PDF Attached

Attached

is a revised US corn balance and US area. See text for changes in the corn section.

USDA

announced 800,000 tons of corn for China 2020-21 delivery. CBOT soybean complex and corn rebounded after getting hammered down Thursday. Wheat continued their downward trend on improving weather.

Note

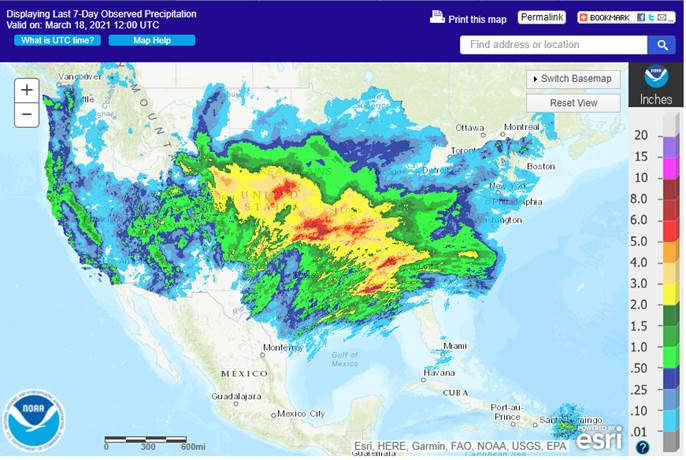

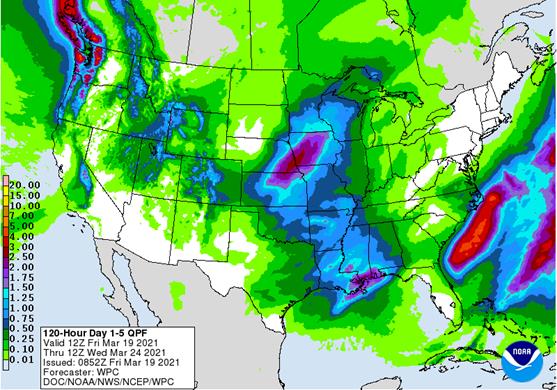

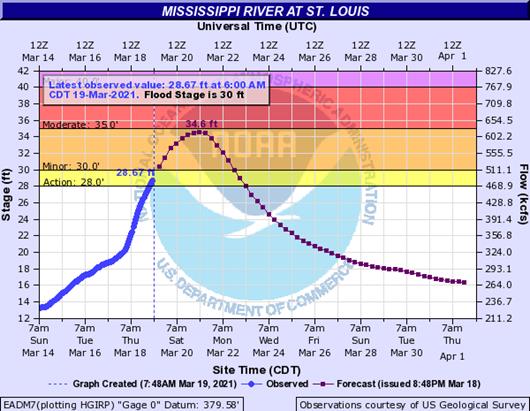

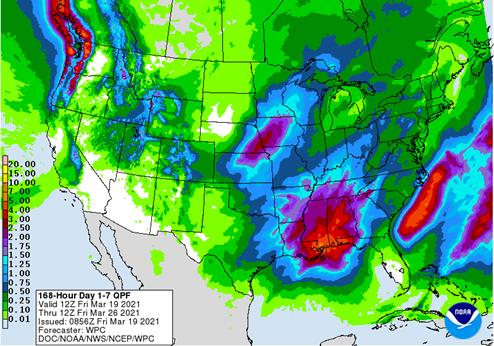

the EU changes clocks this weekend. Morning

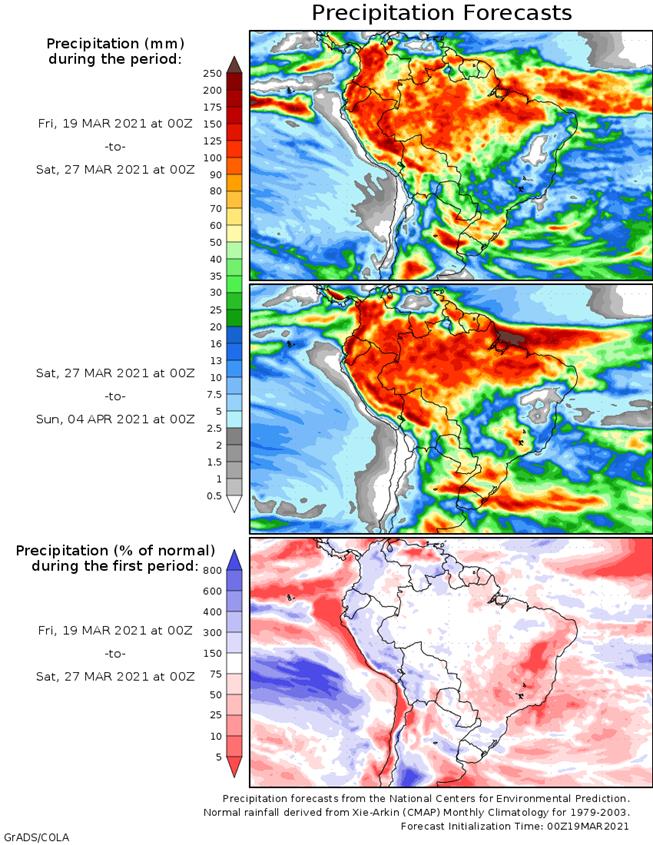

forecast called for the SE US seeing a little more precipitation over the next 10 days, delaying field work activity. The Midwest will see rain Sunday through Tuesday. US HRW wheat country will continue to see improving conditions. The Argentina weather forecast

was slightly drier this morning for the next week. Brazil’s forecast was unchanged-less frequent

rain

that of earlier this month.

5-day

(creates problems for rising US rivers)

World

Weather Inc.

CHANGES

OVERNIGHT

-

Argentina’s

southwestern crop areas were suggested drier today on the European model run for the next ten days while the GFS model run is still quite wet for the region late next week

o

World Weather, Inc. would not be surprised to see the models compromise on the outlook in future model runs with the European model a little wetter and the GFS drier

-

Advertised

rainfall for the southeastern United States was increased overnight with some significant rain anticipated for Wednesday through Friday of next week and March 29-30

o

The GFS is a little too aggressive with these events and a little too widespread with the precipitation

o

The European model solution is preferred leaving northeastern Florida, Southern Georgia and South Carolina out of the greatest rainfall

-

Mississippi,

Alabama, eastern Tennessee, northern Georgia and neighboring areas would be wettest if the European model run verifies -

Australia’s

greatest rainfall in the southeast occurs Sunday through Tuesday at which time fieldwork will be limited and concern over open boll cotton fiber quality will be highest

o

Less rain will occur before and after this period allowing for some needed drying and a chance for cotton fiber to be bleached white again

MOST

IMPORTANT WEATHER IN THE WORLD

-

Argentina

crop conditions remain in an improving mode because of rain that fell significantly over the past week and milder temperatures

o

Some warming is expected in the coming week and precipitation in the southwest may be restricted for a little while which will allow the topsoil to dry down again

