PDF Attached

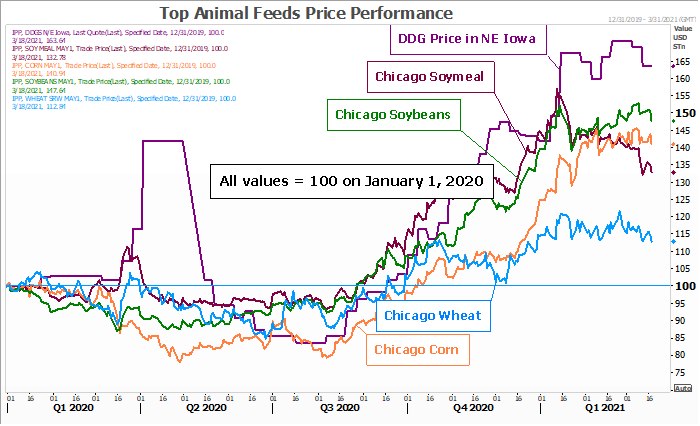

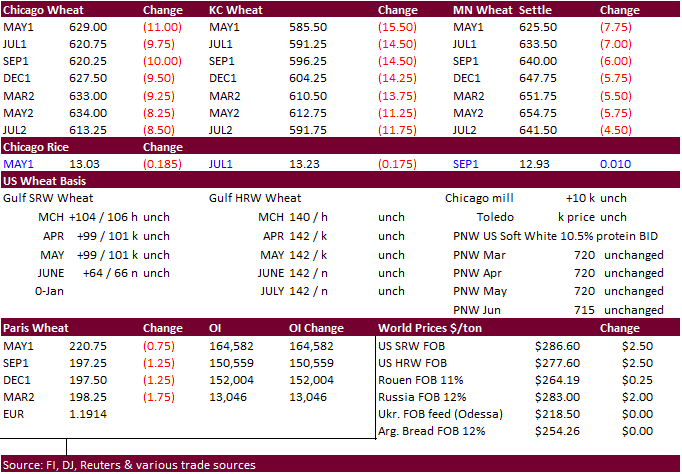

Widespread commodity selling sent US commodity markets lower. Concerns of rising Covid-19 cases outside the US emerged this week. We heard Paris was going back on partial lockdown. Poland and Italy are seeing new lockdowns. The USD was up about 40 points post CBOT close. Meanwhile WTI dropped about $5.50/barrel, or 7 percent, largest decline since December.

![]()

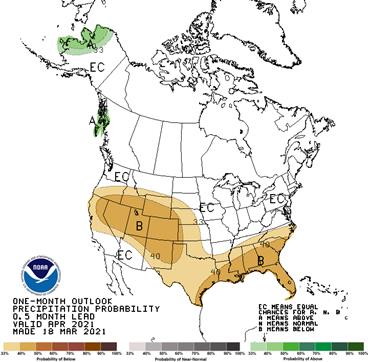

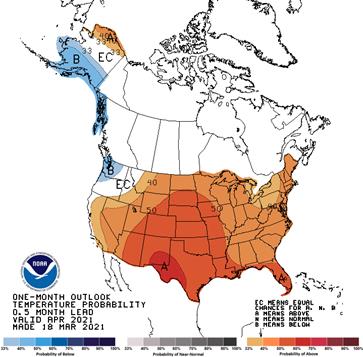

NOAA 30-day:

World Weather Inc.

TODAY’S MOST IMPORTANT WEATHER

- U.S. National Weather Service issues 30-day and 90-day outlooks

o 30-Day outlook for April

- Warmer than usual for the contiguous United States except the far northwestern corner of the nation where western Washington and northwestern Oregon are advertised to be cooler than usual.

An equal opportunity for above, below and near normal temperatures was suggested for the remainder of those two states and in northern Idaho, far northwestern Montana and in coastal areas of California

- Precipitation in April was advertised below average in much of the west and south; including the Great Basin, central and southern Rocky Mountains, central and southern Great Plains and the Gulf of Mexico and southern Atlantic Coast States

- Equal chances for above, below and near normal precipitation was indicated for all other areas

o 90-Day outlook For April through June

- Warmer than usual for the contiguous United States except the northwest half of Washington.

- An equal opportunity for above, below and near normal temperatures was suggested for the remainder of Washington, northern Oregon, northern Idaho and far northwestern Montana

- Rainfall was advertised greater than usual in the eastern half of the Midwest and from North Carolina to southern New England and New York State

- Rainfall was predicted below average from southern Montana, much of Idaho and Oregon to northern California, most of Nevada, all of Utah, most of New Mexico and in the west-central and southern Great plains; including Louisiana and all of Texas.

- Equal chances for above, below and near normal precipitation was noted elsewhere.

- Argentina’s outlook today is a little drier in the west-central and southern parts of the nation and wetter in the northeast

o The bottom line does not change, though

- The nation has moved past the most stressful part of the growing season and crops should finish out relatively well without the broad-based dryness that was present last week

- Brazil is still expecting drier weather in center south, center west and the interior south next week as a high pressure system builds in aloft

o The change will be extremely beneficial in getting late season soybeans harvested and Safrinha corn planted

- However, the very late planting of corn will likely result in lower yields because of limited soil moisture and rainfall during reproduction

- Monsoonal rainfall is expected to abate normally and will not linger longer than usual resulting in the dry bias during reproduction

