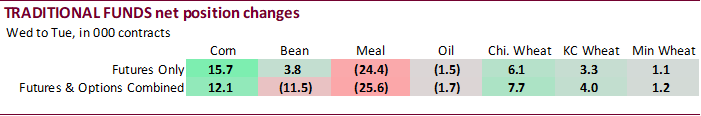

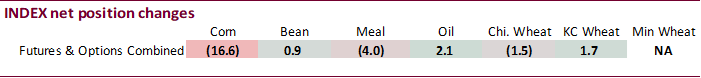

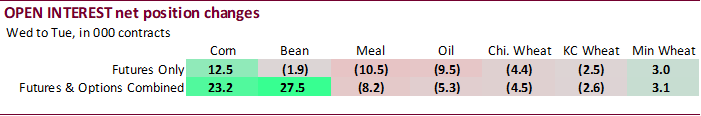

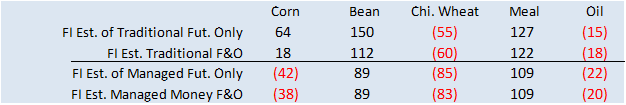

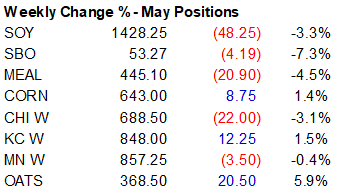

Good

fund selling was seen in soybean meal for the week ending March 21. Funds trimmed their net short position for corn.

Estimates

as of this evening

Reuters

Table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

-52,799 24,835 281,734 -16,629 -163,733 -9,846

Soybeans

94,993 -15,697 128,440 927 -187,442 7,565

Soyoil

-25,609 -2,020 100,992 2,095 -74,888 977

CBOT

wheat -80,136 7,818 80,447 -1,470 -1,809 -6,033

KCBT

wheat -18,667 2,579 44,476 1,733 -22,703 -2,598

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

-41,896 12,238 226,688 -3,827 -175,450 -9,932

Soybeans

110,786 -16,873 92,557 -1,723 -190,682 6,026

Soymeal

115,214 -18,755 87,238 4,318 -232,903 22,789

Soyoil

-5,718 -4,529 106,318 3,351 -101,621 -619

CBOT

wheat -86,500 8,757 62,938 -1,654 -310 -5,756

KCBT

wheat -8,762 3,971 36,154 10 -24,631 -2,345

MGEX

wheat -2,624 1,823 1,305 -15 -634 -1,983

———- ———- ———- ———- ———- ———-

Total

wheat -97,886 14,551 100,397 -1,659 -25,575 -10,084

Live

cattle 63,749 -28,817 43,940 -2,336 -124,278 25,423

Feeder

cattle 7,141 -3,227 1,734 134 -2,004 1,211

Lean

hogs -16,575 -18,712 47,617 658 -30,083 16,788

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

55,860 -120 -65,202 1,640 1,690,830 23,227

Soybeans

23,330 5,367 -35,992 7,205 867,790 27,500

Soymeal

12,698 -6,888 17,753 -1,464 481,613 -8,197

Soyoil

1,513 2,849 -494 -1,052 496,457 -5,291

CBOT

wheat 22,373 -1,031 1,497 -316 454,791 -4,508

KCBT

wheat 345 77 -3,107 -1,714 188,590 -2,585

MGEX

wheat 2,429 -669 -476 843 60,382 3,080

———- ———- ———- ———- ———- ———-

Total

wheat 25,147 -1,623 -2,086 -1,187 703,763 -4,013

Live

cattle 23,528 -32 -6,937 5,764 396,286 -25,456

Feeder

cattle 2,888 119 -9,759 1,762 76,616 834

Lean

hogs -3,771 -1,688 2,812 2,953 310,858 28,295

US

Durable Goods Orders Feb P: -1.0% (exp 0.2%; prev -4.5%)

Durable

Ex Transportation Feb P: 0.0% (exp 0.2%; prev 0.8%)

Capital

Goods Orders Nondef Ex Air Feb P: 0.2% (exp -0.2%; prev 0.8%)

Capital

Goods Nondef Ex Air Feb P: 0.0% (exp 0.2%; prev 1.1%)

Canadian

Retail Sales (M/M) Jan: 1.4% (exp 0.7%; prev 0.5%)

Retail

Sales Ex Auto (M/M) Jan: 0.9% (exp 0.6%; prevr -0.7%)