o

Southwestern Argentina is already drier than other areas in the nation and crop stress will rise, but the most important crop production areas will have favorable subsoil moisture to feed crops for a while without introducing

much stress

-

Heavy

rain in east-central and a part of northeastern Argentina in the coming week may lead to some local flooding, but most coarse grain and oilseed crops will not be negatively impacted

o

Too much rain in cotton areas of the north might be a problem and the distribution of that rain will need to be closely monitored

-

Brazil

is still expecting a welcome drying trend next week that will last through the following weekend and into the last days of this month in center west, center south and interior southern parts of the nation

o

The change will be ideal in getting late season soybean harvesting completed and much of the remaining Safrinha corn planted

o

Firming soil in late season crop areas will not likely cause many problems for a while, but immature crops will require timely rain in late March and April to continue developing most favorably

-

The

driest areas will be from northern Parana to central Bahia during the next ten days

o

Rio Grande do Sul may receive frequent rain in the next ten days maintaining adequate to excessive soil moisture and leaving very little worry over the potential for a dry finish it its more immature crops

-

South

Africa summer crop areas have dried out recently and a little moisture stress may evolve in areas with the poorest soil moisture and where summer crops are most immature

o

The nation is expecting huge yields this year and that would not likely change event if the nation dried out over the next few weeks

o

Timely rainfall is expected in many areas during the coming week, but it will favor northern and eastern parts of the nation more than in the southwest

-

U.S.

weather will be sufficiently mixed with periods of sunshine, rain and mild to warm temperatures to support winter crops

o

Corn, rice and other early season planting in the Delta, Tennessee River Basin and southeastern states will not advance as well as desired because of rain

-

Too

much rain may fall in the interior southeastern corner of the nation where some flooding might occur, although today’s forecast models may be exaggerating some of the rain

o

A good mix of rain and sunshine will occur in hard red winter wheat and soft wheat areas in the Midwest during the next ten days to two weeks