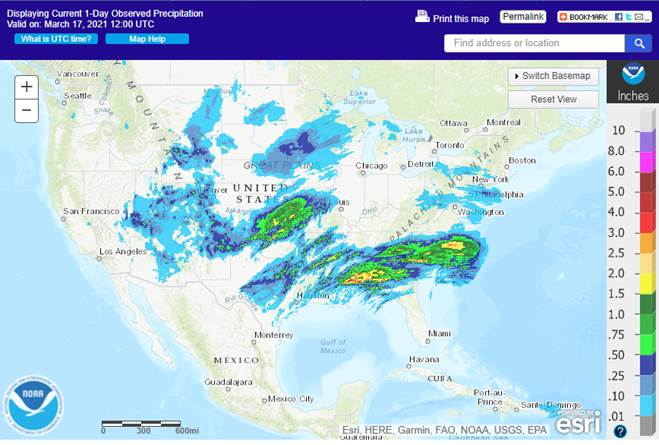

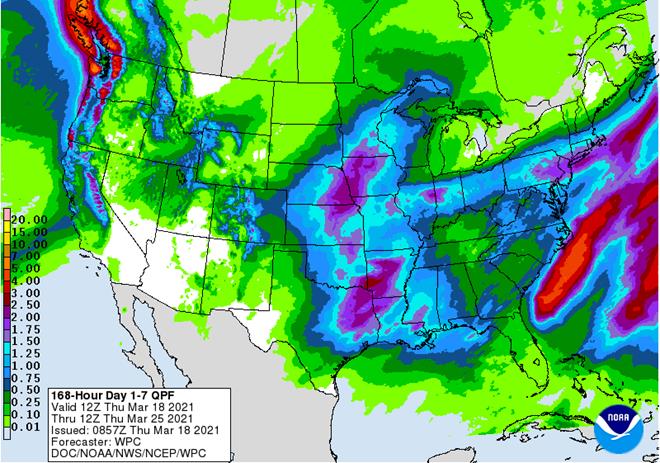

- An active U.S. weather pattern will leave the Midwest and northern Delta too wet for early season fieldwork in early April

o Some local flooding is expected periodically

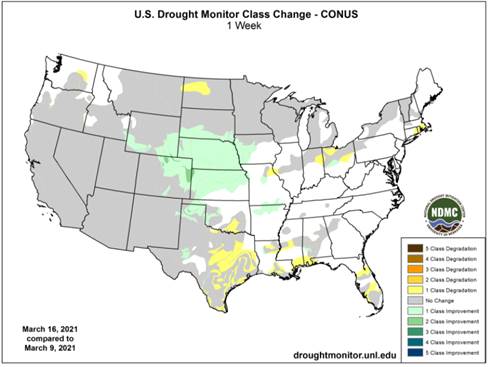

o Some much needed precipitation is expected in the upper U.S. Midwest early next week which will help ease dryness in that region

- U.S. temperatures will be warmer than usual in the northern Plains and upper Midwest as well as in neighboring Canada during the coming week

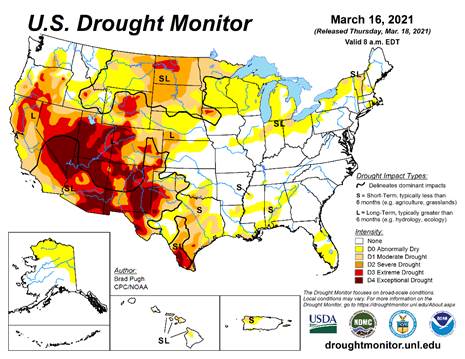

- U.S. hard red winter wheat improvements are expected to be significant in the next two weeks due to recent precipitation events and eventual warming

o Additional rain and a little snow will impact the region Sunday into Monday and again a little later next week

o Southern portions of the Plains still have need for dryness easing rain

- This includes Oklahoma, north-central Texas as well as the western Texas Panhandle

- U.S northwestern Plains and Canada’s Prairies will continue quite dry for the next ten days, despite a few brief showers of snow and rain

o Better weather is expected in April and May that should prove helpful in getting crops planted this year

- West and South Texas still need significant rain along with the Texas Coastal Bend

o Some rain has fallen recently in parts of West Texas, but more significant rain and more generalized rain will be needed before planting begins in cotton, sorghum and corn areas in late April and May

- A few showers will occur in the Rolling Plains and Low Plains of West Texas Sunday into Monday with a few more possible during mid-week next week

- West Texas high Plains region may have a little better chance for precipitation during mid-week

- Most of the resulting rainfall in West Texas will be light leaving need for greater moisture prior to spring planting

o South Texas and the Texas Coastal Bend will struggle for moisture over the next couple of weeks even though a few showers will occur briefly

- U.S. Delta and southeastern states will experience alternating periods of rain and sunshine during the next week slowing fieldwork after a nice start in some southeastern crop areas last weekend

o The southeastern states should see the best mix of rain and sunshine for fieldwork and early crop development

o Portions of the Delta will receive a little too much rain too often and the same is true for the Tennessee River Basin

- The lower Delta will be in better shape than the northern parts of the region

- U.S. Pacific Northwest has some moisture deficits that still need to be reduced, but mountain snowpack is good for adequate runoff to fuel irrigation systems this spring

- California snowpack and snow water equivalents are still below average with little change likely, despite some occasional precipitation events

- Concern over drought in the western U.S. remains, despite some precipitation recently and that which is still yet to come

o Drought will prevail through the growing season this year

- India will receive some brief periods of light rainfall through early next week

o The moisture will slow crop maturation, but may benefit a few immature crops still filling

- Most of the precipitation will be too brief and light to have a lasting impact

- China’s southern rapeseed crop would benefit from more sunshine and warmer temperatures, but the long term outlook is favorable

- China’s northern rapeseed and majority of key winter wheat production areas are poised for aggressive development this spring because of good establishment in the autumn and better than usual winter precipitation along with minimal winterkill

- Eastern Australia’s frequent precipitation pattern expected into late this month is likely to raise concern over open boll cotton fiber quality and some harvest delays

o The moisture will be excellent for late maturing summer crops including sorghum and it will lift soil moisture and water supply for wheat, barley and canola planting that begins in late April

- Middle East precipitation will continue greatest in Turkey and may increase in Afghanistan this week while Iraq, Iran and Syria continue in a net drying mode along with areas south into Israel and Jordan

- Europe precipitation in the coming ten days will be wettest in southern parts of the continent; including areas from Italy and eastern France into the Balkan Countries

o Temperatures will be cooler than usual

o Spain is drying down and will need some moisture soon to protect long term crop development

- Spain and Portugal are drying out and will need a boost in precipitation later this month as seasonal warming becomes more aggressive and begins to accelerate net drying

- Western parts of the CIS will experience frequent bouts of light rain and snow during the coming ten days

o The precipitation will continue to support abundant soil moisture across many areas

o Temperatures will be near normal allowing some warming to occur in far southern crop areas in Ukraine, Moldova and Russia’s Southern Region where soil temperatures may rise enough to induce some greening of wheat and other winter crops in early April.