Canada

Wholesales Fell 1.6% M/M In February – StatCan Flash Estimate

–

Factory Sales Fell 2.8% M/M In February

US

S&P Global US Manufacturing PMI Mar P: 49.3 (exp 47.0; prev 47.3)

US

S&P Global US Services PMI Mar P: 53.8 (exp 50.3; prev 50.6)

US

S&P Global US Composite PMI Mar P: 53.3 (exp 49.5; prev 50.1)

100

Counterparties Take $2.218 Tln At Fed Reverse Repo Op. (prev $2.234 Tln, 99 Bids)

·

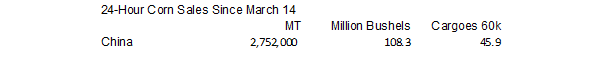

Corn futures rallied on Friday with China buying more US corn. Short covering supported nearby spreads. 204,000 tons was announced under the 24-hour USDA announcement system.

·

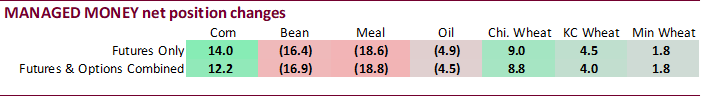

Funds were net buyers of an estimated net 8,000 corn contracts. The latest CFTC report showed funds trimmed their net short position for corn.

·

China corn imports are expected to reach 18 million tons during 2022-23, assuming Ukraine and Brazil combined shipments total at least 9 million tons (maybe more from Brazil). The US has 6.2 million tons on the books and another

641,000 tons bought since March 21 (7.5 million known US commitments). We think all said and done, China will commit 8-9 million tons of US corn for 2022-23 delivery. That comes to 17-18 million tons. We are under the impression Brazil could ship more than

7 million tons of corn by end of September to China (2MMT had already been done) and won’t be surprised if total imports hit above 20 million tons.

·

Russia could extend restrictions on fertilizer exports for six months until November to help support the domestic market, Agriculture Minister Dmitry Patrushev said on Friday. (Reuters)

Export

developments.

-

Private

exporters reported sales of 204,000 metric tons of corn for delivery to China during the 2022/2023 marketing year.

Updated

03/21/23

May

corn $5.85-$6.75

July

corn $5.75-$7.00

·

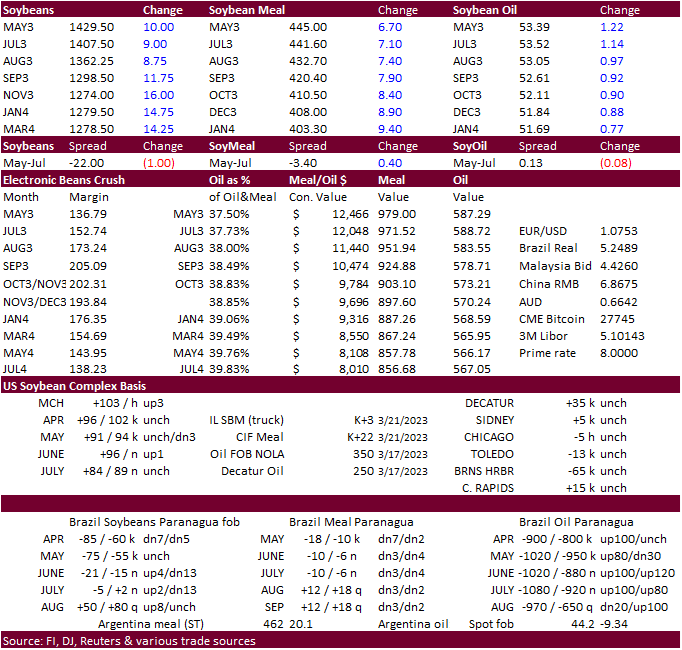

May soybeans reached an October 28, 2022, low overnight on follow through selling but rebounded from short covering and higher products, in part to Russia headlines. CBOT crush rebounded by a large amount. Higher corn and wheat

spilled over into soybeans and meal.

·

Earlier it was said Russia was considering a recommendation producers suspend sales at current prices, effectively curbing exports of sunflower oil and sunflower seed.

·

Malaysian palm was lower and for the week down 10.2 percent.

·

Early this morning offshore values were leading SBO higher by about 104 points (204 higher for the week to date) and meal $0.60 short ton higher ($0.20 higher for the week).

·

Funds bought an estimated net 5,000 soybean contracts, 4,000 meal and 5,000 soybean oil.

·

Earlier we heard Canada committed to canola exports.