-

Winter

wheat in the central Plains continues to improve following recent significant rain -

Rain

advertised periodically in the southern Plains next week will not be heavy, but will be helpful for new wheat development

o

West and South Texas may get a few showers and thunderstorms over the next ten days

-

All

of the rain is needed, and it will be welcome, but greater precipitation frequency and amounts will be needed in some areas to make a greater difference in the spring planting and establishment outlook

o

Northern U.S. Plains and Canada’s Prairies will continue to receive limited precipitation, but there are some opportunities for at least some rainfall during the coming two weeks

-

Much

more precipitation will have to occur before drought will be eased -

Any

moisture will be better than none

o

Southwestern U.S. crop areas will remain drier than usual through the next two weeks

o

California rain and snowfall will become more restricted over the next two weeks

-

Mountain

snowpack is still below average

o

Portions of the Pacific Northwest are still drought ridden and significant moisture is needed in the Yakima Valley and areas southward into Oregon

-

Parts

of Idaho and Wyoming sugarbeet and dry bean areas need moisture too -

Southeastern

Canada’s corn, soybean and wheat production areas are favorably moist and will stay that way for a while despite below average precipitation and warmer than usual temperatures -

Canada’s

Prairies will get some shower activity in the next ten days, but resulting rainfall will often be less than usual and temperatures will continue warm biased

-

India

will receive some brief periods of light rainfall through early next week

o

The moisture will slow crop maturation, but may benefit a few immature crops still filling

-

Most

of the precipitation will be too brief and light to have a lasting impact -

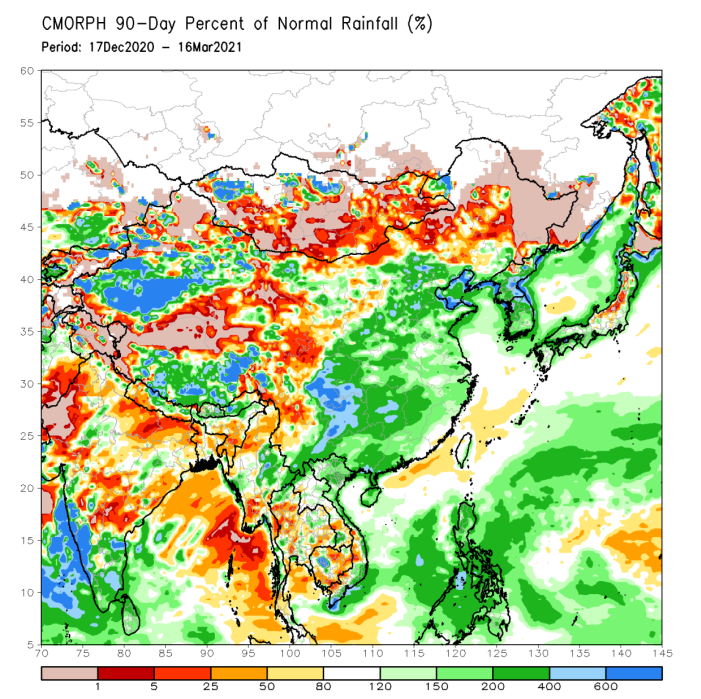

China’s

southern rapeseed crop would benefit from more sunshine and warmer temperatures, but the long term outlook is favorable -

China’s

northern rapeseed and majority of key winter wheat production areas are poised for aggressive development this spring because of good establishment in the autumn and better than usual winter precipitation along with minimal winterkill

o

Seasonal warming is beginning to wake some of these crops up and initial development will go well because of favorable soil moisture

-

Eastern

Australia’s frequent precipitation pattern expected this weekend into mid-week next week and it will raise concern over open boll cotton fiber quality and some harvest delays

o

The moisture will be excellent for late maturing summer crops including sorghum and it will lift soil moisture and water supply for wheat, barley and canola planting that begins in late April

o

Drier weather will occur late this month offering a chance for some of the wetter areas to dry down for a while

-

Middle

East precipitation will continue greatest in Turkey while Iraq, Iran and Syria continue in a net drying mode along with areas south into Israel and Jordan -

Europe

precipitation in the coming ten days will be favorably mixed to maintain mostly good field conditions

o

Temperatures will be cooler than usual

o

Spain is drying down and will need some moisture soon to protect long term crop development

o

Soil moisture in most of the continent is rated favorably and will continue rated that way over the next two weeks

o

Warming is needed to bring a larger portion of winter crops out of dormancy

-

Western

parts of the CIS will experience frequent bouts of light rain and snow during the coming ten days

o

The precipitation will continue to support abundant soil moisture across many areas

o

Eastern Ukraine and Russia’s Southern region will receive some much needed moisture next week that may bolster soil moisture for a while

o

Temperatures will be near normal allowing some warming to occur in far southern crop areas in Ukraine, Moldova and Russia’s Southern Region where soil temperatures may rise enough to induce some greening of wheat and other winter

crops in early April.