- North Africa weather will include a mix of rain and sunshine during the next two weeks

o A boost in soil moisture is needed in northwestern Algeria, parts of Tunisia and southwestern Morocco

o Some rain is expected periodically starting Thursday and lasting into next week with some of the drier areas in Algeria benefiting

- Ivory Coast, Ghana, Benin, Cameroon and southern Nigeria will receive waves of rain in the next ten days

o New rain totals will vary from 0.50 to 3.00 inches and locally more will be supportive of coffee and cocoa flowering and help increase soil moisture for future rice, sugarcane and cotton production

- East-central Africa rainfall will be erratic and light for a while

o Crop conditions are best in Tanzania

o Rain is needed most in Ethiopia, although this is the end of their dry season

- South Africa will experience slowly increasing rainfall during the coming week to ten days with temperatures mostly near to above average

o The recent drying trend encouraged early season crop maturation while subsoil moisture and irrigation supported late season crops

o Summer crop conditions will remain favorably rated as long as the moisture boost occurs as advertised

- Mexico drought conditions are still prevailing, although the impact on winter crops is low due to irrigation

o Water supply is low in some areas and a notable improvement in rainfall is needed, but not very likely

o Dryland winter crops are stressed and will yield poorly

o Freeze damage is common in northern parts of the nation due to a couple of cold surges this winter

o Rain in the coming week will be mostly confined to the east coast and temperatures will be seasonable with a slight warmer bias in the driest areas

- Central America precipitation will continue greatest along the Caribbean Coast and in Guatemala while the Pacific Coast receives the lightest and most erratic rainfall, but some precipitation will fall especially in Costa Rica and Panama.

- Southeast Asia rainfall will occur relatively normally over the next two weeks

o Mainland areas will experience increasing shower activity later this week

- The resulting rainfall will be sporadic and light with net drying probably continuing in many areas for a while longer

o Philippines rainfall will occur moderately periodically during the next ten days with some local flooding possible in the north

o Indonesia and Malaysia weather will occur often enough to support most crop needs

- Peninsular Malaysia needs rain most significantly

- New Zealand weather will be dry with seasonable temperatures over the coming week

o The nation’s soil moisture is drifting farther below average

o Rain will return to some areas next week, but greater rain may be required to restore normal soil moisture

- Southern Oscillation Index has been falling and was at +1.36 this morning. The index is expected to drift a little lower as time moves along.

- Southeast Canada will experience below average precipitation and above normal temperatures during the coming week to ten days

- Canada Prairies will continue drier and warmer than usual maintaining a great level of concern over drought since the region is already extremely short on moisture

Source: World Weather inc.

Bloomberg Ag Calendar

Thursday, March 18:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- Port of Rouen data on French grain exports

- China customs to publish trade data, including import numbers for corn, wheat, sugar and pork

- USDA total milk production

Friday, March 19:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

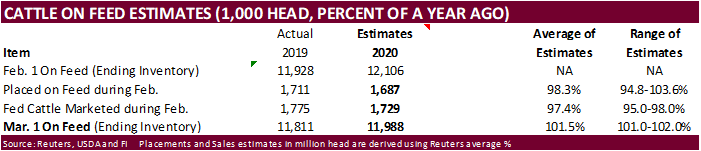

- U.S. cattle on feed

Saturday, March 20:

- China 3rd batch of Jan.-Feb. trade data, including country breakdowns for energy and commodities. No timing

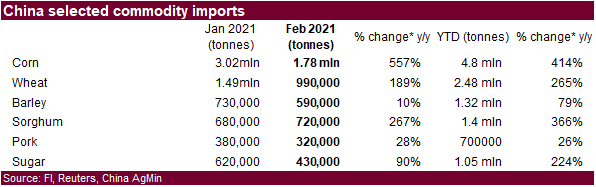

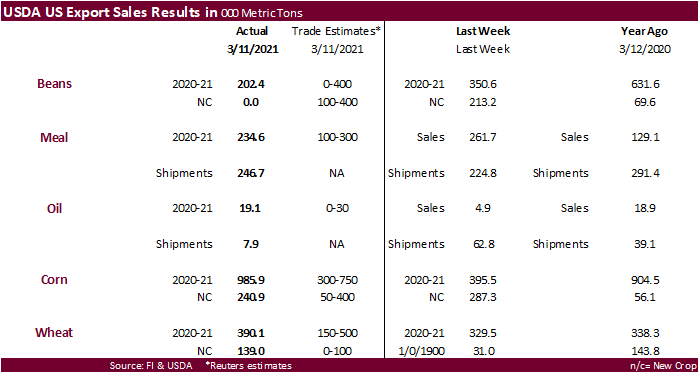

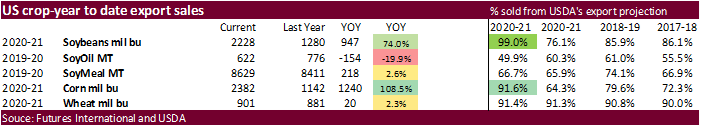

USDA export sales were within expectations for the soybean complex, above estimates for corn and within for all-wheat. China switched 130k wheat from unknown and 612,000 tons of corn from unknown. Sorghum sales were very good at 267,200 tons. Pork sales were 39,700 tons.