Export

Developments

·

None reported

Updated

03/23/23

Soybeans

– May $13.75-$15.00

Soybean

meal – May $400-$475

Soybean

oil – May 49.50-55.55

·

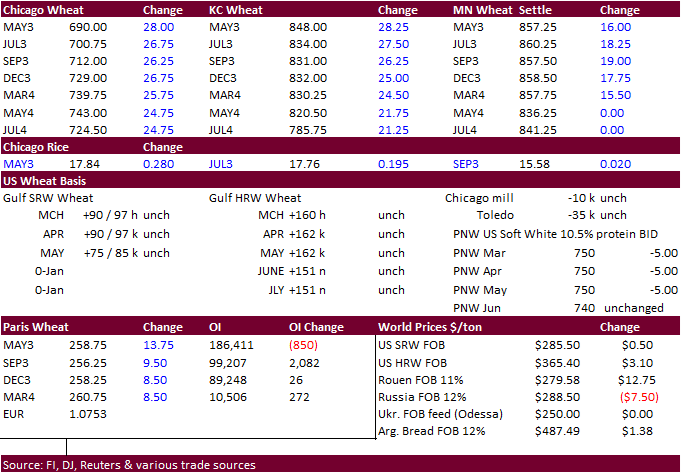

US and EU wheat futures rallied early on Black Sea exportable supply concerns after a report suggested Russia may recommend producers to curb sales to exporters. Later Russia said they have no plans to halt exports but may want

to keep domestic purchases above producer production costs. One source said that price floor could be $275 per ton.

·

Ongoing concerns over poor US winter wheat crop conditions was noted.

·

Funds bought an estimate net 12,000 Chicago wheat contracts.

·

On Monday USDA will release selected state ratings and the following week put out an initial US rating. With little change in the US drought monitor and precipitation occurring this week across the central and upper Great Plains,

some states may post an increase in ratings early next week, but southwestern states may stay the same.

·

Paris May wheat was up 13.75 euros at 259.25 per ton, a 5.6% gain.

·

French winter wheat crop ratings slipped 1 point as of March 20 from the previous week to 94 percent and compare to 92 percent year earlier. Barley was rated 93%, up one point.

·

Coceral raised their estimate of the 2023 EU wheat and rapeseed crops to 144.5 and 21.1 million tons, respectively, from 143.3 and 20.4 million tons previous.

·

Ukraine grain exports through March 24 were 36.6 million tons, below 44.8 million tons as of March 27, 2022.

·

Ukraine summer plantings started with 293,000 hectares sowed.

·

(Reuters) – Two German labor unions representing transport workers called for mass strikes next Monday that are expected to cause widespread disruption on railways and at airports, the latest travel chaos in Germany prompted by

wage disputes.

·

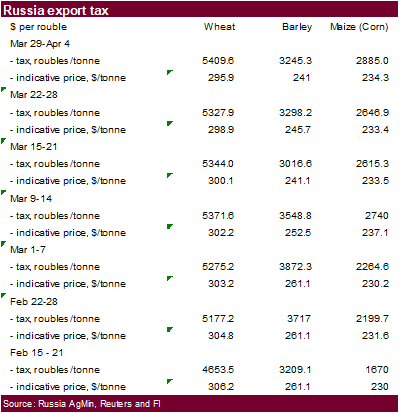

Russia’s AgMin estimated 93 percent of the winter crops in good or satisfactory condition.

·

Russia raised their export duty on wheat by 1.5 percent for the March 29 to April 4 period, from the previous week.

·

Turkey’s TMO seeks 695,000 tons of red milling wheat on March 28 for shipment May 18 to June 16 and June 12 to July 10.

·

Jordan seeks 120,000 tons of wheat on March 28 for Sep-Oct shipment.

·

China plans to auction off 140,000 tons of wheat from state reserves on March 29.

Rice/Other

·

Results awaited: South Korea seeks 121,800 tons of rice, most of it from China.

·

(Reuters) – Speculators reduced their bullish bets in futures of raw sugar on ICE U.S. in the week to March 21, while switching from net short to net long in arabica coffee futures, data from the Commodity Futures Trading Commission

(CFTC) showed on Friday. Funds cut 7,071 contracts to their net long position in raw sugar, taking it to 126,973 lots in the period, and they now hold a net long position of 4,023 contracts in arabica coffee. Speculators raised their net long position in

cocoa futures to 12,951 in the period.

Updated

03/21/23

KC

– May $7.60-$8.75

MN

– May

$8.00-$9.50

#non-promo