-

North

Africa weather will include a mix of rain and sunshine during the next two weeks

o

A boost in soil moisture is needed in northwestern Algeria, parts of Tunisia and southwestern Morocco

o

Some rain is expected periodically into next week with some of the drier areas in Algeria benefiting

-

Ivory

Coast, Ghana, Benin, Cameroon and southern Nigeria will receive waves of rain in the next ten days

o

New rain totals will vary from 0.50 to 3.00 inches and locally more will be supportive of coffee and cocoa flowering and help increase soil moisture for future rice, sugarcane and cotton production

-

East-central

Africa rainfall will be erratic and light for a while

o

Crop conditions are best in Tanzania

o

Rain is needed most in Ethiopia, although this is the end of their dry season

-

South

Africa will experience slowly increasing rainfall during the coming week with temperatures mostly near to above average

o

The recent drying trend encouraged early season crop maturation while subsoil moisture and irrigation supported late season crops

o

Summer crop conditions will remain favorably rated as long as the moisture boost occurs as advertised

- Mexico

drought conditions are still prevailing, although the impact on winter crops is low due to irrigation

o

Water supply is low in some areas and a notable improvement in rainfall is needed, but not very likely

o

Dryland winter crops are stressed and will yield poorly

o

Freeze damage is common in northern parts of the nation due to a couple of cold surges this winter

o

Rain in the coming week will be mostly confined to the east coast and temperatures will be seasonable with a slight warmer bias in the driest areas

- Central

America precipitation will continue greatest along the Caribbean Coast and in Guatemala while the Pacific Coast receives the lightest and most erratic rainfall, but some precipitation will fall especially in Costa Rica and Panama. - Southeast

Asia rainfall will occur relatively normally over the next two weeks

o

Mainland areas will experience increasing shower activity, although greater rainfall would be welcome

- The

resulting rainfall will be sporadic and light with net drying probably continuing in many areas for a while longer

o

Philippines rainfall will occur moderately periodically during the next ten days with some local flooding possible in the north

o

Indonesia and Malaysia weather will occur often enough to support most crop needs

- Peninsular

Malaysia needs rain most significantly - New

Zealand weather will be dry with seasonable temperatures over the coming week

o

The nation’s soil moisture is drifting farther below average

o

Rain will return to some areas next week, but greater rain may be required to restore normal soil moisture

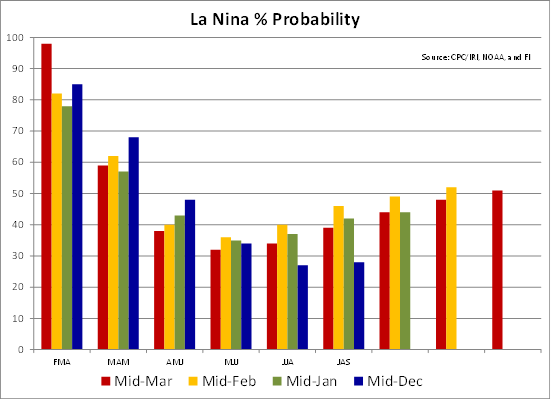

- Southern

Oscillation Index has been falling and was at +0.32 this morning. The index is expected to level off for a while this weekend into next week.

Source:

World Weather inc.