US Initial Jobless Claims Mar-13: 770K (exp 700K; R prev 725K)

– Continuing Claims Mar-6: 4124K (exp 4034K; R prev 4142K)

US Philadelphia Fed Business Outlook Mar: 51.8 (exp 23.3; prev 23.1)

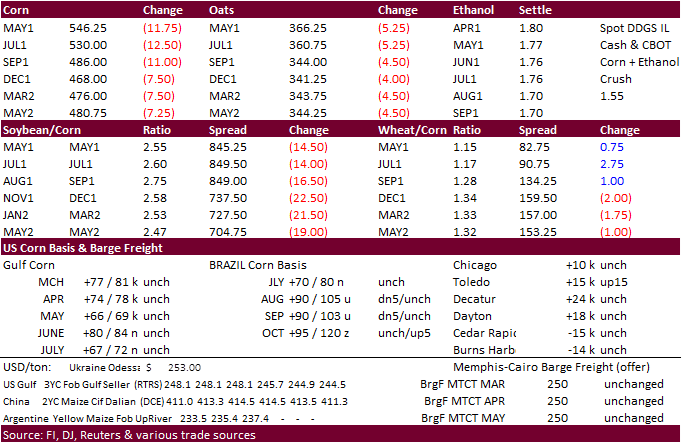

- A major decline in energy markets and sharply higher USD sent corn futures lower. May corn found support at its 20-day MA of $5.4525. It was down 11.50 cents, most for the 2021 contracts. December finished 7.00 cents lower. Corn futures were initially lower on SA weather and higher USD. Corn contracts were see limiting losses after it was announced China bought US corn. But as US energy prices collapsed, so did corn. Recent rains in Argentina’s Pampas growing areas were thought to have stopped the decay of late corn and soybean yields.

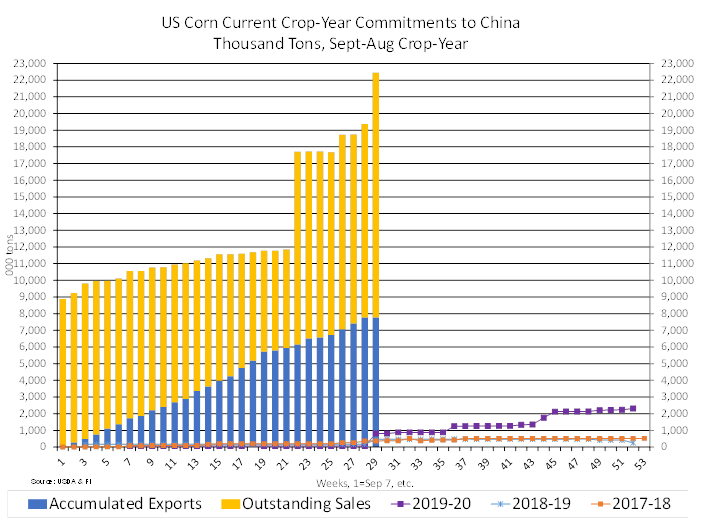

- Private exporters sold 696,000 tons of corn to China, bringing cumulative two-day sales to 3.076 million tons, 8.924 million tons since January 1. China committed to about 22.44 million tons of US corn after today’s sale. There is at least 14.67 million tons of US corn outstanding for China. USDA shows total 2020-21 China corn imports at 24 million tons. Total corn commitments were 59.5 million tons (31.76MMT outstanding and 27.76MMT accumulated exports) as of 3/11.

- China imported 1.78 million tons of corn during the month of February, down from 3.02 million tons from Jan but 557 percent higher than Feb year ago.

- USDA export sales were above trade estimates for corn. China switched 612,000 tons of corn from unknown. 91.6& of USDA’s 2.6 billion corn crop export estimate had been sold. Remember another 3.0+ million tons will be added next week. Sorghum sales were very good at 267,200 tons (China 289,200 MT, including 120,000 MT switched from unknown destinations and decreases of 15,200 MT). Pork sales were 39,700 tons (China 5,800 tons).

- China plans to be aggressive this season in combatting fall army worm.

- China’s AgMin reported the sow heard up 34 percent from the previous year, up 1 percent in both January and February. Some think the heard fell as much as 5 percent during the past two months from ASF problems. China pork prices eroded during February and FH March.

- Another storm system is working its way across the US Delta and Midwest today through Saturday. No major changes to the US forecast was noted this morning.

- EIA reported US generated 902 million D6 blending credits in February, up from 1.1 billion in January.

|

February |

February |

|

|

Fuel (D Code) |

RINs |

Volume (Gal.) |

|

D3 |

41,131,835 |

41,131,835 |

|

D4 |

305,901,758 |

193,877,673 |

|

D5 |

12,248,766 |

8,140,810 |

|

D6 |

901,789,755 |

896,422,583 |

Latest USDA export sales data plus what was reported so far this week…

Export developments.

- Under the USDA 24-hour announcement system, private exporters sold 696,000 tons of corn to China for 2020-21.

- Turkey’s TMO bought 115,000 tons of corn for shipment March 25-April 20. estimated tonnage sold, seller and price in dollars per ton C&F. Traders believe most was Russian origin.

- 30,000 tons $278.10

- 30,000 tons $278.10

- 30,000 tons $278.70

- 25,000 tons $280.70

Updated 3/16/21

May corn is seen in a $5.35 and $5.75 range.

July is seen in a $5.10 and $5.75 range.

December corn is seen in a $3.85-$5.50 range.