Bloomberg

Ag Calendar

Saturday,

March 20:

- China

3rd batch of Jan.-Feb. trade data, including country breakdowns for energy and commodities. No timing

Monday,

March 22:

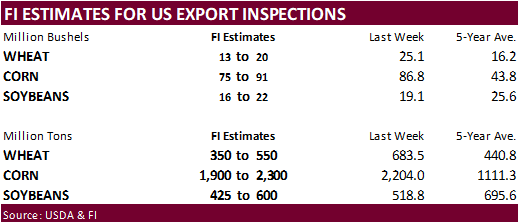

- USDA

Export Inspections – corn, soybeans, wheat, 11am - EU

weekly grain, oilseed import and export data - U.S.

cold storage data — pork, beef, poultry - Ivory

Coast cocoa arrivals

Tuesday,

March 23:

- Bursa

Malaysia Derivatives virtual palm oil conference 2021, day 1 - HOLIDAY:

Pakistan

Wednesday,

March 24:

- EIA

weekly U.S. ethanol inventories, production - Bursa

Malaysia Derivatives virtual palm oil conference 2021, day 2 - U.S.

poultry slaughter - EARNINGS:

JBS - HOLIDAY:

Argentina

Thursday,

March 25:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Seminar

on sustainable palm oil in India by the Solvent Extractors’ Association and the Malaysian Palm Oil Board - International

Grains Council monthly report - Port

of Rouen data on French grain exports - Malaysia’s

March 1-25 palm oil export data - USDA

hogs & pigs Inventory, red meat production

Friday,

March 26:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

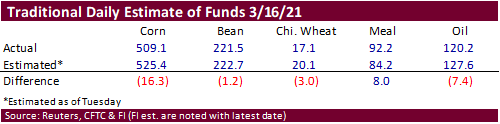

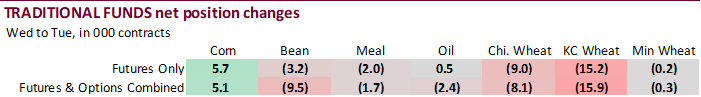

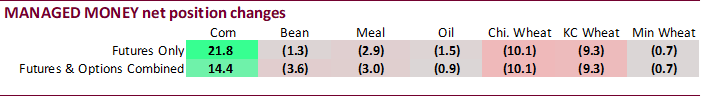

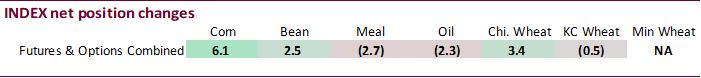

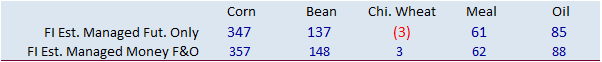

Misses

this week between trade estimates and actual CFTC data may not have an impact on Sunday’s CBOT open. Corn was not as long as expected but the net long position for traditional funds and managed money remains very large.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

343,666 3,864 414,183 6,085 -742,054 -3,344

Soybeans

118,314 -11,456 168,285 2,518 -281,676 9,569

Soyoil

72,994 -1,594 123,024 -2,324 -219,745 538

CBOT

wheat -12,330 -8,096 156,957 3,355 -134,324 1,142

KCBT

wheat 13,255 -14,998 68,559 -503 -82,766 9,842

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

370,900 14,386 261,648 970 -722,634 559

Soybeans

156,040 -3,560 92,736 2,169 -269,805 7,951

Soymeal

61,236 -3,008 71,439 1,133 -181,848 3,449

Soyoil

98,686 -888 93,816 -1,306 -234,828 282

CBOT

wheat 17,525 -10,051 97,023 3,471 -115,904 987

KCBT

wheat 38,342 -9,322 42,394 646 -75,087 9,623

MGEX

wheat 15,883 -707 4,625 709 -27,897 -220

———- ———- ———- ———- ———- ———-

Total

wheat 71,750 -20,080 144,042 4,826 -218,888 10,390

Live

cattle 83,560 1,900 83,480 215 -173,100 -3,284

Feeder

cattle 2,428 2,048 7,257 -167 -3,304 -573

Lean

hogs 75,833 1,545 58,396 3,027 -141,906 -7,448

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

105,883 -9,310 -15,795 -6,605 2,389,663 14,944

Soybeans

25,953 -5,929 -4,923 -631 1,179,511 -14,132

Soymeal

19,196 1,274 29,976 -2,848 477,067 5,565

Soyoil

18,599 -1,470 23,728 3,381 604,977 14,483

CBOT

wheat 11,658 1,995 -10,303 3,599 512,754 9,218

KCBT

wheat -6,600 -6,606 951 5,659 232,247 -989

MGEX

wheat 2,300 442 5,088 -224 87,062 -384

———- ———- ———- ———- ———- ———-

Total

wheat 7,358 -4,169 -4,264 9,034 832,063 7,845

Live

cattle 20,215 418 -14,154 750 392,097 10,240

Feeder

cattle 4,516 525 -10,898 -1,833 54,193 3,507

Lean

hogs 15,433 1,566 -7,756 1,309 334,436 14,487

Source:

Reuters, CFTC & FI

Canadian

Retail Sales (M/M) Feb -1.1% (est -3.0%; prev -3.4%)

–

Canadian Retail Sales Ex. Auto (M/M) Feb -1.2% (est -2.7%; prev -4.1%)

Canadian

February Retail Sales Rose 4.0% In StatsCan Flash Estimate

- After

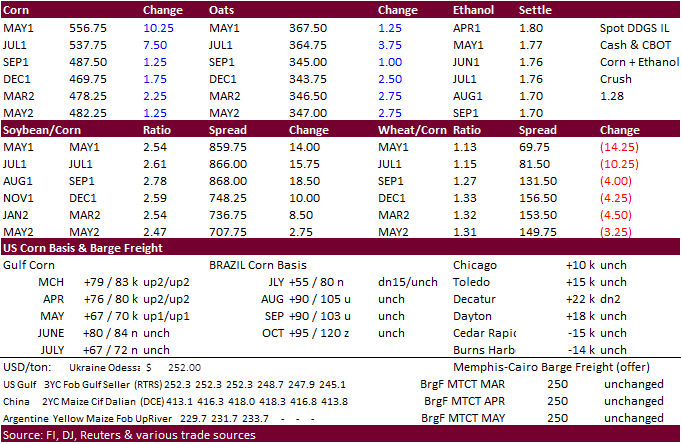

taking a hit from energy prices on Thursday, CBOT corn finished Friday up 3.00-11.25 cents after WTI rebounded and USDA reported another corn sale to China. Spreads were active with May ending 11.25 higher and December up 3.50 cents. The trade is looking

at large US 2021 corn acres, higher than USDA’s 92 million outlook forum projection.

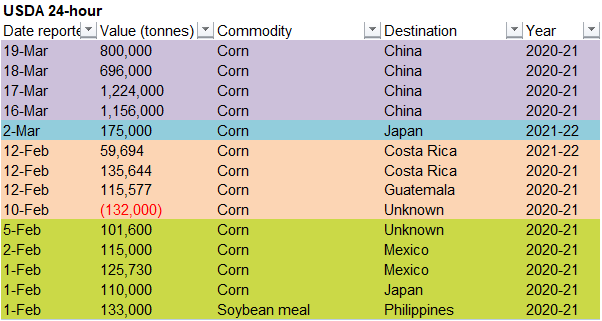

May

contract was supported by news China bought 800,000 tons of corn under the 24-hour system.

- Funds

on Friday bought an estimated net 18,000 contracts. - Private

exporters sold 800,000 tons of corn to China, bringing cumulative four-day sales to 3.876 million tons, 9.724 million tons since January 1. China committed to about 23.24 million tons of US corn after today’s sale. There is at least 15.47 million tons of

US corn outstanding for China. USDA shows total 2020-21 China corn imports at 24 million tons. Total corn commitments were 59.5 million tons (31.76MMT outstanding and 27.76MMT accumulated exports) as of 3/11. Total 2020-21 corn commitments as of 3/18 are

expected to rise into the 69.4 and 70.0 million ton range. USDA could increase their US corn export forecast by 3.7 million tons on April 9th to their 66.04 million tons US corn export estimate. We will pencil in a 150 million bushel increase

in USDA’s corn export estimate to 2.75 billion bushels. We already looked for a 2.7 billion bushel export projection and raised that by 100 million to 2.8 billion. We lowered US corn for feed demand to 5.25 billion bushels from around 5.6 billion previously,

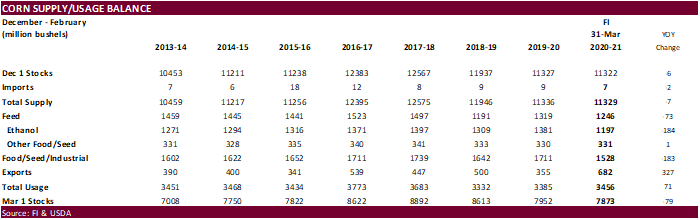

below USDA’s current 5.650 billion. - Attached

is our US corn S&D. Note we increased 2021 US corn plantings to 93 million from 92.3 million previous, and made major adjustments to exports (higher), feed (lower), and ethanol down 100. Our US acreage table also attached reflects a 200,000 acre increase

to cotton to 11.4 million. - Tentative

US March 1 stocks estimate below.