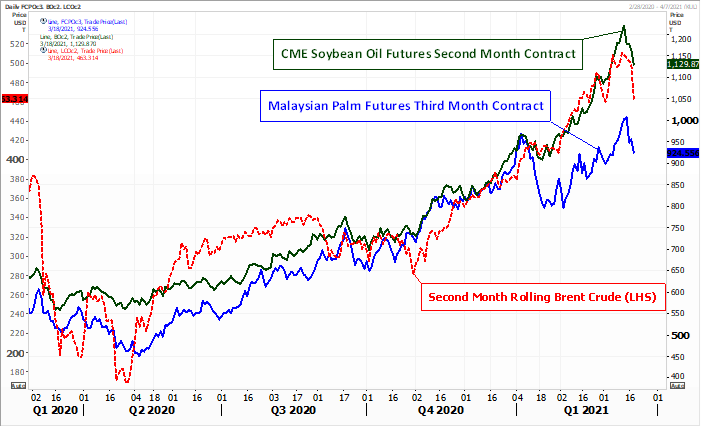

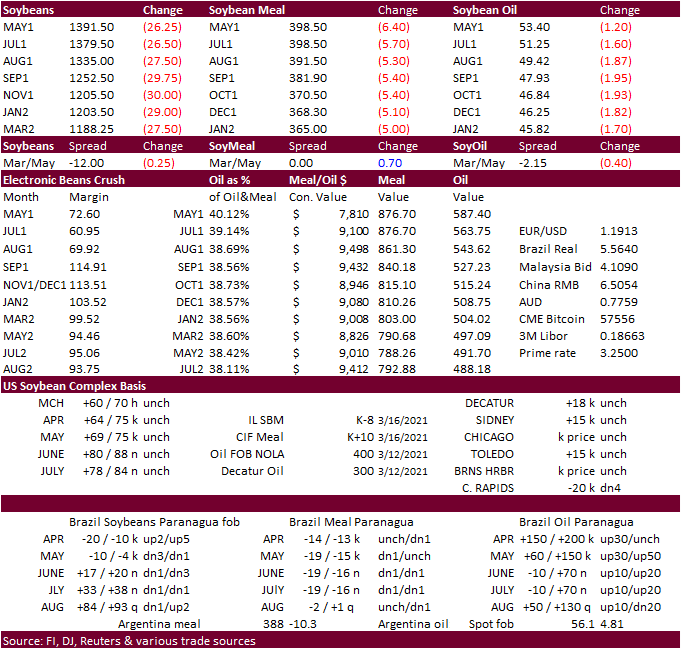

- Sharply lower energy markets and improving SA weather (Argentina crop stress nothing like it was a week ago) sent the CBOT soybean complex sharply lower. May soybeans fell 25.50 cents to 13.9225, after finding support just above its 50-day MA of 13.88, nearly a 3-week low. May soybean meal dropped $6.70 to $398.20. May soybean oil shed 108 points. Sell stops were hit a few times during the session but notably 1,000 BOK sold @ 11:47. Bull spreading in soybean oil limited losses in the nearby contracts. December soybean oil was off 178 points. Malaysian palm futures overnight were down 3.5 percent.

- Funds on Thursday sold an estimated net 14,000 soybean contracts, sold 4,000 soybean meal and 9,000 soybean oil.

- China plans to adjust their compound feed formula that will require less corn and soybean meal for animal feed. This might come after China imported 4.8 million ton of corn during the Jan and Feb period, 400 percent higher than the same period a year ago, and weekly Brazil soybean loadings to China are currently running over 2 million tons. Details of the plan were not provided.

- CNGOIC reported China soybean oil stocks were 760,000 tons, off 80,000 tons from the previous week. AgriCensus noted SBO stocks are lowest in three years. The soybean crush has been running below 2 million tons for a few weeks now and last week fell about 200,000 tons to just below 1.5 million tons.

- One bullish feature overlooked today was talk of Argentina truckers possibly staging protests over rising fuel prices. Don’t be alarmed if we hear about roadblocks on Friday.

- USDA export sales were within expectations for the soybean complex. 99 percent of USDA’s export projection had been sold.

- The morning weather outlook showed no major changes to the SA and US forecast.

- Traders are awaiting news from the China and US meeting today in Alaska. Latest speculation was that China was going to ask to the US to roll back on some of the previous agreed concessions.

- EIA reported US generated 306 million D4 blending credits in February versus 300 in January.

Export Developments

- Results awaited: Iran seeks 30,000 tons of sunflower oil and 30,000 tons of soybean oil on March 18 for March and April shipment.

Third month rolling Malaysian palm oil vs. palm (RHS) and Brent (LHS)

Source: Reuters and FI

Updated 3/18/21

May soybeans are seen in a $13.75 and $14.75 range.

May soymeal is seen in a $385 and $425 range.

May soybean oil is seen in a 52.50 and 55.00 cent range. (dn 100, dn 100)

- A widespread commodity selloff sent US wheat futures lower again, compounded by good Black Sea weather promoting favorable early wheat development and sliding Black Sea wheat export prices. Ukrainian wheat export prices fell $10 a ton this week, according to APK-Inform. Yesterday SovEcon raised its Russian forecast for 2021 wheat crop to 79.3 million tons from 76.2 million tons previously. Crop conditions are good for the Black Sea region. Ukraine mentioned they do not plan to impose variable grain export taxes.

- Funds on Thursday sold an estimated net 6,000 SRW wheat contracts.

- Chicago May wheat futures traded and ended below its 100-day MA. The May contract reached its lowest level since early February and next support level is now seen at $616. Its settled 9.50 cents lower near its 50 percent retracement level (Dec low & Jan high).

- USDA export sales were within expectations for all-wheat. China switched 130k wheat from unknown.

- US weather looks good for the wheat emerging from dormancy and we look for improved crop conditions in coming weeks.

- EU May milling wheat was 1.00 lower at 220.50 euros. Support is seen at 220.00.