- France

will allow southwestern poultry producers impacted by H5N8 bird flu to resume production after the area was hard hit LH February. About 3 million birds, most of them ducks, were culled.

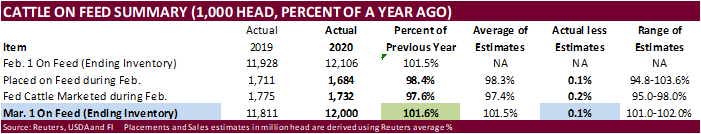

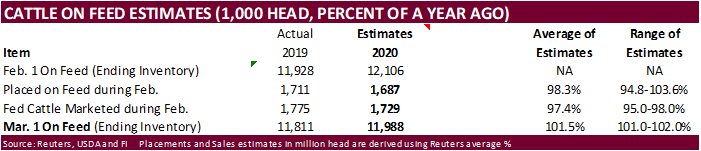

- USDA

Cattle on Feed was slightly higher at 12.0 million head, highest since 2006 for the month.

USDA

Attaché Mexico:

Grain and Feed Annual

USDA

Attaché Japan:

Grain and Feed Annual

Export

developments.

- Under

the 24-hour reporting system, private exporters sold 800,000 tons of corn to China for 2020-21 delivery.

Updated

3/16/21

May

corn is seen in a $5.35 and $5.75 range.

July

is seen in a $5.10 and $5.75 range.

December

corn is seen in a $3.85-$5.50 range.

- US

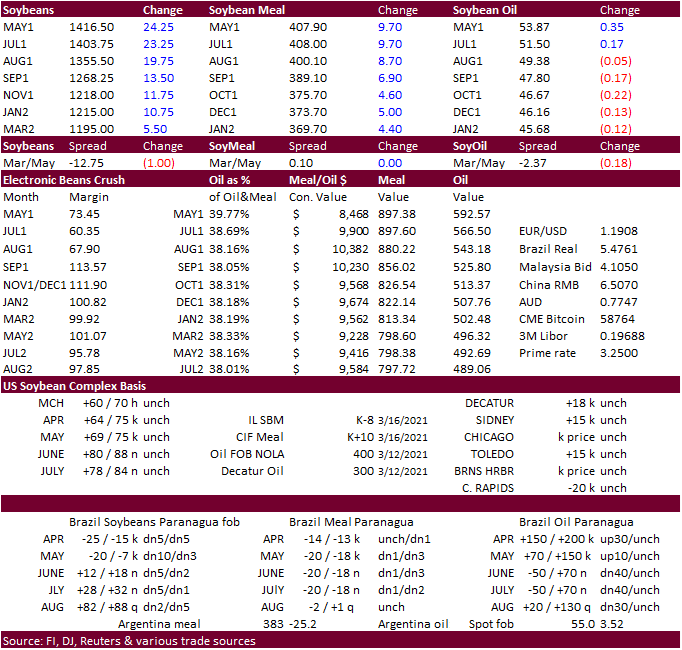

CBOT soybean complex ended higher despite rising concerns over increasing number of Covid-19 cases across the EU. A higher trade in the energy space lent support. Technical buying added positive sentiment. But is was spread plays that created a big imbalance

to contract settlements. SBO was an interesting market to watch as the May contract rebounded and led July higher. Back months SBO ended lower. This comes after a lengthy Reuters article talked about US’s initiative to focus on green energy.

- The

China and US meeting in Alaska concluded today and traders were left with little tradable news. The US announced they made no breakthroughs with China. The countries will likely meet again.

- Argentina

Rosario port workers went on strike this morning for 24 hours to protest layoffs at one of the local crush facilities, but the government stepped in and ended it. Some are wondering if roadblocks are next after fuel prices were increase.

- Funds

on Friday bought an estimated net 12,000 soybean contracts, bought 7,000 soybean meal and bought 2,000 soybean oil.

- Argentina’s

weather was slightly drier in the morning weather forecast but conditions have improved. The Argentina government released its monthly crop report on Thursday, and they left the 2020-21 corn area unchanged at 9.4 million hectares and 17 million hectares unchanged

for soybeans. They pointed out condition of the soybean crop is uneven.

- India

oilseed meal shipments were 393,309 tons in February from 128,761 tons a year earlier, and down from 500,720 tons in January - China

cash crush margins on our analysis were 175 cents, (168 previous) up from 178 cents late last week and compares to 168 cents year earlier.