- Strategie Grains lowered its forecast of soft wheat exports from the European Union and Britain by 900,000 tons to 25.2 million (2020-21). Soft wheat production was unchanged at 129.6 million tons from 119.3 million for 2019-20.

Export Developments.

- South Korean flour mills bought 50,000 tons of milling wheat from the United States for shipment between June 1 and June 30. Reuters noted: “The purchase involved 25,385 tons of soft white wheat of 9.5% to 10.5% protein at an estimated $269.74 a ton, 1,520 tons of soft white wheat of a maximum 8.5% protein bought at $280.76, 8,810 tons of hard red winter of a minimum 11.5% protein bought at $266.83 a ton and 14,285 tons of northern spring wheat of 14% minimum protein bought at $277.76 per ton.

- (Reuters) – Tunisia’s state grains agency bought 117,000 tons of soft wheat, 42,000 tons of durum wheat and 75,000 tons of barley. The soft wheat was said to have been bought at $298.49 a ton on a cost and freight (c&f) basis for four consignments and $302.19 a ton c&f for one consignment. The durum was bought in two consignments, all at an estimated $374.68 a ton c&f. The barley was bought in three consignments, at $280.48 a ton c&f and two at $276.09 and $275.68 a ton c&f. The durum was sought in one consignment of 25,000 tons and one of 17,000 tons for shipment between April 15 and May 5 depending on the origin. The soft wheat was sought in four 25,000 ton consignments and one of 17,000 tons for shipment between April 10 and May 25, also depending on origin. The barley was sought in three 25,000 ton consignments for shipment between April 15 and May 25.

- Results awaited: Algeria’s ONAB seeks 40,000 tons of animal feed barley on March 18 for April 15-30 shipment.

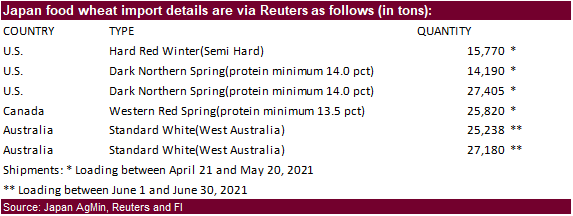

- Japan bought 135,603 tons of food wheat from the US, Canada and Australia. Original details as follows:

- Jordan is back in for feed barley on March 23. Possible shipment combinations are Oct. 1-15, Oct. 16-31, Nov. 1-15 and Nov. 16-30.

Rice/Other

· Lowest offer $417.71/ton CIF – Bangladesh seeks 50,000 tons of rice.

· Mauritius bought 4,000 tons of long grain white rice from India and Pakistan at an average price of around $509.6 a ton c&f.

· South Korea’s Agro-Fisheries & Food Trade Corp. seeks 208,217 tons of rice, on March 25 for arrival in South Korea in 2021 between May 1 and Oct. 31. 64,444 tons of non-glutinous brown rice is sought from the United States. Rest from Thailand, China, Australia and Vietnam.

· Bangladesh also seeks 50,000 tons of rice on March 28.

· Syria seeks 25,000 tons of white rice on March 29, from China or Egypt.

· Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

Updated 3/18/21

May Chicago wheat is seen in a $6.15‐$6.75 range (dn 10, dn 15)

May KC wheat is seen in a $5.65‐$6.60 range (dn 10, dn 15)

May MN wheat is seen in a $6.15‐$6.50 range (dn 5, dn15)

U.S. EXPORT SALES FOR WEEK ENDING 3/11/2021

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

166.2 |

1,428.2 |

1,746.6 |

114.1 |

6,896.9 |

7,133.3 |

25.5 |

283.5 |

|

SRW |

11.1 |

387.9 |

306.2 |

37.1 |

1,377.7 |

2,031.4 |

6.2 |

302.8 |

|

HRS |

142.2 |

1,765.4 |

1,614.3 |

318.3 |

5,537.0 |

5,490.4 |

30.3 |

276.0 |

|

WHITE |

71.4 |

2,016.8 |

1,070.4 |

192.8 |

4,428.8 |

3,748.7 |

77.0 |

157.3 |

|

DURUM |

-0.9 |

153.3 |

146.4 |

0.0 |

518.4 |

682.2 |

0.0 |

5.0 |

|

TOTAL |

390.1 |

5,751.6 |

4,883.9 |

662.3 |

18,758.8 |

19,086.0 |

139.0 |

1,024.6 |

|

BARLEY |

0.0 |

11.5 |

14.7 |

0.0 |

22.0 |

34.4 |

0.0 |

14.5 |

|

CORN |

985.9 |

30,542.7 |

12,815.7 |

2,199.4 |

29,962.1 |

16,202.1 |

240.9 |

1,794.9 |

|

SORGHUM |

267.2 |

2,758.4 |

1,206.9 |

353.2 |

3,447.3 |

1,158.0 |

0.0 |

756.0 |

|

SOYBEANS |

202.4 |

6,779.6 |

4,315.7 |

534.1 |

53,854.4 |

30,531.7 |

0.0 |

5,076.2 |

|

SOY MEAL |

234.6 |

2,708.2 |

3,089.7 |

246.7 |

5,920.6 |

5,320.8 |

-0.3 |

233.1 |

|

SOY OIL |

19.1 |

112.9 |

236.9 |

7.9 |

509.0 |

539.2 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

79.3 |

308.5 |

385.2 |

35.5 |

1,043.2 |

879.6 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

5.4 |

37.7 |

4.5 |

23.5 |

24.1 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

4.1 |

14.5 |

8.7 |

33.1 |

35.9 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

70.2 |

66.0 |

0.5 |

82.4 |

41.8 |

0.0 |

0.0 |

|

L G MLD |

16.4 |

57.5 |

76.6 |

35.0 |

436.2 |

639.9 |

0.0 |

0.0 |

|

M S MLD |

16.4 |

234.0 |

212.5 |

7.1 |

355.0 |

390.0 |

0.0 |

0.0 |

|

TOTAL |

112.3 |

679.7 |

792.5 |

91.2 |

1,973.4 |

2,011.4 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

437.7 |

5,394.1 |

7,028.1 |

351.9 |

8,833.3 |

7,839.7 |

143.3 |

1,432.2 |

|

PIMA |

7.0 |

259.8 |

234.2 |

10.3 |

468.1 |

287.0 |

0.0 |

1.1 |

This summary is based on reports from exporters for the period March 5 – 11, 2021.

Wheat: Net sales of 390,100 metric tons (MT) for 2020/2021 were up 18 percent from the previous week and 40 percent from the prior 4-week average. Increases primarily for China (132,300 MT, including 130,000 MT switched from unknown destinations), Mexico (93,000 MT, including decreases of 1,000 MT), Taiwan (85,000 MT), the Philippines (75,400 MT), and Thailand (54,000 MT), were offset by reductions primarily for unknown destinations (215,800 MT). For 2021/2022, net sales of 139,000 MT were reported for China (65,000 MT), the Philippines (32,000 MT), unknown destinations (28,800 MT), Honduras (7,000 MT) and the Dominican Republic (6,200 MT). Exports of 662,300 MT were up 41 percent from the previous week and 61 percent from the prior 4-week average. The destinations were primarily to the Philippines (178,000 MT), South Korea (100,100 MT), Mexico (80,600 MT), China (67,300 MT), and Bangladesh (58,400 MT).

Optional Origin Sales: For 2020/2021, the current outstanding balance of 10,000 MT, all Spain.

Corn: Net sales of 985,900 MT for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for China (624,800 MT, including 612,000 MT switched from unknown destinations), Mexico (285,500 MT, including 24,500 MT switched from unknown destinations and decreases of 2,000 MT), Colombia (208,500 MT, including 116,000 MT switched from unknown destinations and decreases of 45,300 MT), South Korea (168,200 MT, including 68,000 MT switched from unknown destinations and decreases of 15,500 MT), and Japan (138,300 MT, including 88,800 MT switched from unknown destinations and decreases of 12,000 MT), were offset by reductions primarily for unknown destinations (1,038,000 MT). For 2021/2022, net sales of 240,900 MT were reported for Mexico (195,700 MT), Guatemala (36,300 MT), and Canada (8,900 MT). Exports of 2,199,400 MT–a marketing-year high–were up 38 percent from the previous week and 42 percent from the prior 4-week average. The destinations were primarily to Japan (434,400 MT), Mexico (390,100 MT), China (356,900 MT), Colombia (199,900 MT), and Taiwan (192,400 MT).

Optional Origin Sales: For 2020/2021, new optional origin sales of 30,000 MT were reported for the Ukraine. Options were exercised to export 125,000 MT to Taiwan (70,000 MT) and South Korea (55,000 MT) from the United States. The current outstanding balance of 1,079,400 MT is for South Korea (738,000 MT), unknown destinations (244,000 MT), China (65,000 MT), and the Ukraine (32,400 MT).

Late Reporting: For 2020/2021, net sales totaling 30,000 MT were reported late for Tunisia.

Barley: No net sales or exports were reported for the week.

Sorghum: For 2020/2021, net sales of 267,200 MT resulting in increases for China (289,200 MT, including 120,000 MT switched from unknown destinations and decreases of 15,200 MT), were offset by reductions for unknown destinations (22,000 MT). Exports of 353,200 MT–a marketing-year high–were up noticeably from the previous week and from the prior 4-week average. The destination was China.

Rice: Net sales of 112,300 MT for 2020/2021 were up noticeably from the previous week and up 48 percent from the prior 4-week average. Increases were primarily for Venezuela (30,000 MT), Mexico (25,900 MT, including decreases of 100 MT), Nicaragua (18,000 MT), Haiti (15,100 MT, including decreases of 200 MT), and Japan (12,000 MT). Exports of 91,200 MT were up 89 percent from the previous week and 24 percent from the prior 4-week average. The destinations were primarily to Mexico (32,600 MT), Haiti (30,400 MT), the United Kingdom (8,200 MT), Honduras (8,200 MT), and Canada (2,900 MT).

Soybeans: Net sales of 202,400 MT for 2020/2021 were down 42 percent from the previous week and 31 percent from the prior 4-week average. Increases primarily for China (71,500 MT, including 66,000 MT switched from unknown destinations and decreases of 100 MT), Mexico (66,000 MT, including decreases of 500 MT), Bangladesh (57,100 MT, including 55,000 MT switched from unknown destinations), Indonesia (31,300 MT, including decreases of 900 MT), and Japan (25,100 MT, including 10,700 MT switched from unknown destinations and decreases of 1,300 MT), were offset by reductions primarily for unknown destinations (123,200 MT). Exports of 534,100 MT were down 24 percent from the previous week and 44 percent from the prior 4-week average. The destinations were primarily to Indonesia (127,700 MT), Egypt (90,200 MT), China (82,000 MT), Mexico (70,500 MT), and Bangladesh (57,100 MT).

Exports for Own Account: The current exports for own account outstanding balance is 5,800 MT, all Canada.

Late Reporting: For 2020/2021, net sales totaling 600 MT were reported late for Taiwan.

Soybean Cake and Meal: Net sales of 234,600 MT for 2020/2021 were down 10 percent from the previous week, but up 1 percent from the prior 4-week average. Increases primarily for the Philippines (50,300 MT), Canada (42,500 MT), Guatemala (38,300 MT), Peru (23,000 MT), and Mexico (19,400 MT, including decreases of 5,000 MT), were offset by reductions for Indonesia (4,400 MT) and Belgium (1,600 MT). For 2021/2022, net sales reductions of 300 MT resulting in increases primarily for Guatemala (5,900 MT), were offset by reductions for El Salvador (6,300 MT). Exports of 246,700 MT were up 10 percent from the previous week, but down 16 percent from the prior 4-week average. The destinations were primarily to Indonesia (52,400 MT), Mexico (43,400 MT), Ecuador (33,000 MT), the Dominican Republic (32,000 MT), and Canada (28,100 MT).