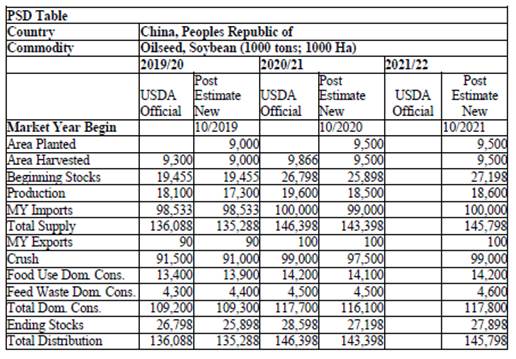

USDA

Attaché expects China

2021-22 soybean imports at 100 million tons, up from 100 million tons USDA official looks for this marketing year.

Source:

World Weather Inc.

USDA

Attaché Canada:

Oilseeds and Products Annual

Export

Developments

- Results

awaited: Iran seeks 30,000 tons of sunflower oil and 30,000 tons of soybean oil on March 18 for March and April shipment.

Updated

3/18/21

May

soybeans are seen in a $13.75 and $14.75 range.

May

soymeal is seen in a $385 and $425 range.

May

soybean oil is seen in a 52.50 and 55.00 cent range.

- US

wheat futures traded two-sided. Chicago and nearby contracts for KC ended lower as good US weather limited upside potential given a very strong rally in soybeans and nearby corn. Spreading was a big feature, and perhaps related to intra commodity spreading.

Note Chicago and KC May ended a little lower than July, and May corn was up 11.25 cents & July corn up 8.50 cents. Losses were limited early for MN after SK bought US milling wheat. May MN finished 1.50 cents higher.

- Funds

on Friday sold an estimated net 4,000 SRW wheat contracts. - French

soft wheat crop conditions declined slightly in the week to March 15 at 87%, down from 88% a week ago and well up from 63% a year ago. Durum fell to 85% from 88% the previous week (67% year ago), winter barley unchanged at 85% vs. 62% year ago.

- EU

May milling wheat was 0.75 lower at 219.75 euros, below a support level of 220.00.

- Ukraine’s

EconMin reported grain exports are down 23% to date to 33.9 million tons. Traders sold 13.98 million tons of wheat, 15.33 million tons of corn and 4.05 million tons of barley.

- Ukraine’s

grain stocks as of March 1 were down two million tons from a year ago to 15.9 million tons, including 4.6 million tons of wheat.

- Sudan

said the US will supply 300,000 tons of wheat this year, rising to 420,000 tons annually from 2022-2024.

Export

Developments.

- Pakistan

bought 300,000 tons of wheat at an estimated $285.97 a ton c&f for August shipment.

- South

Korean flour millers bought 38,000 tons of US milling wheat for shipment between June 1 and June 30. It involved 1,400 tons of soft white wheat of 9.5% to 10.5% protein at an estimated $268.05 a ton, 800 tons of soft white wheat of 8.5% maximum protein at

$277.61 a ton, 10,300 tons of hard red winter of 11.5% minimum protein at $259.80 a ton and 15,500 tons of northern spring wheat of 14% minimum protein at $273.87 a ton. (Reuters) - South

Korean four millers bought 50,000 tons of Australian milling wheat for July arrival. It involved 46,000 tons of Korean Australian standard white blend wheat bought at around $277 a ton FOB, and rest Australian hard wheat grade AH2 bought at an undisclosed

price. (Reuters) - Results

awaited: Algeria’s ONAB seeks 40,000 tons of animal feed barley on March 18 for April 15-30 shipment. - Jordan

is back in for feed barley on March 23. Possible shipment combinations are Oct. 1-15, Oct. 16-31, Nov. 1-15 and Nov. 16-30.

Rice/Other

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 208,217 tons of rice, on March 25 for arrival in South Korea in 2021 between May 1 and Oct. 31. 64,444 tons of non-glutinous brown rice is sought

from the United States. Rest from Thailand, China, Australia and Vietnam.

·

Bangladesh also seeks 50,000 tons of rice on March 28.

·

Syria seeks 25,000 tons of white rice on March 29, from China or Egypt.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

Updated

3/18/21

May

Chicago wheat is seen in a $6.15‐$6.75 range

May

KC wheat is seen in a $5.65‐$6.60 range

May

MN wheat is seen in a $6.15‐$6.50 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.