Soybean Oil: Net sales of 19,100 MT for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Colombia (17,000 MT), the Dominican Republic (1,200 MT), Mexico (700 MT), and Jamaica (700 MT), were offset by reductions for Canada (300 MT), Venezuela (200 MT), and Guatemala (100 MT). Exports of 7,900 MT were down 87 percent from the previous week and 75 percent from the prior 4-week average. The destinations were primarily to Venezuela (4,300 MT), Guatemala (1,900 MT), Mexico (1,100 MT), Canada (400 MT), and Honduras (200 MT).

Cotton: Net sales of 437,700 RB for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Vietnam (135,300 RB, including 5,600 RB switched from China, 1,800 RB switched from South Korea, and 1,600 RB switched from Japan), China (92,700 RB), Pakistan (58,500 RB), Turkey (51,200 RB), and Bangladesh (49,600 RB), were offset by reductions primarily for Hong Kong (1,000 RB). For 2021/2022, net sales of 143,300 RB were primarily for Mexico (112,900 RB). Exports of 351,900 RB were unchanged from the previous week, but up 6 percent from the prior 4-week average. Exports were primarily to China (86,000 RB), Vietnam (76,400 RB), Pakistan (61,000 RB), Turkey (28,400 RB), and Indonesia (26,902 RB). Net sales of Pima totaling 7,000 RB were down 44 percent from the previous week and 40 percent from the prior 4-week average. Increases for India (4,200 RB), China (2,500 RB), and Thailand (400 RB), were offset by reductions for Austria (100 RB). Exports of 10,300 RB were down 56 percent from the previous week and 27 percent from the prior 4-week average. The destinations were primarily to India (4,100 RB), Vietnam (3,800 RB), Italy (1,300 RB), Thailand (400 RB), and Turkey (400 RB).

Exports for Own Account: For 2020/2021, new exports for own account totaling 4,600 RB were to Vietnam (3,000 RB) and China (1,600 RB). Exports for own account totaling 2,700 RB to China (2,600 RB) and Bangladesh (200 RB) were applied to new or outstanding sales. The current exports for own account outstanding balance of 36,800 RB is for China (27,300 RB), Vietnam (9,100 RB), and Bangladesh (400 RB).

Hides and Skins: Net sales of 557,900 pieces for 2021 were up 8 percent from the previous week and 54 percent from the prior 4-week average. Increases primarily for China (412,200 whole cattle hides, including decreases of 11,800 pieces), Mexico (66,400 whole cattle hides, including decreases of 700 pieces), Thailand (29,200 whole cattle hides, including decreases of 500 pieces), South Korea (23,000 whole cattle hides, including decreases of 2,800 pieces), and Brazil (18,300 whole cattle hides, including decreases of 200 pieces), were offset by reductions for Taiwan (1,200 pieces). Exports of 364,300 pieces for 2021 were down 7 percent from the previous week, but up 5 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (195,800 pieces), South Korea (74,900 pieces), Mexico (31,700 pieces), Thailand (31,300 pieces), and Brazil (11,400 pieces).

Net sales of 94,100 wet blues for 2021 were down 35 percent from the previous week and 14 percent from the prior 4-week average. Increases were primarily for China (34,400 unsplit), Vietnam (24,700 unsplit, including decreases of 100 unsplit), Taiwan (10,400 unsplit and 5,100 grain splits), Mexico (6,800 unsplit and 2,900 grain splits), and Italy (5,300 unsplit, including decreases of 700 unsplit). Exports of 99,400 wet blues for 2021 were down 9 percent from the previous week and 1 percent from the prior 4-week average. The destinations were primarily to China (28,900 unsplit), Vietnam (25,900 unsplit), Italy (15,500 unsplit and 9,600 grain splits), Taiwan (3,500 grain splits and 3,200 unsplit), and Thailand (5,800 unsplit). Net sales of 181,100 splits resulting in increases for China (192,300 pounds, including decreases of 14,700 pounds), were offset by reductions for Vietnam (11,200 pounds). Exports of 391,100 pounds were to Vietnam.

Beef: Net sales of 25,900 MT reported for 2021 were up 24 percent from the previous week and 39 percent from the prior 4-week average. Increases were primarily for Japan (8,100 MT, including decreases of 600 MT), South Korea (5,400 MT, including decreases of 400 MT), China (5,300 MT, including decreases of 100 MT), Taiwan (2,000 MT, including decreases of 100 MT), and Hong Kong (1,700 MT, including decreases of 200 MT). Exports of 17,800 MT were unchanged from the previous week, but up 4 percent from the prior 4-week average. The destinations were primarily to Japan (5,700 MT), South Korea (4,000 MT), China (2,700 MT), Mexico (1,300 MT), and Taiwan (1,100 MT).

Pork: Net sales of 39,700 MT reported for 2021 were up 23 percent from the previous week and 5 percent from the prior 4-week average. Increases primarily for Mexico (18,200 MT, including decreases of 400 MT), China (5,800 MT, including decreases of 1,300 MT), Japan (4,900 MT, including decreases of 300 MT), South Korea (4,200 MT, including decreases of 800 MT), and Canada (3,100 MT, including decreases of 400 MT), were offset by reductions primarily for Australia (200 MT). Exports of 40,600 MT were up 3 percent from the previous week and 5 percent from the prior 4-week average. The destinations were primarily to China (12,700 MT), Mexico (8,900 MT), Japan (5,200 MT), South Korea (3,600 MT), and the Philippines (2,200 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.